- Unhashed Newsletter

- Posts

- Bitcoin's upside still in play!

Bitcoin's upside still in play!

Reading time: 5 minutes

No MEV. No Gas

CoW Swap blocks MEV so bots can’t front-run your trades. Keep more of every swap.

Bitcoin's top ‘is not on the horizon’ on the back of low profit taking

Key points:

Profit-taking hit $30 billion in October, way less than the $63 billion in July 2025 or $99 billion in late 2024.

The uptrend could go as high as $185K, according to trader Peter Brandt.

News - Bitcoin could still blast higher, despite printing a new all-time high above $126K. The cryptocurrency has rallied by over 700% from its 2022 cycle low of $15K. However, the market peak, common in Q4 of the post-halving year, may still be far from being hit.

Potential room for growth - CryptoQuant data revealed that the cryptocurrency’s latest ATH attracted only $30 billion in realized profits. In comparison, the local top in July 2025 attracted $63 billion worth of profits, while the December 2024 peak saw $99 billion in sell-offs.

Besides, the current profitability of short and long-term holders is still below overheated levels seen in the past cycle peaks. Over the last few days, short-term holders (STH) booked profits at a 2% margin, against 8% seen in past trends.

For long-term holders (LTHs), the realized gains were at 129% at press time - Way below the 300% seen in the past. On top of that, the sell-offs from OG whales have declined by over 29%.

In light of the low profit-taking, CryptoQuant’s Head of Research Julio Moreno said,

“This suggests that Bitcoin may continue to rally, and that a top is still not on the horizon.”

According to renowned trader Peter Brandt, BTC could rally to $150K or as high as $185K, before topping out.

Short-term leverage risk - Despite the bullish mid-term outlook, traders must brace for wild swings in the short-term amid rising leverage. The recent breakout saw a spike in Futures Open Interest.

In fact, there were over $48 billion leveraged longs parked at $117K, further reinforcing potential volatile swings before the rally could extend beyond $126K.

After MSTR, Kerrisdale Capital shorts ETH treasury firm BitMine

Key points:

Kerrisdale said $100 billion crypto treasury capital from rivals and ETFs could cap BitMine’s upside.

The firm clarified that it’s not ‘betting against ETH,’ but against proxies like BitMine.

News - Kerrisdale Capital thinks the stock price of BitMine Immersion, the world’s largest ETH treasury firm, is overvalued at its press time levels of $60. With several firms jumping on the crypto treasury trend, Kerrisdale believes that BitMine can’t offer better investor returns in the future.

Stock dilution worries- BitMine currently holds over $13 billion worth of ETH (About 2.8 million tokens). It aims to accumulate 6 million ETH or 5% of the overall supply. The aggressive accumulation has been achieved in less than three months.

However, according to Kerrisdale, over the same period, +$10 billion worth of BMNR stock has been issued to fund the ETH strategy. This translates to $170 million per day worth of issuance - A stock dilution the hedge fund said has triggered investor fatigue.

“The sheer velocity of BMNR’s stock issuance has turned early enthusiasm into fatigue, with investors conditioned to believe every rally will be met by more supply.”

In other words, more supply could cap the stock’s upside potential and overall ETH strategy.

Additionally, over $100 billion worth of capital has been raised by other firms to chase the crypto treasury trend. Thanks to ETF proliferation and a potential staking feature, Kerrisdale claimed that competition will shrink BitMine’s premium (The relative value of BMNR stock compared to the ETH it holds) and wreck everyone.

A higher premium allows BitMine to raise cash by selling more stocks to buy extra ETH and offer investors higher returns. However, when the premium collapses below 1, the ability to raise capital for ETH buys and overall investor gains will be affected negatively.

The firm was quick to issue a clarification though,

“Our thesis is not a bet against Ethereum itself, but rather one against the notion that investors should still pay a market premium for it.”

MSTR miss - In early 2024, Kerrisdale made a similar move and shorted Strategy’s MSTR, citing similar reasons in a post-Bitcoin ETF era. It was successful in the short term, but MSTR later outperformed ETFs and BTC. In doing so, it forced the firm to close its short position quietly.

BMNR dropped by 1.35% on 08 October after Kerrisdale’s bearish bet. However, it remains to be seen whether it will hold or become another miss in the long run.

Polymarket founder teases potential ‘POLY’ token

Key points:

Polymarket CEO's recent tease suggested that a native POLY token could be in the works.

One of the platform’s early investors confirmed the token, but added that it will be ‘different.’

