- Unhashed Newsletter

- Posts

- Insiders cash $23M from Kanye West’s coin

Insiders cash $23M from Kanye West’s coin

Reading time: 5 minutes

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs behind Uber and eBay also backed Pacaso. They made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO. Now, you can join, too.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Kanye West’s YZY token linked to nearly $23M in insider gains

Key points:

Onchain analysts tied a YZY sniper wallet to LIBRA‑linked addresses, with insiders extracting nearly $23 million across both launches.

YZY’s market cap jumped to about $3 billion within 40 minutes before sliding toward $1.05 billion amid centralization and liquidity concerns.

News - On Thursday, Ye (Kanye West) launched his YZY token on Solana, setting off a volatile debut. Within 40 minutes, the token’s market value surged to roughly $3 billion, then fell toward $1.05 billion. Pseudonymous sleuth “Dethective” linked a YZY sniper to wallets involved in the LIBRA rollout about six months ago, estimating nearly $23 million extracted across the YZY and LIBRA events.

One YZY wallet reportedly bought $250,000 at $0.20 and realized over $1 million in minutes, routing proceeds to a treasury wallet also funded by LIBRA‑tied addresses. Nansen, an on-chain analytics platform, and Cyvers, a blockchain security firm, said the YZY sniper overlaps with the LIBRA extraction flow, while noting they cannot confirm a link to Hayden Davis, creator of LIBRA.

Celebrity hype, insider doubts - YZY is pitched as part of a “YZY Money” ecosystem that includes Ye Pay and a YZY Card. Although the team deployed 25 contract addresses to deter snipers, on-chain data from Lookonchain shows certain wallets prepared funds in advance and bought immediately at launch.

Coinbase’s Conor Grogan highlighted extreme concentration, with insiders holding about 94% at one point and a single multisig controlling 87% before distribution.

Liquidity risks mirror LIBRA - Lookonchain noted that only YZY was added to the liquidity pool, allowing developers to sell by adding or removing liquidity, similar to LIBRA’s design.

Priority fees were used to speed transactions, including one case around $24,000; OnChain Lens tracked a large buyer sitting on an unrealized gain of about $6 million at the peak. At the time of writing, YZY hovered near $1, down more than 60% over the day, even as traders like Arthur Hayes and James Wynn disclosed buys.

BNB hits record high as Teng’s poll highlights market momentum

Key points:

BNB touched a record $882.59, lifting its market cap above $120 billion and keeping it the fifth‑largest crypto asset.

Corporate treasury bets have grown, but Windtree Therapeutics’ Nasdaq delisting underscores the risks of such strategies.

News - BNB surged to a new all‑time high of $882.59 on August 20, extending a roughly 35% advance over the past 60 days. The rally pushed BNB’s market value to about $120 billion, placing it around $19 billion ahead of Solana by market capitalization. Seizing the moment, Binance CEO Richard Teng asked followers on X to share their “aha” moments in crypto, drawing broad engagement from traders and influencers.

Behind the price strength is a growing wave of corporate treasury allocations. In July, firms including Windtree Therapeutics and Nano Labs collectively allocated about $610 million toward BNB, reflecting a wider balance‑sheet diversification trend inspired by earlier Bitcoin treasury strategies.

Treasury bets turn sour - Windtree’s pivot has quickly run into headwinds. Weeks after touting plans that could scale to a $200 million BNB treasury, the company received a Nasdaq delisting order for failing to maintain the $1 minimum bid. Shares fell about 77% to $0.11 on the news and are now over 90% below their July peak. Windtree says it plans to transition to OTC trading, though outcomes remain uncertain.

On‑chain momentum builds - On‑chain indicators point to firm demand. Exchange balances fell by ~530,000 BNB between August 19 and 20, while HODL waves show both mid‑term and long‑term holders increasing positions. The constructive structure holds as long as BNB stays above key support; a break below $812 would weaken the setup.

Tether and Circle court South Korea’s biggest banks on stablecoin push

Key points:

Circle President Heath Tarbert and Tether executives are meeting Korea’s four largest banks to discuss USDC, USDT, and potential won-backed stablecoins.

The visits coincide with Seoul’s upcoming stablecoin regulatory framework and political debate over how such tokens should be governed.

News - Stablecoin issuers Tether and Circle are stepping up efforts in South Korea. Local media reports confirm executives from both firms are holding meetings this week with leaders from KB, Shinhan, Hana, and Woori, the country’s four largest banking groups.

Circle President Heath Tarbert is set to meet Shinhan CEO Jin Ok-dong and Hana CEO Ham Young-joo on Friday, with additional sessions planned with KB and Woori executives. Tether has dispatched a delegation that includes vice president Marco Dal Lago, underscoring the firm’s intent to expand in the market.

