- Unhashed Newsletter

- Posts

- Binance hit with billion-dollar lawsuit

Binance hit with billion-dollar lawsuit

Reading time: 5 minutes

Binance faces $1 billion terror financing lawsuit as Prestige launch highlights contrasting priorities

Key points:

A $1 billion lawsuit filed by 306 victims of the October 7 Hamas attack accuses Binance of enabling terror financing through off-chain transfers and compliance gaps.

The launch of Binance Prestige, a new service for affluent investors, arrives at a time when the exchange faces heightened legal scrutiny.

News - Binance is confronting significant legal pressure after a federal lawsuit filed in North Dakota accused the exchange of facilitating terror financing linked to the October 7, 2023 Hamas attack.

The civil action, brought by 306 victims and their families, names Binance, founder Changpeng Zhao, and executive Gunagying Chen.

According to the complaint, the exchange enabled transactions for Hamas, Hezbollah, Palestinian Islamic Jihad, and Iran’s Islamic Revolutionary Guard Corps through off-chain transfers and limited compliance oversight.

Court filings cite accounts tied to a Hezbollah commander’s son and a Palestinian Islamic Jihad operative. The lawsuit also references internal messages allegedly showing staff were aware they handled unlawful funds.

North Dakota was selected as the venue because certain transactions reportedly originated from United States IP addresses connected to Hamas-related operatives.

The lawsuit comes shortly after President Donald Trump pardoned Zhao, which voided his criminal conviction and canceled his four-month prison sentence. A recent Senate resolution criticized the pardon, citing the seriousness of the compliance failures involved.

Allegations and responses - Ray Youssef, CEO of Noones, has alleged that Binance seized funds from Gazan users and provided customer identification data to Israel’s military. He continues to lead a boycott campaign based on these claims.

Binance disputes the allegations and highlights United States Treasury statements that cryptocurrency is not widely used by Hamas.

Prestige launches during a sensitive period - Amid these developments, Binance has introduced Binance Prestige, a high touch service designed for family offices, affluent individuals, and institutional clients. The offering includes personalized onboarding, enhanced fiat access, structured products, custody solutions, and reporting tools.

While the launch has not drawn direct criticism yet, its timing places attention on how Binance is expanding offerings for wealthy investors even as it navigates one of the most consequential legal challenges in its history. The parallel rollout underscores the different pressures and priorities the exchange is balancing across its global operations.

Thailand cracks down on Sam Altman’s World, demands erasure of 1.2M iris scans

Key points:

Thailand’s data protection regulator ordered World to halt biometric collection and delete 1.2 million iris scans for violating the country’s Personal Data Protection Act.

The move followed an SEC and cybercrime raid that led to multiple arrests and renewed concerns over global restrictions on World’s digital ID model.

News - Sam Altman’s digital identity project World is under renewed pressure after Thailand’s Personal Data Protection Commission ordered it to stop collecting biometric data and erase the records of 1.2 million users.

Officials said the company’s practice of offering WLD tokens in exchange for iris scans violated Thailand’s Personal Data Protection Act, along with concerns over potential third party transfers of sensitive information.

Thailand had been one of World’s most active markets, with 102 Orb devices operating locally. Verified users received 52 WLD tokens a month, valued at about $0.63 each. The deletion order could impact monthly token income for the 1.2 million verified users in Thailand.

World Thailand said it has complied with the suspension while insisting it had operated transparently.

The order follows a joint raid in October by the Thai SEC and Cyber Crime Investigation Bureau, where authorities arrested several employees and alleged that World was operating an unlicensed digital asset business. Penalties can reach five years in prison along with significant fines under Thai law.

Global pressure mounts - Thailand’s action adds to a growing list of regions restricting World, including Colombia, Spain, Brazil, Kenya, Hong Kong, and Germany. Regulators across these jurisdictions have flagged concerns about transparency, consent, and risks associated with trading biometric data for financial rewards.

Local pushback and economic impact - Opas Cherdpunt of M Vision Plc, which installs Orb devices in Thailand, is preparing a petition with 500 affected users to challenge the deletion order.

Critics argue that removing 1.2 million iris templates could cause significant financial losses for users who rely on monthly token rewards. Thai officials maintain that enforcement is necessary to prevent data misuse and protect citizens under national privacy laws.

