- Unhashed Newsletter

- Posts

- Bitcoin’s September slump or Uptober rally?

Bitcoin’s September slump or Uptober rally?

Reading time: 5 minutes

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Bitcoin’s September challenge: Will Uptober momentum return?

Key points:

Bitcoin rebounded to $111,600 after dipping to $108,000, with $112,500 marked as the key resistance before a possible move toward $115,000.

Only 13.71% of BTC supply is in loss, showing resilience far from capitulation, while traders are also watching $112K–$114K levels for potential liquidations.

News - Bitcoin is stabilizing after a sharp pullback, trading around $111,600 following a rebound from $108,000. The $112,500 level stands as immediate resistance, with a breakout potentially paving the way for $115,000.

On-chain signals suggest resilience, with just 13.71% of circulating BTC in loss, well below the 50% threshold typically associated with bear markets. This highlights strong holder conviction despite recent volatility.

Bitcoin has also broken out of a two-week downtrend, confirmed by a daily close above its descending trend line. Analysts highlight that maintaining above $110,000 provides a base for recovery, though caution remains. Should selling pressure return, levels at $110,000 and $108,000 could be retested.

Seasonal headwinds vs “Uptober” hopes - Historically, September has been Bitcoin’s weakest month, averaging –3.77% returns across the last 12 years. However, the pattern broke in 2023 and 2024, with Bitcoin recording back-to-back September gains, including its best September on record last year.

Optimism this time is bolstered by spot ETF inflows and expectations of a U.S. rate cut later in the month, which could help Bitcoin defy its “red September” label once again.

Macro backdrop: Bond market stress lifts BTC narrative - Global bond yields are surging, with the U.S. 30-year Treasury near 5% and UK gilts at 27-year highs.

Analysts warn of a “collapse” in G7 bond markets, fueling demand for hard assets like gold and Bitcoin. Gold’s rally above $3,500 has already confirmed this shift, and Bitcoin is increasingly viewed as the higher-beta hedge against debt and inflation risks.

Long-term holders add strength - Despite whale movements, Glassnode data shows long-term holders continue to accumulate. Coins held for 7–10 years now make up 8.1% of supply, the highest since 2019, while the 10+ year cohort has grown to 17%. This long-term conviction further supports the case for Bitcoin’s resilience.

Galaxy Digital brings SEC-registered shares onchain via Solana

Key points:

Galaxy Digital has become the first Nasdaq-listed company to tokenize its Class A common stock directly on Solana through Superstate’s Opening Bell platform.

Unlike synthetic equity products, these tokens preserve full shareholder rights, with ownership tracked in real time by an SEC-registered transfer agent.

News - Galaxy Digital, the $9 billion investment firm founded by Mike Novogratz, announced that its Class A shares are now available in tokenized form on the Solana blockchain.

Through a partnership with fintech firm Superstate, the initiative uses the Opening Bell platform to fractionalize and transfer shares onchain while preserving the same rights as traditional stockholders. Superstate acts as the SEC-registered transfer agent, ensuring real-time shareholder register updates as tokens move between wallets.

This marks the first time an SEC-registered equity has been issued directly on a major public blockchain. Early uptake has already begun, with 21 investors tokenizing more than 32,000 shares on Solana.

Unlike synthetic or wrapped products, Galaxy’s shares are legally equivalent to their off-chain counterparts, offering both compliance and blockchain-native benefits like 24/7 settlement, transparency, and composability. Initial access is limited to KYC-verified investors.

Part of a larger tokenization wave - Galaxy’s move comes as tokenization of real-world assets accelerates globally. Platforms like Backed Finance’s xStocks have already tokenized more than 60 public equities, including Netflix and Nvidia, across Solana, BNB Chain, and Tron.

Market data show tokenized stocks now total around $341 million in value, while private credit and U.S. Treasuries have led the broader $64.7 billion RWA tokenization market.

Regulatory push adds momentum - European regulators are prioritizing tokenization as part of broader financial reforms. At the FintechOn Summit in Taipei, EU adviser Peter Kerstens said the European Commission will present proposals in December to integrate tokenized equities, debt, and derivatives into a pan-European Savings and Investment Union.

