- Unhashed Newsletter

- Posts

- Crypto rebounds on Trump’s $2K pledge

Crypto rebounds on Trump’s $2K pledge

Reading time: 5 minutes

Trump’s $2,000 dividend sparks Bitcoin rebound and altcoin surge as funds bleed $1.2B

Key points:

Talk of a U.S. “tariff dividend” helped Bitcoin recover above $106K and lifted altcoins such as XRP, SOL, and HBAR to double-digit gains.

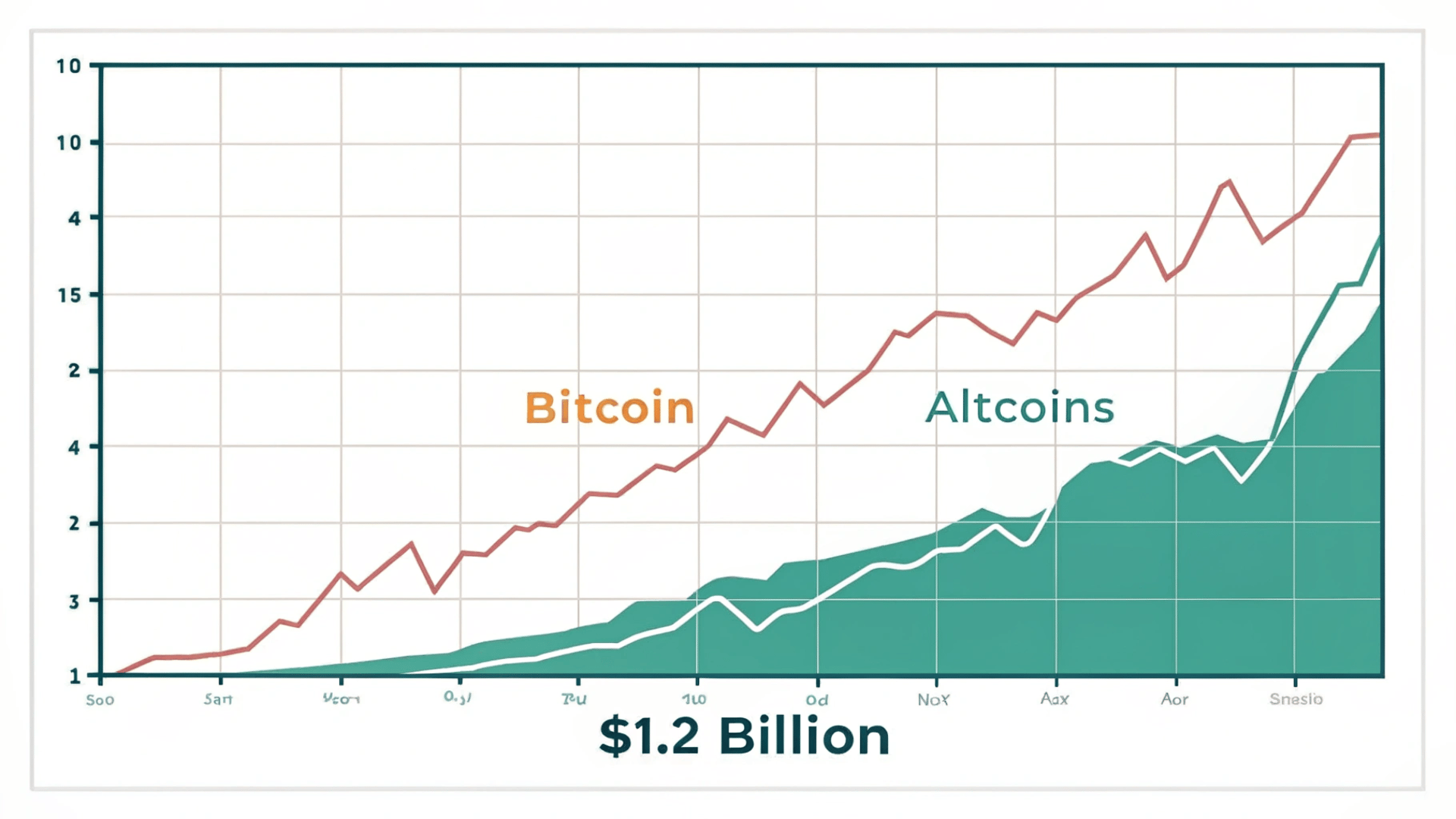

Despite the retail-driven optimism, crypto investment products recorded $1.17 billion in outflows as investors remained cautious on U.S. policy risk.

