- Unhashed Newsletter

- Posts

- Is a dump next for Bitcoin?

Is a dump next for Bitcoin?

Reading time: 5 minutes

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

Bitcoin whale opens $420M short position - Dump incoming?

Key points:

Whale’s aggressive move is one of the largest short positions seen in months.

Despite the implications, however, bullish structure of Bitcoin’s market remains intact.

News - The last few days haven’t been particularly freewheeling for Bitcoin, the world’s largest cryptocurrency. After hitting a peak of over $126K, the crypto put the brakes on its movement with a correction on the charts. As expected, this fueled some concerns about where BTC might head to next. A prominent Bitcoin whale, however, seems to have made up its mind.

Soon after BTC dropped to $121K, the aforementioned whale opened up one of the biggest short positions seen in recent months. The whale desposited $80M in USDC on Hyperliquid and used 5x leverage to open a $420M short. The whale also transferred over $50M to Binance, hinting at a similar short position there.

To put it simply, the whale’s position is a high-stakes bet against the market. Hence, the question - Is the whale’s action indicative of wider whale behaviour? Is a dump incoming if price momentum weakens?

Market is still “ice-cold” - As it stands, a major dump is unlikely. Yes, the aforementioned whale’s actions are aggressive, but it is not indicative of what other players in the market are doing right now.

For instance, a look at Bitcoin’s OI-weighted Funding Rate suggested that longs continue to dominate the cryptocurrency’s market.

That’s not all either as the Mayer Multiple, one of the key indicators of a bull cycle’s status, seemed to indicate that despite Bitcoin trading close to its all-time high, the MM is still “ice-cold.” Ordinarily, whenever a cryptocurrency hits or trades close to its ATH, the MM flashes signals of an overheated market.

An MM reading of over 2.4 is often a sign of an overbought market. As far as Bitcoin is concerned, at press time, its Mayer Multiple’s reading was just 1.6.

Institutions to the rescue - Institutional demand has certainly help hold up Bitcoin’s price on the charts, despite bouts of corrections here and there. Bitcoin Spot ETFs, for instance, saw eight consecutive days of inflows.

These inflows have helped stabilize market confidence, while also offsetting any bearish bets against the market.

Ethereum’s price could head to $5.5K after devs unveil Kohaku roadmap

Key points:

Kohaku is a new privacy and security-focused wallet framework.

Fundstrat analysts believe ETH could drop to $4.2K, before heading higher on the charts.

News - Ethereum’s price action on the charts has grabbed much of the attention lately. However, its development side of things hasn’t been far behind either. In fact, the Ethereum Foundation is in the news today after it unveiled Kohaku - A new privacy and security-focused wallet framework. Led by Vitalik Buterin and Nico Schabanel, a demo for the same is expected to be ready for the Devcon event in November 2025.

In simple terms, Kohaku is a toolkit that would help wallets process private transactions safely. According to the dev team, the project intends to make Web3 wallets “sovereign clients,” ensuring that only the information necessary for a transaction is exposed. Schabanel put it best when he said,

“It’s time for us to go public so you all can go private.”

A roadmap for the future - Kohaku’s usefulness isn’t limited to the aforementioned features though. In fact, its implementation will also lay the groundwork for Ethereum upgrades such as account subtraction and post-quantum verification in the future.

The roadmap also includes features such as running light clients in browsers, using zero-knowledge proofs for identity recovery, and introducing privacy-first peer-to-peer connections.

The introduction of this toolkit comes at an interesting time for the Ethereum ecosystem. While the Foundation is working towards strengthening the user layer, the consensus layer is seeing a different form of activity altogether.

Both entry and exit queues for Ethereum validators surged to their highest levels in 2 years recently. Similarly, queue wait times have also risen sharply.

These developments could be linked to the growing institutionalization of Ethereum staking.

