- Unhashed Newsletter

- Posts

- Ethereum vs Bitcoin: Game on

Ethereum vs Bitcoin: Game on

Reading time: 5 minutes

Ethereum surges against Bitcoin: Treasury boom and GENIUS Act fuel 30% rally talk

Key points:

Ethereum surged over 50% against Bitcoin since April, with analysts eyeing a potential 30% rally as ETH/BTC confirms a bullish breakout.

Public companies like SharpLink, BitMine, and Bit Digital have stockpiled over $1.7B in ETH, accelerating ETH’s institutional adoption and market cap growth.

News - Ethereum's recent momentum has flipped the script on Bitcoin dominance. The ETH/BTC pair has soared 50% since April, recently breaking out of a bullish flag pattern and topping the 200-day EMA for the first time in over a year. Analysts like Michaël van de Poppe and VirtualBacon suggest a 30% rally toward 0.035 BTC could be next, with Ethereum reclaiming leadership in the altcoin cycle.

Meanwhile, ETH’s price spiked to a five-month high of $3,155 as institutional accumulation intensified. SharpLink Gaming, now the largest ETH-holding public company, acquired 280,000 ETH ($884M). BitMine and Bit Digital have followed suit, each building nine-figure treasuries and pivoting away from Bitcoin-focused strategies. Their stock prices have jumped over 1,000% since announcing ETH treasury moves.

Macro momentum and regulatory tailwinds - The GENIUS Act, expected to ban yield-bearing stablecoins, has placed Ethereum at the center of regulatory discussions. Analysts argue this may reinforce ETH’s importance in the digital asset ecosystem, especially as Ethena’s synthetic dollar (USDe) draws attention to Ethereum-based arbitrage yield models.

At the same time, Ethereum recently surpassed Johnson & Johnson to become the 30th largest global asset, with a $382B market cap and a 20.4% weekly gain. Daily transaction counts are nearing 1.5 million, staking is up 4%, and Q2 data shows ETH outperforming BTC by 6%.

Bitcoin dominance weakens as ETH leads the charge - As Ethereum continues outperforming, analysts like Matthew Hyland argue there's a “99% chance” Bitcoin dominance has already peaked. ETH’s relative strength has jumped nearly 10% in 30 days. With Polymarket giving ETH a 75% chance of crossing $3,300 in July and short liquidations worth billions in play, Ethereum may just be getting started.

