- Unhashed Newsletter

- Posts

- Bullish signals flash for Cardano

Bullish signals flash for Cardano

Reading time: 5 minutes

Cardano eyes $3 as bull signals multiply, GENIUS Act fuels rally

Key points:

ADA surged 75% since late June, with triple golden crosses and a bull flag breakout pointing toward a $2.70–$3.00 target.

On-chain metrics show long-term holders aren’t selling, while RSI and MVRV suggest more upside before profit-taking kicks in.

News - Cardano (ADA) has staged a dramatic comeback, climbing over 75% since June 22 and hitting a 20-week high of $0.89. As the GENIUS Act boosts crypto market sentiment and Ethereum leads a broad altcoin rally, ADA is flashing multiple bullish signals that suggest this run may be far from over.

Momentum has been building across both technical and on-chain fronts. ADA recently broke out of a textbook bull flag on the weekly chart, flipping its 50- and 200-day SMAs into support. A rare “triple golden cross” has emerged, with the 20-day EMA cutting above the 50-, 100-, and now 200-day lines. The breakout has positioned ADA for a measured move toward $2.70, which is a 216% jump from current levels.

Adding to the optimism, the Bollinger Bands have begun squeezing while the latest weekly candlestick touched the upper band — a pattern that historically preceded 100%+ rallies for ADA. Analysts like Deezy point to the daily RSI reaching 80 as a potential launchpad, citing past examples where the token rallied another 130% after hitting similar levels.

On-chain metrics show HODLers holding tight - Despite the surge, the Age Consumed metric shows minimal movement from long-term holders. ADA’s MVRV ratio, now around 23%, remains well below the historic “danger zone” of over 100%, suggesting that even recent buyers aren’t under major pressure to take profits.

Macro tailwinds add fuel to fire - The GENIUS Act’s passage has turned market sentiment risk-on, pushing ETH up 21% in a week and dragging ADA, XRP, and DOGE into a parallel surge. With altcoin momentum accelerating and institutional ETH adoption rising, ADA appears well-positioned for a continued run, potentially toward $1.80, $2.70, and beyond.

Crypto blows past $4 trillion, and it’s just the start!

Key points:

The total crypto market cap hit a record $4 trillion, fueled by institutional inflows and bullish U.S. legislation.

Ethereum and XRP outpaced Bitcoin, with analysts eyeing an incoming altcoin season as traders rotate into riskier assets.

News - The crypto market shattered records Friday as the total market capitalization soared past $4 trillion for the first time, before a brief cooldown. Bitcoin and Ethereum drove much of the rally, with BTC’s market cap reaching $2.4 trillion and ETH’s climbing to $440 billion. But this time, altcoins like XRP stole the spotlight, with XRP hitting $3.64, its highest level this year.

The rally follows a one-two punch of bullish catalysts: the U.S. House passed the landmark GENIUS and CLARITY Acts on Thursday, and institutional investors poured over $522.6 million into Bitcoin ETFs in a single day — the second week in a row with inflows above $2 billion. BlackRock’s IBIT captured nearly all of it, hauling in $497.3 million.

Ethereum, XRP steal the spotlight - While Bitcoin topped $120,336, Ethereum surged past $3,600 for the first time since January and is now gaining dominance. ETH's single-day ETF inflows hit $726 million, and its share of the market rose from 9% to 11%, hinting at the beginning of a potential altcoin season.

XRP surged nearly 20% in 24 hours to $3.64, buoyed by House passage of three major crypto bills. According to LVRG Research's Nick Ruck, institutional and regulatory momentum is now the “primary growth driver” for digital assets.

Macro confidence fuels next wave - The total crypto market cap now rivals Nvidia, the world’s most valuable company at $4.2 trillion. Analysts say this parity signals crypto’s arrival as a mainstream asset class.

Charmaine Tam of Hex Trust emphasized that the rally isn’t just hype. “There was no ‘buy the rumor, sell the news’ pullback after the legislation passed,” she noted. With other countries likely to follow the U.S., the wave of institutional capital may just be getting started.