ETH’s next few days - Like Bitcoin, ETH’s price corrected somewhat over the last few days. However, most analysts, including those at Fundstrat, aren’t concerned so far. In fact, according to Managing Director Mark Newton,

“I do not make much of crypto weakness in recent days, and expect ETH likely bottoms out over the next 1-2 days before heading back higher.”

Newton concluded his analysis by predicting that the altcoin’s price could fall to $4.2K, before surging to $5.5K on the charts. The former price level, he claimed, would be an “optimal area of support.”

Monero to tackle spy nodes with new ‘Flourine Fermi’ update

Key points:

Privacy blockchain’s latest client update is expected to provide users greater security.

According to the development team, the update is “highly recommended.”

News - Despite bouts of correction, Monero’s [XMR] price has been on a fairly consistent uptrend on the charts. This was the case when the week started too, with the privacy coin even outperforming Bitcoin over a 48-hour period. However, that’s not the only reason why Monero is in the news these days.

The blockchain has rolled out a new client update to protect users against what the network calls “spy nodes.” Announced on X (Formerly known as Twitter), the dev team behind the update claimed,

“This is a highly recommended release that enhances protection against spy nodes.”

Acting against “spy nodes” - The update, dubbed “Flourine Fermi,” intends to improve peer selection algorithm so that connections to large subsets of IP addresses favoured by “spy nodes” are avoided altogether. Instead, users will be redirected to nodes deemed to be “safe,” with the update also allowing for greater stability and reliability fixes.

Monero’s ecosystem has long prided itself to be all about privacy. However, despite its singular focus, threats to that idea have popped up consistently over the years. For long, the community has tried to find workarounds to the issues stemming from malicious nodes.

In fact, an old proposal to allow node operators to create a ban list of IP addresses suspected to be “spy nodes” was one such effort.

Not all about privacy - Here, it’s worth pointing out that lately, privacy hasn’t been the foremost concern of Monero’s community. Despite its gradual uptrend on the price charts over the last few months, it hasn’t been immune to 51% attacks.

Qubic orchestrated one such attack back in August 2025. As expected, the development encouraged many in the community to put forward several proposals in an effort to make the network more resistant to attacks like these in the future.

‘Bitcoin Jesus’ Roger Ver to pay $48M to settle tax fraud case

Key points:

Ver has reached a tentative agreement with prosecutors in the United States.

Deal will allow one of Bitcoin’s foremost advocates to avoid any jail time.

News - Known to many as “Bitcoin Jesus,” Roger Ver is expected to avoid jail time over a tax fraud case after he reached a tentative agreement with the U.S Department of Justice. According to a report by The New York Times, the deal in question will involve Ver paying over $48M in taxes he owes for his crypto holdings. Once Ver pays up, the deferred prosecution deal will be completed.

The aforementioned case stems from Ver being charged with mail fraud and tax evasion back in 2024. At the time, he was even arrested in Spain, with authorities working since to extradite him back to the United States.

Details of the case - According to the DoJ, the exec sought to evade paying taxes on his assets by renouncing his U.S citizenship in 2014 and becoming a citizen of St. Kitts and Nevis. In its indictment dated April 2024, the DoJ claimed,

“Even though Ver was not then a US citizen, he was still legally required to report to the IRS and pay tax on certain distributions.”

If this agreement is finalized, Ver will avoid any prison time. Since his arrest, his lawyers have consistently worked towards the same, while also making sure he is not extradited to the U.S.

Ver’s case has drawn attention for exposing the tax complexities of leaving the United States while holding volatile digital assets. The IRS exit-tax framework was designed for traditional portfolios. However, in practice, it can be challenging to value cryptocurrency at the time of expatriation accurately.

More stories from the crypto ecosystem

Crypto Scams Uncovered

Bitclub Network was a mining investment platform that operated from 2014 to 2019. It claimed to offer investors shares in crypto mining pools, even though it never operated any. The platform also shared fraudulent earnings reports . In total, the platform conned $722 million in Bitcoin from its investors.

