- Unhashed Newsletter

- Posts

- Bitcoin: A cool-off before $155K?

Bitcoin: A cool-off before $155K?

Reading time: 5 minutes

TD Cowen sees Bitcoin at $155K, to lift Strategy stock price to $680

Key points:

TD Cowen foresees BTC hitting $155k by December, a potential catalyst for Strategy’s MSTR.

Glassnode called for caution amid the rising risk of profit-taking in the near term.

News - Bitcoin’s aggressive rally above $120K has cooled off slightly ahead of Congress ‘Crypto Week’ and June inflation data. But zooming out, BTC still commands huge interest from institutions and retail.

Last week, U.S spot BTC ETFs saw $2.72 billion in weekly inflows. Additionally, Bloomberg reported that anti-Bitcoin Vanguard is a top institutional holder of Strategy (owns 20 million shares of class A MSTR stock), making it an indirect BTC investor.

Institutions and retail fight for BTC - BTC’s breakout rally triggered a FOMO amongst institutions and retail. Out of last week’s $2.7 billion inflows into BTC ETFs, Thursday and Friday saw over $1 billion each in daily inflows.

Collectively, the ETF complex now owns $179.5 billion in assets under management (AuM), surpassing 50% of gold ETFs, noted CoinShares in its weekly inflows report.

“For the first time, this equals 54% of the total AuM held in gold ETPs,” CoinShares wrote.

Unlike the overall misconception that retail has not jumped on the trend based on low Google search interest, this cohort is here. In fact, they are the largest holders of the BTC ETFs ($135B of the $158B), noted Bloomberg ETF analyst Eric Balchunas.

He said, “The ETFs have $158b in assets, estimated hedge funds own 10% and market makers and true institutions own another 5%. The rest is direct retail OR advisors (who are investors for said retail) = $135b in 'retail interest'.“

Bitfinex echoed a similar stance, stating that the on-chain retail demand (those holding 100 BTC and below) hit 19.3K BTC per month.

This alone could reduce BTC’s downward pressure, added Bitfinex in its market update on July 14.

“This (retail) growth in holdings far exceeds the current monthly Bitcoin issuance rate of around +13.4k BTC post-halving, implying that demand from this segment alone is more than enough to absorb all new supply.”

In other words, if these conditions remain constant, BTC’s structural bullish outlook could extend.

Impact on BTC, Strategy stock (MSTR) - As expected, several price targets have been floated amid the bullish sentiment.

According to brokerage and research firm TD Cowen, BTC could tag $155k by the end of the year. Its base case scenario was at $128k and a ‘downside scenario’ of $55K.

The brokerage firm added that Strategy’s stock (MSTR) could hit $680 if BTC rallies to $155k. That’s an implied 52% upside from the current value of $451.

Still, Glassnode called for caution in the near term, warning of a high risk of profit-taking.

“While the breakout is backed by strong metrics, heightened profit margins and positioning imbalances call for increased vigilance going forward.”

Ethereum price defies market pullback as ETH treasury surpasses $4.5B -What’s next?

Key points:

BitMine added $500 million in ETH as Bit Digital set to raise $67.3 million for ETH buys.

ETH treasury reserves surpassed $4.5 billion, underscoring a growing appetite from institutions.

News - Ethereum price has weathered the early week dump much better than Bitcoin. While BTC dropped 2.4% to $116K, ETH held on near $3k after withstanding only a 1.2% dip.

One of the sell-side pressure absorbers was ETH treasury firms led by BitMine Immersion Technologies. Additionally, strong ETF flows and increasing acceptance by Wall Street and banks could fuel ETH’s momentum.

ETH treasury reserves explode - Public companies leveraging ETH treasury to diversify their corporate reserves have recorded massive growth in the past few days.

As of the time of writing, a former BTC-focused firm, BitMine, announced a $500 million ETH acquisition. The firm initially raised $250 million last week, which helped increase its overall stash to 163,142 ETH.

At the same time, another public company, Bit Digital, announced plans to secure $67.3 million to advance its ETH strategy.

Amid the race to capture the expected stablecoin boom and tokenization narratives, several public companies have jumped on the ETH treasury trend. And a potential passage of the stablecoin bill, the GENIUS Act, could further fuel the positioning.