$9.6B Bitcoin whale awakens: Is a sell-off coming?

Key points:

A dormant Satoshi-era whale transferred all 80,000 BTC, worth $9.6 billion, to Galaxy Digital, sparking market speculation.

Blockchain data shows some of the BTC was routed to major exchanges, indicating potential offloading amid new regulatory shifts.

News - A legendary Satoshi-era whale has made waves after transferring their full 80,000 BTC, valued at $9.6 billion, to Galaxy Digital in a series of 15 transactions, according to on-chain data. The final 40,191 BTC moved on Friday follows a similar transfer earlier this week, with Galaxy now holding over 40,288 BTC in its labeled wallet. No outbound movement has been recorded from that wallet, yet.

The move ends a 14-year dormancy. The whale first acquired the stash when Bitcoin traded under $30 in 2011, realizing over 2.4 million percent in gains. Some of the BTC has since been routed to exchanges like Coinbase, Bitstamp, and Gemini, triggering speculation of an impending sell-off.

While sending funds to trading desks doesn’t confirm a sale, it often signals profit-taking or a repositioning strategy, especially amid high prices and evolving regulations. The backdrop: Bitcoin recently touched a new all-time high of $122K before correcting slightly, and the U.S. just passed the GENIUS Act, bringing federal-level oversight to stablecoins.

Profit-taking or strategic play? - Opinions are split on the whale’s motive. Komodo CTO Kadan Stadelmann speculated the move may be about securing life-changing profits or reallocating funds for new ventures. Others suggest it could reflect philosophical discomfort with Bitcoin’s growing institutionalization.

Still, Nansen analysts believe longtime holders likely aren't reacting to short-term regulations. Instead, they may be rebalancing or preparing to leverage their holdings for future projects. Meanwhile, Galaxy’s role, whether intermediary or buyer, remains uncertain.

Market eyes BTC’s next move - As traders assess whether a major sell-off is imminent, market sentiment remains cautious. Option flows suggest a mildly bullish outlook, but fear-greed indicators near 73 hint at potential volatility ahead. All eyes now turn to whether the whale’s next move will shake the market, or quietly fade into history.

XRP’s record rally fuels $100M deepfake scam warning

Key points:

XRP surged to $3.64 before pulling back, fueled by whale accumulation, ETF optimism, and record-breaking volume and open interest.

Amid price highs, deepfake scams and large transfers by Ripple co-founder Chris Larsen are sparking caution among investors.

News - XRP’s dramatic rally to $3.64 has pushed the token back into the spotlight, reigniting hopes of a $4 breakout for the first time since its 2018 peak. Whale accumulation of over 2.2 billion XRP and institutional interest, including Grayscale’s recent fund rebalancing, have added serious momentum. XRP trading volume more than doubled its daily average during the surge, peaking at 490 million units, while perpetual futures open interest shot past $10 billion for the first time ever.

But the hype isn’t without friction. Ripple co-founder Chris Larsen moved over $66 million in XRP to Coinbase and unknown wallets just as the price peaked, stirring speculation about insider selling. Meanwhile, Barstool Sports founder Dave Portnoy went viral after lamenting his mistimed exit at $2.40, saying he “would’ve made millions” had he held on.

Whales in, founders out? - While whales and traders appear bullish, the contrast with Larsen’s transfer raises concerns. Analysts say XRP’s support at $3.42–$3.43 is now critical to maintain bullish structure. Breakouts above $3.53 could pave the way toward $3.84 and possibly $4, but any sell pressure from insiders or ETFs stalling could curb that momentum.

Scammers smell blood - Riding the wave of excitement, bad actors have launched a new deepfake scam featuring a manipulated video of Ripple CEO Brad Garlinghouse promoting a fake 100M XRP airdrop. Ripple CTO David Schwartz has warned users: “There are no airdrops, giveaways, or special offers.” Past XRP legal wins have similarly triggered waves of scam activity, and this time is no different.

