- Unhashed Newsletter

- Posts

- Billionaire Dalio’s portfolio warning: 15% BTC?

Billionaire Dalio’s portfolio warning: 15% BTC?

Reading time: 5 minutes

Ray Dalio’s 15% Bitcoin pivot: Hedge or hype?

Key points:

Ray Dalio now recommends allocating up to 15% of a portfolio in Bitcoin or gold, up from his previous 1–2% suggestion.

While still favoring gold, he cited Bitcoin’s limited supply and utility amid a looming U.S. debt spiral and currency devaluation fears.

News - Hedge fund titan Ray Dalio has dramatically revised his stance on Bitcoin, suggesting investors place 15% of their portfolio in BTC or gold to hedge against what he describes as a growing “debt doom loop” in the U.S.

Speaking on the Master Investor podcast, Dalio emphasized that while he still prefers gold over Bitcoin, the world’s largest cryptocurrency is now a viable hedge against currency devaluation, given its limited supply and global accessibility. His updated portfolio strategy is a major departure from his earlier 2022 view, which capped crypto exposure at just 1–2%.

Dalio’s remarks come amid escalating concerns over the U.S. debt burden. The national debt now stands at over $36.7 trillion, and the Treasury Department expects to issue $12 trillion in new Treasuries over the next year. This sharp uptick in government borrowing is expected to devalue the dollar and rattle equity markets.

Dalio’s concerns about Bitcoin remain - Despite backing Bitcoin as a store-of-value asset, Dalio voiced skepticism about its viability as a reserve currency. He cited blockchain transparency, potential code vulnerabilities, and the risk of government surveillance as limitations.

“Governments can see who is doing what transactions,” Dalio said, warning that such transparency might deter central banks from embracing BTC on a sovereign level.

MARA bets big on BTC accumulation - Dalio’s caution hasn’t slowed institutional appetite. Bitcoin miner MARA Holdings, the second-largest public BTC holder, just raised $950 million to add even more Bitcoin to its treasury. With 50,000 BTC worth nearly $6 billion already in reserve, MARA is doubling down on a strategy Dalio now views as essential in the current macro environment.

Ethereum treasuries boom: SharpLink, BitMine, and institutional giants fuel ETH's ascent

Key points:

SharpLink now holds over $1.6B in ETH, while BitMine and others aim to corner 10% of supply.

Standard Chartered projects a 10x rise in corporate holdings, citing staking yield and DeFi leverage as key drivers.

News - Ethereum’s institutional revolution is accelerating. SharpLink Gaming revealed it acquired 77,209 ETH last week, pushing its total holdings to 438,190 ETH (valued at $1.68 billion). BitMine Immersion, another treasury giant, has surpassed $2 billion in ETH, with a goal of staking 5% of Ethereum’s total supply.

ARK Invest, led by Cathie Wood, also deepened its bet, purchasing $18.6 million worth of BitMine shares. The trend suggests that Ethereum is emerging as a corporate treasury favorite, mirroring Bitcoin’s path, but with higher yield potential.

Treasuries set the pace - According to Standard Chartered, public companies now hold 1% of all ETH, a figure that could surge to 10%. The pace of accumulation has doubled that of Bitcoin over the past two months. Geoff Kendrick from the bank argued that ETH treasuries offer advantages in staking returns, DeFi access, and regulatory positioning, outpacing Bitcoin’s utility in several areas.

BitMine echoed this sentiment by projecting an “implied value” of $60,000 per ETH, based on institutional modeling. Though speculative, the projection underscores the aggressive positioning of ETH-focused firms.

But risks linger - Not everyone is convinced the ETH treasury playbook is foolproof. Analysts at Bernstein flagged liquidity constraints and smart contract vulnerabilities as serious risks. While staking offers yield, delays in unstaking and exposure to complex DeFi systems like Eigenlayer introduce operational challenges.

Still, Ethereum’s price surge, up 57% in July to over $3,900, mirrors the rising conviction. With Strategy-style ETH plays becoming the new norm, companies like SharpLink and BitMine may be reshaping treasury management for the Web3 era.

Final word - As ETH crosses key resistance levels, corporate buyers aren’t just holding, they’re shaping the asset’s future trajectory. The question now isn’t whether institutions believe in Ethereum. It’s how much they plan to own.

Stablecoin surge sets off global tug-of-war over control

Key points:

Stablecoin market cap hit a record $272B as Google search interest peaked after the GENIUS Act passed in the U.S.

The growth has triggered contrasting global responses, from ECB sovereignty concerns to Korea’s legislative clash and Hong Kong’s new registry.

