- Unhashed Newsletter

- Posts

- ETF inflows power Ethereum price rally

ETF inflows power Ethereum price rally

Reading time: 5 minutes

Bitcoin soars to new heights, calm market indicates room for further growth

Key points:

Bitcoin hits $122K with calm markets and strong institutional backing.

On-chain signals hint at more upside, but caution looms.

News - Bitcoin just shattered records again, soaring to a new all-time high of $122,788, but what’s more intriguing is the calm that’s followed. Unlike past rallies marked by frantic selling and wild volatility, long-term holders are sitting tight, and on-chain metrics suggest we haven’t even hit peak euphoria yet.

With July shaping up to be Bitcoin’s third straight green month and no major signs of overheating, could this be the calm before an even bigger storm?

What could be behind this? - Much of the momentum stems from institutional interest, particularly BlackRock’s spot Bitcoin ETF, IBIT, which just crossed a staggering $83 billion in assets under management.

To put it in perspective, IBIT reached this milestone in just 374 days, five times faster than the previous record-holder. With over 700,000 BTC under its belt, BlackRock’s ETF has overtaken many industry giants, firmly cementing Bitcoin's mainstream investment appeal.

Yet what makes this rally even more remarkable is the steady composure in the market. On-chain metrics, like the Long-Term Holder Net Unrealized Profit/Loss, remain below euphoria thresholds, suggesting room for further growth. Remarking on which Bitcoin analyst Axel Adler Jr. said,

“There are no signs of active coin selling in the market. This strengthens both the fundamental and technical bullish signal.”

Meanwhile, transaction volumes are climbing, but still sit below peak bull-cycle levels, hinting that Bitcoin may be revving up for something even bigger. Contributing to this bullish sentiment is Michael Saylor, who teased another major BTC acquisition from Strategy, his firm that briefly paused a 12-week buying spree.

Will this momentum continue or fade out? - While all this is impressivie, it is flashing mixed signals beneath the surface. On one hand, reduced miner selling, strong investor demand, and bullish spot flows have fueled the rally. On the other, warning signs are emerging, exchange stablecoin reserves are drying up, trading volume is cooling, and key valuation metrics like NVT and NVM suggest the market may be overheating.

Though bulls still dominate, the weak trend strength and fading participation raise the possibility of a near-term consolidation. Therefore, the coming days could be pivotal in deciding whether BTC sustains this momentum or takes a much-needed breather.

Ethereum sets sights on $3K amid nine straight weeks of positive ETF inflows

Key points:

On-chain indicators signal Ethereum’s early-stage breakout potential.

Institutional inflows and technical momentum fuel ETH’s climb toward $3.2K.

News - Ethereum is stepping back into the spotlight as Q3 unfolds, with strong institutional interest and bullish on-chain indicators pointing to a potential breakout. ETH has now seen nine straight weeks of positive ETF inflows, with traders and analysts eyeing a parabolic rally ahead. Now, with Bitcoin in price discovery mode, Ethereum may be next in line to set a new all-time high.

What indicators are supporting this? - The current momentum has propelled ETH above the key $2.8K level, signaling intense buyer interest and renewed confidence in its long-term potential. The rally also comes as Ethereum continues to gain ground against Bitcoin, with the ETH/BTC pair showing signs of recovery, an encouraging sign for altcoin dominance.

However, despite the strong upward move, technical charts suggest that a brief pullback to the $2.8K support zone may be on the cards before Ethereum attempts to breach the psychological $3K barrier. However, on-chain indicators such as a high RSI and robust capital inflows reflected in the CMF point to continued buying pressure.

Furthermore, CoinGlass liquidation data reveals significant liquidity clustering above $3K, suggesting price action is likely to chase those levels soon. With Bitcoin in price discovery and Ethereum’s fundamentals aligning, the stage seems set for ETH to continue its upward trajectory, possibly toward the $3.2K mark, should market conditions hold.

What’s ahead? - In fact, for the first time in months, the MVRV Z-Score has moved into positive territory, a shift that often signals the beginning of a new upward cycle, especially when still far below the typical cycle top levels.

