- Unhashed Newsletter

- Posts

- Is Bitcoin nearing its next bottom?

Is Bitcoin nearing its next bottom?

Reading time: 5 minutes

Bitcoin’s $100K break sparks talk of a bottom amid macro shake-up

Key points:

Bitcoin’s drop below $100,000 triggered mass deleveraging and capitulation, with on-chain data now signaling a potential local bottom.

Analysts point to a mix of seller exhaustion, revived long-term supply, and easing macro headwinds as key setup factors for a rebound.

News - Bitcoin slid 11% between November 3 and 4, dipping under the $100,000 mark for the first time in four months. The move wiped out more than $1.3 million in leveraged long positions and coincided with distress-driven selling by short-term holders.

According to CryptoQuant, the coin’s Market Value to Realized Value (MVRV) ratio has fallen near 1.8, levels that previously marked mid-term bottoms, such as in April 2025 when Bitcoin later rallied 50%.

Glassnode’s capitulation data also shows that investors are realizing losses at rates seen only during major cyclical troughs, clearing excess leverage and weak hands.

While capitulation unfolds, long-term holders have been active distributors. Data from Galaxy Research show more than 4.65 million BTC, worth roughly $500 billion, reentered circulation this year, the second-largest wave on record. Yet, analysts suggest this transfer of coins from “old hands” to new buyers could strengthen the market’s foundation.

Fundstrat’s Tom Lee attributes the slump to macro headwinds including a hawkish Fed and the U.S. government shutdown, but believes those pressures are fading. Similarly, Standard Chartered’s Geoff Kendrick said Bitcoin’s stability below $100,000 is essential for DeFi to eventually rival traditional finance, outlining a three-step accumulation plan for investors.

Capitulation or foundation? - Historically, Bitcoin’s steepest corrections have paved the way for long-term rallies. With MVRV near historic lows and revived supply finding new holders, analysts now argue the market could be laying its next structural base.

Macro reset meets market rebuild - As liquidity improves and risk appetite slowly returns, market watchers note that headwinds are turning into tailwinds. If Bitcoin can hold above critical cost-basis levels, the groundwork for its next growth phase may already be in motion.

Tenerife’s 2012 Bitcoin experiment turns into €10 million windfall

Key points:

The Tenerife Island Council plans to sell 97 BTC bought for €10,000 in 2012, now worth nearly €10 million.

The proceeds will fund ITER’s next research phase, including projects in quantum technology.

News - A small blockchain experiment from 2012 is about to yield an extraordinary return. The Institute of Technology and Renewable Energies (ITER), a public research center under the Tenerife Island Council, is preparing to liquidate 97 BTC purchased 13 years ago for €10,000 (about $11,500).

With Bitcoin trading above $103,000, the stash is now valued at roughly €10 million (about $11.54 million), marking a gain of nearly 10,000%.

Officials emphasize that the coins were never bought for speculation but to study blockchain infrastructure. Still, turning research leftovers into a multimillion-euro fund is proving complicated.

Most European banks remain reluctant to handle Bitcoin transactions, citing volatility and regulatory risk. ITER is therefore coordinating the sale with a Spanish financial institution authorized by both the Bank of Spain and the National Securities Market Commission (CNMV).

According to innovation councillor Juan José Martínez, the sale could close within months. Once completed, the proceeds will be reinvested in scientific research at ITER’s facility in Granadilla de Abona, particularly in quantum technologies.

From blockchain curiosity to research catalyst - What began as an experiment to understand decentralized ledgers has evolved into a rare public-sector crypto success story. ITER’s pivot from blockchain studies to quantum research highlights how early technological curiosity can fund future innovation.

Spain’s cautious crypto approach - Spain’s banking sector continues to tread carefully. Even as BBVA partners with Binance to custody client assets, most institutions still avoid direct Bitcoin handling, a reminder that regulation, not valuation, remains Europe’s biggest crypto hurdle.

Coinbase fined $24.8M in Ireland for AML lapses

Key points:

The Central Bank of Ireland issued its first crypto enforcement action, fining Coinbase Europe €21.5 million for AML monitoring failures.

Over 30 million transactions worth €176 billion went unmonitored between 2021 and 2022; Coinbase has since fixed the errors and enhanced compliance.

News - Ireland’s Central Bank has fined Coinbase Europe Limited €21.5 million (around $24.8 million) after uncovering major lapses in its anti-money-laundering and counter-terrorist-financing controls.

The breach, the country’s first enforcement action against a crypto exchange, stemmed from coding errors in Coinbase’s Transaction Monitoring System that left more than 30 million transactions, worth €176 billion ($203 billion), improperly screened between 2021 and 2022.

