- Unhashed Newsletter

- Posts

- Crypto confidence cracks amid fear

Crypto confidence cracks amid fear

Reading time: 5 minutes

Crypto slips to April lows as extreme fear returns and structural doubts grow

Key points:

Total crypto market capitalization slid to $2.93 trillion, its lowest level since April, as bearish sentiment intensified.

Analysts are split between warnings of a structural breakdown and signs of long-term progress beneath weak price action.

News - The global crypto market slipped to an eight-month low this week, with total market capitalization falling to $2.93 trillion and wiping out much of this year’s gains. The decline placed the market back in the middle of a range it has largely traded within since early 2024, following months of choppy, directionless movement.

Pressure mounted amid renewed macro uncertainty. Japan’s central bank raised interest rates to 0.75%, a move some analysts flagged as a potential headwind for risk assets. Bitcoin briefly defied that view, climbing 2.3% after the decision, though broader sentiment remained fragile.

Fear dominated trader behavior. Santiment data showed bearish commentary surging across social media after Bitcoin jumped to about $90,200 before quickly retracing to $84,800. The Crypto Fear and Greed Index fell to 16, signaling extreme fear, and has remained below 30 in fear territory since the beginning of November.

Is crypto structurally broken? - Despite a year marked by ETF launches, institutional participation, and a more favorable US regulatory tone, crypto markets are on track to finish lower than they started.

Some analysts argue the disconnect reflects deeper structural stress, driven by persistent leverage, repeated liquidations, and selling pressure from long-term holders and cycle-focused investors.

Others see the drawdown as a necessary clearing phase. Heavy selling over recent months may exhaust supply and allow prices to stabilize once leverage unwinds.

Progress continues beneath weak prices - Away from spot markets, 2025 marked a shift away from hype-driven narratives toward practical infrastructure. Stablecoins, tokenized assets, applied AI, and privacy-focused tools gained traction by addressing real-world use cases rather than speculation.

Regulatory momentum also advanced, with US senators scheduling a January markup for the Digital Asset Market Clarity Act (CLARITY Act).

However, concerns around regulatory independence and compliance burdens persist, limiting confidence. As a result, even tangible progress has struggled to translate into bullish conviction while uncertainty dominates near-term sentiment.

Bitcoin steadies near $88K as oversold signals clash with 2026 outlook split

Key points:

Bitcoin rebounded toward $88,000 after flashing deeply oversold RSI levels, a signal that has historically preceded major rallies.

Analysts remain divided, with some projecting a 2026 breakout while others warn the current cycle may already be over.

News - Bitcoin stabilized near $88,000 this week following a sharp pullback from its October peak, as RSI readings signaled oversold conditions not seen since early 2023. The relative strength index dipped below 30 on shorter timeframes and fell to the mid-30s on the weekly chart, levels that have previously coincided with market bottoms.

Historically, similar RSI conditions have preceded strong recoveries. Some analysts argue that if past patterns repeat, Bitcoin could stage a significant rally in 2026, potentially reaching new highs once selling pressure fades and liquidity conditions improve.

Others caution that such signals are supportive, not predictive, and depend heavily on macro liquidity and investor risk appetite.

Macro signals offer short-term relief - The rebound came despite tightening in Japan. The Bank of Japan raised interest rates to around 0.75%, the highest in nearly 30 years.

Instead of strengthening, the yen weakened, helping Bitcoin climb above $88,000. Cooler US inflation data also lifted risk sentiment, though markets continue to price in no near-term Federal Reserve rate cut.

Bullish signals meet structural caution - Onchain metrics added to the debate. Bitcoin’s NVT Golden Cross fell into deeply depressed territory, a level associated with historical undervaluation and accumulation phases. Analysts noted the metric has begun to recover, though it remains below equilibrium.

Still, downside risks linger. Fidelity’s macro research lead Jurrien Timmer said Bitcoin may have already topped this cycle, projecting a potential bottom between $65,000 and $75,000 in 2026. Data from derivatives markets showed smart money traders leaning net short on Bitcoin, even as they increased long exposure to Ether.

For now, Bitcoin sits at the crossroads, supported by oversold signals and institutional adoption narratives, but constrained by unresolved macro and cycle uncertainty.

Terraform bankruptcy estate sues Jump Trading for $4B over Terra collapse

Key points:

Terraform Labs’ bankruptcy administrator has filed a $4 billion lawsuit against Jump Trading, alleging manipulation and unlawful profits tied to TerraUSD’s collapse.

