- Unhashed Newsletter

- Posts

- Bitcoin whales buy, but cautiously

Bitcoin whales buy, but cautiously

Reading time: 5 minutes

ETH takes the lead: $1.6B inflows, whale moves, and institutional bets soar

Key points:

Ethereum investment products saw $1.59 billion in inflows last week, marking the second-largest weekly figure ever, while Bitcoin products recorded $175 million in outflows.

Institutional players like SharpLink and Bitmine amassed over $500M in ETH, fueling supply pressure and signaling rising conviction.

News - Crypto investment funds recorded $1.9 billion in inflows last week, extending a 15-week streak and pushing 2025’s total to $29.5 billion. Yet the spotlight was squarely on Ethereum, which outshone Bitcoin with $1.59 billion in inflows: its second-best week on record, according to CoinShares. In contrast, Bitcoin products faced $175 million in outflows, breaking a 12-day inflow streak.

Analysts link the divergence to growing anticipation around altcoin ETFs, rather than a full-blown altseason. Ethereum’s recent inflow surge also coincides with its tenth anniversary and over $5 billion in cumulative spot ETF inflows, outpacing Bitcoin for the first time.

SharpLink’s massive ETH play - SharpLink Gaming deepened its ETH strategy with a $295 million buy, exceeding Ethereum’s net issuance for the entire month. The company now holds over 438,000 ETH, worth more than $1.69 billion, and has staked most of it for long-term yield. Bitmine Immersion Tech, meanwhile, pushed past $2 billion in ETH holdings and aims to eventually control 5% of the asset’s total supply.

Whale activity hints at diverging sentiment - On-chain data highlighted mixed whale behavior. While DeFiance Capital and Justin Sun acquired large ETH positions, others like F2Pool’s Wang Chun moved ETH to exchanges, possibly signaling caution. One address notably shorted $93 million in ETH using 20x leverage, setting up a high-risk bet with a liquidation point near $3,801.

Bitcoin caught between accumulation and entry dilemma as Metaplanet buys big

Key points:

BTC is consolidating near $119K with strong whale accumulation, but analysts warn of a potential pullback to $111,673 before new highs.

Japan’s Metaplanet added 780 BTC this week, pushing its holdings to 17,132 BTC, while struggling firms like Quantum Solutions bet on crypto for survival.

News - Bitcoin hovered around $118,938 to $119,500 this week, holding steady in a tight range between $117,261 and $120,000. Analysts see this consolidation as a potential prelude to a breakout, backed by strong accumulation signals and low sell-side risk.

Glassnode data showed Bitcoin’s sell-side risk ratio hit 0.24, its highest in six months but still well below the neutral threshold of 0.4. Meanwhile, the accumulation trend score remains near 1.0, signaling heavy buying by whales and institutions. Despite August’s historically negative returns, these signals suggest BTC could defy seasonal patterns and push toward a new all-time high if it claims $120,000 as support.

Is now the right entry point? - Not all analysts are convinced the breakout will happen immediately. Markus Thielen of 10x Research warned that a retest of BTC’s May breakout level around $111,673 would offer a better risk-reward setup for bulls. If the dip never comes, he noted that a sustained breakout above $120,000 would still justify entry, though traders should use tight stop-losses given the volatility risk.

Metaplanet goes big, Quantum takes a risk - Japanese firm Metaplanet bought 780 more BTC at an average of $118,145, bringing its total holdings to 17,132 BTC worth over $2 billion. It remains the largest non-U.S. Bitcoin corporate treasury and ranks seventh globally. The move aligns with the company’s broader plan to use its BTC reserves for future acquisitions, including possibly launching a digital bank in Japan.

On the flip side, struggling AI firm Quantum Solutions also revealed plans to acquire up to 3,000 BTC over 12 months. Critics warn this pivot is more about perception than fundamentals, with analysts calling it a “gamble wrapped in hopium” meant to revive investor interest amid financial uncertainty.

XRP bulls push toward $4 as whales buy, volume rises

Key points:

XRP rebounded to $3.28 after defending key levels, with analysts predicting a climb toward $3.83 or even $4.47.

Whale sell pressure dropped 93%, CMF divergence showed rising accumulation, and institutional buying drove volume spikes.

News - XRP climbed nearly 3% in the last 24 hours, trading above $3.28 after bouncing back from intraday lows near $3.16. Strong afternoon volume and institutional inflows reinforced short-term bullish momentum, with analysts now eyeing a potential move past $4.

