- Unhashed Newsletter

- Posts

- Is Binance the next FTX?

Is Binance the next FTX?

Reading time: 5 minutes

Binance pushes back as ‘FTX 2.0’ fears collide with onchain reality

Key points:

Onchain data showed no reserve stress at Binance despite renewed social media panic and “FTX 2.0” narratives.

The exchange’s recent Bitcoin reserve disclosures and SAFU conversions coincided with heightened market scrutiny during a volatile period.

News - Fresh concerns around Binance’s stability resurfaced this week as coordinated posts on X warned users to close their accounts, reviving comparisons to FTX. The renewed scrutiny came during a volatile stretch for crypto markets, with Bitcoin briefly slipping below $74,000.

Onchain data, however, painted a different picture. Blockchain analytics firm CryptoQuant said Binance’s reserves showed no signs of erosion during the sell-off. The exchange held roughly 659,000 BTC, a figure that has remained largely unchanged since late 2025, signaling stable reserve levels during the downturn.

Attention also turned to the origin of the social media posts. Several accounts shared identical messages, usernames, and profile images, suggesting coordinated or inauthentic behavior. Binance co-founder Changpeng Zhao responded by calling the activity bad behavior while reiterating that the platform remains open to constructive and transparent criticism.

Macro volatility vs exchange blame - The renewed debate follows lingering criticism from the October 10, 2025, market crash, which triggered roughly $20 billion in liquidations.

Zhao has repeatedly rejected claims that Binance influenced prices during that event, arguing that the sell-off aligned with global tariff announcements and broader risk-off moves across markets. He emphasized that Binance does not trade to profit from price swings and operates as trading infrastructure rather than a directional market participant.

Reserves, SAFU, and accumulation signals - Recent reserve disclosures added further context. CoinMarketCap’s January 2026 proof-of-reserves report ranked Binance first among exchanges, with $155.6 billion in assets, placing it well ahead of competitors.

Separately, blockchain data showed Binance converting $200 million from its SAFU fund into Bitcoin through two $100 million tranches. The gradual pace of these conversions limited short-term price impact but highlighted a structured approach to reserve allocation.

Taken together, reserve data, SAFU activity, and Zhao’s responses contrast with the renewed “FTX 2.0” narrative circulating online. While criticism and debate continue, current onchain indicators do not show immediate stress signals at the exchange during this period of market volatility.

Tether pulls back $20B raise as valuation pushback mounts

Key points:

Tether scaled back plans for a $15–$20 billion funding round after investors pushed back on a $500 billion valuation.

CEO Paolo Ardoino said the figures were misunderstood, stressing that Tether does not need external capital despite ongoing legitimacy questions.

News - Tether has quietly retreated from its earlier ambition to raise up to $20 billion in new funding, following investor resistance to a valuation that could have placed the stablecoin issuer among the world’s most valuable private companies. Advisers are now discussing a significantly smaller raise of around $5 billion, or potentially no fundraising at all, according to multiple reports.

Chief executive Paolo Ardoino has sought to reframe the earlier discussions, calling the $15–$20 billion figure a ceiling rather than a target. He emphasized that Tether remains highly profitable and would be equally satisfied raising no capital, noting that insiders are reluctant to sell equity even if demand exists.

The pullback comes despite Tether’s scale. The company issues USDT, a dollar-pegged stablecoin with roughly $185 billion in circulation, and reported about $10 billion in profit last year, largely driven by interest earned on reserves, including U.S. Treasuries. Still, investors have reportedly questioned whether a $500 billion valuation is justified, particularly given ongoing regulatory uncertainty and long-standing concerns around reserve transparency.

Why investors are hesitating - Industry observers say the decision reflects deeper institutional caution rather than immediate balance sheet needs. Analysts pointed to heightened scrutiny around governance standards, regulatory durability, and reserve disclosures.

Some also noted that Tether’s profitability benefits from regulatory ambiguity, which could narrow margins under stricter oversight. Exposure to volatile markets, including gold and crypto assets, has further complicated investor confidence at elevated valuation levels.

IPO talk cools, but questions linger - The scaled-back raise has also dampened speculation around a near-term initial public offering. While Tether has not ruled out going public, the retreat suggests a more cautious stance as broader crypto markets remain volatile and investors have balked at the $500 billion valuation.

