- Unhashed Newsletter

- Posts

- Bitcoin’s brutal flush resets the market

Bitcoin’s brutal flush resets the market

Reading time: 5 minutes

Bitcoin’s Sunday flush tests whales, ETF inflows, and safe-haven rotation

Key points:

Bitcoin’s holiday rebound ended abruptly as a sharp Sunday selloff dragged the price from near $92,000 to below $86,000, triggering more than $650 million in liquidations.

Technical signals still lean bearish, even as corporate accumulation, strong fund inflows, and rising safe-haven demand shape a mixed market outlook.

News - Bitcoin’s late November recovery was short-lived. Whales across multiple cohorts shifted into net accumulation last week, with the largest holders posting their strongest buying activity since August.

Retail positioned similarly, and ETF flows finally turned positive after weeks of outflows. BTC products brought in about $70 million and ETH funds saw roughly $312 million, giving majors a 10% weekly lift.

That progress faded overnight when a heavy Sunday selloff pulled BTC below $86,000 from a local high near $92,000. The move wiped out last week’s gains and sparked more than $650 million in liquidations.

By morning, Bitcoin hovered close to $85,700 while crypto majors fell 6 to 8%. At the same time, gold futures climbed to about $4,262, sitting just 3% below a record high, reflecting cautious sentiment and growing expectations of a December rate cut.

Macro bears circle Bitcoin - The monthly MACD flipped bearish in October for the first time this cycle, a signal that historically preceded drawdowns of around 50% in most prior cases. Since that crossover, BTC has already fallen about 35%.

Current projections outline downside areas near $76,250, $66,300, and potentially $62,200 if momentum weakens further.

Strategy builds cash and adds BTC - Strategy established a $1.44 billion reserve funded through recent stock sales, enough to cover about 21 months of dividends and interest. The firm also purchased 130 BTC for $11.7 million, lifting its holdings to 650,000 BTC.

Updated 2025 guidance now expects a BTC yield of 22 to 26% and significantly lower operating and gain targets.

Funds rotate back to crypto amid inflation debate - Digital asset products recorded $1.07 billion in inflows after four weeks of heavy outflows. Bitcoin, Ethereum and XRP led demand as global inflation remains elevated near 4.2% and growth forecasts hover near recession territory.

Investors are balancing gold’s long history as a safe haven with Bitcoin’s tendency to strengthen during policy uncertainty.

Ripple secures wider Singapore approval as XRP whales accelerate activity

Key points:

Ripple received expanded approval in Singapore that allows broader token-based settlement using XRP, RLUSD, and other digital payment tokens.

Despite price weakness this week, on-chain data shows large XRP traders increasing activity as institutional demand rises across APAC and the Middle East.

News - Ripple has strengthened its regulatory footing in Asia after securing expanded approval from the Monetary Authority of Singapore (MAS) to widen the scope of its Major Payment Institution license.

The permissions apply to Ripple Markets APAC and allow the company to offer a larger suite of token-based settlement and payment services using XRP, RLUSD, and other digital payment tokens.

The expansion builds on Ripple’s established presence in Singapore, where it has operated its APAC headquarters since 2017. The firm highlighted that on-chain activity across the region is up roughly 70% year over year, making Asia Pacific its fastest growing market.

The upgraded license gives Ripple added flexibility to deliver regulated payout, settlement, and on-ramp services for banks, fintechs, and crypto firms through a single integration.

Institutional interest is growing as well. Ripple’s payments suite continues to gain traction across APAC and recently received a boost in the UAE, where Abu Dhabi’s regulator greenlisted RLUSD as an Accepted Fiat Referenced Token for collateral, lending and brokerage use.

XRP whales stay active - Although XRP slipped about 7% during the broader market pullback, large traders have continued placing significant spot orders. Data shows that whale-sized transactions have dominated volume for months, suggesting steady accumulation even during price softness.

ETP flows signal renewed demand - Crypto ETPs ended a four-week slump by drawing $1.07 billion in inflows. XRP posted record weekly inflows of $289 million, supported by new ETF launches in the United States and rising institutional exposure.

