- Unhashed Newsletter

- Posts

- Ethereum’s big birthday sparks debate

Ethereum’s big birthday sparks debate

Reading time: 5 minutes

Ethereum turns 10: Treasury boom, ETF tailwinds, and bull trap warnings

Key points:

Public firms including BitMine, SharpLink, ETHZilla, and FG Nexus have poured billions into Ether, as institutional treasuries and ETFs reshape ETH’s outlook.

Despite price resilience, fading U.S. demand and bearish indicators suggest a possible bull trap beneath the surface.

News - Ethereum celebrated its 10th anniversary this week with a surge in corporate interest, as publicly traded firms continue piling into Ether as a strategic treasury asset. BitMine Immersion leads the charge, now holding 625,000 ETH after expanding its repurchase program. SharpLink follows with 438,190 ETH, while biotech firm ETHZilla just rebranded and raised $425 million to accumulate ETH aggressively. FG Nexus joined the fray too, backed by Kraken, Galaxy, and other major investors with a $200 million raise.

Cathie Wood’s ARK Invest also doubled down, acquiring another $15.3 million in BitMine shares across its ETFs. According to Standard Chartered, these treasury acquisitions have already crossed 1% of ETH’s circulating supply and could eventually climb to 10%, driven by staking rewards and regulatory arbitrage.

ETF momentum meets macro tailwinds - U.S. spot Ethereum ETFs have now logged 18 straight days of inflows totaling $5.5 billion. Analysts point to a favorable macro backdrop and shifting regulatory tone under Trump as further fuel, with projections ranging from $4,000 to $5,000 in the near term. Derive’s Sean Dawson expects an all-time high by year-end, while others see rising AI sector sentiment as a bullish tailwind.

But is a trap forming below $4K? - Despite its resilience, Ethereum recently dipped below $3,800. The Coinbase Premium Index turned deeply negative, suggesting waning U.S. institutional demand. On-chain signals are also diverging: the CMF indicator shows weakening capital inflows even as price pushes higher, while Ethereum’s rising wedge pattern hints at a potential bull trap.

The $4,000 mark remains a critical psychological and technical barrier. Whether Ethereum can break through or stalls again could define the next leg of this rally.

Bitcoin’s corporate arms race: Strategy buys big, Twenty One eyes lending

Key points:

Bitcoin-backed loans and yield strategies are gaining traction as Twenty One Capital expands its 43,000+ BTC treasury and eyes a USD lending program.

Meanwhile, Strategy raised $2.5B via perpetual preferred shares to purchase 21,021 BTC, adding to mounting competition among digital asset treasury giants.

News - Bitcoin’s status as a treasury-grade asset continues to rise as major firms ramp up holdings and explore yield generation strategies. Twenty One Capital, backed by Tether and Cantor Fitzgerald, recently expanded its BTC stash to over 43,500 coins, valued at around $5.13 billion, and is now reportedly planning to issue U.S. dollar loans collateralized by Bitcoin.

The move signals a broader evolution in the corporate playbook. “Everything is on the table because we think we can do anything,” a company spokesperson said. CEO Jack Mallers reaffirmed the firm’s Bitcoin-only stance, dismissing Ethereum and Solana as speculative tech assets. “Bitcoin is not a tech stock. It’s a sovereign monetary asset,” he emphasized.

While Twenty One pioneers new lending frontiers, Strategy took a different approach. The Michael Saylor-led firm raised $2.5 billion by issuing STRC, a perpetual preferred stock with floating monthly dividends, and deployed the capital to buy 21,021 BTC at an average price of $117,256. Strategy now holds nearly 629,000 BTC, worth over $74 billion.

Price pressure and market gaps - Despite these bullish moves, Bitcoin’s price has remained flat around $118,200 as traders brace for FOMC decisions. Analysts warn of a possible drop to $112,000 due to thin support in the $115K–$110K range. Glassnode also flagged $141K as a potential resistance zone if momentum returns.

