- Unhashed Newsletter

- Posts

- Fidelity vs VanEck on Bitcoin

Fidelity vs VanEck on Bitcoin

Reading time: 5 minutes

Fidelity and VanEck clash on Bitcoin’s 2026 playbook

Key points:

Fidelity frames Bitcoin as a maturing macro asset, increasingly driven by liquidity cycles, institutional allocation, and long-term network resilience.

VanEck argues Bitcoin’s four-year cycle has broken, pointing to mixed short-term signals and a greater role for institutional flows over halving-driven narratives.

News - Fidelity Digital Assets and VanEck are offering sharply different lenses on Bitcoin’s path into 2026, reflecting a market caught between structural optimism and near-term caution.

Fidelity’s 2026 Look Ahead report positions Bitcoin as a more resilient and institutionalized asset than in prior cycles.

The firm dismissed claims that inscriptions or expanded OP_RETURN usage threaten the network, noting that block space demand remained muted through 2025. It argued that rising transaction fees, if demand increases, would strengthen miner economics rather than undermine usability.

Fidelity also addressed governance tensions and highlighted early efforts around quantum preparedness, including proposals such as BIP-360.

VanEck, meanwhile, contends that Bitcoin’s familiar four-year cycle has fractured. In recent outlooks, the firm emphasized that institutional participation, ETF-driven flows, and macro liquidity now matter more than halving timelines.

While VanEck expects a broadly risk-on environment in early 2026 due to improved fiscal and monetary visibility, it described Bitcoin’s near-term outlook as mixed, with internal debate over how constructive the immediate cycle remains.

Liquidity, cycles, and conflicting signals - Fidelity continues to highlight Bitcoin’s historical relationship with global M2 growth, arguing that easing liquidity conditions and the potential rotation of $7.5T from money market funds could support expansion. It also pointed to over $123B held in spot Bitcoin ETPs as evidence of sustained institutional demand.

VanEck’s caution stems from recent market behavior. Bitcoin has shown periods of decoupling from both equities and gold following the October 2025 deleveraging event, complicating traditional signals.

While political uncertainty and questions around central bank independence could favor non-sovereign assets like Bitcoin, VanEck maintains that short-term signals remain mixed over the next three to six months.

A market without a single roadmap - Together, the two outlooks underline a broader shift. Bitcoin is no longer moving in lockstep with a single model. Whether liquidity-driven expansion or cycle fatigue dominates 2026 remains unresolved, leaving investors navigating a market shaped as much by institutions and policy as by its own evolving structure.

Senate crypto bill backs banks on stablecoin yield

Key points:

A revised Senate market structure draft bans interest paid solely for holding payment stablecoins, delivering a key win for banks after months of lobbying.

Activity-based rewards tied to payments, staking, liquidity, and governance remain permitted, framing the outcome as a compromise rather than a full ban.

News - A newly released draft of the United States Senate Digital Asset Market Clarity Act has drawn a clear line on stablecoin rewards, barring crypto firms from paying interest or yield simply for holding payment stablecoins while preserving incentives linked to active usage.

The provision responds directly to pressure from banking groups, which warned that yield-bearing stablecoins could accelerate deposit flight from traditional banks.

Banking groups cited a Treasury report and industry letters arguing that passive crypto yields resemble unregulated deposit products. Community banks had warned that trillions in deposits could be at risk if stablecoin rewards remained unrestricted.

Under the updated language, digital asset service providers may not offer yield in cash, tokens, or other consideration solely for holding a payment stablecoin. However, the draft explicitly allows rewards tied to transactions, transfers, remittances, settlements, wallet usage, liquidity provision, collateral posting, staking, validation, governance participation, and loyalty programs.

A compromise that satisfies banks but divides crypto - Supporters of the restriction argue it protects the traditional deposit system by reinforcing the distinction between payment stablecoins and bank deposits, without banning stablecoins outright.

Critics within the crypto industry counter that the rule strips stablecoins of a key competitive feature while preserving banks’ ability to pay interest on deposits.

Academic voices have pushed back strongly on banking claims, arguing that fears of widespread deposit flight are overstated.

Some economists note that stablecoin issuers must hold reserves in Treasury bills and bank deposits, a structure they argue could increase banking activity rather than drain it. Others say the dispute centers less on financial stability and more on who captures the yield generated by stablecoin reserves.

