- Unhashed Newsletter

- Posts

- Bitcoin’s hottest September since 2012?

Bitcoin’s hottest September since 2012?

Reading time: 5 minutes

Whale moves and Fed odds collide with Bitcoin’s strongest September since 2012

Key points:

BTC held above $116,000, repeatedly defending the $116,400–$116,600 zone after touching $117,317, while traders watch resistance around $117,300–$118,000.

Analysts highlight the “Uptober” pattern and BTC’s compression versus gold and the S&P 500, even as dormant whales move coins and ETF accumulation remains strong.

News - Bitcoin traded near $116,236 on September 17 after intraday tests toward $117,317. Through the September 16–17 window, price action firmed above $116,000, with multiple retests of the $116,400–$116,600 band confirming short-term support.

Odds for a rate cut at today’s FOMC meeting sat near certainty, with most positioning for a 25 bps move and attention shifting to the Fed Chair’s tone.

Analysts framed the backdrop as seasonally constructive. One noted BTC has compressed more than gold and the S&P 500 since the post-election rally, making it a candidate to lead the next larger move, while another pointed to a pattern of post-September-FOMC strength in most years since 2020, supporting the “Uptober” narrative.

On-chain, several long-dormant whales moved coins in recent days, yet institutional demand was described as resilient, with ETF accumulation outpacing new supply. Into month-to-date context, September gains around 8% would mark BTC’s strongest September since 2012, even as volatility has been relatively subdued for a bull year.

Seasonality and the macro setup - With a widely expected cut, the emphasis is on guidance. If the market reads the tone as supportive of easier conditions, the seasonal “Uptober” tailwind could stay intact.

Whales vs institutions - Dormant addresses transferred sizable tranches ahead of the meeting, but spot ETF flows have recently exceeded issuance, signaling ongoing high-conviction demand.

Levels to watch:

Support: $116,400–$116,600, then $116,000.

Resistance: $117,300 initially, then the $118,000 area. A clean flip of that zone into support would open room toward $120,000, while distribution risk could pull price back toward the mid-$115,000s.

BNB pops on DOJ monitor talk as $1K target comes into view

Key points:

BNB climbed nearly 3% toward $950 after reports that Binance is nearing a DOJ deal to drop a court-appointed monitor, with intraday highs around $962.29 and outperformance versus the broader market.

On-chain and derivatives signals show conviction: NUPL at 0.44, exchange balances down about 50% in four days, high open interest and easing funding, keeping $1,000 in sight while correction risks persist.

News - BNB rose almost 3% to trade near $950 on reports that Binance and the US Department of Justice are discussing an agreement that could remove a settlement monitor tied to the exchange’s 2023 case.

The DOJ has not made a final decision, and a FinCEN monitor remains in place, but any relief on oversight would likely come with stricter internal reporting. Price action extended to fresh highs around $962.29, with trading volumes picking up and BNB outperforming a cautious market ahead of the Fed decision.

On-chain: Holders lean into the breakout - BNB’s NUPL sits at 0.44, its highest in three months, while exchange balances fell from roughly 4.35 million BNB on September 12 to about 2.79 million on September 16.

Cohorts in the 3 to 12 month band increased holdings instead of selling, suggesting supply tightening during strength. Active addresses climbed to about 1.56 million and the MVRV ratio near 1.80 indicates room before historical danger zones.

Derivatives and levels - Open interest remains elevated as funding rates ease, a setup traders say can support another push toward $1,000. Immediate resistance appears at $975 and $1,015, with an extension target near $1,071 to $1,080 if momentum holds.

Supports to watch sit at $950 and $935, with structure weakening on closes below $910. A less supportive Fed outcome could invite a retrace toward the high $800s, while a cut could accelerate attempts at four digits.

Trump sues New York Times, citing harm to memecoin and brand value

Key points:

The lawsuit filed in Florida seeks $15 billion, alleges four New York Times reporters and a book publisher damaged Trump’s brand and his Solana memecoin project.

The complaint highlights a timing gap. The cited reporting appeared in fall 2024, while the TRUMP token launched in January 2025, later rising to a $73B FDV before falling about 88% to roughly $8.6B.

News - President Donald Trump has filed a $15 billion defamation lawsuit against The New York Times, claiming that articles and a book from fall 2024 inflicted “enormous” economic harm on his reputation, companies, and crypto ventures.

The filing in federal court in Florida names four Times reporters and Penguin Random House, and argues that the coverage damaged the standing of his Solana-based TRUMP memecoin among Florida residents. The New York Times has described the lawsuit as without merit and said it will not be deterred from independent reporting.

Timeline at the center of the dispute - According to the complaint, the reports and the book predated the token’s January 2025 launch. Trump’s legal team also alleges the book’s publication was coordinated with the trailer for “The Apprentice,” and that this timing contributed to a drop in Trump Media & Technology Group’s share price.