Coinbase’s internal review found that five of the system’s 21 scenarios failed to capture certain crypto addresses, particularly those containing special characters.

Once identified, Coinbase re-ran the affected data through its corrected monitoring code, flagging 185,000 transactions for further review and filing 2,708 Suspicious Transaction Reports with Ireland’s Financial Intelligence Unit. The flagged activity included possible money laundering, fraud, cyberattacks, drug trafficking, and child exploitation.

Deputy Governor Colm Kincaid said the failures created opportunities for criminals to evade detection, stressing that “robust monitoring is essential for protecting the financial system.”

Coinbase acknowledged the lapses, settled under the Central Bank’s 30 percent discount scheme, and said it has reinforced oversight, expanded testing, and built new detection scenarios to prevent recurrence.

Ireland’s first crypto enforcement - The ruling marks a watershed for Irish regulation, signaling that crypto firms will be held to the same compliance standards as traditional financial institutions.

Coinbase’s European pivot - Following the probe, Coinbase shifted its EU regulatory base to Luxembourg under the forthcoming MiCA framework, seeking a friendlier environment while committing to “the world’s most trusted and compliant platform.”

UN to help governments build blockchain frameworks

Key points:

The United Nations Development Programme is launching a Blockchain Academy for government officials and a global advisory group to support national adoption.

The initiatives aim to provide education, technical guidance, and cross-sector collaboration on public-sector blockchain use.

News - The United Nations Development Programme (UNDP) is stepping up its digital-transformation agenda with two blockchain initiatives designed to help governments implement the technology responsibly.

Robert Pasicko, who leads the UNDP’s fintech division AltFinLab, said the agency will launch a Blockchain Academy for public officials “in a few weeks,” beginning with four pilot governments. The program will go beyond classroom training to assist in building real-world projects and policy frameworks.

UNDP’s research has already mapped over 300 potential government use cases, spanning finance, supply-chain tracking, and social-infrastructure management. Alongside the academy, a UNDP-led Blockchain Advisory Body is due to be operational within two to three months, pending final approval.

Discussed at a recent UN General Assembly session attended by industry groups such as the Ethereum Foundation, Stellar Foundation, and Polygon Labs, the advisory group will connect policymakers with technical experts to promote transparency and inclusive governance.

Pasicko noted that the UNDP currently runs blockchain pilots in 20 countries through partners like Decaf, a crypto-powered payment system enabling access to financial services without traditional banks. He compared the shift to the decline of ATMs and public phone booths, arguing that digital systems will replace much of today’s physical banking infrastructure.

Promise and risk - Pasicko warned that blockchain’s impact will depend on its deployment. “Fire can warm people or burn villages,” he said, stressing that the UNDP’s role is to ensure the technology empowers citizens rather than concentrates control.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

More stories from the crypto ecosystem

Hedera drops 14% weekly – Yet THESE signals suggest HBAR’s rebound

Ripple’s double-hit: $500 mln raise at $40B valuation AND MasterCard partnership for RLUSD

Aerodrome Finance rockets 10% – But can AERO hold above $0.90?

Canada introduces stablecoin regulation framework in Federal budget: More inside

Ethereum whales pour $80 mln into accumulation – Start of a bullish turn?

Interesting facts

Mr. Goxx, a German hamster, was wired up to trade real crypto by selecting “Buy” or “Sell” tunnels and at one point outperformed many human traders in 2021.

The now-infamous SQUID token soared by more than 23 million % in a week in 2021 and then collapsed to zero when the creators vanished with millions of dollars.

In 2024, a dormant wallet from the early Bitcoin era that had remained untouched for about 14 years suddenly moved 80,000 BTC, originally bought for under $210 000, to new addresses, translating into a movement worth more than $8 billion at today’s prices.

Get in on the markets before tech stocks keep rising

Online stockbrokers have become the go-to way for most people to invest, especially as markets remain volatile and tech stocks keep driving headlines. With just a few taps on an app, everyday investors can trade stocks, ETFs, or even fractional shares—something that used to be limited to Wall Street pros. Check out Money’s list of top-rated online stock brokerages and start investing today!