Back in December 2024, Nigerian authorities busted a massive international scam in Lagos involving romance and crypto frauds, arresting 792 suspects, including 148 Chinese and 40 Filipinos. Operating from a seven-story call center, the group targeted victims across the Americas and Europe via WhatsApp and Instagram.

Mixin Network, a Hong Kong-based crypto project, was hit with the largest crypto exploit of 2023. On 23 September, the firm had to abruptly cease operations after hackers drained $200 million from users’ hot wallets.

Get in on the markets before tech stocks keep rising

Online stockbrokers have become the go-to way for most people to invest, especially as markets remain volatile and tech stocks keep driving headlines. With just a few taps on an app, everyday investors can trade stocks, ETFs, or even fractional shares—something that used to be limited to Wall Street pros. Check out Money’s list of top-rated online stock brokerages and start investing today!

Top 3 coins of the day

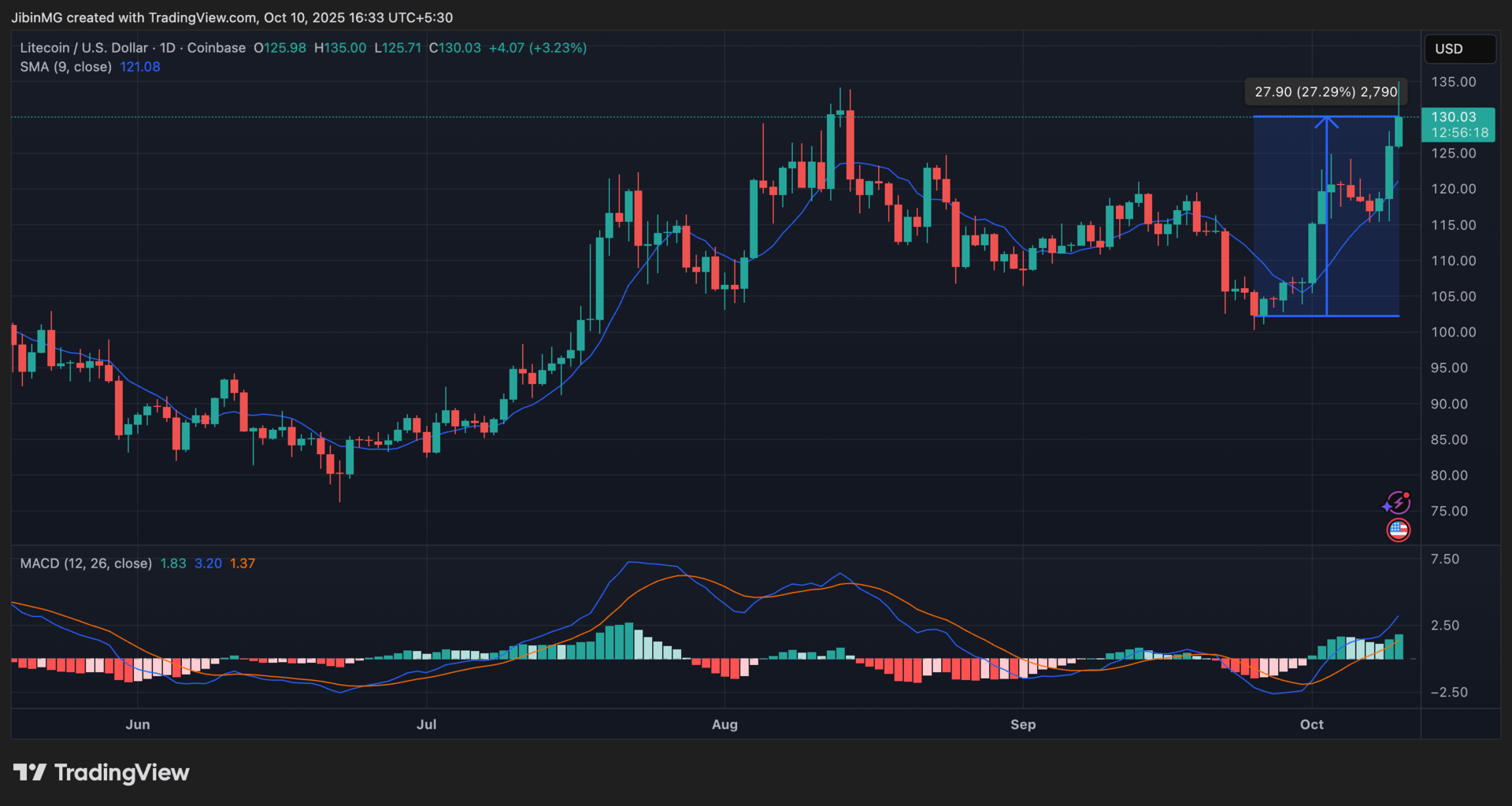

Litecoin (LTC)

Key points:

The silver to Bitcoin’s gold is back to trading around its August 2025 levels.

Litecoin’s technical indicators flashed bullish signals at press time.

What you should know:

Litecoin [LTC] has been one of the market’s biggest beneficiaries after Bitcoin went on a run and rallied to a new ATH on the charts on the back of the “Uptober effect.” Thanks to its high correlation with the world’s largest cryptocurrency, LTC rallied too, with the altcoin climbing by over 27% in just over two weeks.

As expected, this bullishness was evidenced by the crypto’s technical indicators too. The Moving Average, for instance, was positioned below the price candles - A sign of a bullish market. Similarly, the MACD line diverged away from the Signal line as the histograms of the indicator flashed green.

If a Litecoin Spot ETF is approved, that will be a major catalyst for Litecoin’s uptrend - One that possibly takes it outside of the price range it has been trading in for a while now.

