- Unhashed Newsletter

- Posts

- Bitcoin’s make-or-break week begins now

Bitcoin’s make-or-break week begins now

Reading time: 5 minutes

Bitcoin’s defining week: $100K floor, fed cuts, and treasury demand

Key points:

Bitcoin hovered near $116K as analysts said this week could decide whether $100K becomes its new long-term floor.

Institutional momentum surged, with $931 million in Bitcoin ETP inflows and fresh corporate treasury buys led by American Bitcoin, Strategy, and Prenetics.

News - Standard Chartered’s Geoff Kendrick said this week could mark a turning point for Bitcoin, as favorable U.S.–China trade signals, a likely Federal Reserve rate cut, and record ETF inflows align to reinforce Bitcoin’s strength above six figures.

Kendrick noted that easing tensions between Washington and Beijing and a stronger yuan had already shifted sentiment “from fear into hope,” potentially setting $100K as Bitcoin’s new baseline.

The optimism was echoed across institutional activity. Bitcoin ETPs recorded $931 million in weekly inflows, almost fully reversing prior losses, according to CoinShares. The rebound followed lower-than-expected U.S. inflation data and growing expectations of further Fed cuts.

Treasuries keep stacking Bitcoin - Corporates continued to accumulate BTC despite volatile prices. American Bitcoin, co-founded by Eric and Donald Trump Jr., added 1,414 BTC worth $163 million, taking its holdings above $445 million.

Strategy purchased 390 BTC for $43.3 million last week, though its October acquisitions fell 78% month-over-month to 778 BTC.

Meanwhile, David Beckham-backed Prenetics raised $46.8 million to expand its wellness arm and advance its Bitcoin treasury, bringing its holdings to 268.4 BTC.

Macro catalysts in play - The Federal Reserve’s expected 25-basis-point cut, a pending Trump–Xi meeting, and major tech earnings this week could fuel fresh volatility. Kendrick suggested that if ETF inflows remain strong and Bitcoin sustains momentum, it “may never go below $100,000 again.”

XRP gets legal win in India as court blocks WazirX reallocation, calls crypto ‘property’

Key points:

Madras High Court barred WazirX from reallocating a user’s 3,532 XRP, affirming crypto as property held in trust.

WazirX resumed trading after its Singapore-approved restructuring, while XRP price fought to avoid a breakdown near key resistance.

News - India’s Madras High Court granted interim protection to a WazirX user with 3,532 XRP, ruling that cryptocurrency qualifies as property that can be held in trust and cannot be redistributed to cover platform losses from the 2024 hack.

The order, delivered by Justice N. Anand Venkatesh on October 25, directs WazirX’s operator to furnish a bank guarantee of about 9.56 lakh rupees (roughly $11,500) or deposit the amount in escrow during arbitration.

The court noted that the stolen assets were ERC-20 tokens, which are completely different from the user’s XRP, and rejected the exchange’s “socialization of losses” proposal.

WazirX has restarted operations after a Singapore High Court approved its restructuring with strong creditor backing. Trading is being restored, and the platform has announced a temporary zero fee window. The legal decision signals that Indian users can seek domestic relief, even when exchanges operate under foreign jurisdictions.

On the market side, XRP bounced with a bullish candlestick but still faces resistance near the $2.75 area and remains vulnerable to a breakdown if it stays in the lower portion of its long-term channel, according to recent technical analysis.

What the court said:

Crypto is property capable of being enjoyed and possessed, and can be held in trust for users.

WazirX must provide a bank guarantee for roughly 9.56 lakh rupees (about $11,500) or place the amount in escrow while the case proceeds.

Indian jurisdiction can protect users even when restructuring occurs in Singapore.

XRP price watch:

XRP formed a bullish engulfing candle and avoided a breakdown from a long-term channel.

Key hurdles remain, including a resistance area around $2.75 and a long-term diagonal barrier, with breakdown risks highlighted by RSI and MACD divergence.

