- Unhashed Newsletter

- Posts

- Bitcoin stuck as macro pressure mounts

Bitcoin stuck as macro pressure mounts

Reading time: 5 minutes

Bitcoin holds $90K as altcoins diverge ahead of US tariff ruling

Key points:

Bitcoin remained rangebound near $90,000 as traders waited for clarity on US trade tariffs and fresh US economic signals.

Altcoins showed selective strength, with rotation-driven gains emerging despite falling volumes and subdued risk appetite.

News - Crypto markets entered a holding pattern as Bitcoin hovered close to $90,000 during Friday’s Wall Street session, with traders reluctant to commit amid uncertainty surrounding a tariff ruling by the Supreme Court of the United States.

The court adjourned for the week without issuing a decision on the legality of Trump-era tariffs, extending the legal overhang that traders had been watching closely.

While Bitcoin price action stayed muted, earlier expectations around a swift resolution had leaned toward a rollback, according to Polymarket data. However, the lack of a ruling kept risk positioning constrained.

At the same time, weaker-than-expected US unemployment figures reinforced market views that the Federal Reserve is likely to keep interest rates unchanged this month.

Bitcoin stuck in a low-liquidity range - Despite multiple catalysts converging, Bitcoin remained confined to a narrow band that has defined trading since late November. Spot volumes declined, volatility indicators cooled, and derivatives positioning thinned, signaling broad hesitation rather than conviction.

Traders continued to highlight the $88,000 to $92,000 zone as the key area to watch, with liquidity conditions amplifying short-term swings but failing to produce sustained follow-through. With the tariff ruling delayed, Bitcoin remained stuck in a wait-and-see phase.

Altcoins attract rotation flows - In contrast, parts of the altcoin market showed relative strength. Tokens such as XRP and Solana recorded notable weekly gains, driven largely by ETF-related narratives and sentiment-based positioning rather than broad risk-on demand.

The Altcoin Season Index climbed to a three-month high, reflecting increased rotation activity even as overall liquidity remained thin. Analysts cautioned that without a decisive move from Bitcoin, these altcoin gains could remain fragile, with upcoming US jobs and inflation data likely to determine whether rotation turns into a broader trend.

Ripple wins FCA approval as UK tightens crypto rules

Key points:

Ripple secured regulatory approval from the UK’s Financial Conduct Authority, allowing it to scale parts of its payments business through its local subsidiary.

The approval comes as the UK prepares a stricter crypto licensing regime, positioning Ripple among a small group of firms to clear heightened regulatory scrutiny.

News - Ripple secured a regulatory milestone in the United Kingdom after its local subsidiary received approval from the Financial Conduct Authority (FCA), enabling the firm to expand its crypto-enabled payments operations in the country. The approval grants Ripple Markets UK Ltd. registration under the UK’s money laundering regulations and the Electronic Money Institution framework.

The company described the UK as a core market in its global strategy, with the approval arriving as regulators outline plans to bring crypto firms under full oversight when the country’s new regulatory regime takes effect in 2027.

Under the proposed framework, all crypto companies, including those already registered, will need to reapply for authorization once applications open in September.

What the approval allows and restricts - While the FCA registration allows Ripple to provide certain payment-related services and operate within the UK’s regulated financial system, it stops short of full financial services authorization.

FCA records show Ripple Markets UK remains restricted without prior written consent, including limits around serving retail clients, appointing agents or distributors, and issuing electronic money or providing payment services to consumers, micro-enterprises, or charities.

Still, passing the FCA’s screening process carries weight. Industry data shows that a large majority of crypto firms fail to secure registration, highlighting the level of scrutiny involved.

Ripple’s approval signals compliance with anti-money laundering and counter-terrorist financing standards and allows the firm to operate as a compliant counterparty for banks and institutions that cannot engage with unregistered entities.

XRP price reaction and regulatory context - Despite the regulatory win, XRP’s market reaction remained muted. The token traded near $2.10 to $2.13 over the past 24 hours, posting modest daily moves even as weekly gains exceeded 10%.

The broader regulatory backdrop may matter more than the immediate price response. UK regulators are actively consulting on how existing financial rules will apply to crypto activities, including governance, operational resilience, and market conduct.