Already, there are 51 ETH treasury firms controlling over 1.520 million ETH, worth $4.52 billion at current market prices.

And Bank of America’s (BoFA) recent bullish call summarizes Wall Street’s sentiment. In a recent report, BoFA said,

“We believe infrastructure providers such as Stripe, or the Ethereum platform (on top of which public chains are run)... could potentially become the new rails for driving interoperability across digital assets.”

Low sell pressure - ETH’s resilience during the early week pullback was also confirmed by the level of profit taking. Glassnode data showed that realized profit hit $357 million per day on July 14.

This was relatively less compared to the selling pressure of $1B during the May surge or $656 million seen in mid-June.

But BTC saw $4B in profit-taking during this week’s drop below $120K, underscoring higher offloading compared to ETH. The muted sell pressure, growing Wall Street demand, and likely passage of the GENIUS Act could fuel ETH’s uptrend.

PUMP token dumps 13% after trading goes live - What’s going on?

Key points:

PumpFun native token PUMP initially rallied 50% from its ICO price of $0.004 but dumped harder amid BTC pullback.

Market analysts remained divided on PUMP’s short and mid-term prospects.

News - PUMP token ICO was a remarkable success, raising $600M within minutes. A few hours afterwards, the team enabled spot trading and the token mooned to $0.00615, a 54% rally from its ICO price of $0.004. But bears rode on BTC’s pullback and erased nearly every post-ICO gain as of the time of writing.

PUMP’s post-ICO mixed signals - Even before the ICO (Initial Coin Offering) over the weekend, the community had mixed views on the token. In particular, the retail side leaned towards bearish or vowed not to participate, calling the ICO a ‘max extraction’ event.

On the contrary, research analysts from Messari and Delphi Digital and insiders were bullish on the project in the short and mid-term. The bulls pegged their argument on ‘revenue meta’, adding that PumpFun was the only top revenue-generating project.

For perspective, the Solana memecoin launchpad has done a cumulative revenue of nearly $700 million since its debut.

Besides, the team is reportedly considering a revenue-sharing formula with its users. In fact, this was another bullish catalyst cited by some of the research analysts familiar with the tokenomics and distribution.

For his part, Jeff Dorman, CIO of the digital asset platform Arca, linked the community sour sentiment to past ‘bad’ exchange listings. He compared PUMP to Robinhood [HOOD] and expected a mid-term run.

“Exchange listings were so bad that many crypto traders now expect $PUMP to go down. That's insane. Properly issued new stocks, bonds & tokens go up.”

Whales bet big - Still, whales appeared optimistic about the token. According to Nansen's data, there was a strong accumulation among whales after spot trading was activated.

“Top 100 wallets just scooped up 918B PUMP tokens in the past 7 days. The accumulation isn’t slowing down. If you’re still on the sidelines… you might already be late,” the analytics firm wrote on X.

That said, after the +50% rally, Hyperliquid data showed that PUMP declined by 13% to $0.0054 on July 15. While this could be linked to a broader market pullback, it remains to be seen how PUMP will trade going forward.

Coinbase hit $100B market size for the first time - Is $1 trillion next?

Key points:

Coinbase's market cap surged to $100.36 billion amid BTC's breakout to a record high.

10X Research analysts claimed that Coinbase (COIN) was overvalued relative to BTC.

News - U.S.-based crypto exchange Coinbase hit the $100 billion market size for the first time in history. The milestone followed COIN’s rally to $394.01 as of the close of Monday’s trading session.

Since its debut in the public market in 2021, this was the highest daily close in history, too, thanks to BTC's explosive run.

Mixed reactions - However, the remarkable milestone has attracted mixed views from market pundits. According to Kyle Reidhhead of MilkRoad, this $100B step could be a precursor to the $1 trillion growth in the future.

He went on and added,

“I think both Robinhood and Coinbase will reach $1 Trilly by 2030. They are both upgrading the financial system and putting crypto assets and crypto infra at the forefront of their strategy to achieve it.”

Interestingly, the exchange has acquired several ventures, including Deribit and LiquiFi, to improve revenue and end-to-end token issuance. Experts believe these are strategic moves aimed at a bigger picture.

