- Unhashed Newsletter

- Posts

- $500M UAE deal sparks WLFI probe

$500M UAE deal sparks WLFI probe

Reading time: 5 minutes

Trump-linked WLFI draws House probe over $500M UAE deal

Key points:

US House Democrats have opened a formal investigation into a reported $500 million UAE-backed investment in World Liberty Financial (WLFI), a crypto venture linked to Trump’s family.

Lawmakers are examining potential conflicts of interest, national security risks, and the role of WLFI’s USD1 stablecoin in a separate $2 billion Binance transaction.

News - World Liberty Financial (WLFI), a crypto platform associated with Trump-linked entities, is facing congressional scrutiny following reports that an Emirati investment vehicle acquired a 49% stake in the firm shortly before U.S. President Donald Trump’s January 2025 inauguration. The inquiry is being led by Democratic Representative Ro Khanna, who has framed the probe around transparency, accountability, and possible violations of US law.

According to reporting cited by lawmakers, the stake was purchased by Aryam Investment 1, an entity tied to UAE national security adviser Sheikh Tahnoon bin Zayed Al Nahyan. Of the initial $250 million payment, $187 million was directed to Trump family-linked entities, with additional funds routed to affiliates connected to WLFI co-founders and the Witkoff family.

Khanna has sent a letter to WLFI CEO Zach Witkoff requesting 16 categories of records, including transaction agreements, capitalization tables, board appointments, and internal conflict-of-interest policies. He has also urged federal prosecutors to review the deal, citing concerns over foreign sovereign influence.

National security and AI policy concerns - A central focus of the investigation is whether the investment coincided with shifts in US policy on advanced artificial intelligence chip exports to the UAE. Lawmakers have pointed to Sheikh Tahnoon’s oversight of AI-focused firms such as G42 and MGX, which previously faced US restrictions over concerns tied to China.

In November 2025, US authorities approved export licenses for advanced AI chips to G42, prompting lawmakers to question whether commercial relationships intersected with national security decision-making.

Stablecoin activity and Binance links - The probe also extends to WLFI’s USD1 stablecoin, which was used to settle a $2 billion investment by MGX into Binance. Lawmakers are seeking records explaining why USD1 was selected, what revenues were generated, and whether the transaction financially benefited WLFI or its owners.

The inquiry further asks for communications related to the later presidential pardon of Binance founder Changpeng Zhao, as well as any internal discussions tied to export controls or foreign-linked entities.

WLFI has been given until March 1, 2026, to provide the requested documents, as lawmakers assess whether foreign investment, crypto infrastructure, and US policy decisions became improperly intertwined.

Bitcoin slips below $70K as conviction, liquidity come under pressure

Key points:

Bitcoin fell below $70,000 amid sustained selling pressure, with institutional outflows, miner distribution, and regulatory delays weighing on sentiment.

While some industry veterans see the drawdown as a structural reset, others warn of deeper downside risks tied to campaign selling and macro liquidity shifts.

News - Bitcoin’s slide below $70,000 has reignited debate over whether the market is undergoing a temporary reset or entering a more prolonged downturn. The recent selloff followed months of declining momentum, stalled regulatory progress, and a shift in investor attention toward artificial intelligence, while gold continued to rally as Bitcoin struggled to hold key levels.

Longtime holders and market veterans offered sharply contrasting views. Bitcoin maximalist Samson Mow described the drawdown as frustrating rather than extraordinary, arguing that Bitcoin’s scarcity remains intact despite short-term underperformance. Coinbase CTO Balaji Srinivasan echoed a long-term thesis, framing the decline as noise amid a broader shift toward code-based economic systems.

Others struck a more cautious tone. Market analyst Bob Loukas warned that while broader markets have not fully broken down, crypto has already moved past the stage where dips are easy buying opportunities. He stressed that deeper losses remain possible, even if spot Bitcoin is treated differently from speculative tokens.

Institutional selling and downside risk - Veteran trader Peter Brandt attributed Bitcoin’s weak price structure to what he called “campaign selling,” pointing to sustained distribution by miners and declining exposure among US spot Bitcoin ETFs. Onchain data showed miners increasing net BTC sales through January, while ETF balances fell from earlier peaks.

Analysts cited potential downside zones around $63,800, with further risk toward the $54,600 to $55,000 range if selling pressure persists. Some onchain metrics suggest Bitcoin is nearing a transitional phase between capitulation and accumulation.

