- Unhashed Newsletter

- Posts

- Bitcoin beats U.S shutdown fears

Bitcoin beats U.S shutdown fears

Reading time: 5 minutes

‘Uptober’ trumps shutdown fears as Bitcoin’s price hits 7-week high

Key points:

Despite initial fears, the crypto market, led by Bitcoin, rallied to old highs on the price charts.

Bitcoin’s increasing viability as a safe haven asset may have contributed to its hike.

News - The U.S government officially shut down on 01 October after Democrats and Republicans failed to come to a consensus to pass a critical funding legislation that would have funded government agencies and services in October and beyond. As it stands, the key bone of contention between the two parties is healthcare spending.

It is too soon to say when the ongoing shutdown will end. However, it must be noted that according to Polymarket, there is a 65% chance that the shutdown will extend beyond 10 October.

As expected, this development has fueled some uncertainty across markets. In fact, many assumed this uncertainty would precipitate corrections across the crypto-market too. However, that wasn’t to be as Bitcoin rallied instead. The world’s largest cryptocurrency went past $119,000 on the charts to hit a 7-week high.

Why did Bitcoin rally? - The month of October or “Uptober” has historically been a very productive month for Bitcoin. For the world’s largest cryptocurrency, October has yielded bullish returns 10 times over the last 12 years. Hence, it can be argued that the optimism associated with the same has trumped correction fears in the crypto-market this time.

That’s not all though. The weakness of the labor market and the expected Fed rate cuts have had an impact on the crypto market too. For example, according to Nick Ruck, Director at LVRG Research,

“As traditional economic indicators weaken, Bitcoin’s rally past $118,000 demonstrates its increasing sensitivity to monetary policy outlooks and its appeal as a hedge against economic uncertainty.”

The last bit is key here because it can be argued that the latest U.S government shutdown strengthened Bitcoin’s viability as a safe haven asset in times of economic uncertainty. This assertion can be backed by the fact that Gold, another safe haven asset, also rallied to a new high.

Altseason coming up? - As expected, when Bitcoin’s price climbed on the charts, so did the prices of most of the market’s top altcoins. The likes of Ethereum, Solana, XRP, and the many memecoins all saw significant gains. However, while that is good news, some like Bitget’s Vugar Usi Zade believe these short-term returns won’t yield much in the long term.

Speaking to CT, Bitget’s Operating Chief claimed that there won’t be an altseason because there is “no logical reason” behind it thus far.

Solana’s sell-off fears thwarted as exec claims it has ‘edge over Ethereum’

Key points:

Like the rest of the altcoin market, Solana’s price appreciated on the charts.

Its latest uptrend appeared to be contrary to the actions of its whales.

News - Bitcoin’s hike past $119,000 came as a boon to the rest of the altcoin market, with many other cryptos seeing single-digit and double-digit gains. Solana [SOL] was no exception, with the altcoin climbing by over 7% to hit a value of $225 at press time.

The timing of this bullish episode is interesting though since these gains came on the back of significant whale transfers in Solana’s market. To be specific, over 459K SOL worth about $95M were transferred to Coinbase. Whale transfers like these are often an indication of upcoming selling pressure.

However, thanks to the wider market’s bullishness, the whale-induced volatility in Solana’s market was offset significantly.

Strong fundamentals - At the time of writing, there seemed to be significant support for Solana on the metrics and on-chain data side of things too. The 90-day Cumulative Volume Data, for instance, flashed signs of consistent taker buy dominance.

Its findings implied that sell orders are being quickly absorbed by demand, mitigating the risk of sharp declines on the charts.

Similarly, both its Network Growth and Social Dominance stats have risen considerably since their early-September levels.

Staking gives it an edge? - That’s what Bitwise’s Hunter Horsley thinks, in relation to Solana’s competitors. According to the exec, its quicker restaking period gives it an edge over the likes of Ethereum.

In doing so, Horsley cited the recent episode of Ethereum’s staking entry queue hitting levels last seen in 2023.

Launchpads, not users, biggest beneficiaries of memecoin trading - Report

Key points:

Last 18 months have seen many memecoins make their debuts.

Report also found that memecoins remain a popular choice to gain entry in the crypto market.

News - Dogecoin and Shiba Inu. For the longest time, the memecoin sector primarily centered around these two altcoins. Not anymore though, with the last 18 months seeing other memecoins like BONK, PEPE, and WIF hog the spotlight from time to time too.

