- Unhashed Newsletter

- Posts

- Bitcoin to $125K... When?

Bitcoin to $125K... When?

Reading time: 5 minutes

Sponsored:

EarnBet unveils next evolution in Crypto Gaming!

EarnBet, the licensed crypto casino built for players worldwide, is leveling up with its latest platform evolution. Featuring a sleek new interface, upgraded in-house titles like Limbo, Crash, Dice, and Blackjack, plus over 10,000 games from the world’s leading providers, along with expanded rewards and VIP perks, EarnBet delivers a faster, more rewarding experience.

Not a newcomer, EarnBet has been a trusted name in crypto gaming since 2018. With the market’s highest rebate and 62.5% rakeback, players can choose their way to play with deposits supported in both major cryptocurrencies and cards, and instant crypto withdrawals. Backed by a thriving community, the casino keeps action fresh with daily giveaways, exclusive promotions, and interactive challenges.

From casual players to high rollers, EarnBet’s mission is clear - Deliver the ultimate gaming experience with transparency, fairness, and unmatched rewards.

👉 Play EarnBet.io today!

Bitcoin’s price hits $120K - How high can it really go?

Key points:

October has so far provided much-needed impetus to Bitcoin’s price on the charts.

Analysts are optimistic more gains may be in store for the world’s largest cryptocurrency.

News - The month of October has so far been radically different from much of September. While Bitcoin seemed to stall and stutter last month, it has closed in on its ATH quickly this month. At the time of writing, the cryptocurrency was valued at just under $120K, after hiking by 11% in a week.

The fears and later, the reality of the U.S shutdown precipitated the aforementioned surge in Bitcoin’s price as the crypto’s safe haven attributes finally found an audience in times of economic volatility. This was the case with Gold too, with the precious metal climbing to a new ATH of $3,895 per ounce.

However, as far as Bitcoin is concerned, it’s not just a matter of being a safe haven in times of uncertainty that has helped it. Instead, the cryptocurrency’s fundamentals and on-chain data have all played a role in fueling its recent bullishness.

Is the worst behind us? - Consider the Short-term Holder Realized Value Ratio, for instance. While the same has been falling since May, it fell more steeply over the past few weeks. In doing so, it seemed to allude to a decline in speculative excess across the market. What this means is that the market isn’t as overheated as it once was. Instead, the market might be prepping for a new accumulation phase.

Similarly, the Long-term Holders’ Net Position Change metric hinted at a fall in profit-taking tendencies.

This can be supplemented by the finding that while many short-term holders were exiting the market back in September, the same hasn’t been the case in October. To put it simply, not many weak hands have been leaving the market lately.

Bitcoin to $125K next? - Right now, it’s a little difficult to predict where Bitcoin’s price will be seven days from now, let alone a month or six months down the line. While technical indicators and fundamentals might give us a fair idea, the unpredictability of macroeconomic factors might play spoilsport.

Labour market’s weakness, inflation concerns, tariff fears, and steps taken by the Federal Reserve have all affected the cryptocurrency market in 2025. Hence, patience will be key.

Ethereum’s Fusaka a step closer after deployment on Holesky testnet

Key points:

Successful deployment was achieved on 01 October.

Fusaka is latest attempt to push for more speed, efficiency, bandwidth.

A successful test - Ethereum’s development timeline is well on track. Months after the Pectra upgrade back in May, its next upgrade - Fusaka - is right on schedule. This, after it was successfully deployed on the testnet Holesky on 01 October.

Testnet runs like these are important since they allow developers the leeway required to test code on a practice chain, before moving on to the main chain. As far as Holesky is concerned, however, it is expected to shut down soon after Fusaka. This upgrade will be the last to have its trial run on Holesky testnet.

As it stands, two more testnet runs are scheduled for 14 October (Sepolia) and 28 October (Hoodi). If those go successfully, Ethereum developers will lock in the date for the upgrade’s full mainnet launch. Tentatively though, Fusaka is expected to be launched on 03 December.