News - Stablecoins are in the spotlight again, reaching new highs in both search trends and market capitalization. According to Bitwise and Google Trends, global interest in stablecoins surged to an all-time high after the passage of the U.S. GENIUS Act in July. Market cap rose to $272 billion, with over 98% of supply pegged to the U.S. dollar and Tether holding a dominant 60% share.

Bitwise called the trend “parabolic,” while Ethereum treasury firm SharpLink joked, “You can’t spell ‘stablecoins’ without ‘parabolic’.” Crypto analyst “The DeFi Investor” suggested stablecoins could onboard the first billion users on-chain.

ECB fears dollar dominance - In Europe, however, regulators view this growth with caution. Jürgen Schaaf, an adviser to the European Central Bank, warned that the rising use of U.S.-dollar stablecoins could weaken the ECB’s ability to manage monetary policy. He advocated for stronger support for euro-backed stablecoins and the development of a digital euro to protect European sovereignty.

Asia pushes for regulation and control - Across Asia, governments are responding with regulatory clarity. Hong Kong finalized its stablecoin framework, which will take effect on August 1. The HKMA warned that no licenses have yet been issued and urged the public to avoid hype and scams, especially as a public registry for licensed issuers goes live.

Meanwhile, South Korea is witnessing a political showdown over stablecoin regulation. The ruling and opposition parties have submitted rival bills that differ on key aspects such as interest payments and reserve asset protection. Both proposals aim to establish Korea as a global crypto hub while ensuring financial oversight and consumer safeguards.

CoinDCX shuts down Coinbase acquisition rumors after $44M hack

Key points:

CoinDCX CEO Sumit Gupta denied reports of a potential acquisition by Coinbase, calling it a rumor and reiterating the exchange is not for sale.

The denial came shortly after CoinDCX suffered a $44.2 million hack, prompting a recovery bounty initiative and renewed focus on its India-first mission.

News - India’s largest crypto exchange CoinDCX has refuted claims that it is in advanced talks to be acquired by Coinbase. CEO Sumit Gupta posted on X to address the speculation, stating the company is “super focused” on India’s crypto journey and is “not up for sale.”

This direct response came after a report from Mint suggested that Coinbase was planning to acquire CoinDCX for under $1 billion. If true, it would have marked a sharp drop from CoinDCX’s $2.2 billion valuation at the height of the 2021 bull run.

The speculation followed a major security breach on July 18, when hackers exploited one of CoinDCX’s operational wallets and drained $44.2 million in minutes. Gupta clarified that no user funds were compromised, as all customer assets remained safe in cold storage.

Context: What triggered the rumors - Mint’s report cited unnamed sources claiming Coinbase was looking to consolidate its stakes in CoinDCX and rival CoinSwitch. However, both exchanges have denied any active talks. CoinSwitch reaffirmed its independence, adding that healthy competition benefits users and the wider ecosystem.

Coinbase, which became FIU-registered in India in March, declined to comment on speculation but reaffirmed its global investment ambitions.

Security breach and recovery program - In response to the hack, CoinDCX launched a bounty initiative offering white hat hackers up to 25% of any recovered funds. The company reiterated its commitment to transparency and continued focus on building resilient infrastructure in India’s fast-evolving crypto sector.

More stories from the crypto ecosystem

Interesting facts

New Hampshire became the first U.S. state to launch a crypto reserve, authorizing up to 5% of public funds in digital assets under HB 302, setting a precedent for state-level crypto allocation.

Meme tokens named after Hulk Hogan and Ozzy Osbourne spiked by up to 122,000% after their deaths (July 2025), underscoring the speculative volatility of celebrity-linked crypto mania.

Launched by Promsvyazbank and A7 to bypass western sanctions, Russia’s ruble‑backed stablecoin A7A5 has processed more than $40 billion in cross‑border transfers in just weeks, with daily volumes exceeding $1 billion, showing how stablecoins can reshape international payments.