Whale behavior added to the optimism. Large wallet-to-exchange flows plummeted by over 93% since July 11, signaling a significant cooldown in sell pressure. At the same time, Santiment data showed that wallets holding 10 million to 100 million XRP now own over 8.31 billion tokens, a new monthly high. These whales bought the dip near $2.95 rather than exiting, contributing to a strong accumulation phase.

Indicators flash green as support holds - The Chaikin Money Flow (CMF) indicator flashed a bullish divergence, printing higher highs even as XRP price had been forming lower highs. This divergence typically signals that accumulation is outpacing distribution, supporting a potential breakout.

XRP also formed a clean ascending channel, repeatedly defending support at $3.16 throughout the day. Volume surged above the 24-hour average, especially during late-session buying between $3.20 and $3.22. Resistance now sits at $3.30 and $3.37, with analysts setting next targets at $3.62, $3.83, and even $4.

Analysts say “most profitable phase” is here - Multiple analysts agree that XRP could be entering a parabolic rally phase. Dom highlighted the $2.80–$2.95 range as a structural floor, while CasiTrades pointed to a 2.618 Fibonacci extension at $3.82 as a potential Wave 3 target. Meanwhile, XForceGlobal described the ongoing setup as “the most profitable phase,” and Peter Brandt suggested a rare continuation pattern could push XRP toward $4.47.

BNB hits $858 ATH as altcoins surge, PancakeSwap rides ecosystem boom

Key points:

BNB surged to a record $858 before pulling back slightly, with optimism around treasury demand, whale buys, and CZ’s $75B holdings fueling momentum.

Altcoins like Optimism, AVAX, and Worldcoin rallied in tandem, while PancakeSwap’s CAKE jumped 13.4%, reaching a five-month high.

News - BNB hit a new all-time high of $858 this week, up 7% on the day and 43% over the past month. The rally positioned BNB as the fifth-largest crypto by market cap, with Bitcoin dominance slipping from 66% to just over 60%, setting the stage for a broader altcoin rebound.

Optimism led gains with a 12.6% spike, followed by AVAX, Injective, and Worldcoin. Ethereum has also surged over 60% in the past month. This altcoin revival has triggered fresh speculation about a coming “altseason,” as traders rotate out of Bitcoin amid flattening price action.

Why is BNB soaring? - Rising treasury demand and increased whale accumulation are key drivers. Nasdaq-listed Windtree Therapeutics committed to buying $700 million in BNB, while CZ’s holdings are now estimated at $75.8 billion. BNB’s supply continues to shrink due to token burns, with Kronos Research and Komodo Platform analysts pointing to strong on-chain metrics like rising TVL and DEX volumes on PancakeSwap.

Meanwhile, CZ’s family office YZi Labs has backed the launch of a BNB Treasury Company, further amplifying sentiment around corporate crypto adoption.

PancakeSwap and CAKE join the rally - The BNB Chain’s top DEX, PancakeSwap, is reaping the rewards of this momentum. Its native token CAKE jumped 13.4% in a day, crossing $3.23 and hitting a five-month high. With over $1.9 trillion in cumulative volume and nearly 55 million users, PancakeSwap continues to dominate DEX activity on the chain.

Analysts believe CAKE could see further upside if BNB’s run sustains. Some even call it undervalued, suggesting it still has significant ground to cover to reclaim its previous peak.

More stories from the crypto ecosystem

Did you know?

David Chaum’s 1982 dissertation described the first blockchain protocol - Cryptographer David Chaum’s doctoral thesis outlined core blockchain principles nearly 30 years before Bitcoin, making him a true pioneer of digital currencies and online anonymity.

In 2025, fewer than 0.2% of crypto users hold at least 1 BTC - Only about 0.18% of global crypto users hold a full Bitcoin or more, making owning 1 BTC rarer than many elite collectibles.

The Ether Machine IPO aims to raise $1.6B on Nasdaq with 400K ETH on deposit - Slated for Q4 2025, The Ether Machine, backed by Kraken, Pantera, and Blockchain.com, will list on Nasdaq under ticker ETHM, launching with over 400,000 ETH on its balance sheet.