Top 3 coins of the day

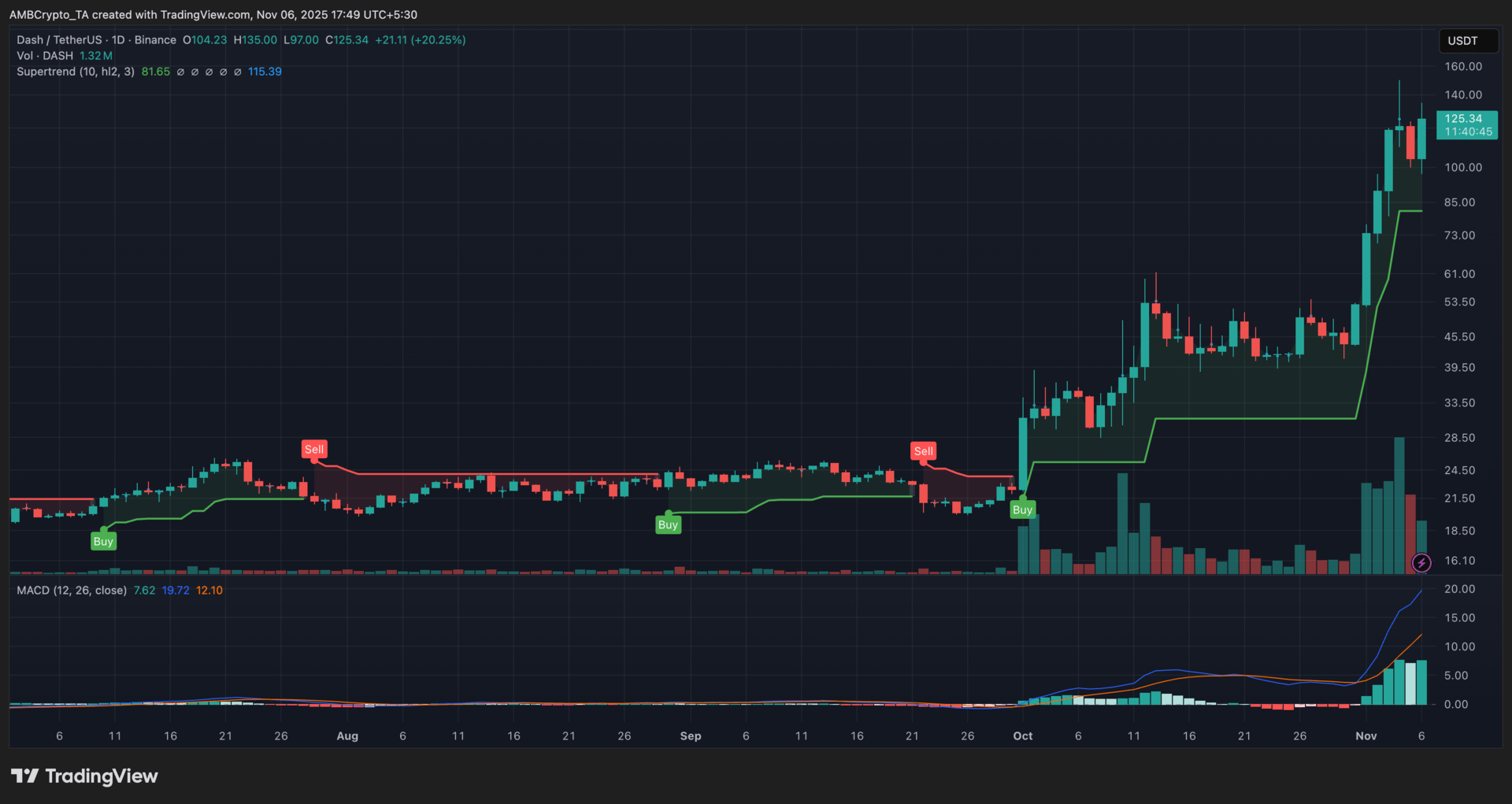

Dash (DASH)

Key points:

DASH extended its rally above $120, gaining over 20% in 24h and outperforming the broader market.

Strong volume and a firm Supertrend signal continued to validate the breakout momentum.

What you should know:

Dash surged to $125, marking a decisive continuation of its multi-week breakout as bullish sentiment around privacy coins intensified. The Supertrend indicator stayed green with dynamic support at $81, confirming sustained trend strength. MACD readings showed widening separation between the main and signal lines, pointing to accelerating momentum. However, the histogram’s sharp rise suggests the rally could be entering overextended territory. Volume more than tripled its 30-day average, underlining broad trader participation. On the non-technical side, renewed privacy narratives and fresh derivatives listings supported DASH’s advance. Traders now watch for consolidation between $115 and $135, as holding above trend support will be key for continued upside.