Singapore’s regulatory clarity drives expansion - Executives noted that Singapore’s licensing framework has provided long-standing clarity for digital asset companies. Ripple said the updated permissions will support deeper investment in the city state and expand its ability to serve regional financial institutions seeking compliant cross-border settlement rails.

Japan’s bond shock collides with crypto as Tokyo prepares 20% flat tax shift

Key points:

Japan is preparing to replace its heavy progressive crypto tax regime with a uniform 20% levy, aligning digital assets with equities and investment trusts.

At the same time, soaring Japanese bond yields are triggering global deleveraging, wiping out more than $600 million in crypto positions as the yen carry trade unwinds.

News - Japan is moving toward its most significant crypto tax reform in years. Lawmakers plan to introduce a flat 20% tax on digital asset gains, placing crypto under the country’s separate taxation framework. Today, retail traders face progressive rates that can reach as high as 55%, a structure long blamed for driving market activity offshore.

Under the proposed reform, national and regional governments would split the 20% rate at 15% and 5%, respectively. Policymakers aim to finalize the measure as part of the 2026 tax package in December. Local exchanges have reported steady demand, with spot volumes crossing $9.6 billion in September as regulated trading grows.

The tax overhaul, however, arrives during a volatile week for crypto markets. Japan’s 10-year government bond yield surged to around 1.84%, its highest level since 2008, triggering global de-risking and more than $640 million in liquidations across digital assets.

Bitcoin fell more than 5%, with Ethereum seeing a similar decline as investors unwound leveraged positions.

Yen carry trade shakeup - The spike in yields signals a deeper shift. Rising Japanese rates threaten to unwind decades of carry trade activity where investors borrowed cheap yen to buy higher yielding assets worldwide. Analysts warn that repatriation flows could tighten liquidity for crypto, equities, and bonds.

Global markets brace for BOJ - Japan’s two-year yield hit 1% and Governor Ueda signaled that a rate hike could be on the table at the December 18 to 19 meeting. Forecasts suggest policy rates could climb toward 1.4% amid inflation pressures and fiscal expansion.

Bond volatility hits risk assets first - Risk assets like crypto typically absorb the initial impact of liquidity shocks. With Japanese yields near 17-year highs and U.S. funding needs at record levels, traders are watching Japan’s bond market as closely as Bitcoin charts.

Sony moves into stablecoins as PlayStation and anime payments go on-chain

Key points:

Sony Bank is preparing to launch a USD-pegged stablecoin in the United States by 2026, aiming to support payments across PlayStation, Crunchyroll and its wider entertainment ecosystem.

The bank has applied for a US license, partnered with Bastion and expanded its Web3 division as part of a broader blockchain strategy.

News - Sony Bank is gearing up for a major move into blockchain payments. The digital banking arm of Sony Financial Group plans to issue a US dollar-pegged stablecoin as early as the 2026 fiscal year. The token is expected to support payments for games, subscriptions, and anime content across PlayStation Store and Crunchyroll, two of Sony’s largest digital platforms.

The shift is designed to lower payment processing costs and offer users a blockchain-based alternative to credit cards, which currently dominate purchases for gaming and streaming. The stablecoin will be issued through a dedicated US subsidiary, for which Sony Bank applied for a banking license in October.

Sony has also partnered with Bastion, a US stablecoin issuer backed by Coinbase Ventures, and participated in the company’s recent funding round.

The move aligns with Sony Bank’s push into Web3. Earlier this year, the bank launched a dedicated blockchain subsidiary called BlockBloom to explore NFT storage, wallets, exchange services, and digital collectibles.

Sony Financial Group’s recent spin off from Sony Group also gives the bank more independence to expand into new business areas such as stablecoins.

Expanding the Sony ecosystem - Sony’s stablecoin aims to reduce payment processing costs and improve the efficiency of digital transactions across its ecosystem. It could also power digital marketplace payouts, offering faster settlement for third-party game studios that distribute content through the PlayStation Store.

Global stablecoin adoption rises - Other jurisdictions are advancing their own frameworks. Uzbekistan will launch a regulated sandbox in 2026 to test stablecoin payments and tokenized securities, signaling broader adoption across Central Asia.

