- Unhashed Newsletter

- Posts

- Ethereum stalls while institutions accumulate

Ethereum stalls while institutions accumulate

Reading time: 5 minutes

Institutions reshape Ethereum bets as ETH holds near $2K

Key points:

Starknet has integrated EY Nightfall to bring private, audit-ready payments to Ethereum rails as institutions deepen onchain participation.

Harvard has rotated part of its Bitcoin ETF exposure into Ethereum while BitMine added $90M in ETH despite depressed market sentiment.

News - Ethereum is seeing a notable institutional reshuffle even as its price has repeatedly failed to clear the $2,000 to $2,120 zone.

StarkWare announced the integration of EY’s open-source Nightfall privacy protocol into Starknet, enabling private B2B payments, cross-border transfers and DeFi access while preserving compliance and selective disclosure. The move targets banks and corporates seeking confidentiality without leaving public Ethereum-aligned infrastructure.

At the same time, capital rotation is underway. Harvard trimmed 1.46M shares of BlackRock’s iShares Bitcoin Trust in Q4 and initiated a new $86.8M position in BlackRock’s iShares Ethereum Trust, bringing total spot crypto ETF exposure to just over $352M.

Corporate treasuries are leaning in as well. BitMine Immersion Technologies purchased 45,759 ETH worth over $90M last week, lifting total holdings to 4.37M ETH. Roughly 3M ETH are now staked, generating $176M in annualized rewards.

Yet price momentum remains constrained. Ethereum attempted three rebounds in ten days but failed near the $2,000 to $2,120 resistance zone.

Infrastructure expands while whales trim - Onchain data shows whales reduced holdings by roughly 260,000 ETH during the rebound attempts, while long-term holder selling increased. A large cost-basis cluster between $1,995 and $2,015 continues to act as supply resistance.

Meanwhile, Polygon briefly surpassed Ethereum in daily transaction fees, driven largely by Polymarket activity, highlighting shifting demand toward Layer 2 networks.

Sentiment weak, positioning strategic - BitMine Chairman Tom Lee compared current sentiment to 2018 and 2022 lows but noted the absence of major institutional collapses.

Between privacy-enabled rails, ETF rotation and staking yield strategies, institutional positioning around Ethereum is broadening even as price remains technically capped.

Bitcoin or gold? Trump’s growth bet splits investors

Key points:

Strategist James Thorne frames Bitcoin as a wager on Trump-led economic reform, while gold reflects skepticism toward America’s fiscal trajectory.

Crypto firms deepen alignment with Trump initiatives as gold and tokenized gold surge during macro uncertainty.

News - The Bitcoin versus gold debate is increasingly being framed as a political and economic choice rather than a simple allocation decision.

Wellington-Altus Chief Market Strategist James E. Thorne argued that gold represents a vote of no confidence in America’s ability to reform its debt-heavy system, describing it as a signal that investors expect continued monetary expansion and currency debasement. Bitcoin, in contrast, reflects confidence that regulatory clarity and pro-growth reforms, including measures such as the proposed CLARITY Act, could position the United States as a global crypto hub.

His comments arrive as gold has rallied amid tariff disputes, currency tensions and fiscal instability, while Bitcoin has experienced drawdowns. Trader Ran Neuner recently questioned Bitcoin’s store-of-value theory, stating that investor flows during stress events appeared to favor gold.

Tokenized gold is also seeing momentum. Tether Gold climbed to $4,933 as physical gold pushed above $4,900 per ounce, lifting the total market value of tokenized gold to $4.5B.

Crypto firms signal alignment - As the debate unfolds, crypto firms are visibly aligning with Trump-linked initiatives.

Kraken pledged to sponsor Trump Accounts for every child born in Wyoming in 2026, following the SEC’s withdrawal of its 2023 lawsuit against the exchange. The program provides $1,000 from the U.S. Treasury to eligible children born between 2025 and 2028, though Kraken has not disclosed its contribution amount.

Meanwhile, Nicki Minaj is set to speak at the Trump-backed World Liberty Forum at Mar-a-Lago on February 18, joining finance and crypto executives, including Goldman Sachs CEO David Solomon and Coinbase CEO Brian Armstrong.

Growth bet or defensive hedge? - James Thorne described Bitcoin as a “speculative flag of success,” tied to growth-driven reform, while positioning gold as a verdict on policy failure.