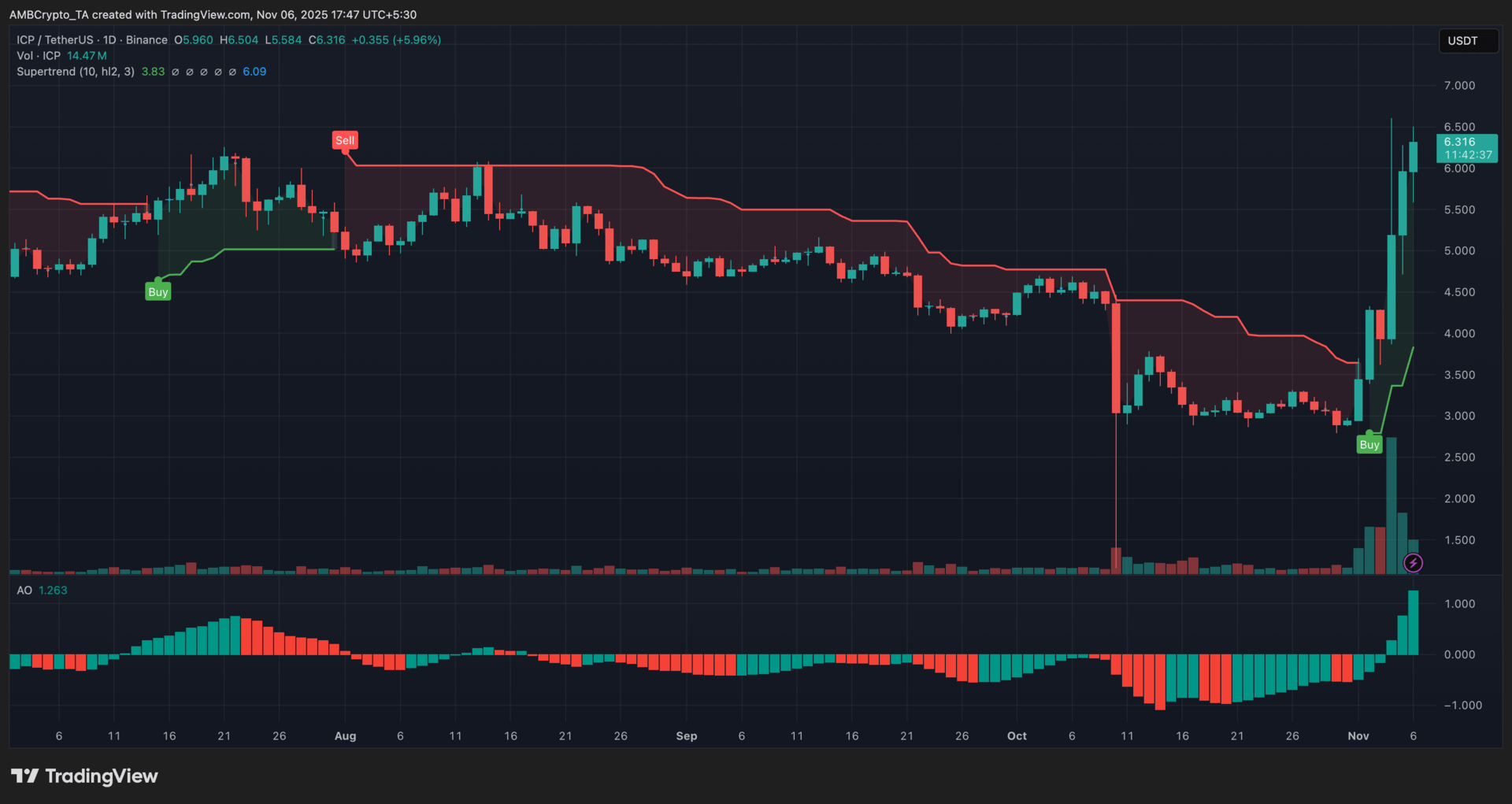

Internet Computer (ICP)

Key points:

ICP extended its breakout, climbing over 5% in 24h as buyers maintained control.

Momentum indicators turned bullish, but short-term overextension hints at possible cooling.

What you should know:

Internet Computer sustained its upward trajectory, closing near $6.31 after rallying sharply through the $5.20 resistance zone. The Supertrend indicator stayed green with active support around $3.83, confirming a strong bullish trend. The Awesome Oscillator stayed positive, printing its tallest green bar above zero, signaling robust momentum but also potential near-term exhaustion. Trading volume surged past 14M, underscoring broad market participation. Externally, optimism surrounding the Caffeine AI launch on the DFINITY network added fuel to the rally, reinforcing ICP’s utility narrative. As enthusiasm builds, traders now eye $6.50 as resistance and $5.80–$6.00 as the area to watch for pullback stability.