News - Shayne Coplan, the founder of prediction platform Polymarket and the latest self-made billionaire, has teased a potential native token - ‘POLY.’

Decoding the cryptic POLY tease - In a recent X post, Coplan reposted mindshare data from Kaito. It highlighted Polymarket’s outperformance after dislodging XRP from the fifth position.

In his cryptic repost, he listed the top crypto assets with ‘POLY’ as the fifth - Suggesting that he is convinced that the native token of Polymarket could rival established assets.

Reacting to the post, 1Confirmation, one of the VCs that have funded Polymarket, said,

“It’s been one or the other - IPO (Coinbase), Token (BNB). Polymarket is different.”

As expected, this has further fueled the speculation that the platform could launch a token and have an IPO (initial public offering) at the same time. Or it could be the first-ever security token by having a stock via IPO and tokenizing it for native on-chain users.

It remains to be seen which route they’ll take. However, the POLY token’s debut seems very likely.

Latest $2B backing- The update comes after the platform got a $2B strategic investment from the Intercontinental Exchange (ICE) - The parent firm of the New York Stock Exchange (NYSE). This raised the platform’s valuation to $9B.

ICE will share Polymarket event-contract data (odds) with financial institutions all over the world. Recently, prediction sites have become more trustworthy than typical surveys because of the financial incentives involved.

Real-time data and probabilities from these sites have now become a crucial risk management and hedging tool, as seen during the recent U.S Presidential Elections.

As a result, the collaboration would allow Polymarket to go institutional while still catering to its retail base. It will also be a credibility boost for the platform as it seeks U.S re-entry after a 3-year ban.

Bitwise ‘not playing around’ - Will its low-fee Solana ETF staking help?

Key points:

Solana ETF staking and fee wars could drive inflows and demand for SOL.

Solana network activity has dropped by half since July, suggesting reduced organic demand for SOL.

News- Bitwise and 21Shares have filed an amended Solana ETF to include a staking feature alongside slashed fees. Bitwise introduced a single management fee of 0.20% to cover all the fund’s operating costs with a 3-month waiver for the first $1B in assets.

Market reactions- Apart from the waiver, the fees charged by Bitwise will be the same as the rate for its Ethereum ETF product. Reacting to the fees, Bloomberg ETF analyst Eric Balchunas hailed it as a likely catalyst for demand. He said,

“Low fees have near-perfect record of attracting investors, so good sign for inflow potential.”

Other issuers that have filed for staking options include Franklin Templeton, VanEck, Fidelity, Grayscale, Canary, and CoinShares. The deadline for the SEC's decision on the filings will be around 10-16 October.

It remains to be seen whether the ongoing U.S government shutdown will interfere with the timeline.

That said, some analysts are projecting that SOL’s price could surge to $290 or $346 post-ETF approval.

However, CryptoQuant has flagged a worrying network fundamental. Solana transactions dropped by 50% from over 125 million in July 2025 to 64 million in October.

According to the analytics firm, the decline could be linked to reduced user activity.

More stories from the crypto ecosystem

Did you know?

Institutions and nation-states now own 3.74 million BTC (worth $456B) or nearly 18% of the overall BTC supply. In particular, ETFs and public companies like Strategy remain the biggest drivers of demand.

Since the activation of staking on the ETH ETF three days ago, Grayscale has staked over $5B (1.16 million ETH). Now, it controls 84% of the overall queued ETH waiting to be staked. The strong demand could drive ETH higher if other issuers follow suit.

The stablecoin market has added over $54B and crossed $300B since the GENIUS Act was passed into law. With issuers opting for intermediaries to offer the controversial stablecoin rewards, the $2T target by 2028 could be feasible.

Want to take advantage of the current bull run?

If you want to take advantage of the current bull market but are hesitant about investing, online stock brokers could help take the intimidation out of the process. These platforms offer a simpler, user-friendly way to buy and sell stocks, options and ETFs from the comfort of your home. Check out Money’s list of the Best Online Stock Brokers and start putting your money to work!

