- Unhashed Newsletter

- Posts

- Crypto’s liquidity crisis isn’t over

Crypto’s liquidity crisis isn’t over

Reading time: 5 minutes

From October shock to 2026 tests: Crypto’s liquidity problem meets policy hope

Key points:

BitMEX stated that the October liquidation cascade broke market-making strategies, leaving crypto liquidity at its weakest level since 2022.

Bitwise believes markets have absorbed that shock, but says fresh highs in 2026 hinge on regulation and broader market stability.

News - The October 10 crypto crash remains a defining reference point for how the market is being assessed heading into 2026. Recent reports from BitMEX and Bitwise frame the event as both a structural failure that damaged liquidity and a psychological overhang the market is now attempting to move past.

BitMEX’s annual report said the roughly $20 billion liquidation cascade exposed weaknesses in exchange risk systems.

As prices collapsed, auto deleveraging was triggered after insurance funds proved insufficient, force closing even profitable hedges held by market makers. That process dismantled delta-neutral strategies, leaving firms exposed to falling spot prices and prompting a global pullback in liquidity through the fourth quarter.

Order books thinned to levels last seen in 2022, increasing volatility and weakening price discovery.

Bitwise offered a more forward-looking interpretation. CIO Matthew Hougan said fears that major market makers or hedge funds would be forced to unwind positions weighed on sentiment late last year but have since faded.

With no follow-on liquidation event comparable to October 10, Hougan said investors have largely put the crash behind them, helping support crypto’s early 2026 rebound.

Why liquidity remains a concern - Despite the price rebound that followed the October selloff, BitMEX warned that liquidity conditions remain fragile. Funding rate arbitrage, once considered a low-risk yield strategy, has become overcrowded, compressing returns below 4%.

The report also highlighted a growing trust issue, with some platforms accused of canceling profitable trades during volatile periods and low-float perpetual listings becoming targets for coordinated squeezes. Decentralized perpetual venues have expanded, but BitMEX said transparency alone has not eliminated manipulation risks.

The remaining checkpoints for 2026 - Bitwise’s Hougan outlined two remaining conditions for sustained upside after the market cleared the immediate post-October overhang.

Progress on U.S. crypto market structure legislation, particularly the Clarity Act, could anchor long-term confidence. At the same time, equities need to avoid a sharp selloff that would pressure risk assets broadly, crypto included.

Taken together, the reports suggest crypto’s next leg higher will depend on whether improving sentiment and policy momentum can offset lingering weaknesses in liquidity and market structure.

BNB faces crosswinds as governance dispute meets risk-off markets

Key points:

A shareholder battle at a major BNB treasury firm has added uncertainty as broader crypto markets turn defensive.

BNB has struggled to reclaim higher levels despite ecosystem growth and Binance’s expanding product lineup.

News - BNB is navigating a mix of internal governance tension and external market pressure, with recent weakness reflecting more than a routine pullback. As risk appetite faded across crypto ahead of key U.S. macro events, attention also turned to a deepening dispute inside one of the largest publicly traded holders of BNB.

At the center of the standoff is CEA Industries, where major shareholder YZi Labs is challenging the company’s leadership over what it claims is a departure from a BNB-focused treasury strategy.

YZi has called for board changes, clearer disclosures, and governance reforms, while CEA has rejected the allegations and adopted bylaw amendments and a stockholder rights plan to limit ownership concentration.

This backdrop has unfolded as BNB trades below $900, slipping into the mid-$880s after failing to sustain earlier gains. Trading activity has remained subdued, pointing to hesitation rather than aggressive selling.

Market pullback adds pressure - The timing has amplified sensitivity. Bitcoin has fallen back below $90,000, memecoins and DeFi tokens have led declines, and U.S.-listed spot Bitcoin ETFs have recorded sizable outflows.

With traders bracing for the U.S. jobs report and a Supreme Court decision tied to global trade sentiment, risk exposure across crypto has been pared back.

Expansion continues beneath the surface - Away from price action, Binance has expanded its derivatives lineup with gold and silver perpetual futures settled in USDT, highlighting demand for access to traditional assets through crypto infrastructure.

