- Unhashed Newsletter

- Posts

- Bitcoin stumbles, ETH gets the love

Bitcoin stumbles, ETH gets the love

Reading time: 5 minutes

Ethereum or Bitcoin? Institutions are splitting their bets as ETH soars and BTC stumbles

Key points:

Sharplink hired BlackRock’s former crypto chief days after rival BitMine’s $2B ETH buy, as Ethereum ETFs post 15 straight days of inflows.

Meanwhile, Bitcoin faces short-term sell pressure despite whale bets on $200K, with $3.7B moved to exchanges and over $500M in liquidations.

News - The race for crypto supremacy is dividing institutional investors. Ethereum is pulling ahead in sentiment and strategy, as Sharplink announced its new co-CEO: Joseph Chalom, a 20-year BlackRock veteran who helped launch the $10B iShares Ethereum Trust (ETHA). The move came just 24 hours after BitMine Immersion revealed a massive $2 billion ETH purchase, flipping Sharplink’s treasury total of 360,807 ETH.

This ETH accumulation war is unfolding alongside surging investor flows. U.S. spot Ethereum ETFs have attracted over $4.6 billion in just the past two weeks, extending their inflow streak to 15 consecutive days. ETH has rallied over 26% in that same span, trading near $3,700. Analysts are now pointing to Ethereum’s lagging correlation with global M2 money supply as a reason it could be trading above $8,000 already. Some forecast a potential high of $13,000 by year-end, citing ETF momentum and a falling Bitcoin dominance rate.

Bitcoin faces liquidations, but Bullish bets remain - In contrast, Bitcoin’s market is showing signs of strain. Galaxy Digital and other large holders moved $3.7 billion in BTC to exchanges, triggering $531 million in liquidations, mostly from overleveraged longs. BTC dropped to $115,000 before stabilizing near $116,365.

Still, not all sentiment is bearish. A whale recently placed a $23.7 million options bet targeting $200,000 BTC by year-end. And despite short-term volatility, corporate adoption is booming: 35 public companies now hold at least 1,000 BTC, up from 24 last quarter, with total institutional holdings surpassing 134,000 BTC.

ETH and BTC: Different roads, same destination? - While Ethereum benefits from rotation and treasury optimism, Bitcoin remains the go-to for long-term conviction bets. Institutions may be diversifying, but the race between ETH and BTC is now driven by strategy, not just price action.

Crypto’s crossroads: Trump’s stimulus buzz meets liquidity paradox and dollar strength

Key points:

Speculation around new Trump-era stimulus checks reignites talk of a retail-driven crypto surge, echoing 2020’s bull cycle.

At the same time, a rising dollar and sidelined liquidity are fueling volatility, with experts warning of leverage risks and market manipulation.

News - Rumors of potential stimulus checks under a second Trump administration have stirred debate about another retail crypto boom. In 2020, pandemic-era payouts led to a flood of retail investors buying Bitcoin and altcoins, triggering one of crypto’s most explosive bull runs. Today, even with more onramps and tokenized investing tools in place, the impact of fresh checks would land in a drastically changed ecosystem, one where liquidity isn’t flowing as freely into crypto.

Despite the U.S. M2 money supply hitting a record $22.02 trillion, analysts say capital remains parked in money markets and Treasuries, not risk assets. Derek Lim of Caladan notes this “dry powder” is awaiting clearer signals. Meanwhile, elevated leverage, especially in altcoins like XRP, has triggered cascading liquidations. ETH, SOL, and XRP have all dropped over 4% to 7% since Thursday’s highs, showing fragility beneath the surface.

Dollar strength, market fatigue, and Layer-1 skepticism collide - Adding further pressure, analysts expect a rebound in the U.S. Dollar Index (DXY), historically a bearish signal for Bitcoin. RSI and technical indicators suggest the dollar may soon bounce, just as Bitcoin enters Q3, typically its weakest quarter, with an average return of just 6.16%.

