- Unhashed Newsletter

- Posts

- Buffett hoards cash, crypto eyes gold clash

Buffett hoards cash, crypto eyes gold clash

Reading time: 5 minutes

Warren Buffett’s $350B cash hoard puts spotlight on Gold vs. Bitcoin

Key points:

Gold has surged near record highs amid U.S. yield curve steepening, while Bitcoin lingers around $107K despite a resilient realized cap.

Buffett’s record $350B cash pile adds caution to risk assets, highlighting Bitcoin’s “split personality” between safe-haven appeal and risk-asset behavior.

News - Gold prices have climbed above $3,480, close to April’s $3,499 record, as the U.S. yield curve undergoes a “bull steepening.” Lower short-term yields are boosting non-yielding assets like gold, while Bitcoin has stumbled to two-month lows near $107,000 despite its realized capitalization reaching a record $1.05 trillion. The divergence underscores Bitcoin’s shifting identity: at times mirroring gold as a hedge, at others moving with equities.

Buffett’s cautionary cash signal - Warren Buffett’s Berkshire Hathaway has raised its cash holdings to an unprecedented $350 billion, echoing past build-ups that preceded major market crashes. With the Nasdaq at stretched valuations, analysts warn that a downturn could spill into Bitcoin, given its 0.73 correlation with tech stocks over the past year.

Realized cap resilience - Despite short-term weakness, Bitcoin’s realized cap shows long-term holders are holding firm. Unlike market capitalization, realized cap only adjusts when coins move, and it has climbed even during this correction. That resilience stands in contrast to earlier cycles, when realized cap fell by nearly 20% during deep bear markets.

Hedging roles in focus - Analysts suggest gold still performs best when equities sell off, while Bitcoin may provide shelter when bond markets come under stress. This split role has defined 2025 so far: gold is up more than 30% year-to-date, compared to Bitcoin’s 15%. For investors, the message is not to pit them against each other, but to recognize their different hedging strengths.

Metaplanet crosses 20,000 BTC but stock slide tests its strategy

Key points:

Japan’s Metaplanet acquired 1,009 BTC, lifting its treasury to 20,000 BTC, overtaking Riot Platforms to become the sixth-largest corporate holder.

Despite record holdings, the firm’s stock has plunged 54% since mid-June, squeezing its equity-linked “flywheel” strategy for financing new Bitcoin buys.

News - Metaplanet, Japan’s largest corporate Bitcoin holder, announced it has purchased an additional 1,009 BTC for roughly $112 million, bringing its total to 20,000 BTC. The move elevates the firm into the global top six treasuries, surpassing U.S. miner Riot Platforms. According to filings, Metaplanet’s average purchase price sits near $102,607 per BTC, giving the company modest gains relative to current spot prices around $109,000.

Yet, market reaction has been muted. Shares closed at ¥831 (down about 5.5%), continuing a slide of more than 50% since June, even as Bitcoin itself gained around 2% in that time. Analysts note that falling stock prices weaken the firm’s ability to rely on warrant exercises from investors such as Evo Fund, undermining the liquidity needed to fund further purchases.

Shareholder bets - At an extraordinary meeting this week, shareholders approved an overseas share sale worth up to $884 million, alongside potential preferred stock issuance that could raise as much as $3.8 billion. Strategic adviser Eric Trump attended the meeting, underscoring the international spotlight on the Tokyo-based company.

Bigger ambitions, higher risks - Metaplanet has outlined a goal to accumulate 210,000 BTC by 2027, but critics warn that without sustained capital inflows, the firm risks becoming over-leveraged. The firm’s financing model has already slowed, exposing fragility compared with Bitcoin’s base asset, which does not rely on equity dynamics.

Ethereum momentum builds as whales rotate from Bitcoin

Key points:

Ethereum exchange balances have dropped to 2018 lows, signaling reduced sell pressure and stronger holder conviction.

A mega-whale has shifted over $4B into Ether, holding just slightly more ETH than corporate giant SharpLink Gaming and about half of Bitmine Immersion’s stash.

News - Ethereum closed August with a 23% monthly gain, and September has opened with stronger signs of momentum. Glassnode data shows ETH exchange balances have fallen to their lowest level since 2018, a decline that reflects investors moving coins off exchanges and reducing immediate sell pressure. The supply squeeze has coincided with a long/short ratio above 1.0, showing traders are increasingly positioned for gains. Analysts point to the $4,664 resistance as the next test, with a potential breakout toward $5,000 if buying pressure holds.