Top 3 coins of the day

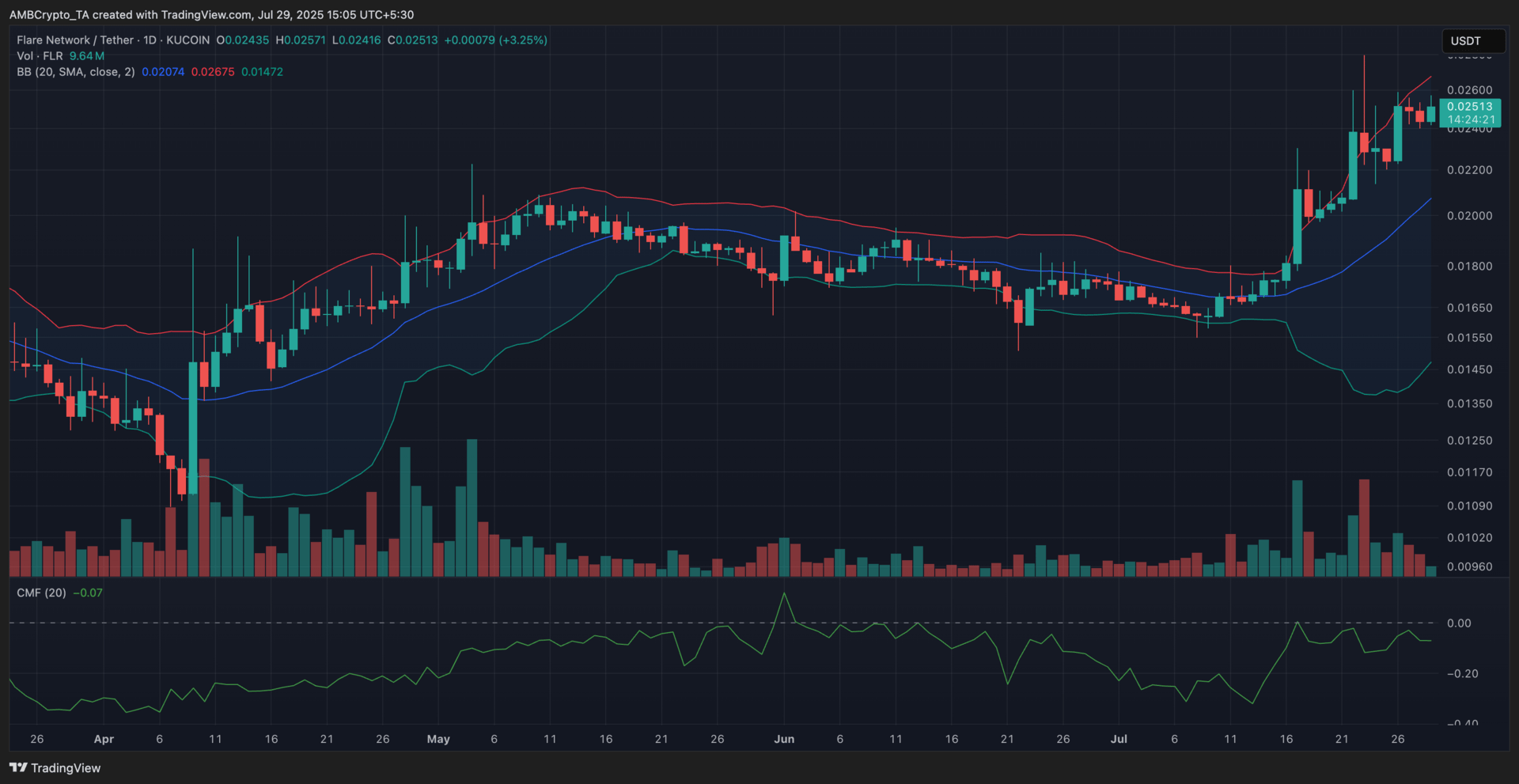

Flare (FLR)

Key points:

FLR changed hands at $0.025 at the time of writing, marking a 3.25% increase in daily value.

The price hovered near the upper Bollinger Band, while the CMF slipped into negative territory at -0.07, hinting at weakening accumulation.

What you should know:

Flare extended its upward momentum and remained range-bound above the $0.024 zone, reflecting short-term buyer interest. The coin continued to trade close to the upper Bollinger Band, though some candles began to compress, suggesting a possible slowdown in volatility. The Chaikin Money Flow (CMF) dropped slightly below the neutral line, indicating capital outflows despite the recent rally. Volume stayed relatively modest compared to the surges seen earlier in July, reinforcing the possibility of a consolidation phase unless fresh bullish triggers appear. One such driver could be the upcoming FAssets Incentive Program, which goes live on July 31 and promises 2.2 billion FLR in liquidity and participation rewards, potentially boosting user engagement and token demand across DeFi platforms. If bulls maintain control, the next resistance to monitor lies at $0.027, while $0.023 may act as a short-term support zone.

