- Unhashed Newsletter

- Posts

- Ethereum faces its make-or-break November

Ethereum faces its make-or-break November

Reading time: 5 minutes

Ethereum’s November crossroads: Short bets rise as altcoin rotation builds

Key points:

ETH dropped below $4,000 as analysts debated whether growing short positions signal deeper weakness or a setup for a rebound.

Institutional flows show capital shifting toward altcoin ETFs even as Ethereum ETFs see outflows, hinting at a broader market rotation.

News - Ethereum fell under $4,000 amid rising short interest and diverging institutional sentiment. Research firm 10x Research suggested shorting ETH over BTC in November, citing the fading “digital treasury” narrative and continued ETF outflows.

Data from SoSoValue showed Ether ETFs recording outflows of about $312 million and $244 million in the final two weeks of October, alongside a single-day outflow of roughly $ 184 million as one issuer reportedly sold a large portion of holdings.

At the same time, analysts noted that these periods of excessive short positioning have historically preceded rebounds.

Santiment’s data showed funding rates turning negative as traders built new shorts, a setup that has often led to short squeezes in past cycles. The Ethereum network’s activity index also reached record highs in October, signaling strong on-chain fundamentals even as leverage dominates market sentiment.

Altcoin flows reshape the institutional narrative - While Ethereum faces pressure, new filings for altcoin ETFs and growing Q3 inflows, $9.6 billion into Ether ETFs versus 8.7 billion into Bitcoin ETFs, reflect continued appetite for regulated crypto exposure.

Analysts believe the next wave of institutional participation could spread beyond ETH, with altcoins like Chainlink, Aave, and Uniswap emerging as early beneficiaries in fund positioning.

The road ahead - Funding resets, ETF flow direction, and retail re-entry will likely determine whether Ethereum leads a market rebound or cedes ground to rising altcoins as November unfolds.

Bitcoin closes red ‘Uptober’ as ETF outflows spike and BNB memecoins surge

Key points:

Bitcoin is set to finish its first red October in seven years amid a wave of U.S. spot ETF outflows and macro uncertainty.

BNB Chain activity jumped as memecoins flooded the market, while stablecoins hit a record $300 billion in market cap.

News - October bucked the “Uptober” trend. Bitcoin is on pace to close the month lower after a mid-October crash and fresh ETF redemptions late in the month. U.S. spot Bitcoin ETFs saw a net outflow of about $388 million on October 30, led by BlackRock’s IBIT at roughly $291 million, with weekly net flows flipping to a $607 million outflow.

Options skew turned more defensive as traders paid up for downside protection. Even so, October’s total ETF net inflow of $3.61 billion still topped September’s $3.53 billion, suggesting the pullback reflects short-term positioning rather than a structural reversal.

BNB memecoin wave - BNB Chain transactions rose about 135% in October as memecoin issuance exploded. More than 100,000 new traders bought in on October 7, with 70% showing gains at one point, before many tokens faded in the following days.

Four.meme overtook Pump.fun on October 8 as the primary launch venue. BNB briefly pushed above $1,300 on October 13 and remained up 6.6% for the month.

Policy watch: EU and U.S. states - EU “Chat Control” remains contested, with a vote delayed to December as member states split on mandatory screening of encrypted messages. In the U.S., four states advanced crypto legislation on topics including public-fund investment, wallet rights, mining taxes, and custody rules.

Liquidity and flows to track - Analysts flagged the Fed’s shift away from balance sheet reduction as a pivotal liquidity cue. Meanwhile, stablecoins surpassed $300 billion in total market value, and Visa added support for four stablecoins across four blockchains, reinforcing payments-focused adoption.

XRP sinks ahead of Ripple swell as whales accumulate and ETF buzz grows

Key points:

XRP slipped more than 7% this week, testing key supports below $2.50 despite optimism surrounding Ripple’s Swell 2025 event.

Long-term holders trimmed exposure while whales added over 1.2 billion XRP, and anticipation builds for Canary Capital’s spot XRP ETF launch on November 13.

News - Ripple’s annual Swell conference, set for November 4–5 in New York, has failed to lift sentiment as XRP extended losses below $2.50. The token fell roughly 7.5% this week and touched$ 2.47 after breaking its $2.50 support, with trading volume surging 158% as institutional selling accelerated.

Analysts noted a rounding-top structure on short-term charts that could push prices toward $2.09 if the $2.37 neckline fails.

While past Swell events have triggered short rallies, this year’s setup looks different. The RSI and MACD both trend lower, showing waning momentum. Analysts highlighted immediate resistance at $2.55 and $2.84 and support near $2.37–$2.40, where traders are watching for stabilization.