More stories from the crypto ecosystem

BlackRock files with SEC to add staking in Ethereum ETF – Details here!

Ethereum’s countdown: 28-day fractal could unlock ETH rally IF…

Bitcoin’s price clears KEY levels, but THESE warning signs suggest…

‘Historic win’ for crypto! – GENIUS Act heads to Trump for final approval

Canary Capital files for staked Injective ETF – Can INJ target $16 next?

Crypto scams uncovered

Africrypt: Brothers vanished with $3.6B in BTC - In 2021, South African crypto platform Africrypt claimed it was hacked, shortly before both founders disappeared. Investigators later found the wallet holding over 69,000 BTC had been drained, making it one of the biggest alleged crypto thefts ever.

Ledger leak fueled long-term phishing nightmare - After a 2020 data breach exposed 1M+ customer emails, scammers sent fake hardware wallet alerts that drained funds. The incident showed how a simple leak could trigger years of targeted crypto theft.

Squid Game token rug: $3.3M vanished overnight - In 2021, a fake token piggybacking on the Netflix show pumped 75,000% before crashing to zero. Investors couldn't sell, and the devs disappeared with millions — a perfect storm of hype and greed.

Top 3 coins of the day

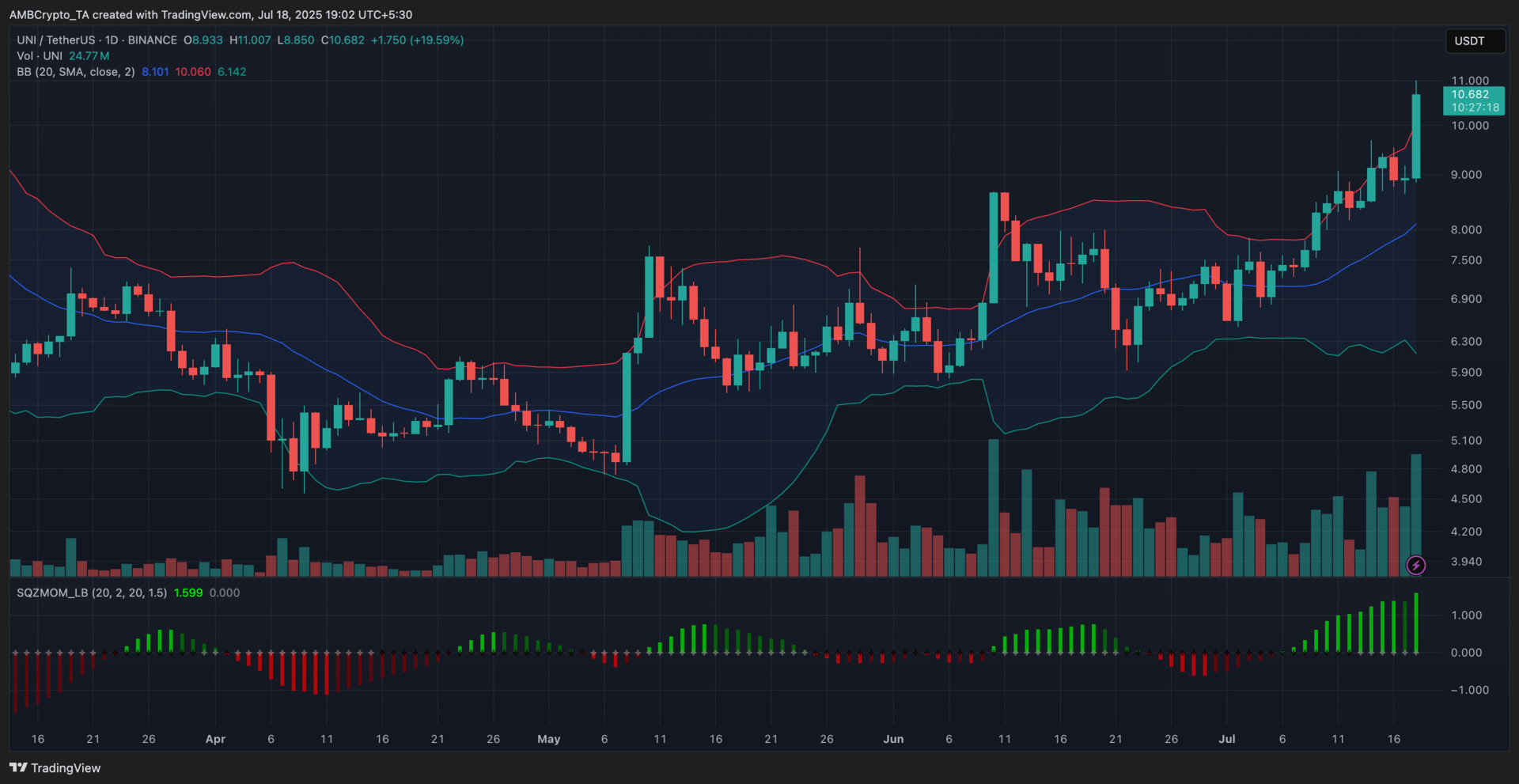

Uniswap (UNI)

Key points:

At press time, UNI was trading at $10.68, marking a 19.59% jump from the prior day’s close.

The price broke above the upper Bollinger Band as bullish momentum intensified on the Squeeze Momentum Indicator.

What you should know:

Uniswap (UNI) extended its uptrend with a sharp 19% single-day rally, pushing the token past the $10 mark for the first time in months. The surge was accompanied by a notable increase in trading volume, which climbed to 24.77 million, supporting the breakout above the upper Bollinger Band. This breakout often signals strong market conviction, particularly when paired with expanding bands as seen here. Recent whale accumulation also played a role, with large holders adding over $26.8 million in UNI over the past 30 days, fueling bullish sentiment among retail traders. The midline of the Bollinger Band at $8.10 acted as a key support during the build-up, while the Squeeze Momentum Indicator flipped deep green, indicating sustained buyer dominance. With Ethereum’s rally and DeFi tailwinds adding momentum, traders should watch resistance near the $11 psychological zone. A continued rise in volume and ecosystem activity could keep UNI’s bullish trajectory intact, though profit-taking may kick in near-term.

