- Unhashed Newsletter

- Posts

- Can Bitcoin survive America’s turmoil?

Can Bitcoin survive America’s turmoil?

Reading time: 5 minutes

U.S. crypto rebound faces political turbulence as Bitcoin whipsaws and ETFs bleed

Key points:

U.S. crypto activity surged 50% in six months under Trump’s pro-crypto policies, surpassing $1 trillion in transaction volumes, according to TRM Labs.

Bitcoin’s sharp fall to $104,000 triggered a healthy market reset, while ETF outflows and protests exposed weakening investor confidence.

News - Crypto momentum in the U.S. remains strong despite growing macro and political headwinds. A new TRM Labs report revealed that transaction volumes in the U.S. soared by 50% in the first half of the year, topping $1 trillion as regulatory clarity, ETF launches, and Trump’s push to make America the “crypto capital of the world” drove renewed optimism.

The report also noted a 30% rise in web traffic to crypto service providers post-election, signaling revived investor engagement.

Yet, the market’s stability has been tested. Bitcoin fell from $115,000 to $104,000 last week, marking a four-day correction that Glassnode analysts described as a “flush” rather than a cycle failure.

The pullback purged excess leverage and shifted traders toward defensive positions, though long-term holders continued offloading BTC to institutions.

SpaceX and ETF stress tests - SpaceX’s $257 million Bitcoin transfers reignited speculation about corporate selling, just as U.S. spot crypto ETFs saw four consecutive days of outflows amid a prolonged government shutdown and “No Kings” protests nationwide.

The unrest, analysts warned, has become a stress test for institutional confidence, deepening a de-risking phase across markets.

Outlook: Business cycles and policy uncertainty - White House adviser Kevin Hassett suggested the shutdown could end this week, potentially restoring regulatory progress and ETF approvals for altcoins.

Still, analysts like Willy Woo cautioned that the next bear market might not come from within crypto at all but from a broader business cycle downturn reminiscent of 2008, posing a new kind of test for digital assets.

ETH stalls near $4K as treasuries buy big and governance rift clouds sentiment

Key points:

SharpLink Gaming bought 19,271 ETH for about $75 million, lifting its treasury to 859,853 ETH after a $76.5 million stock raise.

On-chain and price data show heavy resistance between $3,955 and $4,015, with a stronger test near $4,340 before any path toward $4,960.

News - Ethereum’s price recovery keeps running into a ceiling, even as corporate treasuries add to holdings.

SharpLink Gaming, led by Ethereum co-founder Joseph Lubin, executed its first ether purchase since late August, acquiring 19,271 ETH for roughly $75 million after raising $76.5 million via a direct stock offering. The company now holds 859,853 ETH alongside cash reserves, though its stock remains far below prior peaks.

At the same time, spot price action and on-chain signals explain why $4,000 has been a sticking point. Large holders trimmed about 140,000 ETH since October 20, accumulation has stalled, and more than 1 million ETH changed hands between $3,955 and $4,015, forming a dense supply wall.

Analysts flag $4,340 as the level that would confirm a breakout and open room toward $4,960. Until then, repeated shakeouts and weak spot ETF flows have kept traders cautious, with some desks eyeing downside scenarios if $4,000 fails.

Supply walls to watch:

$3,955 to $4,015: about 1.06 million ETH last transacted, creating near-term sell pressure.

$4,270 to $4,314: another large cluster that aligns with the $4,340 confirmation zone.

Flows and sentiment:

BitMine said it bought another $250 million in ETH and now holds over 3.3 million ETH, about 2.74% of supply, while its chair Tom Lee reiterated a supercycle view.

Separate coverage highlighted persistent outflows from spot Ether ETFs, a bear-flag risk toward $3,100 on some charts, and rising trader frustration with shakeouts.

Ecosystem debate spills into markets - A resurfaced 2024 letter from former Geth lead Péter Szilágyi reignited criticism of the Ethereum Foundation over pay and decision-making.