Mt. Gox delays Bitcoin repayments to 2026, AI post-mortem exposes old flaws

Key points:

Mt. Gox has postponed remaining creditor repayments to October 31, 2026, keeping roughly 34,689 BTC ($4 billion) locked and easing near-term sell pressure.

Former CEO Mark Karpelès ran Mt. Gox’s 2011 code through Anthropic’s Claude AI, which flagged multiple critical security flaws that fueled the early hacks.

News - Defunct exchange Mt. Gox has again pushed back creditor repayments by a year, citing incomplete procedures and processing issues.

Rehabilitation trustee Nobuaki Kobayashi confirmed that while most verified creditors have received partial payments, thousands remain pending. The Tokyo court-approved extension moves the deadline to October 31, 2026.

Mt. Gox still holds around 34,689 BTC worth nearly $4 billion, according to Arkham data. The delay is viewed as mildly bullish for Bitcoin, as it keeps large sums of BTC off the market and reduces immediate sell pressure.

Bitcoin rose about 4% to $115,559 following the announcement, signaling improved market resilience compared to past repayment scares. Analysts note that deeper liquidity and pre-hedged positions mean any eventual release of funds is unlikely to trigger a “shock dump.”

A decade-old lesson revisited - Former CEO Mark Karpelès revisited Mt. Gox’s early codebase using Anthropic’s Claude AI to analyze the vulnerabilities that led to its downfall.

The AI labeled the 2011 system “feature-rich but critically insecure,” citing weak admin passwords, retained access by prior developers, and lack of network segmentation. While AI could have flagged these flaws, Karpelès admitted that poor due diligence and human oversight were equally to blame.

Long shadow of Mt. Gox - More than a decade after the 2014 collapse, Mt. Gox’s 850,000 stolen BTC remain a cautionary tale. The latest extension pushes closure further into 2026, ensuring that the exchange’s ghost still lingers over crypto’s oldest saga.

Japan launches first regulated Yen stablecoin, targeting $65 billion market

Key points:

JPYC Inc. launched Japan’s first legally recognized yen-pegged stablecoin, fully backed by bank deposits and Japanese Government Bonds.

The company aims for 10 trillion yen (~$65 billion) in circulation within three years, challenging the dollar’s dominance in the $297 billion global stablecoin market.

News - Tokyo-based fintech JPYC Inc. has officially launched JPYC, Japan’s first regulated yen-denominated stablecoin under the country’s revised Payment Services Act. The token maintains a strict 1:1 peg to the yen and is supported by 100 percent reserves in bank deposits and government bonds.

Issuance and redemption take place through the firm’s licensed platform, JPYC EX, which operates with full identity verification.

The launch follows Japan’s 2023 regulatory overhaul, which allows only banks, trust firms, and licensed funds-transfer operators to issue fiat-backed stablecoins. JPYC is the first to obtain approval under this regime. Trading began on October 27 and supports blockchains including Ethereum, Polygon, and Avalanche.

A new model for Asia’s FX market - JPYC’s interest-based business model eliminates transaction fees, generating revenue from returns on its government-bond reserves.

With Japan’s long-term bond yields near 1%, the company estimates 10 billion yen in annual interest income per 1 trillion yen issued. Analysts say this design prioritizes stability and transparency, positioning Japan as a regulatory benchmark after the TerraUSD collapse.

Global implications - By introducing a compliant, freely convertible yen stablecoin, Japan joins the U.S. in regulating fiat-pegged tokens. A yen-backed asset could expand decentralized FX markets, pairing with USDC or USDT to form an on-chain USD/JPY market and reduce regional dependence on the dollar.

President Noriyoshi Okabe said the stablecoin has already attracted interest from seven companies planning integrations across retail and enterprise platforms.

No MEV. No Gas

CoW Swap blocks MEV so bots can’t front-run your trades. Keep more of every swap.

