- Unhashed Newsletter

- Posts

- Bitcoin gets a boost from big banks

Bitcoin gets a boost from big banks

Reading time: 5 minutes

Bank of America opens Bitcoin ETF access as institutions converge on 1% to 4% crypto playbook

Key points:

Bank of America will allow wealth advisers to recommend a 1% to 4% crypto allocation starting in January 2026, aligning its guidance with other major Wall Street institutions.

Clients will gain access to four spot Bitcoin ETFs, including IBIT, FBTC, BITB, and the Grayscale Bitcoin Mini Trust.

News - Bank of America is taking a major step into regulated digital assets by approving a 1% to 4% cryptocurrency allocation for its wealthiest clients.

Beginning January 5, 2026, the bank will open access to four Bitcoin ETFs across Merrill, the Private Bank, and Merrill Edge. The adviser network includes more than 15,000 professionals who will now be allowed to recommend these products for the first time.

The bank will grant access to four Bitcoin ETFs: BlackRock’s IBIT, Fidelity’s FBTC, Bitwise’s BITB, and Grayscale’s Bitcoin Mini Trust. These ETFs were previously available only upon client request.

Chief Investment Officer Chris Hyzy said a modest allocation is suitable for investors who are comfortable with thematic innovation and elevated volatility. He added that the bank’s guidance focuses on regulated vehicles and disciplined risk management.

The move follows a policy reversal by Vanguard, which now permits crypto ETF trading, and contributes to a rapidly forming institutional consensus around measured Bitcoin exposure.

Institutional playbook is taking shape - Bank of America’s recommendation joins a growing list: BlackRock previously suggested a 1% to 2% Bitcoin allocation, Fidelity proposed 2% to 5%, and Morgan Stanley endorsed 2% to 4%. Collectively, these firms are pushing a shared framework for risk-managed digital asset exposure across client portfolios.

Why this shift matters - The updated guidance reflects growing client demand for access to digital assets. It also signals that mainstream institutions are now moving in lockstep toward standardized Bitcoin allocations, placing further pressure on remaining holdouts like Wells Fargo, Goldman Sachs, and UBS.

Ethereum slides below $3,000 as holders sell, Fusaka upgrade nears, and whale activity reshapes market

Key points:

Ethereum long-term holders reduced their supply from 8.51% to 7.33% while new on-chain addresses rose 13.4% in one week.

ETH trades near $2,805 as the network prepares for the Fusaka upgrade and renewed attention on whale movements and staking patterns.

News - Ethereum is struggling to reclaim the $3,000 level after a 6% daily drop pushed the asset back from a key technical barrier. The rejection comes at a time when long-term holders have been steadily reducing their position sizes.

HODL Waves data shows that the 2 to 3-year cohort moved from 8.51% of supply to 7.33% since early November, reflecting sustained selling pressure.

Despite this, new network demand is picking up. Over the past seven days, new Ethereum addresses surged 13.4%, rising from 141,650 to 160,690. This marks the strongest jump in more than two months and signals that fresh inflows may help stabilize price action in the short term.

ETH is trading at $2,805 at the time of writing, sitting below the $2,814 resistance level that has formed a narrow range alongside the $3,000 ceiling. Analysts expect ETH to fluctuate within this band unless sustained investor support returns.

Fusaka upgrade brings faster scaling and lower costs - Ethereum’s upcoming Fusaka upgrade centers on PeerDAS, a system that lets validators verify smaller data samples instead of downloading full blobs. This reduces network duplication and improves efficiency for rollups.

The upgrade also introduces a blob-parameter-only schedule that allows future capacity increases without full hard forks. Early signs point to cheaper gas and less congestion across the network.

Whales move millions as older wallets reactivate - Whale activity is adding another layer of volatility. A dormant ICO wallet holding 40,000 ETH resurfaced after nearly a decade and sent the entire $120 million stash into staking.

Other OG addresses have been selling or transferring tokens, while BitMine accumulated nearly $70 million in ETH over the last three days as it continues to move toward its goal of holding 5% of the ETH supply.

Solana’s x402 payments hit record high as Wall Street and prediction markets pile in

Key points:

Solana became the number #1 network for x402 payments, hitting $380,000 in daily volume and a 750% weekly jump.

