- Unhashed Newsletter

- Posts

- Crypto superapps just got SEC backing

Crypto superapps just got SEC backing

Reading time: 5 minutes

SEC’s Paul Atkins ushers in ‘superapp era’ with Project Crypto

Key points:

U.S. SEC Chair Paul Atkins said most tokens are not securities, pledging clear, predictable rules under “Project Crypto.”

The SEC will support the rise of virtual asset superapps, allowing platforms to integrate trading, lending, staking, and custody under one framework.

News - At the OECD Roundtable in Paris, SEC Chair Paul Atkins signaled a sweeping shift in U.S. crypto regulation.

Declaring it “a new day at the SEC,” Atkins said the agency will move away from ad hoc enforcement and toward transparent rules that let innovators thrive. Central to this vision is Project Crypto, a framework designed to unify oversight of trading, lending, and staking activities, while affirming that most crypto tokens do not fall under securities law.

Atkins emphasized that regulation should be the “minimum effective dose” needed to protect investors, cautioning against rules that only large corporations can bear. He also confirmed the SEC will now permit “virtual asset superapps”, platforms offering multiple services in one ecosystem, under a consistent regulatory umbrella.

International cooperation takes center stage - Atkins praised the EU’s MiCA framework as a model of clarity, stressing the importance of global collaboration in fostering innovative markets. He said U.S. regulators have “learned much from Europe’s regulatory experience” and must work with international peers to expand financial freedom and prosperity.

Industry engagement builds momentum - Chainlink CEO Sergey Nazarov recently met with Atkins to discuss integration of blockchain oracles under Project Crypto, underscoring the industry’s growing cooperation with regulators.

Meanwhile, the U.S. Department of Commerce has begun using Chainlink to publish economic data on blockchain networks, highlighting government adoption of decentralized tools.

Outlook - Observers now question whether the SEC’s shift under Project Crypto can successfully balance innovation with investor protection, marking a pivotal test for the agency’s new direction.

XRP battles $3 barrier as institutions buy, sellers cash out

Key points:

XRP drew $14.7 million in institutional inflows last week, second only to Solana, signaling strong demand from professional investors.

Exchange reserves hit multi-year highs, raising questions about whether the surge reflects coordinated accumulation or looming sell pressure.

News - XRP’s price has been caught between bullish institutional demand and mounting sell pressure at exchanges. The token briefly pushed to $3.03 this week before sliding back to $2.94, highlighting resistance near the $3 mark.

CoinShares data shows institutions added $14.7 million into XRP in early September, second only to Solana, underscoring confidence from large investors.

At the same time, more than 235 million XRP worth about $693 million was moved to exchanges, reflecting heightened caution among retail traders. On-chain data from CryptoOnchain revealed synchronized reserve spikes at Binance, Bithumb, Bybit, and OKX, suggesting either coordinated accumulation or an overhang of potential supply.

ETF hopes and macro catalysts - Bloomberg analysts assign odds above 90% for approval of an XRP ETF, with a decision expected in late October. Market watchers say such a move could unlock fresh liquidity and push prices toward $3.34 or $3.60.

Traders are also monitoring the Federal Reserve’s September 17 meeting, where a rate cut could add fuel to risk assets like XRP.

Resistance and support levels - XRP is holding immediate support around $2.94, with analysts pointing to $2.7 as a key floor. A breakout above $3.02 could target $3.34 and beyond, while a failure would likely see the token rangebound.

Futures data shows open interest rising at the CME, reinforcing that institutions remain engaged despite mixed spot market signals.

Outlook - Analysts now debate whether institutions can continue absorbing supply or if sellers will overwhelm momentum at the $3 barrier, making XRP’s next move a closely watched test.

Belarus turns to crypto to counter sanctions pressure

Key points:

President Aleksandr Lukashenko urged banks to expand cryptocurrency and digital payment use as sanctions strain Belarus’ economy.

He ordered regulators to fast-track crypto oversight, warning banks against abusive practices and demanding instant payment rollout by year-end.

News - Belarusian President Aleksandr Lukashenko has doubled down on calls for crypto adoption as the country navigates heavy Western sanctions tied to its support for Russia and alleged rights violations.

At a meeting with banking leaders, Lukashenko pressed for wider use of cryptocurrencies in both domestic finance and cross-border trade, describing digital tokens as vital to combating “unprecedented challenges” faced by the economy.

Cryptocurrency transactions have been legal in Belarus since 2018, but Lukashenko is now urging faster integration, citing a surge in activity across local exchanges. He claimed that external payments via Belarusian crypto platforms could reach $3 billion by year-end, nearly double the $1.7 billion processed in the first seven months.