Top 3 coins of the day

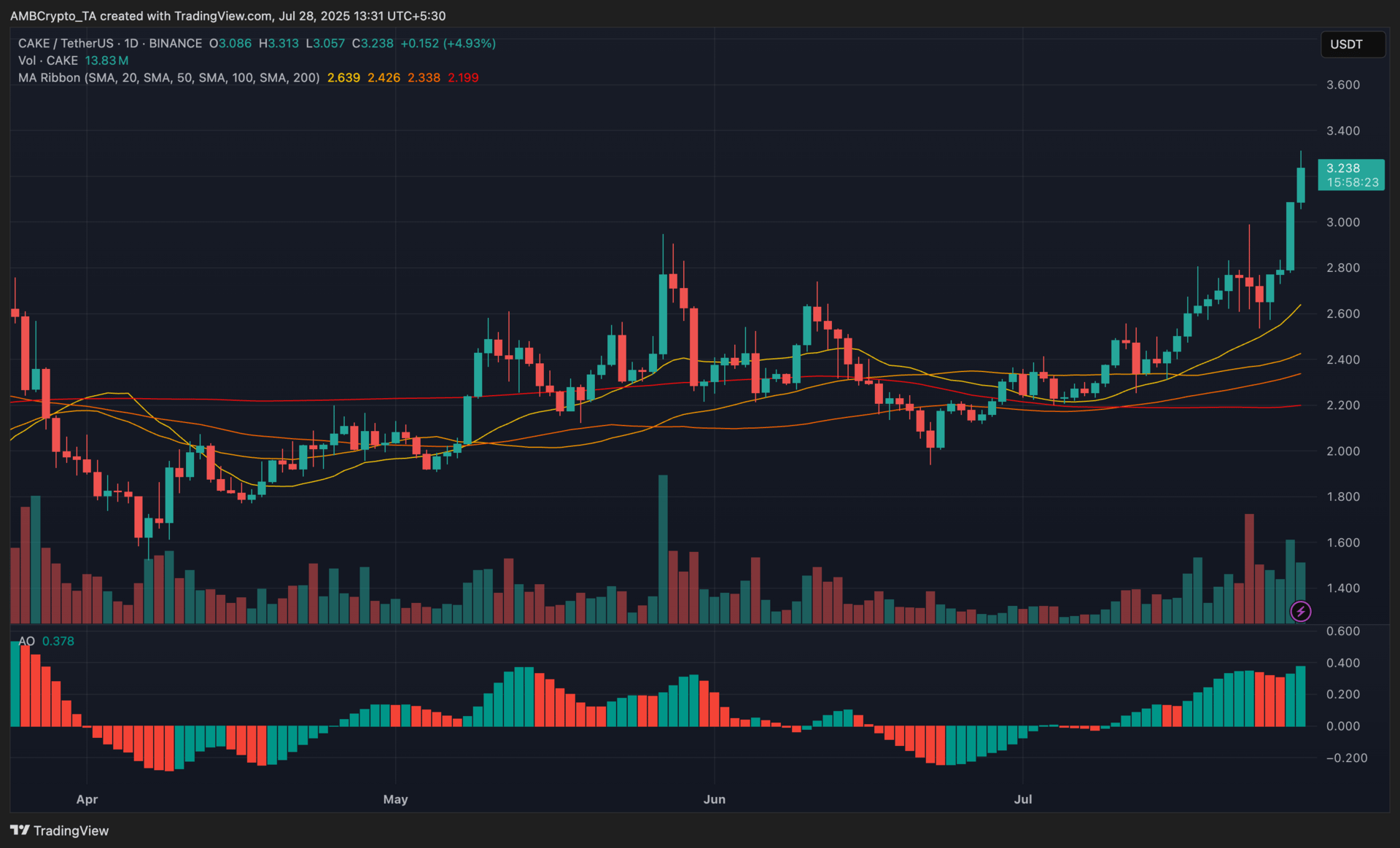

PancakeSwap (CAKE)

Key points:

At press time, CAKE was trading at $3.23, marking a 4.93% increase from its previous daily close.

Volume jumped significantly, while the Awesome Oscillator remained strongly positive, indicating persistent bullish momentum.

What you should know:

CAKE continued its multi-day rally, surging nearly 5% in the last 24 hours. This price movement coincided with the Token Generation Event (TGE) of Delabs Games, launched directly on PancakeSwap via Binance Wallet. The event boosted demand for CAKE as users flocked to the platform, aligning with a broader spike in BNB Chain activity. The chart reflected strong bullish sentiment. CAKE’s price broke above the $3 mark, backed by a steep rise in volume and a pronounced uptick in the AO histogram. The MA Ribbon confirmed trend strength, with the 20-day and 50-day moving averages maintaining separation above the 100- and 200-day SMAs. Immediate resistance now lies at $3.31, while the RSI remains overheated, suggesting possible short-term cooldown.

