- Unhashed Newsletter

- Posts

- Ethereum’s $3K fight begins

Ethereum’s $3K fight begins

Reading time: 5 minutes

Ethereum wobbles near $3K as bears, whales, and Vitalik Buterin narratives collide

Key points:

Ether hovered near $3,000 as weakening demand, ETF outflows, and derivatives data raised downside risks toward the $2,700 to $1,850 zone.

Despite bearish signals, whale accumulation, record staking ambitions, and new protocol ideas from Vitalik Buterin added complexity to the outlook.

News - Ether briefly reclaimed the $3,000 level after a volatile week, but the recovery remained fragile. Data showed declining apparent demand, heavy spot Ether ETF outflows, and sustained selling pressure following large-scale liquidations. At the same time, select institutional players and whales treated the dip as an accumulation opportunity, creating a split market narrative.

Bearish pressure builds below key support - Ethereum’s apparent demand dropped to its lowest level in roughly ten months, a signal historically linked to deeper pullbacks.

Derivatives data showed ETH funding rates briefly turning negative, while options markets priced a higher premium for downside protection. Network activity added to caution, with Ethereum fees declining week over week as rivals like Solana and BNB Chain posted stronger fee growth and transaction dominance.

Technically, repeated failures near $3,400 and a loss of the $3,100 volume control area shifted focus toward the $2,800 to $3,000 demand zone. A breakdown below that region could expose $2,700 and lower liquidity pockets, with longer-term bearish targets extending toward $1,850 if selling accelerates.

Whales accumulate as protocol vision expands - Not all signals were negative. Onchain data showed whales and institutions buying more than $130 million worth of ETH during the dip, while treasury-focused firms expanded their staking positions. However, transfers from BlackRock to Coinbase Prime kept sell-side concerns alive.

Beyond price, Buterin proposed simplifying Ethereum staking through native distributed validator technology, a move aimed at improving resilience and decentralization. He also reiterated plans to prioritize decentralized social media development in 2026, reinforcing a long-term vision even as short-term market pressure persists.

Stablecoin supply breaks records: Yields, banks, and a stalled bill

Key points:

Global stablecoin supply reached a new high above $311 billion as traders rotated into dollar-linked tokens amid crypto market volatility.

Debates over stablecoin yields intensified as banks, lawmakers, and issuers clashed over how digital dollars should fit into the U.S. financial system.

News - The stablecoin market hit a fresh all-time high this week, surpassing $311 billion in total supply, even as the broader crypto market faced sharp drawdowns and heavy liquidations.

Data from DeFiLlama showed the market peaked on January 18, led by continued dominance from Tether’s USDT and Circle’s USDC. The surge came as Bitcoin traded below $90,000 and traders sought shelter from volatility that triggered hundreds of millions of dollars in forced liquidations.

Why stablecoins are growing despite risk-off markets - Analysts pointed to heightened risk aversion as a key driver behind the inflows.

Liquidations across Bitcoin and Ethereum highlighted fragile sentiment, pushing traders toward stablecoins as a short-term buffer. However, market participants on prediction platforms assigned a high probability that total stablecoin supply would remain below $360 billion in the near term, signaling expectations of consolidation rather than runaway growth.

Growth has also been uneven. Expansion in Trump-backed World Liberty Financial’s USD1 stablecoin accounted for a notable share of recent issuance, while most major stablecoins recorded minimal supply changes during the past quarter.

Yields, banks, and a stalled crypto bill - At the World Economic Forum, Circle CEO Jeremy Allaire dismissed concerns that yield-bearing stablecoins could trigger bank runs, calling such fears overstated and pointing to money market funds as a long-standing parallel. He argued that stablecoins could underpin future payment systems, particularly for AI-driven transactions.

Banks disagreed. The American Bankers Association urged lawmakers to restrict stablecoin yields and tighten open banking rules, framing the push as a matter of consumer protection. These disputes contributed to delays in advancing the U.S. crypto market structure bill after Coinbase withdrew support, leaving regulatory clarity on stablecoins unresolved.