Integration across gaming and media - A Sony-issued stablecoin could enable new loyalty programs, in-game rewards, and unified digital payments across PlayStation and Crunchyroll. It also complements Sony’s existing blockchain work, including its Ethereum Layer 2 network Soneium.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

More stories from the crypto ecosystem

AAVE: $160 support in danger? THIS signals a deeper downside ahead

Bitcoin and Ethereum crumble – $647 mln in longs vanish overnight!

Arthur Hayes warns of Monad’s 99% drop, calls it a ‘high FDV, low-float VC coin’

Will more people sell BTC? Peter Schiff unpacks his ‘biggest Bitcoin mistake’

What next for Quant after market-wide reset slashes QNT’s price by 11%?

Did you know?

Iceland briefly turned into a power plant for Bitcoin more than for people - In 2018, Iceland’s energy officials warned that crypto mining was set to consume more electricity than every household in the country, thanks to industrial farms chasing cheap geothermal power.

A Canadian city is piping Bitcoin mining heat into homes instead of letting it go to waste - North Vancouver partnered with cleantech miner MintGreen so that waste heat from Bitcoin rigs can help warm around 100 residential and commercial buildings through the city’s district energy system.

Venezuela launched the Petro as a state crypto it claimed was backed by oil barrels - In 2018, President Nicolás Maduro unveiled the Petro, a government-issued cryptocurrency that the administration promoted as the first state-backed token tied to the country’s oil reserves, pitched as a way to dodge sanctions and raise fresh capital.

The Headlines Traders Need Before the Bell

Tired of missing the trades that actually move?

In under five minutes, Elite Trade Club delivers the top stories, market-moving headlines, and stocks to watch — before the open.

Join 200K+ traders who start with a plan, not a scroll.