Longer-term, BNB continues to be supported by steady large-holder participation, strong user activity across the ecosystem, and growing real-world asset adoption on BNB Smart Chain. For now, traders appear cautious as governance clarity and macro direction remain in focus.

Zcash developer team exits after governance clash, ZEC slides sharply

Key points:

The entire Electric Coin Company team has resigned after a governance dispute with nonprofit overseer Bootstrap.

ZEC sold off sharply following the announcement, though developers insist the Zcash protocol itself remains unaffected.

News - A major governance rupture has emerged within the Zcash ecosystem after the full developer team at Electric Coin Company (ECC) walked away from the project, citing untenable changes imposed by Bootstrap.

The exit, confirmed by ECC CEO Josh Swihart, follows weeks of mounting tension over control, compliance, and the future structure of Zcash development.

Swihart said the team was “constructively discharged,” arguing that altered employment terms made it impossible to continue work with integrity. He accused a majority of Bootstrap board members of drifting away from Zcash’s original mission, framing the departure as a response to what he described as “malicious governance actions.”

The former ECC team now plans to form a new company, while maintaining its commitment to building privacy-focused financial infrastructure.

Bootstrap, which operates as a 501(c)(3) nonprofit, pushed back on that characterization. The board said the disagreement centers on governance and legal compliance, particularly around outside investment discussions tied to the Zashi wallet project.

Bootstrap warned that improperly structured deals could expose the organization to lawsuits, regulatory scrutiny, or forced asset reversals, stressing that its actions are driven by fiduciary duty rather than mission drift.

Protocol stability vs governance turmoil - Both sides emphasized that the Zcash protocol itself remains operational, open source, and permissionless. Former ECC CEO and Zcash founder Zooko Wilcox echoed that view, stating that the dispute does not affect network security or functionality, while expressing confidence in the integrity of the Bootstrap board.

Market reacts swiftly - Despite assurances around protocol continuity, ZEC reacted sharply. The token dropped as much as 16% following the announcement, breaking below $500 as traders digested the leadership shakeup. The selloff comes amid broader technical weakness, with ZEC already down year to date after an outsized rally in 2025.

For now, the split underscores a familiar tension in crypto: decentralized protocols may endure, but governance disputes can still drive short-term volatility and investor uncertainty.