With crypto firms embracing political proximity and gold drawing defensive flows, the debate is sharpening around which vision of America’s economic future markets will ultimately price in.

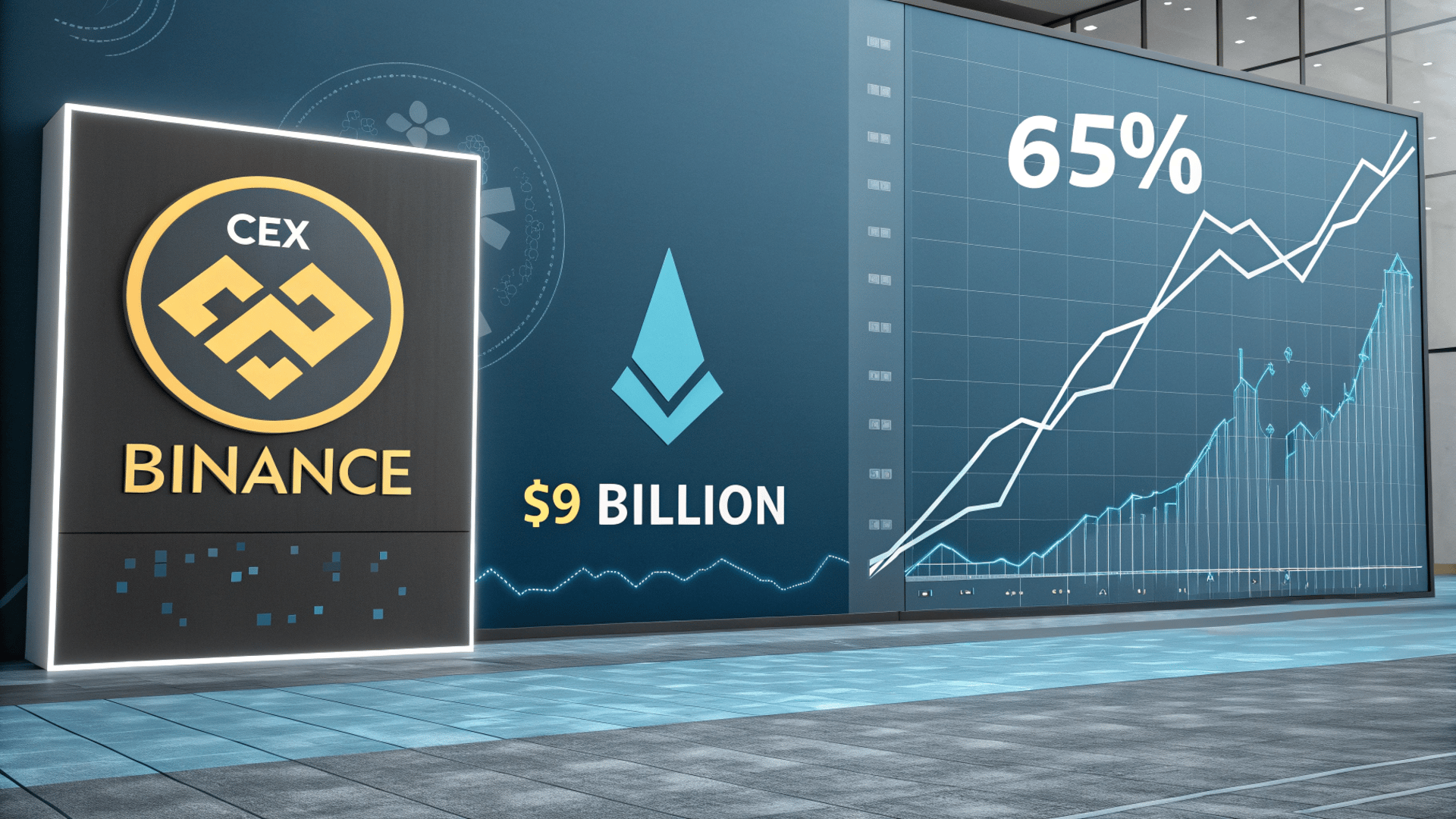

Binance controls 65% of CEX stablecoins even as $9B liquidity drains

Key points:

Binance holds $47.5B in USDT and USDC, accounting for 65% of stablecoins across centralized exchanges.