Top 3 coins of the day

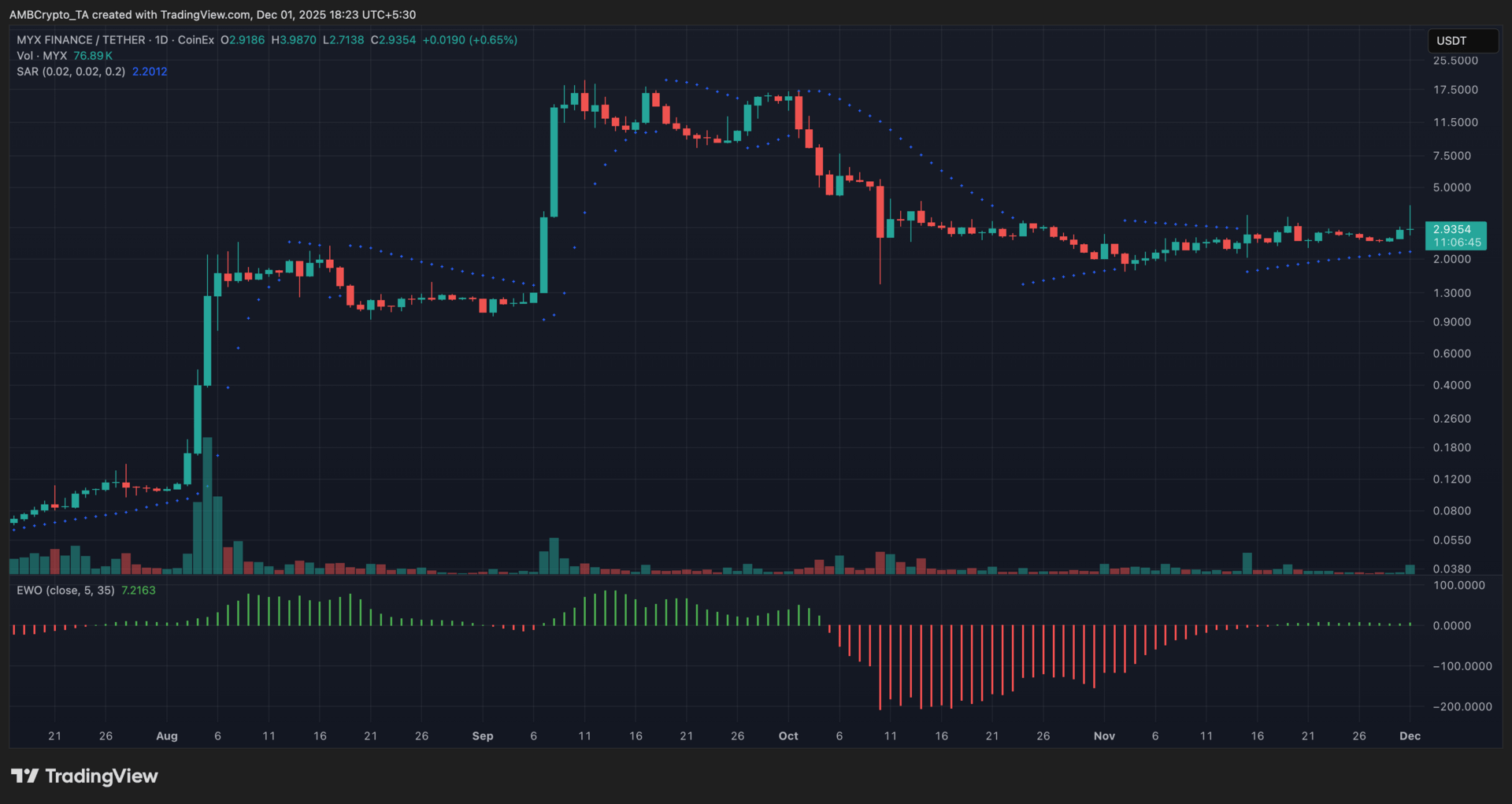

MYX Finance (MYX)

Key points:

MYX was last seen trading near $2.93, marking a mild uptick from its previous daily close while holding steady within its recent range.

The Parabolic SAR stayed below the candles, and the EWO crossed slightly above zero, with light green bars pointing to a modest pickup in bullish momentum.

What you should know:

MYX hovered in a narrow band through late November, and its latest move carried the price toward the upper end of that range. Trading activity stayed relatively muted, with volume remaining on the lower side throughout the month. The Parabolic SAR maintained a supportive position under the candles, while the EWO signaled early momentum improvement after crossing slightly above zero. Beyond the chart, trader attention continued to build around Binance listing speculation, which has been a key sentiment driver for the token. Hype surrounding the project’s upcoming V2 upgrade also added to the broader narrative. For now, MYX still needs a clear push above the visible resistance zone near $3.00–$3.05, while the $2.60–$2.70 region remains an area traders may watch for support.