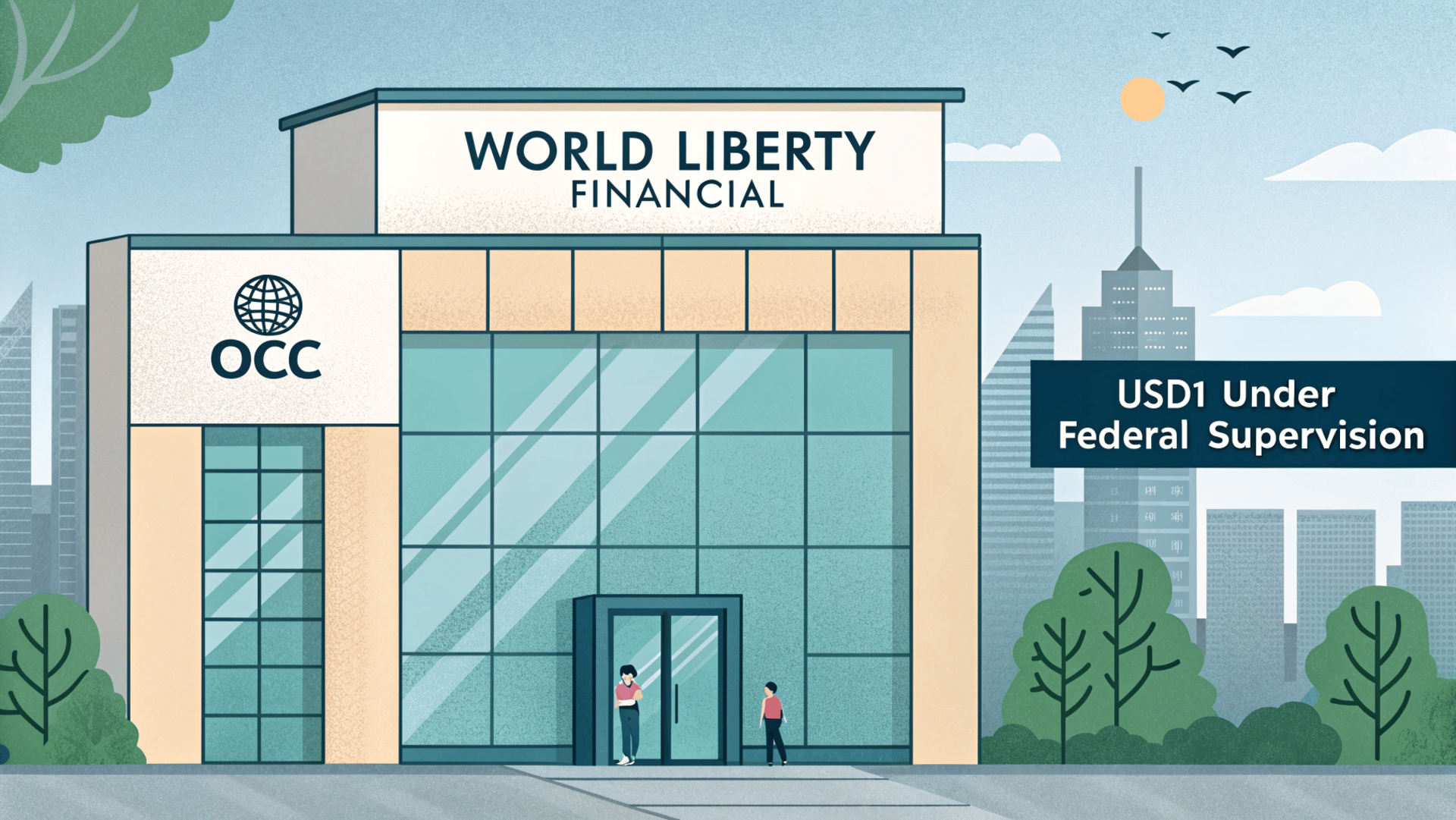

World Liberty Financial seeks OCC charter to bring USD1 under federal oversight

Key points:

World Liberty Financial’s subsidiary has applied for a national trust bank charter to issue, custody, and convert the USD1 stablecoin under OCC supervision.

The move has drawn both regulatory support and criticism, with banks warning of uneven oversight and lawmakers raising conflict-of-interest concerns.

News - World Liberty Financial has taken a major step toward deeper integration with the U.S. financial system by applying for a national trust bank charter through its subsidiary, World Liberty Trust Company.

If approved by the Office of the Comptroller of the Currency, the entity would place issuance, custody, and conversion of the USD1 stablecoin under direct federal oversight.

According to the company, the proposed trust bank would serve institutional clients such as exchanges, market makers, and investment firms.

It plans to offer fee-free minting and redemption of USD1 at launch, along with fiat on- and off-ramps and custody services for USD1 and select other stablecoins. The trust structure would allow these services to operate nationwide without relying on state-by-state licensing.

Why the trust charter matters - Unlike traditional banks, national trust banks focus on custody, settlement, and fiduciary services rather than deposit-taking or lending, and they do not carry FDIC insurance.

World Liberty Financial said the charter would allow USD1 to evolve from a trading tool into a settlement-focused stablecoin operating within a single, federally regulated framework.

General Counsel Mack McCain said the trust company would comply with the GENIUS Act and implement strict standards around anti-money laundering, sanctions screening, cybersecurity, and reserve management. Customer assets would be segregated and subject to regular examinations.

Regulatory momentum and pushback - The application follows a broader shift at the OCC, which has recently granted conditional trust charters to firms including Circle, Ripple, Fidelity Digital Assets, BitGo, and Paxos. Comptroller of the Currency Jonathan Gould has said new entrants can promote competition and innovation in the banking sector.

Still, traditional banking groups have pushed back, warning that crypto trust charters could create a two-tier banking system by granting national privileges without the full regulatory burden placed on insured banks.