For now, Tether’s position underscores a familiar tension. The company does not need external capital to operate, but the difficulty of securing funding on preferred terms highlights unresolved debates around valuation, regulation, and long-term institutional legitimacy.

Vitalik Buterin calls for a reset across creator coins and Ethereum L2s

Key points:

Vitalik Buterin proposed prediction markets and small creator DAOs as a way to fix incentive flaws in creator coin platforms.

He also urged Ethereum layer 2 networks to move beyond pure scaling as usage declines and the main chain grows more capable.

News - Vitalik Buterin has outlined a broader rethink of crypto incentives, arguing that both creator coin platforms and Ethereum’s layer 2 ecosystem are drifting away from their original goals.

In a series of posts, Buterin said creator coins currently reward celebrity and virality rather than substance. As an alternative, he proposed a two-layer system combining prediction markets and creator-focused DAOs.

Under this model, small, subject-based DAOs would curate membership through anonymous voting, while prediction markets would signal which creators are likely to gain admission. Token value, he argued, should be tied to curation and real participation rather than speculation alone.

Buterin framed the prediction market layer as a mechanism for accountability, while DAOs would preserve intrinsic motivation among creators. Several industry figures echoed the logic, arguing that anchoring token economics to curation could move creator coins away from attention-driven speculation.

A parallel shift in Ethereum’s scaling debate - At the same time, Buterin has pushed for a fundamental change in how Ethereum layer 2s define their role. He argued that the original vision of L2s as Ethereum’s primary scaling engine no longer holds, as the main chain now supports greater capacity through lower fees, gas limit increases, and planned native rollups.

Data cited by Buterin showed layer 2 active addresses falling sharply even as Ethereum’s mainnet usage more than doubled. He also warned that many L2s still rely on multisig bridges and have not reached full decentralization, meaning they fail to fully inherit Ethereum’s security.

Builders across the ecosystem largely accepted the shift, though opinions diverged. Some emphasized continued scaling needs, while others pointed to specialization in areas like privacy, identity, social applications, or non-EVM design.

Across both debates, Buterin’s message was consistent. Crypto systems, whether creator economies or scaling networks, need clearer value propositions rooted in quality, accountability, and security rather than celebrity-driven attention or scaling-only narratives.

TRM Labs reaches unicorn status as AI-driven crypto crime grows

Key points:

TRM Labs reached a $1 billion valuation after closing a $70 million Series C funding round led by Blockchain Capital.

Rising AI-enabled fraud and illicit crypto activity are driving demand for advanced blockchain intelligence tools.

News - Blockchain intelligence firm TRM Labs has become a crypto unicorn after completing a $70 million Series C funding round that valued the company at $1 billion. The raise was led by Blockchain Capital, with participation from major financial and technology investors including Goldman Sachs, Bessemer Venture Partners, Brevan Howard Digital, Thoma Bravo, Citi Ventures, Galaxy Ventures, and others.

Founded in 2018, TRM Labs provides software that traces transactions across multiple blockchains, helping governments, regulators, exchanges, and financial institutions identify illicit activity and manage financial crime risks. The company said demand for its tools has accelerated as criminals increasingly rely on automation and artificial intelligence to scale scams, laundering, and sanctions evasion.

Chief executive Esteban Castaño said the new capital will support expansion across AI research, engineering, and financial crime investigations, with a focus on protecting public safety, financial integrity, and national security. TRM plans to grow its global workforce across hubs in San Francisco, New York, Washington, London, and Singapore while advancing its AI-powered compliance and investigative capabilities.

Why demand for blockchain intelligence is rising - Industry data highlights the scale of the challenge. TRM research has found that illicit actors captured nearly 3% of total crypto liquidity in 2025, while separate investigations detailed how state-linked actors moved large sums through crypto exchanges.

The company has also pointed to a sharp increase in AI-enabled scams, with its leadership citing a 500% rise in the use of artificial intelligence across fraud and scam activity.

From analytics to enforcement impact - Beyond analytics, TRM has expanded its role in enforcement efforts. Through partnerships with blockchain networks including Tron and Tether, the firm co-founded the T3 Financial Crime Unit, which has frozen more than $300 million in tainted digital assets.