Regulatory push and warnings to banks - Lukashenko instructed lawmakers to create “transparent rules of the game,” after warning that nearly half of investor funds sent abroad fail to return. He criticized banks for mistreating customers, including forcing insurance on borrowers and rejecting older dollar notes, threatening disciplinary action against offenders starting in 2026.

He also demanded the launch of a national instant payment system this year, signaling urgency in modernizing Belarus’ financial infrastructure.

Sanctions and the crypto workaround - Since 2020, Belarus has been targeted by sweeping sanctions from the U.S., EU, UK, and Canada, cutting off access to major financial rails.

Turning to crypto, Lukashenko positioned digital assets as a workaround for trade and liquidity. He argued that adopting smart contract-powered systems and state-backed mining initiatives could help reduce reliance on intermediaries.

Outlook - Analysts note that Lukashenko’s pivot highlights how crypto is being positioned as a lifeline for sanction-hit economies, though questions remain over whether regulation will balance state control with market growth.

Kraken brings tokenized U.S. stocks to Europe with xStocks

Key points:

Kraken has expanded its xStocks platform to the European Union, offering blockchain-based access to more than 50 U.S. stocks and ETFs.

The launch highlights the surge in real-world asset tokenization, with over $3.8 billion in xStocks trading volume since June.

News - Crypto exchange Kraken has officially launched its tokenized securities product, xStocks, for eligible investors in Europe. Developed in partnership with Swiss fintech Backed, the offering allows users to trade tokenized certificates of popular U.S. equities like Tesla, Apple, and Nvidia, alongside select ETFs.

Each token is backed 1:1 by the underlying security and issued on-chain as an SPL or BNB token, though they do not grant shareholder rights such as dividends or voting. Instead, they mirror the price performance of the assets while being tradable like cryptocurrencies.

Breaking broker barriers - Kraken’s Global Head of Consumer, Mark Greenberg, said the move was designed to lower entry barriers for European investors seeking exposure to U.S. markets.

Clients can trade 24/5 with as little as €1, bypassing traditional brokers and costly conversion fees. Investors also have the option of self-custody, withdrawing their holdings to compatible wallets or using them within DeFi protocols.

Expanding multi-chain access - Since its June launch, xStocks has generated over $3.84 billion in trading volume across centralized and decentralized platforms, according to Dune Analytics.

Kraken has also partnered with Tron DAO and plans to expand token support to BEP-20 on BNB Chain and other networks such as Ink, enhancing multi-chain accessibility.

Outlook - Analysts suggest that Kraken’s EU expansion reflects the broader momentum of tokenized assets, with Nasdaq exploring listings and major consultancies projecting trillions in value by the 2030s.

More stories from the crypto ecosystem

Did you know?

TMTG’s social platform, Truth Social, abandoned plans for its own token and instead integrated Crypto.com’s CRO token, enabling users, especially paid subscribers, to earn “Truth gems” convertible into CRO via Crypto.com wallet infrastructure. This pivot sent CRO's value up nearly 7% today.

Legacy financial giant Fidelity stepped into tokenized finance by introducing the Fidelity Digital Interest Token (FDIT), an on-chain money-market fund powered by Ondo, marking a landmark move by an established asset manager into decentralized money-earning products.

The combined market capitalization of dollar-linked stablecoins has more than doubled over the past 18 months, reaching almost $280 billion: a boom aided by the U.S. regulatory clarity from July’s “Genius Act,” though they still comprise just about 1% of global transaction volume.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Top 3 coins of the day