Meanwhile, Galaxy and Superstate are exploring how automated market makers could support tokenized equity trading under the SEC’s Project Crypto framework, signaling a push to bring DeFi tools into regulated capital markets.

Netherlands fines OKX $2.6M over pre-MiCA registration lapses

Key points:

The Dutch central bank fined OKX €2.25 million ($2.6 million) for offering crypto services without local registration between July 2023 and August 2024.

OKX says the legacy issue has been resolved, with Dutch users migrated to a MiCA-licensed European entity and no impact on customer assets.

News - The Dutch National Bank (DNB) has penalized OKX for operating in the Netherlands without the required registration prior to the EU’s Markets in Crypto-Assets (MiCA) regime taking effect.

The enforcement covers activity from July 2023 through August 2024 and stems from the Netherlands’ 2020 rule that crypto firms must register with DNB for anti-money-laundering oversight.

OKX, legally Aux Cayes Fintech Co., said the matter is closed and that the fine was reduced in light of remedial steps, including moving Dutch customers to its MiCA-licensed European entity.

Company representatives added that customer assets were unaffected and described the penalty as the lowest imposed by DNB on a major exchange after remediation.

What regulators said and the timeline - DNB’s action targets the pre-MiCA window, when platforms were still bound by national registration regimes.

Similar cases have hit other exchanges in the country, including fines for Crypto.com (€2.85 million) and Kraken (€4 million). Previous actions against Binance and Coinbase in the Netherlands also centered on registration failures.

Why this matters for MiCA - MiCA is harmonizing crypto rules across the EU, shifting firms from country-by-country registrations to EU-wide authorizations.

OKX now holds a MiCA license, so it can continue serving Dutch users legally, but the outcome underscores that national authorities remain active in policing historical compliance gaps as the region transitions to the new framework.

Wider compliance backdrop - OKX has faced scrutiny elsewhere in Europe. Maltese authorities fined the exchange €1.1 million in April for AML breaches tied to 2023 findings, and the Philippines SEC recently warned the platform over authorization concerns.

The Netherlands case adds to the signal that EU regulators are tightening expectations as MiCA beds in.

U.S. vaults to No. 2 in crypto adoption as APAC leads a 69% surge

Key points:

The United States climbed from fourth to second in the 2025 Chainalysis Global Crypto Adoption Index, driven by ETF clarity, stablecoin rules, and more than $4.2 trillion in fiat on-ramping.

India retained the top spot for a third year, while Asia Pacific posted the fastest growth with transaction volume up 69% to $2.36 trillion.

News - Chainalysis’ 2025 Global Crypto Adoption Index shows a split engine of growth. Developed markets are accelerating on the back of regulatory clarity and institutional rails, while emerging economies keep adoption high through everyday utility.

The U.S. rose to second place after clearer rules around spot Bitcoin ETFs and stablecoins helped unlock institutional demand and record on-ramp activity. India held No. 1 for a third year, with Pakistan, Vietnam, and Brazil rounding out the top five.

Bitcoin remains the dominant entry point into crypto. Chainalysis tracks more than $4.6 trillion in fiat inflows to BTC between July 2024 and June 2025, more than double the next category of Layer-1 tokens. The U.S. led on-ramping with over $4.2 trillion, far ahead of South Korea in second.

APAC leads the charge - Asia Pacific saw the fastest year-over-year growth, with total value received rising 69% to $2.36 trillion. India, Pakistan, and Vietnam were key drivers across centralized and decentralized services. Eastern Europe leads when adjusted for population, with Ukraine, Moldova, and Georgia at the top.

Stablecoins reshape market structure - Stablecoin activity scaled sharply. USDT processed over $1 trillion monthly, while USDC ranged from $1.24 trillion to $3.29 trillion. Passage of the U.S. GENIUS Act positioned the country to lead fiat-backed stablecoin oversight, spurring payment processors and banks to explore new products.

Methodology tweaks you should know - Chainalysis dropped its retail DeFi sub-index to reduce skew toward niche behaviors and added an institutional activity lens that captures transfers above $1 million. The top-20 list reflects these changes, with India first and the U.S. second, followed by Pakistan, Vietnam, and Brazil.

More stories from the crypto ecosystem

Dogecoin traders, look out for the $0.20 support level – Here’s why!