Legislative pressure builds ahead of markup - The bill’s release has intensified procedural tensions on Capitol Hill. Several Democratic senators have demanded a public hearing, warning that lawmakers will have less than 48 hours to review the 278-page text ahead of the scheduled markup.

Some observers expect delays as committees debate the broader implications for banks, crypto platforms, and consumer choice.

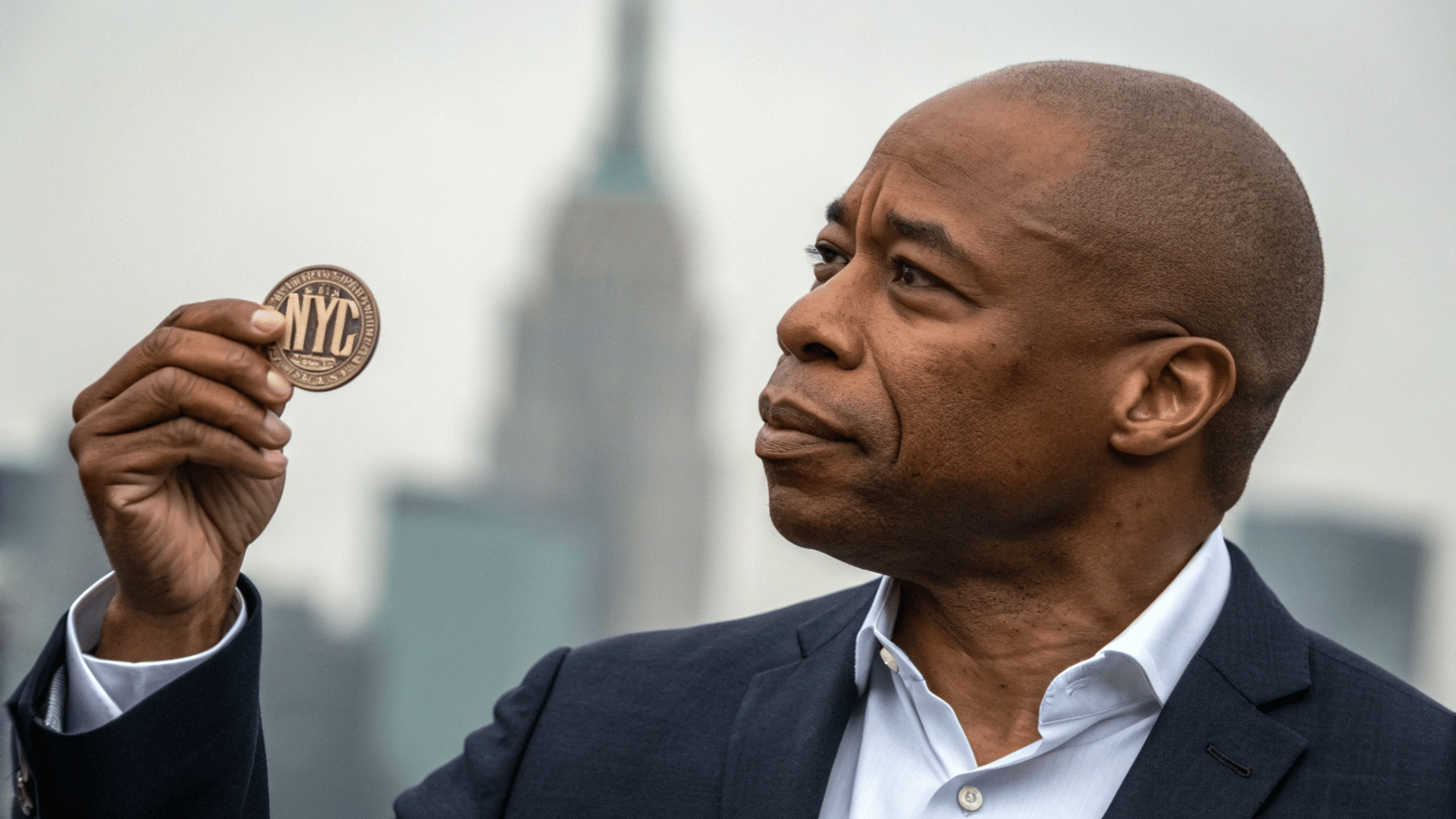

Eric Adams’ NYC token draws rug pull scrutiny

Key points:

The Solana-based NYC Token promoted by former mayor Eric Adams came under scrutiny after large liquidity withdrawals, triggering rug pull allegations from on-chain analysts.