More stories from the crypto ecosystem

Western Union eyes stablecoin rails in pursuit of a ‘super app’ vision

Kaspa [KAS] eyes $0.07 – THESE TWO signs hint at more upside

Is Ethereum staking the new HODL after ETH’s price shoots past $4K?

PENGU’s 9% hike sparks comeback after weeks of bleeding – Details

3 reasons why Tom Lee’s ‘Ethereum is in a supercycle’ claim is right

Did you know?

The latest Chainalysis Global Crypto Adoption Index shows that the U.S. and India are now ranked as the leading countries in crypto adoption by on- and off‐chain activity.

The global crypto futures and options market set a new record in Q3 2025, with combined volume exceeding $900 billion and average daily open interest topping $31.3 billion.

On October 10, 2025, the crypto market experienced its largest single-day liquidation event in history, with more than $19 billion in positions wiped out and over 1.6 million trading accounts affected.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Top 3 coins of the day

Zcash (ZEC)

Key points:

At the time of writing, ZEC was trading at $358 after climbing 10.12% in the last 24 hours.

The Madrid Ribbon stayed widely green, reflecting strong upward momentum, while the RSI hovered near 76.6 as volume spiked to 452.78K.

What you should know:

Zcash continued its bullish ascent, building on a multi-week rally that began in late September. The price climbed from $325 to $374 intraday before stabilizing above $350, reinforcing buyers’ dominance. Momentum remained strong as the Madrid Ribbon showed deep green bands, and the RSI entered overbought territory, signaling robust but stretched buying pressure. The uptick in volume underscored renewed market participation, likely spurred by Arthur Hayes’ viral $10K prediction and the renewed privacy coin narrative amid regulatory debates. If ZEC maintains its footing above $375, the next resistance lies near $400, while immediate support sits around the $307–$325 range.

Ethereum (ETH)

Key points:

ETH was last seen trading at $4,168, recording a modest 0.27% rise over the past day.

The Parabolic SAR stayed above the candles, reflecting ongoing bearish pressure, while the Awesome Oscillator showed green but flattening bars alongside moderate volume of 18.75K.

What you should know:

Ethereum’s price attempted a mild recovery after recent choppy sessions, moving between $4,150 and $4,250 before closing slightly higher. The Parabolic SAR remained positioned above the candles, signaling that the broader downtrend has not yet reversed, though price proximity to the SAR points suggests possible trend exhaustion. The Awesome Oscillator shifted to green in the latest sessions, hinting that bearish momentum has weakened but without clear bullish confirmation. Volume levels showed steady activity, supported by reports of strong ETF inflows and renewed whale accumulation that bolstered investor confidence. For now, traders are watching whether ETH can close above $4,260 to regain momentum, with support resting near the $4,000–$4,050 zone.

Bitcoin Cash (BCH)

Key points:

BCH traded at $560 after inching up 0.20% over the past day.

The +DI line stayed above the –DI on the DMI, confirming bullish control, while the ADX at 26.6 signaled a strengthening trend as price touched the upper Bollinger Band.

What you should know:

Bitcoin Cash held onto its recent rally, with buyers maintaining pressure around the $560 mark following a multi-day recovery from October lows. The Bollinger Bands showed the candles approaching the upper boundary, indicating that bullish momentum remained intact but nearing short-term saturation. The DMI painted a firm bullish picture as the +DI maintained dominance over the –DI, supported by an ADX reading above 25, a sign that the trend has grown stronger. Trading volume of 43.5K BCH further reinforced sustained interest. In the broader market, optimism rose after Mt. Gox’s repayment delay eased sell-off fears, and BCH’s inclusion in a proposed crypto ETF boosted investor sentiment. Traders now look for a clear close above $572 to confirm continued upside, with support near $534–$540.