As crypto crime grows more sophisticated, TRM’s latest funding highlights the growing importance of blockchain intelligence for institutions navigating an increasingly complex digital asset environment.

More stories from the crypto ecosystem

Bitcoin: Whales step back, retail pushes on – Is BTC setting a bull trap?

Dogecoin network activity hits 71,400 – But can DOGE price keep up?

‘We’re in crypto winter’- Bitwise turns bearish as Bitcoin price slips below $75K

Solana wins January on-chain – So why did SOL still drop 20%?

Stablecoin volume hit $10T in January – Here’s why it’s THE most bullish signal!

Did you know?

White House crypto lawmaking hit a deadlock this week: A recent White House-hosted meeting with banks and crypto industry groups ended without resolving major disagreements on digital asset legislation, particularly over whether stablecoin interest payments should be restricted. This has prolonged the stalemate around the Clarity Act in the U.S. Congress.

Major central banks are warming to tokenised collateral: The Bank of England announced it is exploring expanding the types of tokenized assets it will accept as collateral in credit operations. This aligns with the European Central Bank’s move to allow tokenized assets in Eurosystem credit from March 2026, a step toward bridging blockchain with mainstream monetary tools.

Crypto prediction markets have posted record interest growth: In January 2026, global decentralized prediction market volumes hit new all-time highs, reflecting growing investor interest in markets that let people stake on real-world outcomes like politics, sports, and economics rather than simple price bets.