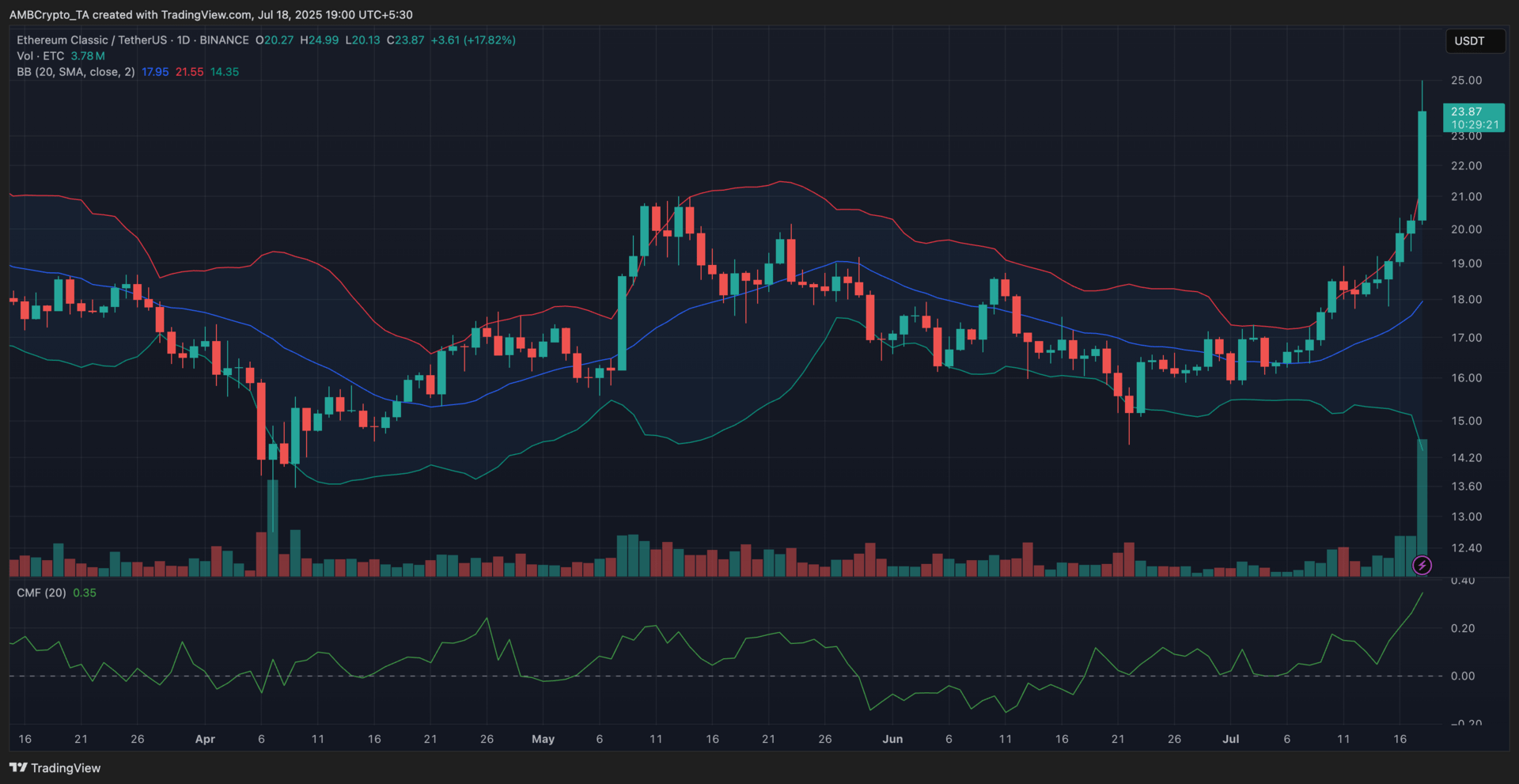

Ethereum Classic (ETC)

Key points:

At press time, ETC was trading at $23.87, marking a 17.82% jump since yesterday’s close.

The price touched the upper Bollinger Band, while the CMF spiked to 0.35, indicating strong capital inflows.

What you should know:

Ethereum Classic [ETC] rallied nearly 18%, driven by bullish altcoin sentiment and a boost in liquidity following its recent listing on Bitstamp by Robinhood. This expanded accessibility, particularly across Europe, and coincided with a notable spike in 24-hour volume. Technically, the breakout above the $21.5 resistance was supported by widening Bollinger Bands and a strong candle close near the upper band. The CMF surged to 0.35, reinforcing sustained accumulation and bullish conviction. ETC also cleared the Bollinger midline at $17.95, flipping it into a support level to watch. With this move extending a six-day green streak, the $25–$26 range could serve as a short-term resistance zone. Any consolidation above $21.5 may pave the way for further upside.