Polygon’s Sandeep Nailwal publicly questioned his loyalty to Ethereum, prompting Vitalik Buterin to praise Polygon’s contributions while noting proof system requirements for full L2 security. The governance noise adds to a cautious backdrop as price battles the $4,000 to $4,340 band.

Crypto and fintech groups push back as U.S. banks target open banking rules

Key points:

A coalition of crypto, fintech, and retail groups urged the CFPB to preserve strong open banking protections, warning that bank-imposed data fees could block crypto wallets and stablecoins.

The CFPB’s Rule 1033 gives Americans ownership of their financial data, but major banks have sued to delay it, citing privacy and compliance costs.

News - A united front of U.S. crypto and fintech advocacy groups is urging regulators to defend open banking from big banks’ attempts to roll it back.

In a joint letter to the Consumer Financial Protection Bureau (CFPB), organizations such as the Blockchain Association, Crypto Council for Innovation, and Financial Technology Association called for maintaining Rule 1033, which guarantees consumers the right to access and share their financial data with authorized third parties like digital wallets and crypto platforms.

The coalition warned that efforts by large banks to narrow definitions of “consumer representatives” and introduce data-access fees could choke off connections between traditional finance and emerging sectors such as stablecoins and decentralized apps. “Financial data belongs to the American people, not the nation’s largest banks,” the groups wrote.

Industry and global context - Open banking, already standard in the U.K., Singapore, and Brazil, was finalized in the U.S. in late 2024 but immediately faced legal pushback from the Bank Policy Institute, representing Wells Fargo, JPMorgan, and others. The CFPB has since reopened consultations amid renewed lobbying pressure.

Crypto voices join in - Gemini’s Tyler Winklevoss warned that Wall Street’s push to “tax and control” consumer data would harm innovation. Meanwhile, the Financial Stability Board noted that excessive data privacy barriers are hindering regulators’ ability to monitor crypto activity globally, leaving systemic blind spots.

Coinbase doubles down on innovation: $375M Echo deal and bold AML reform push

Key points:

Coinbase acquired on-chain fundraising platform Echo for $375 million, integrating its Sonar token-sale product to expand into tokenized assets and community fundraising.

The exchange urged the U.S. Treasury to overhaul outdated AML rules, proposing AI, APIs, and zero-knowledge proofs to modernize crypto compliance.

News - Coinbase is sharpening its innovation strategy on two fronts: fundraising and regulation. The exchange announced a $375 million acquisition of Echo, a crowdfunding startup founded by crypto influencer Cobie.

Echo, which raised over $200 million across nearly 300 deals, enables startups to raise directly from their communities through private or public token sales. The deal follows Coinbase’s $25 million purchase of an NFT to revive Cobie’s UpOnly podcast, highlighting a renewed focus on community-driven engagement.

Under the agreement, Echo will remain a standalone brand for now, while its Sonar software will be integrated into Coinbase’s ecosystem. The company said the acquisition will pave the way for support of tokenized securities and real-world assets, mirroring the resurgence of public token sales reminiscent of the 2017 ICO boom.

A revival of public sales - According to Tiger Research, public fundraising is making a comeback through launchpads like Sonar, Buidlpad, and Kaito, which provide structured on-chain access to early-stage projects. Coinbase’s move positions it at the heart of this shift, bridging institutional trust with retail access.

Reforming crypto compliance - Beyond fundraising, Coinbase urged the U.S. Treasury to replace decades old anti-money-laundering rules with AI and blockchain-driven frameworks.

In a letter by Chief Legal Officer Paul Grewal, the company called for regulatory safe harbors for AI tools and recognition of decentralized IDs and zero-knowledge proofs, arguing the current “check-the-box” system is broken and stifles innovation.

Reddit’s Top Stocks Beat the S&P by 40%

Buffett-era investing was all about company performance. The new era is about investor behavior.

Sure, you can still make good returns investing in solid businesses over 10-20 years.

But in the meantime, you might miss out on 224.29% gainers like Robinhood (the #6 most-mentioned stock on Reddit over the past 6 months).

