- Unhashed Newsletter

- Posts

- ETH whales accumulate as $3K returns

ETH whales accumulate as $3K returns

Reading time: 5 minutes

Ethereum reclaims $3K as whales accumulate amid mixed institutional signals

Key points:

Ether rebounded over 10% to reclaim the $3,000 level as large holders continued to accumulate and exchange balances fell to multi-year lows.

Institutional flows remained mixed, with heavy ETH fund outflows tied to US regulatory delays, even as corporate treasuries kept buying.

News - Ethereum climbed back above $3,000 this week after bouncing from its December lows, marking a sharp recovery driven by sustained on-chain accumulation and a pickup in network activity.

Data showed whale wallets steadily adding ETH over recent months, while the amount of ether held on centralized exchanges dropped to its lowest level in nearly nine years. This combination reduced readily available supply as activity indicators across the network began to improve.

Ethereum’s network usage showed renewed momentum during the rebound. Active addresses and transaction counts increased over the past week, alongside a rise in new wallet creation.

Analysts noted that scaling improvements expected in January, which are set to increase network throughput, could further support activity levels that are already trending higher.

Whale accumulation and corporate buying - Large holders continued to add ETH during the recent pullback, highlighting a clear divergence between whale behavior and smaller investors. On-chain metrics showed bigger wallets accumulating while retail-sized holders reduced exposure, pointing to redistribution rather than broad speculative inflows.

That accumulation trend extended to corporate treasuries. BitMine Immersion Technologies disclosed the purchase of nearly 99,000 ETH last week, lifting its total holdings above 4 million tokens.

The acquisition, valued around $300 million, was made as prices dipped below $2,800, underscoring continued long-term positioning despite the firm sitting on sizable unrealized losses.

Regulatory overhang weighs on funds - Crypto investment products recorded their first weekly outflows in four weeks, with Ethereum leading the losses.

According to CoinShares, the pullback was driven largely by renewed US regulatory uncertainty following delays tied to the Clarity Act. While Ethereum’s year-to-date inflows remain elevated, the episode highlighted how closely institutional positioning has tracked legislative developments.

Levels and momentum in focus - Traders are now watching whether Ethereum can hold above the $3,040 area, which has emerged as a near-term support zone.

On the upside, $3,470 remains a key resistance level that capped a prior rebound earlier this quarter. A decisive break above that level could open the path toward higher targets, while a loss of $2,940 would risk renewed selling pressure. Regulatory clarity in the US remains a key variable shaping sentiment alongside these technical thresholds.

BlackRock backs Bitcoin for 2025 as santa rally hopes clash with weak demand

Key points:

BlackRock named its Bitcoin ETF a top 2025 investment theme despite Bitcoin slipping over 4% year-to-date and ETF outflows weighing on sentiment.

Bitcoin’s move near $90,000 revived Santa rally speculation, but futures-led momentum and weak US demand have raised durability concerns.

News - BlackRock has doubled down on Bitcoin’s long-term role in portfolios, naming its iShares Bitcoin Trust among its top three investment themes for 2025. The endorsement came despite Bitcoin posting its first year-to-date decline in three years and the ETF itself underperforming several higher-fee alternatives.

The move stood out because IBIT has not been BlackRock’s strongest performer this year. Even so, it has attracted over $25 billion in inflows since January, ranking among the most popular ETFs by new investment.

Analysts interpreted the decision as a signal of conviction rather than short-term product promotion, especially as BlackRock highlighted Bitcoin alongside cash and US equity strategies.

$90K Bitcoin rally faces structural doubts - Bitcoin briefly climbed above $90,000 earlier this week, but on-chain and flow data pointed to a derivatives-driven move rather than broad spot demand.

Futures open interest increased while spot buying lagged, a pattern that has previously struggled to sustain momentum. The Coinbase premium also turned negative, signaling softer demand from US investors, while US-listed spot Bitcoin ETFs continued to record net outflows.

Corporate treasuries stood out as the main source of support. Digital asset trusts saw roughly $2.23 billion in inflows last week, the strongest weekly increase since September, driven by balance sheet accumulation across Bitcoin, Ethereum, and XRP.

Santa rally optimism meets caution - Seasonal optimism added another layer to the debate. Historically, US equities tend to rally in the final week of December and early January, a pattern that some analysts believe could lift Bitcoin sentiment due to tighter links between crypto and stock markets. Still, Bitcoin’s own holiday track record has been uneven, and prediction markets continue to assign low odds to a sustained year-end surge.

Meanwhile, derivatives metrics showed short liquidations dominating recent price action, offering tactical upside as long as Bitcoin holds above the $84,000 support zone. A failure to defend that level, however, could expose the rally to renewed downside pressure.