Lawmakers have also flagged potential conflicts of interest tied to President Donald Trump’s association with World Liberty Financial, though the company says the trust structure is designed to avoid direct involvement by Trump or his family in daily operations.

As scrutiny builds, the OCC’s decision could shape how far stablecoin issuers are allowed to move into the core of the U.S. banking system.

More stories from the crypto ecosystem

Interesting facts

Most crypto trading volume is not driven by new money: A significant share of crypto trading activity comes from recycled capital, where the same funds rotate rapidly across exchanges and assets, meaning headline volume figures often exaggerate the amount of fresh capital actually entering the market.

Stablecoins move more value than many national payment systems: On-chain stablecoin transfers now regularly settle trillions of dollars annually, rivaling or exceeding the transaction volumes of some domestic payment networks, even though they operate outside traditional banking rails.

Crypto market crashes are amplified by automation: During sharp downturns, a large portion of forced selling is triggered automatically through liquidations, margin calls, and algorithmic risk controls, causing prices to fall faster than human-driven markets would allow.

Top 3 coins of the day

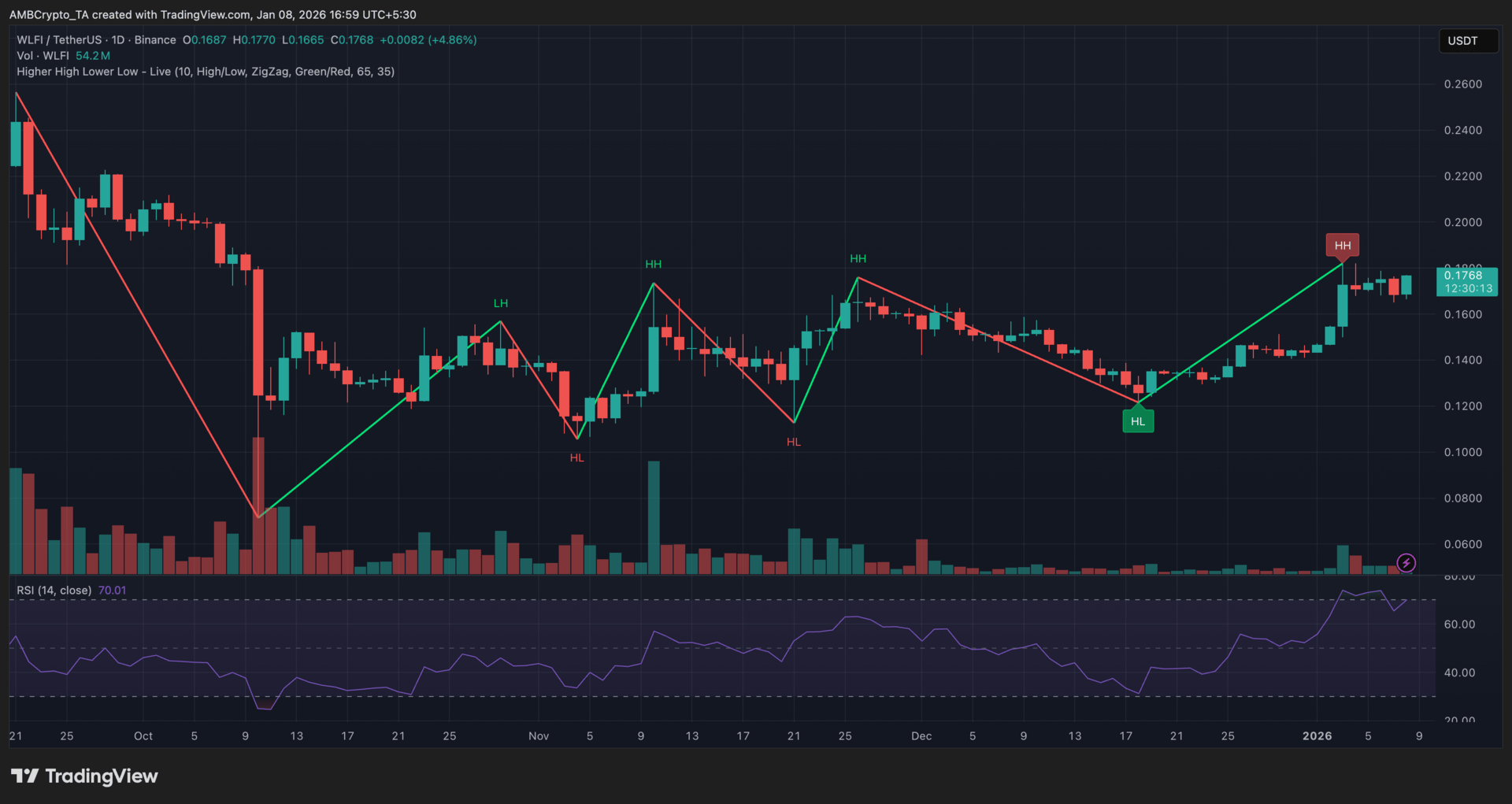

World Liberty Financial (WLFI)

Key points:

WLFI extended its recovery, climbing toward the $0.176 level after printing a fresh higher high on the daily chart.

Volume expanded during the move, while RSI hovered near the upper range, reflecting strong momentum with early signs of short-term heating.

What you should know:

World Liberty Financial continued building on its recent trend reversal, with price maintaining a clear sequence of higher lows and higher highs on the daily timeframe. After stabilizing through mid-December, buyers regained control, pushing WLFI above its recent consolidation range and toward the $0.175–$0.180 zone.

The Higher High Lower Low structure indicator confirmed this shift, with the latest higher high reinforcing the broader recovery rather than a brief bounce. Volume increased alongside the advance, signaling active participation during the breakout phase instead of thin, speculative buying.

Momentum indicators also reflected strength. The RSI stayed elevated near the 70 mark, pointing to sustained bullish pressure, though it also suggested the move was becoming crowded in the short term.

On the catalyst front, optimism around WLFI’s USD1 stablecoin seeking federal oversight likely supported sentiment, adding a narrative tailwind to the technical recovery.

From here, the $0.150–$0.155 region stands as immediate support, while price behavior near $0.180 remains key to judging continuation versus consolidation.