According to a recent report by Galaxy Research, memecoins remain a “powerful entry point into crypto,” with many of these new users often redirected to wallets and DEXs too.

It’s all about Pump.fun - That wasn’t the only finding of Galaxy Digital’s report though. In fact, its most significant observation was that infrastructure providers like launchpads, DEXs, and trading bots made millions in revenue by facilitating memecoin trading. This, in comparison with traders, many of whom lost significant money while betting on these memecoins.

Tokens on Solana’s Pump.fun, for instance, now have a combined $4.8 billion in fully diluted market value - In less than 2 years since the memecoin launchpad’s debut in early 2024.

Out of the nearly 32M tokens on Solana, over 13M have been launched on Pump.fun alone. According to Galaxy Research,

“The platform has simply industrialized token creation on Solana.”

Sweden might be the next country to set up a Strategic Bitcoin Reserve

Key points:

Some Riksdag members believe Bitcoin can be used to tackle inflation and diversify the government’s holdings.

Lawmakers also want assurances the Swedish government won’t introduce a CBDC.

News - The last few years have seen many countries jump onto the cryptocurrency bandwagon. Some, however, have also been trying to go the extra mile by introducing or looking into Bitcoin reserves. The likes of the United States, United Kingdom, and Kazakhstan are perfect examples. In the U.S, for instance, the bipartisan GENIUS Act advances the framework for a Federal Bitcoin Reserve.

On the state level too, this idea has gained a lot of popularity in the United States.

It’s no surprise then that two lawmakers in the Swedish parliament Riksdag are proposing a similar idea to tackle inflation and diversify the country’s holdings.

According to Dennis Dioukarev and David Perez,

“Sweden should participate in this digital arms race and join the growing group of nations that have accepted and recognized the potential of Bitcoin.”

All the details - Like in the United States, Dioukarev and Perez want the proposed Bitcoin reserve to be funded by seized Bitcoin. This idea can be interpreted to be an extension of a 2024 law that now allows the state to seize and confiscate luxury items, including crypto, even if those assets aren’t the target of any investigation or enquiry.

Sweden does not have any Bitcoin or any crypto reserves. It does, however, have significant currency and gold reserves. In light of the global economic uncertainty and Bitcoin’s emergence as a viable safe haven asset, the cryptocurrency and its reserves could be used to supplement the country’s treasuries.

Finally, both lawmakers want assurances that the definition of legal tender won’t be changed. Nor will a Central Bank Digital Currency be introduced by the country.

As it stands, it is difficult to assess how far the aforementioned proposal will go. It’s worth pointing out, however, that the Swedish Democrats are key players backing the country’s ruling coalition.

More stories from the crypto ecosystem

Interesting Facts

Bitcoin is the official currency of Liberland, a micronation proclaimed on 13 April 2015 by Czech politician Vít Jedlička. In fact, Liberland advertises itself as a ‘crypto-friendly sovereign state’ that runs fully on chain.

Kimbal Musk, Elon Musk's billionaire brother, formed Big Green DAO to scale food justice by leveraging blockchain technology. Launched in 2021, the Big Green DAO is the first nonprofit-led philanthropic DAO in the world.

Back in 2014, Dogecoin’s community raised over $55K in just eight days in an effort to sponsor NASCAR driver Josh Wise.

