- Unhashed Newsletter

- Posts

- Bitcoin caught in a macro crossfire

Bitcoin caught in a macro crossfire

Reading time: 5 minutes

Macro signals, treasury buys, and conflicting sentiment shape Bitcoin’s week

Key points:

A dense US macro calendar, rising liquidations, and currency volatility are shaping near-term Bitcoin uncertainty.

Despite growing bear market calls, institutional accumulation and constructive 2026 outlooks remain intact.

News - Bitcoin entered the week facing heightened volatility as investors prepared for a dense slate of US economic events that could sway risk appetite across crypto and traditional markets. Attention is centered on the Federal Reserve’s January policy decision, labor market data, inflation readings, and major US tech earnings, all arriving amid fragile market conditions.

The Fed is widely expected to hold rates steady, but Chair Jerome Powell’s guidance remains a key catalyst. Any indication of future easing could support Bitcoin, while persistent inflation risks may reinforce caution. Jobless claims and December PPI data later in the week are expected to further shape rate expectations and near-term price action.

Liquidations and FX stress add pressure - Macro stress was already evident over the weekend. Bitcoin slid toward the $88,000 region, triggering more than $750 million in crypto liquidations, with long positions accounting for the majority. Open interest has remained range-bound, reflecting muted participation as uncertainty builds.

At the same time, capital has rotated toward traditional safe havens. Gold and silver extended gains amid renewed concerns around Japanese yen intervention, a factor that has historically coincided with sharp Bitcoin drawdowns before recovery phases.

Institutions accumulate as outlooks stay constructive - Despite market weakness, institutional behavior continues to diverge from bearish sentiment. Michael Saylor’s Strategy added 2,932 Bitcoin during the recent pullback, lifting its holdings above 712,000 BTC. January purchases now exceed the firm’s combined accumulation from the prior five months.

Japan-based Bitcoin treasury firm Metaplanet highlighted a similar contrast. While the company reported a large non-cash Bitcoin impairment tied to year-end pricing, it raised its revenue and operating income outlook and projected nearly doubled revenue in 2026, driven by its Bitcoin income strategy.

Survey data from Coinbase Institutional and Glassnode reflects this disconnect. Although roughly one quarter of investors now classify the market as bearish, most institutions continue to hold or increase exposure. Both firms maintain a constructive outlook for early 2026, citing easing inflation, resilient growth, and potential monetary policy tailwinds.

Adding to longer-term optimism, Changpeng Zhao has suggested Bitcoin could enter a supercycle in 2026, arguing that shifting global policy dynamics may disrupt the asset’s traditional four-year pattern. For now, Bitcoin remains caught between short-term macro pressure and sustained institutional conviction.

Ethereum caught between selling pressure and strategic accumulation

Key points:

Ethereum remained under pressure below $3,000 amid a broader risk-off environment and shifting investor sentiment.

Despite price weakness, institutional accumulation, mixed whale behavior, and strong network activity signal continued long-term engagement.

News - Ethereum entered the week trading below the $3,000 level as capital continued flowing toward traditional safe havens. Gold surged past $5,100 per ounce for the first time, extending gains driven by geopolitical tensions and renewed tariff threats from US President Donald Trump. The move reinforced gold’s role during periods of uncertainty, while Ethereum and other cryptocurrencies struggled to attract similar defensive inflows.

Ethereum was last seen near $2,880, down more than 10% over the past week. Prediction market data points to growing short-term caution, with a majority of users now expecting ETH to revisit $2,500 before recovering toward $4,000. Analysts have also noted that Ethereum recently broke a key support level, activating a bearish structure that could open the door to further downside if current levels fail to hold.

Institutional buying and whale activity send mixed signals - Despite ongoing price pressure, large holders and corporate treasuries continue to show selective conviction.

BitMine Immersion Technologies, the largest Ethereum treasury firm, added more than 40,000 ETH in its biggest purchase of 2026, lifting its holdings to over 4.24 million tokens. Nearly half of those holdings are now staked, turning a significant portion of the treasury into a yield-generating position.

On-chain data highlights a split among whales. Several large wallets accumulated ETH on dips or rotated capital from Bitcoin into Ethereum, while other long-dormant addresses transferred sizable amounts of ETH to exchanges. This contrast reflects a tug-of-war between accumulation and potential distribution, with long-term holders increasing exposure even as some large holders reduce risk.

