- Unhashed Newsletter

- Posts

- Ethereum whales quietly tighten supply

Ethereum whales quietly tighten supply

Reading time: 5 minutes

Ethereum whales tighten supply as leverage builds below $3,000

Key points:

Large Ethereum holders added over $2 billion worth of ETH despite muted price action, tightening exchange supply.

Derivatives positioning remained heavily skewed long, with leverage reaching record levels as selling pressure from long-term holders collapsed.

News - Ethereum continued to trade below the $3,000 mark, but activity beneath the surface suggested rising pressure for a decisive move. On-chain data showed aggressive accumulation by whales and institutional players even as broader market sentiment remained cautious.

The wallet known as the “66k ETH Borrow Whale” added another 40,975 ETH, lifting its total purchases since early November to 569,247 ETH, worth about $1.69 billion.

At the same time, treasury accumulation accelerated. BitMine Immersion Technologies acquired nearly $302 million worth of ETH over the past week, pushing its total holdings above 4 million ETH, or roughly 3.3% of the circulating supply.

Another major buyer, Trend Research, purchased 46,379 ETH, raising its total holdings to about 580,000 ETH. The firm also signaled plans to deploy an additional $1 billion into Ethereum, reinforcing long-term conviction despite near-term weakness.

Leverage rises as supply dries up - Derivatives data showed around 70% of global ETH positions on Binance were net long over the past month, while Ethereum’s estimated leverage ratio climbed to an all-time high.

At the same time, ETH held on exchanges continued to fall, with Binance’s exchange supply ratio dropping to its lowest level since September 2024.

Whale behavior splits, but long-term selling fades - Not all large holders were accumulating. Arthur Hayes reduced his ETH exposure, selling over 1,800 ETH while rotating capital into stablecoins and select DeFi tokens. Other entities trimmed holdings for balance-sheet reasons.

However, broader on-chain data told a different story. Long-term holder selling declined by more than 95%, suggesting that most entrenched investors were no longer distributing ETH at current levels, even as short-term positioning shifted.

With leverage elevated and liquid supply shrinking, Ethereum’s compressed range appeared increasingly fragile, setting the stage for an outsized move once price escaped its current consolidation.

XRP slides below $2 as fear builds and traders watch for a reversal

Key points:

XRP slipped below $2 as social sentiment dropped into extreme fear territory, a setup that has preceded sharp rebounds in the past.

Price action remained weak near $1.85, with heavy selling at resistance and thin year-end liquidity limiting upside follow-through.

News - XRP continued to trade under pressure, falling below the $2 mark as broader crypto markets remained volatile into year-end. The token dropped about 1.7% to 1.8% over the past 24 hours, hovering near $1.85, while sentiment across social platforms deteriorated sharply.

According to Santiment, XRP social commentary has entered the “fear zone,” a level that historically coincided with short-term rebounds. The last two comparable sentiment troughs were followed by rallies of 22% and 11%, respectively. Analysts noted that extreme pessimism has often emerged near local bottoms, even when price action remains subdued.

Despite weak momentum, institutional positioning appeared more resilient. Spot XRP investment products continued to see steady inflows, with assets under management (AUM) surpassing $1.2 billion. Analysts pointed out that markets tend to stabilize when sentiment breaks but price holds, rather than when optimism returns.

Resistance stalls recovery attempts - From a market structure perspective, XRP faced repeated rejection near $1.90, where elevated trading volumes suggested larger players were selling into strength. Intraday data showed heavy activity near $1.906, nearly double the daily average, reinforcing the view that rallies were being faded rather than accumulated.

The loss of the $1.87 support band shifted focus toward the $1.85 zone, which emerged as a near-term decision level. Failure to defend this area could expose XRP to further downside toward $1.75 or lower.

Utility grows as price struggles - Away from price action, XRP holders gained access to a new income-generating option.

Upshift, Clearstar, and Flare launched earnXRP, a vault that allows users to earn XRP-denominated yield without selling their tokens. While the product did not immediately lift prices, it highlighted continued ecosystem development during a period of muted demand.

For now, XRP remained caught between fragile sentiment, heavy resistance overhead, and thinning liquidity, leaving traders focused on whether fear-driven exhaustion could once again spark a rebound.