Top 3 coins of the day

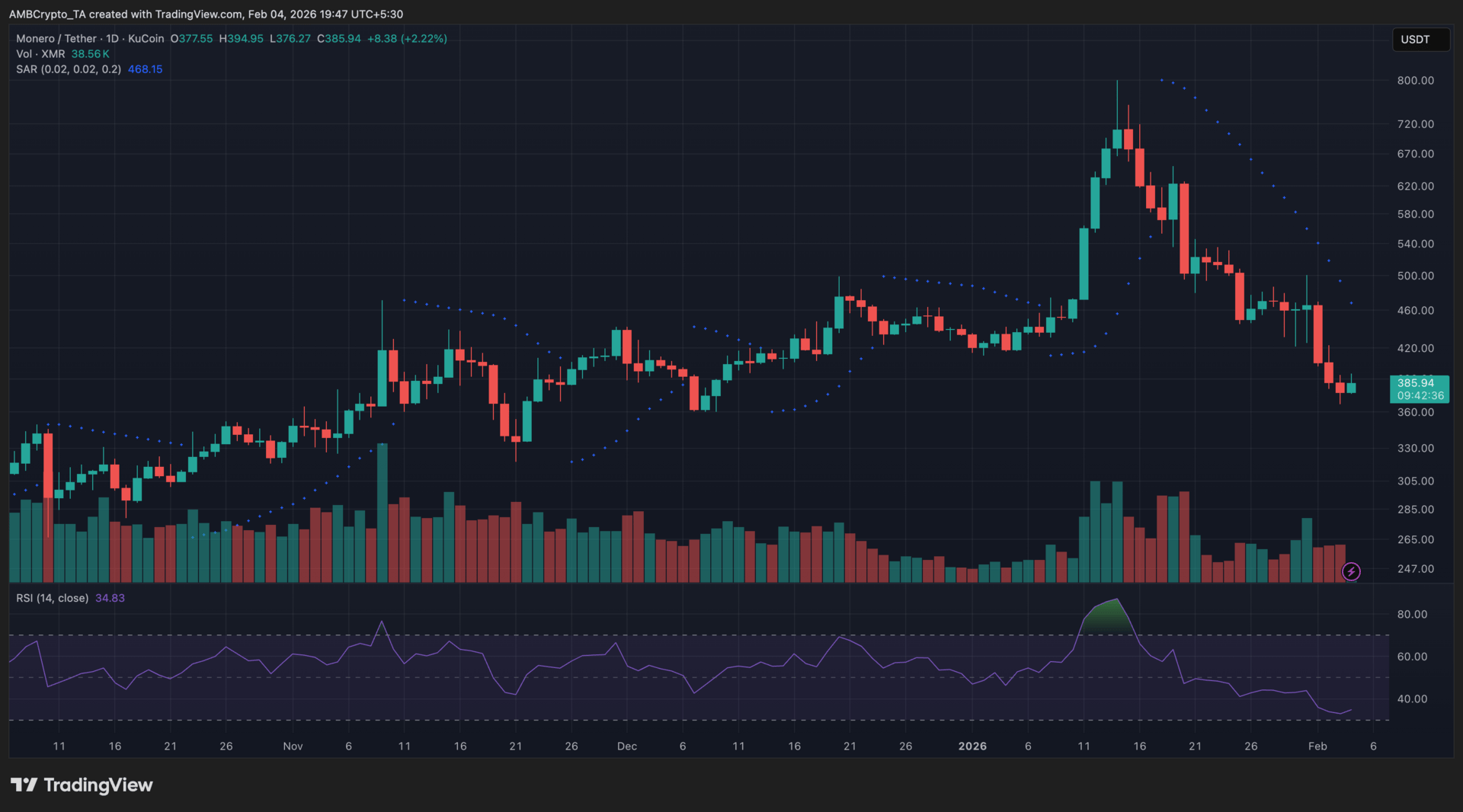

Monero (XMR)

Key points:

XMR steadied near $385 after selling pressure cooled, with price attempting to stabilize following a steep weekly drawdown.

RSI hovered near oversold levels while Parabolic SAR stayed overhead, signaling a pause in downside momentum rather than a trend shift.

What you should know:

Monero spent the past week under sustained pressure, sliding sharply from the $430 region before finding footing around the $360 to $370 zone. The latest daily candles reflected a slowdown in selling rather than aggressive dip-buying, with price holding within a narrow range near $385. Parabolic SAR dots remained positioned above the candles, confirming that the broader trend stayed bearish despite the short-term stabilization.

RSI hovered in the mid-30s, suggesting that selling momentum had eased after approaching oversold territory. This setup typically aligns with short-lived relief moves rather than durable reversals. Volume expanded during the decline but moderated during the rebound attempt, reinforcing the idea that participation cooled after the sell-off instead of flipping decisively bullish.

Broader crypto market stabilization provided some background support, helping XMR avoid deeper losses. On the chart, the $360 to $370 region acts as immediate support, while $400 to $420 remains the first area where supply is likely to re-emerge.