Adding to the bullish outlook, the Spent Output Profit Ratio (SOPR) has not only surged above the neutral level of 1 but also successfully retested it as support, indicating that the majority of on-chain participants are now realizing profits.

Furthermore, the Net Unrealized Profit/Loss (NUPL) indicator has moved decisively into the "optimism" zone, crossing the critical 0.3 mark. This transition confirms that a growing portion of the market is sitting on unrealized gains, yet without triggering the kind of euphoria typically seen at market tops.

Taken together, these indicators suggest that Ethereum could be in the early stages of a powerful breakout. If past patterns are any guide, ETH may soon experience accelerated price appreciation, potentially pushing it toward a new all-time high.

Dolce & Gabbana’s U.S. arm cleared in lawsuit over failed NFT project

Key points:

Dolce & Gabbana USA dismissed from NFT lawsuit due to insufficient legal linkage.

The judge ruled that shared leadership doesn't prove the U.S. arm is controlled by the Italian parent.

News - In 2022, Dolce & Gabbana unveiled its ambitious “DGFamily” NFT project, promising exclusive digital wearables, real-world fashion perks, and immersive experiences. But fast forward to 2025, and the project has landed in legal hot water.

A group of NFT buyers has accused the luxury brand of abandoning the initiative after raking in over $25 million in sales, leaving promised benefits undelivered and investors feeling shortchanged.

What happened? - In a significant legal win, Dolce & Gabbana’s U.S. division has been dismissed from a proposed class-action lawsuit surrounding the failed NFT venture. A New York federal judge ruled that the U.S. entity could not be held accountable for the actions of its Italy-based parent company, stating it wasn't an “alter ego.”

With the U.S. arm out and international defendants yet to be served, the future of the lawsuit hangs in uncertainty, raising broader questions about accountability in cross-border NFT ventures.

How did it conclude? - In the end, the court found the plaintiffs’ arguments lacking in substance and specificity. Despite claims of overlapping leadership and shared operations between Dolce & Gabbana’s U.S. and Italian entities, Judge Buchwald concluded that there was insufficient evidence to prove that the American arm was under the direct control of its parent company.

Emphasizing that shared executives and office space alone didn’t establish legal liability, the judge put it best when she stated,

“The Court finds that plaintiff has not adequately alleged that D&G S.R.L. completely dominated D&G USA.”

Bank of England takes cautious stance on digital money, opposes stablecoins from big banks

Key points:

BoE backs tokenized deposits, warns stablecoins could destabilize banking and enable crime.

UK and US diverge sharply on stablecoin policy amid digital currency transformation.

News - As the global race to digitize money intensifies, Bank of England Governor Andrew Bailey is drawing a bold line in the sand by saying no to stablecoins from big banks. This is in sharp contrast to the U.S., where Trump-era policies are fueling a stablecoin boom.

What are the concerns? - Bailey has voiced deep concerns that privately issued stablecoins could destabilize banking systems, drain lending capacity, and open floodgates for financial crime. He warns that allowing banks to issue their own coins could threaten monetary stability, hamper lending, and open doors to large-scale financial crime.

Spotlighting the potential for liquidity shocks and disintermediation, Bailey said,

“If stablecoins take money out of the banking system, banks have less capacity to lend.”

His comments echo broader European concerns, where regulators are tightening the reins on USD-backed stablecoins to protect euro sovereignty, marking a clear philosophical and regulatory divide from the U.S.'s more aggressive embrace of crypto innovation.

What’s more? - As chair of the Financial Stability Board, his concerns extend beyond national borders, highlighting the global risks posed by unregulated stablecoin flows. So, while the U.S. charges ahead with new legislation like the GENIUS Act and supports projects like the Trump-affiliated USD1 stablecoin, the UK is opting for a more measured approach, prioritizing tokenized deposits that align with existing financial systems.

More stories from the crypto ecosystem

Did you know?