The project denied wrongdoing, attributing the movements to liquidity rebalancing as concerns grew over supply concentration and transparency.

News - Former New York City mayor Eric Adams is facing renewed crypto scrutiny following the launch of the NYC Token, a Solana-based memecoin he unveiled during a Times Square press event. Marketed as a project to fund efforts against antisemitism and anti-Americanism, the token surged rapidly after launch before suffering a sharp reversal.

On-chain data showed NYC’s market capitalization briefly surged into the $500 million to $700 million range before falling back toward roughly $100 million to $110 million within hours. Analysts flagged large liquidity withdrawals tied to wallets linked to the token’s deployer, prompting speculation that the launch resembled a classic liquidity rug pull.

Liquidity moves trigger on-chain alarms - Blockchain investigators, including Bubblemaps, reported that a deployer-linked wallet removed roughly $2.5 million in USDC liquidity near the token’s peak.

About $1.5 million was later returned after the price had already fallen by more than 60%, leaving nearly $900,000 unaccounted for, according to on-chain tracking.

Additional analysis pointed to one-sided liquidity pools created on Meteora and unusually centralized token distribution. One analyst warned that the top five wallets controlled more than 90% of supply, leaving retail traders highly exposed if liquidity were pulled further.

Project response and structural concerns - The NYC Token team disputed allegations of misconduct, stating that the liquidity movements were part of a rebalancing process aimed at maintaining orderly trading. Adams echoed that explanation, saying the team had not sold tokens and was subject to lockups and transfer restrictions.

Despite those assurances, critics highlighted the project’s opaque structure. The token has a total supply of 1 billion, with 70% allocated to a reserve excluded from circulation. The website also includes disclaimers stating the token is not an investment product and is not affiliated with the City of New York or any government body.

Political tokens under the microscope - The episode has revived broader concerns around politically linked crypto projects, especially following last year’s LIBRA token collapse.

Analysts say NYC Token’s trajectory underscores the risks posed by concentrated supply, limited disclosures, and rapid liquidity shifts, reinforcing calls for greater transparency as the token’s market activity continues to unfold.

Polygon bets $250M on regulated stablecoin payments

Key points:

Polygon Labs is acquiring Coinme and Sequence for over $250 million, signaling a shift toward regulated stablecoin payments and transaction-based revenue.

The move pushes Polygon into direct competition with traditional and fintech payment players, raising questions about execution, differentiation, and regulatory complexity.

News - Polygon Labs has signed definitive agreements to acquire Coinme and Sequence for more than $250 million, repositioning the Ethereum scaling firm toward stablecoin-based payments rather than token-driven network growth.

The acquisitions anchor Polygon’s newly announced Open Money Stack, which aims to bundle regulated fiat on and off ramps, enterprise wallet infrastructure, and cross-chain payment routing into a single API.

Polygon CEO Marc Boiron described the strategy as an effort to become a regulated US payments player, with revenue generated through transaction fees rather than reliance on POL token appreciation.

Coinme brings licensed US fiat access, operating in 48 states under money transmitter registrations with FinCEN and offering cash-to-crypto services through more than 50,000 retail locations. Sequence adds smart wallet and cross-chain transaction tooling designed to abstract away gas fees, bridges, and swaps for end users.

From blockchain infrastructure to payments risk - The pivot marks a clear departure from Polygon’s earlier focus on consumer crypto integrations and external partnerships.

While the company is targeting more than $100 million in annual transaction-based revenue, the payments space is already crowded, with firms like Stripe, Visa, and Mastercard actively expanding stablecoin settlement capabilities.

Polygon executives argue their approach differs by acquiring infrastructure first, rather than layering crypto onto existing payment rails.

Timing meets regulation - The deals arrive as stablecoins gain momentum following the passage of the GENIUS Act in 2025, which established clearer federal rules for payment stablecoins.

The Sequence acquisition is expected to close later this month, while the Coinme transaction is expected to close after regulatory approvals, with timelines varying across disclosures.

