- Unhashed Newsletter

- Posts

- Bitcoin fear hits statistical extremes

Bitcoin fear hits statistical extremes

Reading time: 5 minutes

Peak fear returns as Bitcoin hits statistical extremes

Key points:

Extreme investor anxiety, historic oversold readings, and record liquidations have pushed Bitcoin into zones that previously aligned with major market bottoms.

While price action remains volatile, multiple analysts argue the downturn reflects macro-driven de-risking rather than a breakdown in crypto fundamentals.

News - The crypto market’s sharp selloff has driven sentiment to some of its lowest levels since the 2022 collapse, reviving familiar fears while simultaneously triggering debate over whether a long-term bottom may be forming. Bitcoin’s plunge to nearly $60,000 marked its lowest level since October 2024 and erased over $2 trillion in market value from the sector since the October 2025 peak.

Several indicators now sit at historic extremes. Bitcoin briefly traded almost three standard deviations below its 200-day moving average, a level not seen during past crises such as the COVID-19 crash or the FTX collapse. The move ranked among the fastest drawdowns in Bitcoin’s history, with prices falling more than 20% in a single week as nearly $5.4 billion in leveraged positions were wiped out over a 72-hour window.

Anxiety, exhaustion, and market structure - Asset manager Bitwise described the current mood as comparable to late-stage bear markets in 2018 and 2022, periods that later proved to be major accumulation zones for long-term investors. The firm argues that peak anxiety tends to lag price action and often appears near recovery phases rather than at the start of declines.

On-chain data echoes that cautionary optimism. Nearly 10 million BTC are currently held at a loss, one of the highest readings on record, while supply in profit and supply in loss have nearly converged. Historically, that balance has emerged close to broader market turning points, although analysts caution that confirmation may still take time.

Cautious optimism meets macro reality - Not all observers see an immediate bottom. Jefferies noted that institutional de-risking, ETF outflows, and selling by large holders remain active headwinds. The bank framed the downturn as a liquidity-driven correction tied to global risk-off sentiment rather than failing blockchain fundamentals.

Even so, continued network usage, tokenization efforts, and growing traditional finance involvement suggest the disconnect between price and progress may widen before confidence returns. For now, analysts largely agree on one thing: any recovery is more likely to emerge through patience and exhaustion than a sudden surge in enthusiasm.

Corporate Bitcoin conviction holds despite mounting losses

Key points:

Metaplanet and Strategy both reaffirmed long-term Bitcoin accumulation strategies despite steep share price declines and large unrealized losses.

Executives framed the downturn as a stress test for leveraged treasury models rather than a signal to unwind Bitcoin exposure.

News - Corporate Bitcoin treasuries are under renewed scrutiny as the latest market drawdown pushes balance sheets deeper into the red. In Japan, Metaplanet’s leadership reiterated its commitment to Bitcoin accumulation even as the company’s shares continued to slide alongside the broader crypto market.

Metaplanet now holds 35,102 BTC, worth roughly $2.5 billion at current prices, with an average acquisition cost near $107,000 per coin. That leaves the firm sitting on substantial unrealized losses, compounded by roughly $280 million in outstanding debt.

Still, CEO Simon Gerovich said the company plans to steadily expand its Bitcoin holdings and revenue base, maintaining targets of 100,000 BTC by the end of 2026 and 210,000 BTC by 2027 under its “555 Million Plan.”

Losses test treasury models - The pressure is not limited to Metaplanet. Strategy, the world’s largest public Bitcoin holder with more than 713,000 BTC, reported a $12.4 billion net loss for the fourth quarter of 2025 as Bitcoin fell sharply over the period.

Shares dropped 17% following the earnings release, though executives emphasized that the firm’s capital structure remains resilient, citing ample cash reserves and no major debt maturities until 2027.

The broader backdrop remains challenging. Bitcoin is trading roughly 50% below its October 2025 peak, while market sentiment has fallen to its lowest level since the 2022 Terra collapse. More than $1.8 billion in crypto long positions were liquidated during the latest selloff, intensifying pressure on corporate balance sheets tied to digital assets.