However, the 10X Research firm downplayed the milestone, claiming that the firm is overvalued relative to BTC.

“Coinbase remains overvalued relative to Bitcoin, though both have gained. Only a few assets, including Circle and Robinhood, show stronger momentum than Bitcoin.”

The research firm added that COIN rallied on bullish analysts’ ratings and potential S&P 500 inclusion, but subsequent overvaluation ratings tempered the rally.

More stories from the crypto ecosystem

Interesting facts

Last week marked the highest spot U.S. Ethereum ETF inflows since the products debuted in July 2024. ETH ETFs recorded $907M inflows compared to highs of $854M seen last December.

Stablecoins crossed a quarter trillion ($250B) milestone in 2025, just before a clear regulation is set in the U.S. With proper regulation under the GENIUS Act, the market is expected to grow 8x to $2 trillion by the end of 2028, despite reservations from others like JPMorgan Chase.

The Solana network has seen record uptime for 16 consecutive months. Since the last time it had a 5-hour downtime on February 6, the network has seen improvements and resilience despite heavy meme mania.

Top 3 coins of the day

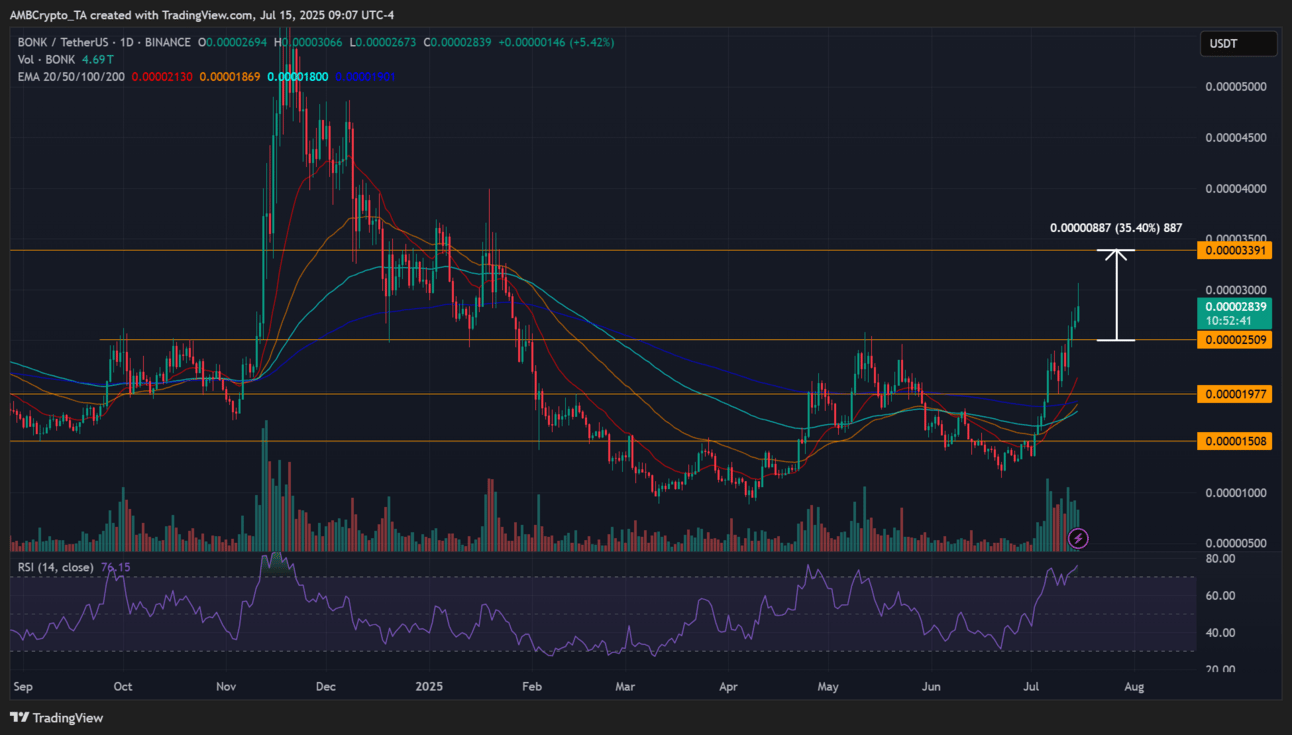

Bonk (BONK)

Key points:

BONK has rallied 115% in July, thanks to growing interest and BonkFun activity.

