- Unhashed Newsletter

- Posts

- CPI relief fuels Bitcoin’s big rebound

CPI relief fuels Bitcoin’s big rebound

Reading time: 5 minutes

Bitcoin tops $110K after softer CPI sparks rally

Key points:

Bitcoin climbed back above $110,000 after softer U.S. CPI data eased inflation fears and restored investor risk appetite.

Implied volatility fell from 52% to 45%, while the altcoin season index dropped below 25, showing traders’ renewed preference for BTC.

News - A milder inflation reading reignited optimism across financial markets, pushing Bitcoin above the $110,000 mark while altcoins continued to lag.

BTC’s implied volatility, measured by Volmex’s BVIV, slid to 45% from 52%, marking a sharp pullback from last week’s volatility spike. Options data indicated a calm derivatives environment, with puts still commanding a premium over calls as traders remained slightly cautious.

Dealer gamma positioning between $112K and $120K suggested reduced volatility within this zone, while CoinMarketCap’s index showed a decisive tilt toward “Bitcoin season.” Tokens such as FET, BONK, and WIF have lost over 50% in the last three months, underscoring the broader weakness across altcoins.

Macro view: Gold and Bitcoin hit historic valuation peak - Bitcoin’s rise coincided with gold’s rally, as both assets reached a combined valuation equal to 133% of the U.S. M2 money supply, nearing the inflation-era highs of 1980.

Fidelity’s Jurrien Timmer warned that the “easy returns” from inflation hedging may have peaked, suggesting limited upside near current valuations.

Market signals and whale activity - On-chain data revealed a hidden bullish divergence in Bitcoin’s RSI, the same signal that sparked a 15% rally in September.

Large holders are again accumulating, with the Accumulation Trend Score back at 1. Meanwhile, a 2009 “Satoshi-era” wallet transferred 150 BTC worth over $16 million: the latest sign of old holders resurfacing amid rising prices.

Caution ahead - Despite renewed optimism, analysts like BitMine’s Tom Lee warned that Bitcoin could still face up to 50% drawdowns, citing historic volatility patterns. Key support sits near $110,050, while a break above $116,500 could reignite another leg higher.

Altcoin season fades as $800B flows into Bitcoin treasuries

Key points:

Corporate digital asset treasuries have absorbed roughly $800 billion from retail investors, deepening the liquidity drain from altcoins.

Spot trading on centralized exchanges jumped 31% in Q3, but most activity remains Bitcoin-focused as altcoin volumes stagnate.

News - The long-awaited “altcoin season” appears to be losing credibility. New data from 10x Research shows corporate crypto treasuries (DATs) have pulled around $800 billion in capital away from retail altcoin markets, signaling that liquidity, momentum, and conviction have rotated back to Bitcoin.

Even Korean traders, once key altcoin speculators, are turning to U.S. crypto stocks instead.

Despite renewed chatter about a rebound, CoinMarketCap’s Altcoin Season Index stands at 23, firmly within “Bitcoin season.” Technical indicators cited by 10x Research confirm that the October 11 crash triggered a sharp rotation back to BTC exposure.

Trading floors recover but confidence doesn’t - Spot trading on centralized exchanges surged 30.6% in Q3 2025 to $4.7 trillion, according to TokenInsight, marking a turnaround after two weak quarters.

Binance retained its dominance with 43% market share, while derivatives volumes also climbed to $26 trillion. Yet Bitget CEO Gracy Chen warned that an altcoin comeback may not arrive until 2026, if at all, citing fading venture funding and low retail interest.

Mixed market signals - Analysts remain split. Some, like Ash Crypto, expect liquidity injections and rate cuts to eventually lift risk assets, paving the way for an altcoin rebound.

Still, on-chain data shows that Bitcoin “dolphins” continue to accumulate, while altcoin volume share has only inched up to 46%, hinting that capital rotation toward BTC persists.