Network fundamentals and protocol direction - Beyond price action, Ethereum’s underlying network activity remains robust. Data shows the seven-day average of active addresses reaching record highs, signaling continued usage despite market volatility.

At the protocol level, the Ethereum Foundation has formed a dedicated post-quantum security team, elevating quantum resistance to a strategic priority.

Ethereum co-founder Vitalik Buterin has also revisited his earlier views on self-validation, now endorsing it as an important fallback to preserve decentralization and user sovereignty during outages or centralization risks. Together, these developments highlight Ethereum’s focus on long-term resilience as it navigates a challenging market phase.

Japan signals crypto ETF shift, with 2028 emerging as key target

Key points:

Japan’s regulator is exploring rule changes that could allow crypto ETFs to list by 2028, expanding regulated retail access.

Major financial groups are positioning early, but the framework remains a policy signal rather than formal approval.

News - Japan is taking early but meaningful steps toward allowing cryptocurrency exchange-traded funds (ETFs), with 2028 increasingly cited as a potential launch window. According to multiple reports, the country’s Financial Services Agency is considering changes that would allow cryptocurrencies to qualify as eligible assets for ETFs under the Investment Trust Act.

If implemented, the shift would give Japanese retail investors access to Bitcoin and other digital assets through traditional brokerage accounts, rather than direct custody via crypto exchanges. Any products would still require approval from both regulators and the Tokyo Stock Exchange, and no official timeline has been confirmed.

Industry estimates suggest Japan’s crypto ETF market could eventually reach about 1 trillion yen, or roughly $6.4 billion, though regulators have not endorsed these projections. The discussions reflect regulatory intent and direction rather than a finalized policy framework.

Financial giants prepare, policy work continues - Large financial institutions are already positioning ahead of potential approval. SBI Holdings and Nomura Holdings have both expressed interest in developing crypto ETF products, including proposals for dual-asset funds that combine Bitcoin with other tokens such as XRP. These plans remain contingent on regulatory clearance.

Japan’s finance minister Satsuki Katayama has also publicly supported deeper integration of digital assets into regulated markets, highlighting the role of exchange-traded products in improving investor access and referencing crypto ETFs used elsewhere as inflation hedges.

However, Japan’s potential 2028 debut would place it several years behind the United States, where spot Bitcoin ETFs launched in early 2024 and have since accumulated well over $100 billion in assets. Hong Kong has also approved retail crypto ETFs, though volumes remain far smaller.

Asia’s ETF race heats up - Across Asia, regulatory approaches continue to diverge. Hong Kong remains the region’s only market with retail spot crypto ETFs, while South Korea is debating its own digital asset legislation amid political uncertainty. By contrast, Japan appears to be opting for a slower rollout that emphasizes investor protection, custody safeguards, and regulatory alignment before allowing products to list.

While still early, the signals suggest Japan is laying the groundwork for a regulated crypto ETF market rather than standing on the sidelines. The pace may be cautious, but the direction is becoming clearer.

US winter storm disrupts Bitcoin mining, testing grid flexibility

Key points:

Extreme winter weather forced US Bitcoin miners to curtail power use, briefly reducing network hashrate.

The episode highlighted both mining concentration risks and the sector’s role in supporting grid stability during periods of stress.

News - Bitcoin mining activity in the US slowed this week as a major winter storm strained power grids across several regions, prompting miners to reduce electricity usage or temporarily halt operations. Network data showed a short-lived increase in block times alongside a measurable decline in hashrate as prolonged subfreezing temperatures pushed grids toward capacity limits.

The impact was most visible among US-focused mining pools. Foundry USA’s hashrate dropped by roughly 60% at its lowest point before beginning to recover. Luxor also recorded a sharp pullback, while other pools with US exposure, including Antpool, posted smaller declines. The changes were linked to grid curtailments and demand-response participation during peak electricity demand.

Concentration risks surface, markets stay calm - While the Bitcoin network continued operating through the storm, the episode renewed attention on mining concentration. Academic research has shown that regional mining outages can lead to longer block times and higher transaction fees when a large share of hashrate is clustered among a small number of pools or geographic areas.

Recent data shows that a handful of mining pools now account for most Bitcoin block production, increasing sensitivity to localized infrastructure disruptions. Despite this, market reaction remained limited. Bitcoin’s price showed little movement during the hashrate drop, indicating that markets appeared largely unfazed by the temporary disruption.

