- Unhashed Newsletter

- Posts

- Institutions won while crypto panicked

Institutions won while crypto panicked

Reading time: 5 minutes

How crypto funds profited as market fear deepened in December

Key points:

A small group of institutional crypto funds managed to lock in December profits even as broader market sentiment remained under heavy pressure.

Extreme fear, capital rotation toward metals, and disciplined year-end selling are reshaping short-term crypto behavior without signaling full risk abandonment.

News - December closed on a fragile note for crypto markets, with prices struggling, sentiment stuck in extreme fear, and retail participation thinning out. Yet on-chain data shows that select institutional players still managed to turn volatility into opportunity.

Analytics from Nansen revealed that firms such as Wintermute and Dragonfly Capital ended December with realized gains running into the millions.

These profits, however, were followed by clear signs of de-risking. Bitcoin, Ethereum, and select altcoin exposures were trimmed as liquidity conditions tightened and year-end positioning took priority. This pattern suggested tactical profit-taking rather than a decisive shift toward long-term bearishness.

At the same time, crypto sentiment metrics painted a far bleaker picture. The Crypto Fear and Greed Index remained in extreme fear for a 14th consecutive day, despite Bitcoin trading far above levels seen during the 2022 FTX collapse.

Weak social engagement, falling search interest, and cautious expectations around Federal Reserve policy have kept confidence subdued.

Profitability did not mean accumulation - On-chain activity highlighted a consistent trend: profitable funds leaned into selling after gains.

Ethereum transfers to exchanges, partial exits from positions such as Mantle, and reduced exposure by market makers all pointed toward active risk management. The behavior reinforced the idea that institutional resilience in December came from execution discipline rather than directional conviction.

Capital rotation and a changing macro lens - Crypto’s struggles have unfolded alongside a powerful rally in metals.

Copper, gold, and silver outperformed Bitcoin on a year-to-date basis, drawing attention from macro-focused investors searching for scarcity and inflation hedges. This rotation added further pressure to crypto sentiment, even as institutional inflows into US Bitcoin ETFs continued in the background.

A reminder beyond the charts - Against this backdrop, long-time Bitcoiner James Howells offered a sobering perspective. He argued that understanding, usage, and risk discipline matter more than short-term price action, especially in fearful markets.

His message underscored a broader theme of December: while confidence may be shaken, structured players continue to adapt rather than exit outright.

Memecoin market slumps as retail appetite cools in 2025

Key points:

The memecoin sector has shed around 65% of its value in 2025, reflecting a sharp pullback in retail-driven speculation.

Falling volumes and fading political narratives point to a broader shift toward caution across high-risk crypto assets.

News - The memecoin market is closing 2025 on a markedly weaker footing after one of its sharpest annual reversals. By December 19, total market capitalization had dropped to around $35 billion, down roughly 65% from its peak near $100 billion during Christmas 2024, before rebounding modestly to about $36 billion.

Trading activity mirrored the decline in valuations. Annual trading volume across memecoins fell 72% to $3.05 trillion, signaling a sustained retreat from speculative risk by retail participants.

Market observers have long viewed memecoins as a thermometer for retail sentiment, and the sector’s contraction suggests a far more defensive environment than last year.

From election hype to confidence erosion - Political narratives played a central role in the sector’s rise and fall. In 2024, election-themed tokens surged in popularity as the U.S. presidential race dominated social media, launch platforms, and on-chain activity. That momentum carried memecoin valuations to record highs.

In 2025, the same political focus weighed on sentiment. High-profile tokens tied to political figures faced sharp corrections, undermining confidence and accelerating the sector’s decline. Analysts noted that insider activity and failed launches further eroded trust, turning enthusiasm into skepticism.

Retail pullback spreads across speculative assets - The retreat from memecoins has coincided with weakness in other speculative corners of crypto. NFT valuations fell to $2.5 billion in December, their lowest level of the year, while participation dropped to levels not seen since early 2021.

Together, these trends point to a broader recalibration of retail behavior, with capital moving away from hype-driven assets toward perceived stability.