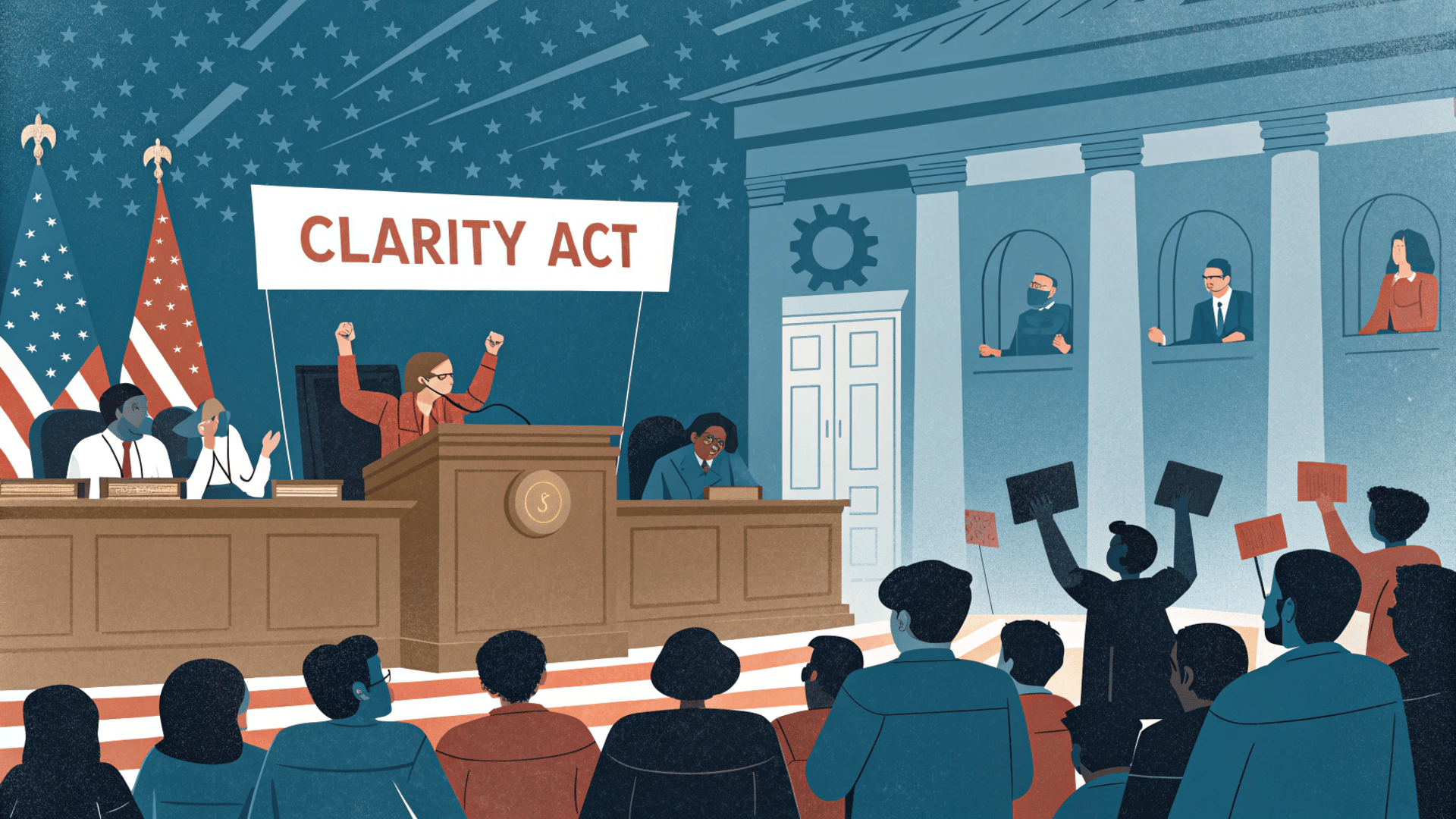

CLARITY Act vote looms amid crypto divide

Key points:

The U.S. House is preparing to vote on the CLARITY Act this week, aiming to define crypto’s regulatory future despite industry concerns.

DeFi leaders warn the bill may stifle innovation, while backers argue it’s a practical step toward mainstream institutional adoption.

News - The U.S. House of Representatives is set to vote on the CLARITY Act this week, a pivotal crypto market structure bill poised to reshape digital asset regulation in America. While some lawmakers and industry giants are calling it a long-overdue foundation for clarity, others, particularly from the decentralized finance (DeFi) sector, are raising alarms about its unintended consequences.

Backed by years of bipartisan effort, the CLARITY Act is being hailed by proponents as the best available path forward, even if imperfect. Bill Hughes, senior counsel at Consensys, emphasized the bill’s value despite its flaws: “CLARITY isn’t a sweetheart deal… It sets a high standard for decentralization and gives both regulators and innovators a durable framework.”

Wall Street ready, but critics push back - According to Bitwise CIO Matt Hougan, regulatory clarity through CLARITY could unlock billions in new institutional investment and trigger mass migration of traditional assets onto blockchain rails. "You can’t put the genie back in the bottle,” Hougan wrote, as Wall Street players like JPMorgan and Nasdaq await green lights to scale crypto involvement.

Yet DeFi leaders are sounding the alarm. They argue that the bill imposes traditional finance rules onto decentralized platforms, potentially driving developers overseas and curbing innovation. Critics cite vague language around digital commodities and lack of self-custody protections for companies, warning the bill favors centralized incumbents like Coinbase and Ripple.

Trump’s Crypto Week and Senate uncertainty - Dubbed “Crypto Week” by the Trump administration, the push for swift legislative progress gained momentum after Trump met with House GOP holdouts to secure support. However, while CLARITY is likely to pass the House, its fate in the Senate remains uncertain, particularly amid sharp criticism from DeFi advocates and Senate Agriculture Democrats.