Bitget Token [BGB] spikes 16% past $5 – But one RISK remains!

Decoding BNB’s ‘cup & handle’ breakout – Is $1,300 in sight?

Elon Musk’s lawyer part of $175 mln Dogecoin treasury – But it’s not helping DOGE

‘World Liberty Financial will make it way harder’ for crypto legislation – Why?

Did you know?

The global crypto market cap topped $4 trillion for the first time. Just weeks after the GENIUS Act became law, total market capitalization surged past $4 trillion in July 2025, highlighting how regulatory clarity can trigger powerful market confidence.

A political scandal erupted after a government minister accepted a criminal’s Bitcoin donation. In mid‑2025, the Czech Justice Minister resigned after accepting 468 BTC (≈ $45 million) as a donation from a convicted criminal without verifying its origin, triggering a no-confidence vote and widespread public backlash.

Trump family’s WLFI token is now publicly tradable, but volatility reigns. After raising $700 million in private sales, the Trump‑affiliated WLFI token has launched trading publicly. Although its price initially surged, it has since dropped to around $0.22, while the Trump family retains 25% of total supply in lockup.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Top 3 coins of the day

Injective (INJ)

Key points:

INJ was last seen trading at $13.26, recording a 2.1% daily gain.

The Parabolic SAR remained above the candles, while the MACD histogram showed signs of easing bearish pressure.

What you should know:

INJ advanced from $12.90 to $13.29 before closing near $13.26 in the most recent session. Volume rose to 321.51K, adding weight to the rebound, though indicators reflected caution. The Parabolic SAR dots stayed above the price, pointing to ongoing bearish pressure, while the MACD remained in negative territory but edged closer to neutral, hinting that downside momentum may be fading. Immediate resistance lies at $13.50, while support is seen near $12.5–$12.7. Beyond chart action, Injective’s fundamentals added to sentiment: its recent launch of perpetual futures tied to NVIDIA H100 GPUs marked a novel DeFi–AI crossover product, and anticipation around its upcoming EVM-compatible mainnet continues to draw developer attention. Whether INJ can sustain a break above $13.50 will likely dictate short-term direction.

Fartcoin (FARTCOIN)

Key points:

FARTCOIN was last seen trading at $0.80, notching a 1.5% rise over the past 24 hours.

The 20-day MA stayed below the 50-day MA, while the DMI confirmed bearish dominance with -DI holding above +DI.

What you should know:

Fartcoin climbed from $0.78 to $0.82 before settling around $0.81 in the latest session. Trading volume reached 8.51M, showing moderate support behind the rebound. However, the broader picture stayed weak: the 20-day MA remained under the 50-day MA, keeping a bearish crossover intact, and the DMI highlighted continued downside pressure with -DI leading and ADX above 25. Resistance is seen near $0.85–$0.86 at the short-term moving average, while the $0.77 zone serves as a key support. Outside the charts, large wallets reportedly increased their holdings through August, signaling renewed whale interest, and speculation around a possible Pump.fun announcement for community coins kept sentiment lively. A decisive break above $0.86 would be needed to shift momentum back toward the bulls.