Long-term commitment amid volatility - Strategy also used the earnings call to clarify downside risk scenarios. Management acknowledged that an extreme 90% Bitcoin drawdown to around $8,000 would strain its debt-backed model, potentially requiring restructuring or new financing before any forced asset sales. Leadership stressed that such a scenario is considered highly unlikely and would unfold over several years.

Despite the losses, neither company has signaled plans to reduce Bitcoin exposure. Strategy outlined plans to initiate a Bitcoin security program focused on long-term risks such as quantum computing and disclosed that it continued adding to its Bitcoin position during the downturn. Metaplanet, meanwhile, announced capital-raising efforts aimed at funding further purchases and managing debt.

Together, the disclosures highlight how aggressive corporate Bitcoin strategies are being tested by volatility, while underscoring a shared belief that long-term conviction, not short-term price action, will ultimately define success.

Polymarket takes legal steps toward long-awaited POLY token

Key points:

Polymarket’s parent company has filed U.S. trademark applications for “POLY” and “$POLY,” reinforcing plans for a native token and future airdrop.

The move comes as Polymarket expands partnerships and infrastructure while navigating mounting regulatory and legal scrutiny in the U.S.

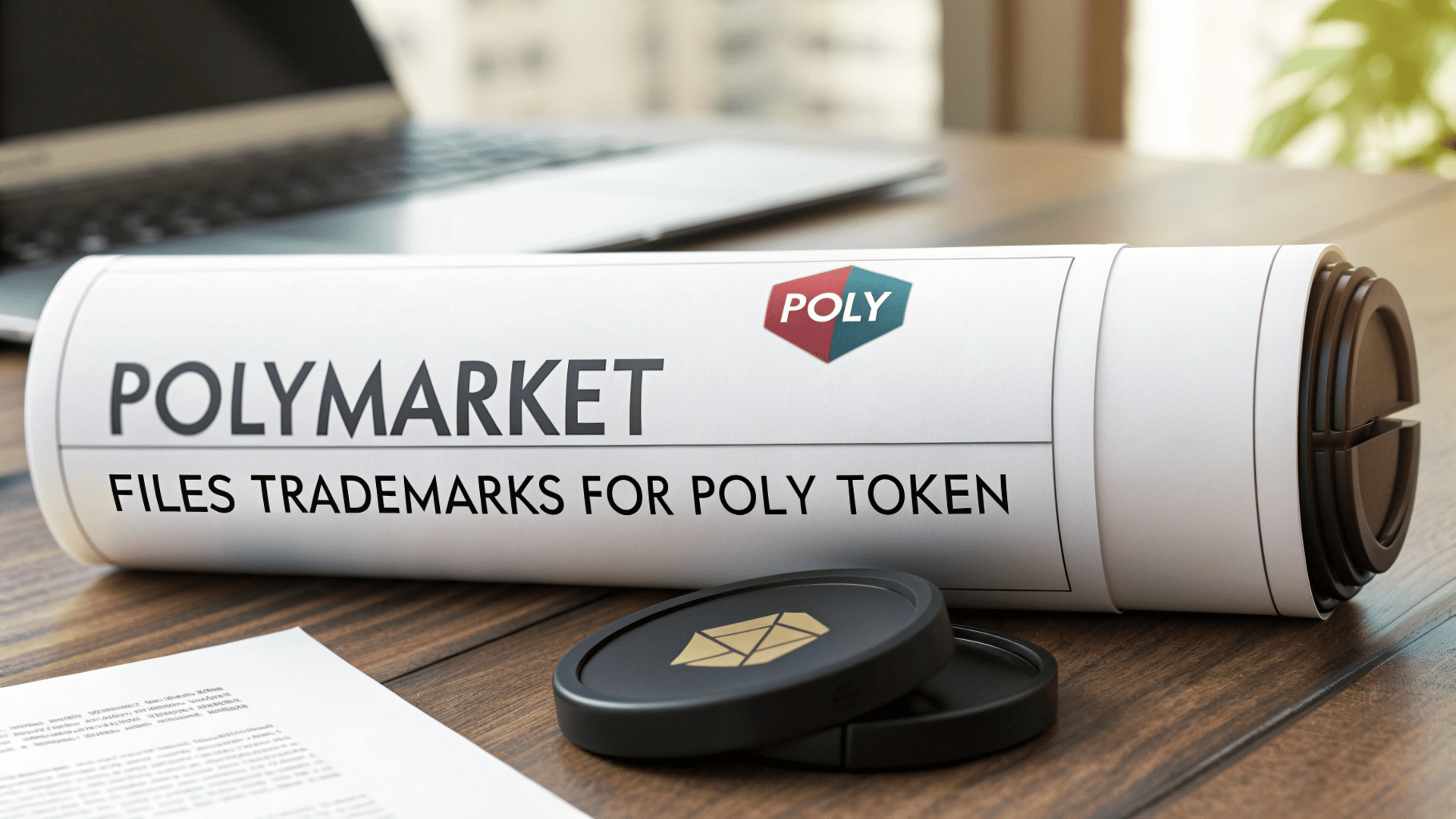

News - Polymarket has taken a formal legal step toward launching its long-anticipated native token. Blockratize Inc., the company behind the crypto-powered prediction markets platform, filed trademark applications in the United States for the wordmarks “POLY” and “$POLY,” according to records from the U.S. Patent and Trademark Office.

Both applications were submitted on February 4 and are listed as live and pending. They were filed on an intent-to-use basis and span multiple categories, including downloadable financial software, cryptocurrency and digital token services, and platform tools for electronic trading and clearing. The filings have met minimum requirements but have not yet been assigned to an examining attorney.

Token plans meet legal reality - The trademarks add a legal layer to plans Polymarket executives have already acknowledged publicly. Company leadership confirmed last year that a POLY token and accompanying airdrop are planned, though no timeline or token mechanics have been disclosed. Executives have previously indicated that restoring and strengthening the platform’s U.S. presence would take priority before any token rollout.

Market attention around POLY has grown alongside Polymarket’s expanding footprint. The platform has emerged as one of the largest global prediction markets by trading activity, posting $7.7 billion in volume last month. That scale has intensified expectations that a token layer could eventually be integrated into the broader ecosystem.