Banks, analogies, and diverging narratives - Large financial institutions have also weighed in. Deutsche Bank said Bitcoin’s selloff reflects fading conviction rather than a broken market, driven by institutional outflows, thinner liquidity, and stalled progress on the Digital Asset Market CLARITY Act. The bank noted Bitcoin’s decoupling from both equities and gold, leaving it exposed in a risk-off environment.

Comparisons to past cycles have added fuel to the debate. "Big Short" investor Michael Burry drew parallels with the 2021–22 downturn, suggesting Bitcoin could face a deeper reset before stabilizing. Meanwhile, Stifel analysts outlined a far more bearish scenario, arguing that shifting dollar dynamics and tighter liquidity could push prices significantly lower.

ETF holders show resilience - Despite the downturn, ETF analysts noted that spot Bitcoin ETF holders have largely held their positions. Analysts said recent outflows remain modest compared to prior inflows, even as Bitcoin trades well below its recent highs. Some observers noted that bearish sentiment has become widespread, underscoring how fragile market confidence remains during the current drawdown.

Ethereum activity surges as selling, structural doubts cloud outlook

Key points:

Ethereum network activity has hit record highs, but historical patterns and rising exchange inflows suggest elevated downside risk rather than a clear bullish signal.

Vitalik Buterin’s ETH sales, whale distribution, and growing scrutiny of Ethereum’s layer-2 model have added to market uncertainty despite resilience in DeFi lending infrastructure.

News - Ethereum is seeing its most active period onchain, with transfer counts reaching record levels. While heightened activity is often associated with growing adoption, historical data suggests it can also coincide with market peaks. Similar spikes in 2018 and 2021 were followed by sharp ETH price reversals, raising concerns that the current surge may reflect heightened repositioning and elevated risk rather than organic expansion.

That risk appears reinforced by exchange inflow data. Large ETH deposits into exchanges rose sharply in early February as prices slipped below $2,300, signaling that selling pressure remains unresolved. Analysts noted that increased transaction volume often reflects investors repositioning or exiting, especially during periods of weakening confidence.

Market sensitivity intensified after Vitalik Buterin sold roughly 2,961 ETH worth about $6.6 million through a series of small swaps. The sales followed his earlier disclosure that withdrawals from his personal holdings were planned, with proceeds earmarked to support privacy-focused infrastructure and Ethereum Foundation initiatives during a period of financial restraint.

Whales, hodlers, and conviction shifts - Onchain data showed that large holders and long-term investors began reducing exposure around the same time. Whale balances declined by roughly 140,000 ETH after February 3, while HODLer net position change turned negative for the first time in weeks. Together, these moves suggested selling activity picked up across multiple investor cohorts.

At the same time, Buterin sharpened his criticism of Ethereum’s layer-2 ecosystem, arguing that many rollups have become repetitive and overly reliant on branding rather than meaningful integration. He said Ethereum’s improving base layer capacity weakens the case for copycat networks, urging builders to focus on tighter integration or application-specific designs.

DeFi resilience offers partial counterweight - Not all signals were bearish. Ethereum-based lending surpassed $28 billion in active loans, led by Aave, which processed more than $140 million in automated liquidations during a late-January market crash without downtime or bad debt. The episode highlighted the growing resilience of Ethereum’s DeFi infrastructure, even as price momentum and sentiment remain under pressure.

Bhutan moves $22M in Bitcoin as markets slide below $72K

Key points:

Bhutan transferred roughly $22 million worth of Bitcoin over the past week to market makers, exchanges, and new wallet addresses as BTC slipped toward $70,000.

Analysts say the transactions align with Bhutan’s established treasury operations, though the timing has drawn attention amid broader market stress.

News - Bhutan has moved approximately $22.4 million worth of Bitcoin from government-linked wallets over the past week, according to blockchain data from Arkham Intelligence. The transfers were executed through Druk Holding Investments, the country’s sovereign investment arm, and included two notable transactions: 184.03 BTC valued at about $14.09 million and 100.82 BTC worth roughly $8.31 million.

A portion of the Bitcoin was sent directly to addresses associated with QCP Capital, while other funds moved to new wallets and exchange-linked destinations. The activity marked Bhutan’s first notable wallet movement in roughly three months and came as Bitcoin fell below $72,000, extending its decline to more than 40% from its October 2025 peak.

Market observers offered mixed interpretations. Some analysts said the transfers may signal structured trades or liquidity management rather than outright selling, noting that the amounts were smaller than Bhutan’s typical liquidation tranches of around $50 million. Others pointed out that moving Bitcoin to market makers and exchange-linked wallets often precedes sales, even if immediate liquidation is not confirmed.

