- Unhashed Newsletter

- Posts

- $200M short squeeze flips sentiment

$200M short squeeze flips sentiment

Reading time: 5 minutes

Crypto short squeeze sparks sentiment flip across top tokens

Key points:

Crypto markets recorded their largest short squeeze since October, with roughly $200 million in bearish positions liquidated across the top 500 tokens as prices rebounded sharply.

Investor sentiment flipped from fear to greed for the first time in nearly three months, reflecting a rapid reset in risk appetite following the liquidation wave.

News - Crypto markets staged a sharp reversal this week as a wave of short liquidations rippled through futures and perpetual contracts, forcing bearish traders to unwind positions.

Data from Glassnode showed that around $200 million in short positions were wiped out in a single day, marking the largest short squeeze since the October selloff that erased nearly $1 billion in bearish bets.

The sudden move followed a rebound in prices that caught leveraged traders off guard. As short sellers rushed to cover losses, buying pressure intensified, amplifying upward momentum across major tokens and reviving expectations of improving market conditions.

Bitcoin led the liquidation surge, with about $71 million in shorts cleared over the past 24 hours. Ether followed with $43 million, while Dash saw roughly $24 million in bearish positions unwound. The concentration of liquidations in large-cap assets highlighted how quickly market structure can shift when leverage collides with price strength.

Bitcoin finds support from macro uncertainty - Beyond technical dynamics, macro forces also played a role. Bitcoin has begun outperforming the US dollar amid growing concerns around Federal Reserve independence and rising geopolitical volatility.

Analysts noted that uncertainty surrounding global politics and scrutiny of US monetary leadership has pressured the dollar while supporting alternative reserve assets.

Bitcoin’s price is up 10.6% year to date, compared with a 0.75% rise in the US Dollar Index, reinforcing its relative strength during periods of instability.

Greed returns, but caution lingers - The short squeeze coincided with a notable sentiment shift. The Crypto Fear & Greed Index climbed to 61, signaling a move into “greed” territory for the first time since October’s $19 billion liquidation event.

While the reading reflects improving confidence as Bitcoin reclaimed two-month highs, analysts caution that sentiment gauges provide context rather than clear market signals.

For now, the move underscores how swiftly market psychology can reset when forced liquidations and macro uncertainty align.

Bitcoin enters a new phase as institutions reshape market cycles

Key points:

Ark Invest argues that Bitcoin is moving into a more institutional and lower-volatility phase as ETFs and corporate treasury strategies absorb a growing share of supply.

Recent ETF inflows, improving spot demand, and Bitcoin’s climb above $97,000 suggest this structural shift is already influencing near-term market behavior.

News - Bitcoin’s market cycle is evolving as institutional vehicles increasingly dominate demand, reshaping both price behavior and investor participation.

According to Ark Invest, the asset is entering a new chapter defined less by belief-driven speculation and more by allocation decisions made through regulated products such as spot exchange-traded funds (ETFs) and digital asset treasury strategies.

Ark analyst David Puell said ETFs and treasury-focused firms have already absorbed roughly 12% of Bitcoin’s total supply, far exceeding early expectations. This structural demand has contributed to tighter supply conditions and a noticeable decline in volatility.

Puell noted that drawdowns have become less severe compared with prior cycles, potentially making Bitcoin more accessible to risk-averse investors over time.

Despite long-term holders continuing to take profits near cycle highs, institutional buying has acted as a counterbalance.

Ark maintains its long-range valuation framework, projecting Bitcoin prices between $300,000 and $1.5 million by 2030 across bear, base, and bull scenarios. The firm emphasizes that these targets reflect its internal model rather than short-term market forecasts.

Spot demand reinforces the institutional shift - Recent market action appears to support Ark’s thesis. Bitcoin climbed past $97,000 as risk appetite improved, even amid geopolitical uncertainty and regulatory friction in the United States.

Spot Bitcoin ETFs recorded $843 million in net inflows in a single day, with Ether ETFs adding another $175 million. Products from major asset managers have played a central role in attracting sustained institutional capital.

On-chain data and market analysis suggest that continued spot demand and ETF inflows are key to Bitcoin reclaiming higher psychological levels, including a potential move toward $100,000 if overhead supply is absorbed.

Gold comparisons and the liquidity debate - Some analysts have drawn parallels between Bitcoin’s ETF-driven demand and gold’s scarcity-led rally in recent years, arguing that persistent buying could eventually exhaust sellers.