Traditional finance and prediction markets are accelerating activity on Solana through new ETF disclosures and tokenized event contracts.

News - Solana is seeing a surge in real usage as x402 payment activity hits new highs. Daily volume reached about $380,000 on Sunday, marking a 750% week-over-week increase and placing Solana at the top of the ecosystem for x402 transactions.

The HTTP-402-based protocol is now being used for real machine-driven payments rather than speculative churn, with AI agents and automated services settling recurring gasless USDC transfers through Solana’s low-fee environment.

This trend highlights the rapid expansion of the x402 ecosystem across Web3. More teams are adopting the protocol for privacy layers, agent coordination, and platform monetization. Researchers note that x402 is evolving from a niche experiment into a practical revenue rail, enabling recurring micropayments without credit systems or API keys.

TradFi steps in with Solana ETF exposure - Institutional participation is rising in parallel with on-chain demand. Cantor Fitzgerald disclosed a position of 58,000 shares in the Volatility Shares Solana ETF in its recent Form 13F filing, valued at $1,282,960 at quarter-end prices.

The futures-based ETF launched earlier this year and joins a broader wave of Solana-linked products from firms like Fidelity, VanEck, and Canary. Analysts say a regulated firm holding a Solana ETF helps lower perceived risk for retail investors and signals that sentiment is shifting into tangible market behavior.

Kalshi brings prediction markets on-chain - Prediction market operator Kalshi is also pushing deeper into Solana after announcing tokenized versions of its event contracts. The setup connects Kalshi’s off-chain markets to Solana liquidity through DFlow and Jupiter, giving users access to a unified liquidity pool and on-chain settlement.

The firm has launched a $2 million builders program to encourage integrations across dashboards, bots, analytics tools, and mobile apps. Kalshi’s valuation recently climbed to $11 billion following a reported $1 billion raise, underscoring growing demand for alternative trading formats.