Three straight months of negative netflows have erased roughly $9B in overall stablecoin reserves, signaling tighter liquidity conditions.

News - Binance remains the dominant stablecoin hub in crypto, but liquidity inside the exchange ecosystem is thinning.

According to CryptoQuant, Binance holds $47.5B in USDT and USDC, representing 65% of all stablecoins sitting across centralized exchanges (CEXs). That figure is up 31% from $35.9B a year ago and far exceeds competitors, with OKX holding $9.5B, Coinbase $5.9B, and Bybit $4B.

Yet despite that concentration, overall stablecoin reserves in recent CryptoQuant readings have fallen sharply in recent months. Stablecoin balances dropped from approximately $50.9B in November to around $41.8B, marking a contraction of nearly $9B.

Monthly netflows show acceleration. December recorded about $1.8B in outflows, January nearly $2.9B, and February has already approached roughly $3B despite the month being only halfway complete. The stretch marks the longest sequence of negative stablecoin netflows since the 2023 downturn.

Capital concentration or capital flight? - Recent exchange flow data indicate that total CEX stablecoin outflows over the past month were about $2B, compared to $8.4B at the start of the late 2025 bear market. At the same time, separate CryptoQuant readings show sustained negative netflows at Binance over multiple months.

Sustained negative netflows typically indicate shrinking exchange liquidity. Stablecoins function as deployable trading capital, and lower balances reduce an exchange’s ability to absorb volatility.

Bear market signals resurface - Analysts noted that three consecutive months of stablecoin outflows have previously coincided with bear market conditions. Some of the recent withdrawals have been linked to defensive positioning amid macro uncertainty and geopolitical tensions.

While Binance remains one of the most liquid venues in centralized crypto markets, the ongoing drawdown suggests traders are adopting a more cautious approach to risk exposure.

Steak ’n Shake credits Bitcoin as sales rise, while Monero usage stays resilient

Key points:

Steak ’n Shake credits Bitcoin payments with double-digit same-store sales growth and total Bitcoin exposure around $15M.

Monero activity remains elevated despite exchange delistings, with 48% of new darknet markets in 2025 supporting only XMR.

News - Two cryptocurrencies are proving their relevance in very different arenas.

Steak ’n Shake says its nine-month Bitcoin strategy has driven a sharp rise in same-store sales since it began accepting BTC payments in May 2025. The company reported 11% quarter-on-quarter growth in Q2 2025 and 15% in Q3 2025, outpacing major rivals during the same period.

All Bitcoin receipts are routed into a Strategic Bitcoin Reserve. The company now has total Bitcoin exposure around $15M and currently holds about 161 BTC. Bitcoin payments are also tied to employee bonuses, with hourly staff eligible for crypto-based incentives under a two-year vesting schedule.

However, based on public treasury data, the reserve sits roughly 26% below its average purchase price of $92,851 per coin.

Bitcoin as corporate strategy - Steak ’n Shake says the program has reduced payment processing fees by about 50% and positioned Bitcoin as part of its operational model rather than a marketing experiment.

While merchant demand for Bitcoin payments remains limited more broadly, the company appears to be an outlier, according to industry commentary cited in the reports.

Monero’s privacy demand persists - Elsewhere, Monero is holding firm despite regulatory pressure.

Transaction activity in 2024 and 2025 has remained above pre-2022 levels, even after widespread exchange delistings. TRM Labs found that 48% of newly launched darknet markets this year support only XMR.

Although most ransomware payments still occur in Bitcoin due to liquidity, Monero continues to fill a specific demand for privacy-focused transactions. Recent network research also found that 14–15% of Monero nodes display non-standard behavior, though the protocol’s cryptography remains unchanged.

In one corner of crypto, adoption is visible and brand-driven. In another, resilience depends on remaining opaque.

More stories from the crypto ecosystem

Litecoin’s ETF spotlight returns – Is $55 a bargain now for LTC?

Memecore [M] fades from $1.60 peak – But THESE 2 metrics suggest…

Pump.fun team sells 543mln PUMP at loss – Here’s what it means for holders!