Top 3 coins of the day

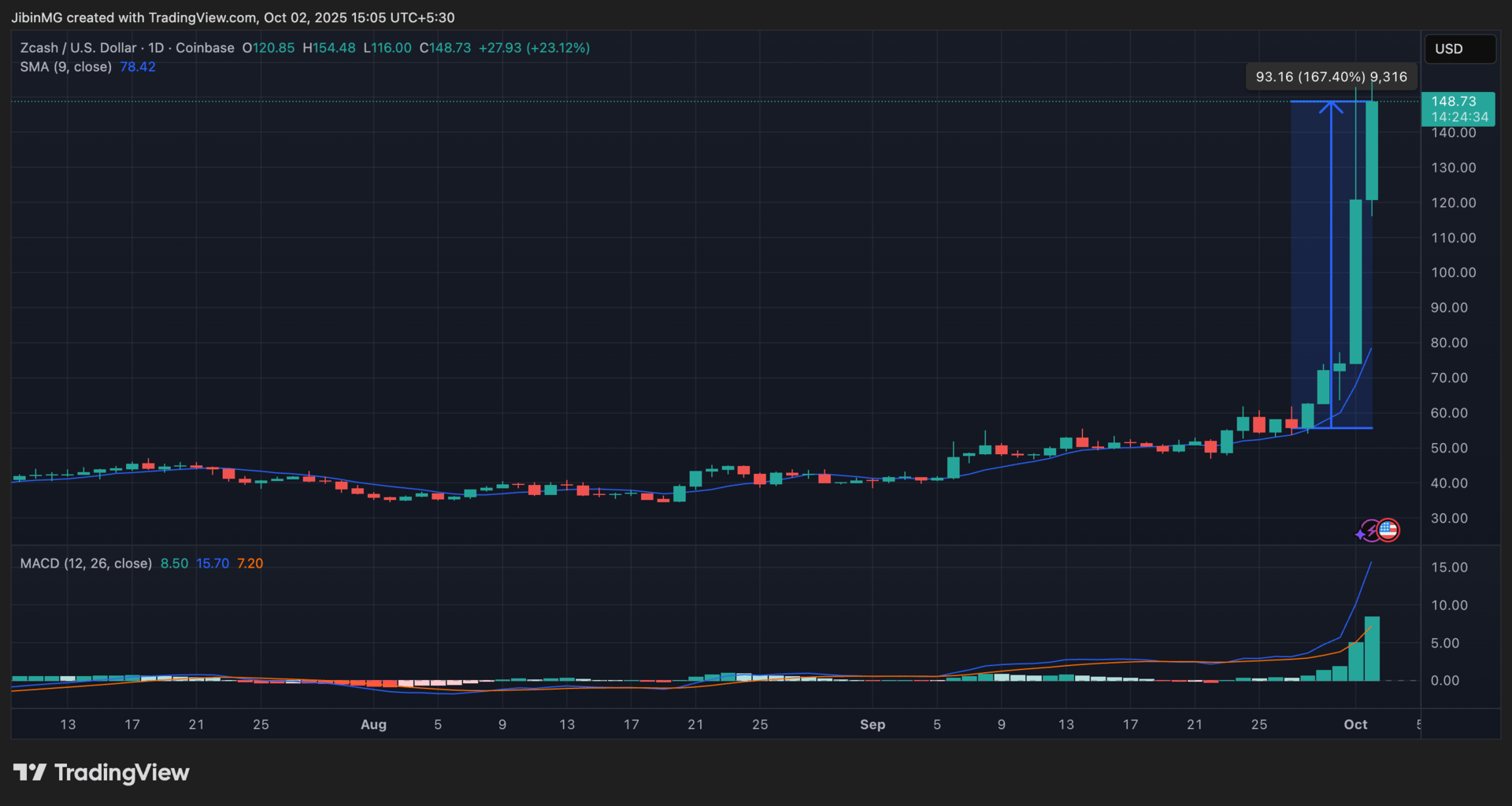

Zcash (ZEC)

Key points:

Popular privacy coin rallied by over 150% on the price charts.

Latest uptick was precipitated by a comment made by a renowned investor.

What you should know:

While the rest of the altcoin market saw single-digit or double-digit hikes, Zcash [ZEC] soared by over 150%. The popular altcoin had been on a glacial uptick since mid-August. However, it was given a major impetus after Naval Ravikant endorsed Zcash as “insurance against Bitcoin.” Thanks to such a bullish comment and in light of the upcoming NU7 upgrade, the altcoin rallied.

At the time of writing, ZEC was valued at $148.73, up over 160% in less than a week. Its technical indicators underlined the bullishness of the market. While the Moving Average crept under the price candles, the MACD line diverged away from the Signal line against the backdrop of green histograms.

Even so, traders should be wary of a price correction soon. Especially since according to CryptoQuant’s Futures Volume Bubble Map metric, Zcash might be in an “overheating” phase.