Amid these macro signals, Columbia Business School’s Omid Malekan issued a reality check, calling out the crypto industry’s profit motives, inflated metrics, and the rise of unnecessary Layer-1 chains. He warned that many projects are drifting away from decentralization in pursuit of short-term hype.

Outlook: Retail return or reality check? - With institutional flows cooling, any new stimulus could revive retail activity. But with macro headwinds, market froth, and credibility questions mounting, crypto’s next move may not be as simple as stimulus = surge.

NFTs roar back: CryptoPunks lead $6.6B market comeback

Key points:

The NFT market surged 94% in July, hitting $6.6 billion in market cap as floor prices and high-profile sales returned.

CryptoPunks reclaimed the spotlight with a $5 million sale, 83 new holders in a day, and 400% spikes in related collections like CryptoBatz.

News - After a prolonged downturn, the NFT market is staging a powerful comeback. Market capitalization jumped 94% in July to $6.6 billion, while weekly trading volumes surged 51% to $136 million, according to DappRadar. The spike reflects growing investor confidence, with a shift toward high-value assets and blue-chip collections.

CryptoPunks, the Ethereum-based OG collection, is once again the poster child for NFT resurgence. Floor prices climbed over 53% to 47.5 ETH, with some rare Punks fetching multi-million dollar valuations. GameSquare Holdings snapped up the iconic Cowboy Ape Punk #5577 for $5.15 million in stock, while another buyer picked up over $4.3 million worth of hoodie Punks in a two-day spree on OpenSea.

On July 22 alone, 83 Punks were acquired by new wallets. Pudgy Penguins and Bored Ape Yacht Club also saw sharp gains, with the former briefly overtaking CryptoPunks in trading volume before settling just behind.

Blue-chip FOMO returns - The NFT rebound is being driven not by mass volume, but by fewer trades at much higher prices. Average NFT prices surged 40% in a week to $146, while collections like Art Blocks and Moonbirds staged impressive comebacks thanks to platform upgrades and acquisitions.

Telegram NFTs and legal clarity add fuel - Telegram’s NFT market added to the optimism, generating $12 million in minutes through sold-out launches. Meanwhile, the U.S. SEC clarified that most NFTs with creator royalties do not count as securities. A federal court ruling also confirmed NFTs can be trademarked under the Lanham Act, giving the sector a stronger legal foundation.

What’s next? - While critics remain cautious, the return of blue-chip momentum, celebrity-linked collections, and legal clarity suggest the NFT market may have more staying power this time around.