Whether Polygon’s bet delivers sustainable growth or exposes it to new regulatory and competitive pressures remains an open question.

More stories from the crypto ecosystem

Interesting facts

Millions of Bitcoin are likely gone forever: Blockchain analysis suggests that a significant share of Bitcoin’s total supply is permanently lost due to forgotten keys, discarded hard drives, or early wallets that have never moved funds, meaning the effective circulating supply is far smaller than the headline cap.

Crypto governance is often decided by a tiny minority: Studies of decentralized autonomous organizations (DAOs) show that voting participation is frequently low, with a small group of large token holders shaping outcomes, raising questions about how decentralized on-chain governance really is in practice.

Crypto development slowed even as prices recovered: Despite market rebounds, developer activity across many crypto ecosystems declined in 2023, with fewer monthly active developers compared to peak years, suggesting that price recoveries do not automatically translate into sustained builder growth.

Top 3 coins of the day

Dash (DASH)

Key points:

DASH jumped toward the $60 zone after breaking out of a multi-week range, delivering one of its strongest daily moves in months.

The Supertrend flipped bullish, while +DI surged above -DI, even as ADX suggested trend strength was still developing.

What you should know:

DASH broke out sharply after spending several weeks compressing between the $38 and $45 range. The rally unfolded in a single wide-ranging candle, marking a decisive shift in price behavior following a prolonged period of low volatility. Prior downside pressure faded quickly as buyers stepped in with force, lifting DASH well above its recent consolidation zone.

From a technical perspective, Supertrend switched from red (sell) to green (buy) as price closed decisively above the indicator, signaling a change in directional bias.

DMI reflected a clear surge in buying dominance, with +DI overtaking -DI, though ADX remained relatively subdued, indicating the move was still in its early stages rather than a fully established trend. Volume expanded sharply during the breakout, reinforcing the strength of the advance.

Beyond the chart, momentum was likely amplified by a broader privacy coin rally and elements of a short squeeze, which may have accelerated upside moves. The $52–$55 area now acts as near-term support, while $70–$75 stands as the next resistance zone to watch.