Key points:

JPMorgan has filed a high-risk structured note linked to BlackRock’s IBIT ETF, offering 16% returns by 2026 or amplified gains by 2028, while exposing investors to losses if IBIT drops more than 30%.

As Wall Street shifts toward engineered Bitcoin derivatives, governments and regulators are pulling in different directions, from Texas buying IBIT to Spain’s proposed 47% crypto tax and renewed quantum security concerns.

News - JPMorgan is road-testing a new way for institutions to ride Bitcoin’s four-year halving rhythm. The bank has filed a structured note tied to BlackRock’s IBIT spot Bitcoin ETF that is explicitly designed around BTC’s historic cycle of mid-term drawdowns and halving year rallies.

If IBIT hits a preset price by the end of 2026, investors receive a minimum 16% return. Moreover, if the ETF remains below that level and then rallies strongly into 2028, investors can earn around 1.5 times their original stake with no stated cap on upside.

The trade-off is severe. Once the underlying ETF falls more than 30%, losses begin to track the decline, and JPMorgan warns that investors could lose a large portion or even all of their principal.

The design mirrors traditional equity structured products that use barriers, auto call features, and leveraged payoffs, signaling a shift from simple spot ETF exposure to Wall Street-style Bitcoin derivatives aimed at yield-seeking institutional clients.

States and regulators position around Bitcoin - While banks package halving-linked products, public policy is splintering.

In Spain, a junior ruling party has proposed raising the top tax rate on individual crypto gains to 47% and classifying all digital assets as seizable, a move critics describe as an attack on Bitcoin. By contrast, Japan’s financial watchdog is pushing to cut crypto taxes to a flat 20% to compete with other markets.

In the United States, Texas has bought $5 million of IBIT and earmarked another $5 million for self-custodied Bitcoin as part of its emerging reserve strategy, joining Wisconsin and other institutional IBIT buyers.

Quantum risk stays long-term but real - Saudi Aramco’s deployment of a 200 qubit quantum computer has refocused attention on a long-term threat often called Q Day, the point at which powerful machines could forge signatures and drain Bitcoin wallets.

Experts note that today’s devices, including the new Pasqal system, remain far below the threshold needed to break Bitcoin’s cryptography, yet warn that rapid advances give quantum computing a non-trivial probability of becoming a major risk over the long run.

Crypto bull Kevin Hassett emerges as top Fed chair contender, Coinbase ties stir conflict fears

Key points:

Kevin Hassett, head of the White House National Economic Council and key figure in Trump’s digital asset working group, has reportedly moved to the front of the race to replace Jerome Powell as Federal Reserve chair.

Hassett’s past advisory role at Coinbase and his $1 million to $5 million COIN stake are fueling conflict of interest concerns as markets weigh the impact on interest rates, the dollar, and crypto regulation.

News - Kevin Hassett has vaulted to the top of President Donald Trump’s shortlist to replace Jerome Powell as Federal Reserve chair when Powell’s term ends in May 2026.

Hassett, a longtime Trump ally and director of the National Economic Council, is viewed inside the administration as more willing to cut interest rates quickly, aligning with Trump’s push for lower borrowing costs to support growth, markets, and digital assets.

Treasury Secretary Scott Bessent has been running a structured search since the summer and recently completed second round interviews with Hassett and other contenders, including Christopher Waller, Kevin Warsh, Michelle Bowman, and BlackRock executive Rick Rieder.

Bessent has signaled there is a strong chance Trump will announce his choice before Christmas, though the decision could still slip into early 2026.

Prediction markets now give Hassett the highest implied probability of securing the nomination, reflecting his growing lead over rivals like Waller and Warsh.

Hassett’s Coinbase footprint raises questions - Hassett is not a typical central banking pick. He previously served as an advisor to Coinbase and disclosed owning at least $1 million in Coinbase stock, with filings suggesting the stake could be as high as $5 million.

Hassett also earned just over $50,000 for serving on Coinbase’s Academic and Regulatory Advisory Council, a group that has included figures like former SEC chair Jay Clayton and former CIA counsel Courtney Elwood.

These ties have sparked debate in Washington and on trading desks over whether a Fed chair with significant personal exposure to a major crypto exchange could face conflicts in decisions on stablecoins, bank crypto exposure, and a potential digital dollar.

What a Hassett Fed could mean for crypto - Hassett’s supporters argue that his involvement in Trump’s digital asset working group and his pro rate cut stance could bring a more predictable, crypto aware regulatory environment. Critics counter that blending monetary policy with deep industry ties could blur lines between referee and participant.