Ripple’s approval positions it favorably as the UK formalizes its crypto framework heading into the October 2027 regime.

Grayscale lays groundwork for BNB and Hyperliquid ETFs

Key points:

Grayscale registered new Delaware trusts tied to BNB and Hyperliquid, marking an early step toward potential ETF launches.

The move signals growing institutional interest in altcoin-linked ETFs, including exposure to newer crypto infrastructure assets.

News - Grayscale took a preliminary step toward expanding its crypto ETF lineup after registering two statutory trusts in Delaware linked to BNB and Hyperliquid’s HYPE token. The filings, dated January 8, were made under CSC Delaware Trust Company and typically precede a formal registration statement with the U.S. Securities and Exchange Commission.

The newly formed entities, Grayscale BNB Trust and Grayscale HYPE Trust, do not guarantee ETF filings or regulatory approval. Instead, they represent administrative groundwork that asset managers often complete ahead of submitting an S-1, which would outline the structure, strategy, and risk disclosures of any proposed fund.

Competitive pressure builds in the ETF race - Grayscale’s move places it alongside other asset managers pursuing similar products.

VanEck has already registered a trust and submitted an S-1 for a spot BNB ETF, and has confirmed plans for a Hyperliquid-linked product. Bitwise has amended filings tied to Hyperliquid exposure, while 21Shares has taken a more aggressive approach by pursuing a leveraged HYPE-linked product.

The broader backdrop includes declining inflows into spot Bitcoin and Ether ETFs in early January, contrasted by steadier demand for some altcoin-linked products. Grayscale has framed recent ETF outflows as largely tax-related and has expressed optimism around regulatory clarity and institutional demand heading into 2026.

Why Hyperliquid stands out - A potential HYPE ETF would mark a departure from Grayscale’s historical approach.

Analysts note that Hyperliquid would be the youngest asset Grayscale has considered for an ETF structure, with the protocol only about a year old. Despite its short history, Hyperliquid operates one of the largest decentralized perpetual futures platforms and has handled periods of heavy liquidation activity without major disruptions.

Market context - At the time of reporting, BNB traded near $892, posting a modest daily gain, while HYPE hovered around $25.92 after a short-term pullback. With nine crypto ETFs already live, Grayscale’s latest filings suggest a continued push to broaden institutional access beyond Bitcoin and Ether as the regulatory environment evolves.

South Korea signals crypto shift with spot Bitcoin ETFs and stablecoin rules

Key points:

South Korea plans to approve spot Bitcoin ETFs this year as part of a wider digital asset push under its 2026 economic growth strategy.

New legislation will impose strict stablecoin rules while expanding blockchain use in public finance and enforcement.

News - South Korea is preparing a major shift in its digital asset policy, with plans to allow spot Bitcoin exchange-traded funds this year and introduce comprehensive stablecoin regulation. The initiative is being led by the Financial Services Commission as part of the government’s broader 2026 Economic Growth Strategy.

Until now, cryptocurrencies were not recognized as eligible underlying assets for ETFs in the country, effectively blocking domestic spot products. Regulators now appear to be following developments in the United States and Hong Kong, where spot Bitcoin ETFs have gained traction among institutional investors.

Stablecoins and blockchain-based public finance - Alongside ETF approvals, South Korea is drafting a new Digital Asset Act that will establish a formal licensing regime for stablecoin issuers.

Under the proposed framework, issuers will be required to maintain reserve assets equal to 100% of issued tokens and guarantee user redemption rights. The law will also address how stablecoins can be transferred across borders.

The government is also moving to digitize public finance. By 2030, 25% of treasury operations are expected to be executed using blockchain-based deposit tokens, which are government-issued digital instruments distinct from stablecoins.

Pilot programs are already underway, with legislative amendments related to the central bank and treasury expected later this year.

Enforcement tightens as legal clarity improves - Regulatory expansion has been accompanied by firmer enforcement.

In a landmark ruling disclosed in December, South Korea’s Supreme Court confirmed that Bitcoin held in centralized exchanges can be seized under criminal law. The decision clarified that exchange-custodied Bitcoin qualifies as an object of seizure, strengthening authorities’ ability to freeze and confiscate assets linked to alleged crimes.