News - Crypto markets rebounded after two weeks of losses, driven by President Donald Trump’s proposal of a $2,000 “tariff dividend” for most Americans. Bitcoin rose about 4% to stabilize near $106,000, while Ethereum climbed past $3,600.

Altcoins outperformed as retail traders anticipated fresh liquidity entering the market. CoinMarketCap’s altcoin-season index jumped from 23 to 34, underscoring renewed risk appetite beyond Bitcoin.

However, Treasury Secretary Scott Bessent later clarified that the dividend could arrive as tax cuts rather than direct checks, tempering expectations of an immediate cash influx. Analysts warned that indirect measures may have a weaker near-term effect on crypto prices compared with pandemic-era stimulus payments.

Bitcoin rebounds, altcoins shine - XRP, XLM, and HBAR all gained over 10% in 24 hours, reflecting rising speculative interest amid Trump’s announcement and optimism over a potential end to the U.S. government shutdown.

DeFi markets also expanded, with total value locked climbing to $142.8 billion as protocols like Starknet and Suilend saw 20% inflows.

Funds still face outflows - Despite the retail-driven rally, institutional flows remained negative. CoinShares reported $1.17 billion in outflows from digital asset products, led by Bitcoin ($932 million) and Ether ($438 million).

Solana and XRP defied the trend with combined inflows exceeding $140 million, showing selective institutional confidence even in a risk-off environment.

What to watch - Markets now await clarity on the dividend’s final structure and the Federal Reserve’s December rate stance. A confirmed U.S. shutdown resolution or dovish pivot could convert short-term optimism into sustained inflows across crypto funds.

U.S. shutdown deal fuels XRP ETF frenzy and 12% rally

Key points:

XRP surged over 12% to around $2.56 after the U.S. Senate reached a deal to end the record 40-day government shutdown.

The rally followed 11 XRP ETF listings appearing on the DTCC’s “active and pre-launch” page, signaling growing institutional readiness.

News - XRP saw one of its strongest rallies in months as optimism returned to markets following the U.S. Senate’s agreement to end the longest-ever government shutdown. The move eased financial uncertainty and revived investor risk appetite across crypto, with traders eyeing new spot XRP exchange-traded funds (ETFs).

The Depository Trust and Clearing Corporation (DTCC) website showed at least 11 XRP ETF products under active or pre-launch status, including filings from 21Shares, Bitwise, Franklin Templeton, Volatility Shares, CoinShares, and Canary Capital.

While a DTCC listing doesn’t equal SEC approval, it signals that ETF infrastructure is ready for potential trading on U.S. markets once regulatory clearance is granted.

Market analysts noted that the Senate’s deal could restore SEC operations, allowing delayed ETF reviews to resume. “Government shutdown ending = spot crypto ETF floodgates opening,” said ETF Store President Nate Geraci, while Bloomberg’s Eric Balchunas called it “the final nail in the coffin for the old anti-crypto guard.”

Profit-taking signals caution - Despite the bullish momentum, on-chain data revealed that profit-taking by long-term XRP holders rose by 240% since late September. This aligns with persistent selling from whales holding between 1 million and 10 million XRP tokens.

However, Santiment data showed that whale outflows have started to ease following $650 million in sales, hinting at possible stabilization.

Technical outlook - XRP faces stiff resistance between $2.60 and $2.80, where significant supply clusters exist. Traders are watching for a breakout above $2.80 to confirm a move toward $3, while maintaining support around $2.39 remains key for sustaining the uptrend.

Bank of England moves to cap retail stablecoin holdings at £20,000

Key points:

The Bank of England proposed temporary limits of £20,000 for individuals and £10 million for businesses holding systemic stablecoins to prevent deposit flight from commercial banks.