The case revives scrutiny over secret market-making arrangements that allegedly masked structural flaws before the $40 billion wipeout.

News - The court-appointed administrator overseeing Terraform Labs’ bankruptcy has filed a $4 billion lawsuit against Jump Trading and senior executives, accusing the firm of unlawfully profiting from and materially contributing to the collapse of the Terra ecosystem.

The complaint was filed in US federal court in Illinois by plan administrator Todd Snyder and was first reported by The Wall Street Journal (WSJ).

The lawsuit names Jump Trading, co-founder William DiSomma, and former Jump Crypto president Kanav Kariya. It alleges that Jump engaged in undisclosed trading arrangements with Terraform that allowed the firm to extract billions of dollars in value while concealing weaknesses in TerraUSD, the algorithmic stablecoin that collapsed in May 2022.

Terraform Labs confirmed the lawsuit, stating that the action aims to recover value for creditors and hold Jump accountable for alleged market manipulation, self-dealing, and misuse of assets. Jump has denied the allegations, according to WSJ.

Alleged secret deals and peg support - According to the filing cited by WSJ, Jump and Terraform began working together as early as 2019 under agreements that gave Jump access to large quantities of LUNA at steep discounts.

In one instance referenced in the lawsuit, Jump was allegedly permitted to acquire LUNA at around $0.40 while the token was trading above $110.

The complaint further alleges that Jump later entered into a so-called gentlemen’s agreement to support TerraUSD’s peg, including purchasing tens of millions of tokens during a May 2021 depegging event.

Terraform and Jump allegedly told the public that the recovery reflected the success of TerraUSD’s algorithmic design, despite Jump’s trading activity playing a central role.

Following this episode, Jump allegedly renegotiated its contracts to remove vesting restrictions, enabling faster receipt and sale of LUNA into the market.

Fallout and broader implications - Terraform’s collapse erased more than $40 billion in value across TerraUSD and LUNA and triggered contagion across the crypto industry.

Terraform filed for bankruptcy in January 2024 and later agreed to pay roughly $4.5 billion to settle a civil securities fraud case with the SEC. Former CEO Do Kwon was sentenced earlier this month to 15 years in prison.

The lawsuit adds to mounting legal pressure on large trading firms and could set precedents around market-making conduct, disclosure, and accountability in crypto markets if it proceeds.

Coinbase sues three states to block gambling rules on prediction markets

Key points:

Coinbase has filed federal lawsuits against Connecticut, Michigan, and Illinois, arguing that prediction markets fall under the CFTC’s exclusive authority.

The legal fight comes ahead of Coinbase’s planned January 2026 launch of CFTC-regulated event contracts through Kalshi.

News - Coinbase has sued regulators in Connecticut, Michigan, and Illinois, challenging state attempts to classify prediction markets as illegal gambling. The crypto exchange argues that event-based contracts fall under the exclusive jurisdiction of the US Commodity Futures Trading Commission and cannot be regulated by individual state gaming boards.

The lawsuits seek declaratory and injunctive relief, with Coinbase warning that state enforcement actions create an immediate risk to its ability to offer federally regulated products.

Chief Legal Officer Paul Grewal said state efforts to block prediction markets “stifle innovation and violate the law,” adding that Congress deliberately placed such contracts within the federal commodities framework.

The legal action follows enforcement moves in Illinois, where the state’s Gaming Board issued cease-and-desist letters in April to Kalshi, Robinhood, and Crypto.com over sports-related event contracts. Illinois regulators later warned that participation in prediction markets without state gambling licenses could constitute illegal wagering.

Federal authority versus state gambling laws - Coinbase argues that prediction markets are derivatives, not sportsbooks. Unlike casinos, which profit from customer losses, the exchange says prediction markets operate as neutral venues that match buyers and sellers without setting odds.

Court filings emphasize that Congress excluded only a narrow set of commodities, such as onions and motion picture box office receipts, from CFTC oversight. Everything else, including sports and political events, falls within federal jurisdiction, Coinbase contends.

The company also warned that requiring state gambling licenses would undermine federal rules mandating impartial access to designated contract markets nationwide. In Illinois alone, compliance would restrict services to in-state users, conflicting with CFTC standards.

What is at stake for prediction markets - The lawsuits arrive amid rapid growth in prediction markets, which saw billions of dollars in trading volume in 2025. Kalshi, a CFTC-designated contract market since 2020, was valued at $11 billion following a $1 billion funding round in November.