Mining as a flexible load - Industry participants noted that such slowdowns are becoming a routine feature of modern mining operations. During periods of extreme demand, miners often curtail power use to reduce stress on electricity grids, then resume activity once conditions stabilize.

As the storm eased, hashrate began moving back toward prior levels. The episode demonstrated how temporary fluctuations are absorbed by Bitcoin’s difficulty adjustment process, while also underscoring the growing importance of energy management and geographic concentration in shaping mining resilience.

More stories from the crypto ecosystem

$235mln Ethereum whale buying follows $2.8K breakdown – What happens next?

Bitcoin: $677mln liquidations meet THESE 3 signals flashing risk

Solana slides 16% as staking hits record highs – Will SOL bulls defend $126?

Stablecoins hit $300B market cap: Why Tether’s $10B profit is just the beginning

Assessing RIVER’s 21% rally after Justin Sun’s $8mln infrastructure boost

Did you know?

A major crypto IPO window just reopened: Crypto custody firm BitGo made its NYSE debut on January 22, 2026, with shares opening about 24.6% above the $18 IPO price, briefly valuing the company at $2.59 billion during the initial surge, compared to its $2.08 billion valuation at pricing.

Tokenized ETFs are moving closer to reality: On January 21, 2026, F/m Investments filed with the SEC seeking approval to tokenize shares of its 3-month T-bill ETF (TBIL) on a permissioned blockchain while keeping the fund under the Investment Company Act of 1940.

Strategy’s Bitcoin stash just got bigger, fast: Between January 12 and January 19, 2026, Strategy bought about 22,305 BTC worth roughly $2.13 billion, taking its total holdings to 709,715 BTC.

Top 3 coins of the day

Axie Infinity (AXS)

Key points:

AXS rallied strongly as renewed GameFi interest and tokenomics changes drove aggressive dip-buying.

The move was reinforced by rising volume and a bullish MA crossover, though momentum has started to cool.

What you should know:

Axie Infinity extended its sharp rebound as traders reacted to renewed optimism around the project’s evolving tokenomics and a broader rotation into GameFi tokens. The rollout of the bAXS reward framework helped revive sentiment by addressing long-standing concerns around sell pressure, while renewed discussion around in-game utility supported speculative demand.

Price climbed above both the 20-day and 50-day moving averages, confirming a short-term trend shift after weeks of consolidation. The rally was accompanied by a clear expansion in volume, pointing to fresh participation rather than a thin bounce. RSI stayed above 60, reflecting strong momentum, although it cooled as price pulled back from the $2.70–$2.90 supply zone.

On the downside, $2.20–$2.30 now acts as near-term support, with deeper pullbacks exposing the 20-day MA near $1.90–$2.00. On the upside, resistance remains at $2.70–$2.90, followed by the $3.00 psychological level.