Tokenization gains ground across governments and Wall Street

Key points:

Governments and global institutions are accelerating asset tokenization, positioning blockchain as core financial infrastructure rather than a speculative layer.

From sovereign assets to Wall Street products, tokenized real-world assets are emerging as a multi-trillion dollar market opportunity.

News - Tokenization emerged as one of the dominant crypto narratives at the World Economic Forum in Davos, with government officials, financial institutions, and blockchain leaders signaling a shift from experimentation to real-world deployment.

Binance co-founder Changpeng Zhao revealed he is in discussions with roughly a dozen governments about tokenizing national assets, including infrastructure, real estate, and commodities, as a way to unlock capital through fractional ownership.

From sovereign assets to financial plumbing - Zhao framed tokenization as a tool for governments to monetize state-owned assets more efficiently, allowing broader investor participation while raising funds for development. The concept mirrors earlier privatization efforts but introduces blockchain-based settlement, transparency, and divisibility.

At Davos, tokenization of real-world assets dominated panel discussions, with industry leaders describing 2026 as an inflection point. Institutions are moving beyond pilot programs and deploying tokenized bonds, funds, equities, and real estate products at scale. Data shared during the forum showed tokenized real-world assets surpassing $21 billion in total value locked, reflecting both rising adoption and a broader mix of assets moving on-chain.

Institutions, regulation, and the road ahead - Large financial players are increasingly anchoring this transition.

BlackRock highlighted that Ethereum currently underpins about 65% of tokenized assets, positioning the network as a preferred settlement layer for Wall Street’s tokenization efforts. The firm argued that stablecoins and tokenized securities are demonstrating utility beyond speculative trading, particularly for settlement and treasury use cases.

Meanwhile, ARK Invest projected that tokenized real-world assets could reach $11 trillion by 2030, contingent on regulatory clarity and institutional-grade infrastructure. The outlook reinforces a broader theme from Davos: tokenization is no longer framed as a future experiment, but as a structural evolution quietly reshaping global capital markets.

BitGo’s $18 IPO tests institutional appetite for crypto custody

Key points:

Crypto custody firm BitGo priced its IPO at $18 per share, valuing the company at just over $2 billion ahead of its NYSE debut.

The listing positions BitGo as a rare custody-first crypto firm testing public market demand in 2026.

News - BitGo has priced its initial public offering (IPO) at $18 per share, above the previously marketed range, as the company prepares to begin trading on the New York Stock Exchange (NYSE) under the ticker BTGO. The offering includes roughly 11.8 million shares of Class A common stock and is expected to raise about $213 million in gross proceeds, with trading scheduled to begin Thursday.

The IPO values BitGo at slightly more than $2 billion, positioning it as a rare crypto custody-focused listing in U.S. public markets. Founded in 2013, the company has built its business around regulated custody, staking, and infrastructure services rather than trading-driven revenue.

Custody-first model under the spotlight - BitGo’s public market pitch centers on predictable, service-based revenue. The company has reported managing more than $90 billion in assets under custody and serving thousands of institutional and enterprise clients globally. Analysts have pointed to custody and staking as the firm’s primary revenue drivers, offering steadier earnings compared to transaction-heavy crypto platforms.

Recent regulatory filings show that BitGo’s leadership and early investors remain significant shareholders. Disclosures indicate that CEO Michael Belshe holds a substantial stake through a combination of Class A and Class B shares, along with restricted stock units and options that vest over time. The company will not receive proceeds from shares sold by existing stockholders.

A litmus test for crypto IPOs - BitGo’s listing arrives after a difficult stretch for publicly traded crypto companies, many of which have underperformed amid broader market volatility. By contrast, BitGo is positioning itself as a lower-risk infrastructure play aligned with institutional demand for compliant digital asset storage.

Market participants are watching closely to see whether BitGo’s custody-focused model can attract sustained investor interest, serving as an early litmus test for other crypto and fintech firms considering public listings later in 2026.

More stories from the crypto ecosystem

Spot BTC, ETH ETF outflows deepen, but the market refuses to break

Bitcoin dips 3.8% amid EU and Greenland tensions- Is BTC at $85k ‘premature’?