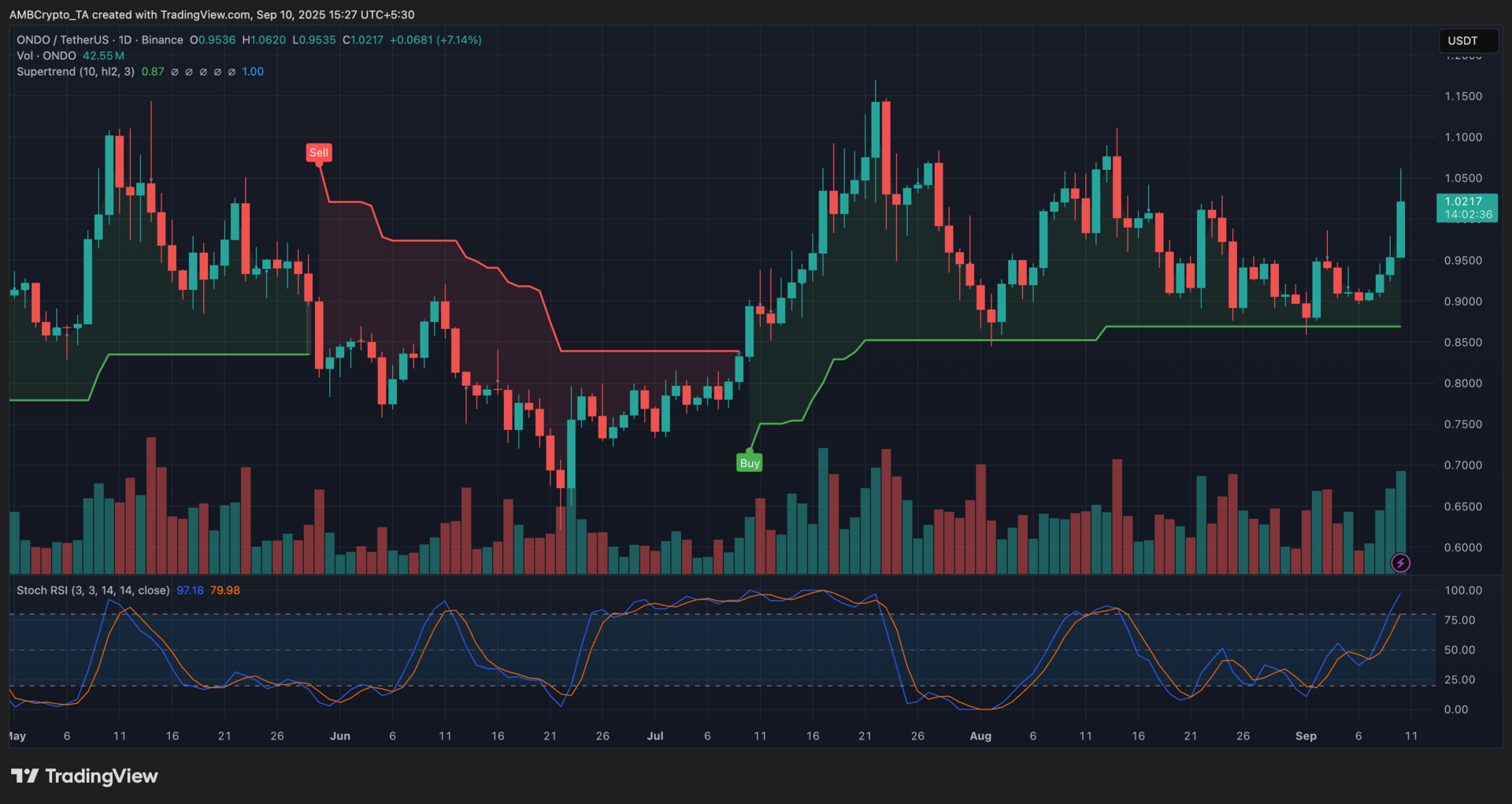

Ondo (ONDO)

Key points:

At press time, ONDO was trading at $1.02, marking a 7.14% gain over the last 24 hours.

The Supertrend has stayed in buy mode since mid-July, while the Stochastic RSI pushed into overbought territory, and volume rose to 42.55M.

What you should know:

ONDO climbed above the $1.00 level as buying pressure intensified. The Supertrend flipped bullish in mid-July and has held its signal since, while the Stochastic RSI surged above 80, indicating strong upward momentum but also potential overbought conditions. Trading volume expanded notably, suggesting heightened participation during the move. From a broader perspective, ONDO’s rally coincided with renewed strength in the Real-World Asset (RWA) sector, where tokenized products like Ondo’s USDY and OUSG continue to attract institutional interest. Regulatory progress also played a role, with Indonesia adding ONDO to its list of legally tradable assets this month, complementing earlier CFTC guidance supportive of compliant projects. ONDO now faces resistance near $1.05. If buyers hold the $1.00 threshold, the next upside target lies in the $1.14–$1.26 zone. A drop below $0.93 could weaken the bullish case.