Others caution that Bitcoin remains more sensitive to macro liquidity conditions than gold, making its path inherently more volatile.

BitMEX co-founder Arthur Hayes has framed Bitcoin’s outlook as a liquidity story, suggesting that expanding US dollar liquidity in 2026 could help the asset regain momentum relative to gold and technology stocks.

For now, the debate highlights a market in transition, where institutional structure is reshaping Bitcoin’s behavior even as macro forces continue to set the pace.

Coinbase pullback pauses CLARITY Act as industry divisions surface

Key points:

Coinbase withdrew support for the CLARITY Act, prompting the Senate Banking Committee to delay a key markup vote and pushing US crypto market structure reform into limbo.

Lawmakers and industry leaders remain split, with some framing the pause as late-stage negotiation while others warn the draft could leave the industry worse off than no bill at all.

News - Efforts to advance comprehensive US crypto market structure legislation hit another roadblock after Coinbase publicly withdrew its support for the CLARITY Act. The decision came just days before a scheduled Senate Banking Committee markup, which was subsequently postponed as disagreements over the bill’s latest draft intensified.

Coinbase CEO Brian Armstrong said the company could not support the legislation as written, arguing it would be “materially worse than the current status quo.”

His objections centered on provisions that would effectively ban tokenized equities, impose restrictions on decentralized finance, limit stablecoin rewards, and shift regulatory authority away from the Commodity Futures Trading Commission toward the Securities and Exchange Commission.

Coinbase said it would prefer no bill at all over one that entrenches these outcomes.

Senate Banking Committee Chair Tim Scott described the delay as a brief pause rather than a breakdown, saying lawmakers were continuing to engage with industry participants, regulators, and colleagues across party lines.

The Agriculture Committee, which also has jurisdiction over the bill, has similarly delayed its own markup, extending uncertainty around the timeline.

A bill paused, not abandoned - Despite Coinbase’s pullback, several lawmakers and crypto executives pushed back against narratives of collapse.

Senate supporters argued negotiations were entering a critical phase, while industry leaders from firms including Ripple, Kraken, and venture capital groups emphasized that imperfect legislation could still be improved through amendments.

The White House also weighed in, warning that abandoning the bill entirely could leave the US trailing other regions that are moving ahead with unified crypto frameworks.

Markets look past the policy noise - While the policy debate intensified, crypto markets showed limited immediate reaction.

Bitcoin continued trading near recent highs, supported by renewed ETF demand and improving liquidity, even as lawmakers delayed the markup. The price action suggested that investors were focused on broader market conditions and capital flows, with regulatory developments remaining a secondary consideration in the near term.

Eric Adams denies profiting as NYC token collapse sparks scrutiny

Key points:

Eric Adams has denied transferring funds or profiting from the NYC Token after the Solana-based asset plunged more than 80% shortly after launch.

On-chain data and conflicting liquidity explanations have fueled transparency concerns, even as Adams says proceeds are intended for nonprofit and education initiatives.

News - Former New York City mayor Eric Adams has rejected allegations that he benefited financially from the launch of the NYC Token, a politically branded cryptocurrency that briefly surged before suffering a steep collapse.

The token reached an estimated market capitalization of nearly $580 million before falling more than 80% in its early trading hours, leaving many participants with significant losses.

Adams’ spokesperson, Todd Shapiro, said Adams did not move investor funds and did not profit from the token’s debut, describing claims of wrongdoing as unsupported by evidence. Shapiro attributed the sharp decline to market volatility rather than insider activity, stressing that Adams’ involvement was never intended for personal gain.

The controversy intensified after on-chain analysts flagged unusual liquidity movements tied to wallets associated with the token’s deployment. Critics described the activity as resembling a liquidity drain, a charge Adams’ team disputes.

Statements from the NYC Token’s own social media account acknowledged that liquidity had been “rebalanced” during the volatile launch period, with additional funds later added to the pool, a clarification that appeared to conflict with Shapiro’s assertion that no funds were removed.

What the blockchain data shows - Blockchain analysis firms and data platforms continued to examine early trading activity. Reports highlighted that liquidity was removed near the token’s price peak and partially returned after prices had already dropped sharply.

Visualizations showed how losses were distributed among thousands of traders during the first hours of trading, reinforcing calls for clearer disclosures around wallet control and partner involvement.