Ethereum ends 2025 under pressure as 2026 scaling plans take shape

Key points:

Ethereum hovered near $3,000 into late December as ETF outflows, mixed whale positioning, and a rising share of supply held at a loss kept sentiment fragile.

Developers and researchers still framed 2026 as a pivotal year for Ethereum’s longer-term scaling roadmap, led by early adoption of ZK-proof validation and broader interoperability work.

News - Ethereum’s year-end trading action reflected a market caught between short-term strain and longer-term optimism.

On-chain data showed that more than 40% of ETH supply sat at a loss as December volatility continued and price struggled to hold above $3,000. Large holders took opposing paths, with some shifting ETH to exchanges or rotating into other assets, while others continued accumulating despite sizable unrealized drawdowns.

Traditional market signals remained cautious too. Ethereum ETFs logged roughly two weeks of outflows, with only one session posting net inflows, adding to the pressure near the $3,000 zone. Price held close to $2,978, with $2,798 highlighted as a key retest level that could determine whether buyers regain control or downside opens toward lower supports.

At the same time, debate around Ethereum’s 2026 outlook stayed active. Crypto analyst Benjamin Cowen warned that even if ETH were to reclaim prior highs next year, the move could turn into a bull trap, followed by a sharp reversal if broader market conditions remain unstable.

What whales, losses, and flows signal - Recent activity pointed to a split market. Some prominent holders moved ETH toward venues typically used for trading, while other whales continued steady accumulation through December.

Combined with elevated leverage metrics and ETF outflows, the setup suggested that confidence remained selective rather than broad-based.

Why 2026 still matters for Ethereum - Away from price, Ethereum’s roadmap signaled a major technical shift.

Researchers outlined plans for validators to begin checking ZK-proofs for blocks instead of re-executing transactions, with early participation expected to grow through 2026. Alongside this, interoperability initiatives aimed to reduce fragmentation across dozens of rollups, pushing the ecosystem toward a more unified user experience.

Trust Wallet Chrome extension hack triggers $7M loss and insider concerns

Key points:

Trust Wallet users lost over $7 million after a compromised Chrome extension update, prompting an urgent security response.

Binance co-founder Changpeng Zhao said affected users will be reimbursed as investigations point toward possible insider involvement.

News - Trust Wallet users suffered significant losses on December 25 after funds were drained from wallets linked to the project’s Chrome browser extension. The incident followed the release of a recent extension update, with on-chain investigators quickly flagging suspicious activity and unauthorized transfers.

Blockchain investigator ZachXBT first raised the alarm, reporting multiple cases of wallet balances being emptied without user approval. Trust Wallet later confirmed a security incident affecting browser extension version 2.68 only, advising users to disable that version immediately and upgrade through the official Chrome Web Store.

Losses tied to the exploit were estimated at more than $7 million. Changpeng Zhao, co-founder of Binance, which owns Trust Wallet, stated that impacted users would be fully reimbursed. The company clarified that mobile-only users and other browser versions were not affected.

How the exploit unfolded - Cybersecurity firm SlowMist revealed that the exploit appeared to have been prepared weeks in advance. According to its analysis, malicious code was implanted into the extension days before Christmas, enabling attackers to drain funds and export sensitive user data once the update went live. Hundreds of users were reportedly affected.

Some industry observers suggested the nature of the attack raised insider risk concerns, as the attacker was able to submit a new version of the extension. Zhao acknowledged that the incident was most likely linked to insider access.

Extension risks back in focus - The Trust Wallet breach has renewed scrutiny on browser-based wallets and extensions, which operate with elevated permissions.

Security researchers warned that compromised updates can expose transaction approvals and sensitive user data. In response, users were urged to review recent transactions, revoke unnecessary approvals, and move remaining funds to fresh wallets if compromise is suspected.

The Headlines Traders Need Before the Bell

Tired of missing the trades that actually move?

In under five minutes, Elite Trade Club delivers the top stories, market-moving headlines, and stocks to watch — before the open.

Join 200K+ traders who start with a plan, not a scroll.

More stories from the crypto ecosystem

Crypto scams uncovered

Fake “regulator recovery” scams are surging: The UK’s FCA said it received 4,465 reports of scammers impersonating the regulator in the first half of 2025, with 480 victims tricked into sending money, often via claims the FCA had “recovered” funds from a crypto wallet and needed details or payments to release it.