Token boom and drawdown - After launch, the TRUMP token briefly reached a fully diluted valuation above $73 billion before retreating by about 88 percent to near $8.6 billion.

Separate from the token’s slide, Trump and his sons saw their net worth increase by roughly $6 billion earlier this month as trading began for WLFI, the governance token of World Liberty Financial.

What to watch next - The New York Times has pushed back on the claims and framed the suit as an attempt to chill reporting. Legal experts cited in coverage note that the timeline gap between the 2024 reporting and the 2025 token launch could become a focal point if the case advances.

Coinbase breach tied to TaskUs insider ring, $400M fallout and $20M bounty

Key points:

Court filings trace a 69,000-user data breach to TaskUs staff, led by employee Ashita Mishra, who allegedly photographed up to 200 customer records per day and sold them for about $200 each.

Coinbase says less than 1% of monthly active users were affected, reimbursed victims, cut ties with TaskUs, and set a $20 million reward fund after refusing a matching ransom.

News - Newly unsealed filings outline an insider scheme at Coinbase’s support contractor TaskUs, alleging that employee Ashita Mishra began stealing sensitive customer data in September 2024 and recruited colleagues into a hub-and-spoke operation. Investigators say Mishra’s phone contained data from more than 10,000 customers by January 2025.

In total, at least 69,461 users were exposed, with damages that Coinbase estimates could reach up to $400 million. The records included names, emails, addresses, bank details, balances, and some government identifiers. Coinbase says private keys and seed phrases were not compromised.

The filings further allege that TaskUs downplayed the breach and moved to silence internal scrutiny, including large staff cuts in India and dismantling an HR investigation unit, while proceeding with a $1.6 billion Blackstone deal. TaskUs has said only a limited number of workers were involved and that it is cooperating with authorities.

Coinbase response and customer impact - Coinbase terminated implicated vendor access, tightened insider controls, notified users and regulators, reimbursed victims, and offered credit monitoring and identity restoration. The company refused a $20 million ransom and instead posted a $20 million bounty for information leading to arrests and convictions.

Alleged cover-up and class action aims - Plaintiffs accuse TaskUs of negligence and concealment, seeking compensation for stolen assets, out-of-pocket costs, and long-term risks tied to exposed PII. They also want a court order mandating stronger security measures to prevent future breaches.

Regulatory backdrop - Separately, Coinbase has urged the Department of Justice to support federal preemption of conflicting state crypto rules, arguing that patchwork enforcement harms consumers and innovation.

More stories from the crypto ecosystem

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Did you know?

UK & US set to deepen regulatory cooperation on crypto frameworks - The UK and U.S. are preparing to announce enhanced collaboration on digital asset regulation, particularly around stablecoins and cross-border market access, aiming to better align their regulatory regimes and reduce frictions for crypto firms operating in both jurisdictions.

India mandates cybersecurity audits for all crypto exchanges - Reacting to frequent cyber-heists, the Indian government has made it compulsory for all cryptocurrency exchanges, custodians, and intermediaries to undergo cybersecurity audits to ensure stronger protocol compliance and better protection for users.

UK regulator proposes relaxing integrity rules for crypto firms - The UK’s Financial Conduct Authority (FCA) is considering exemptions for crypto companies from some traditional finance principles, like acting with integrity and offering suitable advice, while tightening standards in areas such as risk and cyber security.

Top 3 coins of the day

Aerodrome Finance (AERO)

Key points:

At the time of writing, AERO traded at $1.28 after climbing 2.72% in the last 24 hours, outpacing the broader market’s 0.87% rise.

The Parabolic SAR rested below the candles while the MACD histogram flipped strongly green, signaling renewed bullish momentum amid rising volumes.

What you should know:

AERO gained ground over the past day, with price action supported by improving technical conditions. The Parabolic SAR positioned below the candles pointed to ongoing upward momentum, while the MACD reflected a bullish crossover and strengthening histogram bars. Volume ticked higher, though still below the peaks seen in August, suggesting moderate buying interest. Beyond the charts, governance discussions around reducing token emissions have fueled optimism by highlighting potential supply tightening. Meanwhile, Aerodrome’s August integration into Coinbase’s app boosted adoption, giving the protocol access to over 100 million retail users and reinforcing its role as a Base liquidity hub. Looking ahead, traders are watching the $1.30 level as immediate resistance, while $1.14 remains a support zone to monitor.