Expansion and scrutiny run in parallel - The trademark filings arrive amid rapid expansion and increasing scrutiny.

Polymarket has announced major partnerships and capital backing, including a $2 billion investment from Intercontinental Exchange, alongside integrations across finance, sports, and media. Those efforts have been accompanied by infrastructure changes, including a move to native USDC issued by Circle to improve settlement transparency and address cross-chain compliance concerns.

At the same time, the platform continues to face regulatory pressure in the U.S. State-level actions in Nevada and Tennessee have limited access in certain jurisdictions, while federal lawmakers have introduced the Public Integrity in Financial Prediction Markets Act of 2026, reflecting growing attention on prediction market activity.

While the trademark filings do not confirm a launch date, they signal preparation for a token-branded extension of the platform, even as legal and regulatory questions remain unresolved. For now, POLY remains a planned feature rather than a defined product.

Bitwise’s spot UNI ETF filing lands as UNI slides

Key points:

Bitwise filed an S-1 for a spot Uniswap ETF that would hold UNI directly, with Coinbase Custody named as custodian and no staking at launch.

UNI fell further on the news, even as activity signals like trading volume and token burn metrics pointed to elevated onchain engagement.

News - Bitwise has filed with the U.S. Securities and Exchange Commission (SEC) to launch what is being framed as the first spot ETF focused on Uniswap’s UNI token, pushing DeFi exposure deeper into traditional product design.

The registration statement, dated February 5, outlines a trust structure designed to track UNI’s value, net of expenses, with Coinbase Custody Trust Company listed as custodian. The filing also states the fund would not include staking at inception, though Bitwise left room to add it later.

The S-1 submission followed earlier Delaware statutory trust filings, marking a formal escalation of the regulatory process after the SEC concluded its investigation into Uniswap Labs last year, easing a key overhang for protocol-linked products.

Despite the milestone, UNI’s price did not respond positively. Reports placed UNI around $3.20 to $3.22, down roughly 14% to 15% over 24 hours, with some coverage describing the move as a five-year low and others calling it the weakest level since June 2024. The broader takeaway was consistent: ETF progress is a process step, not an instant sentiment reset.

Why the headline was not a catalyst - The selloff reinforced how fragile altcoin tape remains during a wider market downturn. Even with a regulated wrapper potentially offering brokerage access without wallets or private keys, the filing did not attract immediate bid-side support. Some market commentary pointed to overhead resistance around $3.95 as a key level that would need to be reclaimed to shift the short-term tone.