Whale accumulation and holder behavior - On-chain data showed over 90 million XRP left major wallets in two weeks as long- and short-term holders took profits. Yet whales holding 100 million–1 billion XRP added about 1.27 billion tokens worth $3.15 billion since mid-October, signaling accumulation. Mid-tier wallets also turned net-buyers late in the month, hinting at an early attempt to form a base around $2.60–$2.63.

ETF momentum returns - Amid the price drop, institutional interest remains active. Canary Capital is targeting a November 13 launch for its spot XRP ETF pending Nasdaq approval, following recent listings for Solana, Litecoin, and Hedera.

Earlier XRP products such as XRPR already crossed $100 million AUM, suggesting solid appetite for regulated XRP exposure.

Outlook - Bulls need to reclaim $2.50 to neutralize short-term pressure. Until then, traders are watching the $2.40–$2.37 zone for potential accumulation as the market weighs Swell announcements and ETF-driven demand.

Sam Bankman-Fried resurfaces with “FTX was never insolvent” defense

Key points:

Former FTX CEO Sam Bankman-Fried posted a new 14-page report claiming the exchange was never insolvent and blaming bankruptcy lawyers for its downfall.

Investigators and analysts dismissed the claims, calling them an attempt to rewrite history and influence his slim odds of a presidential pardon.

News - Nearly two years after FTX’s collapse, Sam Bankman-Fried (SBF) has returned to public view with a lengthy self-defense posted on X, insisting that “FTX was never insolvent.”

The document, titled FTX: Where Did the Money Go?, argues that the exchange had sufficient assets to repay all customers “in full, in kind,” and that bankruptcy lawyers, rather than mismanagement, triggered its downfall.

According to the report, FTX’s holdings in Solana, Robinhood, and AI startup Anthropic could now be worth more than $100 billion if the company had continued operating. Bankman-Fried accuses law firm Sullivan & Cromwell and current FTX CEO John Ray III of seizing control in 2022 “to collect fees,” claiming their decisions wiped out over $120 billion in value.

Community reaction and rebuttals - The post drew immediate backlash from blockchain investigator ZachXBT, who said SBF is ignoring the 2022 liquidity crisis that prevented customer withdrawals. He noted that current asset valuations reflect today’s bull market, not FTX’s balance sheet at the time of bankruptcy.

A push for redemption - SBF, convicted on seven counts of fraud and sentenced to 25 years in prison, has reportedly sought a presidential pardon through Trump-aligned lawyers.

Prediction market Kalshi assigns only a 10% chance of success. His renewed online presence appears aimed as much at rehabilitating his image as at revising the history of one of crypto’s biggest scandals.

No MEV. No Gas

CoW Swap blocks MEV so bots can’t front-run your trades. Keep more of every swap.

More stories from the crypto ecosystem

Crypto scams uncovered

A bogus YouTube livestream impersonating Nvidia’s GTC keynote featured a deepfake version of CEO Jensen Huang appealing for crypto deposits, drawing nearly 100,000 viewers and exposing how AI is being weaponised in crypto fraud.

Australian regulator AUSTRAC fined crypto ATM operator Cryptolink for late reporting of large cash transactions and weak anti-money laundering controls, following a finding that its ATMs were being used by criminals to facilitate scams.

Authorities in India arrested two suspects in Kolkata for allegedly running a crypto investment scam that defrauded investors of roughly $3 million, promising unrealistically high returns.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Top 3 coins of the day