What will Fusaka do? - Once launched, Fusaka will be able to scale Ethereum’s speed and bandwidth by encouraging lighter nodes and cheaper L2 transactions. For the former, for instance, data will be ‘sampled,’ instead of the entire blob data being downloaded - Reducing storage and bandwidth needs.

This would also allow L2s to push more transactions at lower costs.

Impact on price - As expected, the world’s largest altcoin reacted positively to the successful launch of Fusaka on the Holesky testnet. In fact, ETH’s price appreciated by over 5%, before it corrected slightly at press time.

Given the bullishness of the wider market this “Uptober,” more gains can be expected in the near term.

‘All currencies will be stablecoins’ - Tether co-founder

Key points:

Reeve Collins believes all forms of finance will finally go on-chain by 2030.

His latest prediction was made on the sidelines of the Token2049 Conference in Singapore.

Stablecoins are all the rage - With Bitcoin hitting new highs and levels every other month, it has been somewhat easy to ignore or forget about the growth of stablecoins across the market. Not anymore though as according to CoinMarketCap, the total circulating value of the global stablecoin market recently crossed $300 billion for the first time ever.

This is a remarkable achievement for the sector. However, it’s also a product of progress being made on legislative fronts. In the United States, for instance, the passage of the GENIUS Act now allows much-needed clarity and impetus to institutional crypto adoption.

As is stands, Tether’s USDT and Circle’s USDC share an overwhelming chunk of the stablecoin market - Almost 90%.

SUI joins hands with Ethena - That doesn’t mean other stablecoins don’t matter or aren’t making their mark though. In fact, synthetic stablecoins have seen their market share spur quite an uptick recently. Ethena’s USDe, for instance, is the market’s largest synthetic stablecoin right now and it has seen its market cap double since July 2025. At press time, it had a market capitalization of close to $15 billion.

The upcoming launch of stablecoins native to the Sui ecosystem - suiUSDe and USDi - in partnership with Ethena Labs is likely to contribute to synthetic stablecoins’ growing market share.

A prediction for 2030 - Reeve Collins’ latest statements could be a product of recognizing that popularity. At the Token2049 Conference in Singapore, Collins told CT,

“All currency will be a stablecoin. So even fiat currency will be a stablecoin. A stablecoin simply is a dollar, euro, yen, or, you know, a traditional currency running on a blockchain rail by 2030.”

Collins went on to say that within the next five years, stablecoins will be the primary method of transferring money around.

Memecoin MELANIA up by 10% after First Lady’s latest post

Key points:

MELANIA has seen losses of over 95% since its launch on Inauguration Day.

First Lady’s latest promotion on X involved an AI-generated video.

Bad 2025 for MELANIA - It hasn’t been a great year for the crypto-market’s memecoins. Less so for memecoins named or themed after political figures and entities. The case of Official Trump [TRUMP] is a perfect example, with the memecoin on a steady downtrend since its peak in January.

However, Melania Meme [MELANIA] has had it worse in 2025. While TRUMP has seen some bouts of upside this year, that hasn’t been the case with MELANIA. In fact, it has already lost over 95% of its value since its peak back during Inauguration Day.

Now, while this memecoin may be down, it definitely isn’t out. And, that’s what First lady Melania Trump thinks too. After months of staying mum, Trump took to X (Formerly Twitter) to promote her Solana-based namesake. In doing so, she used an AI-generated video with a caption of “Into the future.”

Upside on the price front - While insignificant in the larger scheme of things, the First Lady’s post had some impact on the memecoin’s valuation. In fact, it registered an uptick of over 10% - It’s most significant gains since in July.

Worth pointing out, however, that it is too soon to say if the memecoin will hold on to these gains. In fact, in all likelihood, it is possible that MELANIA will instead correct again soon. That’s what the altcoin’s bearish indicators alluded to at press time.