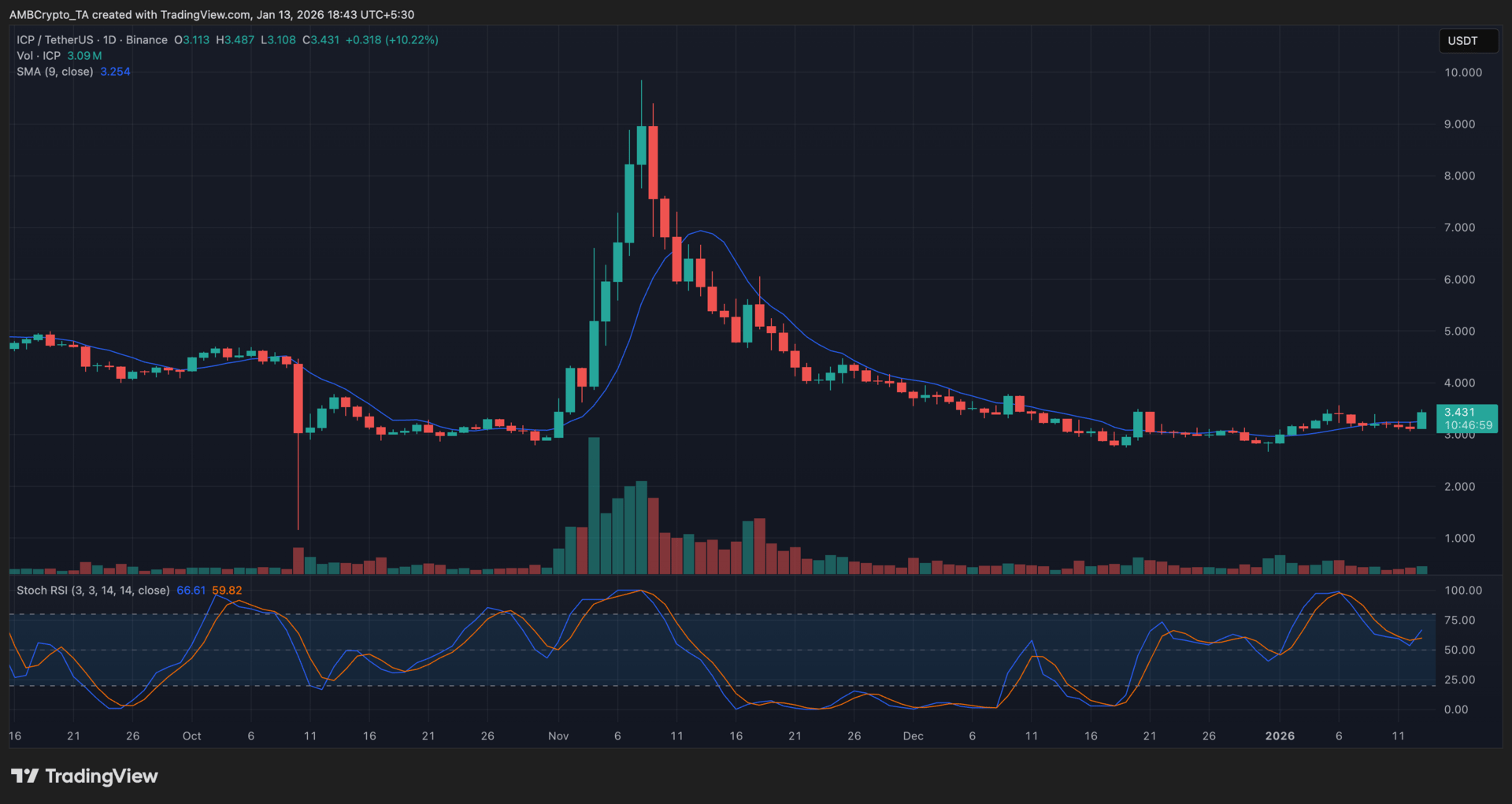

Internet Computer (ICP)

Key points:

ICP climbed toward the $3.40 region after snapping a prolonged downswing, posting one of its strongest daily candles in weeks.

Price reclaimed the 9-day SMA, while Stochastic RSI turned higher, pointing to a short-term momentum revival.

What you should know:

ICP staged a sharp rebound after drifting lower for much of December, with the latest session breaking a stretch of subdued price action.

The move lifted ICP decisively above its short-term moving average, signaling a shift in near-term bias after weeks of persistent pressure. Unlike earlier attempts, this advance unfolded with a clear expansion in range and participation.

From an indicator standpoint, the 9-day SMA, which had capped upside through late December, was reclaimed during the rally. Stochastic RSI pushed into the upper half of its range, reflecting improving momentum, though not yet extreme conditions. Volume rose notably alongside the breakout, suggesting fresh interest rather than a low-liquidity uptick.

Beyond technicals, ICP likely benefited from altcoin rotation as traders rotated into higher-beta names, alongside steady narratives around on-chain growth supporting longer-term confidence. The $3.20–$3.25 zone now acts as immediate support, while $3.55–$3.60 remains the key resistance to watch.