Fundamentals stay active under the surface - While price action stayed heavy, several activity signals moved in the opposite direction.

Trading volume was reported up more than 90% to about $692.7 million, and separate onchain data pointed to record daily UNI burns alongside rising fees and activity. There were also signs of positioning divergence, including a reported whale purchase of UNI funded by sales of XAUT and ETH, even as exchange reserve data was cited as a potential source of selling pressure.

For now, Bitwise’s filing is a DeFi milestone, but UNI’s market still looks focused on risk appetite, flows, and whether buyers step in beyond the headline.

More stories from the crypto ecosystem

Crypto scams uncovered

Organized scam syndicates in India were dismantled in major crypto fraud raids: India’s Delhi Police recently busted five cyber fraud rings across the West District, solving 20 cases involving crypto-linked scams totaling ₹4.8 crore (about $580,000) and recovering funds for some victims.

Hackers stole ~$40 million from Step Finance by compromising executives’ devices: In late January 2026, the DeFi analytics platform Step Finance suffered a major breach when attackers gained access through compromised executive devices, leading to roughly $40 million in cryptocurrency theft and prompting the platform to pause certain operations.

European authorities dismantled a deepfake-enabled crypto fraud network causing huge losses: Europol recently announced it dismantled an international cryptocurrency fraud and money-laundering network tied to deepfake scams that inflicted about €700 million in investor losses, using AI-generated identities to deceive victims and move funds across borders.

Daily news for curious minds.

Be the smartest person in the room. 1440 navigates 100+ sources to deliver a comprehensive, unbiased news roundup — politics, business, culture, and more — in a quick, 5-minute read. Completely free, completely factual.