Together, the policy overhaul and court ruling signal a turning point for South Korea’s crypto market, combining broader market access with tighter oversight as digital assets become more integrated into the country’s financial and legal framework.

More stories from the crypto ecosystem

Crypto scams uncovered

Fake job offers are being used to steal crypto wallets: Cybercriminal groups have increasingly targeted crypto users with fake job interviews or coding tests, tricking victims into installing malware that quietly drains wallets once access is granted.

SIM-swap attacks still drain crypto accounts: Attackers continue to hijack phone numbers through SIM-swap fraud, allowing them to reset exchange passwords and intercept two-factor authentication codes, leading to direct crypto theft even without wallet access.

Dusting attacks are meant to track you, not steal immediately: In dusting attacks, scammers send tiny amounts of crypto to many wallets to trace transaction patterns and link addresses, which can later be exploited for phishing, blackmail, or targeted scams.

Top 3 coins of the day

Polygon (POL)

Key points:

POL surged sharply in the latest session, extending its rebound from late-December lows as buyers stepped in aggressively above the $0.13 zone.

Momentum improved alongside a clear expansion in volume, while trend signals suggested a recovery phase rather than a full trend reversal.

What you should know:

Polygon’s price climbed decisively after breaking out of its recent consolidation range, supported by a strong increase in trading volume. The move marked a shift away from the prolonged downtrend, with POL reclaiming the lower band of the MA ribbon and pushing into a recovery structure.

The EWO flipped firmly positive, with green histogram bars expanding, reflecting strengthening upside momentum after weeks of bearish pressure. Volume also rose to some of its highest levels in recent weeks, confirming active participation behind the advance rather than a low-liquidity bounce.

On the catalyst front, sentiment improved following Polygon’s Open Money Stack announcement, alongside a reported surge in network activity that increased fee generation and token burns.

Structurally, the $0.13–$0.14 area now stands as immediate support, while $0.16–$0.17 is the first resistance to watch. Sustained strength above the reclaimed ribbon remains key for continuation.

Pump.fun (PUMP)

Key points:

PUMP rebounded from its recent lows, with buyers stepping back in after a prolonged corrective phase.

Momentum indicators and volume behavior pointed to a recovery attempt rather than a confirmed trend reversal.

What you should know:

Pump.fun posted a sharp rebound after stabilizing near its late-December base, with price moving higher alongside a visible pickup in trading activity. The latest daily candles reflected renewed buying interest following an extended period of downside pressure, although the broader structure remained below earlier November highs.

From an indicator perspective, price moved away from the lower Bollinger Bar after spending several sessions compressed near it, signaling a volatility expansion phase. The Bollinger Bars began to widen, reinforcing the idea that the recent move was driven by fresh participation rather than thin liquidity.

Meanwhile, the MACD histogram flipped positive and expanded modestly, suggesting improving momentum after a prolonged bearish stretch.

Volume rose compared to prior sessions, lending credibility to the rebound. Beyond technicals, increased platform activity on Pump.fun, broader memecoin sector strength, and ongoing token buybacks appeared to have supported sentiment.

The $0.00205–$0.00210 zone now stands as immediate support, while $0.00245–$0.00260 remains the key resistance area to watch as momentum develops.