Back in August 2010, a hidden flaw in Bitcoin's code allowed someone to generate 184 billion BTC, which is far beyond its cap. Though Satoshi Nakamoto swiftly patched the glitch, it remains one of crypto’s most mysterious exploits to date.

A glitch during Binance’s $PENGU listing misrepresented its value at one-tenth the actual price. To make amends, Binance airdropped 135 million PENGU tokens to impacted traders.

In 2014, Vitalik Buterin was awarded the $100,000 Thiel Fellowship, an opportunity that led him to drop out of university and dive headfirst into blockchain development, ultimately leading to Ethereum's creation.

Top 3 coins of the day

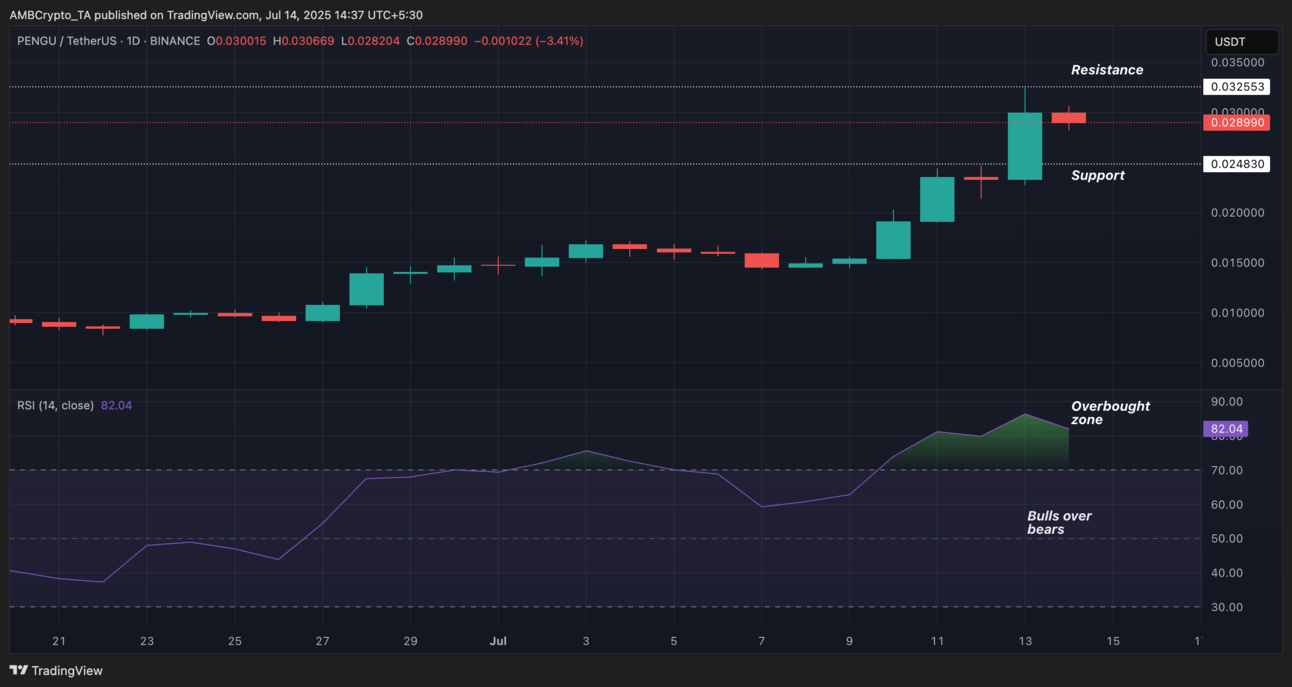

Pudgy Penguins (PENGU)

Key points:

PENGU surged 22.22% to $0.0289, but RSI shows it's now in the overbought zone.

A pullback is likely if it hits $0.0325 without consolidating above $0.024 support.