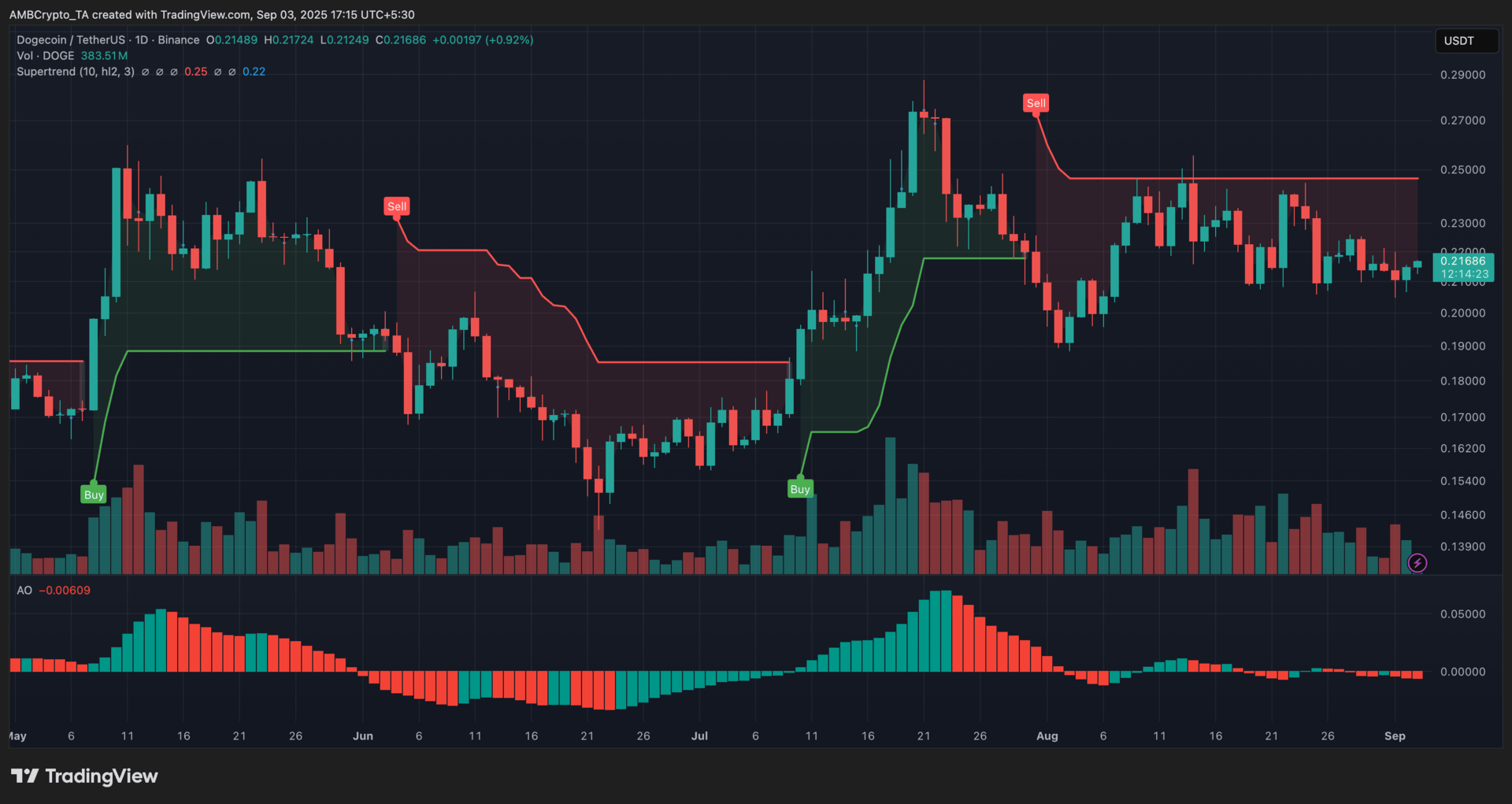

Dogecoin (DOGE)

Key points:

DOGE was trading at $0.216 at press time, reflecting a 0.9% gain in the past 24 hours.

The Supertrend indicator stayed in sell mode, while the Awesome Oscillator hovered near zero, signaling weak momentum.

What you should know:

Dogecoin edged higher from $0.215 to $0.217 before closing near the upper end of its daily range. Trading volume stood at 383.51M, steady but not showing the kind of surge typically associated with strong breakouts. The Supertrend indicator maintained a sell bias, with resistance positioned near $0.250, while support around $0.210 remained intact. The Awesome Oscillator printed near the zero line, suggesting indecisive momentum. Beyond the charts, sentiment drew support from speculation around Grayscale’s Dogecoin ETF application, with a mid-October SEC decision deadline keeping traders watchful. At the same time, on-chain data pointed to whales accumulating over 1B DOGE in recent weeks, underscoring confidence in its upside potential. For DOGE, reclaiming $0.220–$0.225 is crucial to validating a stronger push toward the $0.250 resistance zone.

Built for Managers, Not Engineers

AI isn’t just for developers. The AI Report gives business leaders daily, practical insights you can apply to ops, sales, marketing, and strategy.

No tech jargon. No wasted time. Just actionable tools to help you lead smarter.

Start where it counts.

How was today's newsletter? |