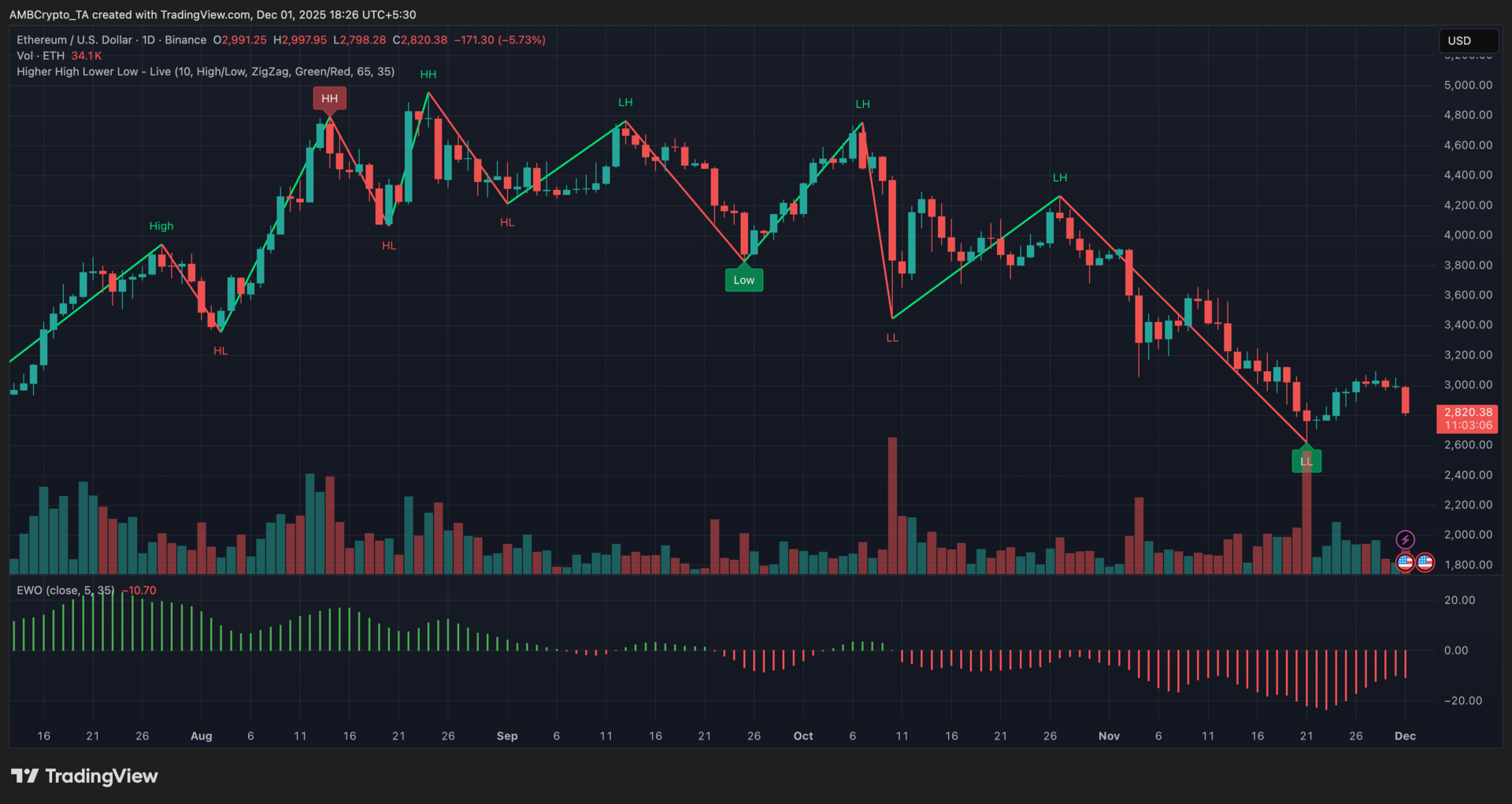

Ethereum (ETH)

Key points:

ETH was recently trading close to $2,820, sliding further from its prior daily close as sellers continued to control the short-term trend.

The Higher High Lower Low structure stayed bearish, while the EWO remained deep in negative territory with red bars that showed only a slight slowdown in downside momentum.

What you should know:

ETH extended its decline after forming another lower low toward the end of November, reinforcing its ongoing sequence of lower highs and lower lows. The latest drop came with strong red volume, while the minor rebound that followed showed lighter participation. The EWO stayed negative, reflecting persistent bearish pressure even as the most recent bars eased slightly. Outside the chart, market sentiment took a hit from Japan’s proposed crypto tax and renewed caution around upcoming Federal Reserve commentary. The fallout from Yearn Finance’s recent exploit and broader liquidation pressures added to the downside. For now, traders are watching whether ETH can stabilize above the visible support region near $2,600–$2,700, while the $3,000 area stands out as the next resistance to monitor.