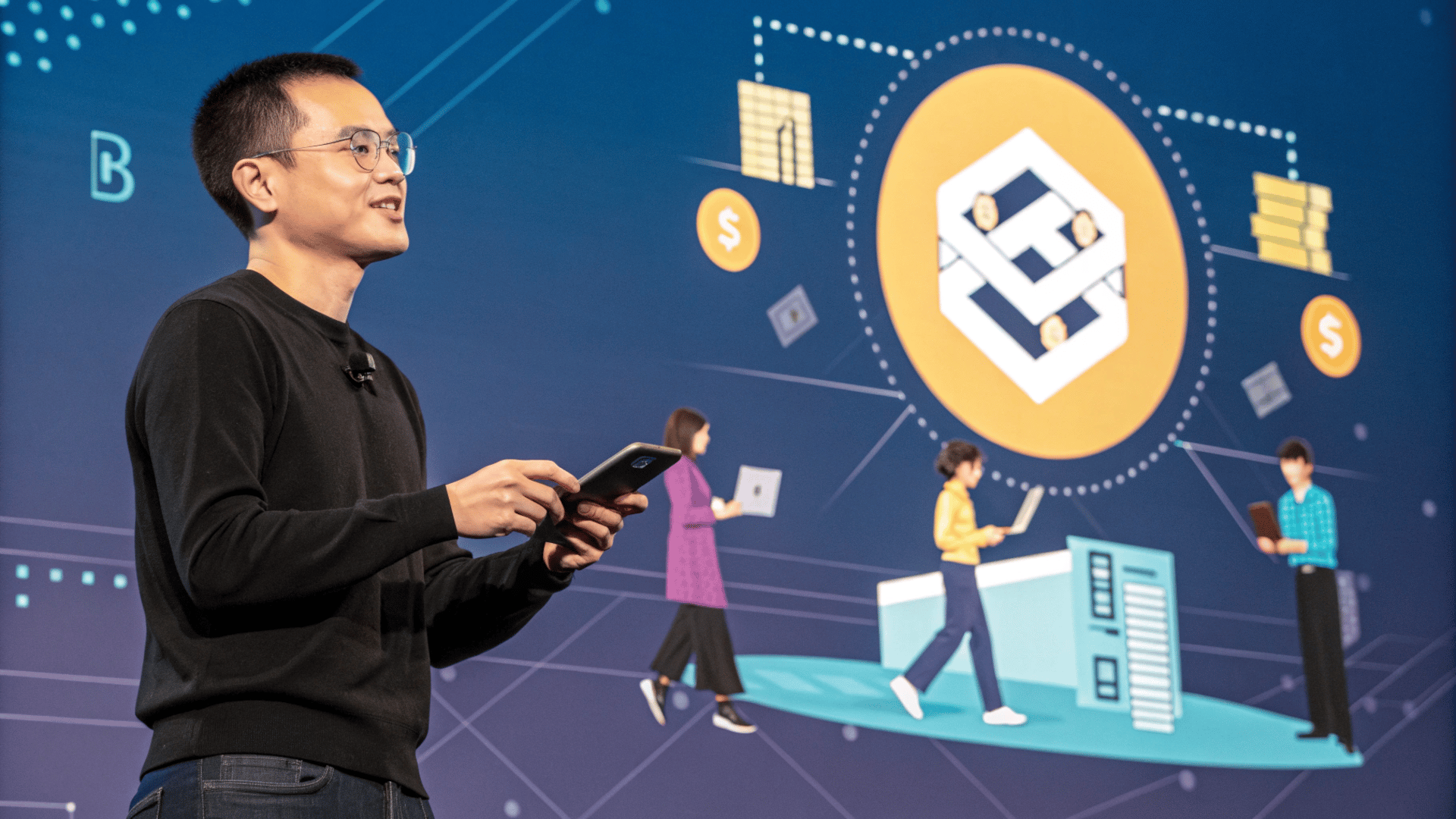

CZ’s Trust Wallet pushes in-wallet prediction markets as YZi Labs targets BNB treasury shakeup

Key points:

Trust Wallet has rolled out a native Predictions tab powered first by Myriad, with plans to add Kalshi and Polymarket, making it the first Web3 wallet to integrate prediction markets directly.

At the same time, CZ-linked YZi Labs is pushing to overhaul CEA Industries, the largest public BNB treasury firm, after its stock collapsed while BNB itself held up comparatively better.

News - Trust Wallet, the self-custody wallet backed by Binance co-founder Changpeng “CZ” Zhao, has launched Predictions, an in-wallet section that lets users trade tokenized outcome markets on real-world events without leaving the app.

The feature aggregates markets from platforms such as Myriad and is set to onboard Kalshi and Polymarket, reflecting a broader trend of bundling trading tools, tokenized stocks, and now prediction markets inside a single interface.

In parallel, CZ’s investment firm YZi Labs is pressing for a board and management shakeup at CEA Industries, a publicly traded BNB treasury vehicle it helped finance.

CEA’s shares have fallen more than 90% from their post-pivot highs, even as BNB itself is still up double digits year to date, prompting YZi to accuse the current leadership of “destruction” of shareholder value and weak communication with investors.

Wallets add native prediction markets - With Predictions live, Trust Wallet now offers access to narrative-driven markets, from elections to token launches and sports, directly inside the wallet.

Myriad, a Web3 prediction protocol launched by Dastan, a media-linked Web3 company, has already crossed $100 million in cumulative volume after growing 10 times in three months.

Trust Wallet’s integration gives those markets a one-click entry point for tens of millions of users, while MetaMask’s separate tie-up with Polymarket shows that multiple wallets are starting to integrate prediction markets into their existing interfaces for on-chain opinions and information trading.

BNB treasury dispute highlights CZ-linked activism - YZi Labs’ consent filing with the SEC seeks to expand CEA’s board, elect its nominees, and unwind bylaw changes made since July.

The filing argues that CEA’s management is directly responsible for the stock’s underperformance, citing slow investor updates, limited media and marketing efforts, and weaker execution even as BNB’s price has risen since the treasury strategy was announced.

Whether shareholders back YZi’s proposals will determine whether the CZ-linked firm gains greater influence over CEA’s board and the direction of one of the largest BNB treasury vehicles on public markets.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

More stories from the crypto ecosystem

China declares a new war on crypto – This time, stablecoins are the target

Is tokenized gold the next revolution people should be ready for?

Vanguard just ‘caved’ – 50M investors can now trade crypto ETFs

Bitcoin: Why Japan’s Yen carry fears put BTC’s $88K support at risk

Ethena’s price action issues ‘warning’ as ENA repeats June 2025 pattern

Interesting facts

An Indian high court has explicitly classified crypto as property that can be held in trust - In an October 2025 ruling, the Madras High Court held that cryptocurrency is “property” under Indian law and can be owned, enjoyed, and even held in trust, reinforcing legal protection for digital assets in one of the world’s largest crypto user bases.