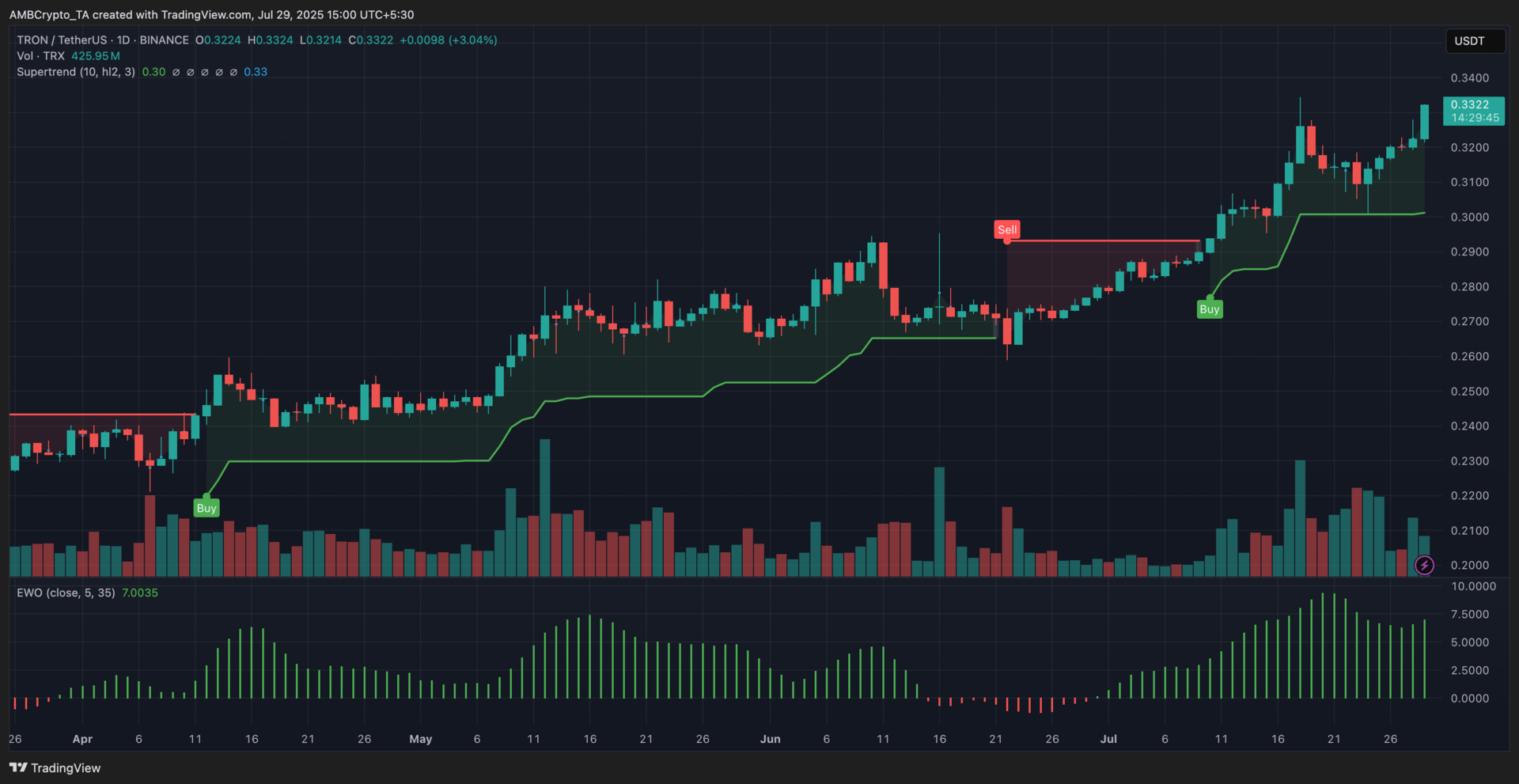

TRON (TRX)

Key points:

TRX climbed to $0.33, marking a 3.04% daily rise and continuing its strong bullish stretch from the previous week.

The EWO remained firmly positive, while the Supertrend indicator continued flashing a clear buy signal.

What you should know:

TRON’s price maintained its upward trajectory after breaking past the $0.32 resistance level, with bullish momentum supported by Tron Inc.'s announcement of a $1 billion SEC-registered securities offering. The offering is intended to fund TRX accumulation, mirroring MicroStrategy’s Bitcoin playbook and signaling institutional confidence in the network. On the technical front, a steady increase in volume further validated buyer strength, while the Elliott Wave Oscillator (EWO) maintained strong bullish bars for the fourth consecutive session. The Supertrend indicator held its green buy signal throughout July, reinforcing the ongoing upward momentum. If the current momentum sustains, TRX could challenge the $0.34 level as the next major resistance, while immediate support rests at $0.31.