Reddit's top 15 stocks gained 60% in six months. The S&P 500? 18.7%.

AltIndex's AI processes 100,000s of Reddit comments and factors them into its stock ratings.

We've teamed up with AltIndex to get our readers free access to their app for a limited time.

The market constantly signals which stocks might pop off next. Will you look in the right places this time?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

More stories from the crypto ecosystem

Interesting facts

According to 2025 surveys by Gemini Trust Company, crypto ownership in key markets rose year-over-year to nearly 24% of respondents in the U.S., UK, France and Singapore, up from around 21% in the same countries in 2024.

In Q3 2025, all six major crypto market sectors posted positive returns, yet Bitcoin notably underperformed other segments, prompting Grayscale Investments to flag a “distinct altseason” driven by smart contract platforms and stablecoin legislation.

As of September 2025, over 37 million unique cryptocurrencies have been created globally, though only a small fraction remain actively traded or meaningful in market cap.

Swap Without MEV

Protect your swaps from MEV. CoW Swap stops bots from jumping your order, reducing slippage and failed transactions. Keep more of what you trade with execution you can trust. Trade smarter.

Top 3 coins of the day

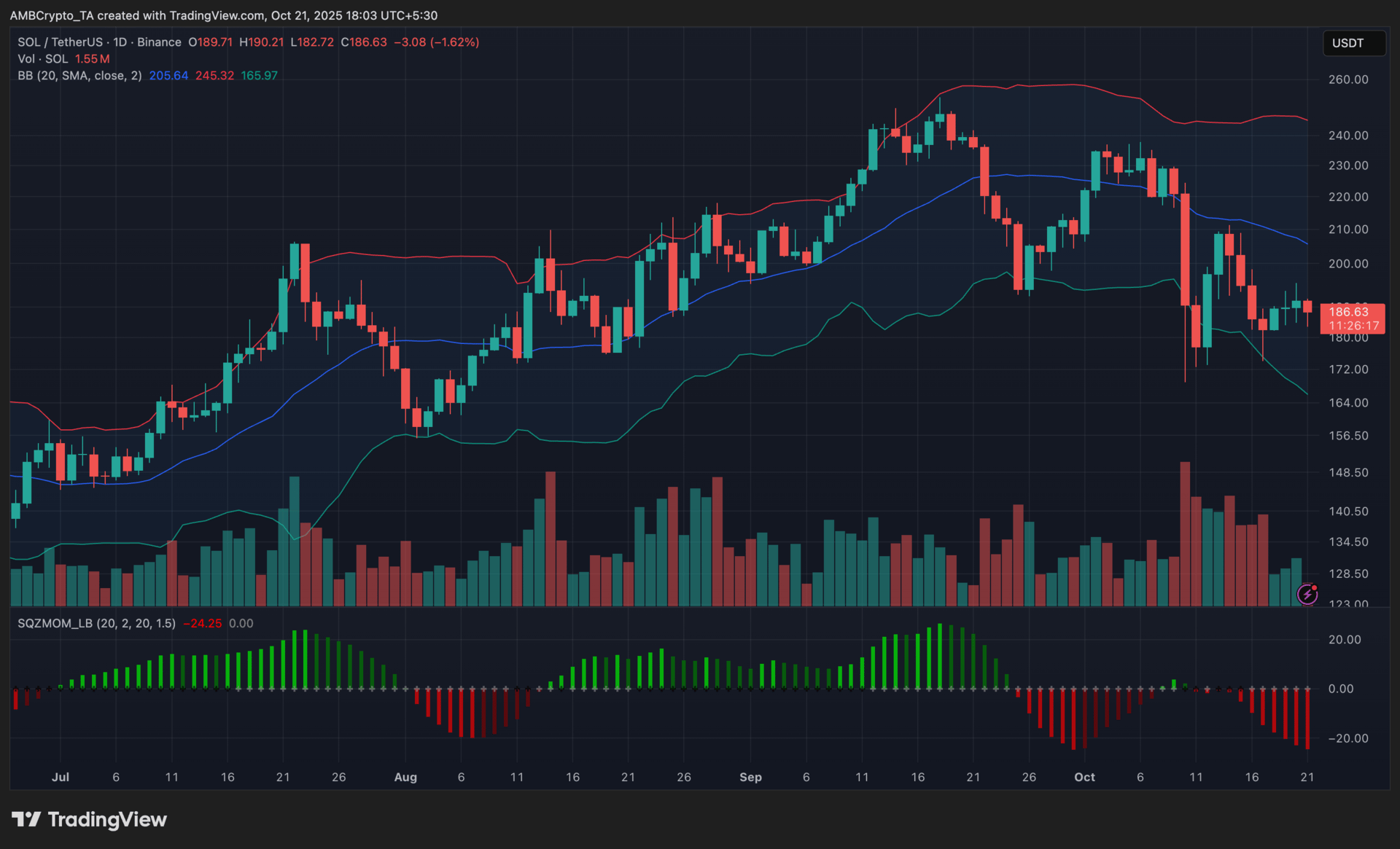

Solana (SOL)

Key points:

SOL was last seen trading at $186, recording a 1.6% daily loss as bearish pressure persisted following Bitcoin’s market-wide pullback.

The Squeeze Momentum Indicator stayed negative, while candles moved near the lower Bollinger Band, signaling weak momentum and a cautious sentiment shift.

What you should know:

Solana’s price slipped further after Bitcoin’s 3% drop sparked $320 million in market-wide liquidations. The token traded below the midline of its Bollinger Bands at $205, reinforcing short-term bearishness, with the $165–$170 range acting as the next key support. The Squeeze Momentum Indicator continued to flash red, showing sellers retained control even as volatility cooled. Volume eased to 1.55 million, reflecting a slowdown in participation. On the fundamentals side, Solana’s SIMD-0266 DeFi upgrade, which promises major efficiency gains, may support sentiment once broader market risk stabilizes. For now, traders watch whether SOL can reclaim the $205–$210 resistance zone to confirm a trend reversal.