What you should know:

At press time, PENGU was trading at $0.0289, marking a notable 22.22% increase over the past 24 hours. This strong price action has been backed by bullish momentum, as indicated by the Relative Strength Index (RSI), which currently sits above the neutral 50 level, typically a signal of sustained buying pressure. However, a closer look at the RSI reveals that the asset has now entered the overbought zone, which often precedes a short-term price correction. Therefore, to maintain its bullish structure, PENGU will need to stay above or near the immediate support level of $0.024. On the flip side, if the price rallies further and tests the key resistance level at $0.0325 while still in the overbought zone, the likelihood of a pullback grows significantly. A failure to break this resistance with strong volume could trigger a wave of selling, potentially pushing the price back toward lower support levels.

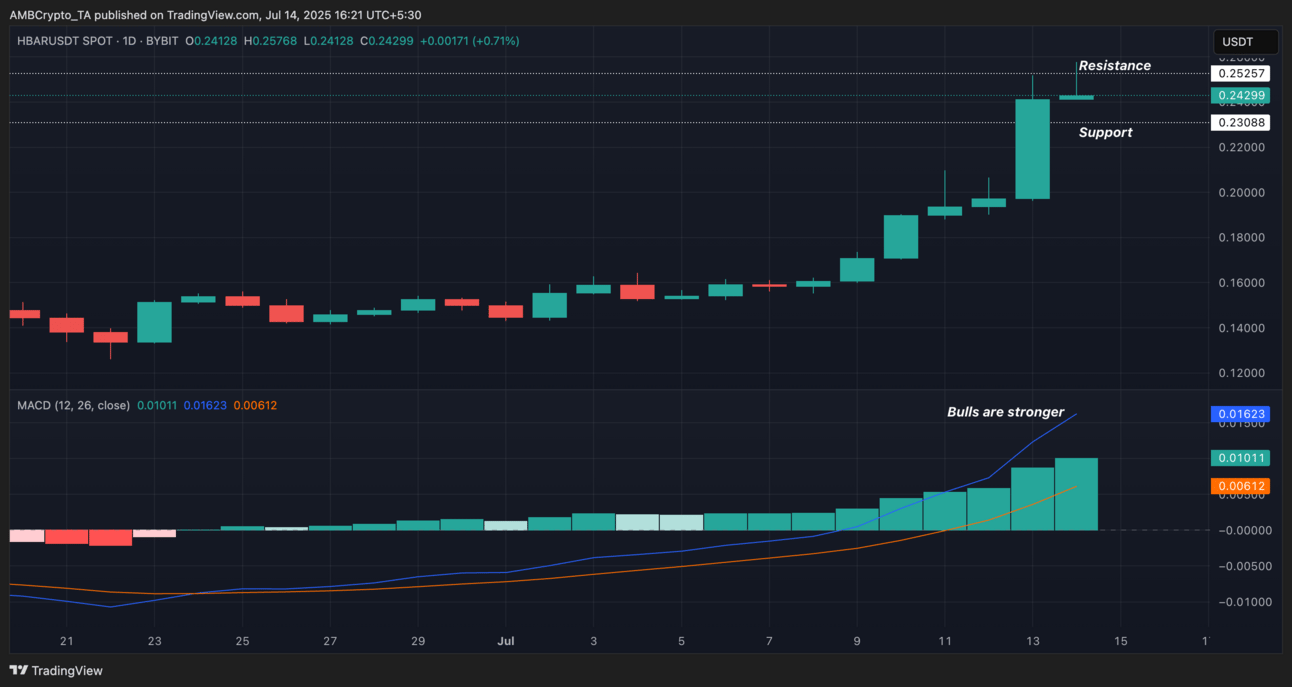

Hedera (HBAR)

Key points:

HBAR shows bullish momentum with MACD signaling strong upward pressure.

Price must hold above $0.230 to avoid a bearish reversal.

What you should know:

Ranked 15th on CoinMarketCap, HBAR was trading at $0.242 at press time, reflecting a 6.7% gain over the past 24 hours. Technical indicators suggest that bullish momentum is currently in play. The MACD stands above the neutral zone, with the MACD line positioned above the signal line and accompanied by green histograms, an indication of strengthening upward pressure. However, for this bullish trend to sustain, HBAR needs to approach but not decisively break past the immediate resistance level at $0.252. If the price consolidates near this zone, it could support further upside movement. On the flip side, failure to hold this momentum may expose the altcoin to a potential retracement toward the support level at $0.230.