Legal outcomes remain mixed. Courts in some states have allowed temporary protection for Kalshi, while others have sided with state regulators. With Coinbase now adopting a similar federal preemption strategy, the cases could shape how prediction markets are treated across the US ahead of 2026.

The Headlines Traders Need Before the Bell

Tired of missing the trades that actually move?

In under five minutes, Elite Trade Club delivers the top stories, market-moving headlines, and stocks to watch — before the open.

Join 200K+ traders who start with a plan, not a scroll.

More stories from the crypto ecosystem

Crypto scams uncovered

Pig butchering just got hit with a real clawback: Federal agents seized nearly $8.5 million in USDT (Tether) tied to a crypto investment “pig butchering” scheme, showing law enforcement can sometimes recover funds even after scammers push money on-chain.

Treasury is sanctioning scam factories, not just scammers: OFAC sanctioned a network of scam centers across Southeast Asia, describing an industry that stole over $10 billion from Americans in 2024 and relied on forced labor and violence to run crypto investment scams at scale.

Interpol’s “Red Card” sweep shows scams are now cross-border operations: An INTERPOL-led crackdown across 7 African countries resulted in 306 arrests tied to banking, investment, and messaging-app scams, with investigators noting proceeds were converted into digital assets to hide the trail.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Top 3 coins of the day

Stellar (XLM)

Key points:

XLM rebounded toward $0.22 after defending the $0.20–$0.21 demand zone, though the broader trend remained pressured.

The Supertrend stayed in sell mode, while the Stochastic RSI dipped deep into oversold territory, hinting at short-term exhaustion rather than a full reversal.

What You Should Know:

XLM attempted a recovery after sliding for several sessions, with price stabilizing near the $0.21 region before pushing higher. Despite the bounce, the asset continued to trade below the Supertrend line, keeping the prevailing structure tilted to the downside. This suggested that the move was corrective rather than trend-changing. Momentum indicators supported this view. The Stochastic RSI remained near oversold levels, signaling easing selling pressure but stopping short of confirming sustained upside momentum. Meanwhile, volume stayed relatively muted during the rebound, pointing to selective dip-buying instead of broad accumulation. On the catalyst front, sentiment drew support from the Marshall Islands rolling out its blockchain-based UBI program on Stellar, reinforcing the network’s real-world payments narrative. Additional optimism stemmed from expectations of a more crypto-friendly regulatory climate in the US. For now, $0.20–$0.21 acts as key support, while $0.24–$0.26 stands as the immediate resistance zone to watch.