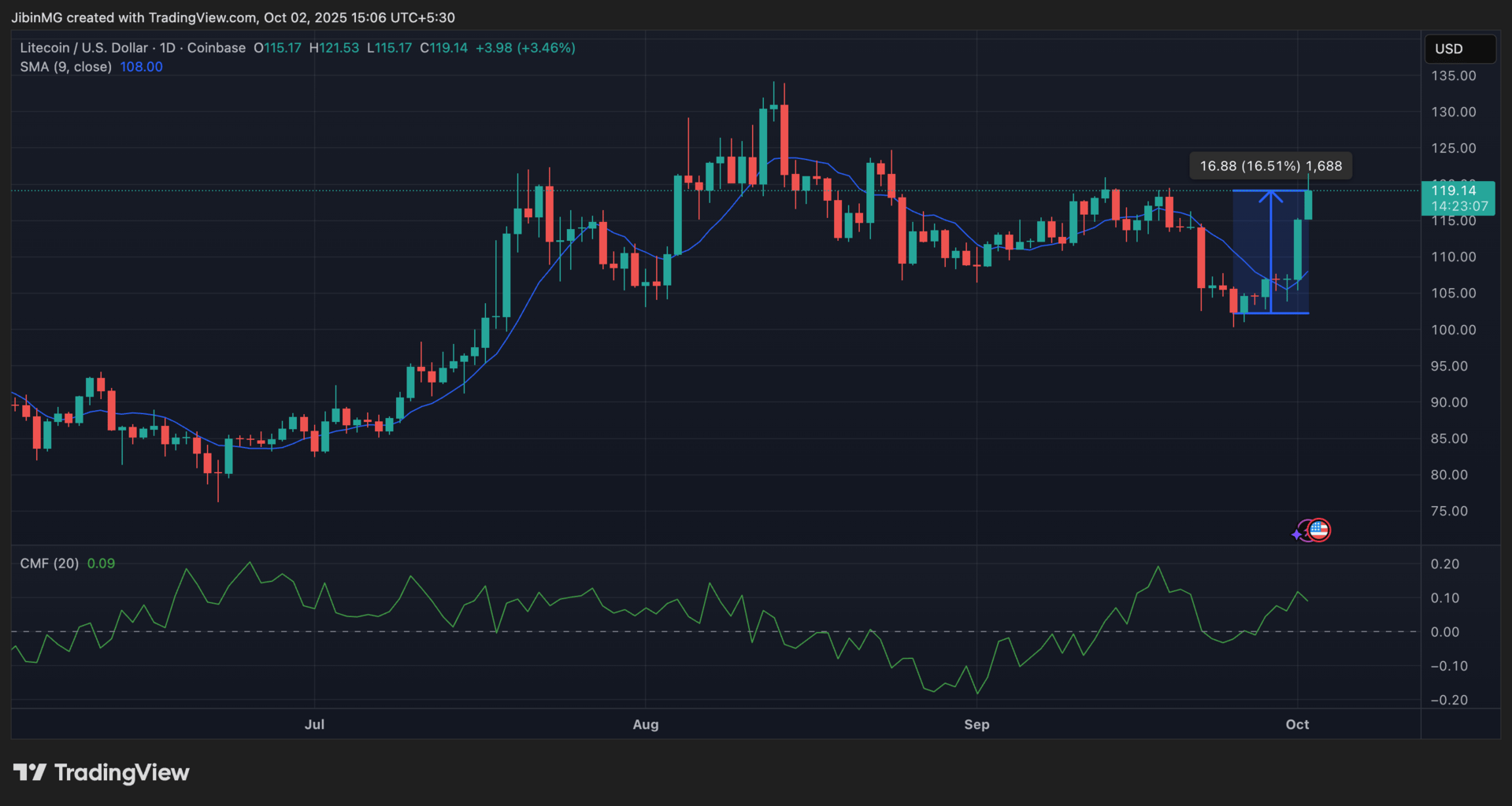

Litecoin (LTC)

Key points:

At press time, LTC was valued at $119 after hiking by 16%.

Altcoin’s uptrend might be inhibited by the price range it has been trading within.

What you should know:

The once-popular silver to Bitcoin’s gold has fallen on hard times over the last few years. In fact, LTC is now “only” the 26th largest cryptocurrency in the market. And yet, it profited significantly when Bitcoin rallied on the price charts. Thanks to its still-strong correlation with the king coin, Litecoin saw a price hike of over 16% in a matter of days.

However, it’s still too soon to say for how long the altcoin’s latest uptrend will last. Especially since it has rallied similarly in the recent past too. Only to eventually end up trading within its current price range. Hence, Litecoin will have to breach through its immediate resistance levels first to hit new levels.

On the technical side of things, the Moving Average’s positon highlighted the bullishness of the altcoin’s market. Similarly, the Chaikin Money Flow crept above zero to indicate a surge in capital inflows.