Issuers would need to back up to 60% of reserves with short-term UK government debt and at least 40% with Bank of England deposits, with rules set for finalization in 2026.

News - The Bank of England (BoE) has opened a public consultation on its long-awaited stablecoin regulatory framework, introducing what it calls “temporary” caps on holdings as the UK integrates digital money into its financial system.

Under the proposal, individuals would be limited to £20,000 (about $26,000) per stablecoin, while businesses could hold up to £10 million. The BoE said the restrictions are transitional measures meant to avoid sudden outflows from commercial bank deposits during the shift toward stablecoin-based payments.

Deputy Governor Sarah Breeden argued that the caps are essential to protect credit markets, given that UK consumers rely heavily on bank-issued mortgages. Once risks to financial stability ease, the limits will be removed.

Businesses such as exchanges or supermarkets could apply for exemptions where higher balances are needed for operations.

Balancing stability and innovation - The consultation paper also outlines new reserve requirements: issuers may hold up to 60% of backing assets in short-term UK government debt, with the remainder placed as unremunerated deposits at the BoE. Systemic issuers could temporarily hold as much as 95% in government securities during early scaling.

The BoE stressed that its regime targets sterling-denominated systemic stablecoins, while non-systemic tokens used for trading will fall under the Financial Conduct Authority.

Industry reaction and timeline - Industry groups and crypto advocates criticized the proposal as overly cautious compared with the US and EU approaches, warning it could deter innovation. The consultation remains open until February 10, 2026, with the final rulebook expected in the second half of 2026.

Hong Kong launches third digital green bond to cement tokenized finance lead

Key points:

Hong Kong will issue its third batch of blockchain-based government digital green bonds, denominated in USD, EUR, HKD, and offshore yuan.

The AA+-rated “digitally native” bonds reflect Hong Kong’s push to strengthen its position as Asia’s digital asset hub amid growing tokenized debt activity.

News - Hong Kong is preparing to issue its third blockchain-based digital green bond since 2023, expanding its role as a pioneer in tokenized finance. The upcoming multi-currency offering, denominated in U.S. dollars, Hong Kong dollars, euros, and offshore yuan, could be priced as early as this week, according to sources cited by Bloomberg.

The latest issuance builds on Hong Kong’s prior green bond programs that used distributed ledger technology (DLT) for trading and settlement.

The bonds are created and recorded entirely on blockchain, marking a shift toward digitally native government debt. HSBC’s infrastructure will manage issuance and clearing, allowing investors to track the full lifecycle on-chain.

Strengthening Hong Kong’s digital asset hub status - This new issue comes amid competition from Singapore and Dubai, both of which are courting tokenized finance markets.

Corporations in Hong Kong have already launched at least six blockchain-based bonds, raising a combined $1 billion, including from Shenzhen Futian Investment Holdings and Shandong Hi-Speed Group.

Institutional confidence builds as tokenization grows - Hong Kong already accounts for nearly 30% of Asia’s international bond issuance, and the new initiative demonstrates rising institutional trust in blockchain-based debt.

S&P assigned the new notes an AA+ rating, noting a contingency mechanism allowing the bonds to migrate to traditional systems in case of disruption.

A milestone in the race for digital finance leadership - With Franklin Templeton’s recent tokenized money-market fund debuting in Hong Kong, the government’s latest bond sale underscores the city’s accelerating race to become Asia’s premier digital asset gateway.

JUST IN: Earning Markets on Polymarket 🚨

Polymarket, the world's largest prediction market, has rolled out Earnings Markets. You can now place a simple Yes/No trade on specific outcomes:

Will HOOD beat earnings?

Will NVDA mention China?

Will AMC beat estimated EPS?

Profit directly from your conviction on an earnings beat, regardless of the immediate stock movement.

Why trade Earnings Markets?

Simple: Clear Yes/No outcomes.

Focused: Isolate the specific event you care about.

Flexible: Tight control for entry, hedging, or exit strategy.

Upcoming markets include FIGMA, ROBINHOOD, AMC, NVIDIA, and more. Built for how traders actually trade.

More stories from the crypto ecosystem

Did you know?