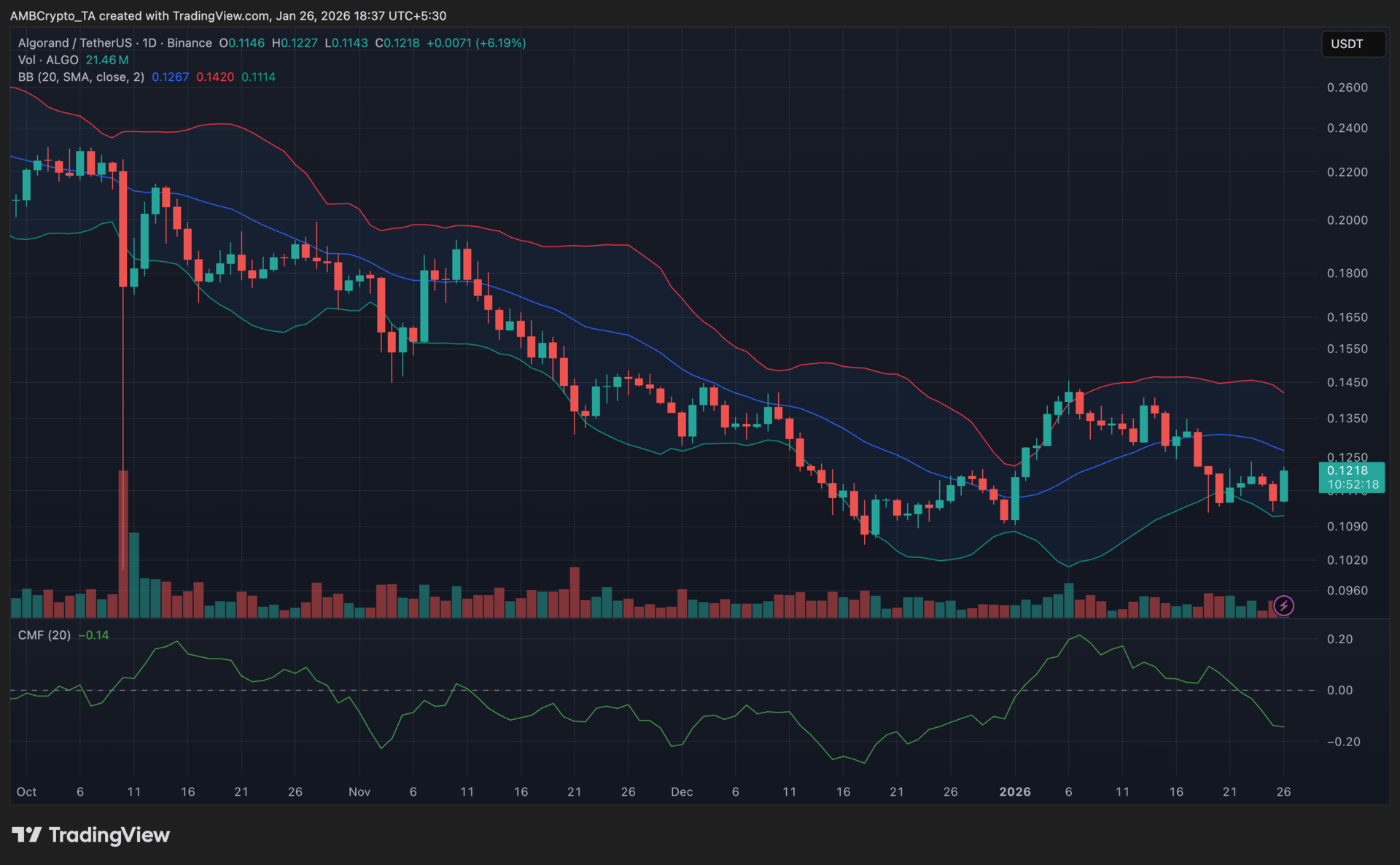

Algorand (ALGO)

Key points:

ALGO was last seen trading at $0.121, logging a solid daily rebound after defending the $0.110 zone.

Price rebounded from the lower Bollinger Band, while CMF stayed negative, pointing to a bounce driven more by positioning than strong inflows.

What you should know:

Algorand staged a short-term recovery after revisiting the $0.110–$0.113 support region, an area that previously absorbed selling pressure. The bounce began near the lower Bollinger Band, suggesting mean reversion rather than a confirmed trend shift. Price pushed back toward the middle band around $0.126–$0.130, which now acts as the first area to watch for continuation or rejection.

Despite the rebound, CMF remained below zero, indicating that capital inflows were still muted and accumulation lacked conviction. Volume improved slightly during the upswing, but it did not expand aggressively, reinforcing the view that the move was driven by dip buying rather than sustained demand.

On the catalyst side, altcoin rotation narratives helped lift sentiment, while Kraken’s USDC deposits and withdrawals on Algorand supported liquidity expectations across the ecosystem. For now, ALGO needs to hold above $0.113 support and reclaim the $0.130 zone, while the upper Bollinger Band near $0.140–$0.145 remains a key resistance to monitor.

Ethereum (ETH)