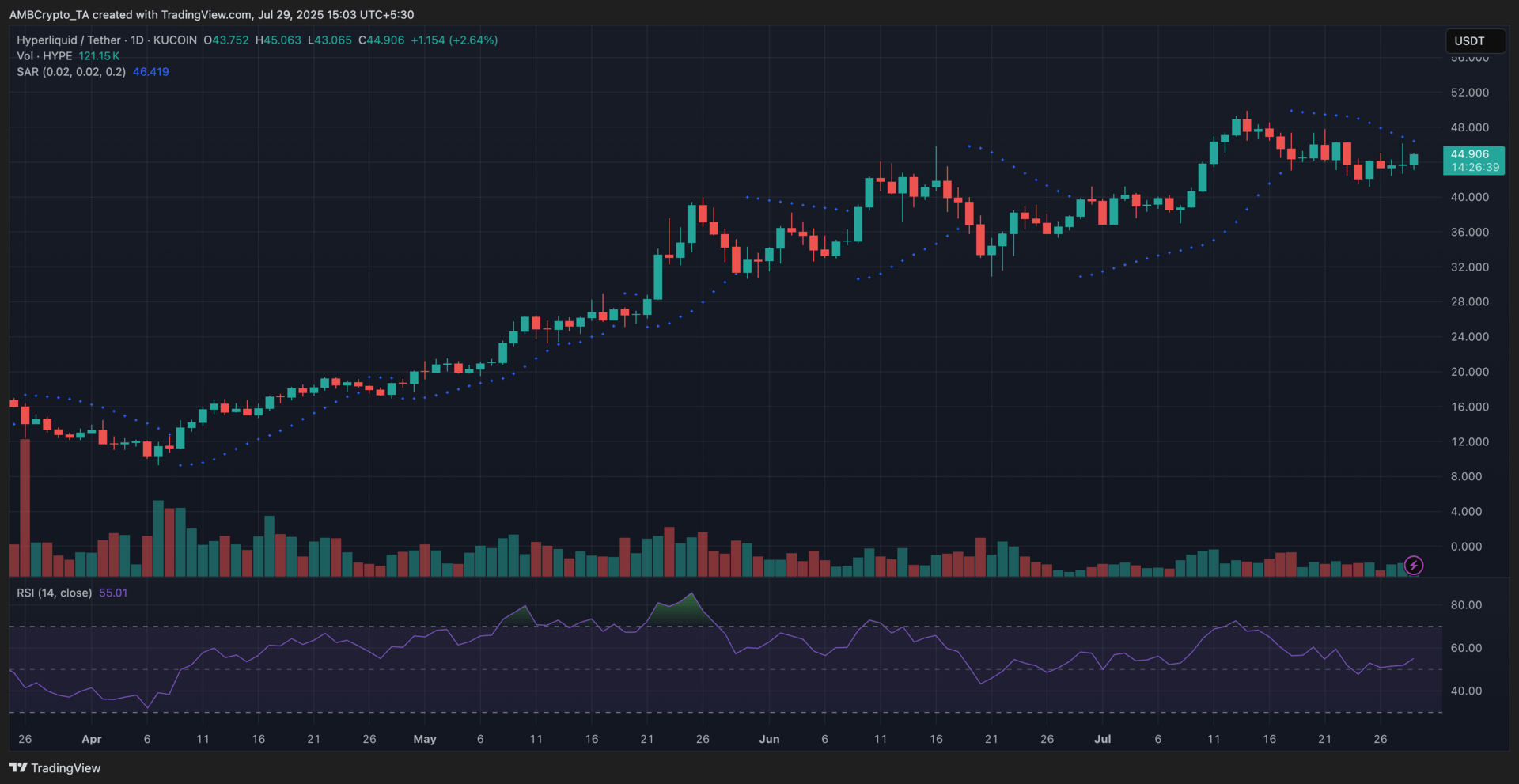

Hyperliquid (HYPE)

Key points:

HYPE stood at $44.90 at the time of writing, logging a 2.64% increase since its previous daily close.

The Parabolic SAR remained above the candles, while the RSI climbed to 55.01, hinting at early bullish attempts amid lingering caution.

What you should know:

HYPE’s latest bounce reflected renewed buying pressure as the token climbed above the $44 mark. This uptick coincided with a broader short squeeze risk tied to Abraxas Capital’s $800 million in leveraged crypto shorts, including substantial exposure to HYPE. With $106 million in unrealized losses, the threat of cascading liquidations may be fueling speculative upside from long-positioned traders. On the technical front, the Relative Strength Index (RSI) pushed above neutral, suggesting growing momentum without overbought conditions. Meanwhile, the Parabolic SAR stayed above the price, suggesting that bearish pressure had not fully faded, even as bulls attempted to regain control. If bulls extend control, the next resistance lies at $45.52, while support may hold near $43.05.

How was today's newsletter? |