Whale rotation reshapes the landscape - One of the largest crypto whales has rotated billions from Bitcoin into Ether. On-chain data shows the whale controls 886,371 ETH worth more than $4 billion, slightly edging SharpLink Gaming’s corporate holdings of about 797,000 ETH, while still only half the size of Bitmine Immersion’s 1.7 million ETH treasury. The whale began reallocating in late August and has since inspired other whales, with nine addresses collectively scooping up $456 million in ETH.

Institutional and Wall Street signals - Joseph Lubin, Ethereum’s co-founder, argues Wall Street adoption of staking and DeFi rails could eventually see ETH “flip” Bitcoin as a monetary base, predicting a 100x potential rise. Spot Ether ETFs have recently attracted over $1 billion in inflows, with some reports noting as much as $1.4 billion in a week, underscoring growing institutional conviction. With stablecoin supply on Ethereum now above $160B, demand for the network’s ecosystem is accelerating alongside whale and fund accumulation.

Trump-backed WLFI debuts on major exchanges amid unlock and scrutiny

Key points:

WLFI and its USD1 stablecoin launched on Binance, Upbit, and other top exchanges, with derivatives open interest peaking near $1B.

Despite the hype, WLFI traded around $0.29–$0.34, showing weakness even as early investors saw gains of over 2,000% from presale prices.

News - World Liberty Financial’s WLFI token, a project tied to Donald Trump’s family, began trading Monday across major exchanges including Binance, Bybit, HTX, OKX, and Upbit. Binance applied its “seed tag” and required risk disclosures, while Upbit also listed USD1, the project’s stablecoin collateralized by U.S. Treasuries and cash. USD1 quickly saw $24.8M in volume within its first hour, highlighting strong demand in South Korea.

WLFI’s debut followed months of token sales, with presale prices as low as $0.015. At current levels near $0.30–$0.34, early backers still sit on profits exceeding 2,000%. Yet market reaction was muted, as most tokens typically rally on listing day.

Supply unlock raises questions - The launch unlocked 24.6B WLFI tokens, with allocations spanning World Liberty Financial Inc. (10B), Alt5 Sigma (7.7B), liquidity and marketing (2.8B), and public sale participants (4B). About 20% of presale allocations were immediately released, while the rest remain subject to governance votes. Open interest in WLFI derivatives surged to $950M before cooling to $887M, with daily volume topping $4.5B.

Political capital meets crypto risk - Trump is listed as “Chief Crypto Advocate,” with Eric, Donald Jr., and Barron Trump named as “Web3 Ambassadors.” Analysts caution that WLFI’s insider-heavy ownership and political ties could magnify risks for retail traders, with Compass Point warning that thin liquidity may “decimate” late entrants. Legal experts add that WLFI’s debut tests the limits of U.S. crypto regulation, as its scale and political backing may secure exceptions others would not.

More stories from the crypto ecosystem

BETH launch sparks debate – Can proof-of-burn redefine Ethereum’s scarcity?

Whales scoop $962M XRP in 2 weeks – Is $4 closer than you think?

Metaplanet’s Bitcoin strategy on the ropes after 54% decline – Details

A legendary Bitcoin whale just made a $3.8B bet on Ethereum – Details

Bitcoin’s $100K battle: Why this support level decides BTC’s bull run fate

Did you know?

The U.S. has formally embraced digital assets at state level: as of August 2025, it holds around 198,000 BTC, making it the largest known governmental holder of Bitcoin, via its newly established Strategic Bitcoin Reserve and Digital Asset Stockpile unveiled in March.

Despite being one of crypto’s dominant asset classes, 59% of people familiar with cryptocurrency say they don’t trust its security, and nearly one in five among owners report having difficulties withdrawing funds from custodial platforms. This reflects widespread concerns over safety and access in the industry.

In 2024, stolen cryptocurrencies surged by about 21% year-on-year, totaling $2.2 billion, with North Korean hackers alone accounting for $1.34 billion (61%) through private key compromises, as cryptocurrencies, especially stablecoins, remain a favored sanction-evading tool.