Top 3 coins of the day

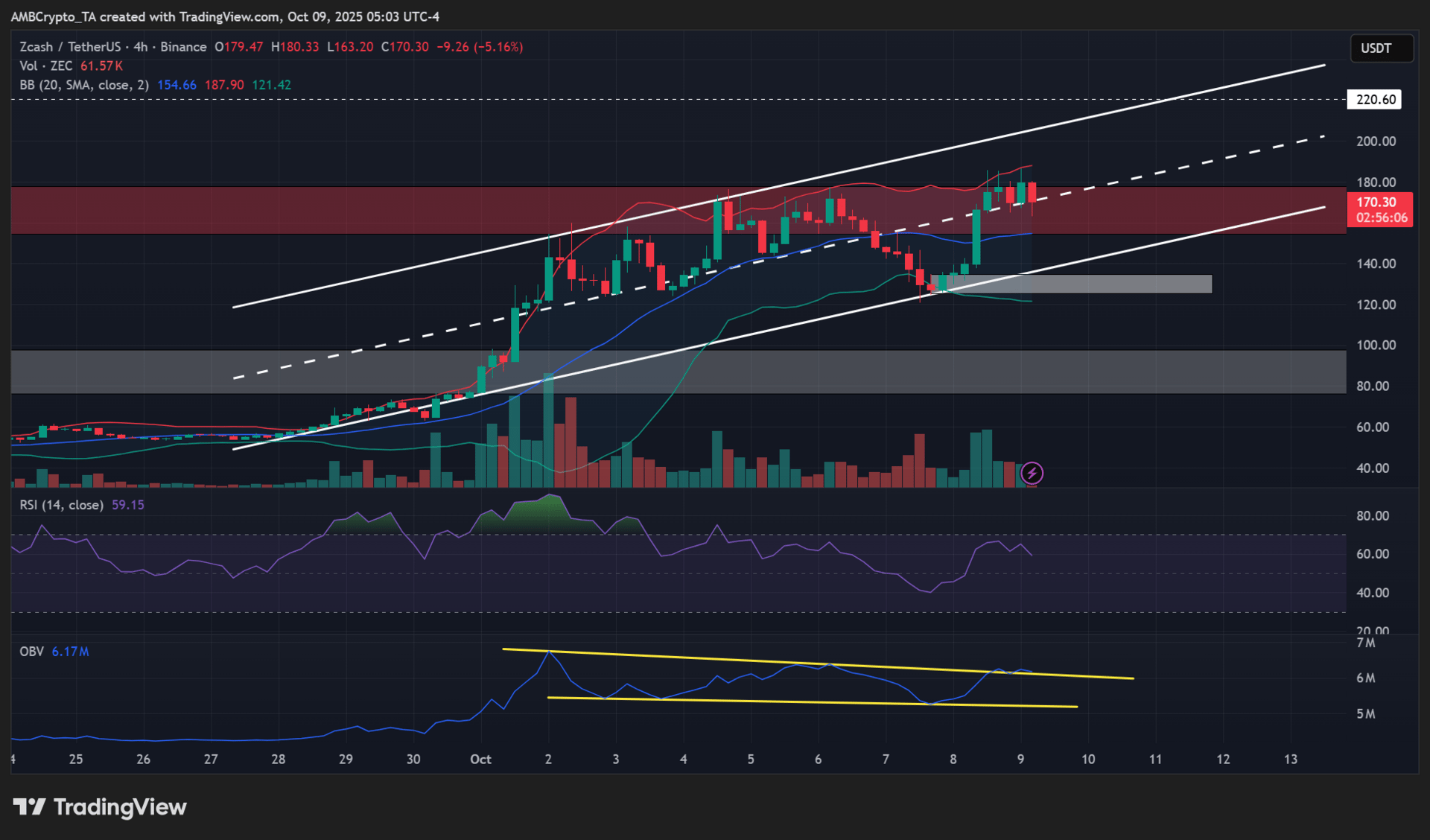

Zcash (ZEC)

Key points:

Zcash [ZEC] reversed recent losses and fronted a 50% run to $186.

ZEC could hit $220 if it maintains its rising channel structure.

What you should know:

Despite the recent cool-off in Zcash [ZEC], Monero [XMR], and others, they recently rebounded, underscoring the strong interest in the privacy coin narrative. Three days ago, ZEC dropped 32% to $120. However, it reversed the losses after a 50% surge, following BTC's attempt to reclaim $124K.

If the privacy coin narrative and the rising channel hold, ZEC could extend its run to $220 in the next few days. The range lows and highs could act as trading opportunities for scalpers or swing traders.

The OBV chakled a bullish falling wedge pattern that supported further upside. But a price dip below $120 and the range lows would invalidate the bullish outlook. In such a bearish scenario, the $100 level could be hit.

