- Unhashed Newsletter

- Posts

- Grayscale sees a narrower crypto 2026

Grayscale sees a narrower crypto 2026

Reading time: 5 minutes

Grayscale’s 2026 view puts Bitcoin ahead as altcoins thin out

Key points:

Bitcoin’s price remains constrained by thin liquidity, legacy holder selling, and cautious positioning, despite stronger institutional and macro conviction.

Regulatory clarity and selective capital allocation are shaping a 2026 market where Bitcoin stands out amid rising pressure on weaker altcoins.

News - As crypto markets head into 2026, conviction and price continue to diverge. Bitcoin remains the focal point. Institutional adoption is expanding, yet short-term price action has stayed fragile amid holiday liquidity, uneven regional flows, and persistent distribution from older holders.

Recent activity has been driven largely by discretionary spot and perpetual buying rather than forced positioning. Strategy’s purchase of 1,229 BTC for $108.8 million added to near-term demand, but options markets suggest the upside remains sensitive to positioning shifts.

After a major expiry, funding rates rose and dealer exposure flipped, creating conditions that could amplify momentum if prices move decisively.

Why $94,000 is the key trigger - Options positioning points to $94,000 as a critical level. A sustained move above it could force hedging activity that reinforces buying pressure. At the same time, downside protection demand has eased as large put positions expired.

With roughly half of open interest cleared, volatility is expected to return as traders rebuild exposure.

Beyond that, $100,000 to $110,000 remains a major resistance zone where selling from long-term holders could re-emerge.

Regulation, macro, and the 2026 framework - Attention is increasingly shifting toward structural drivers. Grayscale expects US crypto market structure legislation to advance in 2026, potentially unlocking broader institutional participation and deeper on-chain activity.

Analysts view regulatory clarity as a more immediate catalyst than speculative risks such as quantum computing, which are unlikely to influence prices next year.

Macro pressures such as rising government debt, persistent fiscal deficits, and concerns around fiat debasement continue to reinforce Bitcoin’s store-of-value appeal heading into 2026.

Altcoins face a narrower path - While Bitcoin’s long-term framework continues to strengthen, the outlook for altcoins appears far more selective.

Crypto analyst Michaël van de Poppe warned that most altcoins may not survive into 2026, pointing to prolonged underperformance, weak token economics, and rising competition as key pressures. He argued that assumptions around broad altcoin recoveries are increasingly risky in a market shaped by institutional capital and tighter financial conditions.

Rather than a wide-based resurgence, Van de Poppe expects capital to concentrate around a smaller group of projects showing genuine growth in activity, usage, and revenue, even if token prices remain under pressure.

XRP caught between holder buying and whale selling

Key points:

XRP remains trapped in a bearish channel, with holder accumulation slowing downside but failing to flip the broader structure.

Institutional ETF inflows continue, yet whale selling and rising exchange deposits keep price action defensive.

News - XRP is closing the year in a fragile equilibrium. The token traded near $1.85 to $1.87 after losing key short-term support, extending a broader downtrend that has persisted since October. Despite renewed buying from both long-term and short-term holders, price remains confined within a descending channel, leaving XRP vulnerable if support fails.

On-chain data shows long-term holders reversing weeks of net selling late in December, adding millions of XRP over a short window.

Short-term holders have also increased their share of supply, a cohort that often fuels sharp moves but exits quickly during volatility. This dual-layer buying has helped XRP hover near the upper end of its bearish structure, but it has not produced a decisive breakout.

Whales and exchange flows add friction - While smaller holders accumulate, whales are moving in the opposite direction. Large XRP wallets reduced holdings by over 130 million tokens in late December, adding meaningful sell-side pressure.

At the same time, exchange inflows have surged, signaling that more XRP is being positioned for potential distribution rather than long-term holding.

This supply dynamic helps explain why rebounds have repeatedly stalled. Even as buyers step in, whale trimming and elevated exchange deposits have capped upside attempts and reinforced a defensive tape.

ETFs offer support, not a breakout - Institutional interest remains a stabilizing force. US-listed spot XRP ETFs extended their inflow streak to 29 consecutive days, pushing cumulative inflows past $1.15 billion.

December inflows remained positive even as Bitcoin and Ether ETFs saw heavy outflows, suggesting XRP continues to attract differentiated demand tied to regulatory clarity and its cross-border settlement use case.