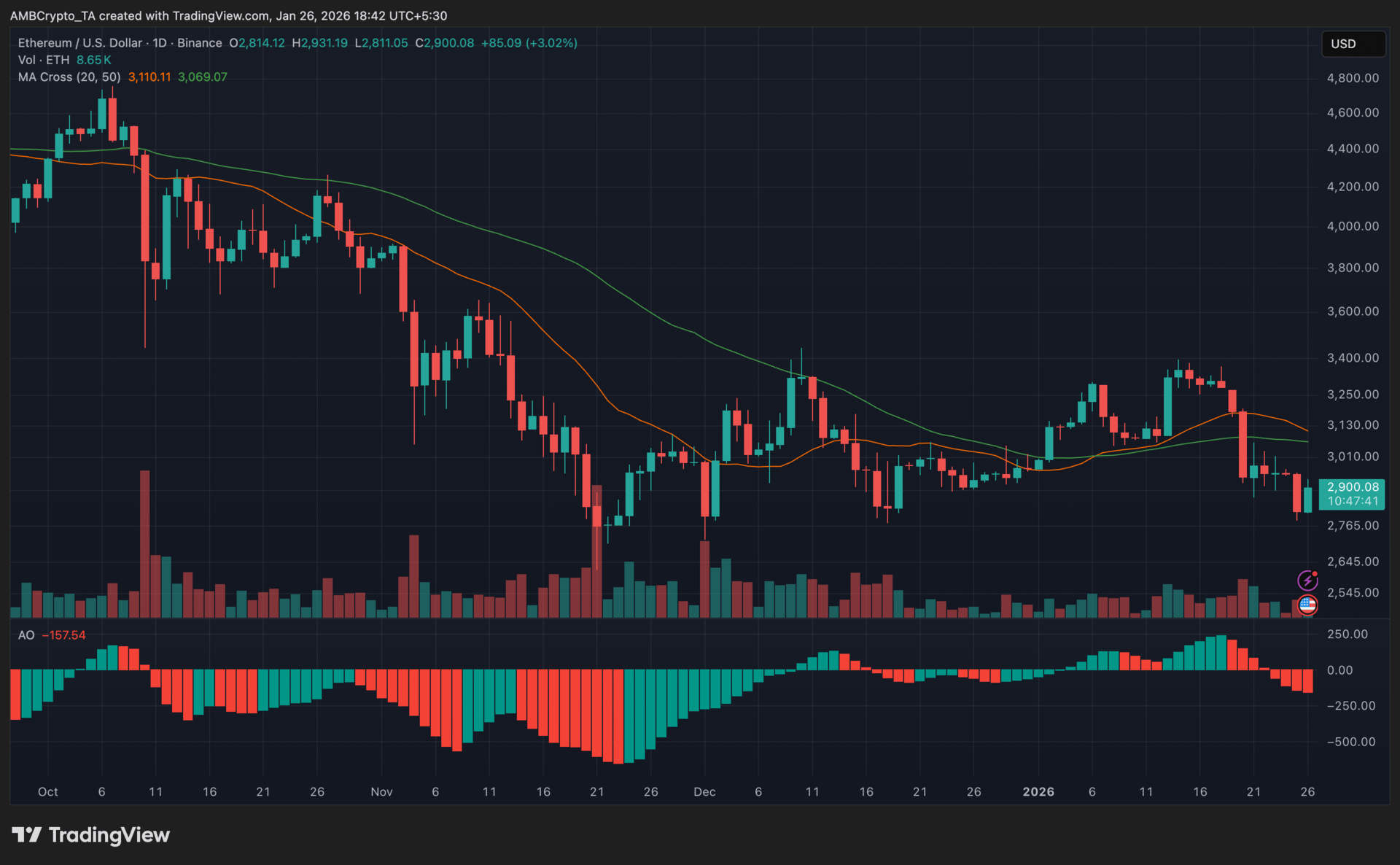

Key points:

ETH rebounded over 3% in the latest session, trading near $2,900 after a volatile pullback phase.

The 20-day MA remained above the 50-day MA, but price stayed below both, while the Awesome Oscillator continued to print negative momentum.

What you should know:

Ethereum exhibited a short-term rebound after recent selling pressure, with the latest daily candle closing higher near $2,900. Despite this bounce, price continued to trade below both the 20-day and 50-day moving averages, which currently sit around the $3,070–$3,110 zone and remain key overhead resistance levels to monitor.

The MA alignment itself stayed constructive, with the 20-day holding above the 50-day, but the failure to reclaim either level kept ETH technically constrained.

Momentum indicators offered limited confirmation. The Awesome Oscillator remained in negative territory, showing that bearish momentum had not fully unwound despite the recovery attempt. Volume during the rebound was moderate, suggesting the move was driven more by short-term positioning than strong conviction buying.

From a catalyst perspective, persistent outflows from Ethereum-linked investment products continued to weigh on sentiment, while broader market caution also limited follow-through. For now, ETH needs a sustained move back above the short-term moving averages to shift the near-term bias, while support remains in the $2,780–$2,800 region.

How was today's newsletter? |