Stablecoins have become both crypto’s workhorse and its favorite rail for crime - TRM Labs and Chainalysis data show that stablecoins processed more than $4 trillion in transactions between January and July 2025 with about 99% of that activity licit, yet stablecoins now account for roughly 60 to 63% of known illicit crypto transaction volume even as illicit flows make up only about 0.14% of total on-chain volume.

A handful of Wall Street style giants dominated tokenized US Treasuries as of April 2025 - RWA.xyz data from that period showed six issuers, including BlackRock, Franklin Templeton, and Ondo, controlling about 88% of all tokenized Treasuries, with BlackRock’s BUIDL fund alone holding roughly 41% of sector assets at around $2.5 billion in market cap.

The Headlines Traders Need Before the Bell

Tired of missing the trades that actually move?

In under five minutes, Elite Trade Club delivers the top stories, market-moving headlines, and stocks to watch — before the open.

Join 200K+ traders who start with a plan, not a scroll.

Top 3 coins of the day

NEAR Protocol (NEAR)

Key points:

NEAR was recently trading around $1.72, recovering from its prior session’s decline after bouncing off a new lower low.

The DMI kept its bearish setup, with the -DI leading the +DI and ADX holding elevated levels that continued to signal trend strength.

What you should know:

NEAR posted a modest rebound after dropping to a fresh lower low near the $1.60–$1.62 region. The Higher High Lower Low structure reflected a sustained downtrend across recent weeks, and today’s green candle formed with only moderate support from volume. The DMI stayed tilted in favor of sellers, with the negative directional line above the positive one and ADX showing that trend strength remained intact. Beyond the chart, interest surrounding NEAR Intents continued to grow as cross-chain activity climbed and integrations expanded the protocol’s reach. Institutional demand also played a role, following recent treasury accumulation that reduced available supply. Traders are monitoring whether NEAR can build enough momentum to revisit the $1.90–$2.00 resistance band while keeping the $1.60 support area intact.

Cronos (CRO)

Key points:

CRO traded near $0.108, marking a steady climb from its previous daily close as buyers stepped in after a prolonged period of compressed volatility.

The Bollinger Bands stayed tight while the Squeeze Momentum Indicator showed lighter red bars, indicating that bearish momentum continued to ease.

What you should know:

CRO recorded a firm intraday advance as price moved toward the Bollinger midline after several weeks of trading along the lower band. The indicator structure reflected a gradual slowdown in downside momentum, with the Squeeze Momentum histogram shifting to lighter red and volatility remaining compressed. Volume stayed modest during the move, suggesting a measured return of interest rather than a strong breakout attempt. Outside technicals, sentiment improved following renewed attention around the upcoming Trump Media SPAC-related treasury plans, which signaled potential long-term supply absorption. Market participants also reacted to developments tied to the CRO treasury deal nearing closure. Traders are watching whether CRO can gain enough strength to push above the $0.11 midline, while the $0.095–$0.10 area remains a visible support zone.

Pump.fun (PUMP)

Key points:

PUMP hovered around $0.0028, marking a steady upward push after a period of compressed movement.

The Parabolic SAR positioned itself beneath the candles, while the Stochastic RSI stayed in its upper zone, reflecting continued short-term strength.

What you should know:

PUMP’s latest session delivered a clearer upward push, with the price moving gradually toward the $0.0030 barrier that repeatedly limited upside attempts through November. The Parabolic SAR continued signaling a supportive structure as its markers held beneath the recent candles. At the same time, the Stochastic RSI remained firmly elevated, showing sustained momentum even as volatility stayed relatively contained. Trading volumes were stable, indicating that the move was driven more by measured accumulation than by sudden speculative surges. Away from the chart, interest built around fresh whale inflows as a newly active large buyer absorbed a significant amount of PUMP over several days. This accumulation helped shift market attention back to the token during a cautious broader environment. Traders now look to see if PUMP can maintain its pace and press past $0.0030, with the $0.0025–$0.0026 region serving as the immediate support cushion.

How was today's newsletter? |