Top 3 coins of the day

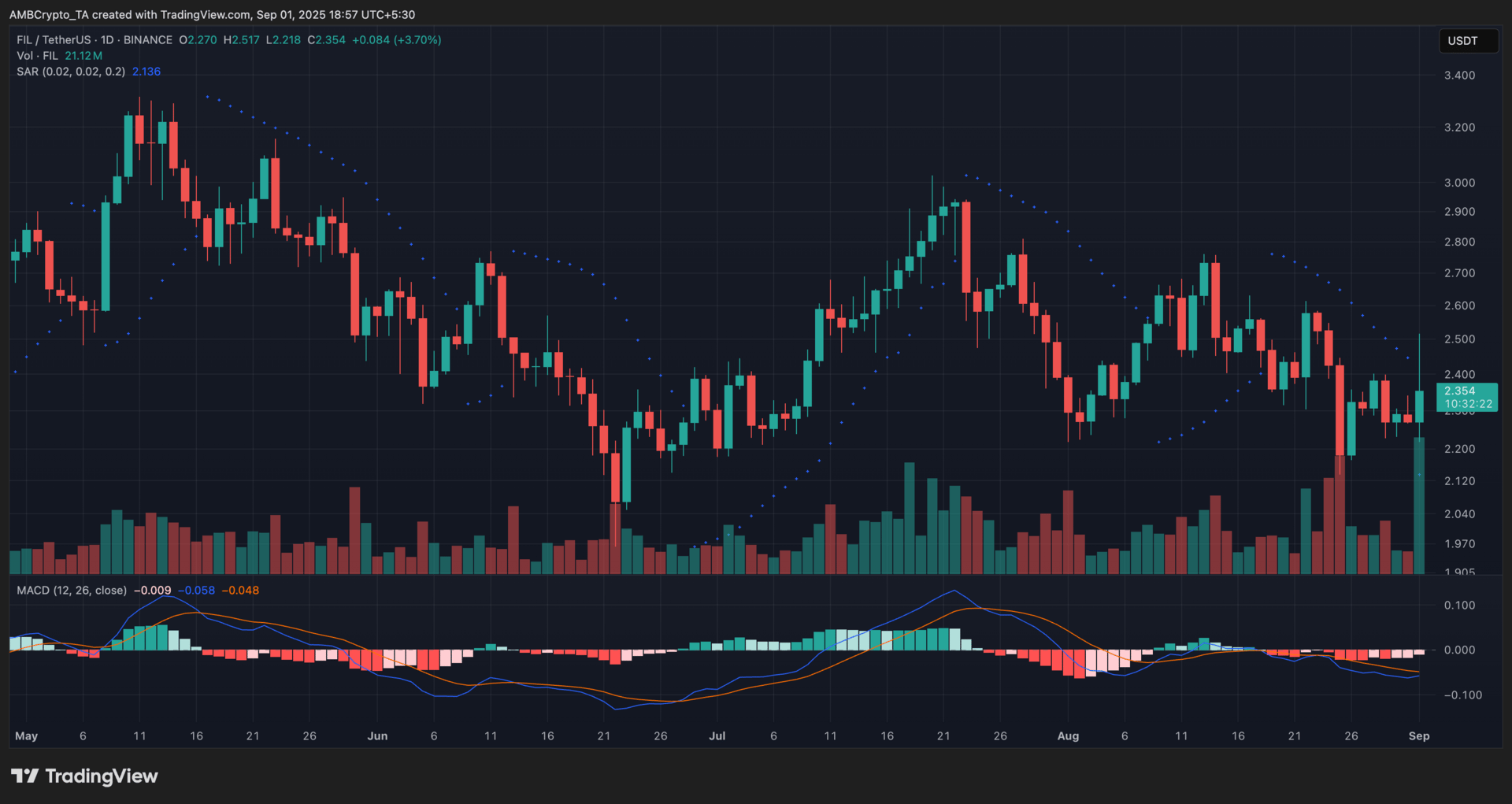

Filecoin (FIL)

Key points:

FIL traded at $2.35, rising 3.70% after ranging between $2.22 and $2.52 in the session.

The Parabolic SAR stayed above price, while the MACD histogram narrowed in the negative zone as volume climbed to 21.12M.

What you should know:

Filecoin rebounded from recent lows to close near $2.35, supported by a session high of $2.52. The Parabolic SAR remained bearish with dots above the candles, but weakening momentum on the MACD suggested selling pressure had slowed. Trading volume rose to 21.12 million, indicating renewed interest after August’s pullback. Beyond chart signals, sentiment was shaped by Filecoin’s partnership with Blockfrost to support Cardano dApp redundancy, reinforcing its role in decentralized storage adoption. At the same time, FIL outperformed a flat broader market as the Fear & Greed Index stayed at 39, reflecting lingering caution among traders. For now, $2.20 acts as a crucial support, while a breakout above $2.50 could strengthen bullish prospects.