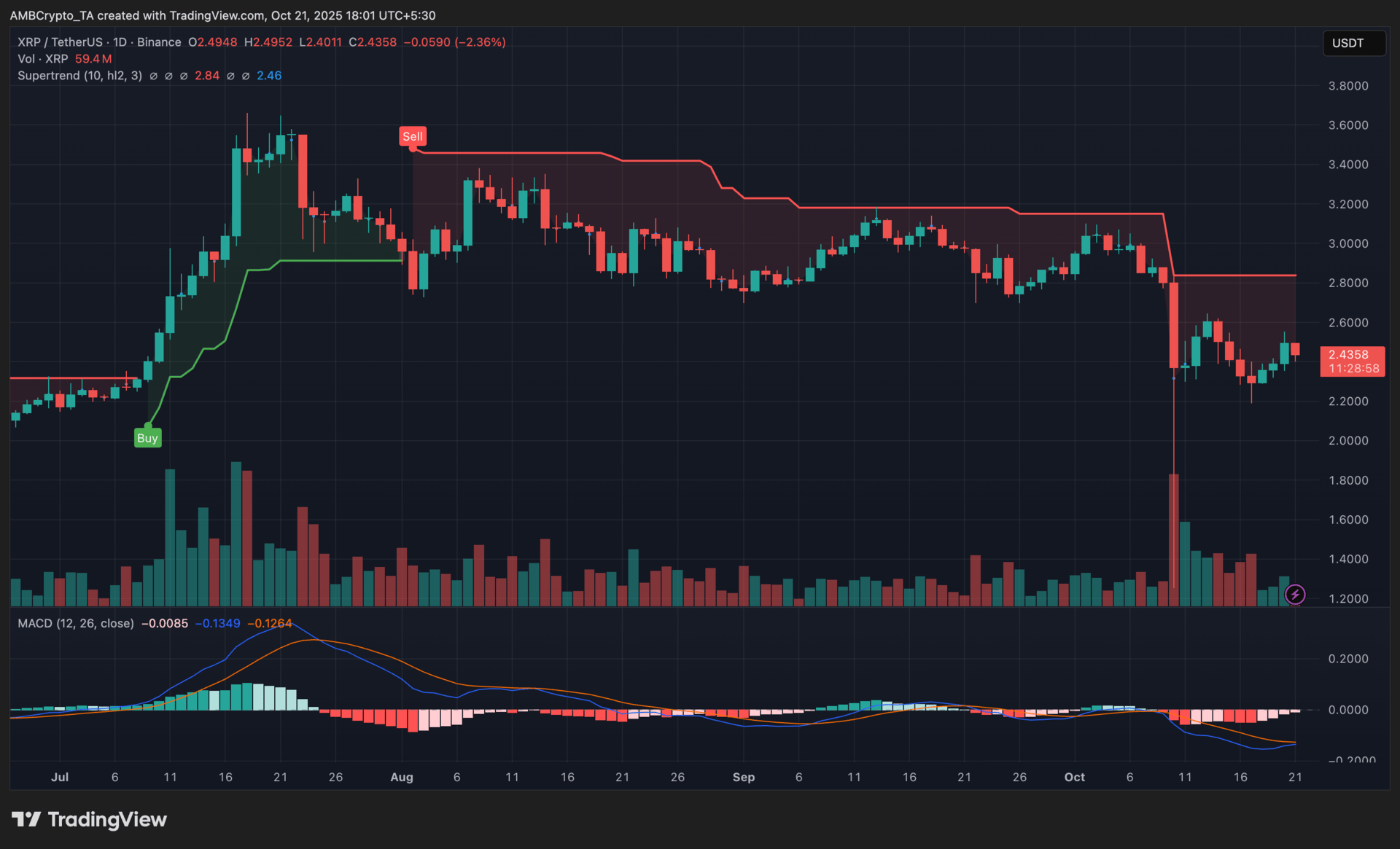

XRP (XRP)

Key points:

XRP was trading at $2.43, marking a 2.4% intraday decline as the token extended its recent losing streak alongside broader market weakness.

The Supertrend remained in a Sell phase since late July, while the MACD histogram stayed slightly negative, hinting at persistent bearish pressure despite narrowing momentum.

What you should know:

XRP continued to face downside pressure after Ripple co-founder Chris Larsen’s 50M XRP transfer to Evernorth stirred renewed selling sentiment. The token’s price hovered below the Supertrend resistance near $2.84, confirming bears still held control. The MACD line remained below the signal line, though the decreasing red bars hinted that momentum loss may be slowing. Volume rose to 59.4 million, suggesting short-term traders were still active even as price drifted lower. Broader market weakness, driven by Bitcoin dominance nearing 59%, also weighed on sentiment. If XRP manages to hold above the $2.30–$2.35 support area, it could stabilize before attempting another test toward the $2.84 resistance zone.