What about the token sales? - The timing of Trump’s X post is interesting, especially since it didn’t really coincide with any update on the developmental side of the memecoin.

Worth noting that Melania’s re-appearance once again fueled queries about the memecoin’s questionable tokens sales and practices. Back in April, for instance, the team behind the token moved and sold $30M in community funds. According to blockchain data visualization platform Bubblemaps, this was done “quietly, and without any explanation.”

More stories from the crypto ecosystem

Crypto scams uncovered

Back in 2021, the BBC almost aired a 30-minute documentary about Birmingham-based crypto investor Hanad Hassan. Its programme on Hassan’s newfound wealth and his efforts to help his community was canceled after it was revealed that Hassan had been accused of defrauding several investors through charity tokens like Orfano.

DeFi platform Forsage once promoted itself as a profitable investment opportunity, one with a built-in reward system. The platform’s founders were later indicted for running a $340 million Ponzi scheme. Over 80% of investors received fewer ETH than what they invested.

The last 12 months have seen a significant increase in “pig butchering scams” across South-east Asia and the United States. Of late, these scams have been enhanced by AI-generated personas, with victims often emotionally manipulated into putting crypto into fake investment platforms.

Top 3 coins of the day

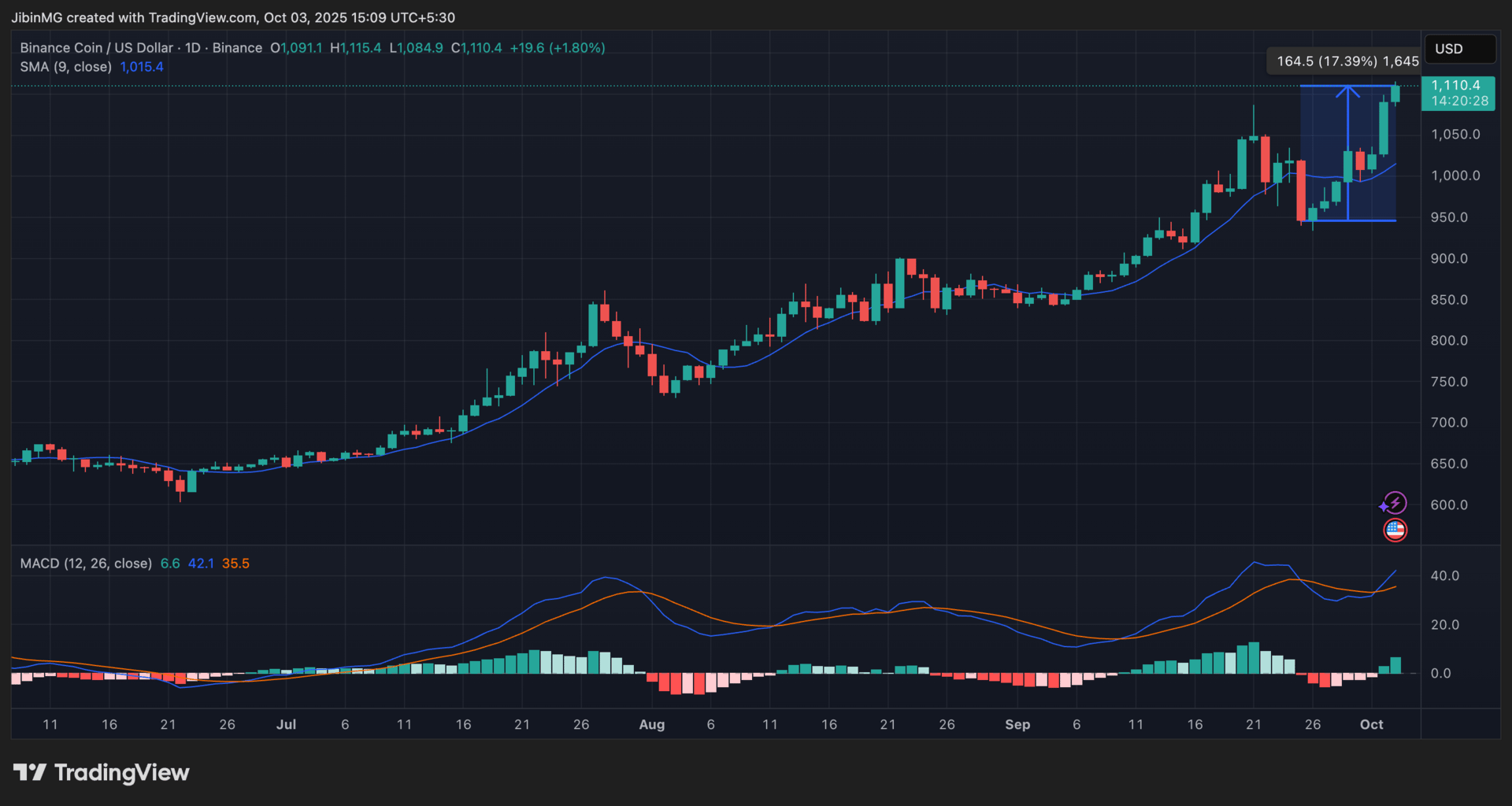

Binance Coin (BNB)

Key points:

BNB hit another ATH on the price charts.

At press time, the altcoin was valued at $1,110, up 17% in just over a week.

What you should know:

It’s been a good year for BNB investors, with the exchange coin hitting one ATH after the another in 2025. The last 24 hours saw the altcoin follow a similar trajectory, with the crypto hitting $1,110 after gains of over 17% on the price charts. A few catalysts have contributed to BNB’s price performance. For starters, the price action of both BTC and ETH - Cryptos BNB shares a strong correlation.

That’s not all though as an increasing number of treasury companies have started stacking BNB. Regular token burns have contributed to price gains too.

The altcoin’s bullishness was clearly evident when the technical indicators were looked at. While the position of the Moving Average below the price candles hinted at the same, so did the MACD Line’s bullish crossover with the Signal Line.