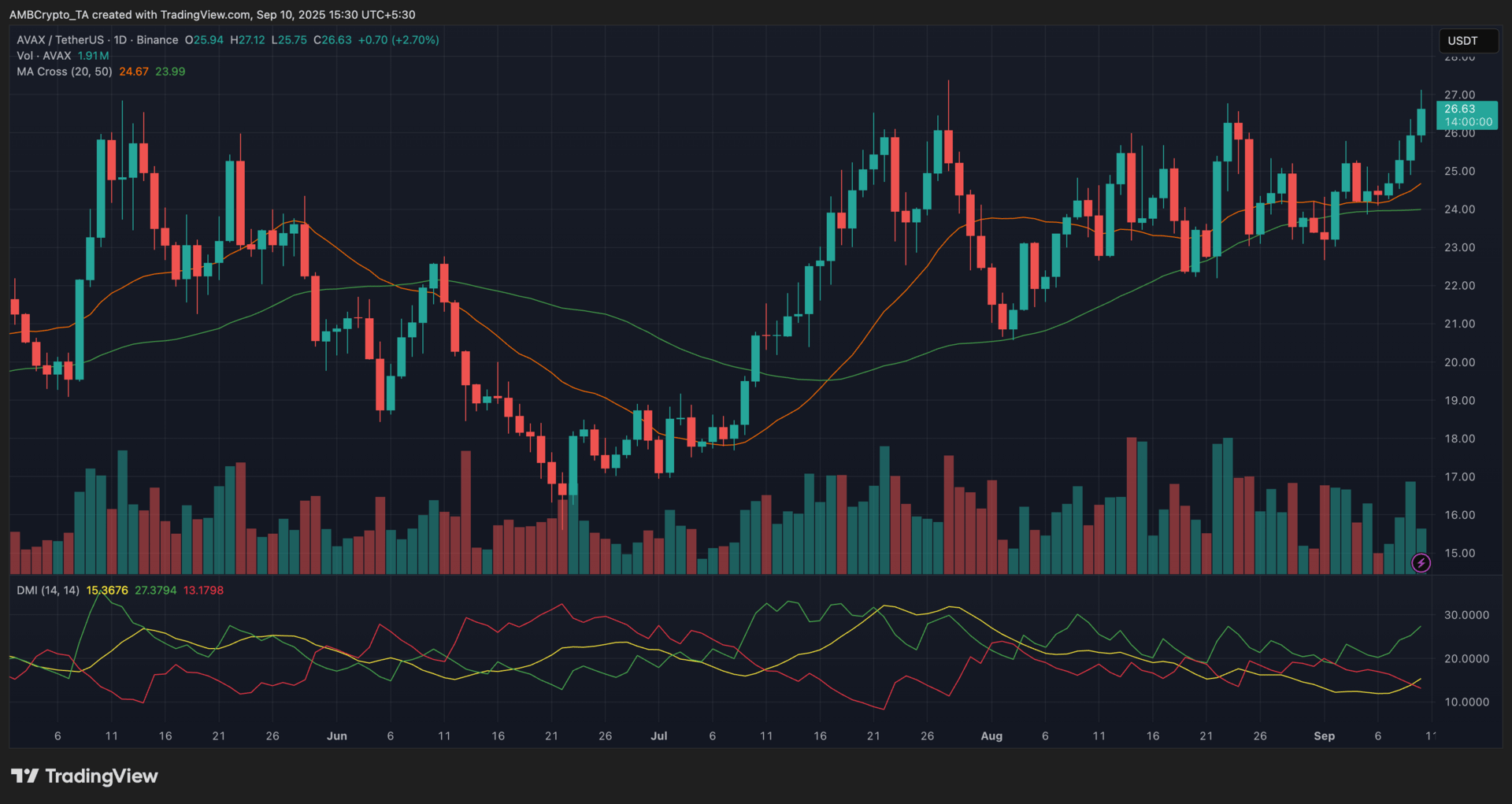

Avalanche (AVAX)

Key points:

At press time, AVAX was trading at $26.63, reflecting a 2.70% increase in the past 24 hours.

The 20-day MA remained above the 50-day MA, while the DMI signaled a bullish edge with +DI over -DI, though trend strength stayed modest.

What you should know:

AVAX extended its climb as bulls maintained control above the $25.50 support zone. The 20-day moving average held firm above the 50-day, reinforcing the ongoing uptrend. Meanwhile, the DMI confirmed positive momentum, though the ADX suggested the trend was not yet strongly established. Trading volumes hovered around 1.91M, steady but not explosive. On the fundamental side, speculation around Bitwise’s rumored AVAX ETF filing added institutional optimism, while Avalanche’s C-Chain hit a record 35.8M transactions in August, driven by real-world asset activity and memecoins. If buyers sustain pressure, the next resistance lies near $27.20, with a potential move toward $28.00. However, slipping below $25.50 could test the $23.90 support zone.

OFFICIAL TRUMP (TRUMP)

Key points:

At press time, TRUMP was trading at $8.79, recording a 1.38% gain over the past 24 hours.

The 9-day SMA hovered near $8.49, while the RSI stayed neutral at 52.90, reflecting consolidation rather than strong momentum.

What you should know:

TRUMP traded sideways as it attempted to build support above $8.50. The 9-day SMA provided a near-term cushion, though momentum indicators suggested caution. The RSI held close to neutral, signaling a lack of strong buying pressure despite the modest uptick. Daily volumes remained light at 1.37M, consistent with consolidation phases. Non-technical factors weighed on sentiment. A major 50M token unlock (~$520M) on July 18 expanded circulating supply, and while Trump-affiliated entities hinted at buybacks, their impact faded into September. Meanwhile, profit-taking after last week’s 5% rally and waning retail buzz contributed to muted upside. If bulls reclaim $9.13, the next resistance lies at $9.38, while support remains firm at $8.52. Sustained closes below that level could risk a retest of $7.14, TRUMP’s 2025 low.

How was today's newsletter? |