Civic goals meet transparency questions - In interviews, including remarks aired on FOX Business, Adams said proceeds from the NYC Token are intended to fund nonprofit programs, scholarships for students in underserved communities, and educational efforts addressing antisemitism and anti-Americanism. However, details on how these funds would be managed or distributed have not been publicly disclosed.

Despite these stated goals, the episode has revived broader concerns around governance, disclosure, and accountability in politically affiliated crypto projects. Data from DEXScreener shows the token trading near $0.13 following its initial collapse, with scrutiny over its structure and transparency continuing.

More stories from the crypto ecosystem

‘Too many issues’- Coinbase CEO withdraws support for CLARITY Act

Bitcoin reclaims $97K – Why this BTC breakout still looks fragile

Ethereum – Here’s why this White House whale foresees +60% upside to $5.4K

Ethereum has crossed from vision to reality, says Vitalik Buterin

Can Chainlink sustain its breakout as whales shift $4.8M in LINK?

Interesting facts

A large share of crypto is now held by custodians, not individuals: Recent disclosures show that a growing portion of crypto assets are held through custodial entities such as exchanges, ETFs, and institutional platforms, meaning a significant amount of “on-chain wealth” is no longer directly controlled by end users.

Crypto has quietly become a salary rail: Freelancers and remote workers in tech and creative industries increasingly receive part or all of their compensation in crypto or stablecoins, using wallets as payment endpoints rather than investment tools.

NFTs failed as investments but succeeded as access tools: While most NFT traders did not make profits, many NFT projects have pivoted toward using tokens as access passes for events, memberships, or gated communities, shifting their role from speculative assets to digital credentials.

Top 3 coins of the day

Dash (DASH)

Key points:

DASH posted a sharp daily rally, surging to the mid-$80 zone after breaking out of a multi-week consolidation range.

The Parabolic SAR flipped below price and the MACD histogram expanded, while volume spiked alongside the move.

What you should know:

DASH recorded a strong upside move after spending several weeks consolidating between the $38–$42 range. The breakout unfolded with aggressive buying pressure, pushing the price toward the $84 level and marking one of its strongest daily candles in recent weeks.

The Parabolic SAR flipped below the candles, signaling a trend shift after a prolonged bearish phase, while the MACD crossover and expanding histogram reflected accelerating bullish momentum.

Volume surged well above recent averages, confirming that the move was backed by participation rather than low-liquidity drift. On the price structure, the $75–$78 region now stands as a key support zone, while $87–$90 remains the immediate resistance area to watch.

Beyond technicals, DASH benefited from a broader privacy coin rally, a short squeeze triggered by rapid upside acceleration, and renewed attention following the Alchemy Pay integration, which expanded global fiat on-ramp access. Together, these factors reinforced speculative interest and helped sustain momentum beyond the initial breakout.