Politics and regulation - The meetings align with South Korea’s plan to introduce a stablecoin bill in October under the Virtual Asset User Protection Act. The move follows the central bank’s decision in June to suspend CBDC pilots in favor of developing won-backed tokens.

Political debate continues: the ruling Democratic Party is advancing legislation for stablecoins and crypto ETFs, while opposition lawmakers push for tighter limits on interest-bearing tokens. Bank of Korea Governor Rhee Chang-yong has backed won stablecoin development but stressed that banks should lead issuance.

Strategic positioning - Circle is presenting USDC as part of a global payments network, while Tether focuses on building partnerships and market research, supported by its newly hired Korean expansion manager. Both firms see potential in South Korea’s trade-driven economy, where stablecoins could play a role in settlement and cross-border transactions.

MetaMask enters stablecoin market with wallet-native mUSD

Key points:

MetaMask announced its first native stablecoin, mUSD, launching later this year on Ethereum and Linea, fully backed by US cash and Treasuries.

Issued by Stripe-owned Bridge and powered by M0, mUSD will integrate across MetaMask’s ecosystem, including swaps, bridging, and debit card payments.

News - MetaMask, the self-custodial wallet by Consensys, has unveiled MetaMask USD (mUSD), marking the first wallet-native stablecoin from a major crypto wallet provider. The token, issued by Bridge (a Stripe subsidiary) and supported by the M0 protocol, will be backed 1:1 by cash and short-term US Treasuries. It is expected to launch later in 2025 on both Ethereum and Consensys’ Linea network.

MetaMask said mUSD will function as the default digital dollar unit within its wallet, simplifying on-ramps, swaps, bridging, and payments for its global user base of over 100 million. By the end of the year, the token will also be available as a payment option through the Mastercard-powered MetaMask Card, enabling everyday transactions.

More than just another stablecoin - Ajay Mittal, VP of product strategy, noted that the yield generated from reserve assets will support improvements to MetaMask’s ecosystem. Gal Eldar, product lead, highlighted how mUSD lowers barriers to entry by reducing costs and simplifying onboarding. Unlike most tokens, which are issued first and later integrated, mUSD is native to MetaMask from the outset.

Regulatory clarity fuels adoption - The rollout follows the passage of the US GENIUS Act, signed in July, establishing the first federal framework for payment stablecoins. With monthly stablecoin volumes surpassing $1 trillion, MetaMask sees mUSD as a “core liquidity layer” across its wallet ecosystem and the growing Linea DeFi network. The project also showcases how Bridge and M0’s infrastructure could accelerate a wave of application-specific stablecoins beyond MetaMask.

More stories from the crypto ecosystem

Interesting facts

Asia’s wealthy families and family offices are increasingly allocating around 5% of their portfolios to cryptocurrencies, as regulators enact clearer frameworks and digital‑asset confidence grows, highlighted by a new crypto equity fund pulling in over $100 million in Singapore.

Crypto-related thefts have surpassed $2.17 billion in H1 2025 alone, already eclipsing the total amount stolen in all of 2024, driven by mega-heists at exchanges like ByBit and CoinDCX and underscoring mounting security vulnerabilities across the ecosystem.

In August 2025, Story Protocol raised a staggering $82 million, leading major crypto fundraising activity this month, highlighting ongoing institutional momentum in blockchain infrastructure, gaming,and decentralized identity sectors.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Top 3 coins of the day