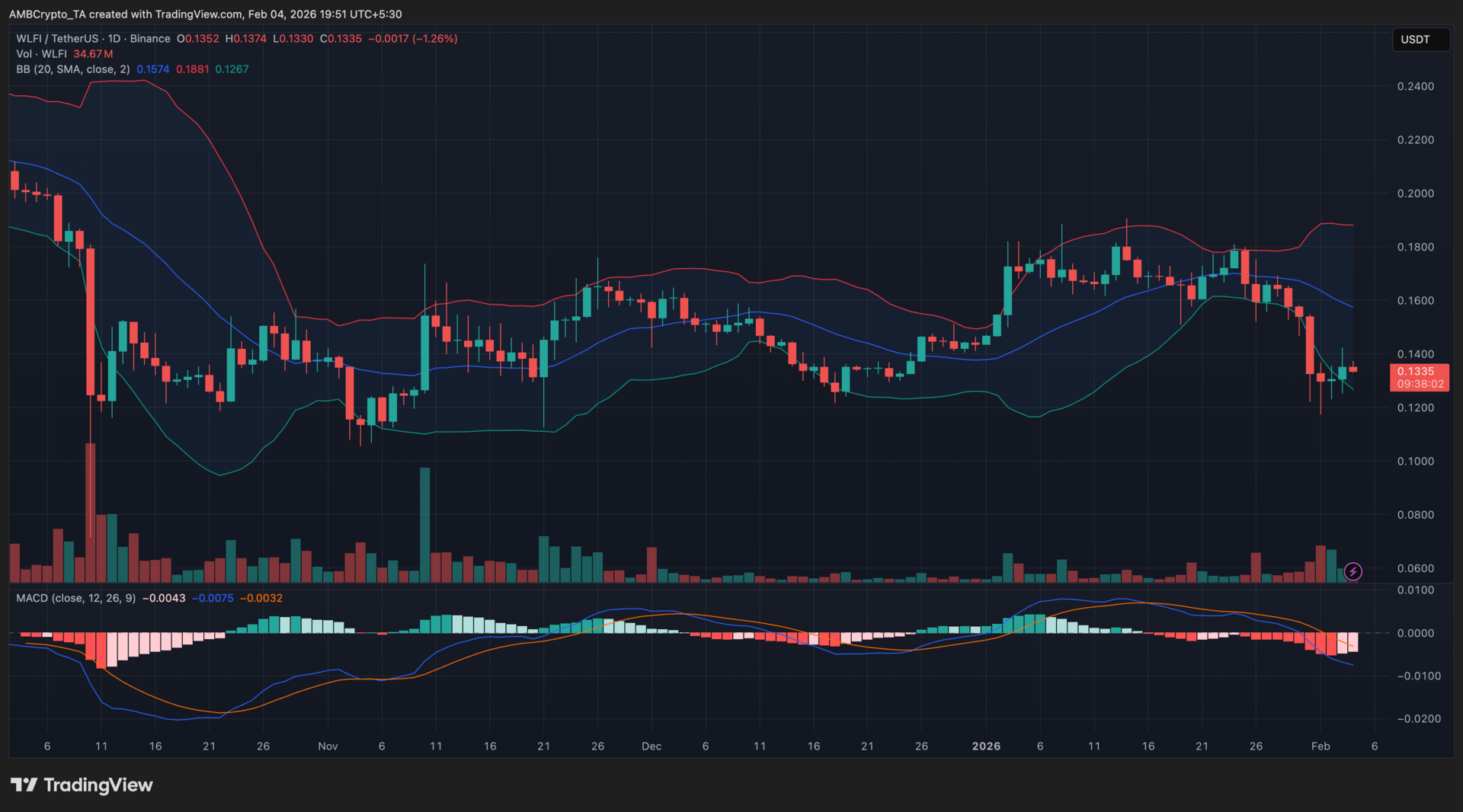

World Liberty Financial (WLFI)

Key points:

WLFI hovered near $0.133 after drifting toward the lower Bollinger Band, highlighting sustained selling pressure rather than a momentum reset.

MACD remained negative while volume stayed elevated, signaling that bearish control persisted despite attention-driven trading activity.

What you should know:

WLFI continued to trade under pressure over recent sessions, with price gravitating closer to the lower Bollinger Band after repeated failures to sustain moves above the $0.17 to $0.18 region. This positioning reflected ongoing downside bias rather than a neutral consolidation, as candles consistently closed in the lower half of the band structure. Bollinger Bands stayed moderately wide, pointing to elevated volatility without signs of bullish expansion.

Momentum indicators reinforced this view. The MACD histogram stayed in negative territory and deepened slightly, confirming that bearish momentum persisted instead of showing a fresh reversal signal.

Volume patterns added context, with activity remaining elevated compared to prior weeks. This coincided with intensified media and social discussion around reports of a $500M UAE-linked investment tied to the Trump-associated project, which drew speculative interest and short-term trading flows.

On the chart, $0.125 to $0.130 acts as immediate support, while $0.165 to $0.175 remains a key supply zone where prior advances stalled.