Top 3 coins of the day

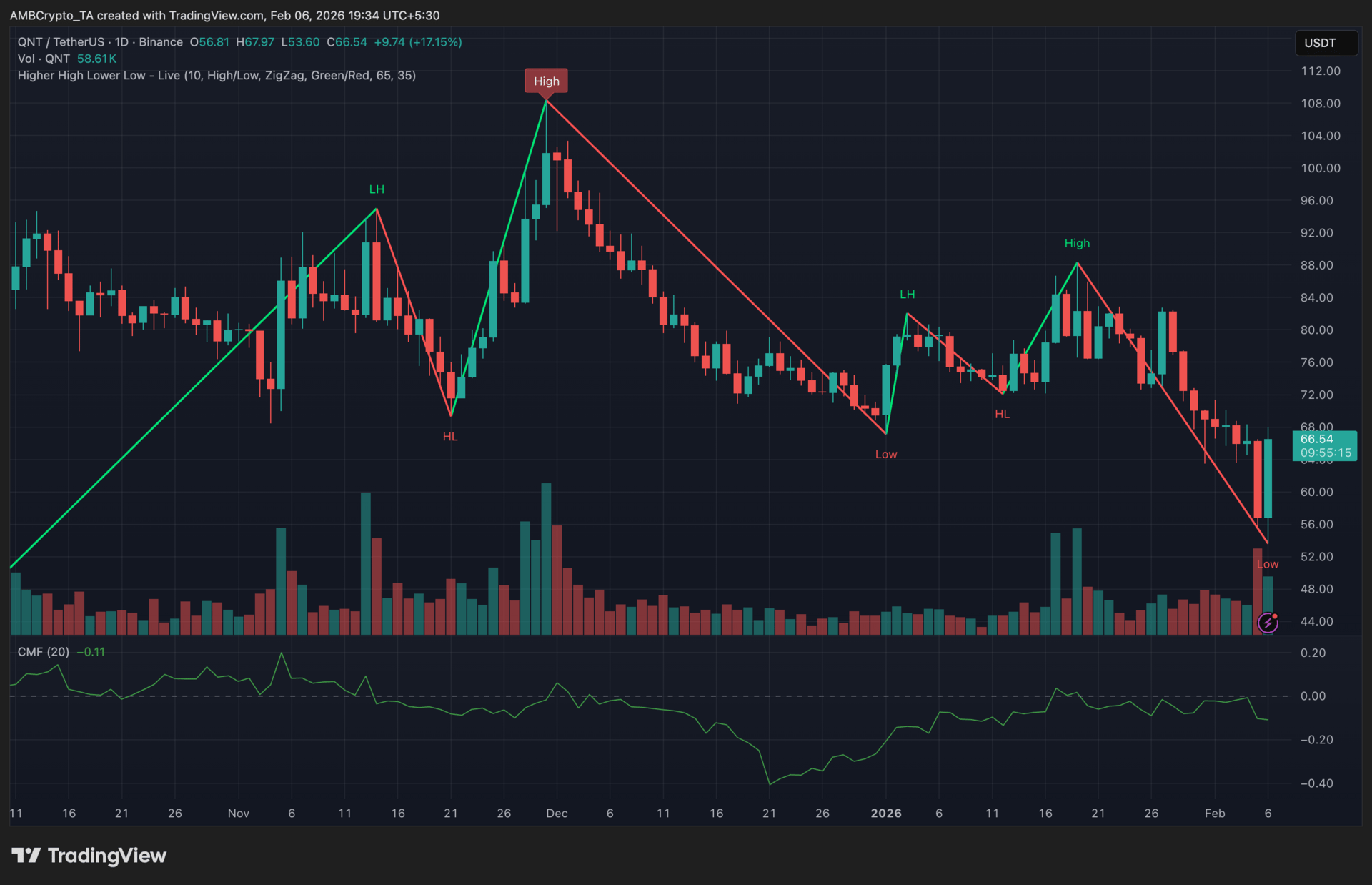

Quant (QNT)

Key points:

At press time, QNT was trading at $66, marking a sharp rebound from its recent swing low near $55 after a period of sustained downside pressure.

Buying interest picked up alongside a visible volume expansion, though capital inflows remained muted as the CMF stayed in negative territory.

What you should know:

QNT’s price action reflected a reactive bounce after sliding into a fresh lower low earlier in the week. The recovery followed a prolonged sequence of lower highs and lower lows, suggesting the move was corrective rather than a confirmed trend reversal. The Higher High Lower Low structure remained intact, indicating that the broader market structure was still tilted to the downside despite the short-term lift.

Trading volume increased notably during the rebound, signaling dip-buying activity near the $55 to $56 region. However, this buying strength did not fully translate into sustained accumulation. The CMF remained negative around -0.11, highlighting continued capital outflows and limited conviction behind the move.

For the rebound to gain traction, QNT needs to hold above the $55 support zone while gradually reclaiming the $70 to $72 area, which now stands as immediate resistance. Until inflows improve, upside attempts may remain vulnerable to renewed selling pressure.