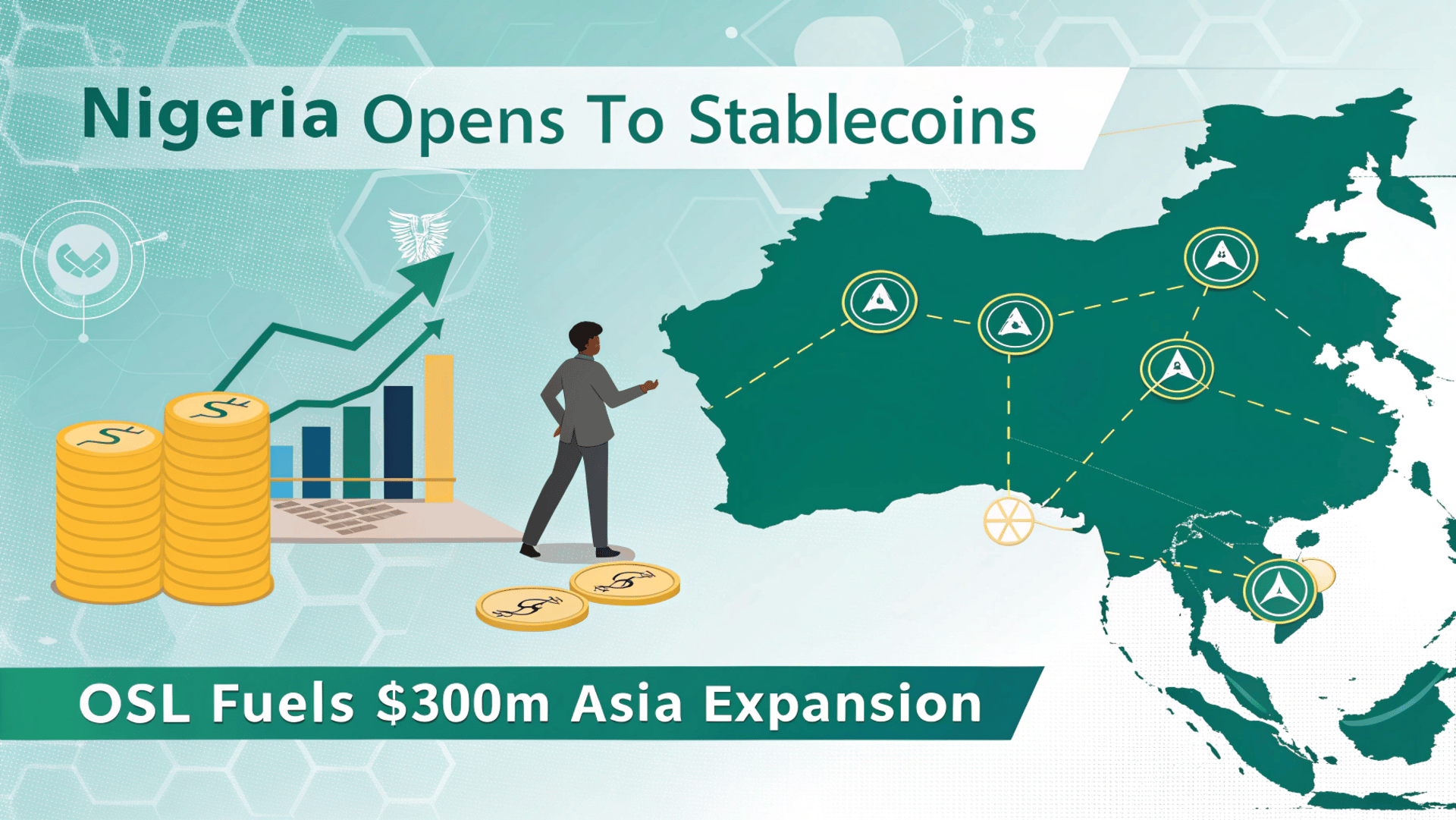

Nigeria opens to stablecoins as OSL fuels $300M Asia expansion

Key points:

Nigeria’s SEC welcomed stablecoin firms under regulatory oversight, signaling a policy shift after its crackdown on Binance.

Meanwhile, Hong Kong’s OSL Group raised $300M to expand stablecoin infrastructure ahead of new licensing laws.

News - Stablecoins are entering a new chapter in both Africa and Asia. Nigeria’s Securities and Exchange Commission (SEC) said it is now open to onboarding stablecoin-focused businesses through its regulatory sandbox, provided they comply with national guidelines.

Speaking at the Nigeria Stablecoin Summit, SEC Director-General Emomotimi Agama declared, “Nigeria is open for stablecoin business, but on terms that protect our markets and empower Nigerians.” He emphasized that regulating the sector is key to Nigeria’s financial future, calling stablecoins a “critical element” in the country’s evolution. The shift comes more than a year after Nigeria’s aggressive action against Binance, including a now-dropped lawsuit and executive detention.

Industry observers say trust will take time to rebuild. “Nigeria won’t become a stablecoin hub overnight,” said Ryan Yoon of Tiger Research, though firms like Blockchain.com have already resumed plans to expand in the country.

Asia's $300M stablecoin bet - In parallel, Hong Kong-based OSL Group secured $300 million in equity financing: Asia’s largest public crypto raise to date. Around $90 million will be directed toward stablecoin and payments infrastructure as OSL expands across Japan, Australia, Europe, and Southeast Asia.

The capital raise aligns with Hong Kong’s upcoming stablecoin licensing regime, set to launch next week. OSL, already licensed by the region’s monetary authority, is positioning itself to meet the rising demand for compliant, enterprise-grade stablecoin rails.