How the banking industry’s ‘rural America’ plea stalls the crypto bill

Assessing Ripple’s growth – RLUSD’s Binance listing and XRP’s long-term prospects

‘Painful dip’ before gains? Fundstrat’s Tom Lee flags 2026 market turbulence

Interesting facts

Tokenized bank money is coming, says ECB policymaker: ECB policymaker Fabio Panetta said commercial bank money will “inevitably” become fully tokenized over time, arguing tokenized bank money and tokenized central bank money will both remain core to the monetary system.

The digital euro has a working launch pathway: The ECB’s latest progress update says it is now in a preparation phase, with a working assumption that EU co-legislators adopt the digital euro regulation during 2026, a pilot and initial transactions could start as soon as mid-2027, and a potential first issuance is targeted for 2029.

One of Ethereum’s major upgrades was defined by a specific EIP bundle: Ethereum’s Pectra upgrade was formally specified under EIP-7600 and included changes like raising the maximum effective staking balance (EIP-7251) and increasing blob throughput (EIP-7691), with scheduled testnet activations that were laid out by the Ethereum Foundation.

Top 3 coins of the day

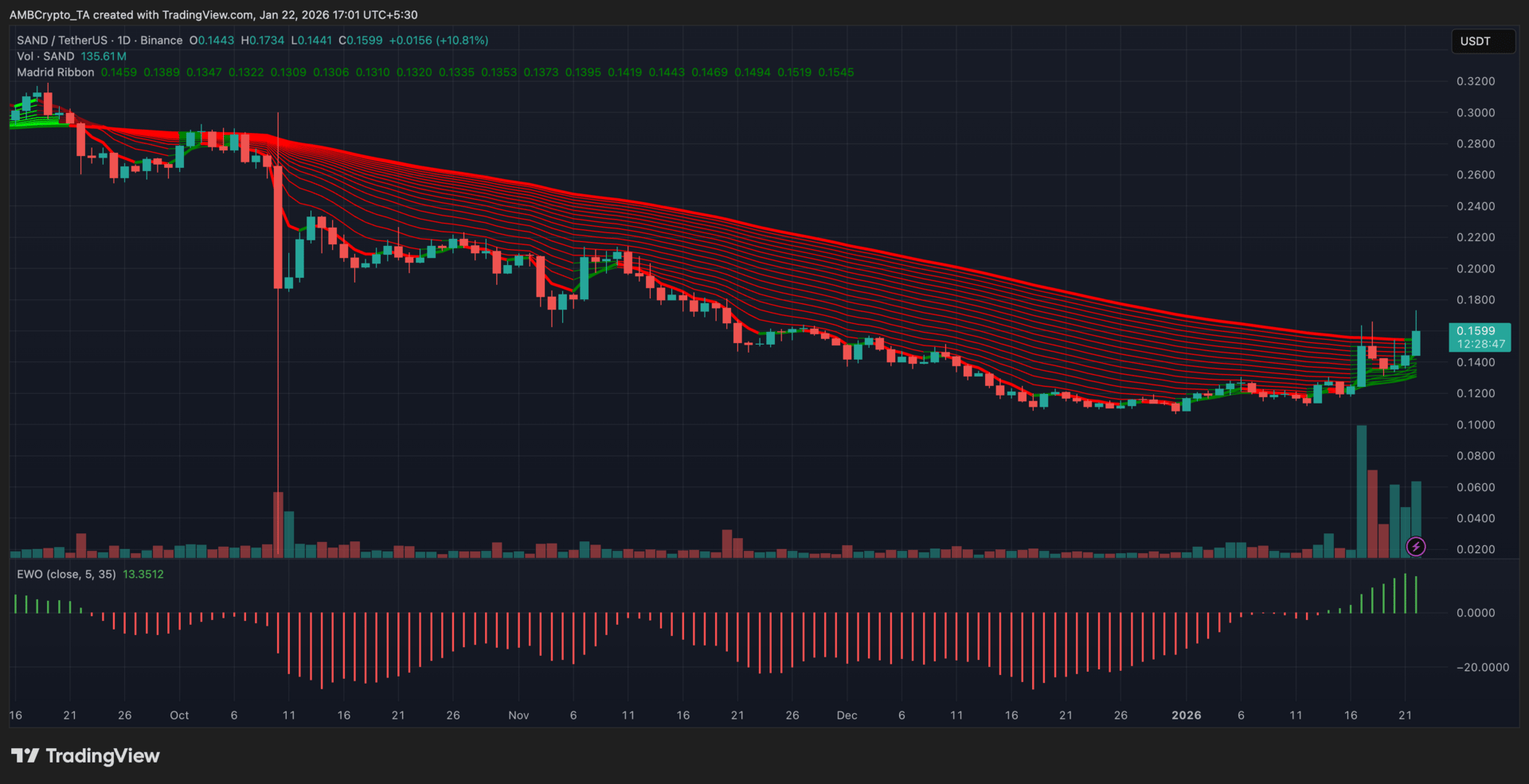

The Sandbox (SAND)

Key points:

SAND rallied over the last session, extending its recent upside as buyers stepped in with strong volume backing.

The Madrid Ribbon began flashing early trend improvement, while EWO flipped positive, hinting at easing downside pressure.

What you should know:

SAND posted a sharp intraday advance, pushing price toward the upper end of its recent range as participation picked up noticeably.

Trading volume expanded significantly compared to prior sessions, suggesting the move was supported by real demand rather than thin liquidity. This increase in activity coincided with improving sentiment across the altcoin market, where capital rotation away from majors appeared to favor higher beta tokens like SAND.