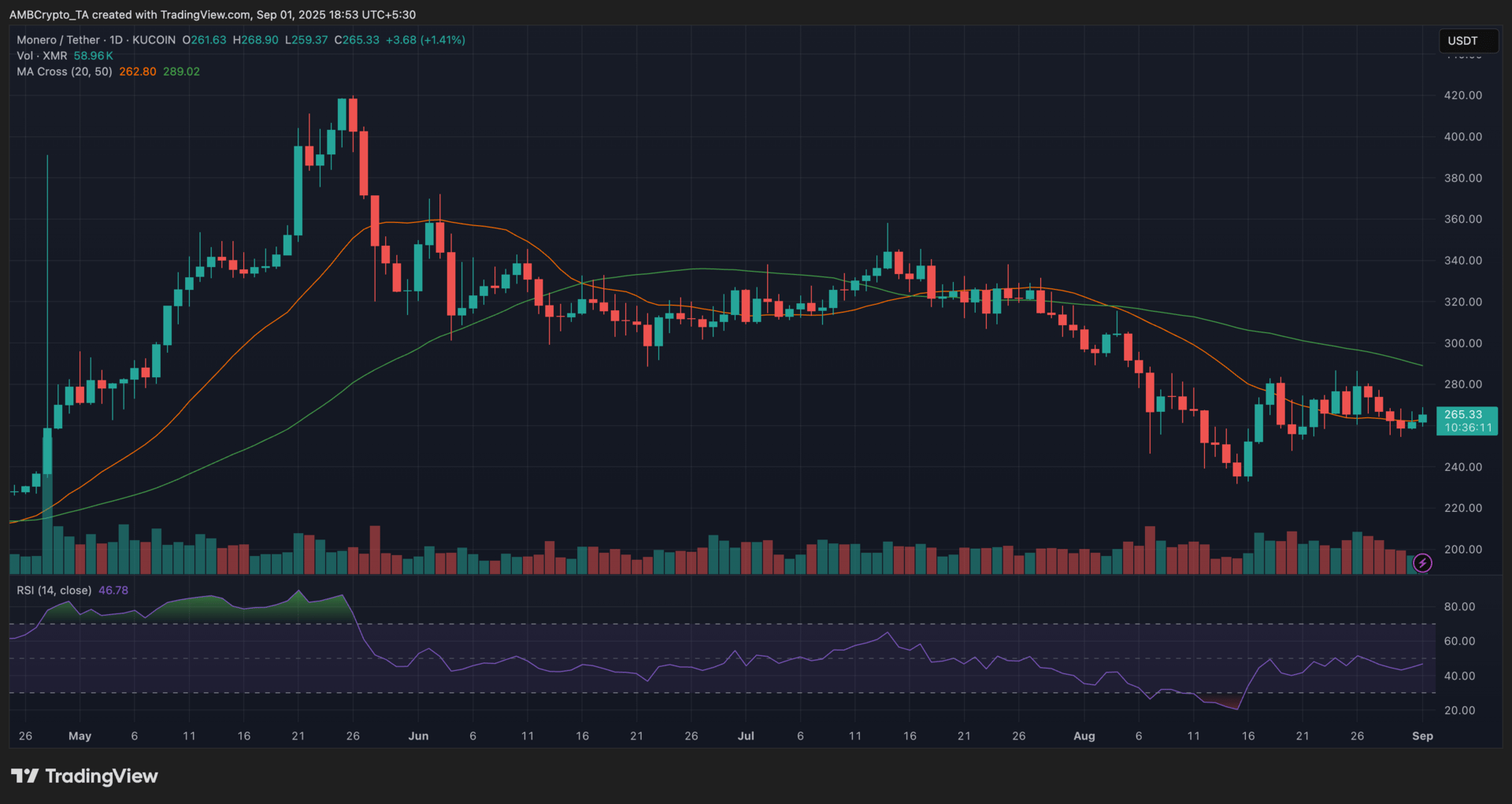

Monero (XMR)

Key points:

XMR traded at $265, climbing 1.41% after swinging between $259 and $268.

The 20-day MA sat just above price at $262, while the 50-day remained higher at $289; RSI held at 46.78 with muted volume.

What you should know:

Monero’s price edged higher to $265 after defending the $260 pivot, though the chart still reflected a bearish crossover with the 20-day MA below the 50-day. RSI at 46.78 pointed to subdued momentum, while daily volume of 58.96K suggested consolidation rather than strong inflows. Beyond technicals, sentiment improved after Monero’s community successfully countered Qubic’s failed 51% attack, restoring confidence in network resilience. Liquidity also got a boost as GMX added XMR/USD perpetuals with up to 100x leverage, drawing new traders and open interest. For now, $260 remains the key support, while a break above $276 could open the path for stronger recovery.