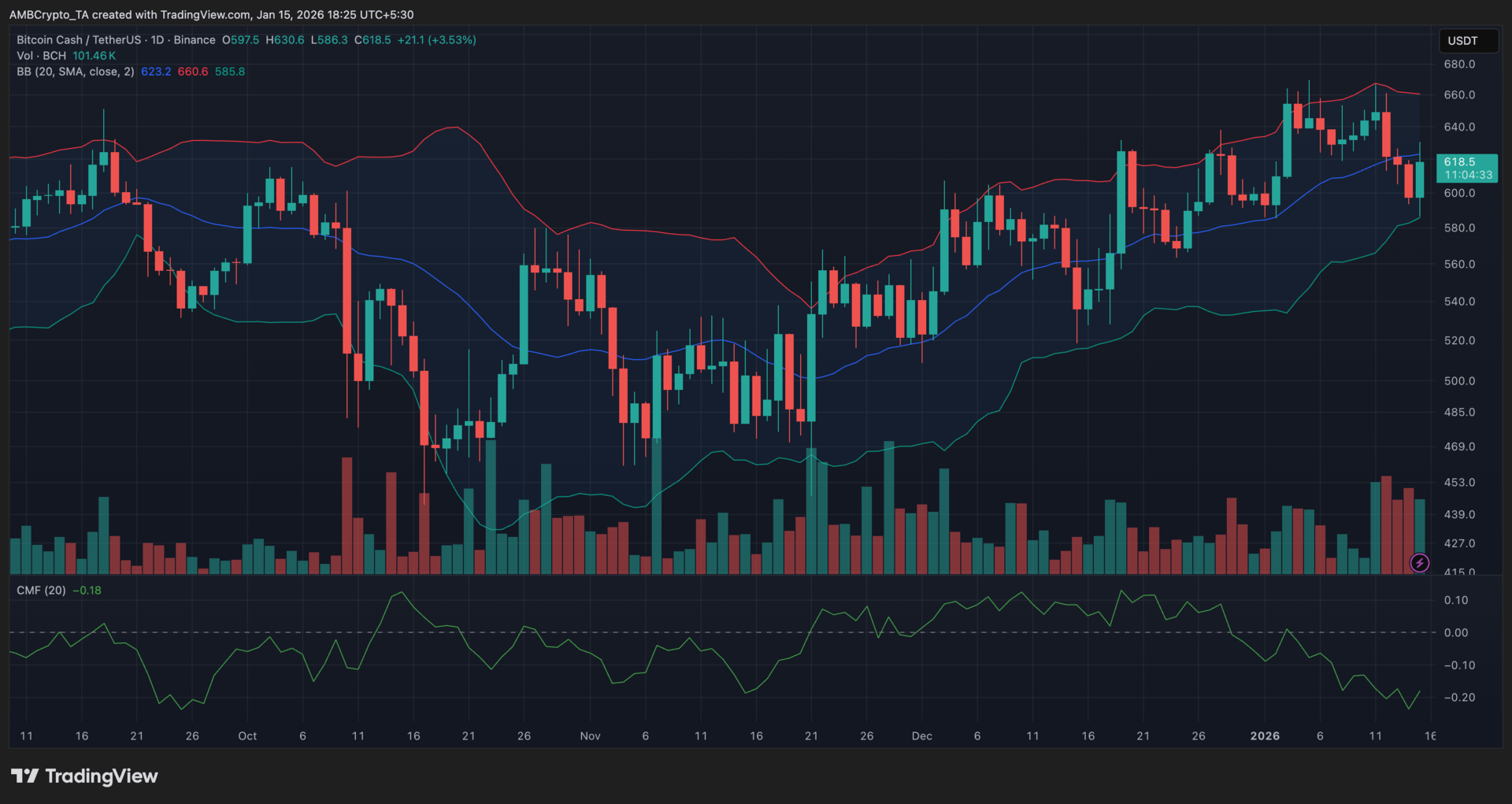

Bitcoin Cash (BCH)

Key points:

BCH was trading near $618 after posting a modest daily recovery, following a pullback from its recent highs around $650.

Price stabilized near the Bollinger Bands’ midline, even as CMF stayed negative, hinting at cautious participation.

What you should know:

Bitcoin Cash attempted to regain momentum after retreating from the upper end of its recent range. The price had earlier pushed close to the upper Bollinger Band near $660, but buying pressure cooled, pulling BCH back toward the middle band. Despite this, the structure held steady, suggesting consolidation rather than a sharp reversal.

The Chaikin Money Flow slipped to around -0.18, reflecting capital outflows during the pullback phase. This divergence indicated that conviction weakened even as price tried to stabilize. Meanwhile, trading volume eased after a prior spike near the highs, reinforcing the idea of short-term hesitation among traders.

From a levels perspective, support sits between $585 and $600, while resistance remains near $650–$660, where sellers previously stepped in. Zooming out of technicals, BCH appeared to benefit from rotation into established tokens, as well as whale accumulation narratives, which helped cushion downside pressure during broader market consolidation.