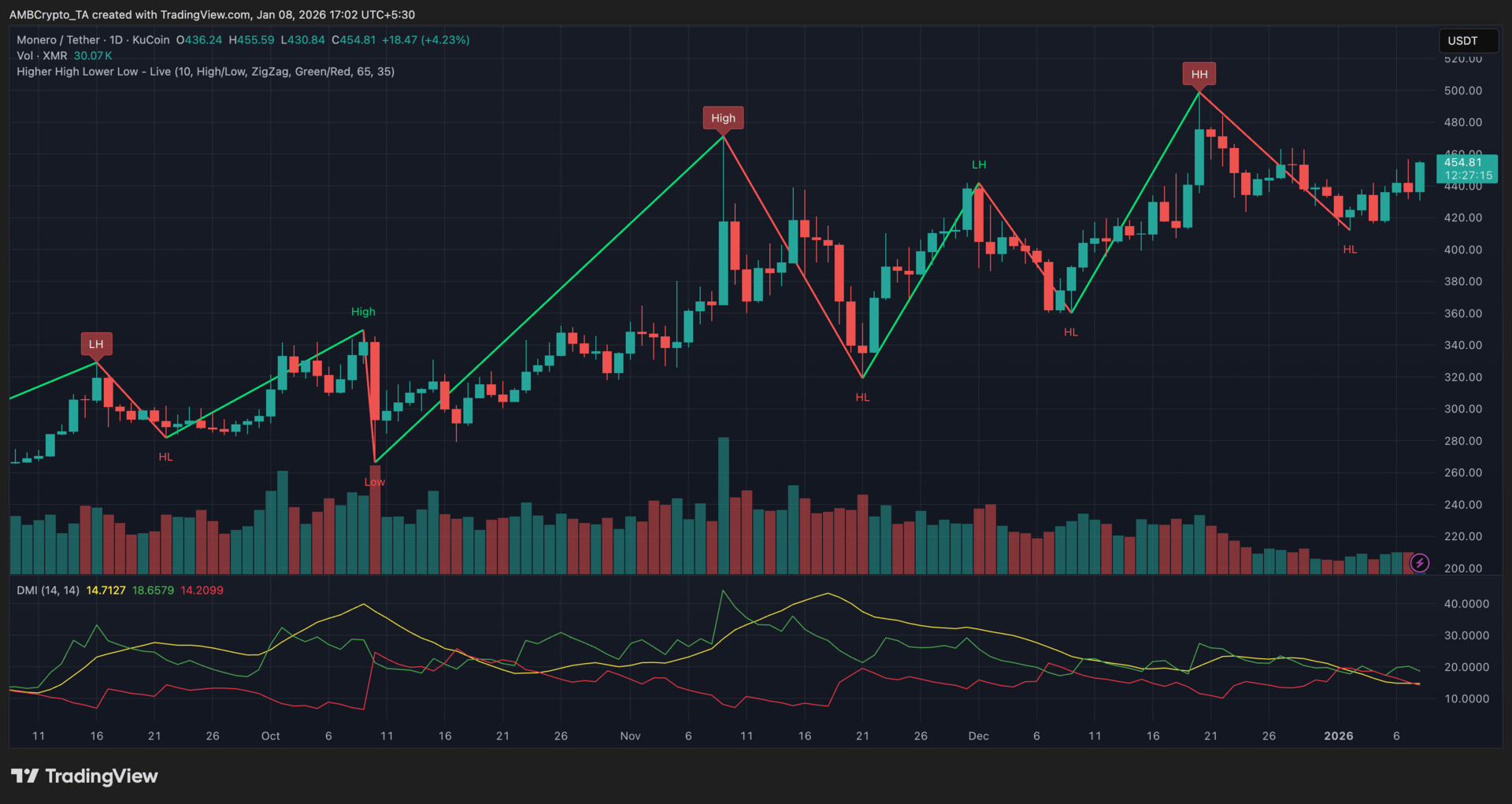

Monero (XMR)

Key points:

Monero held its upward structure, with price action maintaining a series of higher lows despite recent consolidation near local highs.

Directional momentum stayed constructive, as buying pressure remained dominant and pullbacks attracted relatively lighter volume.

What you should know:

Monero extended its recovery over recent sessions, building on a higher low formed after its early-December pullback. The Higher High Lower Low structure remained intact on the daily chart, signaling that the broader trend stayed biased toward continuation rather than reversal.

Directional Movement Index readings showed +DI holding above -DI, reflecting sustained buyer control, while trend strength appeared steady rather than overheated. This suggested accumulation at higher levels instead of aggressive chasing.

Volume expanded during upside impulses and tapered off during pullbacks, pointing to measured profit-taking rather than distribution. That behavior helped XMR stabilize above its recent support zone instead of giving back gains quickly.

From a market perspective, renewed interest in privacy-focused assets and ongoing anticipation around Monero’s FCMP++ upgrade supported sentiment, even as the wider market softened. Structurally, the $420–$430 region remains the key area to hold, while $480–$500 stands as the primary resistance zone to watch for follow-through.