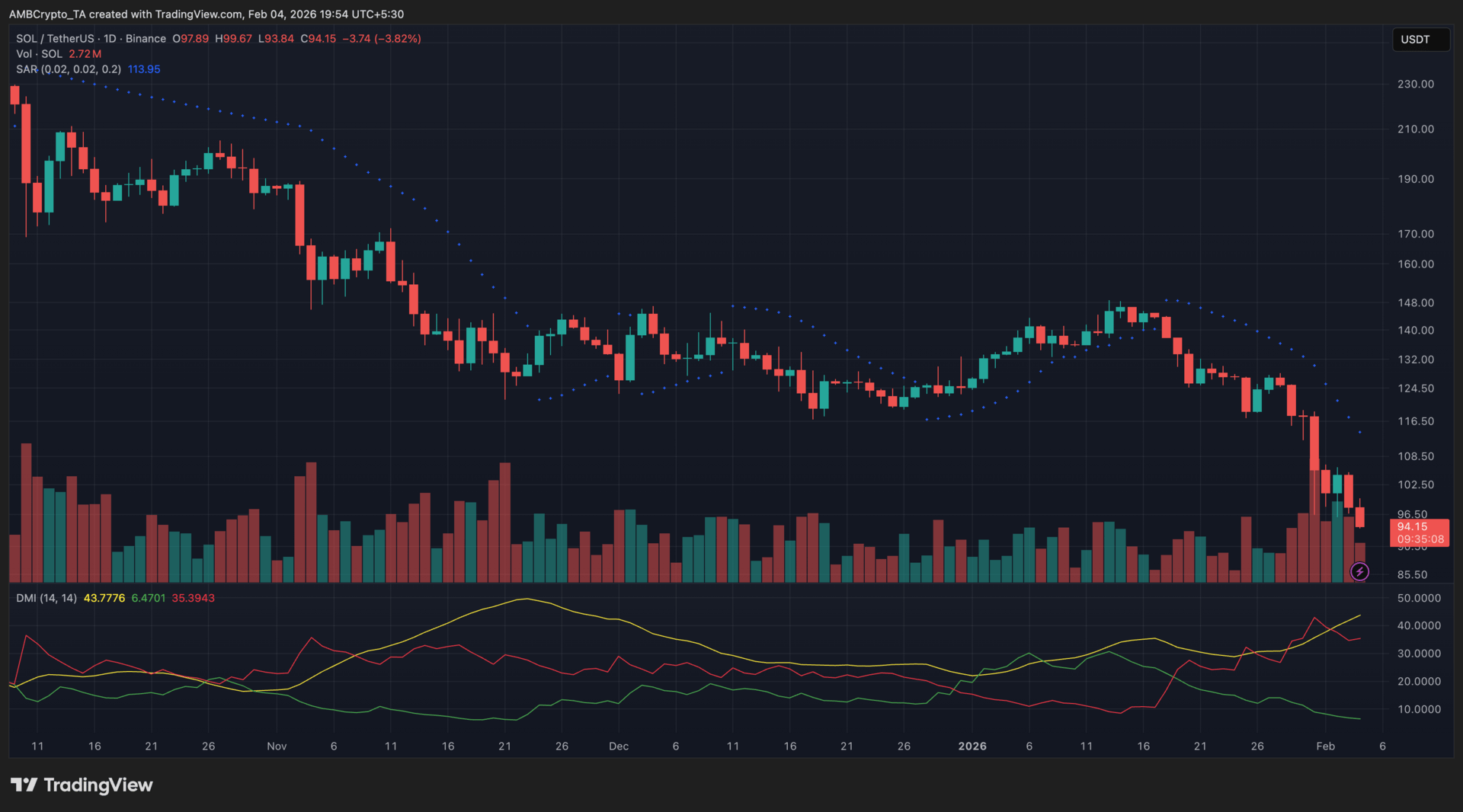

Solana (SOL)

Key points:

SOL slid to $94 after another heavy sell-off, extending its weekly decline as downside pressure intensified.

The Parabolic SAR stayed above price, while DMI reflected a strengthening bearish trend supported by rising sell volume.

What you should know:

Solana remained under pressure as sellers pushed the price lower toward the $94.00–$96.00 region. The decline unfolded steadily rather than through a single flush, with recent candles closing weak and showing limited demand. The Parabolic SAR continued printing above price throughout the move, reinforcing that the broader downtrend stayed intact.

Directional indicators also leaned bearish. The -DI remained firmly above +DI, while the ADX rose sharply during the decline, signaling that selling strength increased rather than faded. Volume expanded on the largest red candles, pointing to active distribution instead of low liquidity drift.

On the catalyst side, SOL tracked broader market stress tied to continued risk-off positioning, alongside capital rotation away from high-beta altcoins. Negative sentiment deepened after Standard Chartered lowered its 2026 Solana price target, prompting further de-risking as traders reassessed SOL’s near-term growth outlook.

Going forward, the $92.00–$96.00 zone acts as immediate support, while resistance remains present around the $108.00–$112.00 region.

How was today's newsletter? |