Many now view the Senate as the last venue to amend the bill before it becomes law. With only months left in the legislative calendar, industry voices are weighing whether rushing imperfect regulation today is worth the long-term cost.

Cantor’s $4B Bitcoin bet: SPAC merger with Blockstream signals institutional surge

Key points:

Cantor Fitzgerald is finalizing a $4 billion SPAC deal to acquire 30,000 BTC from Blockstream, making it one of the largest institutional Bitcoin plays of 2025.

The move could propel Cantor’s total crypto exposure to nearly $10 billion, as it races to rival Strategy’s Bitcoin treasury dominance.

News - Financial giant Cantor Fitzgerald is closing in on a groundbreaking $4 billion Bitcoin acquisition through a special-purpose acquisition company (SPAC) deal with Blockstream’s Adam Back. The agreement would see Back contribute up to 30,000 BTC, worth roughly $3.5 billion, in exchange for equity in the newly renamed BSTR Holdings.

The SPAC, originally launched as Cantor Equity Partners 1 with a $200 million IPO in January, also aims to raise up to $800 million in external capital to fuel further BTC purchases. If successful, this would place BSTR among the world’s top institutional Bitcoin holders.

A page from Strategy’s playbook - This isn’t Cantor’s first crypto venture. In April, the firm launched Twenty One Capital in collaboration with Tether, Bitfinex, and SoftBank—a $3.6 billion initiative modeled after Michael Saylor’s Bitcoin-heavy treasury strategy. Together, BSTR and Twenty One could take Cantor’s total BTC exposure close to $10 billion this year alone.

The Trump effect and SPAC surge - This deal lands during what Republicans have dubbed “crypto week,” as lawmakers debate key digital asset legislation. It also comes amid a broader surge in SPAC-led Bitcoin treasuries under the pro-crypto Trump administration. Other players like Nakamoto Holdings and ProCap Financial are following suit, raising hundreds of millions for similar public-facing crypto vehicles.

As more firms seek to maximize BTC per share over earnings per share, Cantor’s aggressive pivot underscores how institutional Bitcoin adoption is entering a new phase, which is less about experimentation, and more about scale.

$27M BigONE hack sparks outrage, exchange promises full compensation

Key points:

Crypto exchange BigONE suffered a $27M exploit via its hot wallet on July 16 but pledged to reimburse all affected users.

Blockchain sleuths linked the attack to supply chain vulnerabilities, while critics accused BigONE of past scam facilitation.

News - BigONE is the latest crypto exchange to fall victim to a high-profile exploit, confirming a $27 million hack on July 16 due to unauthorized access to its hot wallet infrastructure. Despite user panic, the exchange assured that all affected users will be fully reimbursed, with no private keys compromised and trading set to resume shortly.

The stolen tokens spanned across Bitcoin, Ethereum, Tron, Solana, USDT, SHIB, DOGE, CELR, UNI, and more. To restore liquidity, BigONE will deploy internal reserves and borrow externally for illiquid assets. However, withdrawals remain temporarily suspended as enhanced security upgrades are implemented.

Inside the attack - CI/CD Weaknesses and Cross-Chain Laundering

Investigations by SlowMist and Cyvers revealed that the attack was likely executed through compromised CI/CD pipelines and server-level logic manipulation. The hacker reportedly bypassed risk controls, deploying malicious binaries to drain funds across multiple chains.

The stolen assets were rapidly converted to BTC, ETH, TRX, SOL, and WETH, then routed through fresh intermediaries to obfuscate tracking, suggesting preparations for mixing or DEX-based laundering.

Controversy and criticism emerge - While BigONE moved quickly to contain the breach, blockchain investigator ZachXBT reignited controversy by accusing the exchange of previously processing scam-related volumes tied to romance and investment frauds. The claim cast doubt on BigONE’s operational history, even as the platform vowed transparency in ongoing updates.