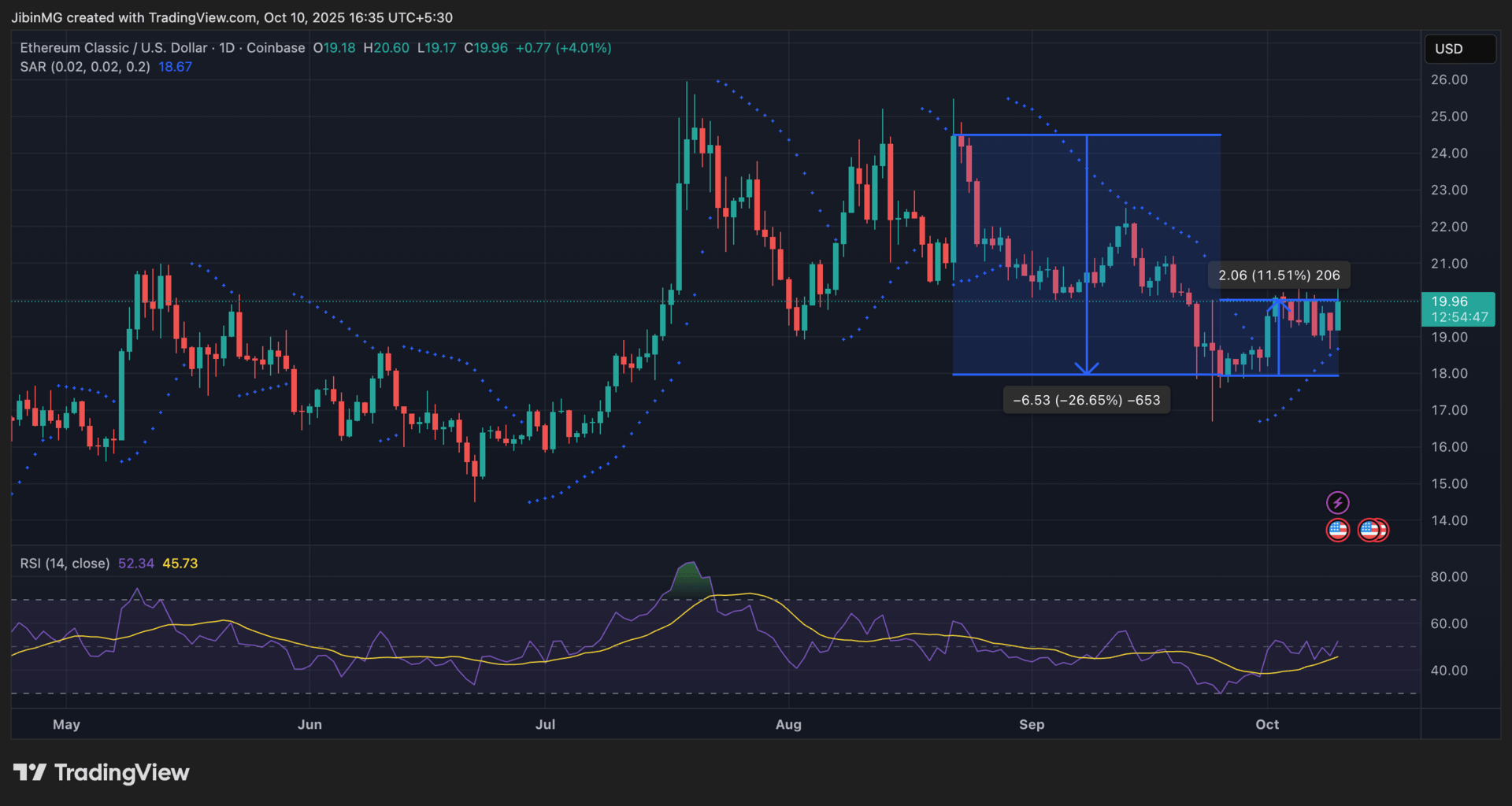

Ethereum Classic (ETC)

Key points:

Like LTC, last few weeks have seen ETC climb on the charts too, albeit not as significantly.

Too soon to say if Ethereum Classic will be able to reverse its losses since mid-July though.

What you should know:

Ethereum Classic too has profited from Bitcoin’s rally to a new all-time high. However, its gains have been relatively minimal, with the altcoin up by “just” 11.5% in the last two weeks. And yet, its price is far from where it’s supposed to be. Especially since the aforementioned gains come on the back of ETC losing over 25% of its value in under a month.

At the time of writing, the Parabolic SAR’s dotted markers hinted at the bullish nature of the market. On the contrary, the findings of the RSI were more neutral. This suggested that ETC’s market was neither oversold nor overbought. Hence, it would be difficult to make any long-term predictions for Ethereum Classic. It is also too soon to say if ETC will register more gains on the charts.