Here’s what happened in crypto today – BTC, Harvard, crypto ETPs & more

Nicki Minaj partners with the Trump family – Will speak at WLFI’s Mar-a-Lago event

Interesting facts

El Salvador’s Bitcoin accumulation continues: El Salvador has steadily increased its Bitcoin reserves, with holdings reaching 7,565.37 BTC, a continuation of the country’s strategy started in 2021 to integrate BTC into national financial policy and treasury management, maintaining its position as one of the most Bitcoin-forward sovereign states.

Bitcoin privacy development gets a nonprofit boost: The Payjoin Foundation, the nonprofit behind Bitcoin’s privacy-enhancing PayJoin Dev Kit, has secured 501(c)(3) status from the U.S. IRS, allowing donors to make tax-deductible contributions to support broader adoption of privacy tools for Bitcoin transactions, a notable step toward mainstream privacy-focused infrastructure.

Cross-border CBDCs already have an MVP and it is not theoretical anymore: The BIS Innovation Hub’s Project mBridge reached a minimum viable product stage testing a shared multi-CBDC platform that enables near-instant cross-border payments and settlement between participating central banks and commercial banks, moving CBDCs beyond theory toward real interoperable infrastructure.

Tired of news that feels like noise?

Every day, 4.5 million readers turn to 1440 for their factual news fix. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture — all in a brief 5-minute email. No spin. No slant. Just clarity.

Top 3 coins of the day

Raydium (RAY)

Key points:

RAY jumped to $0.67 after rebounding from the $0.55–$0.58 base, reclaiming the $0.65 breakout zone on strong daily gains.

The Parabolic SAR flipped below price and the MACD turned positive with a fresh green histogram, while volume expanded sharply on the rally.

What you should know:

After trending lower for several months, RAY found support near $0.55 and began carving out higher lows into mid-February. The latest daily candle closed around $0.67, reflecting a decisive push above the $0.65 region that had capped prior attempts. The Parabolic SAR now sits beneath the candles, indicating a short-term bullish shift, while the MACD crossed upward from negative territory, signaling improving momentum.

The move coincided with a 630% surge in 24-hour trading volume to roughly $130.2M, pointing to concentrated speculative buying rather than a slow grind higher. This spike in participation suggested capital rotation back into Raydium within the Solana DeFi ecosystem.

Holding above $0.65 keeps the recovery intact, while $0.75 and $0.80 represent the next resistance zones to monitor.

MemeCore (M)

Key points:

MemeCore rebounded to $1.50 after defending the $1.30–$1.40 range, pushing back toward the upper boundary near $1.60.

The Supertrend remained supportive near $1.28 while +DI edged slightly above -DI on the DMI, with volume rising alongside the advance.

What you should know:

After weeks of sideways movement between roughly $1.20 and $1.70, MemeCore regained traction with a strong daily close near $1.50. Buyers stepped in following a dip toward the $1.30 region, allowing price to reclaim mid-range positioning within its broader consolidation band. The Supertrend line around $1.28 continues to act as structural support, while the $1.60–$1.65 area caps upside attempts for now.

Directional momentum showed early improvement as +DI moved slightly above -DI, although the ADX remained below 20, signaling that the trend is still developing rather than firmly established.

The advance coincided with a 35.99% increase in 24-hour trading volume to approximately $10.85M, pointing to fresh speculative flows into the memecoin segment. Sustained strength above $1.40 keeps the recovery intact, while $1.28 remains the key support to watch.

Sky (SKY)

Key points:

SKY advanced to $0.068, edging closer to the $0.070 range ceiling after building higher lows from the $0.055 swing bottom.

The Parabolic SAR stayed beneath price, while the Stochastic RSI hovered above 70, signaling sustained upside momentum with rising volume support.

What you should know:

SKY extended its recovery through mid-February, lifting from the $0.055 area and steadily reclaiming ground within its established $0.055–$0.070 range. The latest daily close near $0.068 placed price just below the upper boundary around $0.070, where prior rallies have stalled. The Parabolic SAR continued to print below the candles, reinforcing the current short-term bullish bias.

Momentum strengthened noticeably as the Stochastic RSI climbed into the upper band, reflecting firm buying pressure. However, readings above 70 suggest the move is nearing overbought conditions, which may slow immediate follow-through. Volume improved compared to early February sessions, though it has not reached breakout levels.

Holding above $0.065 keeps the higher-low structure intact, while a decisive move beyond $0.070 would open the door toward the $0.072 area.

How was today's newsletter? |