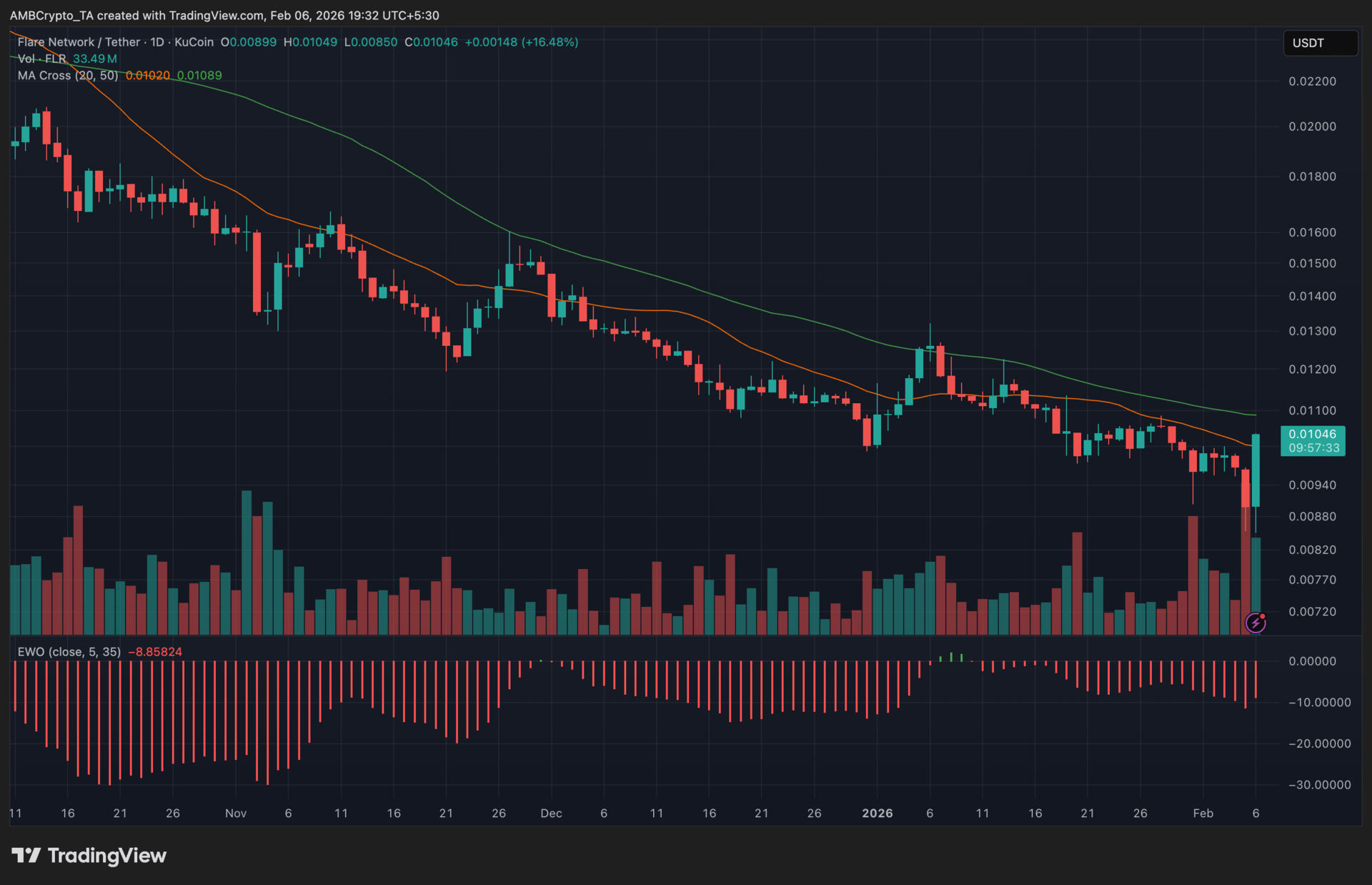

Flare (FLR)

Key points:

At press time, FLR was trading around $0.01046, marking a sharp intraday rebound after defending the $0.00900–$0.00950 zone.

The recovery was backed by a clear pickup in volume, while momentum indicators showed selling pressure easing rather than fully reversing.

What you should know:

FLR’s latest move unfolded as a reactionary bounce following an extended downtrend. Price had spent most of January printing lower highs and lower lows, remaining capped below both moving averages. The recent rebound saw FLR reclaim the faster MA, but the slower MA continued to act as overhead resistance, keeping the broader structure cautious.

Momentum conditions remained fragile. The EWO stayed in negative territory, reflecting that bearish momentum was still in control, though the slightly shrinking histogram suggested downside pressure had started to cool. This pointed more toward short-term relief than a confirmed trend shift.

Volume played a central role in the bounce. Trading activity expanded notably on the recovery candle, signaling active participation rather than a thin, low-liquidity move. For continuation, FLR now needs to hold above $0.00950. Resistance remains near $0.01080–$0.01120, where supply previously emerged.