On the technical side, the Madrid Ribbon, which had remained compressed and red through much of the prior downtrend, recently began turning green at the lower bands. This shift pointed to early trend stabilization after a prolonged period of weakness. Meanwhile, the EWO moved decisively into positive territory, reflecting improving momentum following weeks of persistent negative readings.

From here, the $0.145–$0.150 zone acts as immediate support, while $0.160 remains the near-term resistance to monitor if momentum continues to build.

Axie Infinity (AXS)

Key points:

AXS climbed over the last session, extending its sharp recovery and pushing price into the $2.50 zone as momentum accelerated.

The Madrid Ribbon flipped green while the Squeeze Momentum histogram expanded, supported by a clear surge in trading volume.

What you should know:

Axie Infinity recorded a strong upside move, building on its recent rebound and marking one of its most decisive sessions in weeks. Price action strengthened after reclaiming the Madrid Ribbon, which flipped green and began fanning upward, reflecting a shift in trend structure rather than a brief bounce. The Squeeze Momentum indicator reinforced this move, as green bars expanded and signaled volatility release following a prolonged compression phase.

Volume expanded sharply during the rally, confirming active participation behind the advance instead of thin, speculative buying. This expansion aligned with broader signs of capital rotation into higher-beta altcoins, a backdrop that has favored tokens showing relative strength like AXS.

From here, the $2.10–$2.20 zone acts as immediate support, while the $2.60–$2.80 region stands as the next area to monitor if momentum holds. The ribbon remaining green and volume staying elevated are key conditions to watch for continuation.