Treasury strategy under scrutiny - Bhutan has quietly accumulated Bitcoin since 2019 through state-backed mining powered by hydroelectric energy. At its peak, the country held over 13,000 BTC, but its stash has since fallen to around 5,700 BTC, placing it among the top sovereign holders globally.

Arkham data shows Bhutan’s tracked crypto portfolio is now valued near $412 million, down sharply from earlier highs due to both sales and market depreciation.

Analysts said the recent transfers reflect a broader shift among large holders, including sovereign entities, toward treating Bitcoin as an active balance sheet asset during periods of volatility rather than a static reserve. Observers will be watching for further wallet movements as market conditions remain volatile.

More stories from the crypto ecosystem

Is ‘bailing out Bitcoin’ possible? U.S. Treasury Secretary says…

Is there any truth to ‘FTX 2.0’ accusations directed at Binance?

Why is Bitcoin’s price down today? U.S tech slump, ETF outflows & more

Solana: Here’s why SOL’s slip below $100 signals a textbook bear trap

XRP barely reacts as Ripple Prime integrates Hyperliquid — Why?

Interesting facts

Europe’s anti-money-laundering agency is gearing up crypto oversight by 2028: The European Union’s Anti-Money Laundering Authority (AMLA) is set to become fully operational in 2028 with a mandate to supervise 40 high-risk financial institutions and explicitly include crypto asset risks in its framework, signaling a more unified EU-wide approach to illicit finance prevention.

UBS is exploring crypto investing for private banking clients: Swiss banking giant UBS is reportedly planning to offer crypto investment options to select private banking clients, indicating continued interest from traditional finance firms to integrate digital assets into wealth management portfolios.

Mastercard and Chainlink teamed up to simplify on-chain crypto purchases: In 2025, Mastercard partnered with Chainlink to enable cardholders to purchase cryptocurrencies directly on-chain via decentralized exchanges, aiming to lower the barriers for mainstream users entering digital asset markets.

Top 3 coins of the day

MYX Finance (MYX)

Key points:

MYX was trading at $6.16 at press time, posting a modest daily gain while continuing to outperform a broadly weaker crypto market.

The 9-day SMA continued to track closely beneath price, while the EWO remained green, reflecting sustained bullish momentum rather than a fresh expansion.

What you should know:

MYX extended its steady advance after consolidating above the $5.80 zone, with price continuing to respect the rising 9-day SMA. The short-term average acted as dynamic support during minor pullbacks, allowing MYX to maintain its broader upward structure without sharp volatility.

Momentum conditions remained stable rather than reactive. The EWO histogram stayed in positive territory, a state it has held since late November, signaling that bullish momentum persisted instead of flipping anew. Recent histogram bars flattened slightly, suggesting controlled strength rather than aggressive acceleration.

Volume patterns supported this view. While no sustained spike accompanied the latest move, periodic bursts during prior rallies indicated selective participation rather than speculative excess. This helped MYX avoid sharp retracements even as broader market sentiment softened.

For now, $5.80 remains the key support zone, while the $6.40 to $6.60 area stands as immediate resistance. As long as price holds above the short-term average and momentum remains positive, the trend structure stays intact, though upside follow-through may depend on renewed volume expansion.