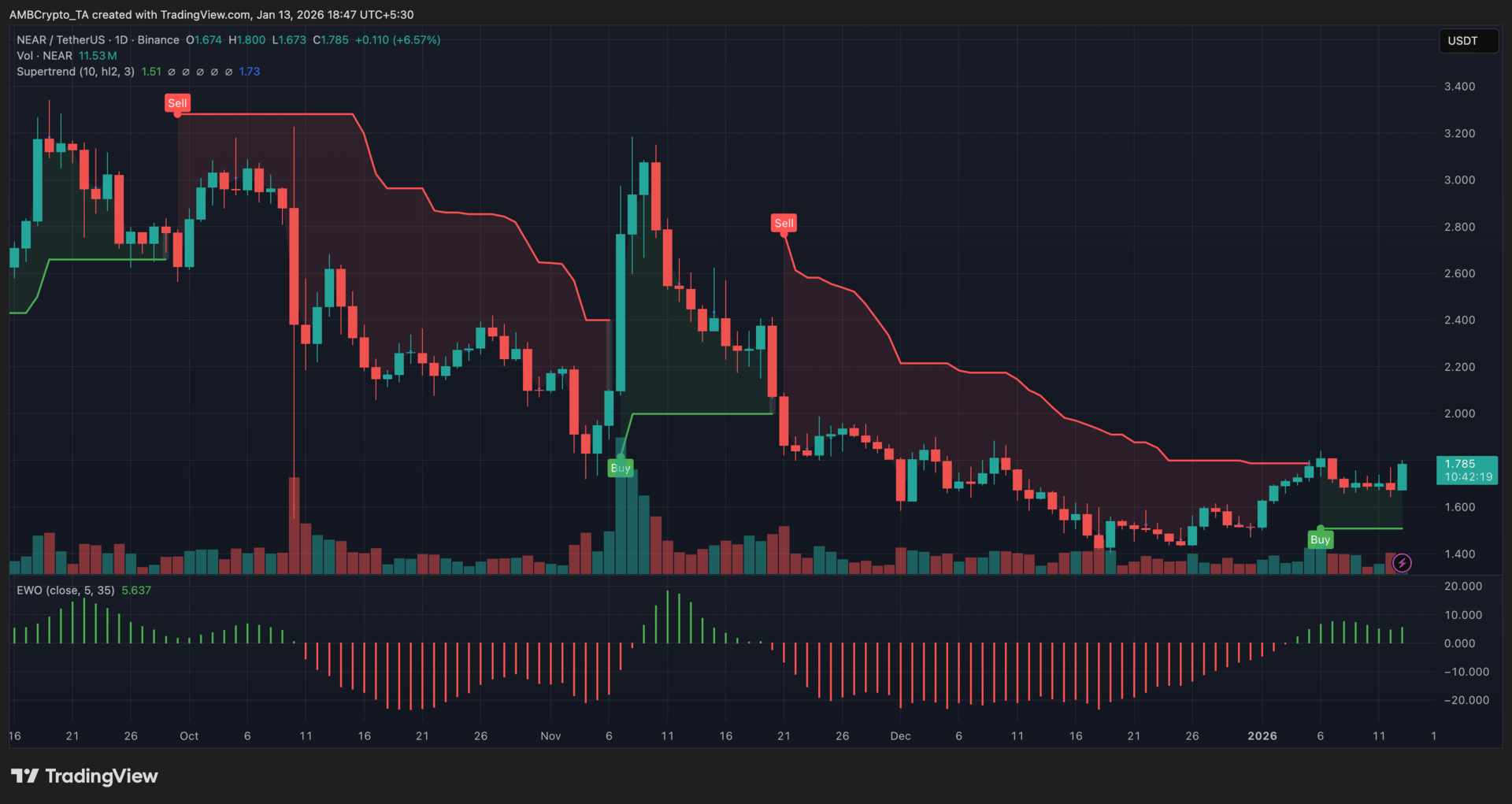

NEAR Protocol (NEAR)

Key points:

NEAR advanced toward the $1.78 area after rebounding from December lows, easing its recent downtrend.

Supertrend turned supportive, while the EWO shifted into positive territory, reflecting a pickup in upside momentum.

What you should know:

NEAR continued its recovery after finding support near the mid-$1.40 region, with recent sessions producing higher closes and firmer follow-through. The move marked a clear shift from the steady decline seen through most of December, though price remained well below earlier peak levels from November.

From a technical standpoint, Supertrend flipped bullish during the rebound and remained below price, signaling improving short-term direction. Momentum also strengthened, as the Elliott Wave Oscillator moved out of negative territory and printed expanding green bars, pointing to growing upside pressure.

Volume increased during the rebound phase, suggesting the recovery was backed by participation rather than a thin bounce.

Moreover, sentiment around NEAR appeared to benefit from broader network momentum narratives and analyst optimism, with figures like Michael Poppe highlighting the token’s recovery structure. The $1.60–$1.65 zone now acts as immediate support, while $1.85–$1.95 stands as the next resistance area to monitor.

All the stories worth knowing—all in one place.

Business. Tech. Finance. Culture. If it’s worth knowing, it’s in the Brew.

Morning Brew’s free daily newsletter keeps 4+ million readers in the loop with stories that are smart, quick, and actually fun to read. You’ll learn something new every morning — and maybe even flex your brain with one of our crosswords or quizzes while you’re at it.

Get the news that makes you think, laugh, and maybe even brag about how informed you are.

How was today's newsletter? |