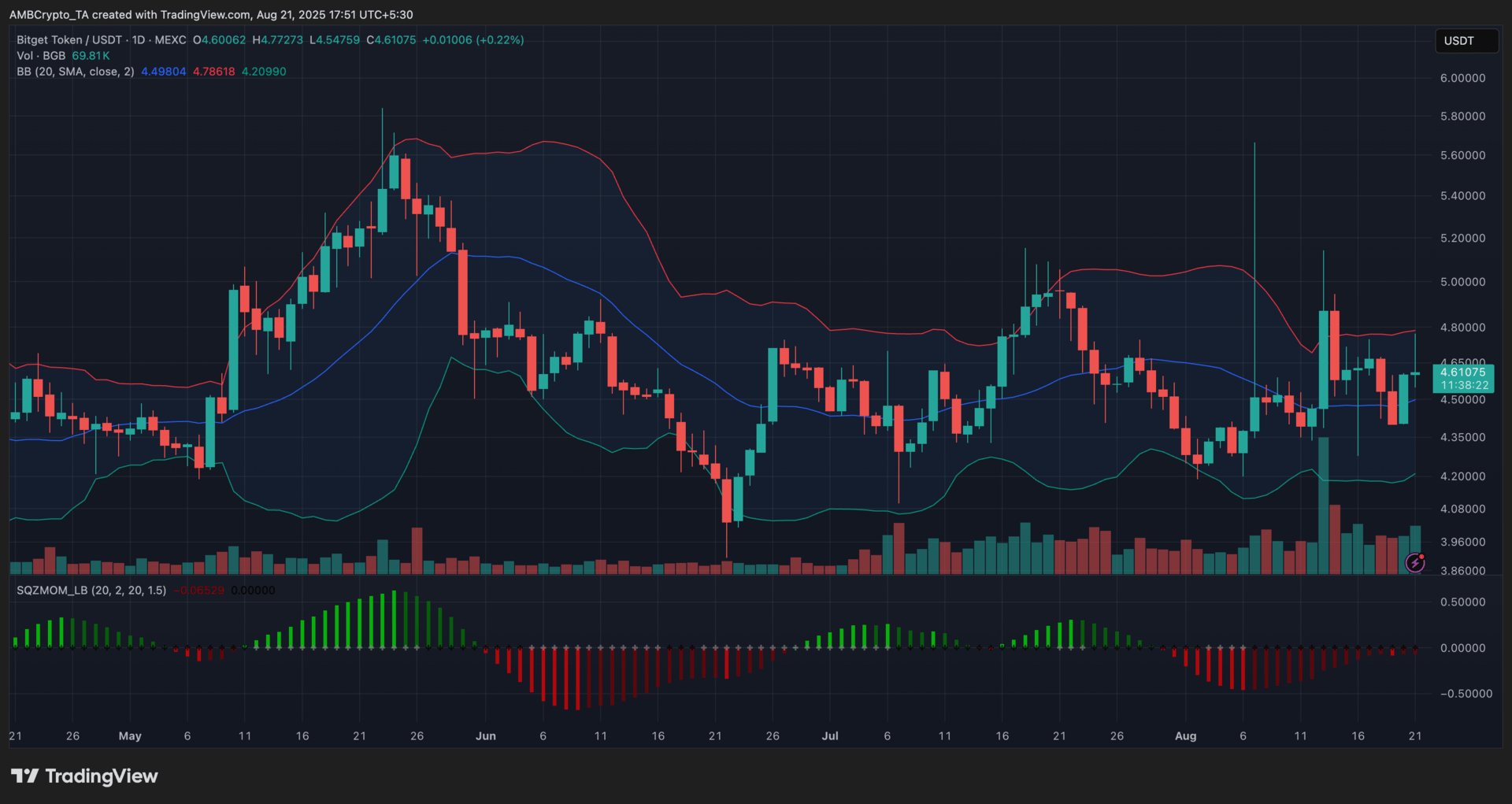

Bitget Token (BGB)

Key points:

BGB was last seen near $4.61, up 0.22% over the past 24 hours.

Price edged toward the upper Bollinger Band as the SQZMOM red bars thinned and buy volume improved.

What you should know:

BGB inched higher today and tested the upper‑band zone, while earlier dips found bids near the basis around $4.50. On the Squeeze Momentum Indicator (SQZMOM), negative bars narrowed, so downside pressure eased. Volume picked up compared with the recent lull. Immediate resistance is near $4.79 at the upper band, with a prior swing area around $4.95 on extension. Initial support is the basis near $4.50, and the lower band is around $4.21 if momentum cools. Off the chart, large holders reportedly withdrew about $1.1M in BGB from exchanges, and Bitget has burned roughly 860M BGB since December 2024, which reduced circulating supply and likely underpinned today’s mild advance.