Bitcoin maximalism meets Wall Street - As more firms attempt to mimic Strategy’s blueprint, analysts caution that few can replicate its scale, stock price premium, and Wall Street access. With Twenty One entering the lending race and Saylor deepening yield appeal, Bitcoin’s corporate financialization is accelerating, but not everyone will survive the competition.

$10M bet: "Trump’s WLFI backs stablecoin challenger

Key points:

WLFI, backed by Trump affiliates, has invested $10 million in Falcon Finance to bridge synthetic and fiat-backed stablecoin models.

USD1, WLFI’s reserve-backed token, will now serve as collateral for Falcon’s USDf, which recently crossed $1 billion in circulation.

News - World Liberty Financial (WLFI), a DeFi platform affiliated with Donald Trump’s family, has invested $10 million into Falcon Finance to enhance on-chain dollar liquidity and stablecoin interoperability. The partnership aims to strengthen technical infrastructure for seamless conversion between WLFI’s fiat-backed USD1 and Falcon’s synthetic USDf.

With this integration, USD1 will now be accepted as collateral within Falcon’s overcollateralized protocol, blending two distinct models: Falcon’s risk-adjusted synthetic dollar and WLFI’s fully redeemable stablecoin. The move is expected to accelerate adoption of both tokens across institutional and retail markets, particularly in cross-chain liquidity use cases.

Falcon Finance recently crossed a major milestone with USDf’s circulating supply surpassing $1 billion, while WLFI’s USD1 continues to expand its footprint following its controversial use in a $2 billion Binance investment deal.

Strategic ambitions and regulatory tension - WLFI co-founder Zak Folkman described the collaboration as a step toward a more robust and programmable digital dollar ecosystem. Falcon’s managing partner Andrei Grachev added that combining fiat-backed and synthetic formats could offer scalable, transparent alternatives to traditional finance.

However, the timing of this expansion has sparked concerns. USD1, linked to Trump’s son Eric, recently lost its dollar peg amid market volatility. Critics have also flagged the growing overlap between Trump-affiliated ventures and U.S. crypto legislation efforts, calling it a potential conflict of interest.

Political pushback intensifies - Democratic leaders in Congress, including Rep. Maxine Waters, have condemned Republican-backed crypto bills, citing WLFI’s growing presence as part of what they describe as an “unprecedented crypto scam.” The debate has now intensified around whether Trump-aligned platforms like WLFI could influence or derail federal regulatory reform.

Key points:

JPMorgan is partnering with Coinbase to allow Chase customers to buy crypto with credit cards and redeem rewards points for USDC by 2026.

The collaboration also introduces JPMorgan’s JPMD deposit token for institutional use, signaling a dual-pronged retail and institutional push into digital assets.

News - JPMorgan is deepening its crypto strategy with a major partnership with Coinbase, giving Chase’s 80 million customers expanded access to digital assets. Beginning this fall, Chase credit card holders will be able to fund Coinbase accounts directly. By 2026, users will also gain the ability to redeem Chase Ultimate Rewards points for USDC and link bank accounts to the platform.

This marks the first time a major U.S. credit card rewards program will allow direct crypto redemptions. The redemption rate will be 100 points for $1 worth of USDC, credited via Coinbase’s Base blockchain. The collaboration aims to “onboard the next generation” of retail crypto users, said Coinbase’s Max Branzburg.

Institutional innovation with JPMD - In parallel, JPMorgan is advancing institutional blockchain adoption with the launch of JPMD, a tokenized commercial bank deposit designed for 24/7 settlement. Unlike stablecoins like USDT or USDC, JPMD will be limited to institutions and integrated within JPMorgan’s infrastructure, offering a potential yield-bearing, on-chain cash solution.

Coinbase’s credibility was a key factor in securing this partnership, according to JPMorgan blockchain executive Naveen Mallela.

Strategic shift despite past skepticism - The collaboration is especially notable given JPMorgan CEO Jamie Dimon’s previous skepticism of crypto. But the bank now appears to be accelerating its blockchain initiatives. Recent reports also suggest JPMorgan is exploring crypto-backed loans using Bitcoin and Ether by 2026, although the plans are not yet finalized.