Trump-linked crypto activity accelerates as USD1 supply jumps and Bitcoin holdings shift

Key points:

The Trump family-linked USD1 stablecoin added $150 million in supply after Binance rolled out a high-yield incentive program.

Trump Media reshuffled 2,000 BTC following fresh inflows, signaling active treasury management rather than liquidation.

News - Crypto activity tied to Trump-linked entities picked up pace this week, spanning stablecoins, bitcoin treasury movements, and a broader pro-crypto policy backdrop in Washington.

The USD1 stablecoin, issued by World Liberty Financial and linked to the Trump family, saw its market capitalization climb from $2.74 billion to $2.89 billion after Binance introduced a promotional yield program offering up to 20% APR on qualifying deposits above $50,000.

The incentive runs until January 23, 2026, with rewards distributed daily through Binance Earn accounts.

Binance has steadily expanded support for USD1 in recent months. The exchange added fee-free trading pairs, converted collateral backing its BUSD stablecoin into USD1 at a 1:1 ratio, and integrated the token across more products. These moves helped USD1 rise to become the seventh-largest stablecoin by market capitalization, trailing PayPal USD.

Bitcoin treasury moves draw attention - Alongside stablecoin growth, Trump Media and Technology Group moved roughly 2,000 BTC, worth about $174 million, across multiple wallets shortly after increasing its holdings to 11,542 BTC.

About $12 million of the transfers went to Coinbase Prime Custody, while the remainder stayed within wallets linked to the same entity.

The transfers did not appear to signal selling. Custody movements are commonly associated with reserve reorganization, especially following new purchases. Bitcoin’s price remained stable between $86,000 and $87,000 despite the activity.

Policy tailwinds fuel crypto expansion - These developments unfolded as crypto mergers and acquisitions hit a record $8.6 billion in 2025, driven in part by regulatory shifts under the Trump administration.

New stablecoin frameworks and licensing clarity have encouraged firms to scale faster, reinforcing the intersection between political influence, capital flows, and crypto market structure.

Aave governance turmoil deepens as founder’s token-buy sparks backlash

Key points:

Aave founder Stani Kulechov faced criticism after a multi-million dollar AAVE purchase ahead of a contentious DAO vote on brand control.

AAVE price weakened amid governance uncertainty, with voting power concentration and tokenholder rights at the center of the debate.

News - Aave’s governance crisis intensified this week as scrutiny mounted over a recent AAVE token purchase by founder Stani Kulechov. Critics questioned whether the roughly $10 million buy was intended to increase voting influence ahead of a high-stakes DAO proposal focused on reclaiming control of the protocol’s brand assets.

The proposal asked whether trademarks, domains, social media accounts, and related intellectual property should move under a DAO-controlled legal structure. While supporters argued the shift would align brand ownership with tokenholder risk, others said the vote was rushed.

Former Aave Labs CTO Ernesto Boado stated the proposal was escalated to a snapshot vote without his consent, undermining community trust.

Concerns around voting power concentration added fuel to the dispute. Snapshot data showed the top three voters controlled more than 58% of total voting weight, with a small group of wallets dominating outcomes. As of the latest count, a majority of votes cast opposed transferring brand ownership, while a significant portion of voters chose to abstain.

Token price reflects governance stress - Market reaction mirrored the internal tension. AAVE fell about 20% over the past week and traded near $148, remaining below key resistance levels.

Elevated trading volume near resistance suggested sellers were active, while on-chain data showed continued outflows, pointing to risk reduction rather than accumulation.

DAO vs Labs: A broader DeFi question - The dispute exposed a deeper fault line between decentralized governance and centralized execution.

Supporters of Aave Labs argued that retaining brand control enables faster development and clearer accountability. DAO advocates countered that governance now maintains risk management and revenue generation, making brand ownership a logical extension of tokenholder rights.

With the vote still unfolding, the outcome is being watched closely across DeFi, where the balance between builders and tokenholders remains an unresolved structural challenge.

If You Could Be Earlier Than 85% of the Market?

Most read the move after it runs. The top 250K start before the bell.