The breach has added to an already grim 2025, with crypto hack losses surpassing $2.47 billion in just the first half of the year, topping 2024’s full-year total.

More stories from the crypto ecosystem

XRP’s technical indicators flash green, but is the price really close to a breakout?

PENGU surges 14%, defies market slump – Why it’s more than just FOMO

Solana’s tokenized assets just hit $550M in volume – Here’s why it matters!

Uniswap’s President steps down after 4 years – What’s next for UNI?

‘Crypto Week’ meets TRUMP’s 40mln unlock – Possible 80% upside IF…

Did you know?

Publicly traded firms are increasingly turning to Ethereum treasuries: BitMine, Bit Digital, and SharpLink Gaming saw stock surges of 25%, ~30%, and 400%, respectively, after pivoting to ETH—marking a major institutional shift from pure Bitcoin holdings .

Bitcoin briefly became the fifth-most valuable asset globally, as its market cap surged to approximately $2.4 trillion, surpassing Amazon and reflecting growing institutional momentum.

Bitcoin just reached a record high near $123,100, driven by the U.S. House's high-profile “Crypto Week” legislative push, including the GENIUS, CLARITY, and Anti‑CBDC Surveillance State Acts.

Top 3 coins of the day

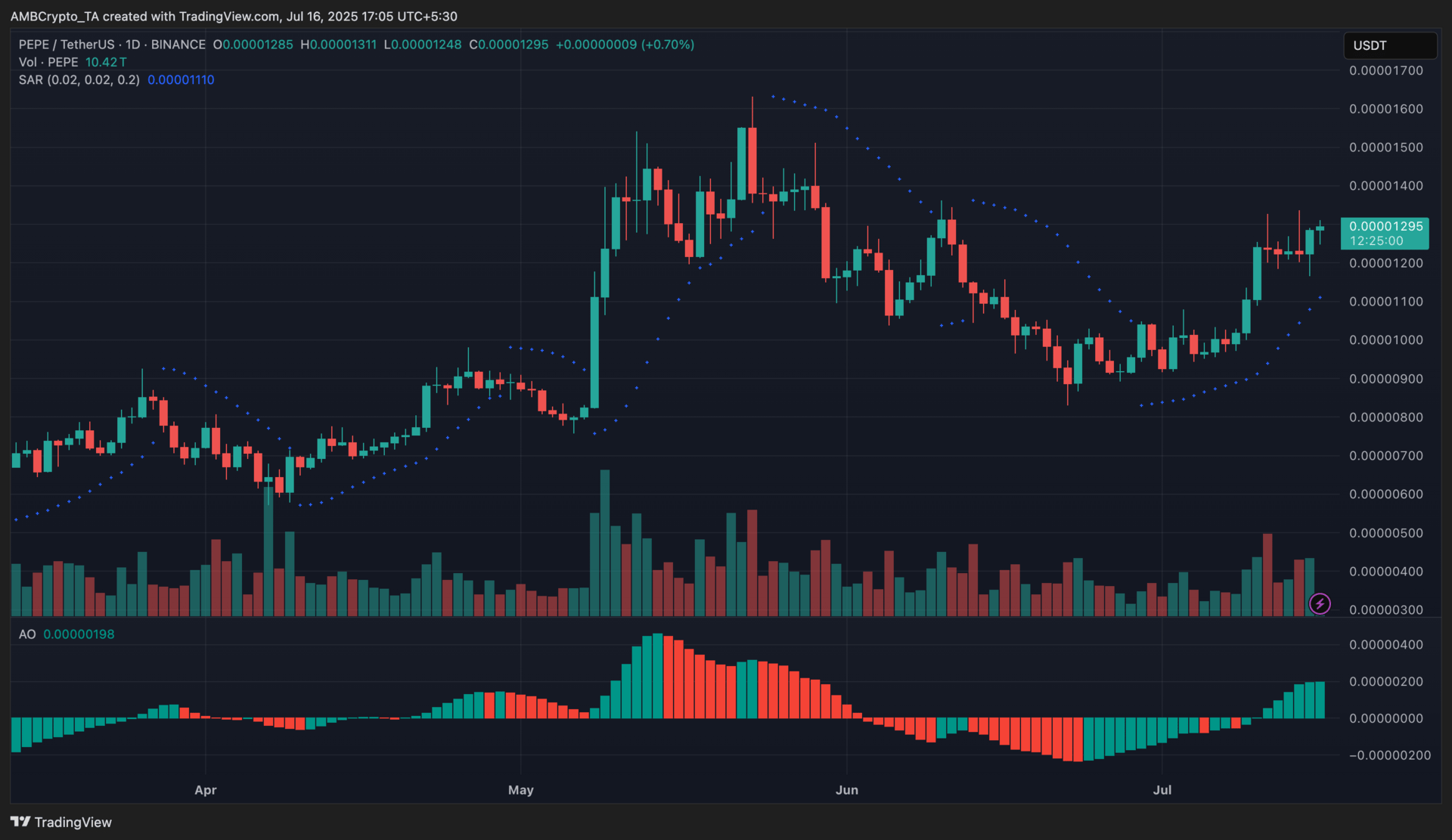

Pepe (PEPE)

Key points:

At press time, PEPE was trading at $0.00001295, reflecting a 0.70% increase over the last 24 hours.

The Parabolic SAR remained below the price, while the Awesome Oscillator continued printing stronger green bars, indicating sustained bullish momentum.

What you should know:

PEPE climbed steadily after bouncing from the $0.00000900 zone earlier this month, reclaiming bullish momentum in the process. The Parabolic SAR flipped to support during the recent rally and stayed below the candles, underscoring the upward trajectory. Moreover, the Awesome Oscillator flipped green at the start of July and continued expanding, with the latest bars reaching their highest level since May, reinforcing bullish conviction. The rally also aligned with Ethereum’s broader surge and rising ETF inflows, which boosted sentiment across ERC20 memecoins like PEPE. Volume trended higher throughout the last week, confirming broader market participation behind the breakout. If PEPE breaches the $0.00001330 resistance zone with strong volume, bulls could push toward $0.00001470. Conversely, failure to maintain current momentum may see the price revisit the $0.00001100–$0.00001140 support band.

Ethereum (ETH)