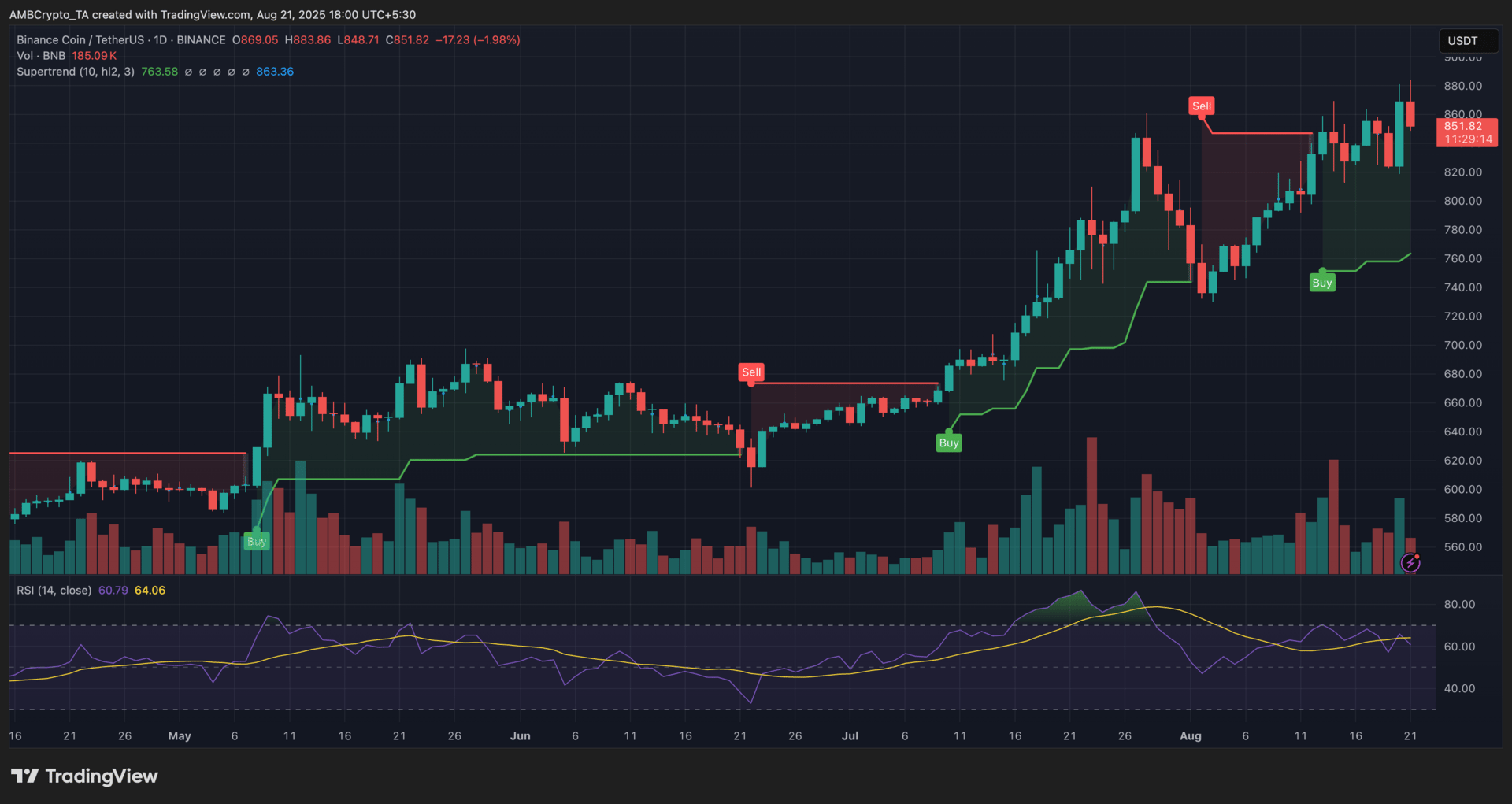

BNB (BNB)

Key points:

BNB slipped to around $851, marking a 1.98% drop over the past 24 hours.

The Supertrend remained in buy territory while the RSI hovered near 64, keeping momentum constructive despite the pullback.

What you should know:

BNB retreated from its recent highs today, sliding back toward the mid-$850 zone. The Supertrend still held in green, providing support near $763, while the Relative Strength Index (RSI) at 64 reflected sustained strength without tipping into overbought. Volume rose on the red candle, pointing to some profit-taking after the latest rally. The next test lies at the $869–880 resistance region, with Supertrend support firm at $763. Beyond the chart, institutional conviction has been building: Nasdaq-listed BNC expanded its BNB treasury to 325K tokens ($276M), adding to July’s corporate allocations. On the developer side, BNB Chain’s AI-driven hackathon attracted over 180 projects, bolstering ecosystem activity. Together, institutional demand and network growth underpinned the coin’s mid-term outlook, even as today’s decline signaled near-term cooling.

Solana (SOL)

Key points:

SOL fell 2.29% in the past 24 hours to trade around $183.

The Supertrend stayed in buy mode with support at $165, while the EWO turned lower and volume picked up on the sell-side.

What you should know:

SOL pulled back today after testing the $190 zone earlier this week, with its Supertrend line still holding green support near $165. The Elliott Wave Oscillator (EWO) remained positive but trended down, signaling that bullish momentum faded. Meanwhile, red volume expanded on the day’s decline, confirming heavier selling activity. Overhead, the $186–190 pocket acts as immediate resistance to reclaim. On the fundamental side, WEEX’s SOL Ecosystem Week has spurred liquidity by offering trading rewards, drawing short-term demand across Solana tokens. Separately, the Bullish exchange’s $1.15B IPO settlement using Solana-minted stablecoins reinforced institutional trust in its network utility. While such drivers have underpinned adoption, the market’s mood stayed cautious as traders weighed resistance zones against ongoing inflows.

How was today's newsletter? |