Daily RSI flagged an overbought condition that could lead to a brief cool-off.

What you should know:

As of press time, BONK traded at $0.000028, 4.2% in the past 24 hours. It was among the top daily gainers on CoinMarketCap. When zoomed out, the memecoin has rallied over 115% and entered a price range seen in last December. Should the rally extend, BONK could offer an extra 35% to $0.000033. But the daily RSI has entered the overbought territory, suggesting a brief cool-off could be likely. But provided the price action stays above the moving averages, any pullbacks could be great buying opportunities targeting the overhead resistance.

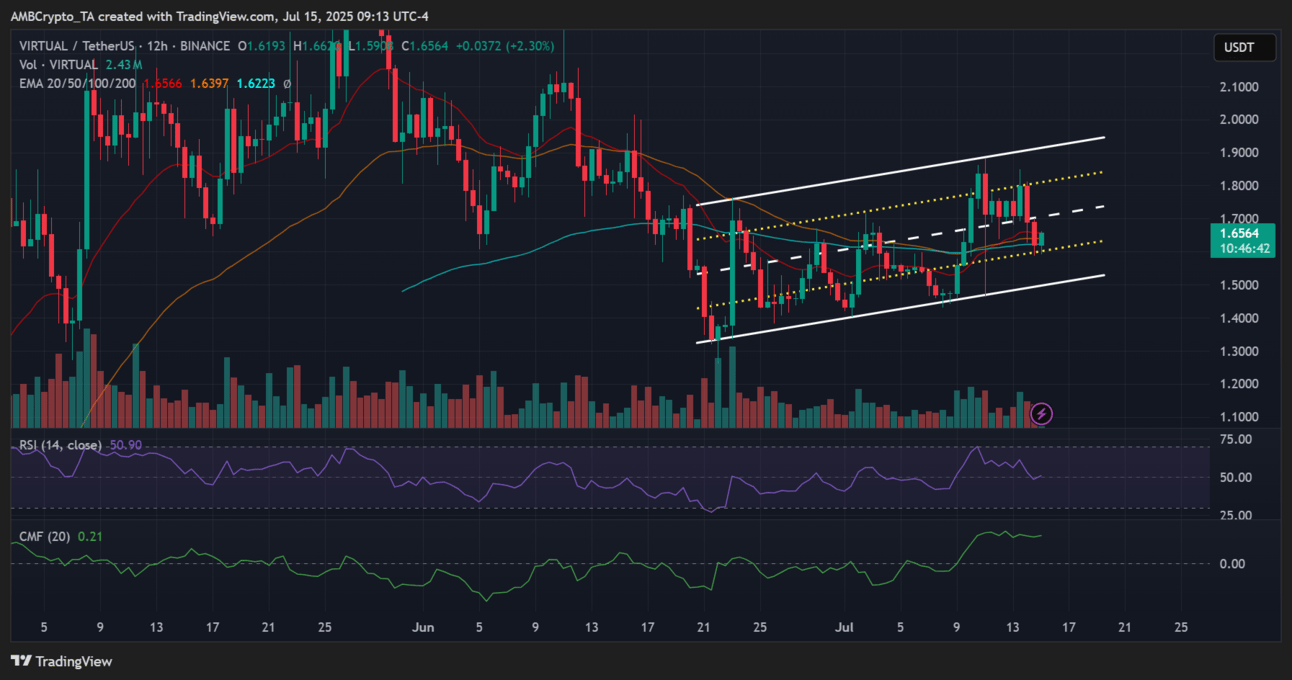

Virtual (VIRTUAL)

Key points:

VIRTUAL price dumped 13% since the weekend and was on the verge of dropping further to its range lows.

Technical indicators were at a pivotal level, suggesting a reversal or an extended could be likely.

What you should know:

VIRTUAL price has seen steady and choppy growth since mid-June, as shown by the rising channel (white). However, recent price rejection at the upper range near $1.8 has dragged it lower. If bears maintain the market edge, the token could dip to the range lows at $1.5. But technical indicators showed price action could go either way. The RSI was at a neutral level, and any break lower could drive VIRTUAL to $1.5. However, if the RSI rebounds at the 50-mark, the VIRTUAL could mark a bottom at $1.6 and retarget the upper range. With the inflows stagnant as shown by the flat CMF, it was a wait-and-see game for VIRTUAL bulls.