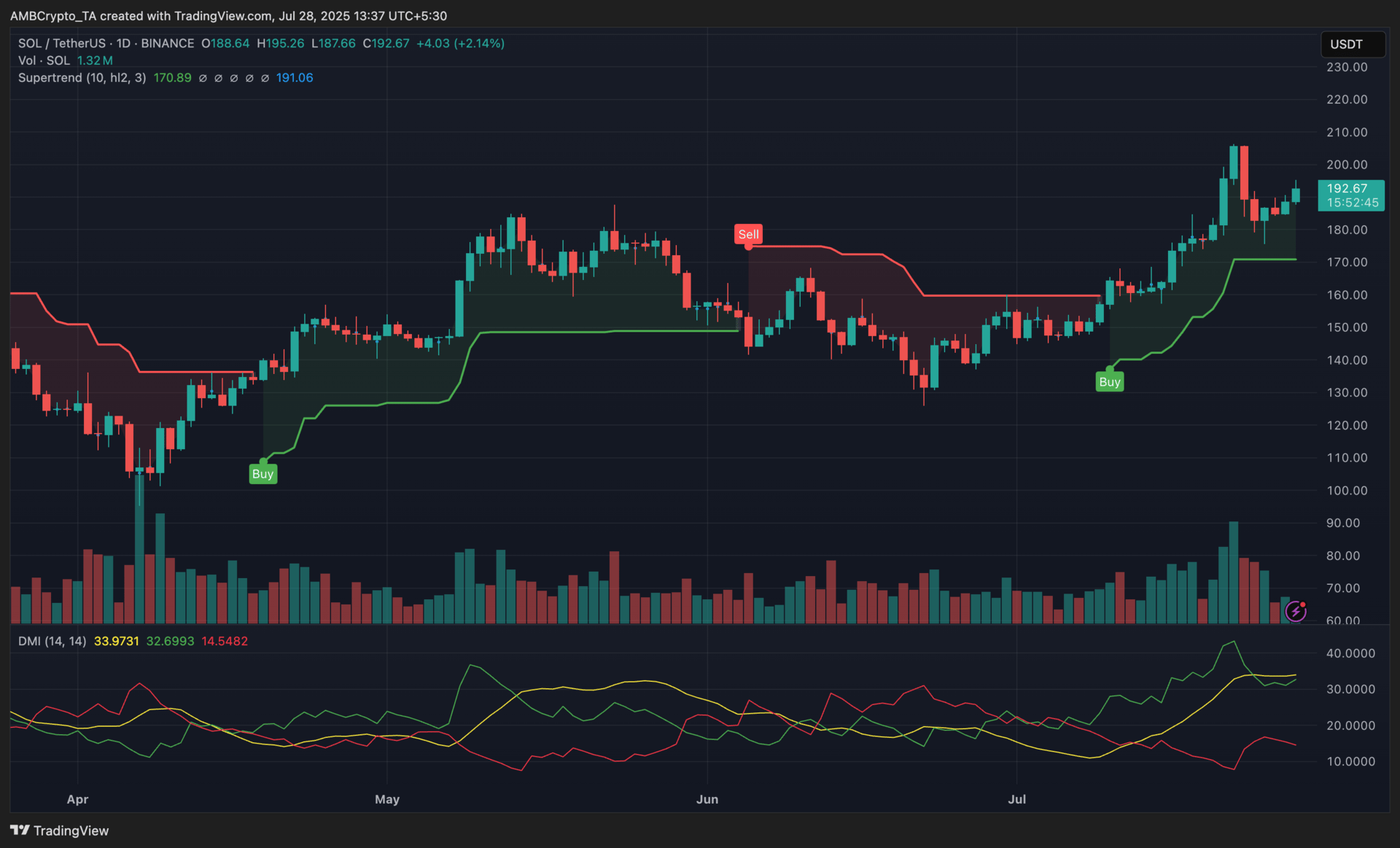

Solana (SOL)

Key points:

At press time, SOL was trading at $192, reflecting a 2.14% rise from yesterday’s close.

The Supertrend continued to flash a 'Buy' signal, while the DMI showed strong directional strength favoring bulls.

What you should know:

SOL extended its upward move with a modest gain above $190, supported by strong macro sentiment and ETF-related buzz. The Supertrend indicator maintained its bullish stance, signaling ongoing upward pressure since early July. Meanwhile, the Directional Movement Index (DMI) displayed a solid spread between the +DI and -DI lines, confirming buyer dominance. Volume held steady after a prior spike, indicating sustained interest. This climb also mirrored broader crypto optimism following reports of a U.S.–EU tariff de-escalation and continued ETF speculation around Solana. Notably, institutional SOL holdings rose, with firms like DeFi Development Corp increasing exposure. SOL now tests the upper band of its recent range, with $200 acting as near-term resistance and $170 as immediate support.