More stories from the crypto ecosystem

When will altcoin season start? – 3 KEY catalysts to watch out…

SEC delays decision on Trump’s Truth Social Bitcoin ETF – Details inside!

Solana longs surge 91%, but can SOL’s price stay above $180?

MARA Holdings sees 64% growth, posts record $238.5M in Q2 revenue!

‘It’s a new day’: SEC approves in-kind redemptions for spot Bitcoin, Ethereum ETFs

Did you know?

Over 861 million people worldwide use crypto in 2025. Global crypto adoption now stands at nearly 11% of the population, driven by rapid growth in Asia, Latin America, and Africa.

U.S. adoption of institutional crypto has grown explosively, with Bitcoin ETF inflows surpassing $14.8B by mid‑2025. This sharp rise, though still short of the $50B mark often speculated by bulls, is steadily catching up to early gold-ETF trajectories.

Blockchain-based tokenization of real-world assets could reach $2T–$4T by 2030. Institutional demand is fueling a boom in tokenized real-world assets, from real estate to equities, with forecasts aiming for $2 trillion to $4 trillion in tokenized value in a few years.

Top 3 coins of the day

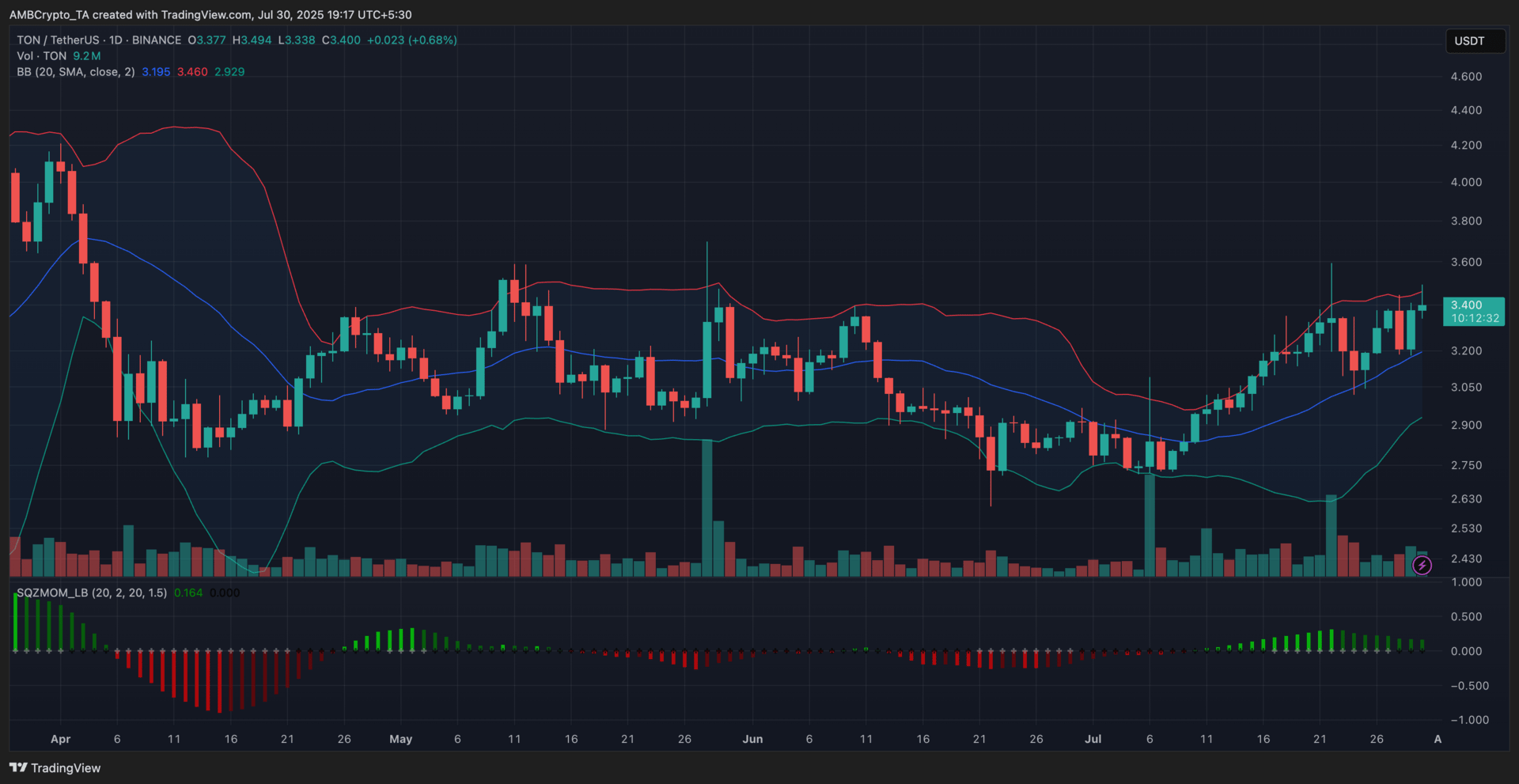

Toncoin (TON)

Key points:

As of writing, TON changed hands at $3.40, marking a 0.68% uptick compared to the previous session.

It hovered near the upper Bollinger Band, while the Squeeze Momentum Indicator maintained strong bullish pressure with rising green bars.

What you should know:

Toncoin extended its recent gains after closing above $3.38, buoyed by growing DeFi momentum and improving sentiment. The price trended near the upper Bollinger Band, signaling persistent buying pressure, while the band width slightly expanded, indicating rising volatility. The Squeeze Momentum Indicator continued flashing green bars, pointing to sustained bullish momentum. Meanwhile, daily volume stood at 9.2 million, adding weight to the price breakout. Externally, bullish DeFi developments added fuel to TON’s uptrend. STON.fi, a leading DEX on the TON network, announced a $9.5 million Series A raise to launch cross-chain swaps and concentrated liquidity pools. This coincided with a 54.8% spike in TON’s 24-hour trading volume, reflecting renewed institutional interest. If bulls maintain momentum, the next resistance to monitor is at $3.52. Conversely, $3.20 could serve as a near-term support level if price momentum stalls.