Scam centers are losing their storefronts: In December 2025, the DOJ’s new Scam Center Strike Force announced the seizure of a domain used to defraud Americans through fake crypto investment schemes tied to the Tai Chang scam compound in Burma, after earlier domain seizures linked to the same compound.

Crypto scams are increasingly exploiting transaction approvals: In 2024, the FBI’s Internet Crime Complaint Center (IC3) reported that many crypto losses occurred when victims were tricked into authorizing transactions themselves, typically through fake investment sites or malicious links, rather than through stolen passwords or private keys, a pattern that continues to shape crypto fraud today.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Top 3 coins of the day

Ethena (ENA)

Key points:

ENA was last seen trading near $0.21, after rising over 6% in the past 24 hours, marking one of its stronger daily performances this week.

The price edged above the 9-day SMA, while the Awesome Oscillator printed a green bar below zero, signaling easing bearish momentum alongside steady volume.

What you should know:

ENA posted a notable rebound after several sessions of subdued price action, with buyers stepping in around the $0.20 region. The latest daily candle closed slightly above the 9-day SMA, reflecting a short-term improvement after weeks of downward pressure. While the broader trend stayed cautious, the shift suggested that selling pressure had begun to cool.

Momentum indicators supported this view. The Awesome Oscillator remained below the zero line, but the most recent green histogram bar pointed to weakening downside momentum rather than a confirmed trend reversal. Volume stayed moderate, indicating controlled dip-buying instead of aggressive speculative inflows.

Beyond the chart, sentiment found support from reports of Arthur Hayes accumulating ENA during the pullback, alongside Ethena’s recent integration with Mantle Vault, which reinforced its ecosystem narrative. For now, $0.20 remains a key support to watch, while the $0.22–$0.23 zone stands as near-term resistance that could cap further upside if momentum stalls.