State-level crypto coup - In May 2025, New Hampshire became the first U.S. state to pass a law that allows its treasurer to invest up to 5% of public funds in digital assets, provided they have a market cap over $500 billion (currently only Bitcoin qualifies).

Global watchdog flags crypto blind spots - The Financial Action Task Force (FATF) revealed in June 2025 that only 40 out of 138 countries had met its anti-money-laundering standards for virtual assets. The finding exposes how most nations still lag in regulating crypto flows despite years of global pressure.

Czech justice minister quits over Bitcoin scandal - In 2025, the Czech Ministry of Justice accepted a 468 BTC (≈$45 million) donation from a convicted cyber criminal, sparking outrage. The justice minister resigned amid accusations that the gift bypassed anti-money-laundering safeguards.

13 Investment Errors You Should Avoid

Successful investing is often less about making the right moves and more about avoiding the wrong ones. With our guide, 13 Retirement Investment Blunders to Avoid, you can learn ways to steer clear of common errors to help get the most from your $1M+ portfolio—and enjoy the retirement you deserve.

Top 3 coins of the day

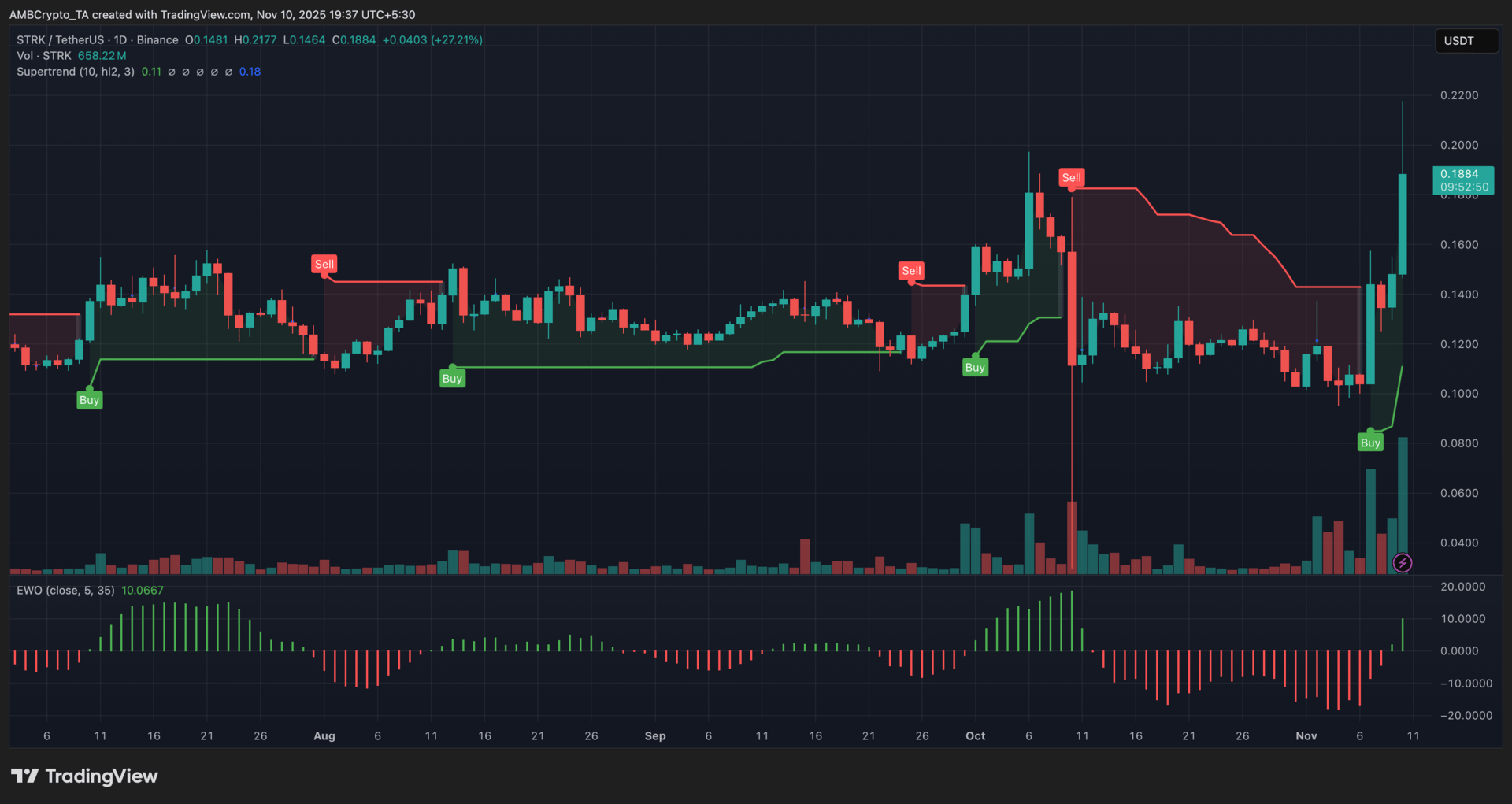

Starknet (STRK)

Key points:

At the time of writing, Starknet was trading near $0.18, marking a 27% surge in 24 hours as buyers drove a breakout from the $0.10–$0.12 range.

The Supertrend indicator remained in a buy phase, while the EWO flipped green for the first time in weeks, with its latest bar rising above +10, signaling an early bullish revival backed by strong trading volume.

What you should know:

STRK witnessed a sharp upswing as trading volumes exceeded $650 million, reflecting renewed accumulation pressure. The Supertrend’s recent flip to a buy signal near $0.09–$0.10 helped validate the token’s rebound from its earlier consolidation zone. Meanwhile, the EWO turned positive after a prolonged bearish phase, hinting at an emerging uptrend rather than a fully established one. Beyond the technicals, macro relief and renewed ETF optimism lifted broader risk sentiment, supporting capital inflows into altcoins like Starknet. Additionally, its BTCFi initiative, focused on Bitcoin-DeFi integration and liquidity expansion, added narrative strength to the rally. Going forward, traders may watch for support near $0.11 and resistance between $0.19–$0.20, key zones that could define STRK’s next directional move.