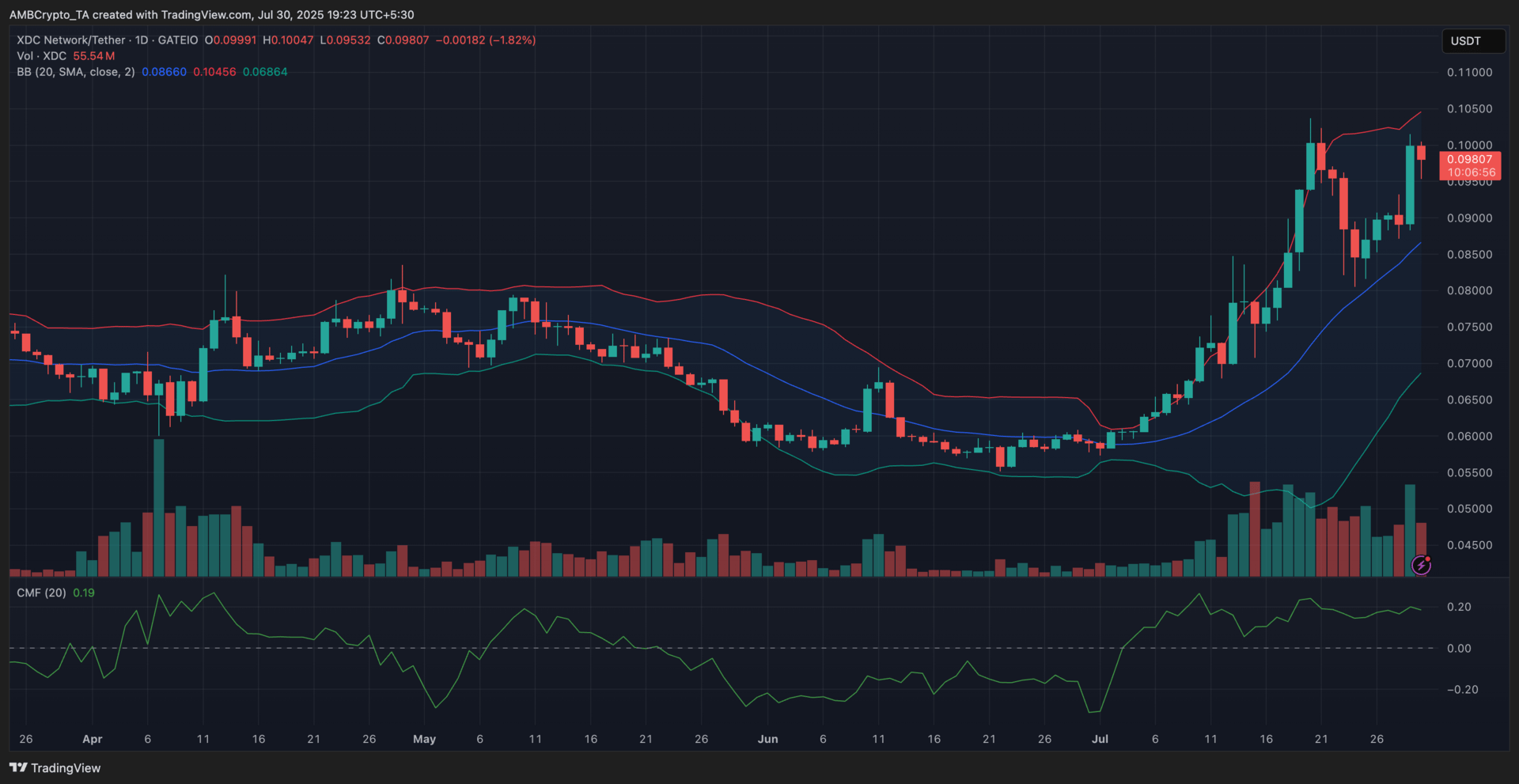

XDC Network (XDC)

Key points:

At press time, XDC was priced at $0.098, reflecting a 1.82% drop since the previous daily close.

The price pulled back from the upper Bollinger Band, while the CMF held steady at 0.19, signaling ongoing capital inflows.

What you should know:

XDC cooled off slightly after briefly touching the $0.100 mark, paring gains from its recent rally. The price slipped from the upper Bollinger Band, suggesting short-term profit-taking, while volatility remained elevated with wide band dispersion. Still, the Chaikin Money Flow (CMF) stayed firmly in positive territory, indicating that buyer interest persisted despite the minor retracement. Trading volume hovered above 55 million, aligning with increased activity since XDC’s Binance US listing, which served as a major catalyst. This followed the exchange’s recent activation of XDC/USDT trading, driving a 63% volume surge. Broader optimism around the network’s LayerZero cross-chain integration and ETF speculation also supported bullish sentiment. If buyers regain control, the $0.101 level remains the key resistance to watch. On the downside, support could emerge near $0.088 if selling pressure intensifies.