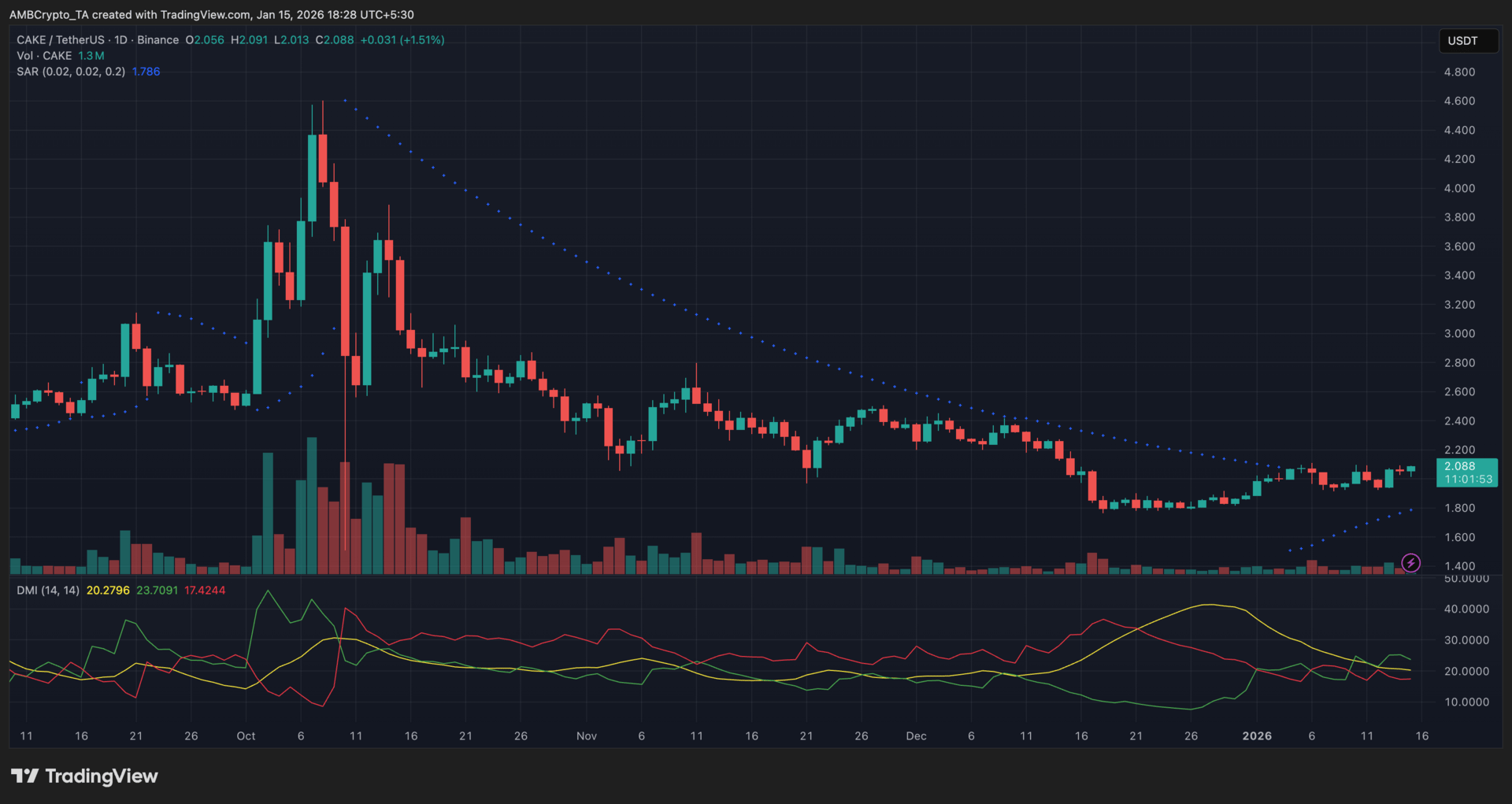

PancakeSwap (CAKE)

Key points:

CAKE posted modest gains over the last 24 hours, building on its recent weekly recovery after stabilizing near the $2.00 zone.

The Parabolic SAR flipped below price, while DMI reflected improving buyer control amid steady but restrained volume.

What you should know:

PancakeSwap’s price edged higher after establishing a base above $1.80–$1.85, with recent candles showing a controlled push beyond the $2.00 mark. The move lacked aggressive expansion but signaled improving short-term structure following weeks of consolidation.

Parabolic SAR dots shifted beneath the candles, suggesting bullish bias remains intact as long as price stays above dynamic trend support. Meanwhile, the DMI showed the +DI line holding above -DI, indicating buyers gradually regained control, though trend strength remained moderate rather than impulsive.

Volume stayed relatively muted compared to earlier peaks, reinforcing the view that the advance was driven by accumulation rather than speculative excess. Moreover, $2.00 now acts as immediate support, while the $2.20–$2.30 region stands as the next overhead supply zone to watch.

Beyond the chart, sentiment was supported by renewed discussion around a proposed CAKE supply reduction, alongside optimism tied to the BNB Chain Fermi upgrade, which may improve network efficiency and user activity for PancakeSwap.

All the stories worth knowing—all in one place.

Business. Tech. Finance. Culture. If it’s worth knowing, it’s in the Brew.

Morning Brew’s free daily newsletter keeps 4+ million readers in the loop with stories that are smart, quick, and actually fun to read. You’ll learn something new every morning — and maybe even flex your brain with one of our crosswords or quizzes while you’re at it.

Get the news that makes you think, laugh, and maybe even brag about how informed you are.

How was today's newsletter? |