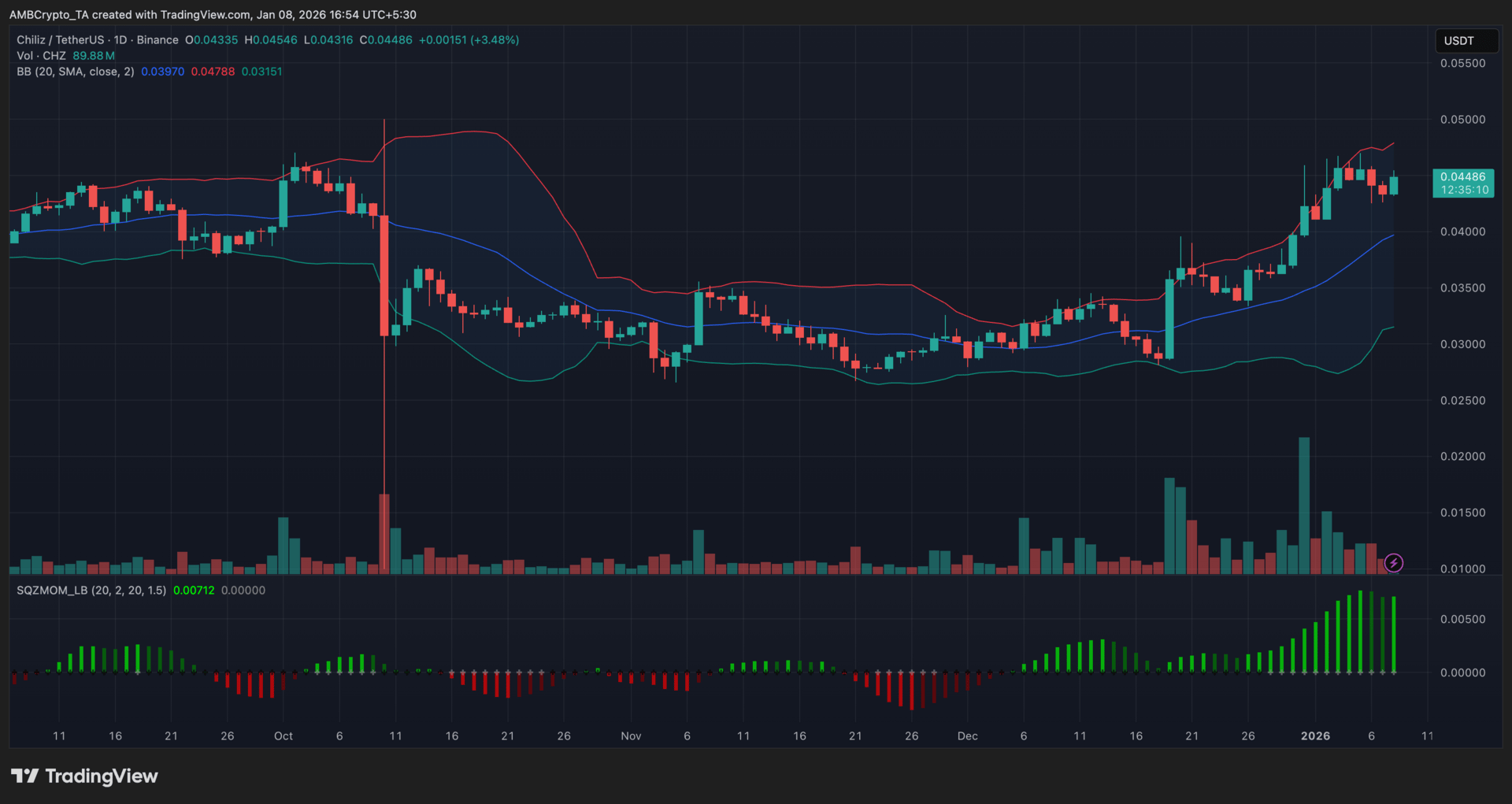

Chiliz (CHZ)

Key points:

CHZ sustained its recent upswing, supported by expanding volatility and follow-through buying after the breakout.

SportFi-linked catalysts and volume expansion helped reinforce momentum, even as short-term cooling emerged.

What you should know:

Chiliz traded firmly after breaking out of its prior consolidation range, with price pushing above the Bollinger Bands’ midline during the rally phase. The widening of the bands confirmed volatility expansion, pointing to broad participation rather than a thin, speculative move.

Beyond technicals, sentiment was supported by growing attention around SportFi use cases, including real-world asset initiatives tied to sports revenue tokenization and early positioning ahead of major global football events. These narratives helped sustain interest as volume expanded sharply during the breakout and remained elevated in subsequent sessions.

While the latest candles suggested consolidation rather than acceleration, the Squeeze Momentum Indicator stayed positive, signaling that bullish pressure persisted despite easing momentum intensity.

Structurally, the $0.043–$0.044 zone now acts as immediate support, while $0.047–$0.048 remains the next resistance area to watch. Holding above the mid-band keeps the broader recovery structure intact, even if price pauses near current levels.

How was today's newsletter? |