Institutional participation around XRP has reflected a longer-term positioning approach rather than short-term trading behavior. Accumulation activity earlier in December appeared focused on gaining exposure ahead of expected ETF-driven demand, with institutions prioritizing structural positioning over immediate price movements.

Levels that matter next - XRP needs to hold above $1.79 to avoid accelerating downside toward $1.64 and $1.48. A daily close above $1.98 would neutralize the bearish channel and reopen the path toward $2.28. Unless whales return and exchange inflows ease, broad holder buying may slow declines but still struggle to flip the trend.

Iran’s currency crisis revives Bitcoin’s store-of-value debate

Key points:

Iran’s rial has collapsed to record lows, triggering protests and intensifying inflationary pressure across the economy.

The crisis has reignited discussion around Bitcoin as a hedge against currency debasement, though access and volatility remain constraints.

News - Iran’s deepening currency crisis has pushed the rial to historic lows, fueling widespread protests and renewed debate around alternative stores of value.

By late December, the rial had fallen to around $1.4 million per US dollar, marking a loss of more than 40% since June. Inflation climbed to 42.2%, with food prices surging 72% year on year, placing severe strain on households and small businesses.

Demonstrations spread across Tehran and other major cities after shops closed in protest, reflecting growing frustration over rising prices, sanctions, and declining purchasing power. The unrest culminated in the resignation of central bank governor Mohammad Reza Farzin, underscoring the scale of economic stress facing the country.

Bitcoin enters the conversation - Against this backdrop, Bitwise CEO Hunter Horsley pointed to Bitcoin as a potential safeguard against currency collapse.

Horsley argued that persistent economic mismanagement has repeatedly eroded confidence in national currencies, positioning Bitcoin as an alternative for preserving value when local monetary systems falter.

The debate echoes a broader view that Bitcoin can serve as a hedge during periods of currency debasement, particularly in economies grappling with inflation, capital controls, or political instability. Previous episodes in countries like Argentina have shown rising use of Bitcoin and stablecoins during periods of peso depreciation.

Gold rallies, limits remain - Traditional safe havens have also surged. In Iran, gold coins reached roughly 1.7 billion rials in December, more than doubling since June, highlighting how demand for stores of value intensifies during currency stress. However, access to Bitcoin remains uneven.

While crypto trading is permitted in Iran, rules around self-custody are unclear, and mining is tightly regulated amid government crackdowns.

Bitcoin’s fixed supply and independence from domestic monetary policy continue to underpin its appeal during crises. Still, volatility, regulatory barriers, and enforcement risks mean it often sits alongside traditional hedges like gold rather than fully replacing them in environments like Iran’s.

Metaplanet deepens Bitcoin bet as income strategy outperforms

Key points:

Metaplanet lifted its Bitcoin holdings to 35,102 BTC after adding $451 million worth of BTC in late December.

Its Bitcoin Income Generation business exceeded forecasts, highlighting a hybrid treasury model focused on accumulation and yield.

News - Tokyo-listed Metaplanet closed out 2025 with a major expansion of its Bitcoin treasury, acquiring an additional 4,279 BTC at a cost of about $451 million. The purchase lifted its total holdings to 35,102 BTC, placing the firm among the largest publicly disclosed corporate Bitcoin holders globally.

The company also reported a 2025 BTC Yield of 568.2%, a proprietary metric that tracks changes in Bitcoin holdings per fully diluted share rather than realized profits.

The accumulation capped a year in which Metaplanet leaned harder into a hybrid treasury model that combines long-term Bitcoin ownership with recurring revenue generation.

In a recent filing, the company reported that its Bitcoin Income Generation business outperformed expectations, delivering 8.58 billion Japanese yen, or roughly $54 to $55 million, in revenue for 2025.

A treasury model built on yield - Unlike firms that hold Bitcoin purely as a balance-sheet asset, Metaplanet uses option-based strategies to generate income from a separate pool of BTC. These strategies are designed to earn premiums while leaving the company’s core long-term holdings untouched, turning Bitcoin into a productive asset rather than a dormant reserve.

The income arm has scaled rapidly, posting a quarterly compounded growth rate of about 57% since late 2024. Metaplanet has positioned the income arm as support for ongoing accumulation alongside corporate financing tools.