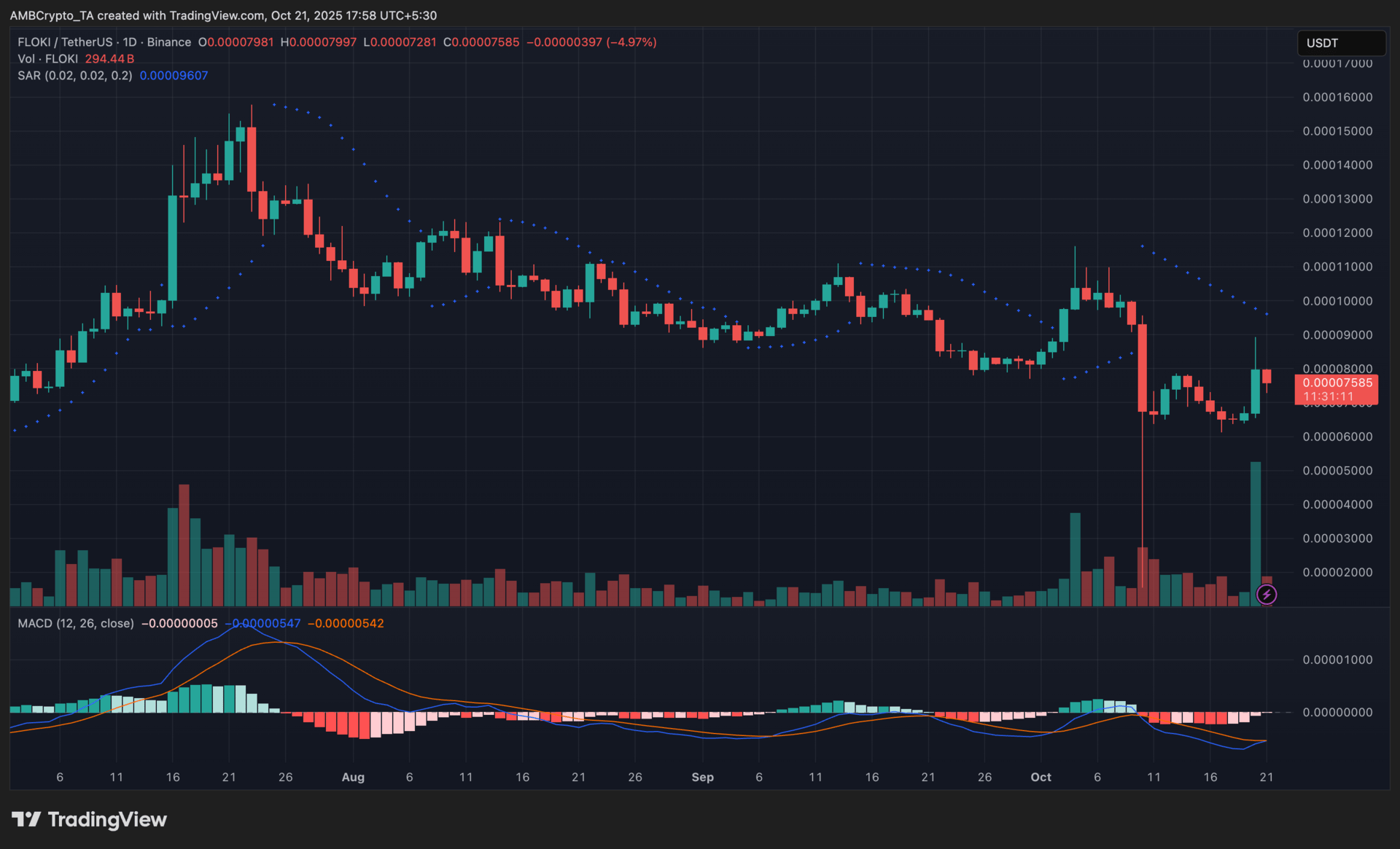

FLOKI (FLOKI)

Key points:

FLOKI was last priced at $0.000075, marking a 4.9% daily decline as traders took profits following a brief Musk-driven rally earlier this week.

The Parabolic SAR remained above the candles, confirming a bearish setup, while the MACD histogram hovered near neutral, showing fading momentum after heightened volatility.

What you should know:

FLOKI retraced after surging nearly 27% on October 20, when Elon Musk’s tweet featuring his Shiba Inu reignited memecoin enthusiasm. The price slipped back below the $0.000088 resistance, with bears reasserting control as profit-taking kicked in. The Parabolic SAR continued to flash bearish pressure, and the MACD line stayed slightly under the signal line, pointing to ongoing consolidation. Trading volume jumped to 294.4 billion, signaling strong but speculative activity. Broader market caution amplified the pullback, with altcoins underperforming amid risk aversion. If buyers manage to defend the $0.000073–$0.000065 support area, FLOKI could attempt to stabilize before its next directional move.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

How was today's newsletter? |