Long-term conviction, near-term uncertainty - While short-term signals remain mixed, long-term projections remain bold.

Galaxy Digital forecast Bitcoin reaching $250,000 by 2027, citing institutional adoption and maturing market structure. Even so, its research team warned that 2026 could prove difficult to predict, underscoring the gap between long-term optimism and near-term caution that continues to define Bitcoin’s outlook.

Aave governance backlash deepens as brand vote sparks price slide

Key points:

A rushed governance vote over control of Aave’s brand assets triggered backlash from delegates and sent AAVE down over 10%.

Critics say the escalation exposed deeper tensions around governance process, founder influence, and offchain control.

News - Aave is facing renewed scrutiny after a governance proposal on brand ownership was pushed to a Snapshot vote amid unresolved community debate.

The proposal asks whether AAVE token holders should regain control of key brand assets, including domains, social media handles, naming rights, and intellectual property, via a DAO-controlled legal structure.

The decision to fast-track the vote sparked immediate backlash. Aave founder Stani Kulechov said the community was ready to decide after several days of discussion, arguing that moving to a vote followed established governance norms.

However, multiple stakeholders disputed that characterization, warning that the process limited participation and cut short meaningful deliberation.

“Rushed” escalation draws internal pushback - Former Aave Labs CTO Ernesto Boado, whose name appeared on the proposal, said it was escalated without his consent or knowledge. He stated that he would not have approved a vote while discussion was still active, calling the move a breach of trust.

Marc Zeller of the Aave Chan Initiative echoed those concerns, describing the escalation as unilateral and poorly timed, particularly given the holiday period, which he said historically suppresses delegate participation.

Zeller warned that what began as an attempt to clarify the relationship between token holders and protocol stewards was now being framed by some as a hostile takeover attempt by Aave Labs.

Token sell-off reflects governance fears - Market reaction was swift. AAVE fell more than 10% within 24 hours, with reports pointing to a roughly $50 million sell-off as governance tensions intensified.

The sell-off coincided with broader allegations that Aave Labs redirected frontend swap revenue without explicit DAO approval following an integration change, further amplifying concerns around transparency and control.

Prediction markets reflected low confidence in the proposal’s outcome, while traders warned that a failed vote could deepen downside pressure on the token.

A broader test for DAO governance - Beyond price action, the dispute has reignited a familiar DeFi question. While DAOs can govern on-chain contracts, control over brands, interfaces, and distribution often remains offchain, where legal structures and incentives can diverge.

As the Snapshot vote proceeds, the episode highlights ongoing challenges around escalation, accountability, and decision-making in large DeFi protocols.

Hong Kong weighs crypto access for insurers under strict capital rules

Key points:

Hong Kong regulators are reviewing rules that could allow insurers to invest in cryptocurrencies under a 100% capital charge framework.

The proposal signals cautious institutional approval and could open part of the city’s $82 billion insurance market to digital assets.

News - Hong Kong Insurance Authority is reviewing a proposal that would allow insurance companies to allocate capital to cryptocurrencies and related infrastructure projects, Bloomberg reported. Any crypto exposure would carry a 100% risk charge, requiring insurers to hold regulatory capital equal to the full value of their crypto positions.

The review forms part of a broader update to Hong Kong’s risk based capital regime, aimed at supporting the insurance sector and economic development while maintaining conservative safeguards.

Industry feedback is currently being assessed, with the proposal set to enter public consultation from February through April 2025, followed by legislative submissions later in the year.

A cautious opening for institutional capital - Under the proposal, direct crypto holdings would face the strictest capital treatment, reflecting concerns around volatility. Stablecoins, however, would be treated differently, with risk charges tied to the fiat currencies they are pegged to, making them more capital efficient from a regulatory standpoint.

Hong Kong’s insurance sector is sizable. The city hosts 158 authorized insurers and recorded roughly HK$635 billion, or about $82 billion, in gross premiums last year. Even limited allocations under the proposed framework could bring institutional capital into the digital asset market.

Part of a broader policy push - The crypto provisions are not being considered in isolation. The framework also includes incentives for infrastructure investment, aligning with Hong Kong’s efforts to channel private capital into priority projects amid fiscal pressures.

This approach reflects Hong Kong’s broader stance on digital assets. Hong Kong Monetary Authority has rolled out its Fintech 2030 strategy and implemented a stablecoin regulatory framework, reinforcing the city’s ambition to position itself as a regulated hub for institutional crypto activity.

Regional contrast takes shape - Hong Kong’s move stands apart from some regional peers that continue to limit insurers’ direct exposure to cryptocurrencies.