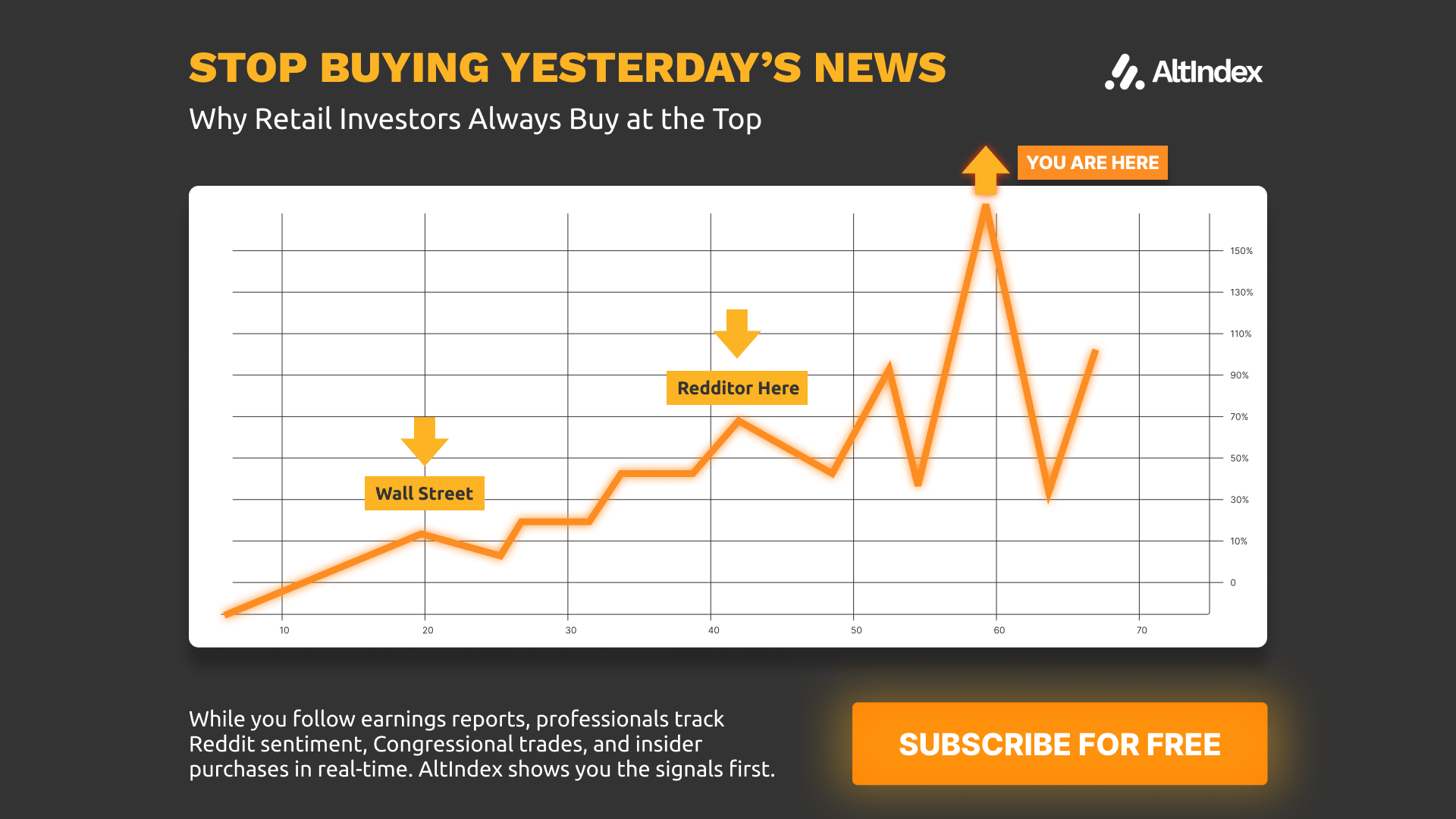

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

How was today's newsletter? |