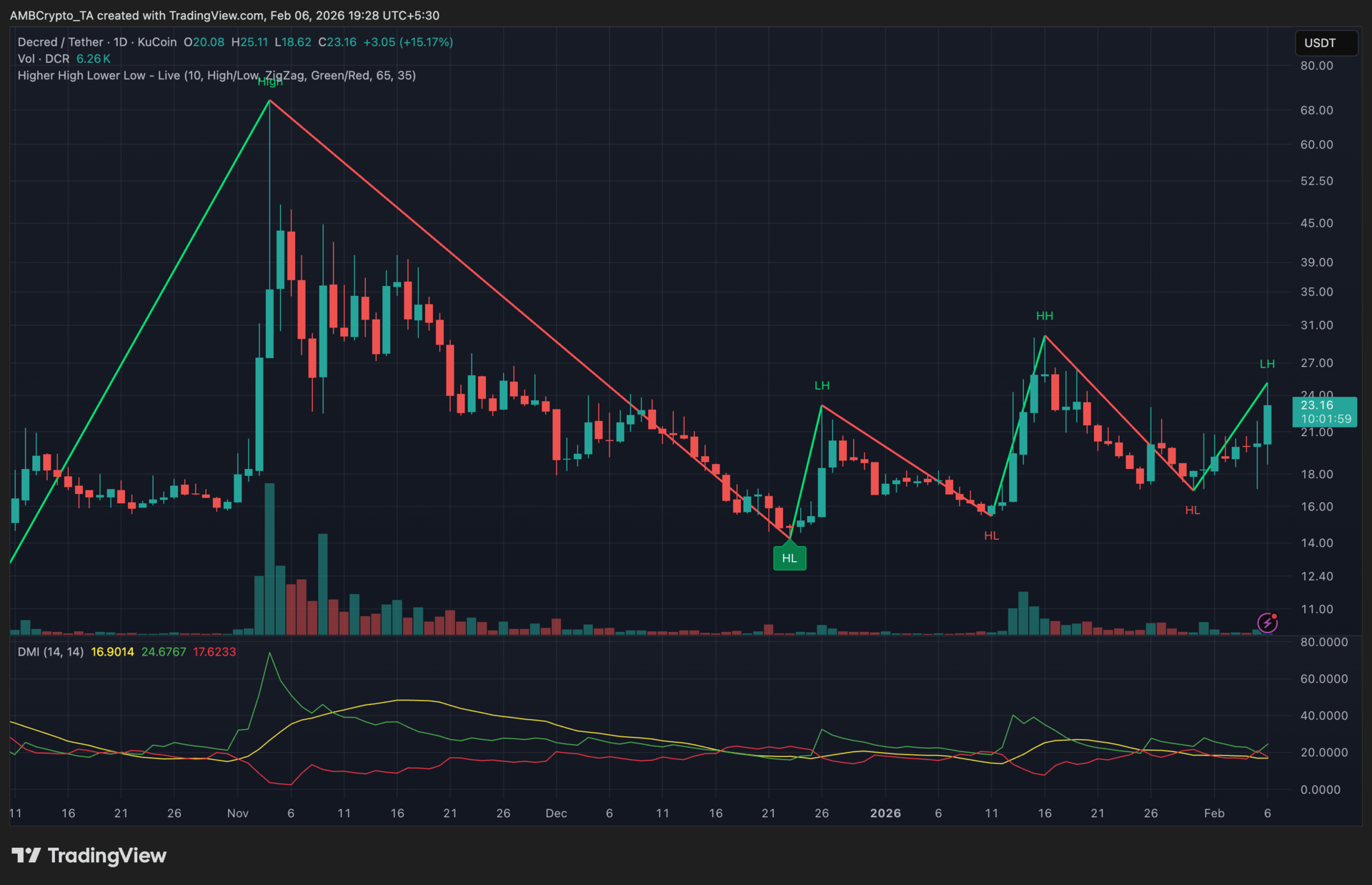

Decred (DCR)

Key points:

DCR surged to $23, marking a sharp daily advance as buyers stepped in aggressively after defending recent lows.

While the structure printed a higher low, the subsequent lower high showed upside momentum remained capped despite the rebound.

What you should know:

Decred recorded a strong upside move after bouncing from its recent low near $20, with price climbing toward the $23 region. The Higher High Lower Low structure highlighted a shift in downside behavior, as sellers failed to push price to a fresh low. However, the recovery stalled below the previous peak, resulting in a lower high and signaling that buyers had not yet regained full control.

Volume expanded during the rebound, confirming active participation rather than a thin relief move. That said, follow-through strength appeared limited, aligning with the structural hesitation visible on the chart.

From an indicator perspective, the DMI reflected a balanced setup, with trend strength remaining muted rather than decisively directional. This supports the view that the move functioned more as stabilization than a confirmed trend reversal.

Going forward, $22 remains the key support zone, while $25 stands as the immediate resistance area to watch. A break above that level would be needed to validate a broader bullish shift.

How was today's newsletter? |