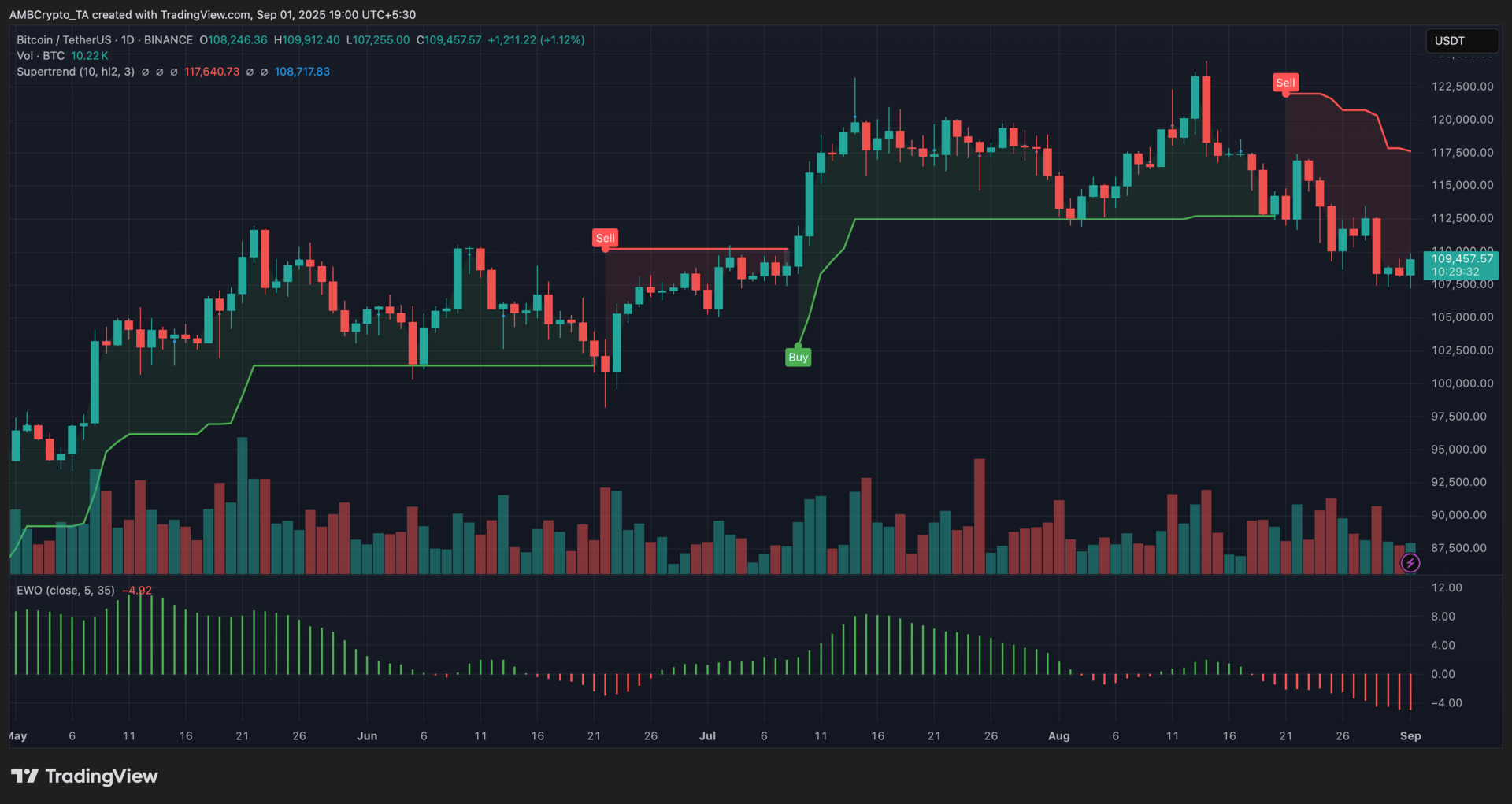

Bitcoin (BTC)

Key points:

BTC traded at $109,457, gaining 1.12% after moving between $107,255 and $109,912 in the session.

The Supertrend flashed resistance near $117,640, while the EWO dipped further into negative territory at -4.92 as volume stayed muted at 10.22K.

What you should know:

Bitcoin ticked higher to $109K after bouncing off $107K support, though the Supertrend remained bearish with resistance overhead at $117,600. The Elliott Wave Oscillator deepened further into negative territory, showing that bearish momentum has been strengthening despite the price rebound. Daily volume was relatively subdued, suggesting the move lacked broad participation. On the fundamentals side, spot Bitcoin ETFs logged fresh inflows, with U.S. funds reversing prior outflows and absorbing supply. Meanwhile, short sellers face growing liquidation risk if BTC clears the $110K mark, setting up the possibility of a squeeze. For now, $108,700 acts as the key support zone, while $117,600 remains the resistance level to break for a clearer bullish shift.

How was today's newsletter? |