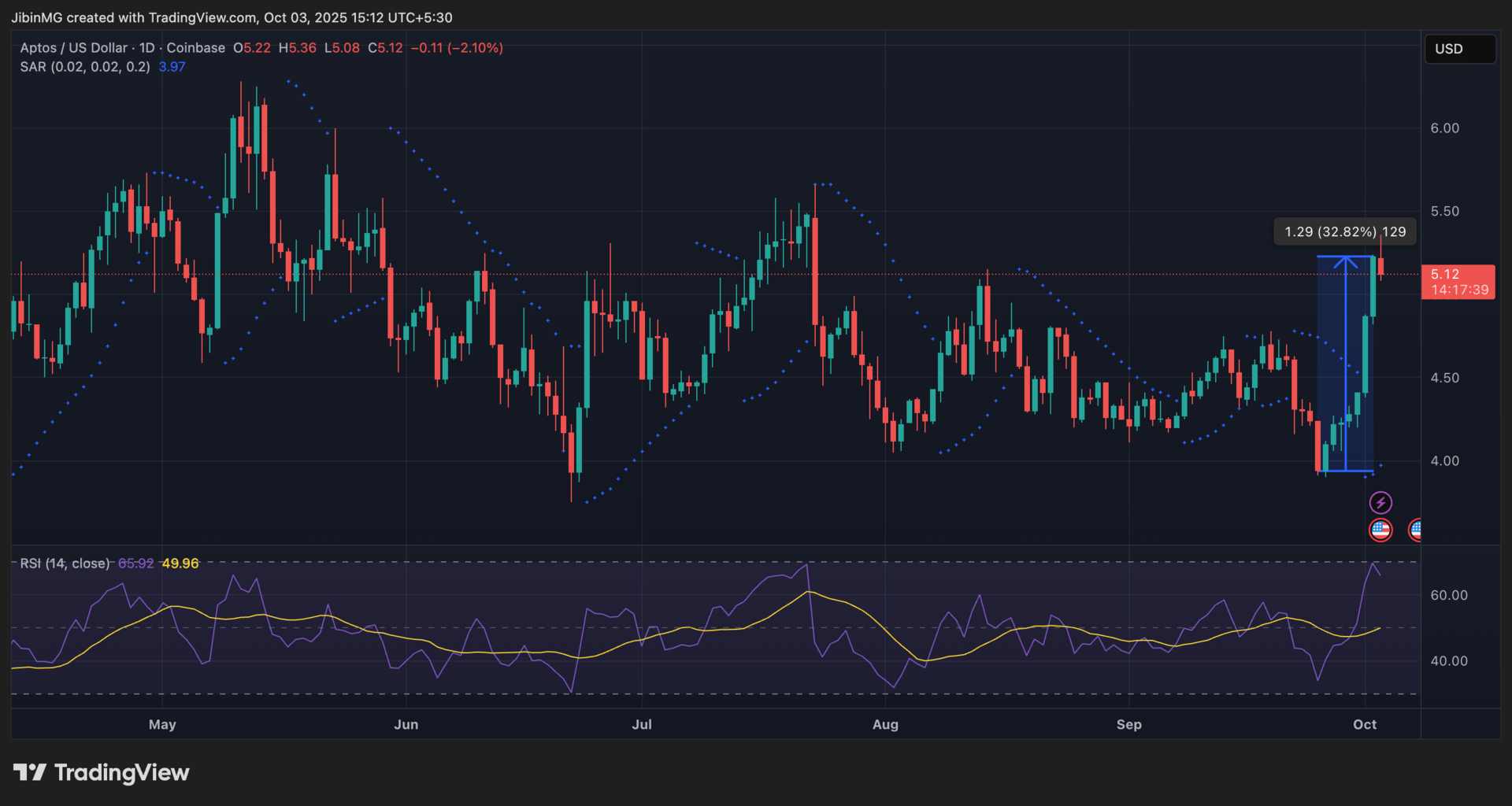

Aptos (APT)

Key points:

APT’s latest hike saw the altcoin climb by over 32%.

A major correction could be in the offing soon for APT.

What you should know:

After weeks of topsy-turvy movement, APT’s price action went on a steep uptrend, one that took many of its investors by surprise. In fact, in less than a week, the altcoin saw gains of over 32%. At the time of writing, APT was trading at $5.12 - Around its mid-August levels.

Now, while the hike was significant, context is important. Especially since despite the aforementioned gains, the altcoin is still trading within the price range it has been in for months. Simply put, the crypto’s latest upside hasn’t allowed it to breach this range yet.

Will it though? That is uncertain. Especially since at press time, its technical indicators seemed to be flashing mixed signals. Consider this - The Parabolic SAR’s dotted markers were below the price candles to highlight the market’s bullishness. On the contrary, the RSI seemed to be dropping after hitting the overbought zone - A sign of incoming corrections.