From experiment to execution - As regions like Nigeria and Hong Kong shift from regulatory ambiguity to structured oversight, stablecoins are becoming more than a tool for speculation. They are now seen as essential financial infrastructure for global payments, cross-border trade, and tokenization.

More stories from the crypto ecosystem

World’s largest corporate ETH treasury just grew by 700% in 16 days!

BlackRock’s ETH ETF hits $10B milestone in record time! – Details

Ripple co-founder moves $175M in XRP – Market reaction explained!

Fartcoin dips 8% after $2.72M whale dump – Can bulls defend $1.30?

MARA Holdings’ Texas mine faces lawsuits as town fights back against Bitcoin

Crypto scams uncovered

Crypto Beast’s $190M $ALT rug - A pump-and-dump plot by an influencer called Crypto Beast caused the altcoin $ALT's market cap to crash from $190M to $3M in hours by July 14, 2025, a market value loss of roughly $187 million. On-chain investigator ZachXBT exposed the scheme, revealing the influencer's associated wallets gained an estimated $11 million.

CoinDCX’s $44M hack - India’s largest exchange, CoinDCX, was hacked on July 19, resulting in the theft of $44.2 million from an operational wallet. Luckily, customer funds remained unaffected due to isolation protocols.

"Triangular” fraud cost American $16M - In mid-July, U.S. authorities shut down “Triangular”, a foreign-operated crypto investment scheme that defrauded an individual in Missouri out of $16 million via a fake trading platform.