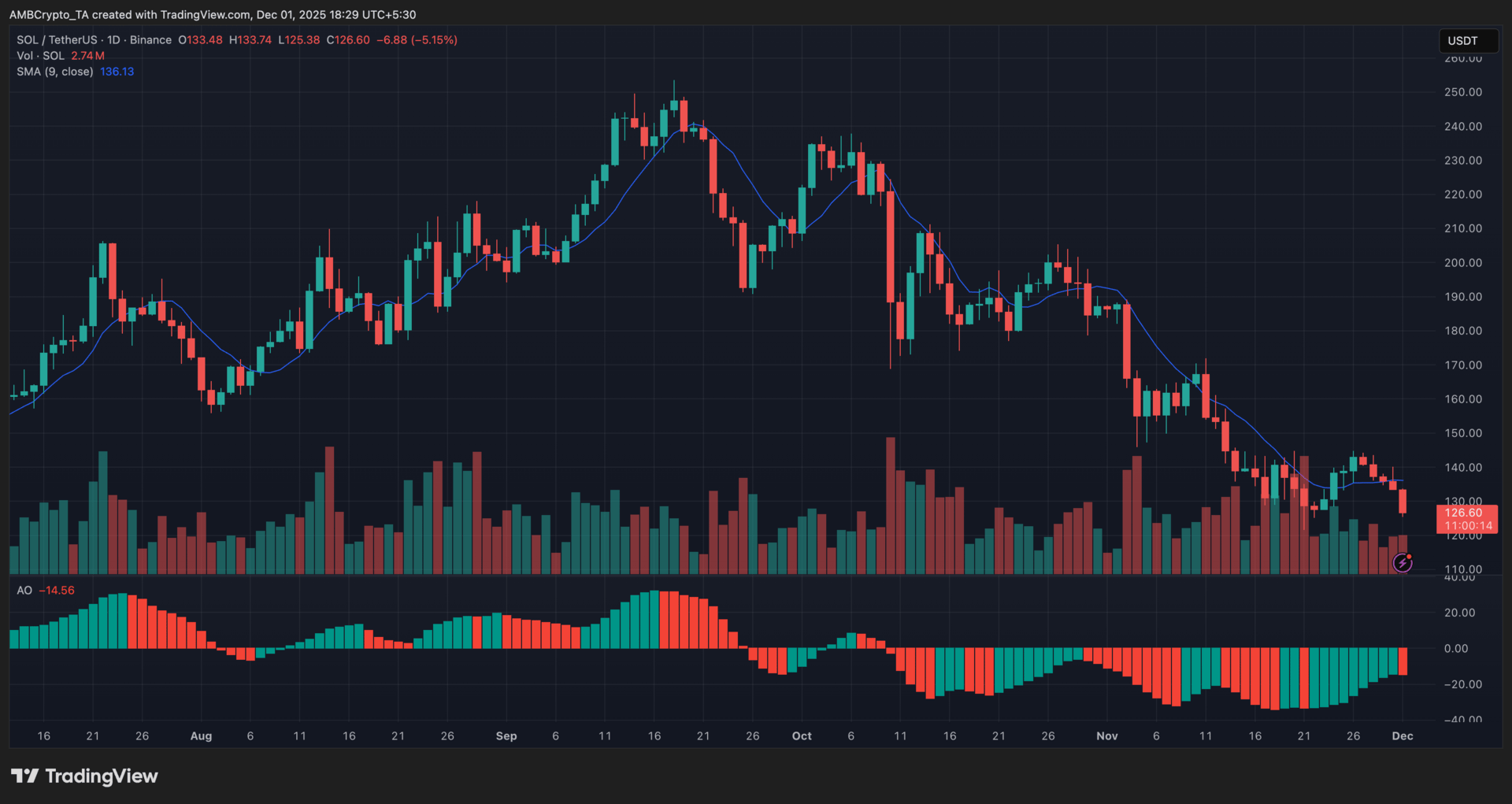

Solana (SOL)

Key points:

SOL last traded near $126, marking a sharper pullback from its previous daily close as sellers kept pressure on the market.

The 9-day SMA stayed above the candles, while the Awesome Oscillator flipped red on the latest bar after a brief run of green, signaling that upward momentum faded again.

What you should know:

SOL continued to slide across November, with each recovery attempt failing to reclaim its declining 9-day SMA. The latest daily candle extended that weakness after a rejection near the $135–$140 region. Sell volume remained elevated compared to recent buy-side activity, and the Awesome Oscillator turned red after a short stretch of green bars, showing that bullish momentum had cooled off quickly. Market sentiment outside the chart also leaned risk-off. A spike in global liquidations and rising concerns around Japan’s bond yields added pressure across major assets. Solana-specific factors, including ETF outflows and renewed FUD tied to the recent Upbit incident, contributed to the broader pullback. Traders are now watching whether the $120–$122 zone can act as near-term support, with the $135 area standing out as resistance to monitor.

How was today's newsletter? |