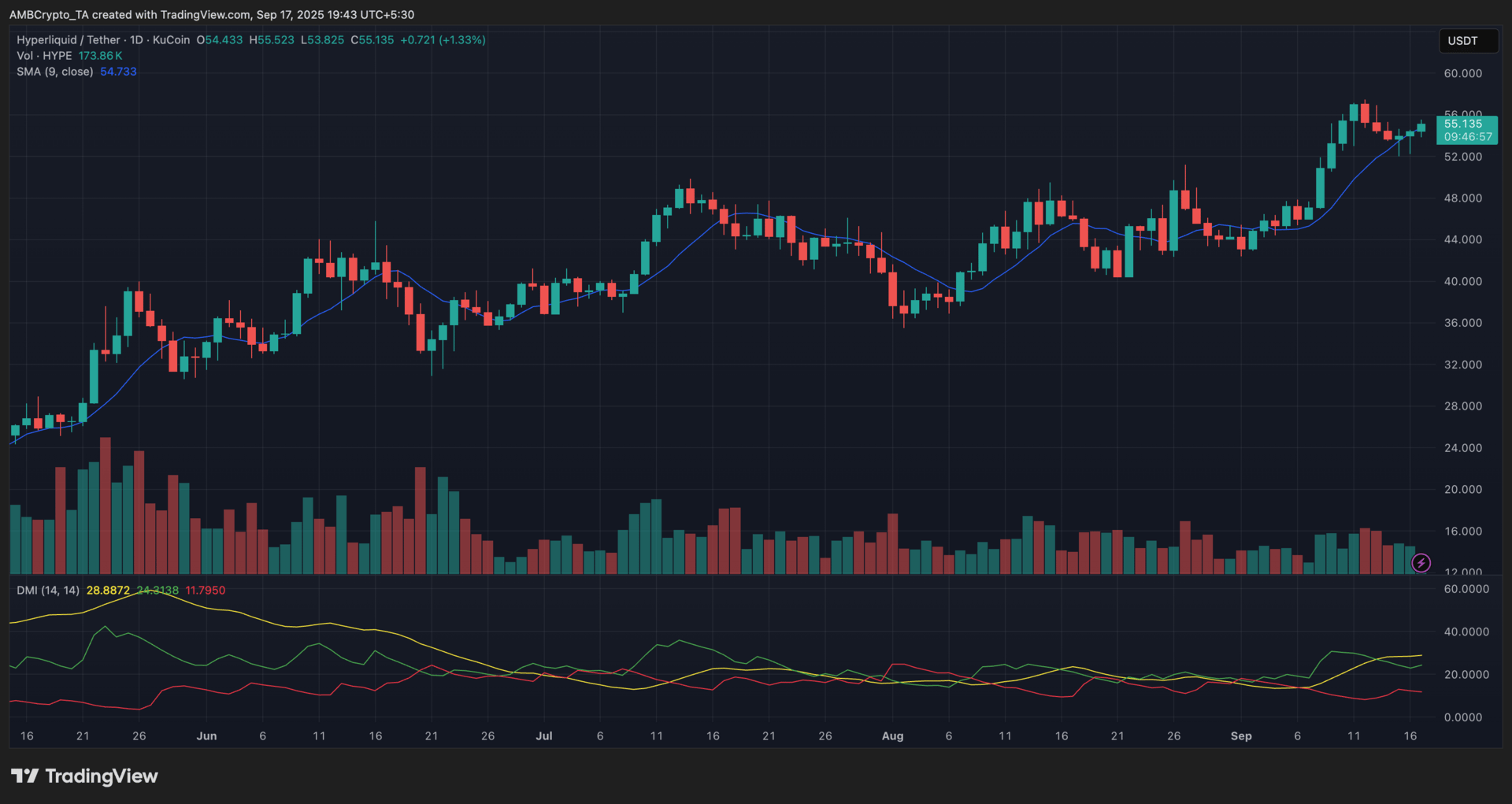

Hyperliquid (HYPE)

Key points:

HYPE was last seen trading at $55, recording a 1.33% increase over the previous day.

The 9-day SMA held beneath the candles, while the DMI showed +DI leading -DI with a strengthening ADX, hinting at sustained bullish pressure.

What you should know:

HYPE edged higher in the last session, with its price holding above the 9-day SMA to signal continued momentum. The DMI confirmed buyer dominance as +DI outpaced -DI, supported by an ADX that pointed to a firmer trend. Trading volumes picked up slightly compared to early September, though they remained moderate relative to the surges seen in August. Beyond the technical picture, progress on Circle’s testing of native USDC integration on HyperEVM has reinforced confidence in the project’s liquidity profile. Broader sentiment has also lent support, with the ongoing altcoin rotation drawing capital into high-utility tokens like HYPE. Going forward, the $52 region remains a key support to watch, while $57–58 stands as immediate resistance.