Whoever Trump ultimately selects will shape the path of interest rates, dollar liquidity, and the broader policy climate for digital assets well beyond Powell’s remaining term.

Tackle your credit card debt by paying 0% intro APR until 2027

Did you know some credit cards can actually help you get out of debt faster? Yes, it sounds crazy. But it’s true.

The secret: Find a card with a “0% intro APR" period for balance transfers or purchases. This could help you fund a large purchase or transfer your debt balance and pay it down as much as possible during the intro period. No interest means you could pay off the debt faster.

More stories from the crypto ecosystem

Metaplanet’s $130 mln loan to raise Bitcoin raises eyebrows – This is why

Is Bitcoin losing strength ahead of 2026? THESE datasets suggest…

$5mln Bitcoin buy at discount: All about Texas’ historic move

Pudgy Penguins [PENGU] rises – But THIS will decide what really lies ahead

Crypto VC hits $4.65B in Q3 – But is this really a comeback?

Did you know?

Hong Kong just set a global record for digital bonds - Hong Kong priced a HK$10 billion digital green bond in November 2025, the largest tokenized government bond ever issued, and even enabled settlement using tokenized versions of the Hong Kong dollar and Chinese yuan.

Spain is experimenting with tokenized central bank money for financial institutions - Spain’s central bank launched a wholesale CBDC program that lets banks settle transactions with tokenized funds on a dedicated blockchain network, marking one of Europe’s most advanced tests of digital settlement rails.

Before Bitcoin, there were early digital money experiments as far back as the 1990s - In the early 1990s, cryptographer David Chaum introduced a protocol called eCash that used cryptography to enable anonymous digital payments, a direct precursor to modern digital currencies and proof that the idea of “crypto cash” predates Bitcoin by nearly two decades.

Pet insurance can help your dog (and your wallet)

Did you know 1 in 3 pets will need emergency treatment this year? Pet insurance helps cover those unexpected vet bills, so you can focus on care—not cost. View Money’s list of the Best Pet Insurance plans and protect your furry family member today.