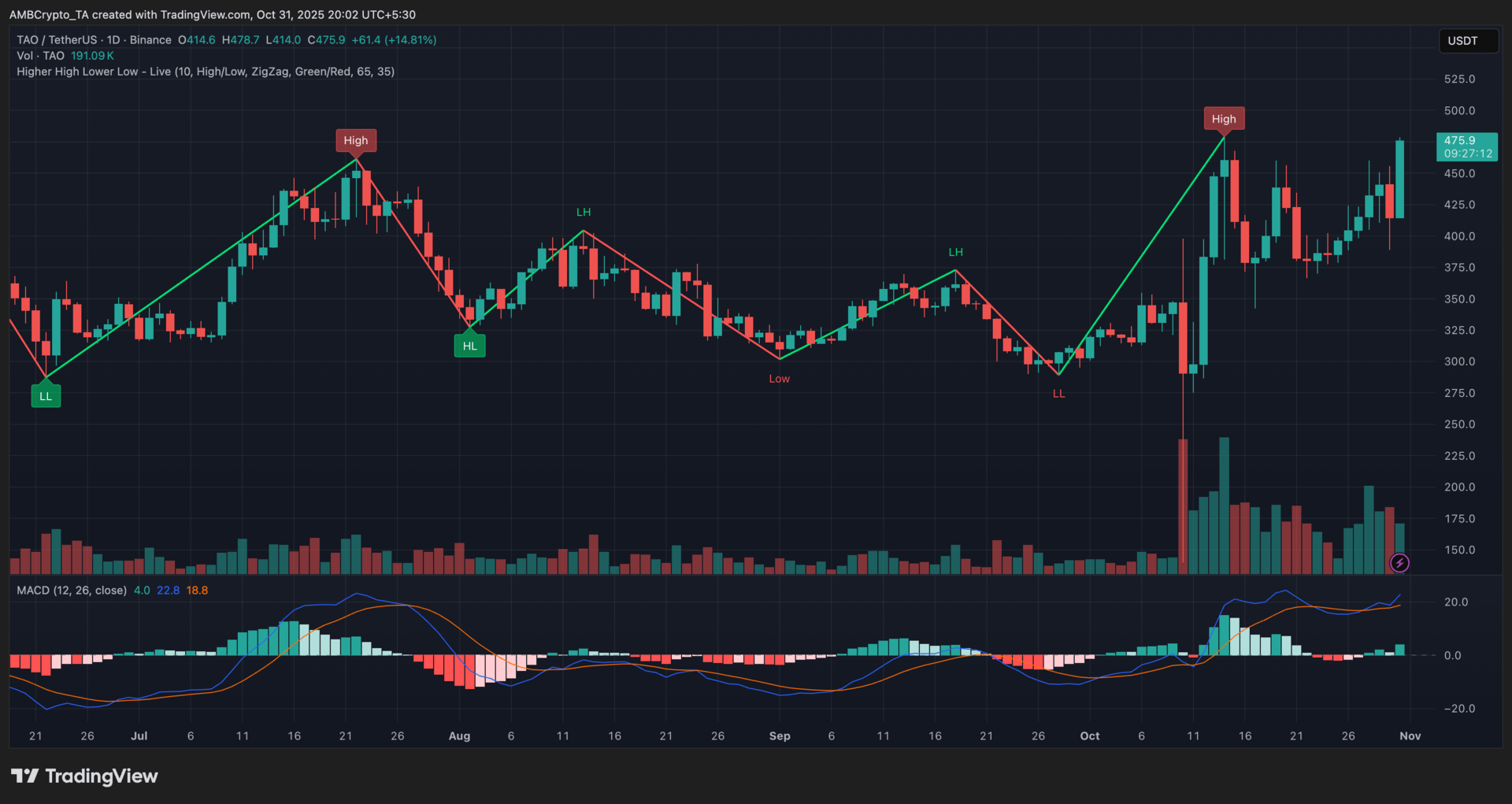

Bittensor (TAO)

Key points:

TAO traded at $475, recording a 14.81% rise over the last 24 hours as momentum returned alongside renewed buying interest.

The MACD showed a sustained bullish crossover, while the higher high pattern and rising volume signaled strong market conviction.

What you should know:

Bittensor’s latest surge followed growing optimism from the launch of the Staked TAO ETP on Switzerland’s SIX Exchange, a regulated product offering institutions exposure to TAO with staking rewards. The listing boosted credibility and liquidity for the AI-focused network. From a technical standpoint, TAO maintained its higher high, higher low structure, supported by steady volume and a positive MACD histogram. Traders observed the price testing resistance near $480, while $420 remains a key support zone to monitor. Anticipation surrounding Bittensor’s first halving in December 2025 also fueled speculative interest, as participants positioned early for potential supply-driven upside.

DeXe (DEXE)

Key points:

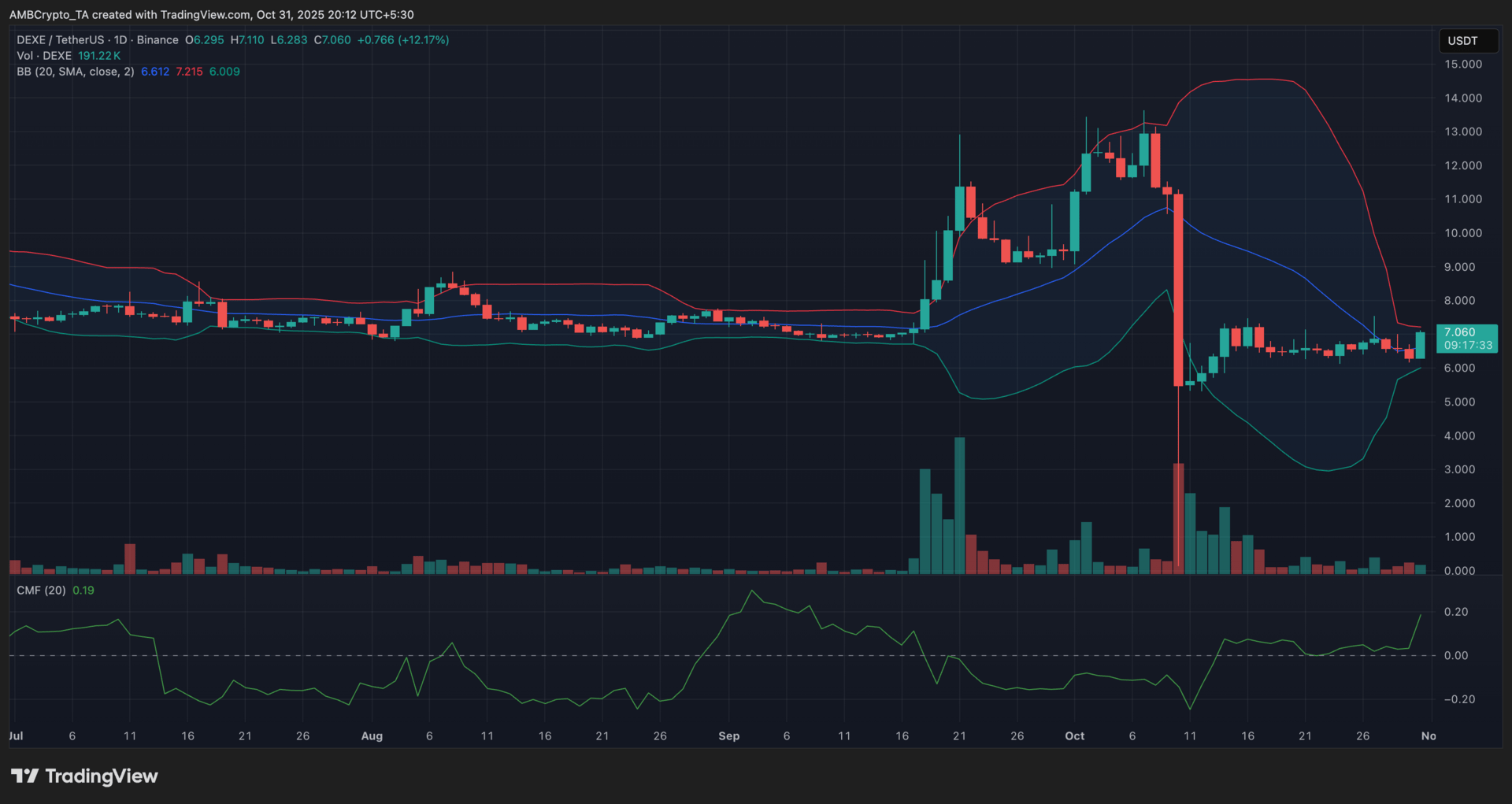

DEXE was last seen trading at $7.06, marking a 12.17% surge in the past 24 hours.

The price moved above the Bollinger midline, while the CMF turned positive at +0.19, signaling renewed capital inflows.

What you should know:

After days of subdued trading, DeXe regained momentum as buying pressure lifted it above the Bollinger midline near $6.61. Volume reached roughly 191K, indicating sustained participation even as volatility eased from mid-October’s spikes. The upper Bollinger Band near $7.21 remains the next resistance to monitor, while the midline around $6.60 serves as near-term support. Beyond chart signals, sentiment improved following DeXe’s ongoing AI governance upgrades and its integration with TheOneTradeAI, which expanded cross-chain utility. These developments helped stabilize demand for the protocol’s DAO-driven token after last week’s correction, keeping traders focused on a potential retest of the $7.20–$8.00 zone.