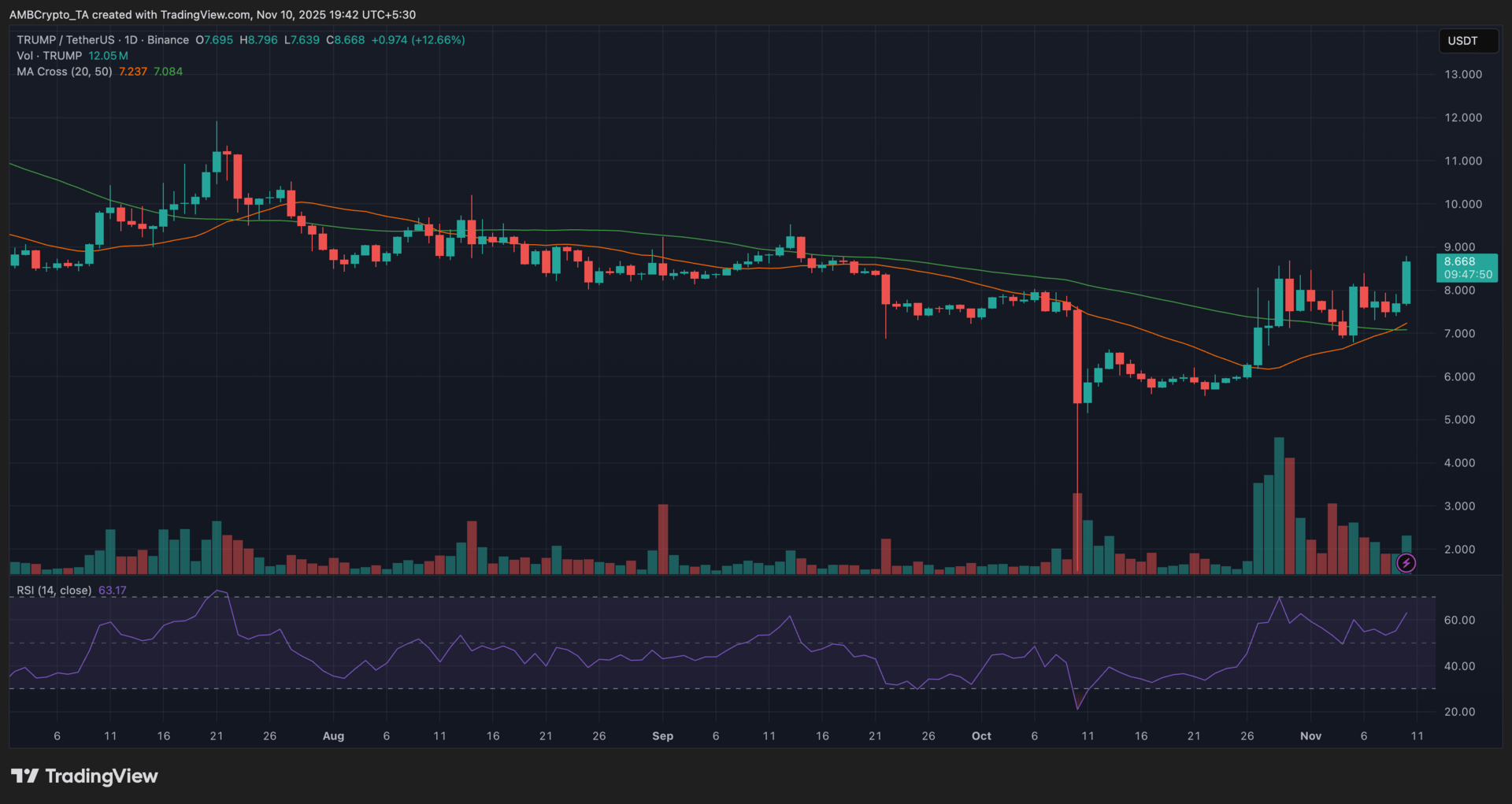

OFFICIAL TRUMP (TRUMP)

Key points:

TRUMP was last seen trading near $8.66, marking a 12.6% rise over the past day as it broke above both its 20-day and 50-day moving averages.

The MA Cross hinted at a developing bullish crossover while the RSI hovered around 63, reflecting growing buying strength without breaching overbought territory.

What you should know:

TRUMP gained upward traction as volume climbed noticeably, reinforcing renewed accumulation after weeks of subdued activity. The short-term moving average is on track to cross above the long-term one near $7.20, signaling a potential trend shift if maintained. Meanwhile, RSI readings around 63 show healthy bullish momentum, leaving scope for further advances. Beyond the chart, speculation over Fight Fight Fight LLC’s potential acquisition of Republic.com’s US operations has fueled renewed investor attention. Broader macro optimism tied to the U.S. government’s reopening talks and Trump’s proposed “tariff dividend” also lifted sentiment. Traders now eye support at $7.20 and resistance near $8.80–$9.00 to gauge whether this recovery can evolve into a sustained uptrend.