Top 3 coins of the day

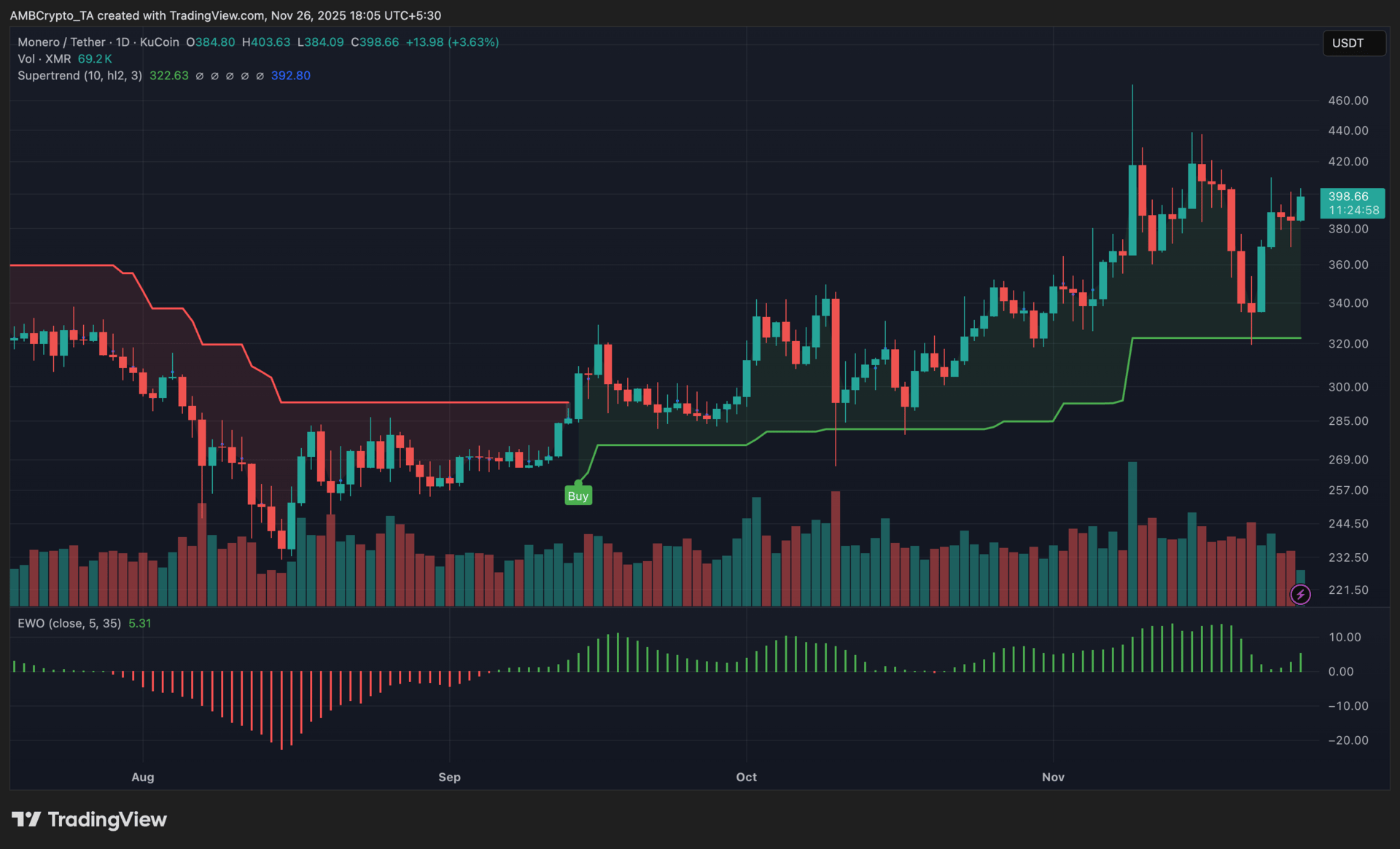

Monero (XMR)

Key points:

XMR traded around $398 after extending its November uptrend, placing it among today’s stronger large cap performers.

The Supertrend remained in bullish territory while the EWO held positive, reflecting continued upward momentum.

What you should know:

Monero pushed higher again after climbing from the $350 region earlier this month, with the latest candle showing firm buying interest. Price stayed comfortably above the green Supertrend band, signalling that bullish control remained intact throughout the recent rally. Volume also held steady, with multiple upticks on green candles confirming healthy participation from buyers. The EWO maintained a positive reading, reinforcing the view that momentum still favored the upside even after several weeks of gains. Beyond the chart, renewed interest in privacy assets supported XMR’s climb. The momentum spilled over from Zcash’s rapid rise earlier in the month, lifting sentiment for the entire privacy sector. Real-world utility also strengthened following ShopinBit’s launch of a no KYC concierge app that integrated Monero for global purchases. Resistance near $420 to $425 remains the next key zone to watch.