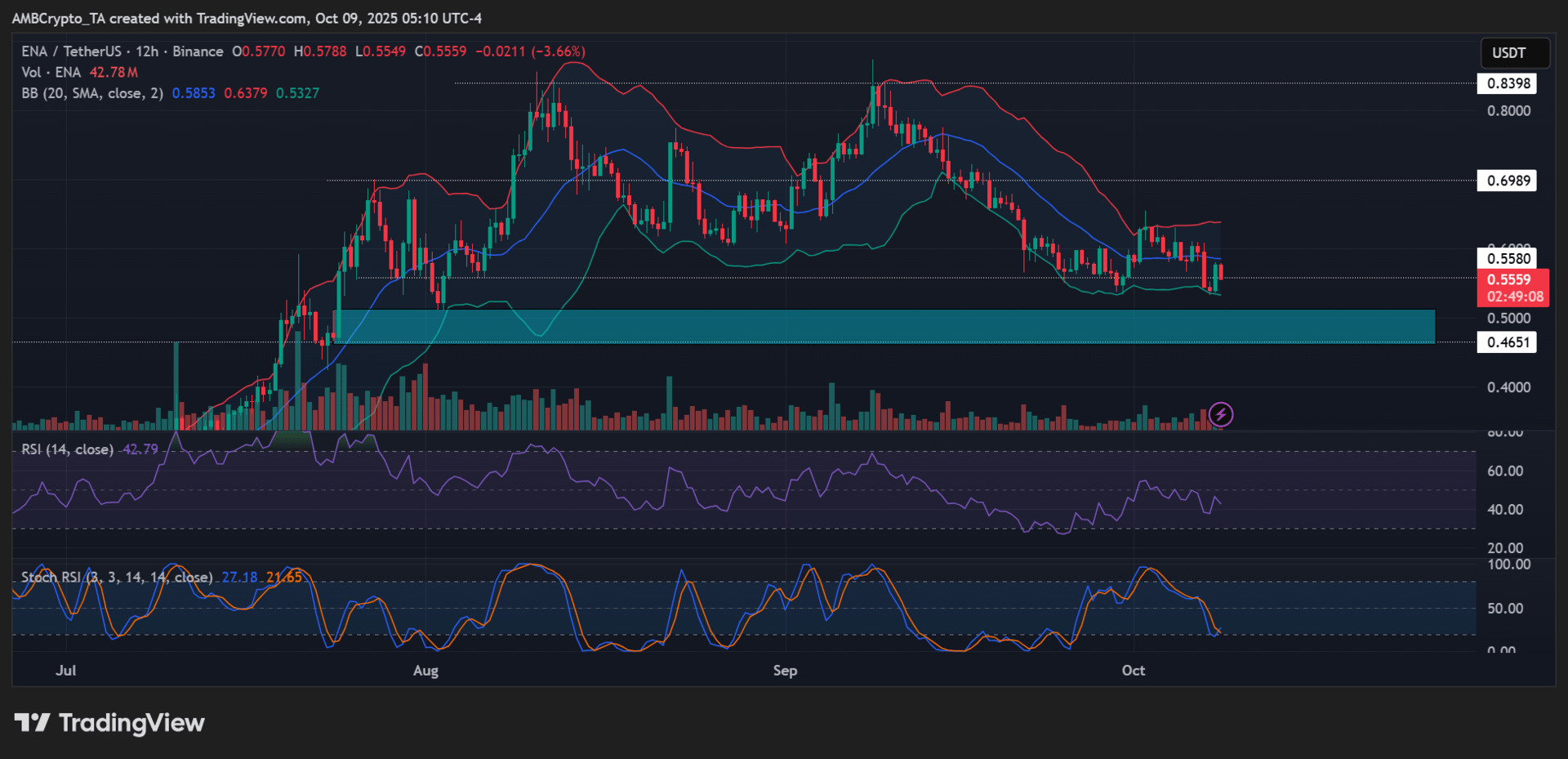

Ethena (ENA)

Key points:

ENA pumped 6% on Wednesday and may be on track to erase all of its recent losses.

The altcoin has been muted near its Q3 support at $0.5.

What you should know:

Ethena jumped 6% on Wednesday after bagging the Jupiter ecosystem stablecoin deal. But the recovery appeared short-lived. As of press time, it was down about 4% and any extended sell-off could drag it to the Q3 support at $0.5.

The stochastic RSI showed that a stronger price reversal was close, but the broader pullback was not yet done. If past trends repeat, a dip into the oversold zone could be a buying opportunity, especially if $0.5 support is defended.

The immediate bullish target in such a potential recovery would be $0.55 and $0.7, about a 10%-40% gain if hit. A breach below $0.5 would invalidate the recovery prospect.