Strong accumulation, mixed market response - Metaplanet’s strategy echoes the aggressive Bitcoin accumulation seen across corporate treasuries in 2025, including at Strategy. However, the market response has been more cautious.

Metaplanet’s market-to-Bitcoin net asset value ratio slipped below 1 in October, signaling that its shares traded at a discount to the value of its Bitcoin holdings.

The company said it is reviewing how the stronger-than-expected income results will affect its consolidated outlook and plans to update guidance once that assessment is complete.

If You Could Be Earlier Than 85% of the Market?

Most read the move after it runs. The top 250K start before the bell.

Elite Trade Club turns noise into a five-minute plan—what’s moving, why it matters, and the stocks to watch now. Miss it and you chase.

Catch it and you decide.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

More stories from the crypto ecosystem

Interesting facts

Tokenized T-bills are quietly becoming a category: Tokenized money market funds have been rising as a bridge between traditional cash management and on-chain settlement, with regulated structures increasingly wrapping short-duration government debt into blockchain-native products.

Half of Bitcoin has not moved in over a year: Roughly 52% of Bitcoin’s circulating supply has remained inactive for 1+ year, a sign that long-term holding still dominates even as ownership rotates through newer participants.

The weekend market is shrinking, not disappearing: The share of BTC traded on weekends has declined over time, suggesting liquidity is becoming more “weekday-heavy” as market structure professionalizes, which can make weekend conditions thinner during stress.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Top 3 coins of the day

Cronos (CRO)

Key points:

CRO edged higher to around $0.094 after a muted daily gain, as selling pressure eased following an extended downtrend.

Price remained below the 20-day and 50-day moving averages while RSI stabilized near 40, pointing to reduced downside momentum amid light volume.

What you should know:

Cronos showed early signs of steadiness after weeks of gradual decline, with price consolidating just above the $0.092 zone. While the latest session ended in positive territory, CRO continued to trade beneath both key moving averages, keeping the broader structure tilted to the downside. The rebound attempt reflected short-term stabilization rather than a confirmed shift in trend.

Momentum conditions remained cautious. RSI recovered from deeper December lows and settled near the low-40s, signaling that bearish pressure had softened without transitioning into bullish territory. Volume stayed relatively thin, reinforcing the lack of aggressive participation behind the move.

Outside the chart, sentiment found modest support from renewed attention on institutional-facing CRO products and ongoing staking and validator activity on the network. These factors helped stabilize expectations without materially changing near-term dynamics. Support sits near $0.092–$0.094, while resistance remains clustered around $0.098–$0.10.