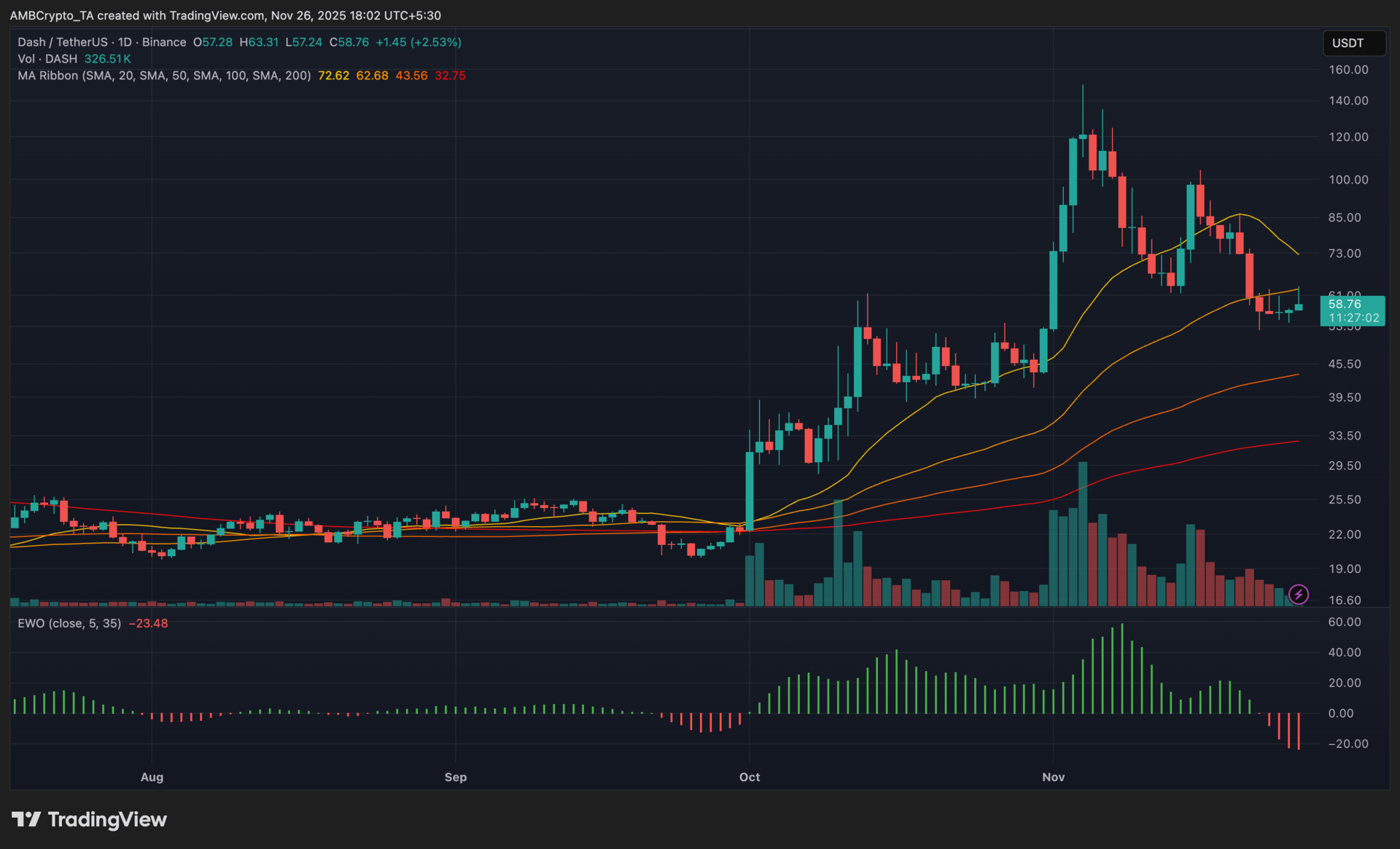

Dash (DASH)

Key points:

DASH hovered near $58 after recovering from last week’s lows, marking a steady continuation of its short-term rebound.

The price sat below the 20 SMA while the EWO turned negative again, signaling that momentum stayed cautious despite the latest bounce.

What you should know:

Dash attempted to push higher after stabilizing above the $50 support range, with today’s candle adding to its recent recovery. The MA ribbon showed a mixed trend structure, as DASH traded below the short term 20 SMA yet held above the 50 and 100 SMAs. This suggested that while broader momentum cooled, longer-term trend support was still intact. The EWO slipped back into red territory, pointing to fading momentum even as price tried to reclaim lost ground. Volume remained consistent through the uptrend, though it did not display a strong accumulation spike. Off the chart, Dash benefited from renewed interest in privacy-oriented assets and fresh ecosystem activity. Integrations with Maya Protocol and NymVPN, along with expansion initiatives like Dash to Anything, helped improve sentiment. Immediate resistance stands near the 20 SMA around $62 to $63.