Elite Trade Club turns noise into a five-minute plan—what’s moving, why it matters, and the stocks to watch now. Miss it and you chase.

Catch it and you decide.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

More stories from the crypto ecosystem

Did you know?

The IMF is openly talking about “too much” crypto regulation: In a 2025 Reuters interview, International Monetary Fund (IMF) Managing Director Kristalina Georgieva said early signs of U.S. digital asset deregulation were “quite encouraging,” arguing that in some cases there had been “overdose regulation” that created barriers for entrepreneurship and growth.

Bitcoin’s supply tap is already tightened from the 2024 halving: After the April 2024 halving, Bitcoin’s block subsidy dropped to 3.125 BTC per block, cutting new issuance in half and reshaping miner revenue dynamics.

Ethereum staking finally became “liquid” by design: Ethereum’s Shanghai/Capella upgrade enabled staking withdrawals on April 12, 2023, meaning validators get to withdraw rewards (and fully exit) once withdrawal credentials are set.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Top 3 coins of the day

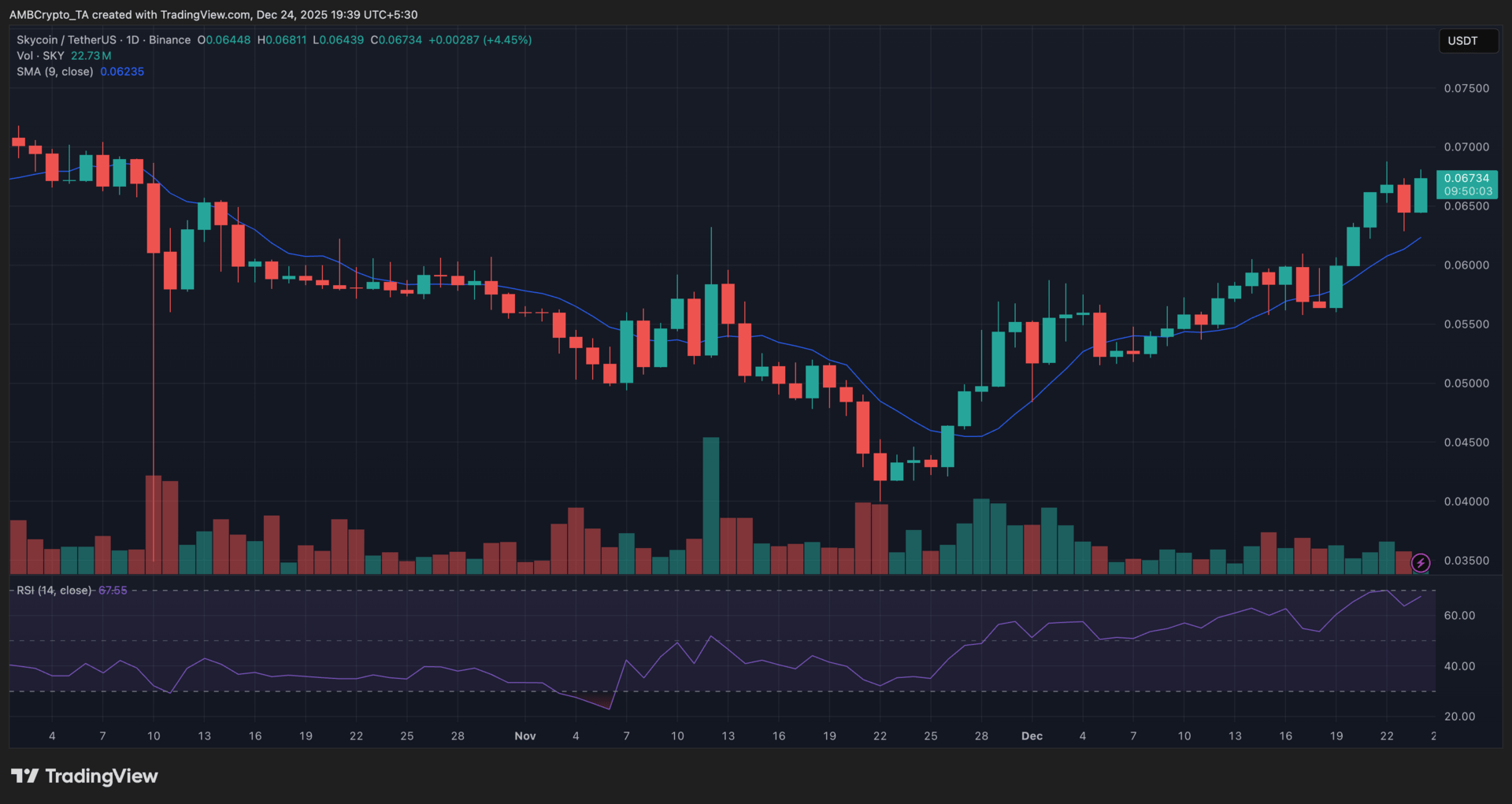

Sky (SKY)

Key points:

SKY posted a steady daily gain, holding above its 9-day SMA as buying pressure remained consistent.

RSI climbed into the upper-60s, signaling strengthening momentum while nearing overbought territory.

What you should know:

SKY extended its recovery after reclaiming the 9-day SMA, with price action printing higher closes through late December. The advance unfolded gradually rather than through sharp spikes, pointing to controlled accumulation instead of short-term speculation.

Trading volume expanded during the move, reinforcing the bullish structure and confirming participation behind the rally.

RSI trended higher and stayed above 65, reflecting rising momentum while approaching overbought conditions. While this highlighted strength, it also suggested upside could slow unless fresh volume continues to support price. A mild RSI cooldown without a sharp pullback would still keep the broader structure intact.

Beyond technicals, ongoing protocol buybacks helped absorb sell-side pressure and supported price stability during minor dips. At the same time, steady growth within the USDS stablecoin ecosystem aligned with the measured nature of the move rather than a hype-driven surge.

For now, $0.062 acts as key support, while $0.070 remains the immediate resistance zone to watch.

Zcash (ZEC)

Key points:

ZEC hovered around $425 as price action compressed between a higher low and a fresh lower high.