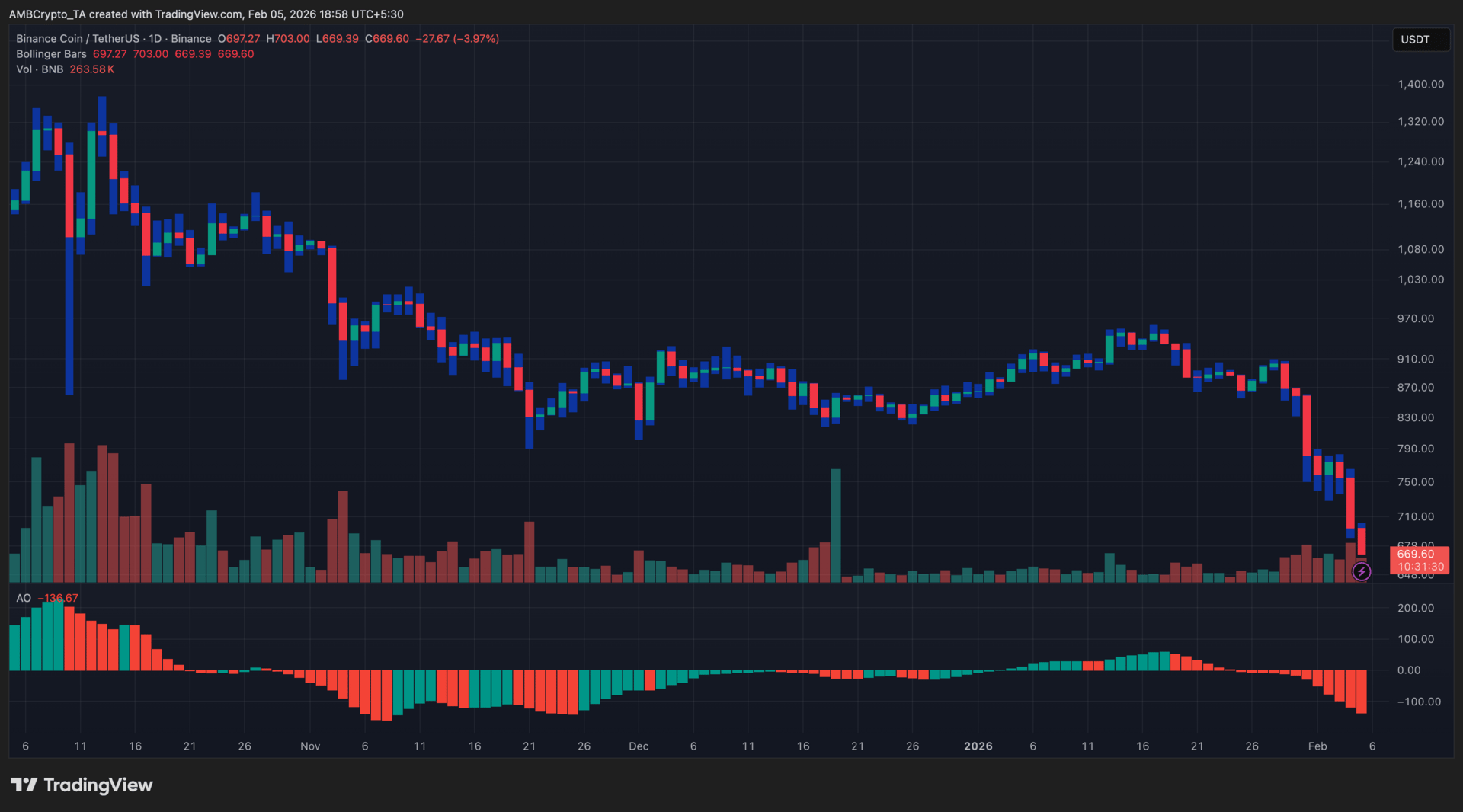

BNB (BNB)

Key points:

BNB slid to $669 after a sharp sell-off, extending its recent downside move as selling pressure accelerated across the broader market.

The Awesome Oscillator stayed deeply negative, while rising sell-side volume confirmed that bearish momentum remained dominant rather than stabilising.

What you should know:

BNB’s decline unfolded as part of a broader liquidation-driven market move rather than a token-specific breakdown. Price pushed decisively toward the lower Bollinger region, with candles clustering away from the mid-range, reflecting sustained downside pressure instead of a mean-reversion setup.

The Awesome Oscillator remained below the zero line and expanded further into negative territory, reinforcing that bearish momentum had already been in place and intensified during the latest drop.

Volume expanded alongside the sell-off, pointing to forced unwinds rather than low liquidity drift. From a market perspective, the move aligned with a wider risk-off wave that hit high-beta assets harder, as leveraged positions were flushed and sentiment deteriorated rapidly.

Going forward, the $650 to $670 zone acts as immediate support, where selling pressure may begin to stabilize. On the upside, resistance sits near $700 to $720, an area that previously capped price during consolidation and remains a key zone to reclaim for any recovery attempt.