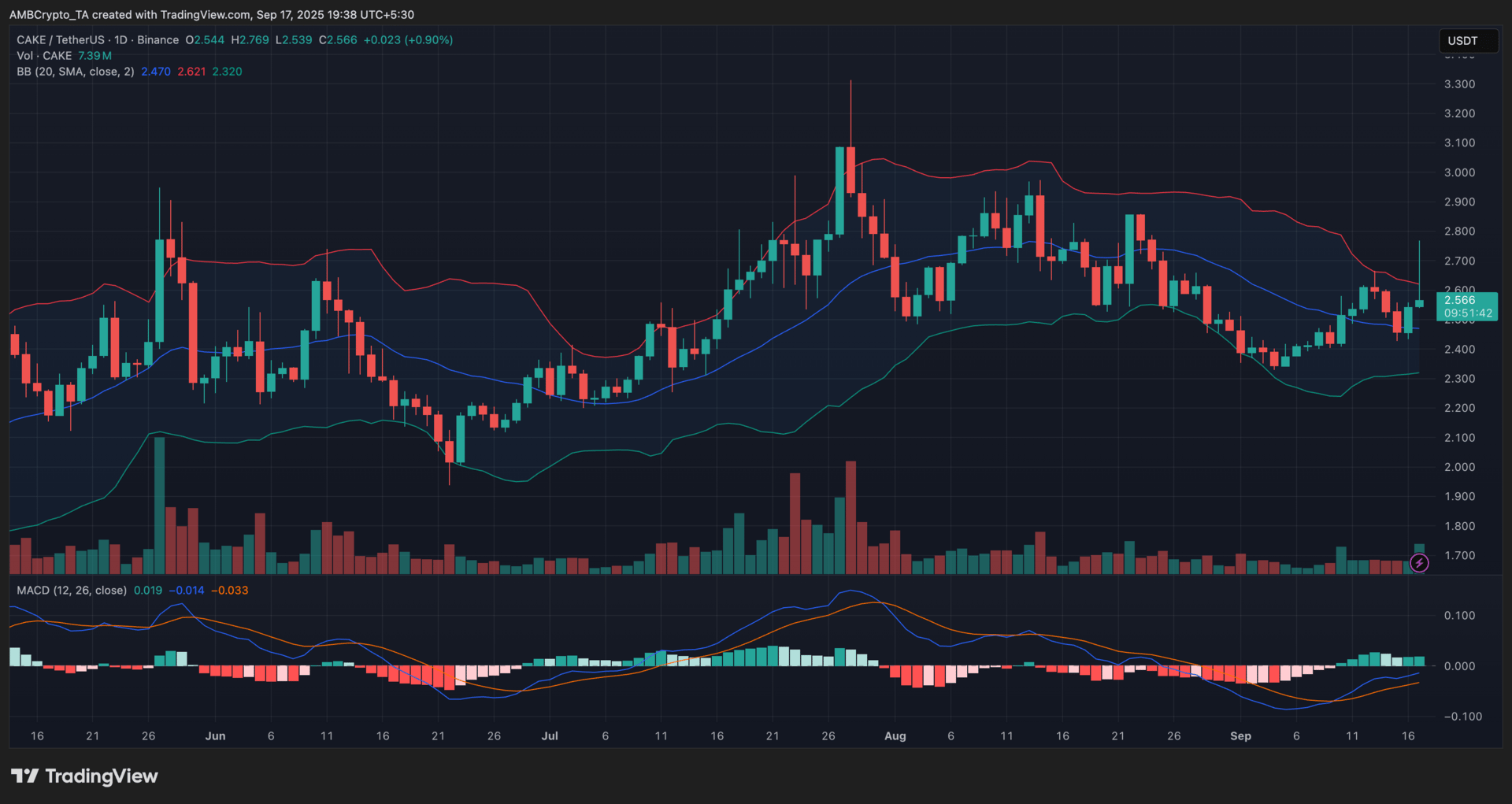

PancakeSwap (CAKE)

Key points:

CAKE traded at $2.56 at press time, reflecting a 0.90% rise over the past 24 hours.

The price broke above the upper Bollinger Band, while the MACD maintained its earlier bullish crossover with green histogram bars holding firm.

What you should know:

CAKE inched upward over the past day, with price action pushing above the upper Bollinger Band after several days of upward pressure near the top of the range. This move pointed to growing bullish momentum, though it also suggested the token may be entering an overextended zone. The MACD’s bullish crossover from earlier sessions remained intact, with the histogram staying positive to confirm ongoing momentum. Volumes held steady but did not yet match the heavier surges from July and early August. Outside the charts, PancakeSwap continued its deflationary drive by burning over 26 million CAKE in August, reinforcing scarcity as part of its long-term roadmap. Its ecosystem growth also gained traction, supported by Solana pool activity and liquidity access via Coinbase Wallet’s DEX. In the near term, $2.62–2.65 forms immediate resistance, while $2.47 is the support to watch.

How was today's newsletter? |