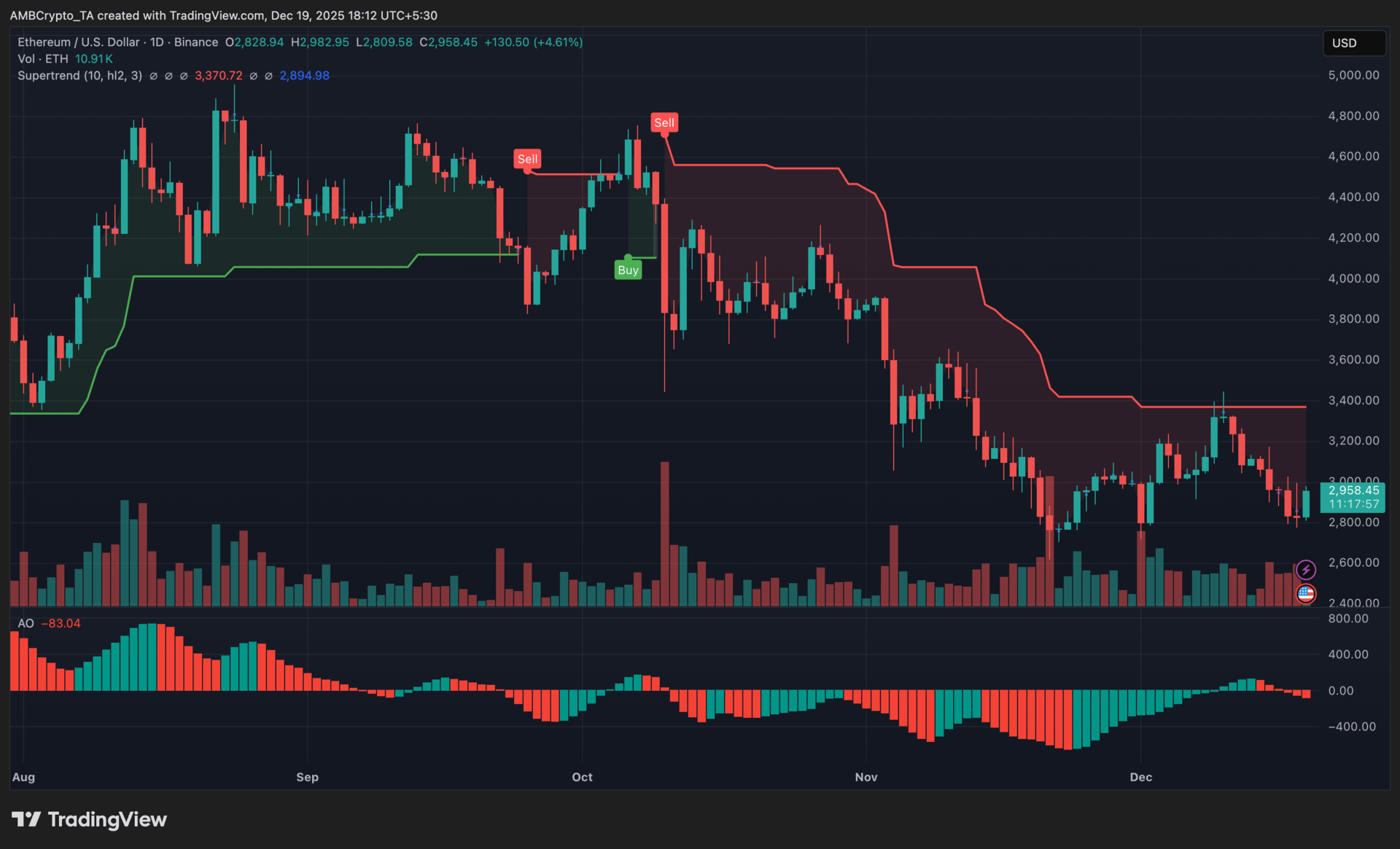

Ethereum (ETH)

Key points:

ETH last changed hands around $2,958, stabilizing after an extended corrective phase.

Trend signals stayed bearish, with the Supertrend overhead and the Awesome Oscillator showing strengthening downside momentum.

What you should know:

Ethereum hovered near $2,958 after failing to reclaim higher levels earlier this month, following a steep selloff that dragged price toward the $2,800 area. While buyers stepped in to slow the decline, the broader structure remained under pressure. The Supertrend continued to print sell signals, underscoring that ETH had yet to regain directional control. Momentum indicators reinforced this caution. The Awesome Oscillator remained below the zero line, and the most recent red bars grew slightly taller, pointing to increasing negative momentum rather than exhaustion. This suggested that downside forces were still active, even as price attempted to stabilize. Volume rose modestly during the recovery attempt, though it stayed well below levels seen during prior distribution phases. From a catalyst standpoint, corporate treasury accumulation helped limit further downside, while softer U.S. inflation data briefly lifted broader risk sentiment. At present, $2,800 continues to act as a downside buffer, while the $3,100–$3,200 region stands as immediate overhead resistance. A sustained shift higher requires both a Supertrend reversal and improving momentum confirmation.

Bitcoin Cash (BCH)

Key points:

BCH climbed toward $588 after rebounding from the mid-$520 zone, with buyers attempting to stabilise structure after a volatile November swing.

The EWO flipped positive, while volume expanded on the rebound, suggesting improving momentum but without full trend confirmation yet.

What you should know:

Bitcoin Cash recovered from its November trough near $450 and pushed back into the $580 to $590 range, retracing a sizable portion of its prior drawdown. The rebound briefly produced a higher low followed by a higher high, but that structure did not persist, as the latest dip failed to set a new base, leaving the broader trend indecisive. The Higher High Lower Low overlay captured this choppiness, showing alternating advances and pullbacks rather than a sustained directional sequence. At the same time, the EWO histogram turned positive after an extended bearish stretch, signalling improving momentum, although the bars remained relatively shallow. Volume expanded during the upswing, pointing to renewed interest, but buying strength lacked consistency. Beyond technicals, increased futures participation and signs of whale rotation into BCH likely supported the move, while Cashinals-related ecosystem activity added speculative interest. For now, $530 acts as immediate support, while acceptance above $600 is needed to reinforce upside conviction.

How was today's newsletter? |