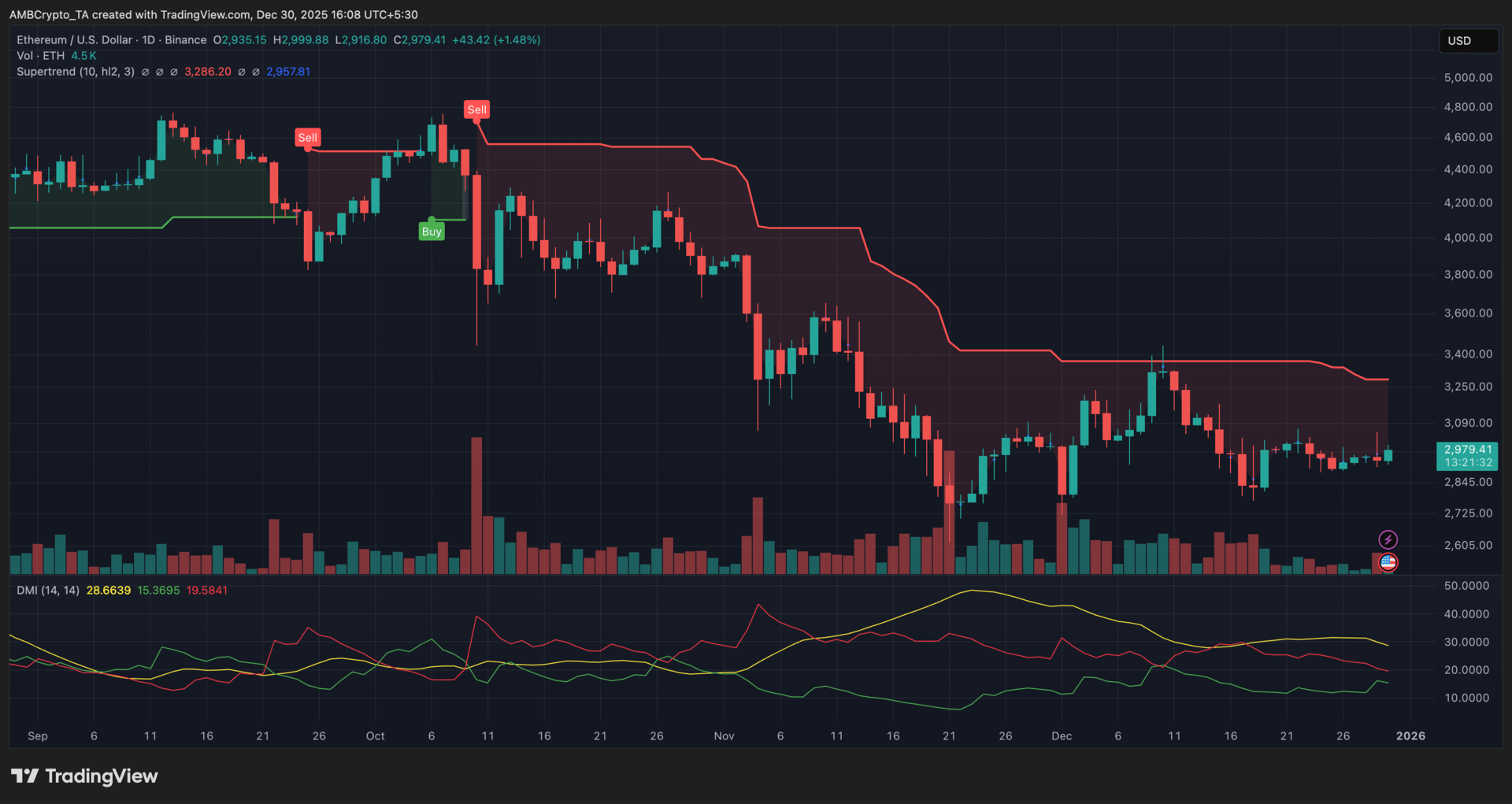

Ethereum (ETH)

Key points:

ETH hovered near the $3,000 level after a measured rebound, but upside traction remained limited.

Supertrend and DMI continued to lean bearish, indicating that recent gains lacked confirmation.

What you should know:

Ethereum’s price action shifted into a holding pattern after recent volatility eased, with ETH stabilizing just below the $3,000 threshold. Instead of a sharp rebound, the market transitioned into sideways movement, suggesting that traders were reassessing direction rather than aggressively repositioning. The Supertrend indicator stayed overhead, reinforcing that ETH had yet to reclaim trend control despite short-term price recovery.

Momentum signals supported this cautious tone. The DMI showed -DI remaining above +DI, while ADX stayed elevated, pointing to a prevailing bearish structure even as downside pressure softened. Volume picked up during select recovery candles but remained muted overall, signaling hesitation rather than conviction among participants.

On the catalyst front, sizable ETH transfers to exchanges introduced near-term supply concerns, while the recently activated Fusaka upgrade continued to underpin longer-term network optimism. Support sits around the $2,950 zone, while resistance remains near $3,250–$3,300, aligned with the Supertrend ceiling.

TRON (TRX)

Key points:

A Supertrend flip altered TRX’s short-term bias, shifting focus toward trend defense rather than decline.

Early momentum signals emerged without aggressive participation, keeping expectations tempered.

What you should know:

TRON’s technical posture changed meaningfully after the Supertrend indicator switched into Buy mode during recent sessions. With the green trend line now tracking below price, the $0.27 area has taken on greater importance as a reference point for near-term structure. This shift did not follow a sharp breakout but instead developed through compression, reflecting a market that paused rather than rushed.

Momentum readings echoed that change in tone. The Elliott Wave Oscillator moved marginally into positive territory, marking the first sustained appearance of bullish momentum after an extended negative phase. However, the absence of expanding volume suggested that positioning remained cautious, with traders reacting selectively rather than committing heavily.

On the narrative side, SUN.io’s earlier fee reduction continued to reinforce TRON’s low-cost DeFi appeal, while Justin Sun’s strategic capital allocation added a layer of longer-term confidence. Immediate support remains near $0.27, while $0.29 stands as the next area where trend follow-through is tested.

How was today's newsletter? |