For now, institutional treasuries and patient holders appear to be winning the capital tug-of-war against short-term altcoin traders.

Trump’s CZ pardon sparks political storm and BNB rally

Key points:

President Donald Trump’s pardon of Binance founder Changpeng “CZ” Zhao reignited controversy in Washington, drawing sharp rebukes from lawmakers and legal experts.

BNB gained 3.3% to $1,126 with trading volume up 35%, reflecting renewed investor optimism despite warnings that the pardon could deepen Binance’s legal exposure.

News - A presidential pardon meant to close one chapter of Binance’s history has opened several others.

Trump’s decision to clear CZ’s record triggered immediate backlash from Democratic leaders such as Maxine Waters, who called it a “pay-to-play” favor tied to the Trump family’s World Liberty Financial empire. She alleged that Binance had funneled billions into the Trump-linked DeFi company, calling the act “corrupt and unsurprising.”

CZ fired back at critics including Senator Elizabeth Warren, insisting that he never faced “money-laundering” charges and had only pleaded guilty to failing to maintain an effective AML program under the Bank Secrecy Act. He served four months before being released last September.

A pardon that doesn’t erase guilt - Legal analysts stressed that a pardon is not an acquittal.

According to Joshua Chu of the Hong Kong Web3 Association, CZ’s acceptance of clemency cements the conviction and may invite civil lawsuits from victims of prior misconduct. The executive act removes punishment but not liability, and foreign jurisdictions could still pursue action using U.S. findings as evidence.

Market reaction and speculation - BNB’s price spiked in parallel, climbing more than 3% on the day with trading volume surging 35%. On-chain data showed BNB outflows rising 230% from October 20 – 23 as traders pulled tokens off exchanges, signaling accumulation.

The political spectacle also rippled into prediction markets, with Polymarket bettors doubling the odds of a Sam Bankman-Fried pardon to 12%.

Key points:

JPMorgan plans to let institutional clients use Bitcoin and Ether as collateral for loans, with pledged assets held by a third-party custodian.

The move, expected to roll out globally by late 2025, marks a major step in Wall Street’s growing adoption of digital assets.

News - JPMorgan Chase is preparing to introduce crypto-backed lending for institutional clients, according to a Bloomberg report.

The bank’s upcoming program will allow customers to post Bitcoin (BTC) and Ethereum (ETH) as collateral for credit lines, with assets secured by an independent custodian rather than held directly by the bank.

The initiative expands JPMorgan’s crypto exposure beyond ETFs, following its 2024 approval of spot Bitcoin ETF collateralization. Analysts view this as a natural evolution of the bank’s digital asset strategy and a pivotal moment for integrating cryptocurrencies into traditional credit systems.

Wall Street’s strategic pivot - The shift highlights a broader institutional realignment. Firms like Morgan Stanley, State Street, Fidelity, Goldman Sachs, and Deutsche Bank are ramping up blockchain and custody offerings, while HSBC and UBS are testing settlement solutions. Together, these moves signal a coordinated transition from caution to structured crypto adoption across global banking.

Dimon’s pragmatic turn and blockchain expansion - Despite CEO Jamie Dimon’s long history of crypto skepticism, calling Bitcoin a “fraud” as recently as 2023, JPMorgan’s internal actions tell another story.

The bank’s blockchain network Kinexys now processes over $2 billion in daily volume, while its Deposit Token (JPMD) provides a blockchain-based alternative to stablecoins.

The upcoming lending framework could put Bitcoin and Ether alongside Treasuries and equities as accepted collateral classes, transforming them from speculative assets into institutional-grade financial instruments.

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

More stories from the crypto ecosystem

Chainlink’s quiet 5-month accumulation just revealed THIS bullish signal

From Base to Tempo: Why crypto heavyweights are betting big on privacy

Ethereum – High selling pressure, but long-term outlook remains bullish!

Does the 6% fall in gold’s price boost Bitcoin’s ‘digital gold’ narrative?