Momentum indicators reflected indecision, with DMI lines tightly coiled and volume remaining muted.

What you should know:

Zcash consolidated after rebounding from its early December low, carving out a higher low while failing to reclaim prior highs, resulting in a developing lower-high structure. This pattern highlighted fading upside strength rather than trend continuation.

Directional momentum remained unclear. The +DI and −DI stayed closely intertwined, while ADX stayed subdued, confirming the absence of a dominant trend. Volume also cooled from November levels, reinforcing the lack of conviction behind recent moves.

Beyond the chart, ZEC continued to benefit from periodic privacy-coin rotation, as traders repositioned amid ongoing regulatory discussions around transaction anonymity. This narrative helped cushion downside pressure but did not translate into sustained upside momentum.

The $400–$410 zone now serves as immediate support, while the $450 region caps upside. A decisive volume expansion and clearer DMI separation are needed to resolve this range.

XDC Network (XDC)

Key points:

XDC traded at $0.049 at press time, marking a modest intraday recovery after recent downside pressure.

The Parabolic SAR remained above the candles, while the Stochastic RSI stayed elevated, signaling cautious momentum rather than a confirmed trend shift.

What you should know:

XDC’s price action recently reflected a prolonged corrective phase, with sellers largely in control as the Parabolic SAR stayed positioned above the candles. This structure highlighted sustained downside pressure, even as short-lived rebounds appeared along the way.

Over the last few sessions, price stabilized near the $0.048–$0.049 zone, where buying interest briefly absorbed selling pressure.

The Stochastic RSI hovered in the upper mid-range, suggesting momentum had improved from earlier oversold conditions but had not yet entered a clear breakout phase. This pointed to consolidation rather than strong directional conviction.

Meanwhile, volume spikes during recent green candles hinted at short-term participation, though follow-through remained limited.

On the catalyst front, sentiment was supported by XDC’s ongoing $10 million Surge Program, which continued incentivizing liquidity and DeFi activity across the network. In parallel, MiCA-aligned regulatory positioning and stablecoin integrations helped reinforce XDC’s institutional narrative.

For now, the $0.048 region acts as immediate support, while sustained acceptance above $0.052 is key to watch for a firmer recovery.

How was today's newsletter? |