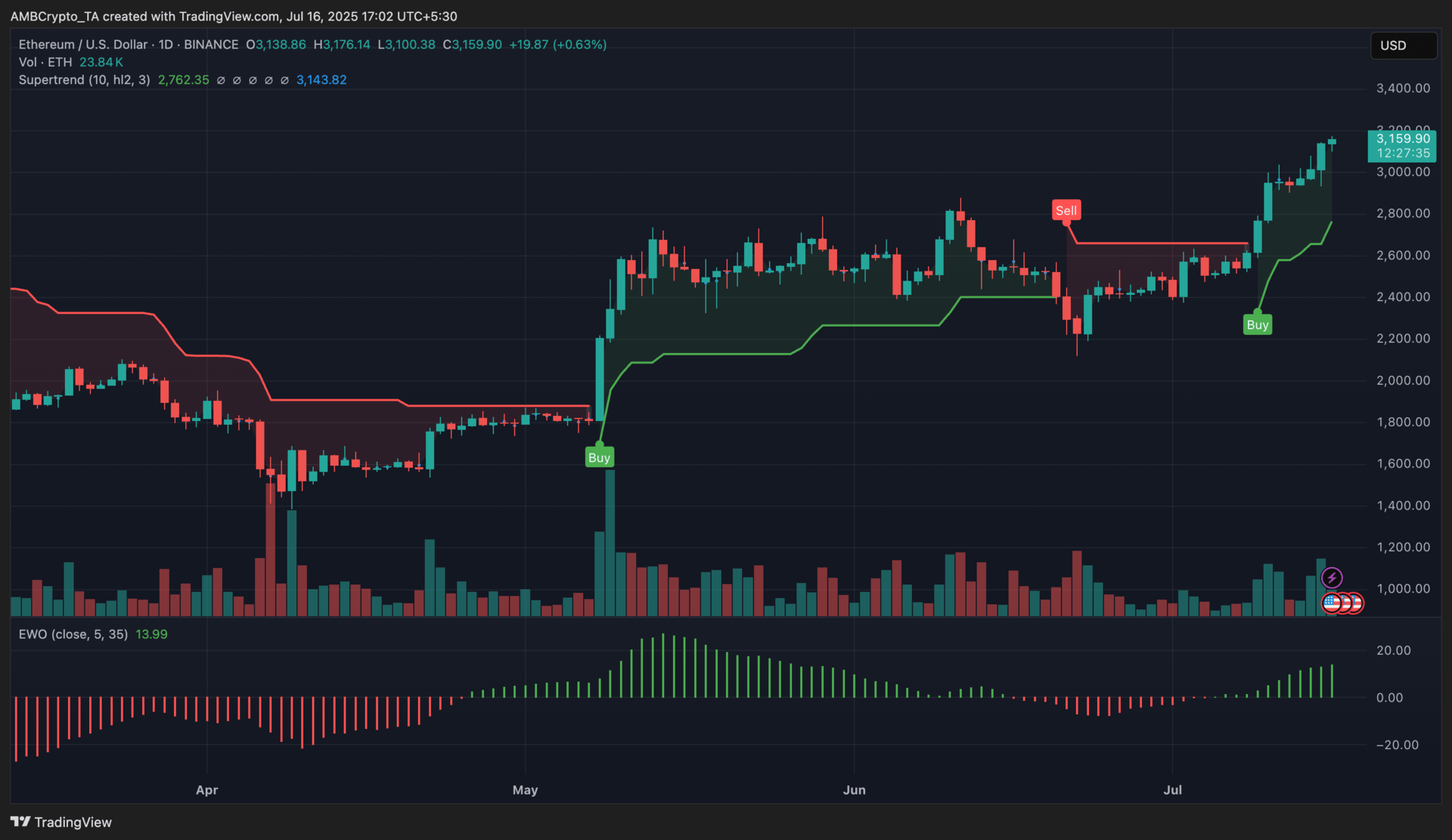

Key points:

At press time, ETH was trading at $3,159, reflecting a 0.63% increase over the last 24 hours.

The Supertrend remained firmly in buy territory, while the Elliott Wave Oscillator printed a series of rising green bars, highlighting growing bullish strength.

What you should know:

Ethereum’s price maintained its strong upward trajectory after breaking past the $3,000 psychological level earlier this week. Volume activity remained elevated, with a steady influx of buyers fueling the rally. The Elliott Wave Oscillator continued its bullish expansion, recording its highest green bars in over two months, which is a signal of sustained upward momentum. Meanwhile, the Supertrend indicator has remained in a buy position since the start of July, with no reversal triggers in sight. This bullish structure was reinforced by SharpLink Gaming’s $275M ETH accumulation spree, signaling growing institutional interest. Additionally, a rise in the Altcoin Season Index and a dip in BTC dominance reflected broader capital rotation into altcoins. With ETH eyeing the $3,175 mark, the next resistance to monitor sits near $3,250. On the downside, $2,950 remains key support.

Arbitrum (ARB)