Top 3 coins of the day

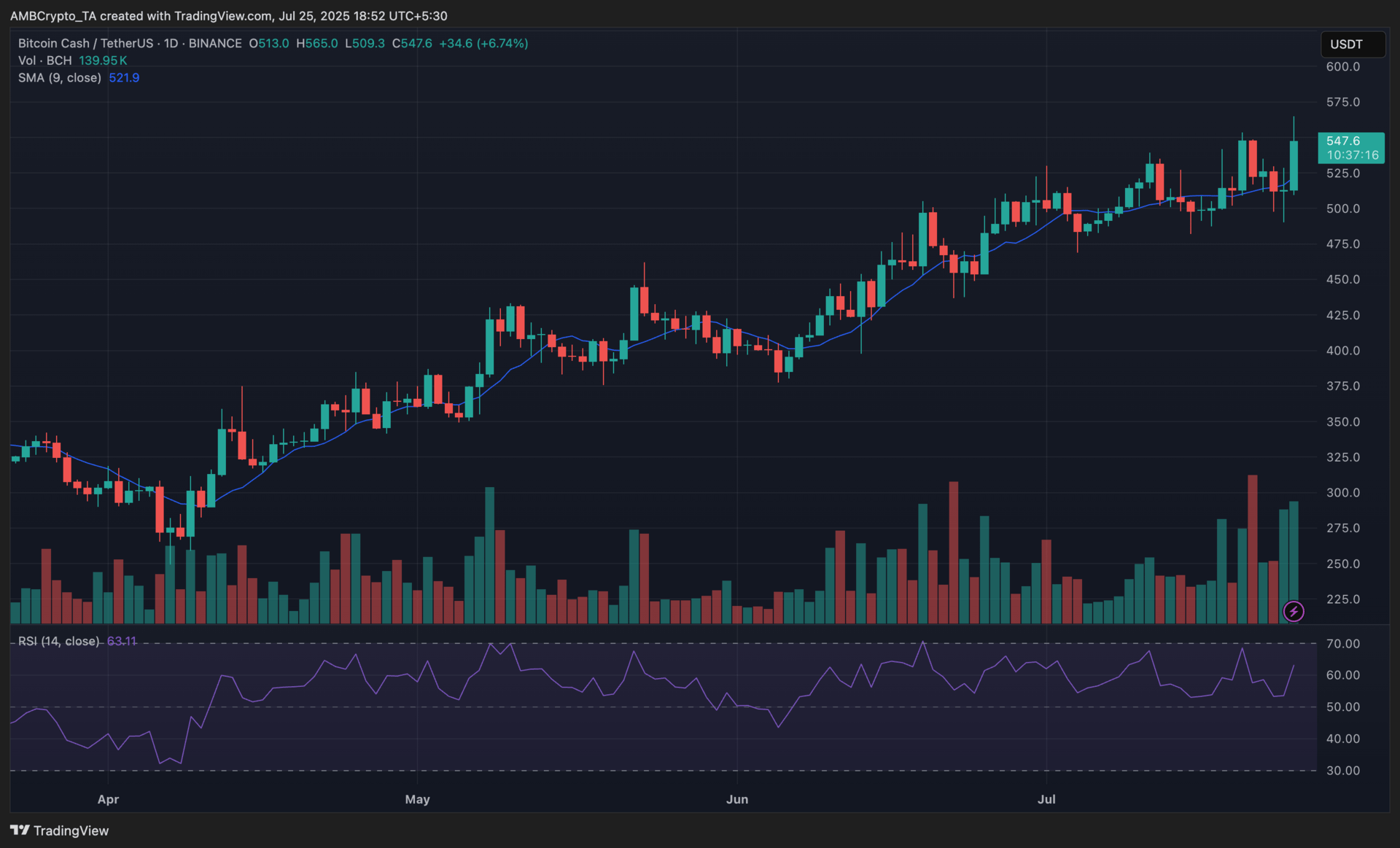

Bitcoin Cash (BCH)

Key points:

At press time, BCH was trading at $547, reflecting a 6.74% jump from the previous daily close.

The price surged above its 9-day SMA, while the RSI hovered at 63.11, showing strengthening bullish momentum.

What you should know:

BCH’s strong intraday rally was accompanied by a visible uptick in volume, reinforcing breakout conviction above the $540 mark. The Relative Strength Index climbed toward the bullish zone but stayed below the overbought threshold, indicating continued buying interest without immediate exhaustion. The price closed well above the 9-day Simple Moving Average at $521, reaffirming its short-term bullish structure. Beyond technicals, traders likely responded to whale accumulation reports and rising derivative activity. Over $1.3B in 24-hour derivatives volume (+28%) and a 24% spike in open interest was noted, fueled by large buys on Binance and OKX. Much of this demand was reportedly driven by Chinese traders seeking lower-fee alternatives to BTC amid altcoin rotation trends.

Uniswap (UNI)

Key points:

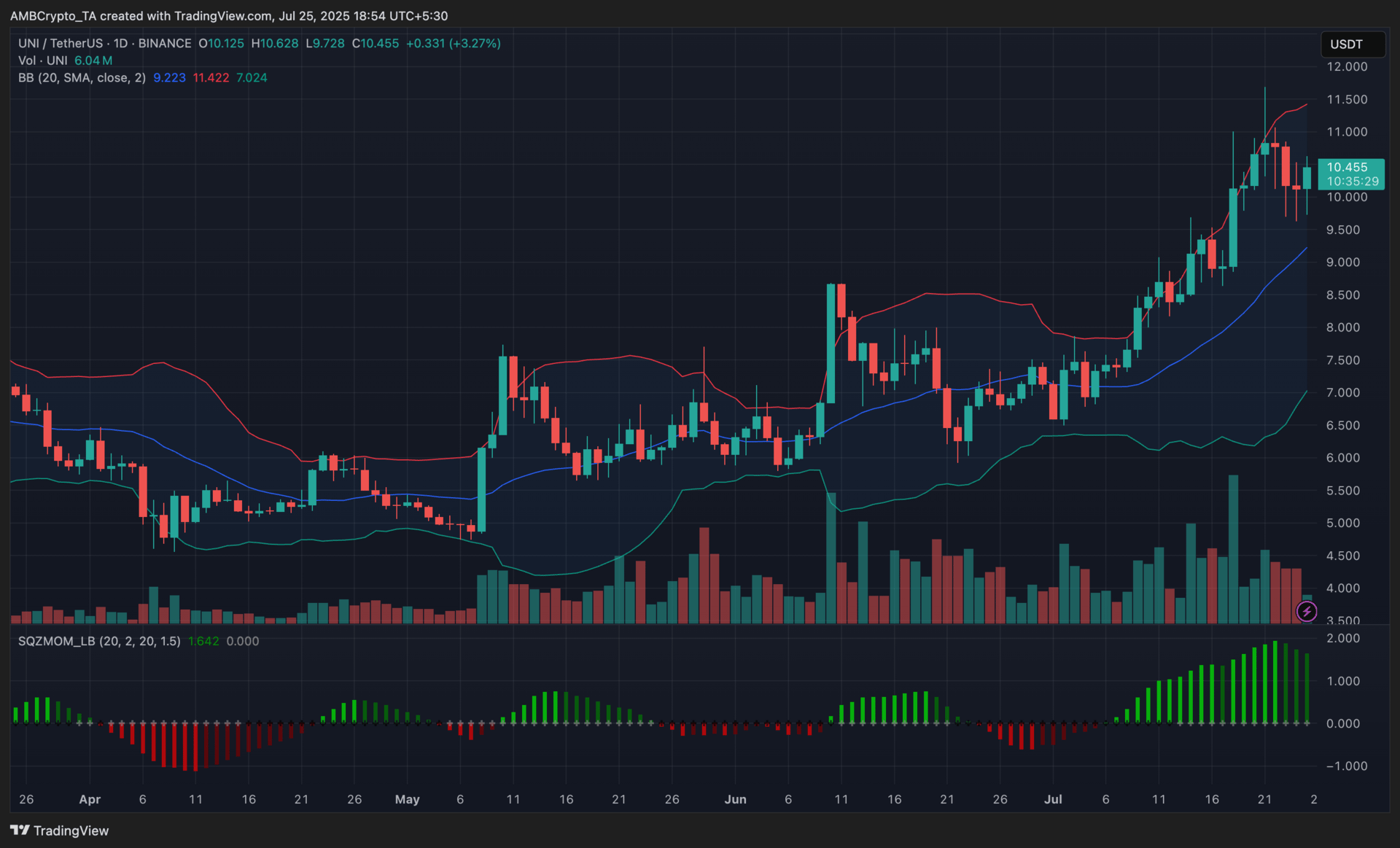

At press time, UNI was trading at $10.45, up 3.27% from its prior day’s close.

The price hovered above the midline of the Bollinger Bands, while the Squeeze Momentum Indicator remained firmly green, reflecting continued bullish strength.

What you should know:

UNI extended its upward trajectory after bouncing near the Bollinger Band’s midline support around $9.22. The token’s latest daily close showed consolidation above the $10 level, while the Squeeze Momentum Indicator signaled sustained bullish pressure, despite reduced volume compared to recent highs. The Bollinger Bands also showed a healthy spread, supporting ongoing volatility in favor of the bulls. This short-term recovery followed a broader DeFi rally, aided by Ethereum’s rebound and fresh whale accumulation signals. According to latest data, over $99M in UNI and USDC was withdrawn by two whale wallets, suggesting strategic positioning amid rotation into high-beta assets. Additionally, rising anticipation around Uniswap v4 and increased DeFi token interest likely reinforced market confidence in UNI’s trajectory.

Ethereum (ETH)

Key points:

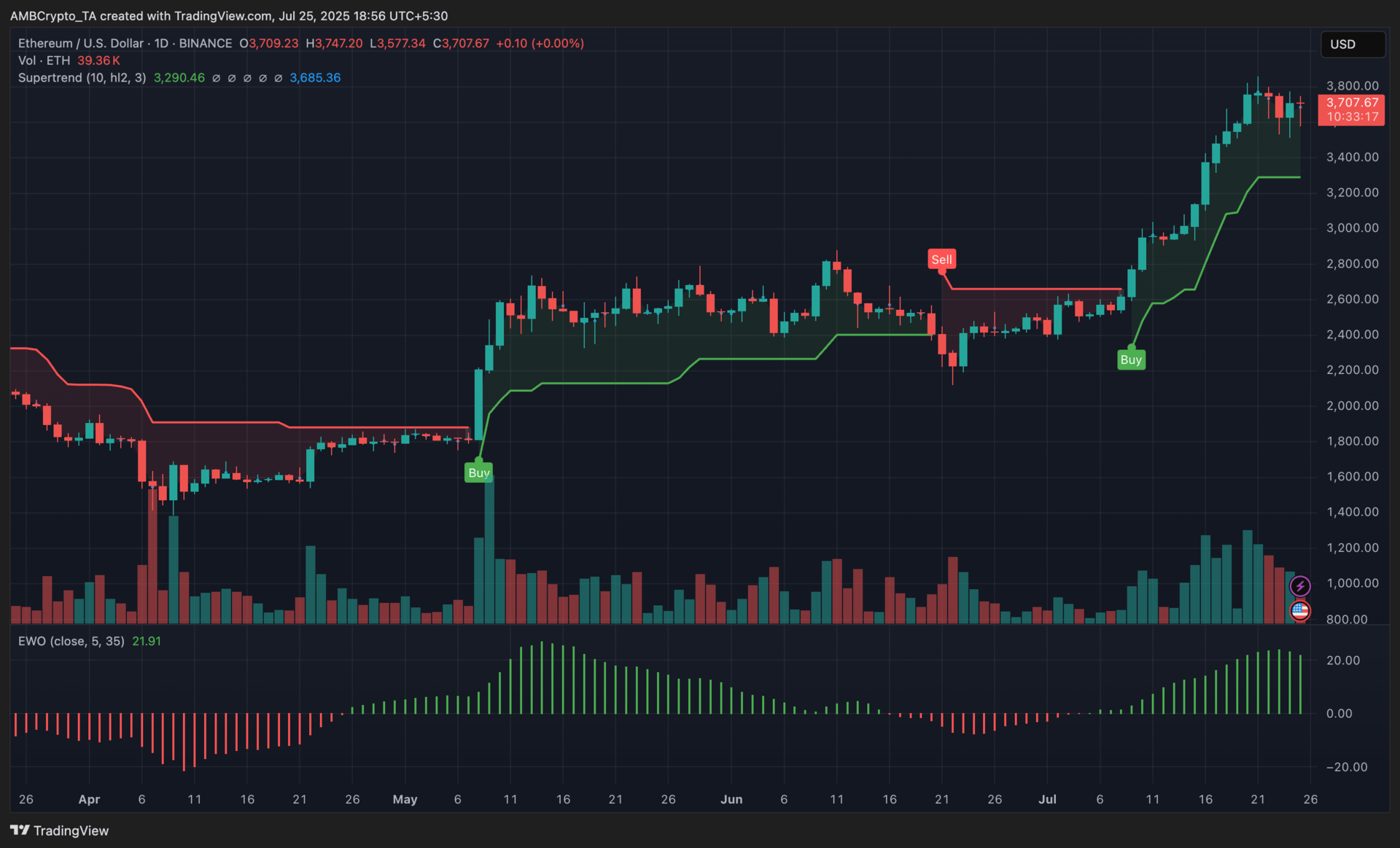

At press time, ETH was priced at $3,707, flat from the prior day’s close after a 1.56% 24-hour gain.

The Supertrend indicator continued to flash a strong buy signal, while the EWO stayed deep in bullish territory at 21.91.

What you should know:

ETH maintained its rally above $3,700 after a brief dip toward $3,576, which now acts as key short-term support. The Supertrend indicator has remained in bullish alignment since early July, while the Elliott Wave Oscillator continued to print strong green bars, reflecting trend conviction despite consolidation. Volume, however, showed early signs of tapering, hinting at a potential cooldown unless new buyers step in. The recent price action has also been influenced by massive institutional interest. BitMine reportedly purchased $970M worth of ETH in just one week, with plans to accumulate up to 5% of the total circulating supply. This intensified demand has tightened supply and reinforced ETH’s narrative as the go-to altcoin in this market cycle.

How was today's newsletter? |