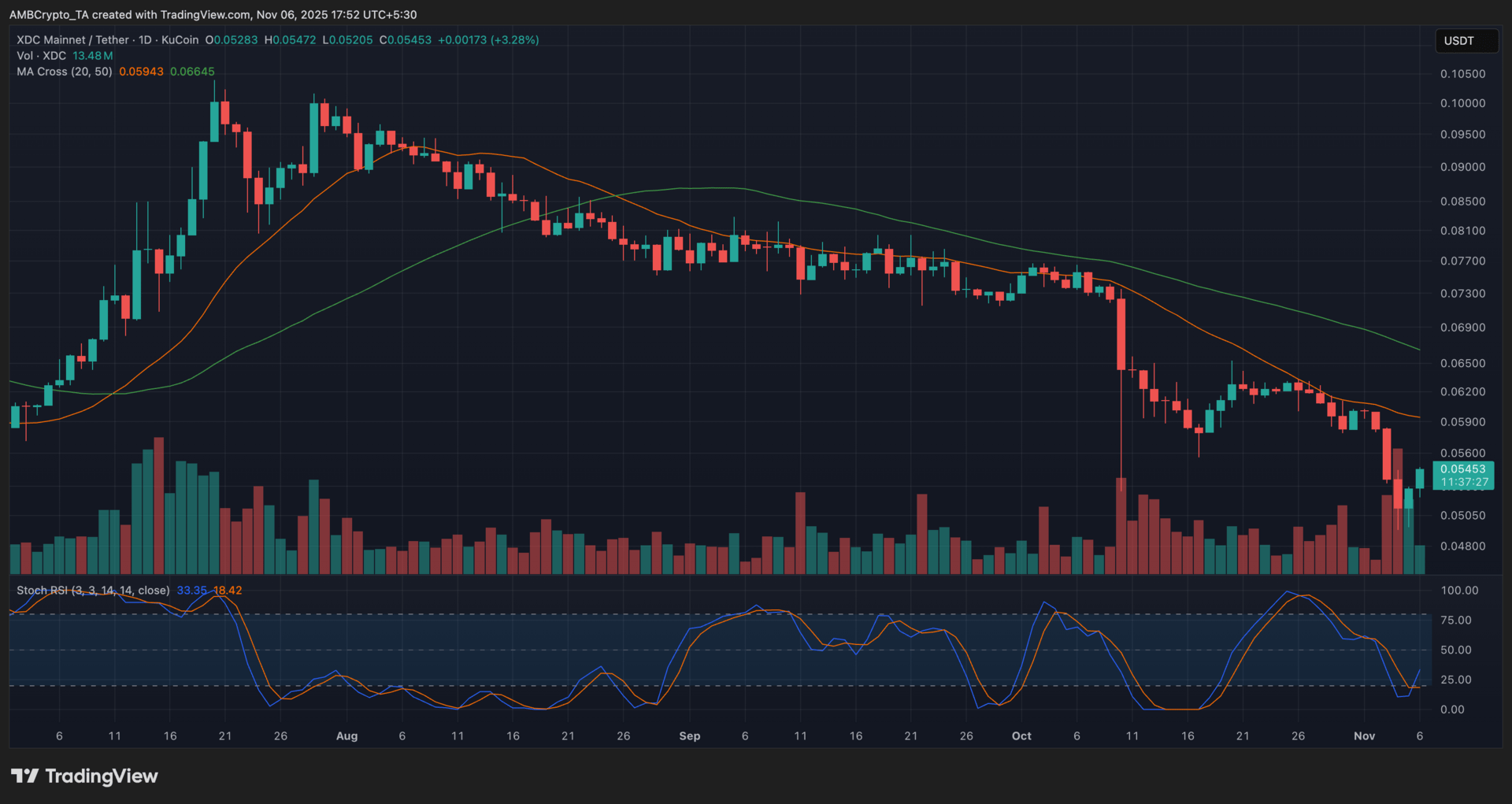

XDC Network (XDC)

Key points:

XDC bounced higher after testing multi-month lows, showing the first signs of short-term recovery.

Momentum indicators improved, but major trend resistance still limits upside potential.

What you should know:

XDC traded near $0.054, recovering 3.2% in 24h after a prolonged decline. The MA Cross (20, 50) still shows a bearish setup, but the price is attempting to reclaim its 20-day moving average, an early signal of stabilization. The Stochastic RSI formed a bullish crossover as values climbed from oversold territory (K 33.35 > D 18.42), reflecting growing buying momentum. Trading volume rose to 13.4M, indicating fresh accumulation at lower levels. Externally, sentiment improved following XDC’s Contour Network acquisition and USDC integration, both expanding its trade-finance footprint. For now, traders should monitor $0.056 as resistance and $0.050 as key support to gauge whether recovery can sustain.

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

How was today's newsletter? |