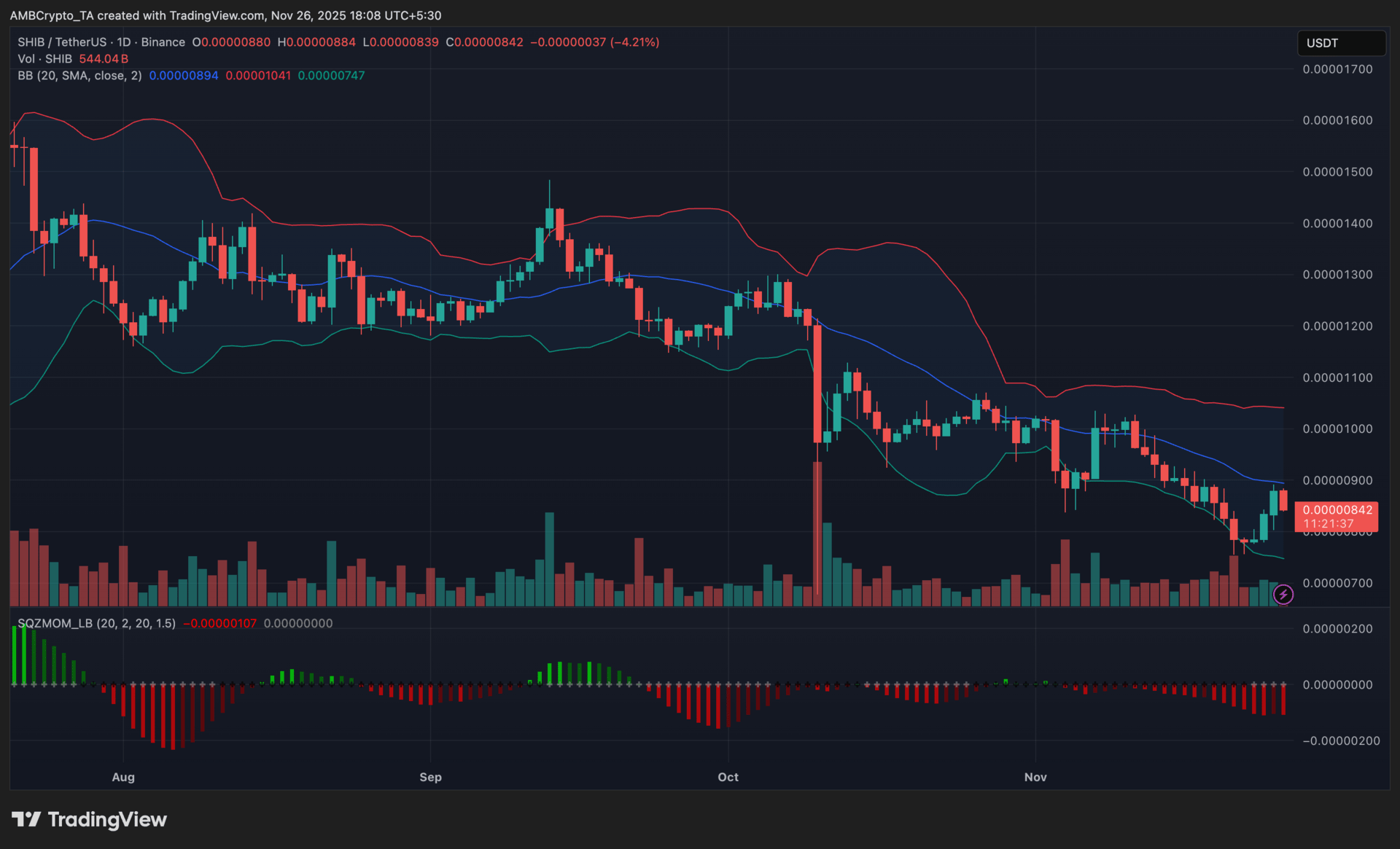

Shiba Inu (SHIB)

Key points:

SHIB slipped to around 0.0000084 after its short lived rebound from the lower Bollinger Band, marking a pause in its recent recovery attempt.

The Squeeze Momentum Indicator stayed in negative territory, while volume remained steady without a decisive accumulation spike.

What you should know:

Shiba Inu gave back part of its recent gains after finding support near the lower Bollinger Band around the 0.0000075 to 0.0000077 region. The price moved higher earlier in the week, but it remained below the middle band near 0.0000089, which continued to act as an overhead barrier. Momentum stayed weak as the Squeeze Momentum Indicator kept printing red bars, although the histogram showed subtle signs of easing pressure. Volume held at moderate levels, suggesting that traders remained cautious after November’s broader pullback. Outside the chart, sentiment around large-cap meme tokens helped stabilize SHIB’s decline as the token regained attention among retail traders. The market now watches whether SHIB can challenge the middle Bollinger Band, as a clear move above it would open the path toward the upper band near 0.0000104.

Become An AI Expert In Just 5 Minutes

If you’re a decision maker at your company, you need to be on the bleeding edge of, well, everything. But before you go signing up for seminars, conferences, lunch ‘n learns, and all that jazz, just know there’s a far better (and simpler) way: Subscribing to The Deep View.

This daily newsletter condenses everything you need to know about the latest and greatest AI developments into a 5-minute read. Squeeze it into your morning coffee break and before you know it, you’ll be an expert too.

Subscribe right here. It’s totally free, wildly informative, and trusted by 600,000+ readers at Google, Meta, Microsoft, and beyond.

How was today's newsletter? |