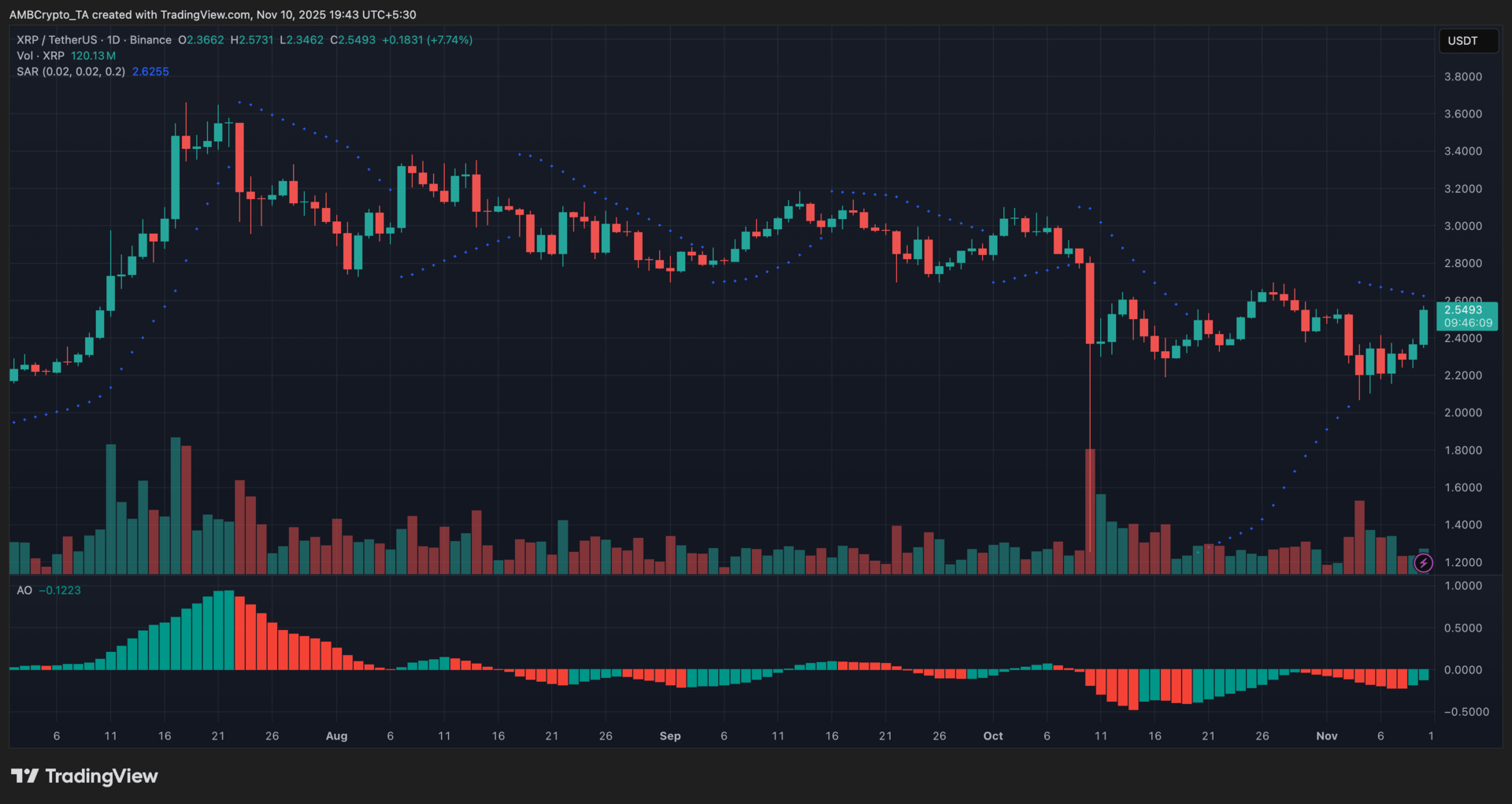

XRP (XRP)

Key points:

XRP traded near $2.55, up 7.7% in 24 hours, as trading volume climbed past 120 million tokens following renewed investor activity.

The Parabolic SAR stayed above the candles while the Awesome Oscillator flipped green, pointing to weakening bearish momentum and early signs of a potential trend recovery.

What you should know:

XRP saw an upswing in price and volume after days of sideways movement, with the Awesome Oscillator turning positive for the first time in weeks. The histogram’s green bars reflected the return of buying strength, even as the Parabolic SAR remained above the candles, signaling that the broader downtrend had not yet fully reversed. Sentiment improved on reports of Canary Capital’s potential spot XRP ETF and a Mastercard pilot leveraging XRPL for instant settlements, both of which boosted institutional confidence. Traders are now watching support around $2.30–$2.35 and resistance near $2.62–$2.65, key levels that could determine whether XRP confirms a bullish shift in the coming sessions.

Get in on the markets before tech stocks keep rising

Online stockbrokers have become the go-to way for most people to invest, especially as markets remain volatile and tech stocks keep driving headlines. With just a few taps on an app, everyday investors can trade stocks, ETFs, or even fractional shares—something that used to be limited to Wall Street pros. Check out Money’s list of top-rated online stock brokerages and start investing today!

How was today's newsletter? |