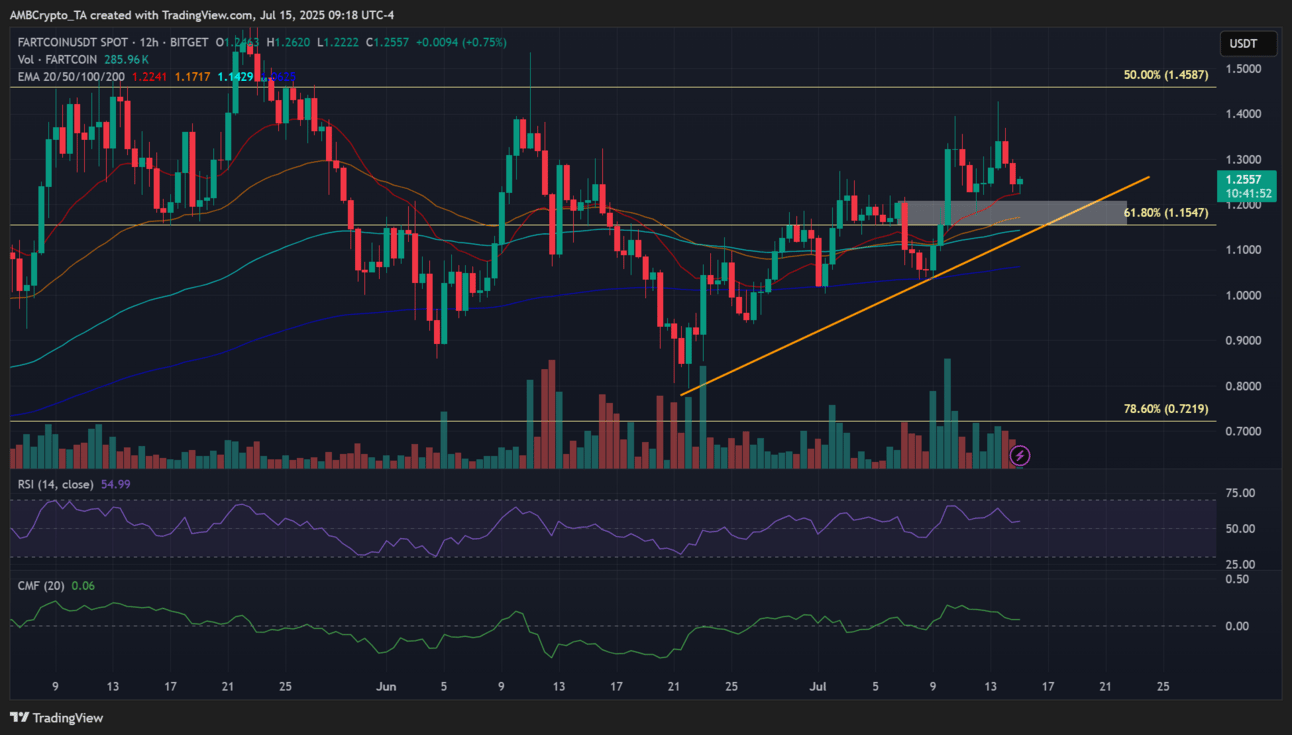

Fartcoin (FARTCOIN)

Key points:

Fartcoin has retraced to a nice support that could offer short-term bulls a new entry opportunity.

Technical indicators dropped to potential inflection points that could offer a rebound.

What you should know:

FARTCOIN has declined by 13% earlier in the week. But the pullback has tagged a short-term support above $1.15 (white) that triggered the weekend rally. Besides, the area doubled as a trendline support, making it a potential rebound in the short term. Should it hold, this level could offer new market entry opportunities for near-term bulls. The immediate target would be $1.4, offering a potential 18% gain if hit. The RSI and CMF were above neutral levels, suggesting demand was still there to push the memecoin higher. However, a break below the support would invalidate the bullish set-up.

How was today's newsletter? |