By pairing strict capital requirements with explicit regulatory permission, the city is signaling controlled acceptance rather than prohibition. The outcome of the consultation process could influence how insurance capital engages with digital assets and whether Hong Kong’s approach shapes future regulatory thinking in the region.

More stories from the crypto ecosystem

MoonPay President warns banks: ‘Can’t freeze progress’ on tokenization

Kaspa eyes breakout past the $0.048 local resistance: Can it happen?

Bitcoin reacts to $6.8B Fed liquidity – Is a 2026 bull run taking shape?

Bitcoin sheds $716B since ATH – Here’s what’s weighing on BTC

Aave CEO’s ‘no vote’ on token alignment proposal sparks more backlash

Did you know?

A “digital bond” milestone just got a social impact twist: On December 3, 2025, IFC invested $100 million in Akbank’s digitally-issued gender bond, described as the world’s first digital gender bond, issued and settled using distributed ledger technology (DLT) with T+0 settlement.

The World Bank is putting public money on-chain for transparency: In September 2025, the World Bank Group rolled out FundsChain, a blockchain-based tool to track development project funds, after testing it in 13 projects across 10 countries, with plans to scale it to around 250 projects by June 30, 2026.

Crypto ETFs posted a blockbuster inflow week this fall: While crypto prices grabbed headlines, the bigger story played out quietly in October, when ETFs attracted a record $5.95 billion in weekly inflows, led by U.S. investors.