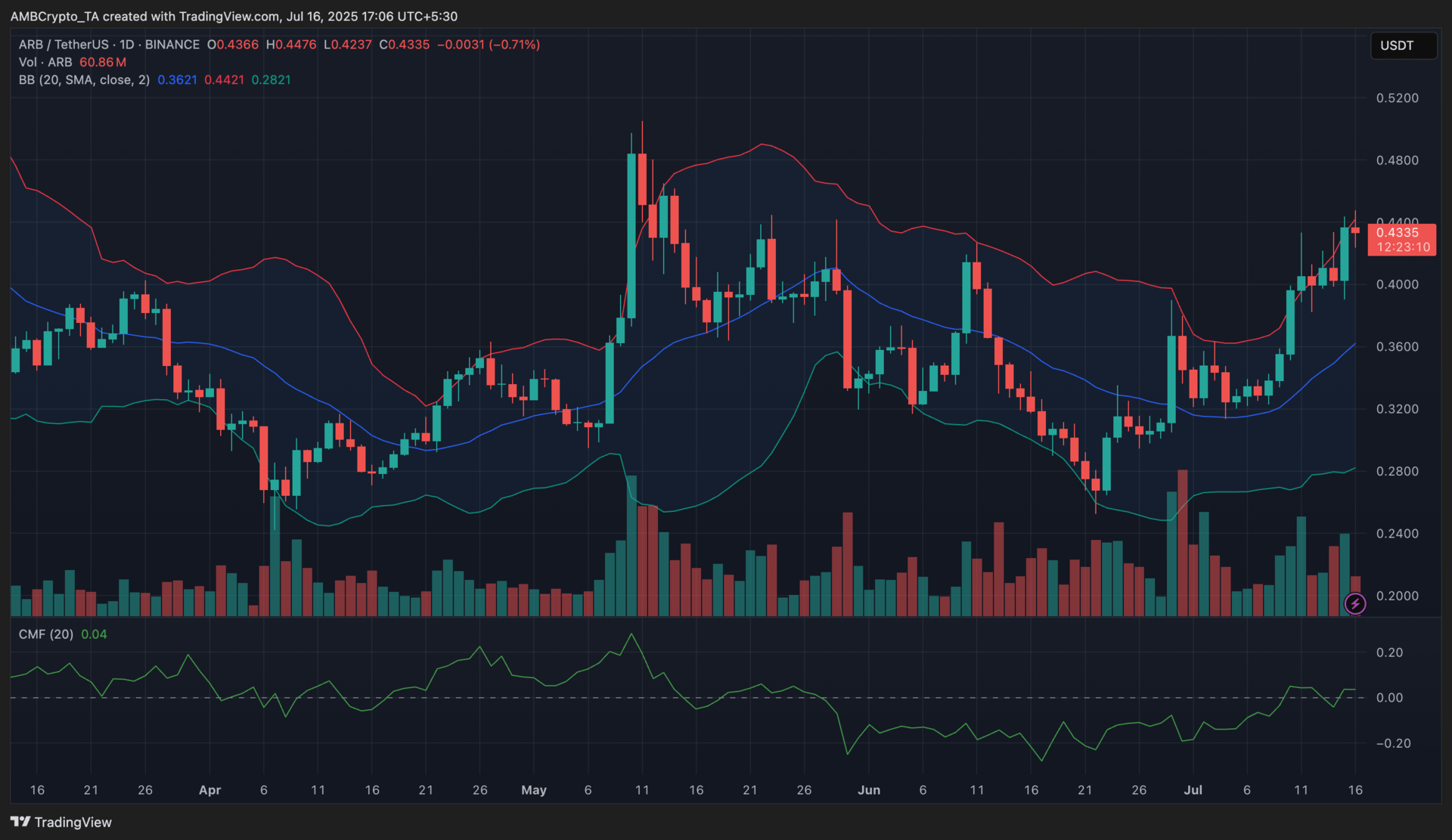

Key points:

At press time, ARB was trading at $0.43, reflecting a 0.71% dip over the last 24 hours.

The price hovered near the upper Bollinger Band, while the CMF stayed in positive territory at 0.04, indicating steady capital inflows.

What you should know:

ARB extended its bullish trajectory over the past week, reclaiming momentum after bouncing from the $0.34 support zone in early July. The price pushed through the midline of the Bollinger Bands and climbed toward the upper band, suggesting elevated bullish volatility. The Bollinger Bands also widened, indicating rising dispersion. Additionally, the CMF flipped positive and held above zero, confirming continued buying pressure. Volume stayed elevated during this move, reinforcing the strength of the breakout. The rally coincided with PayPal’s expansion of its PYUSD stablecoin to Arbitrum, boosting network adoption and real-world utility. The integration also introduced a yield-based rewards program, aligning with Arbitrum’s growing focus on real-world assets. If bulls maintain momentum and flip $0.44 into support, a move toward $0.50 may follow. Otherwise, ARB risks a pullback toward the $0.38–$0.36 zone.

How was today's newsletter? |