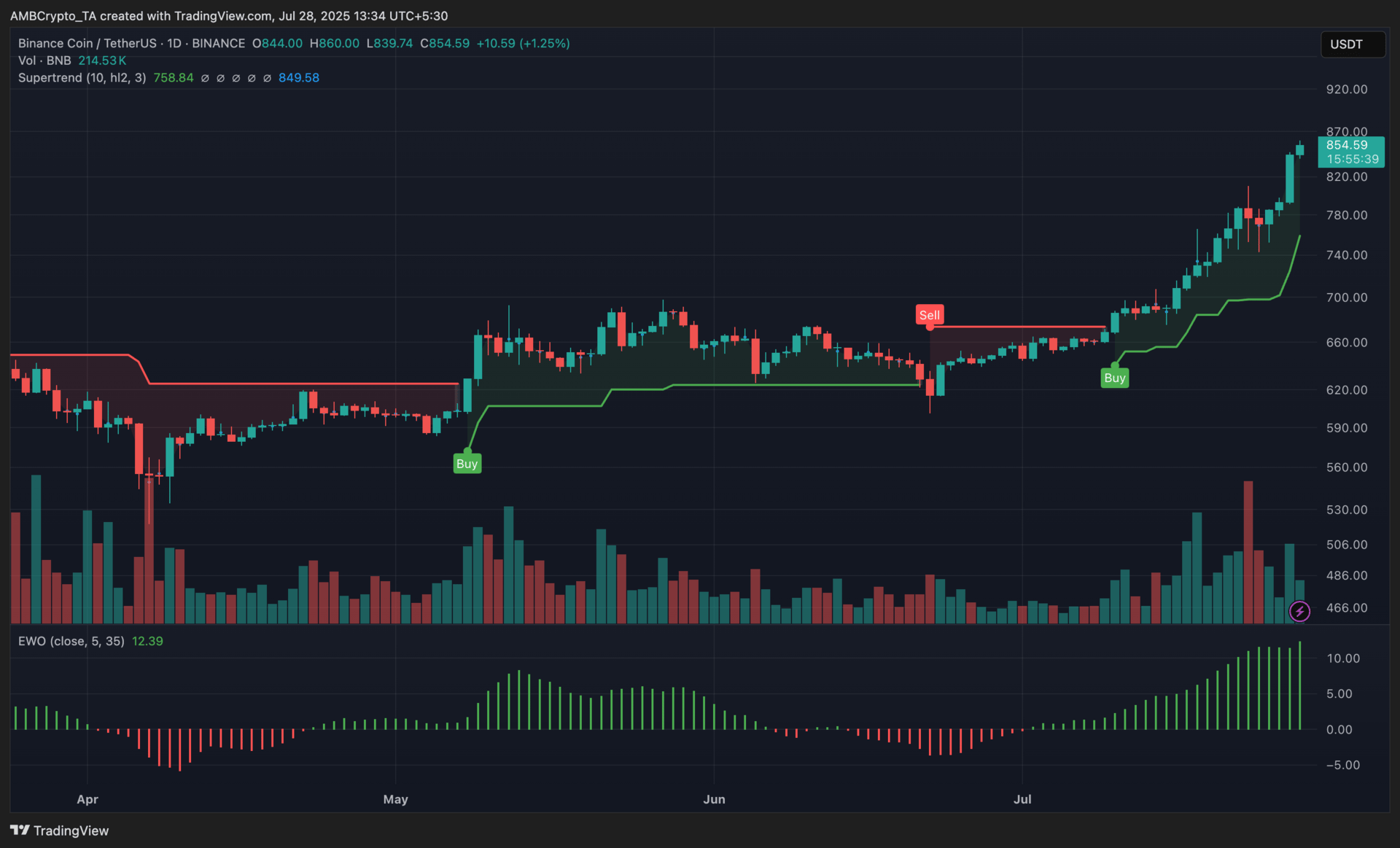

BNB (BNB)

Key points:

BNB hovered around $854 at the time of analysis, marking a 1.25% climb over the past 24 hours.

The EWO continued its strong bullish expansion, while the Supertrend maintained its Buy signal, supporting sustained upward momentum.

What you should know:

BNB carried on its winning streak with steady upward momentum, closing in on its recent highs. The Supertrend maintained a bullish signal after flipping green near $660, while the Elliott Wave Oscillator (EWO) surged to 12.39, its highest level since April, indicating strong bullish conviction. Trading volume remained elevated, supporting the price rally as BNB cleared the $850 level. Adding to the price action, Binance Wallet’s Delabs Games Token Generation Event (TGE) required BNB staking for participation, locking up supply and contributing to demand. This ecosystem activity likely enhanced market sentiment around the token. Traders should now watch for potential resistance near $878, while bullish momentum may persist as long as the EWO remains firmly in positive territory.

How was today's newsletter? |