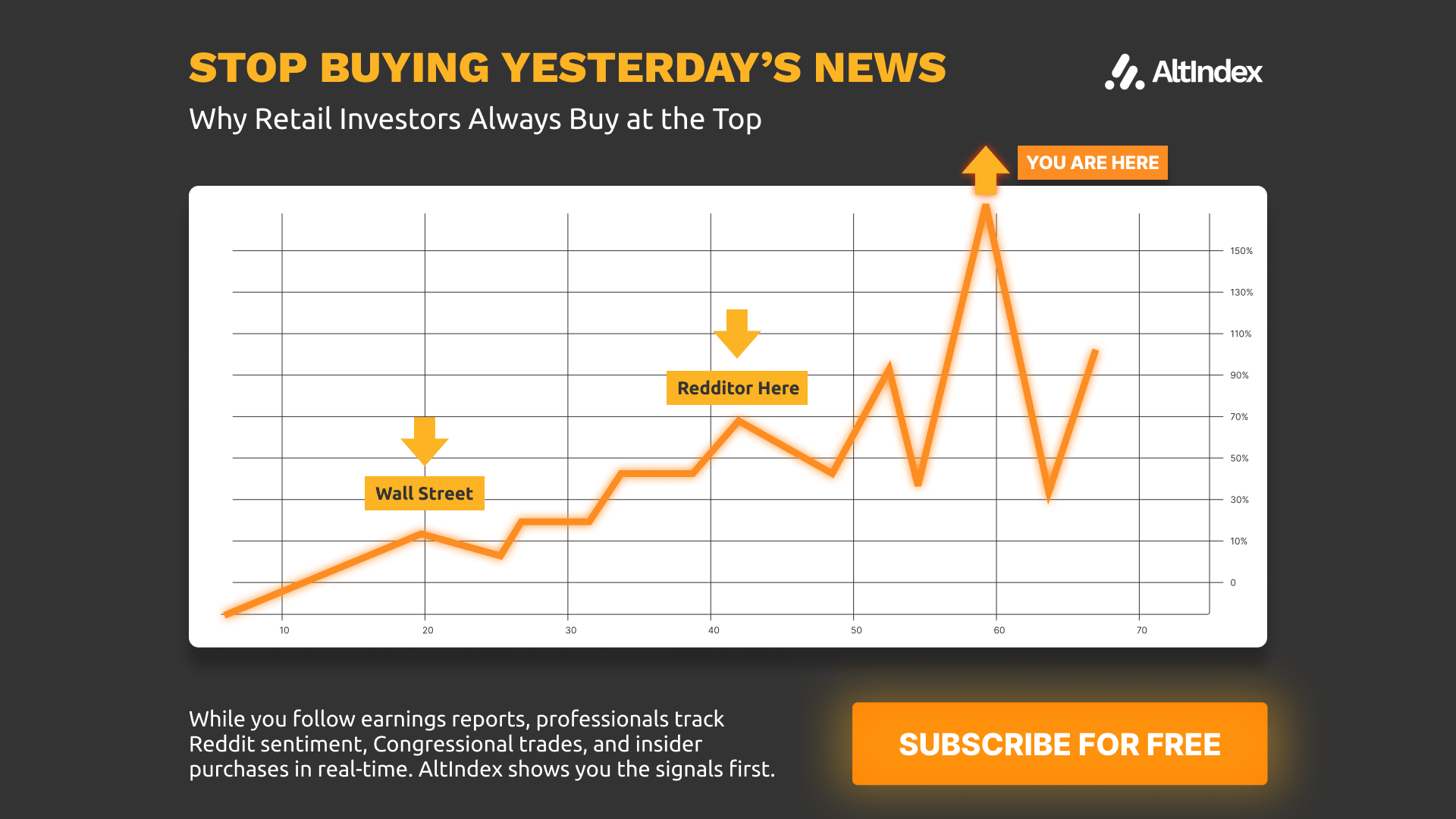

If You Could Be Earlier Than 85% of the Market?

Most read the move after it runs. The top 250K start before the bell.

Elite Trade Club turns noise into a five-minute plan—what’s moving, why it matters, and the stocks to watch now. Miss it and you chase.

Catch it and you decide.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

Top 3 coins of the day

NEAR Protocol (NEAR)

Key points:

NEAR climbed to around $1.57, marking a daily gain of over 4%, as short-term buyers stepped in after recent weakness.

The rebound unfolded while the MA ribbon stayed bearishly aligned and the EWO remained negative, signaling a relief move rather than a confirmed trend shift.

What you should know:

NEAR attempted a recovery after sliding steadily through December, with price bouncing from the $1.50 zone on a noticeable uptick in volume. Despite the move higher, NEAR continued trading below its MA ribbon, where the 20-day and 50-day averages remained under the longer-term 100-day and 200-day lines. This kept overhead pressure intact and capped upside momentum. The EWO stayed below zero, though the latest red bars shortened slightly, hinting that selling pressure had begun to stabilize instead of intensify. Volume expanded during the rebound, but it failed to match earlier sell-off spikes, reinforcing the idea of tactical dip-buying rather than strong accumulation. On the narrative side, NEAR drew attention from its expanding AI-focused ecosystem and recent cross-chain functionality through NEAR Intents, which may have helped underpin short-term demand. For now, $1.50 remains a key support to watch, while the $1.65–$1.75 region stands as the immediate resistance zone.

Sei (SEI)

Key points:

SEI traded near $0.11 after stabilizing from a broader downtrend, with price action still capped below short-term averages.

The Stochastic RSI hovered near oversold territory, hinting at easing selling pressure but without a confirmed reversal.

What you should know:

SEI’s price action remained under pressure after it slipped below the $0.12 zone earlier in the week, a level that previously acted as a short-term floor. The decline unfolded with strong sell-side volume, though activity cooled as the token moved into consolidation near $0.11. Price continued to trade below the 9-day SMA, reinforcing that near-term momentum stayed tilted toward sellers. That said, the Stochastic RSI dipped close to its lower band and began to curl upward, suggesting that downside momentum had started to lose intensity. Volume during the recent sideways movement appeared more balanced, pointing to cautious positioning rather than aggressive distribution. On the non-technical front, SEI drew attention as Upbit announced a temporary suspension of deposits and withdrawals for a scheduled network upgrade. While the pause likely reduced short-term liquidity, it also kept the token in focus. Going forward, $0.10 remains the immediate support to watch, while $0.12 stands as the first resistance zone that needs to be reclaimed.

Solana (SOL)

Key points:

Solana was last seen trading near $127, posting modest gains over the past 24 hours despite remaining within a broader downtrend.

The price stayed below the Bollinger midline, while CMF remained negative, reflecting cautious participation rather than strong accumulation.

What you should know:

Solana’s recent move higher came after an extended decline, with price action previously tracking the lower Bollinger Band before stabilizing. Although short-term selling pressure eased, SOL continued to trade below the 20-day basis, signaling that bearish structure had not fully reset. The Bollinger Bands remained wide, pointing to ongoing volatility rather than consolidation. Volume patterns suggested that earlier sell-offs were driven by stronger participation, while the latest sessions showed lighter turnover, indicating reduced urgency from sellers rather than aggressive dip-buying. Meanwhile, CMF hovered below the zero line, confirming that capital inflows stayed limited during the rebound. On the narrative front, fresh USDC minting on Solana supported liquidity conditions across the ecosystem, helping stabilize sentiment. Broader institutional exploration around Solana also contributed to resilience, though price action showed traders remained selective. For now, $120 stands as immediate support, while the $135 to $140 zone acts as the first area to reclaim for any sustained recovery.

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

How was today's newsletter? |