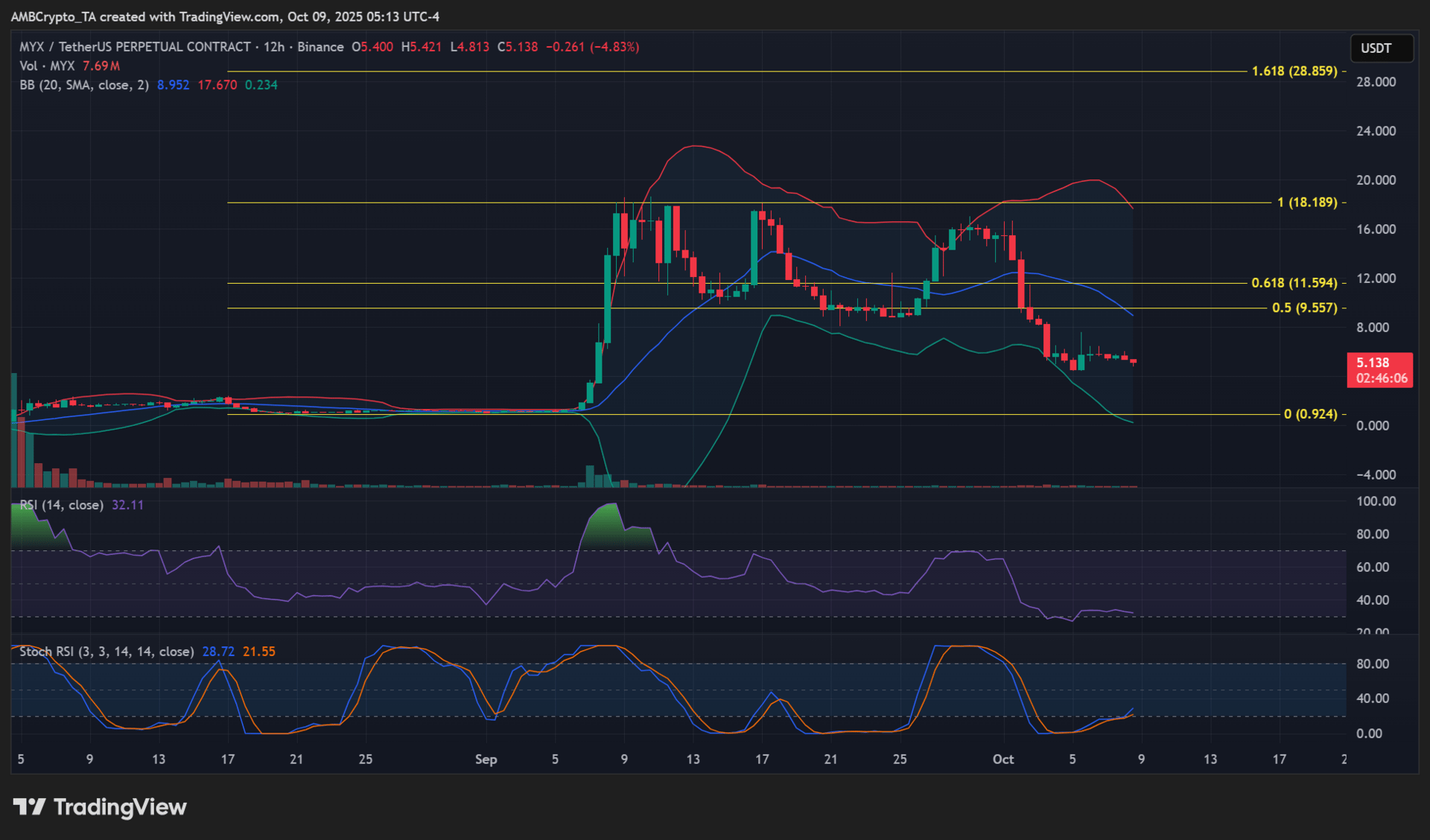

MYX Finance (MYX)

Key points:

MYX has dropped over 70% from its record high of $18.

A strong recovery is yet to be confirmed, hence the $2-target could be tagged.

What you should know:

MYX Finance [MYX] dropped 12% and led the sell-off across the perpetual DEX sector. Overall, the altcoin has declined by over 70%, slipping from a record high of $18 to $5. It was close to erasing all the gains after the explosive rally in early September.

Although it appeared to have bottomed out near $5, the technical indicators didn’t align. The stochastic RSI showed recovery from the oversold zone in October, but it has been sluggish.

With eyeballs concentrating on Hyperliquid, Aster, and other perp DEX, the altcoin may be far from forming a true bottom. If so, a dip to $2 could be likely.

How was today's newsletter? |