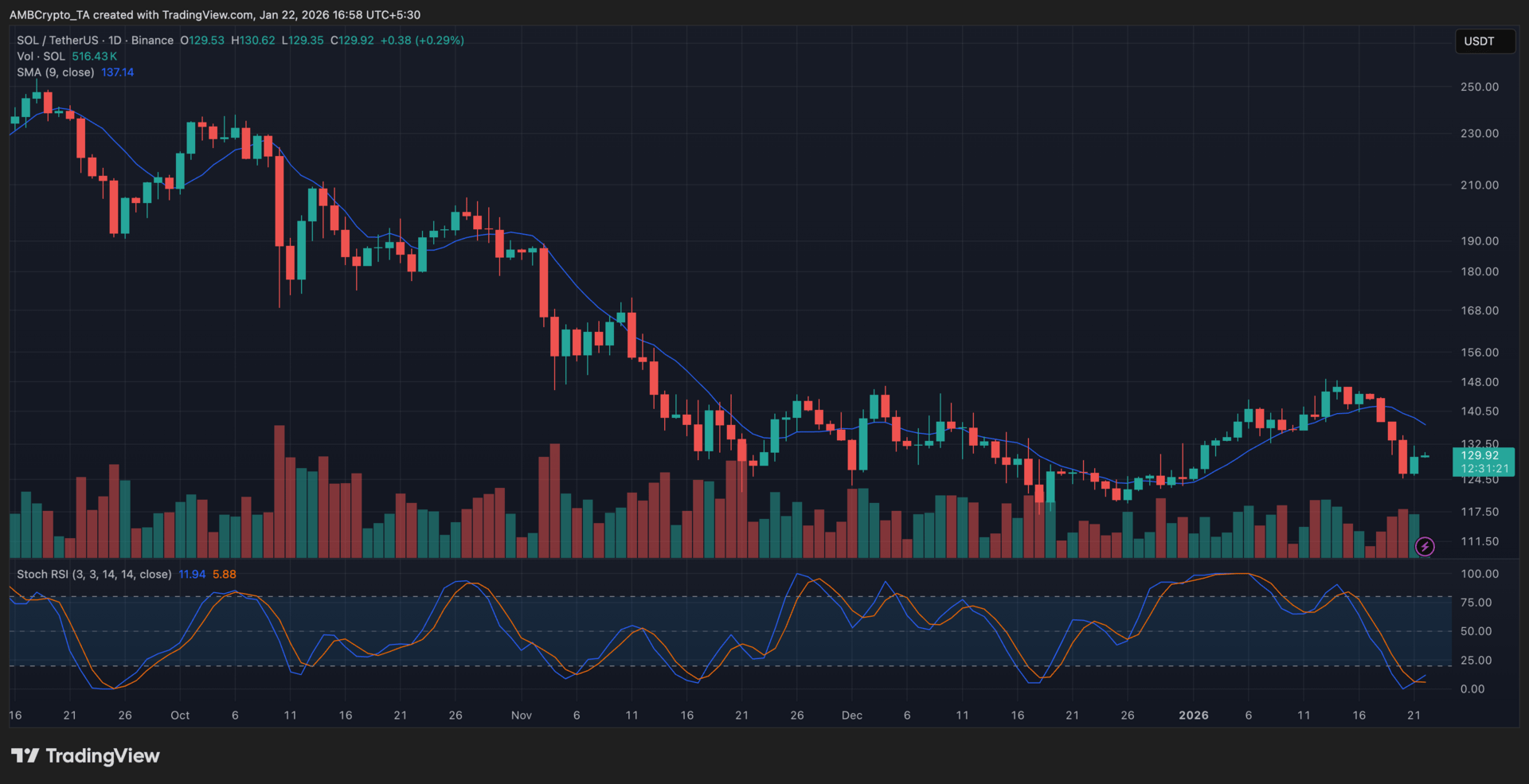

Solana (SOL)

Key points:

SOL saw a mild recovery attempt after last week’s sharp decline, but upside traction remained limited near the short-term trend line.

Momentum indicators hinted at easing sell pressure, though volume confirmation stayed muted.

What you should know:

Solana attempted a mild rebound after steep weekly losses, with price stabilizing in the low-$130 region. Despite the bounce, SOL mostly traded below its 9-day SMA, which continued to cap upside moves and reflect short-term weakness. Repeated rejections near this level highlighted cautious buyer behavior.

The Stochastic RSI dipped deep into oversold territory before beginning to curl upward, suggesting selling pressure had started to ease. Still, follow-through remained limited, leaving the recovery fragile. Volume picked up slightly during the rebound but lacked strong expansion, pointing more toward short-covering than sustained accumulation.

Broader sentiment improved as macro tensions eased, helping stabilize crypto markets. At the same time, ongoing speculation around spot Solana ETF filings and renewed focus on ecosystem activity, including Solana Mobile’s SKR token distribution, offered modest support. SOL needs to reclaim the 9-day SMA to improve recovery odds, while the $125 zone remains key support to monitor.

How was today's newsletter? |