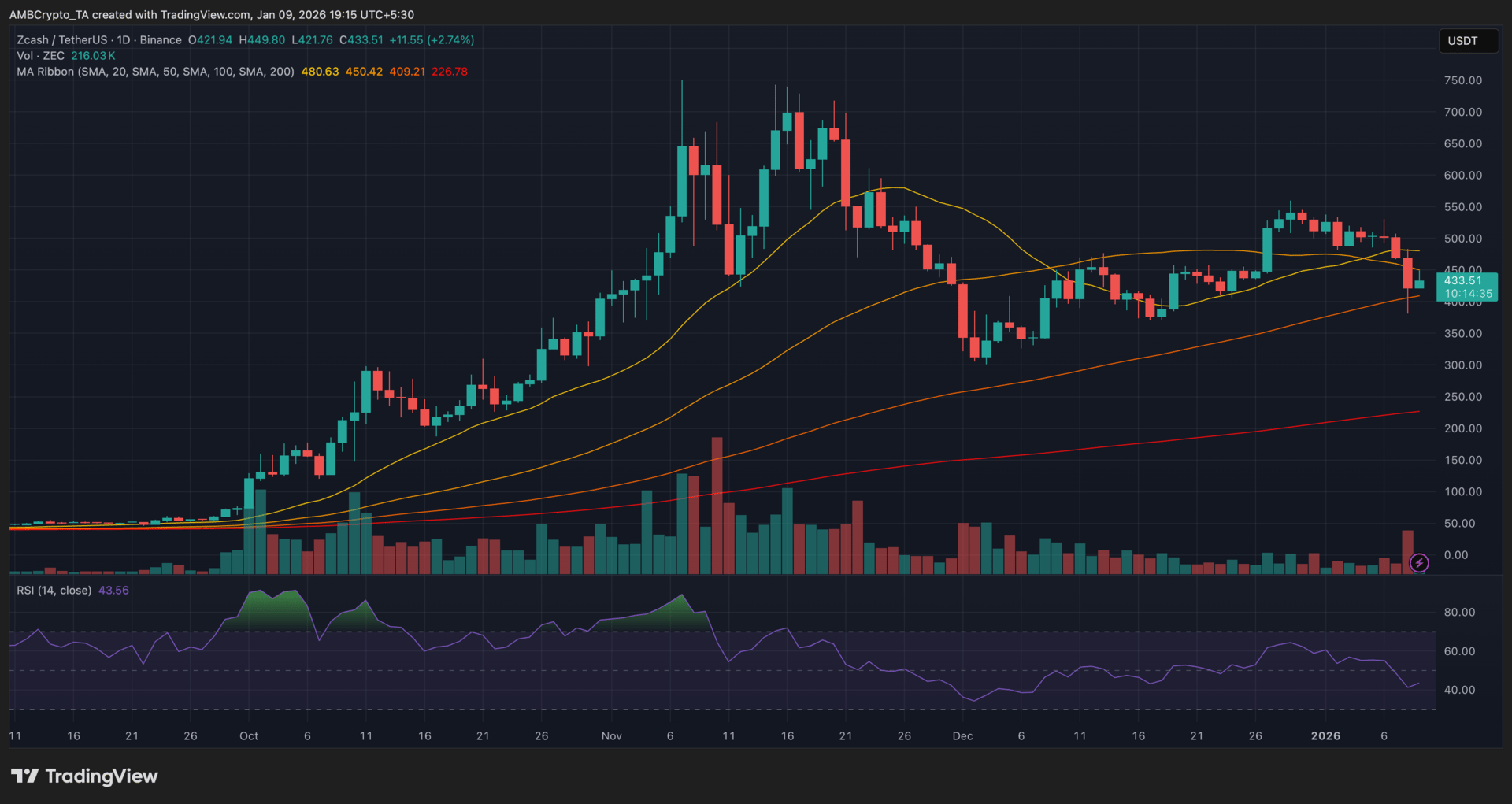

Zcash (ZEC)

Key points:

Zcash rebounded after recent weakness, with buyers returning following a sharp governance-driven sell-off.

Selling pressure appeared to ease as momentum stabilized, supported by improving sentiment and reduced panic activity.

What you should know:

Zcash staged a recovery move after slipping earlier in the week, as the market digested uncertainty tied to recent developer exits. The pullback pushed price into oversold territory, where selling pressure began to fade and dip buyers emerged. ZEC managed to recover toward the $430 region, signaling stabilization rather than a continuation of the prior decline.

At a trend standpoint, price temporarily slipped below the faster layers of the MA Ribbon but remained above the longer-term averages, suggesting the move was corrective within a broader structure rather than trend-breaking.

The RSI recovered from deeply oversold levels toward the mid-range, reflecting cooling downside momentum instead of aggressive bullish strength.

Volume spiked during the sell-off, consistent with capitulation, but moderated during the rebound, pointing to easing fear rather than speculative chasing. Governance clarity following the CashZ wallet announcement helped calm sentiment, while reduced FUD and selective accumulation allowed ZEC to stabilize.

For now, the $420 zone acts as key support, while $450–$470 stands as the next resistance area to monitor.

How was today's newsletter? |