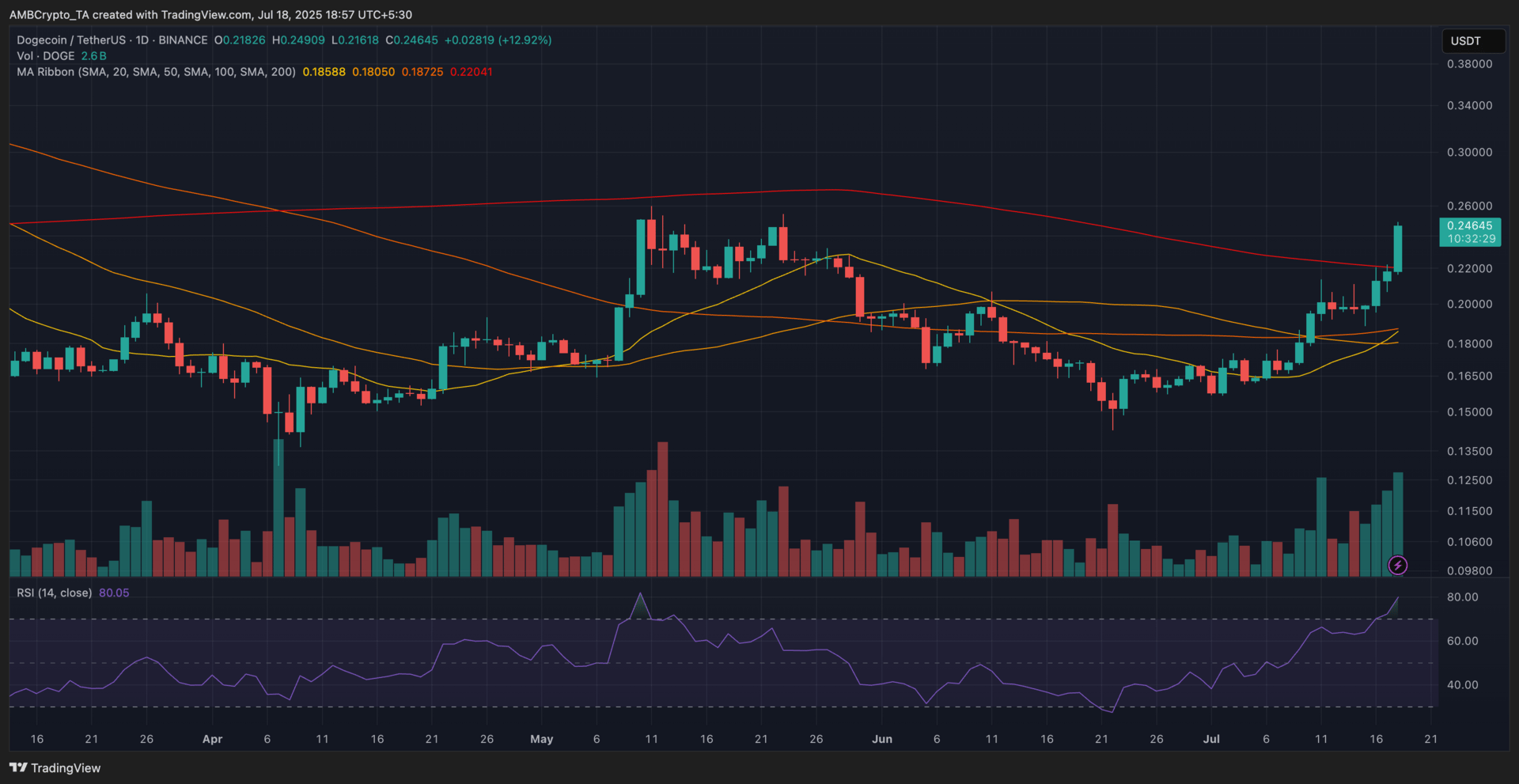

Dogecoin (DOGE)

Key points:

DOGE was priced at $0.24 at the time of writing, up 12.92% from its previous daily close.

It broke above the 200-day SMA, with the RSI jumping to 80.05—well into overbought territory.

What you should know:

Dogecoin surged nearly 13% after Nasdaq-listed Bit Origin revealed a $500M DOGE treasury plan, marking the first institutional move of its kind. The company allocated $15M for initial purchases, triggering optimism across the memecoin sector. Technically, DOGE rallied past its 200-day SMA near $0.22 on strong volume, suggesting heightened retail and whale interest. The RSI spiked to 80.05, its highest since May, signaling strong momentum, but also potential overextension. Price action also sliced through all key short-term SMAs in the MA Ribbon, turning the structure bullish. The 20-day SMA now acts as dynamic support around $0.18. With growing institutional attention, DOGE could test resistance near $0.26–$0.28, though consolidation around $0.22–$0.23 remains possible.

How was today's newsletter? |