Bitcoin: Why THIS signal echoes BTC’s pre-rally setup from last year

Crypto scams uncovered

In the U.S., losses related to crypto ATM scams reached nearly $250 million in 2024, more than double the previous year, as fraudsters increasingly force victims to deposit cash into crypto kiosks that convert funds instantly and irrecoverably.

A new U.S. estimate shows Americans lost at least $10 billion in 2024 to Southeast Asia-based crypto investment scam operations, marking a 66% jump from the prior year.

Authorities in Southern Nevada have issued fresh warnings that a surge of scams is targeting residents via local crypto ATMs. Victims are being coerced with fake legal threats to deposit tens of thousands of dollars into a kiosk, after which the funds typically disappear.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Top 3 coins of the day

Virtuals Protocol (VIRTUAL)

Key points:

VIRTUAL was last seen trading at $0.84, reflecting a 7.9% daily rise after several sessions of sideways consolidation.

The AO histogram stayed green, signaling sustained bullish momentum as the price approached the Supertrend resistance near $1.07.

What you should know:

VIRTUAL’s rebound continued as buyers defended the $0.78 zone, helping the token recover from its recent lows. The Supertrend indicator remained in bearish territory, but narrowing gaps suggest a potential shift if price strength holds. The Awesome Oscillator stayed green, showing persistent bullish energy despite still being below the zero line, while daily volume improved moderately to 13.49 million, hinting at growing trader participation. Externally, the token benefited from post-listing stability on Robinhood and renewed interest in its AI agent ecosystem, where the launch of the ‘Unicorn’ AI agent platform and partnerships with Pendle have strengthened its narrative. With support holding near $0.77 and resistance at $1.00–$1.07, traders are now watching whether VIRTUAL can sustain its current momentum and break into a new accumulation phase.

World Liberty Financial (WLFI)

Key points:

WLFI traded at $0.14 after extending its recovery across two consecutive 12-hour sessions.

The Parabolic SAR trailed below the candles, confirming a bullish reversal, while the RSI hovered near 51, reflecting balanced momentum.

What you should know:

WLFI stabilized after a sharp October dip, maintaining a narrow range between $0.13 and $0.16. The Parabolic SAR positioned below the candles signaled an early trend shift, supported by a rise in trading volume to 96.82 million. The RSI at 51 indicated neutral momentum, leaving room for upside continuation if buying pressure builds. Externally, optimism resurfaced after Trump’s pardon of former Binance CEO Changpeng Zhao, which reignited investor confidence in the Trump-backed project. Meanwhile, Abu Dhabi’s MGX sovereign fund’s $2 billion allocation into USD1, WLFI’s stablecoin, added legitimacy to its ecosystem. The token now faces resistance near $0.16, while holding above $0.13 remains key for sustaining its current momentum.

BNB (BNB)

Key points:

BNB was last seen trading at $1,123, easing by 0.26% after facing resistance near the 20-day SMA.

The MA Ribbon continued to offer structural support, while the DMI reflected weakening trend strength amid lighter trading volume.

What you should know:

BNB consolidated after recent gains, with the price holding above its 50-day SMA ($1,052) and 100-day SMA ($933). The MA Ribbon indicated the broader uptrend remained intact, though rejection near the 20-day SMA ($1,168) signaled short-term exhaustion. The DMI showed the +DI slightly below the –DI, and the ADX near 24 suggested reduced momentum. Trading volume of 128.69K was moderate, consistent with this phase of consolidation. Externally, Trump’s pardon of former Binance CEO Changpeng Zhao helped renew optimism around Binance’s regulatory outlook. This, coupled with institutional BNB accumulation by firms such as Nano Labs and BNC, underscored sustained investor confidence. For now, maintaining closes above $1,050 keeps BNB’s bullish structure intact, while a breakout past $1,170 could reopen the path toward $1,270.