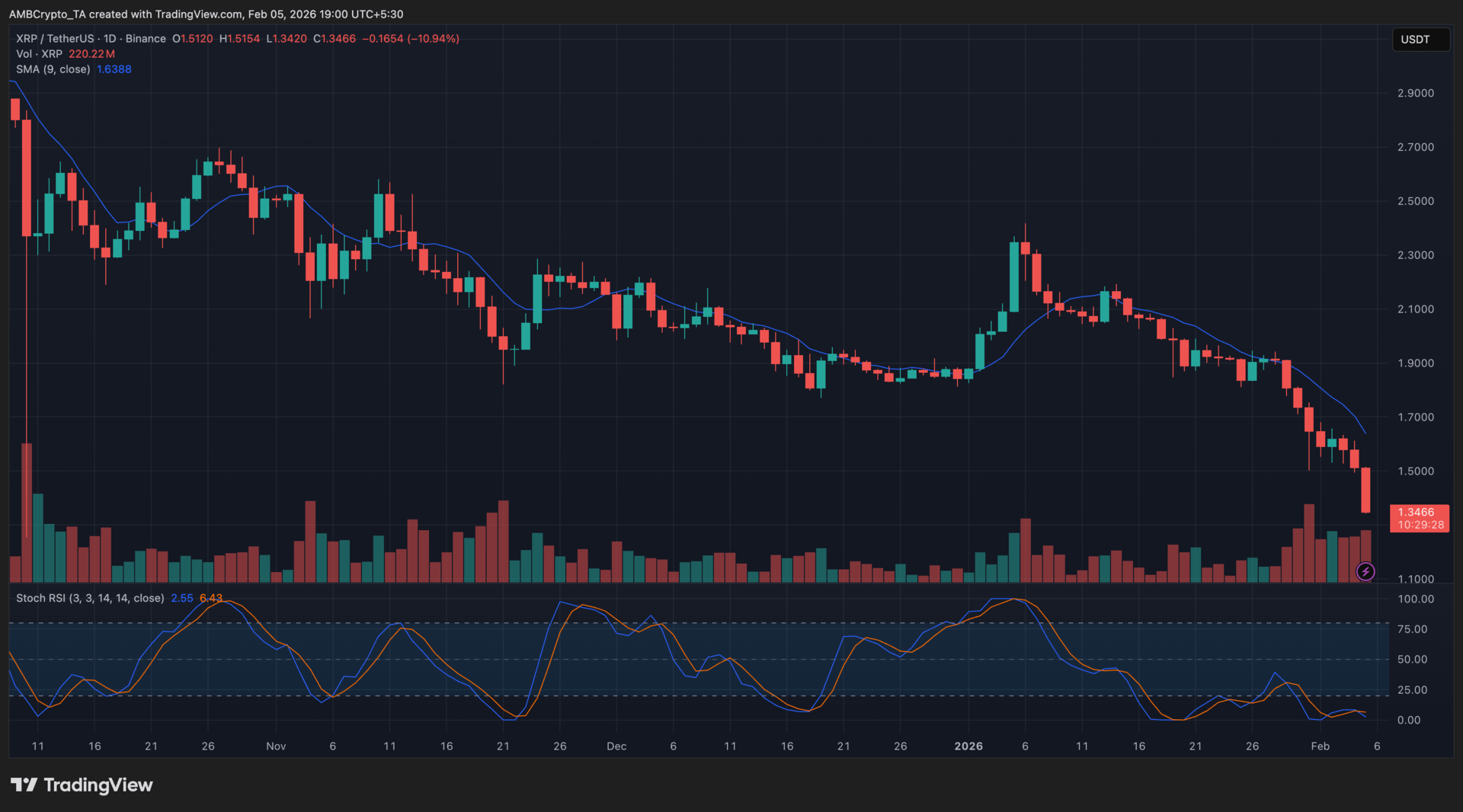

XRP (XRP)

Key points:

At press time, XRP was trading at $1.34, marking a sharp double-digit decline over the last 24 hours.

The price remained below the 9-day SMA, while the Stochastic RSI stayed pinned in oversold territory, reflecting sustained downside pressure rather than a relief bounce.

What you should know:

XRP extended its sell-off as heavy liquidation flows swept across the broader market. The decline coincided with a sharp rise in leveraged unwinding, with global crypto liquidations accelerating alongside Bitcoin’s drop and spilling over into high-beta altcoins. XRP’s volume expanded into the breakdown, particularly during the loss of the $1.50 region, confirming aggressive distribution rather than low-liquidity drift.

On the chart, XRP continued trading below the 9-day SMA, reinforcing short-term trend weakness. The Stochastic RSI remained deeply oversold without a clear bullish crossover, signaling that sellers retained control despite stretched conditions. This behavior suggested the move was driven by forced exits rather than opportunistic dip-buying.

At current levels, the $1.30 zone acts as immediate support, while any recovery attempt faces resistance near $1.50, followed by the descending 9-day SMA. A stabilization in broader market leverage would be required before XRP can attempt a sustained rebound.

What do these names have in common?

Arnold Schwarzenegger

Codie Sanchez

Scott Galloway

Colin & Samir

Shaan Puri

Jay Shetty

They all run their businesses on beehiiv. Newsletters, websites, digital products, and more. beehiiv is the only platform you need to take your content business to the next level.

🚨Limited time offer: Get 30% off your first 3 months on beehiiv. Just use code PLATFORM30 at checkout.

How was today's newsletter? |