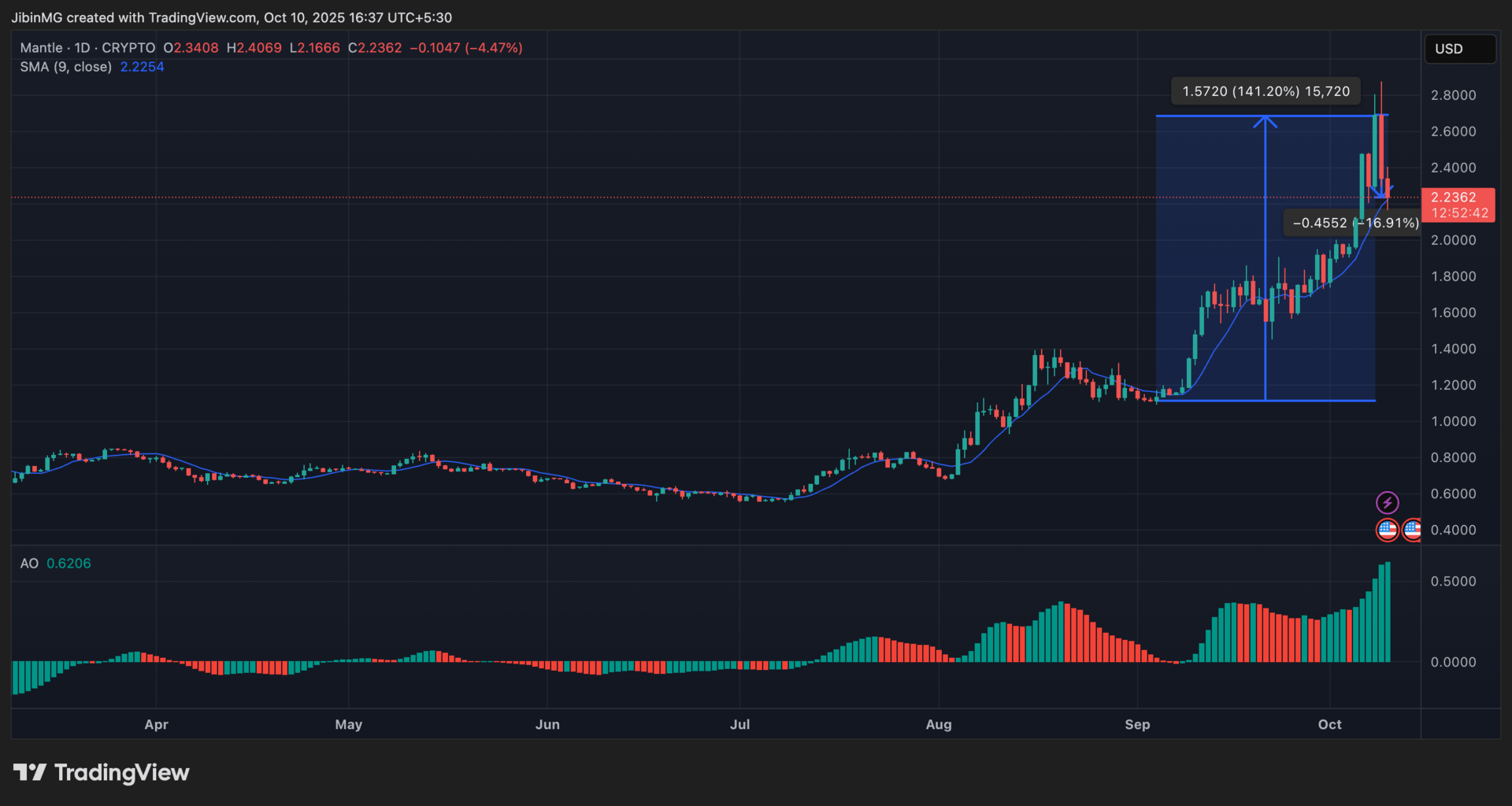

Mantle (MNT)

Key points:

MNT’s price corrected on the charts after the altcoin hit a new all-time high.

Losses of over 15% did little to offset crypto’s latest gains.

What you should know:

Mantle [MNT], the cryptocurrency ranked 31st on the charts, has seen the value of its token climb exponentially since mid-September. While the altcoin’s price did stabilize somewhat as October began, it soon shot up again until it hit an ATH of $2.86. At the time of writing, MNT was on its way down, with the crypto losing over 16% of its value if just 24 hours.

Should traders be concerned though? Probably not since these losses are the product of a natural correction after MNT hit an all-time high. In fact, despite the aforementioned double-digit losses, the altcoin’s technical indicators were flashing significantly bullish signals at press time. This was evidenced by the positioning of the Moving Average, and the green historgrams on the Awesome Oscillator.

Why did MNT climb as high as it did though? Well, Mantle being chosen for the deployment of World Liberty Financial’s USD1 stablecoin helped.

How was today's newsletter? |