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

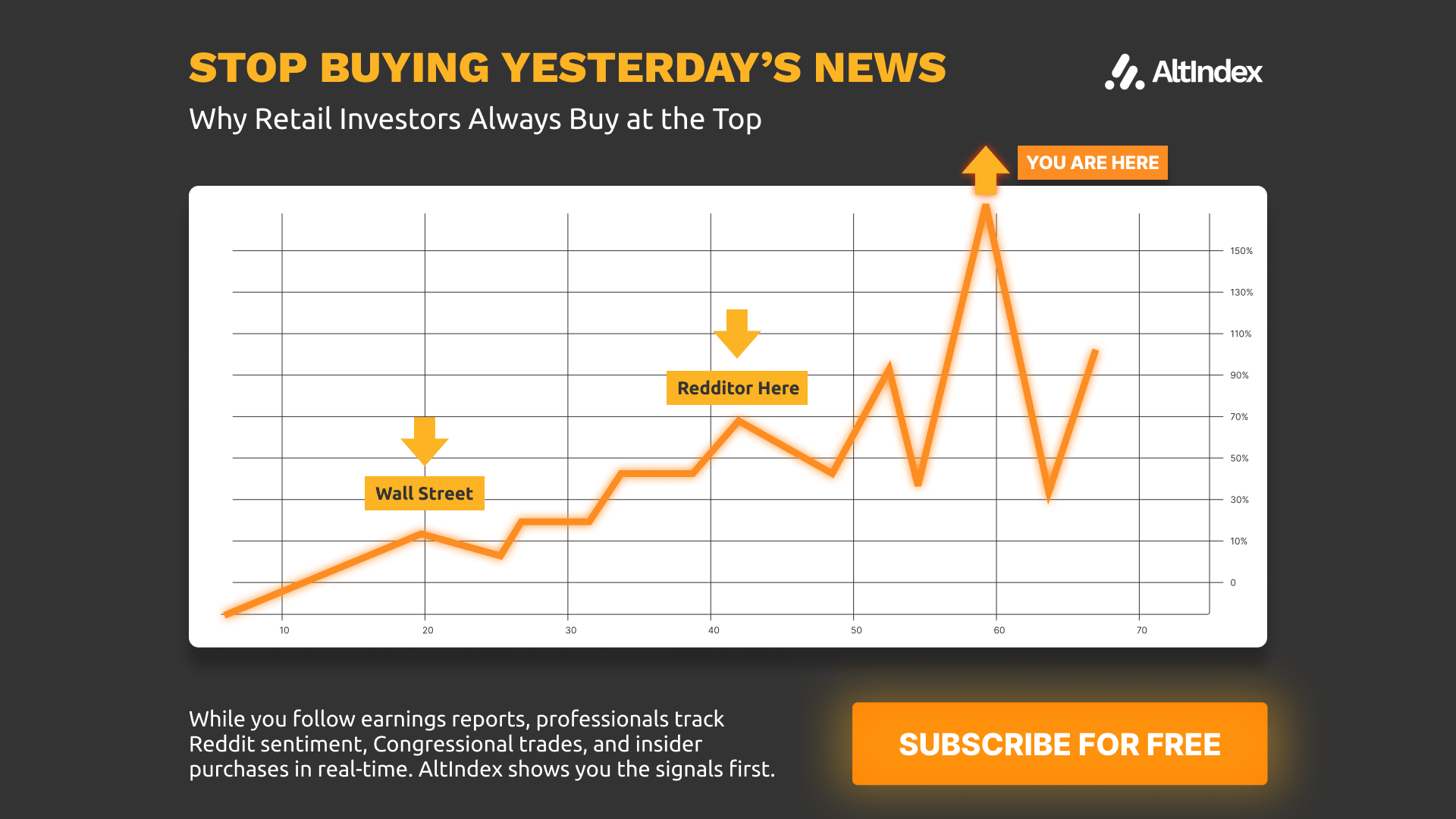

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

How was today's newsletter? |