Zcash (ZEC)

Key points:

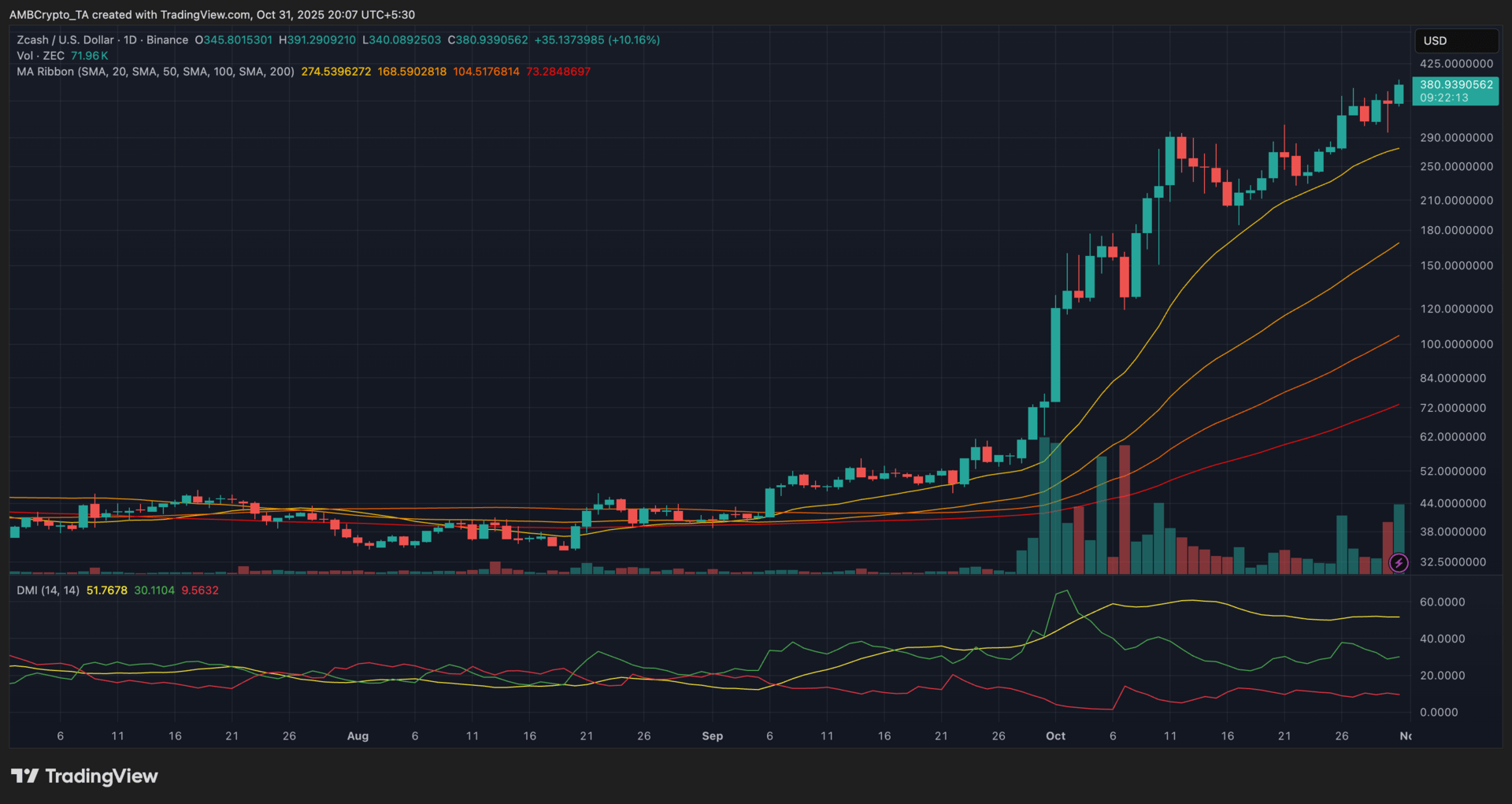

At the time of writing, ZEC traded around $380 after gaining 10.16% in the last 24 hours.

The MA Ribbon remained firmly bullish, while the ADX hovered near 51.7, signaling a powerful uptrend supported by strong buy-side control.

What you should know:

Zcash maintained its steep October climb, adding another leg upward as volume rose to nearly 71.96K. The price held well above all major moving averages, with the 20-day SMA at $274 providing nearby dynamic support. The DMI continued to favor bulls, as +DI stayed far above –DI and the ADX confirmed a trend of exceptional strength. Traders are now eyeing $400 as immediate resistance, while the $370 zone acts as an important support region to protect recent gains. Momentum also drew fuel from Arthur Hayes’ $10K price projection and Naval Ravikant’s endorsement of ZEC as “insurance against Bitcoin,” boosting retail attention. Alongside this, the shielded supply climbed past 4.5 million, reducing liquid circulation and reinforcing scarcity narratives.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

How was today's newsletter? |