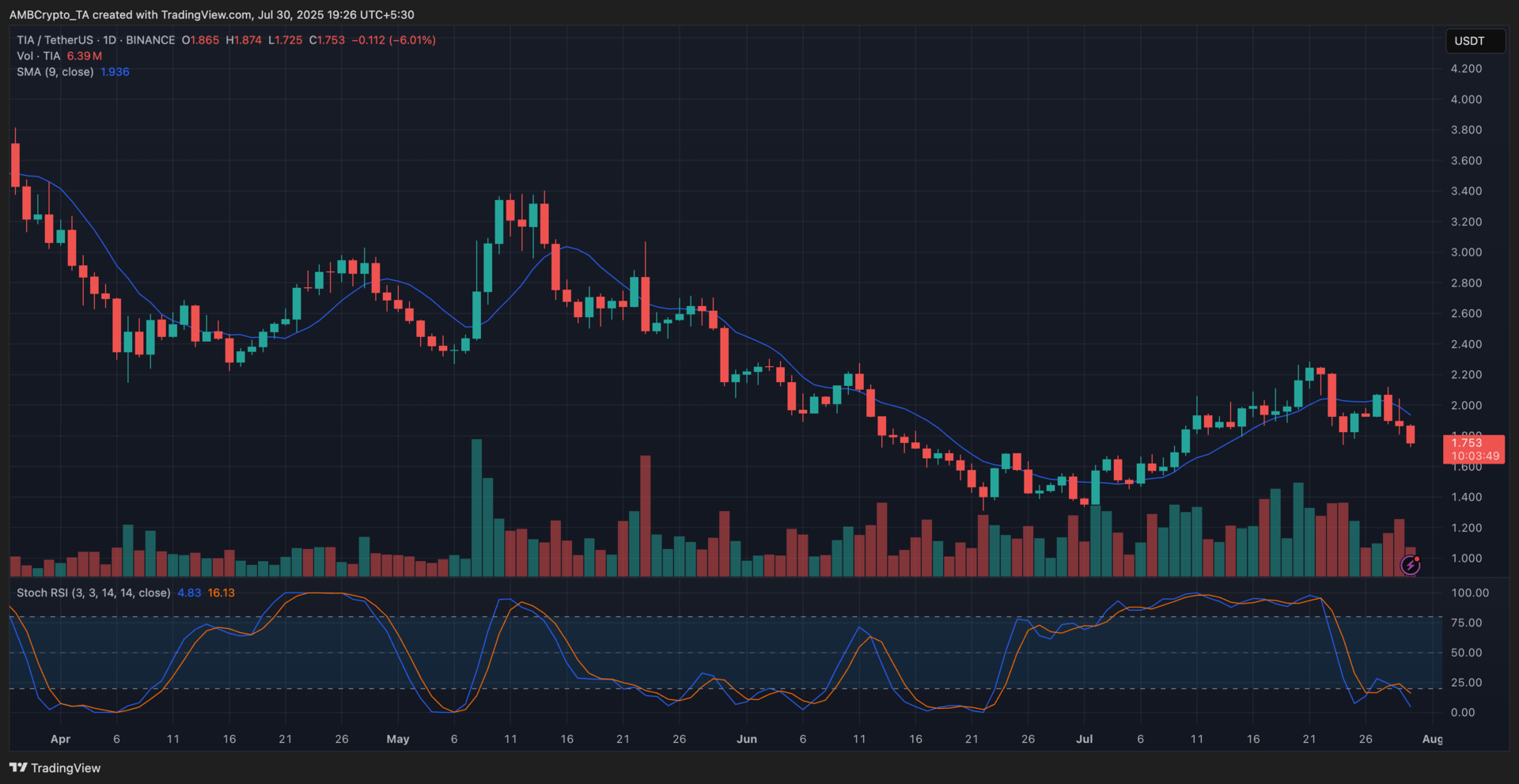

Celestia (TIA)

Key points:

At press time, TIA was trading at $1.75 after falling 6% over the last 24 hours.

The Stochastic RSI lines hovered in oversold territory, while the 9-day SMA continued to slope downward, indicating persistent bearish pressure.

What you should know:

Celestia extended its losses after breaking below the $1.75 level, reinforcing a bearish short-term trend. The price remained below the 9-day Simple Moving Average (SMA), while the Stochastic RSI stayed deep in oversold territory, suggesting that the downtrend could persist despite temporary relief bounces. The decline followed a major $14.2 million token unlock, which increased TIA’s circulating supply by nearly 7 million coins during a low liquidity phase. This supply dilution, paired with stop-loss triggers around key levels, fueled cascading sell pressure. Additionally, a broader altcoin slump amid rising Bitcoin dominance amplified the downside. If the sell-off continues, the $1.54 and $1.34 levels could act as support zones. Any recovery attempt must reclaim the $1.81 region to shift near-term sentiment.

How was today's newsletter? |