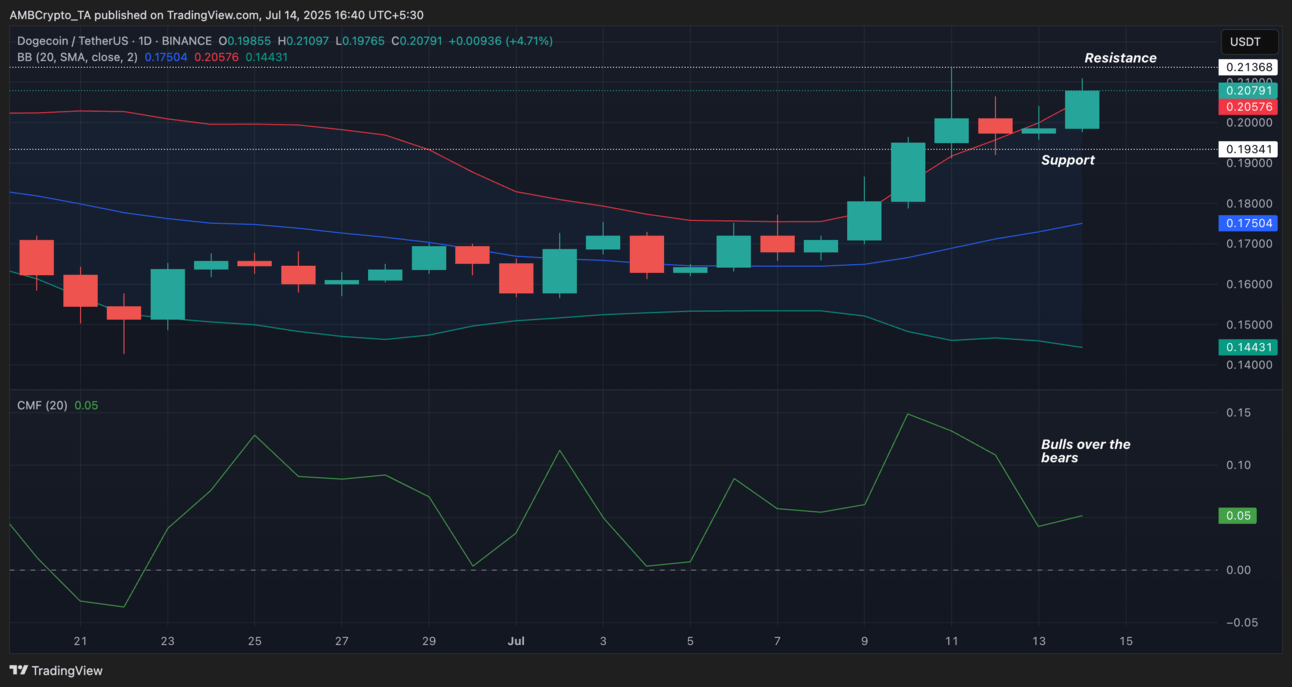

Dogecoin (DOGE)

Key points:

DOGE shows bullish momentum with strong inflows and rising price volatility.

A break above $0.213 may trigger a rally, but failure risks drop to $0.193 support.

What you should know:

At press time, DOGE was trading at $0.207, reflecting a 4.9% increase over the past 24 hours, according to CoinMarketCap. The Chaikin Money Flow (CMF) indicator supported this bullish trend, staying above the neutral line, suggesting strong capital inflow and continued buying interest. However, the widening of the Bollinger Bands signals rising price volatility, indicating that significant price movement, either upward or downward, could be imminent. Thus, to maintain its upward momentum, DOGE needs to break and hold above the immediate resistance level at $0.213. A decisive breakout above this point could trigger a fresh rally. However, if the price fails to breach this resistance and buying pressure weakens, the coin may retrace toward the support level at $0.193. A breakdown below this level could shift sentiment bearish, increasing the risk of further downside.

How was today's newsletter? |