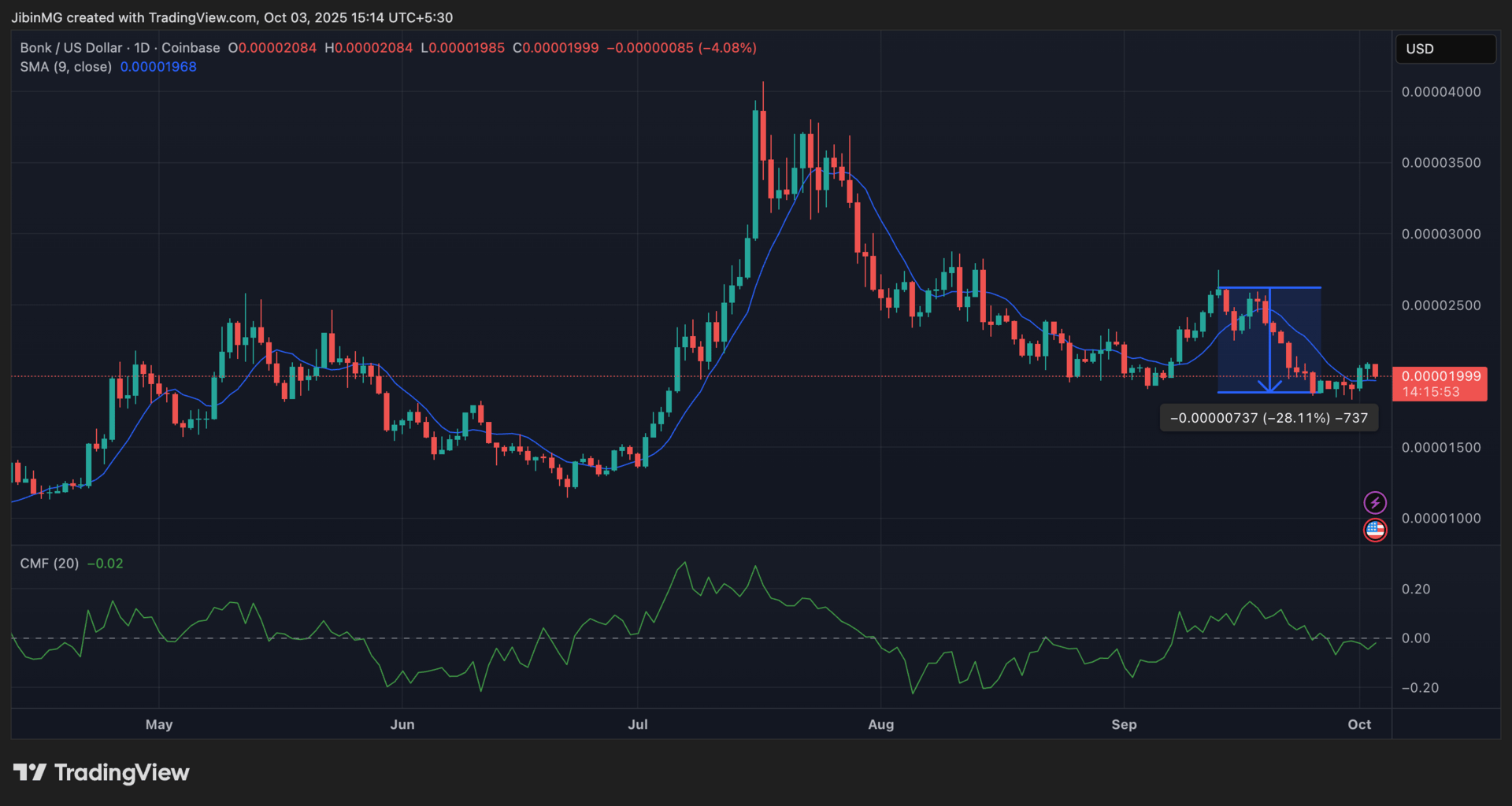

Bonk (BONK)

Key points:

Wider market’s bullishness hasn’t had a significant positive impact on the memecoin yet.

BONK is still recovering from its losses in late September.

What you should know:

It hasn’t been a particularly profitable year for the crypto-market’s memecoins. BONK is no exception, with its press time value of $0.000019 much lower than its levels earlier in the year. Bitcoin and the wider crypto-market did recover considerably on the back of the “Uptober effect.” However, its impact is yet to be found as far as BONK is concerned.

In fact, it can be argued that the memecoin is still recovering from its 28% losses from mid-September. Some upside was evident over the last 48 hours though. However, this upside is unlikely to have a lasting impact on the memecoin’s outlook in the long term.

This upside was highlighted by the Moving Average’s positioning at press time. The Chaikin Money Flow was more ambivalent though, with the same suggesting capital inflows and capital outflows were mostly equal.

How was today's newsletter? |