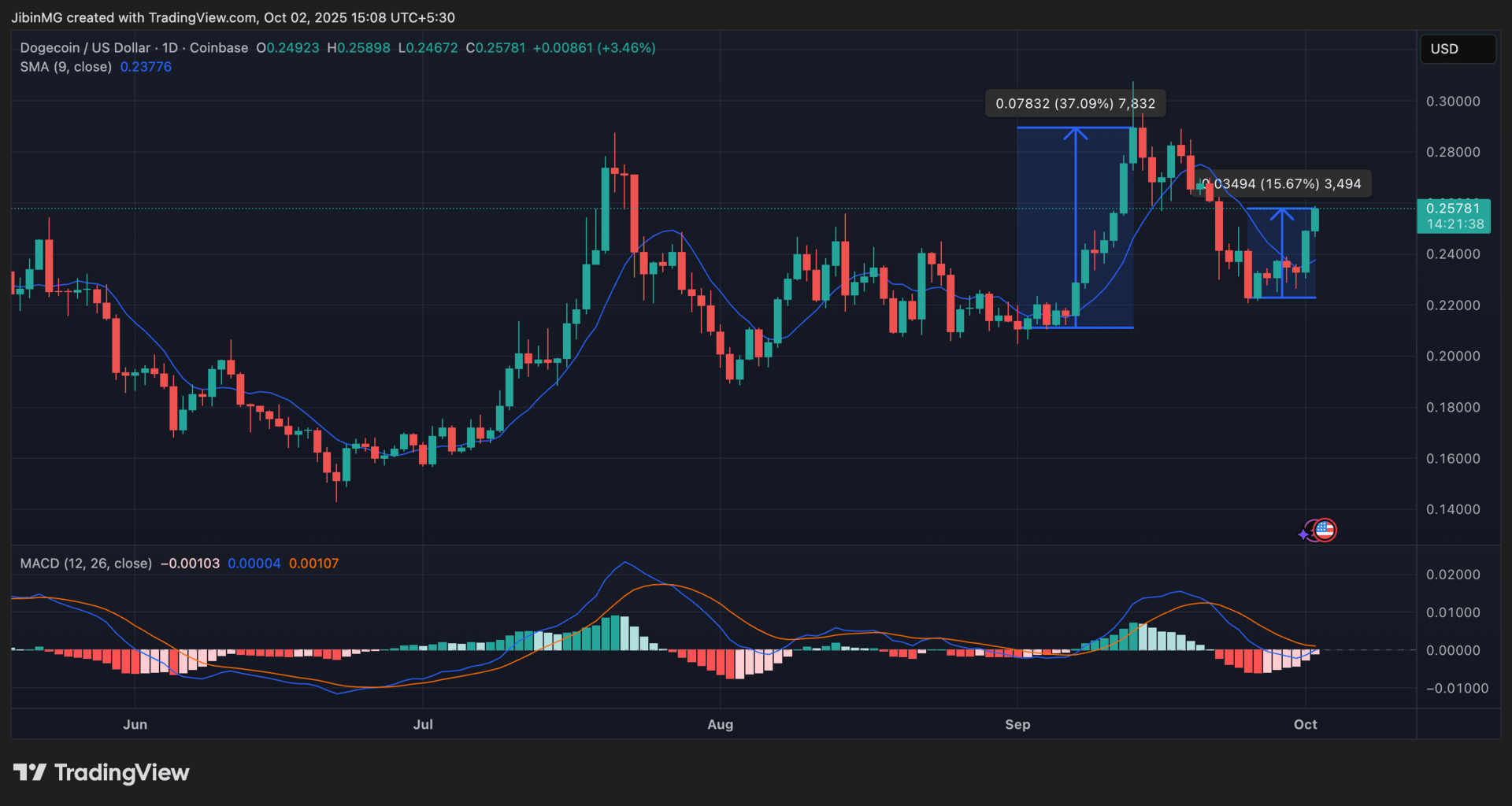

Dogecoin (DOGE)

Key points:

Like Litecoin, Dogecoin’s price action has been fairly topsy-turvy lately.

Days after a significant fall, DOGE’s price appreciated by over 15% in less than a week.

What you should know:

The crypto-market’s biggest memecoin hasn’t had a great 2025 so far. Despite major bouts of appreciation, DOGE’s price has often seen sustained rounds of depreciation too. Hence, its latest uptick should be looked at with some wariness.

On the charts, DOGE climbed by just over 15% on the back of Bitcoin’s own surge towards $119,000. Give the strong correlation it shares with BTC, an uptick of its own was inevitable for the memecoin.

This was best evidenced by the fact that while the Moving Average crept under the price candles to signify bullishness, the MACD Line seemed to be closing in on a bullish crossover with the Signal Line.

How was today's newsletter? |