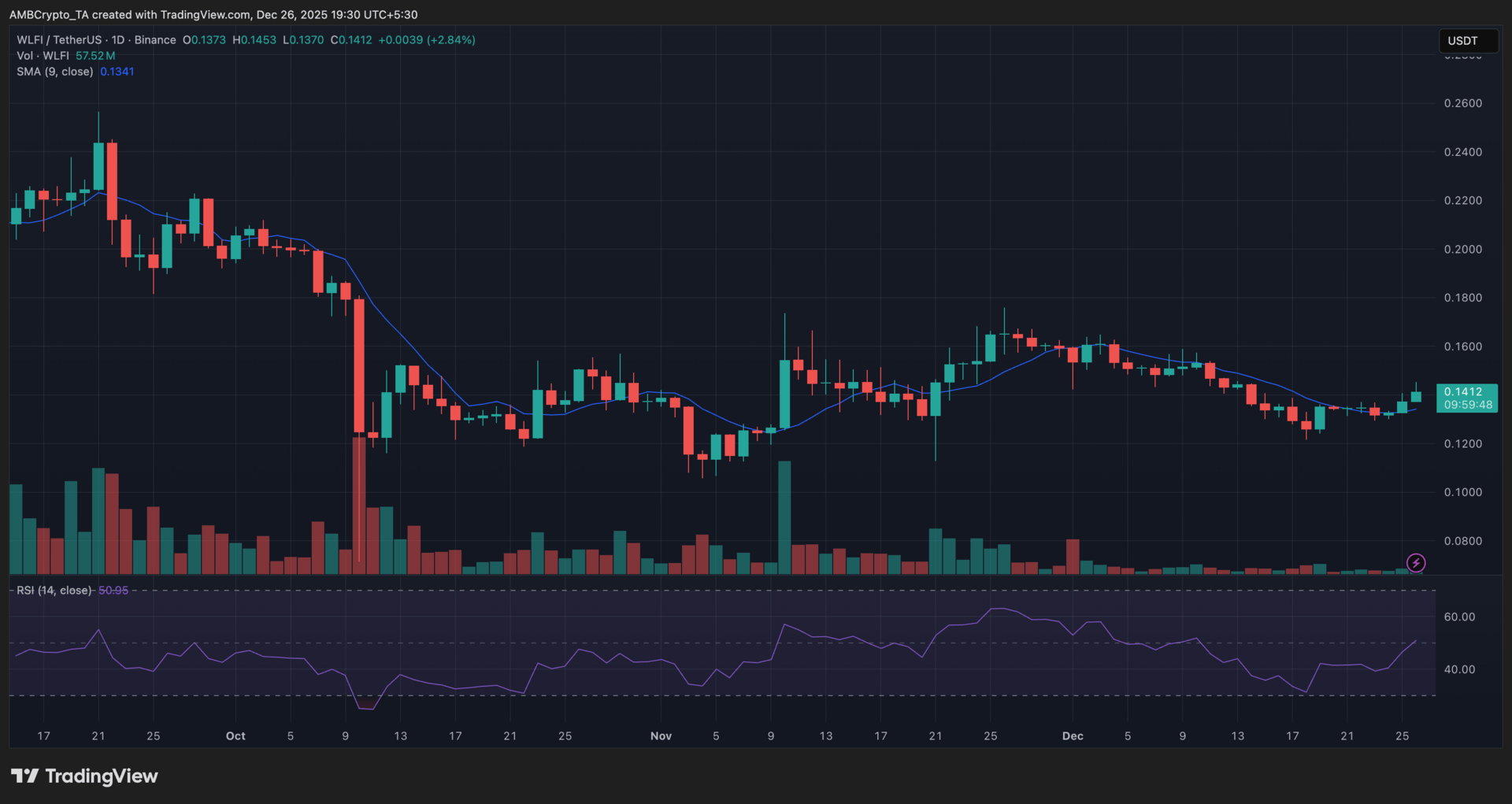

World Liberty Financial (WLFI)

Key points:

WLFI climbed to around $0.14 after gaining nearly 3% over the past 24 hours, extending its gradual recovery from earlier monthly lows.

The price moved above the 9-day SMA, while the RSI hovered near the neutral 50 level, pointing to stabilizing momentum alongside subdued volume.

What you should know:

WLFI saw buying interest resurface after spending much of December trading within a narrow range, following the sharp decline recorded in early October. The most recent session ended with price settling just above the 9-day SMA, hinting at early stabilization rather than a confirmed trend change.

Over the past few weeks, the token established a pattern of higher intraday lows, signaling a gradual improvement in structure, even as overall momentum remained cautious.

The RSI stayed close to the midpoint, reflecting balanced conditions without clear overbought or oversold signals. Volume remained relatively light during the advance, showing that participation stayed measured rather than aggressive.

On the narrative side, sentiment drew support from growing attention around USD1 stablecoin adoption within the WLFI ecosystem, which continued to underpin interest despite muted trading activity. The $0.13 zone remains key support to monitor, while resistance is now clustered between $0.15 and $0.16, where prior advances have faced selling pressure.

Ethereum (ETH)

Key points:

ETH was last seen trading near $2,980 after posting a roughly 2.6% daily gain, as price continued to consolidate following November’s sell-off.

Parabolic SAR dots stayed above price while the EWO remained negative but compressed, signaling fading bearish momentum alongside steady volume.

What you should know:

Ethereum recorded a measured advance after several sessions of sideways movement, with price holding above the $2,900 area. The latest rebound lacked strong continuation, but it showed that downside pressure had eased compared to earlier in the month.

Despite the recovery attempt, ETH remained capped below the $3,000 handle, keeping the broader structure corrective rather than trend-driven.

From an indicator perspective, the Parabolic SAR continued to trail above price, suggesting the prevailing trend had not yet flipped. At the same time, the Elliott Wave Oscillator stayed below zero, although shrinking histogram bars pointed to weakening bearish momentum. Volume remained moderate throughout the move, reinforcing the view that positioning stayed controlled.

On the narrative front, sentiment garnered mild support from ongoing developer roadmap discussions, selective large-holder accumulation during consolidation, and continued stablecoin activity on Ethereum’s network. The $2,900 level remains key support, while resistance sits between $3,000 and $3,100, where recent recovery attempts have stalled.

How was today's newsletter? |