- Unhashed Newsletter

- Posts

- Justin Sun vs Trump’s WLFI freeze

Justin Sun vs Trump’s WLFI freeze

Reading time: 5 minutes

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

World Liberty Financial freezes Justin Sun’s wallet as WLFI crashes

Key points:

World Liberty Financial blacklisted Justin Sun’s wallet tied to nearly 3 billion WLFI tokens, including 540 million unlocked valued at more than $100 million.

WLFI’s price fell by almost 50% in days, sparking debates over governance, decentralization, and political influence.

News - World Liberty Financial (WLFI), the Trump-backed DeFi protocol, has frozen the wallet of Tron founder Justin Sun. The move affects 540 million unlocked WLFI tokens and 2.4 billion locked ones, according to Arkham and Nansen data.

Blockchain records show Sun’s wallet transferred $9 million worth of WLFI before the freeze, fueling speculation of insider selling.

WLFI’s price tumbled, falling as low as $0.16, a decline of more than 50% since its September 1 debut. Retail buyers who entered at $0.33 are now sitting on losses of nearly 45%, while early investors like Sun remain deeply in profit after acquiring WLFI at $0.015.

Sun, WLFI’s largest outside backer with a $75 million investment, has denied any market manipulation. He insisted the transactions were “deposit tests” with no impact on prices and demanded his tokens be unblocked, calling unilateral freezes a violation of blockchain’s fairness and transparency principles.

Community divided - The dispute has fractured the WLFI community. Some accuse Sun of using exchanges under his influence, such as HTX, to offload tokens, while others view WLFI’s decision as an overreach that undermines decentralization.

Political and regulatory angle - The controversy carries political weight, given the Trump family’s involvement. Community members have even urged Donald Trump to push regulators to investigate Sun’s activities.

With WLFI trading volumes exceeding $1 billion in its first hours, regulators may scrutinize the project’s governance and concentrated ownership.

Trump-linked Thumzup bets big on DOGE mining, ETF buzz builds

Key points:

Thumzup Media, backed by Donald Trump Jr., will add 3,500 Dogecoin rigs via Dogehash, projecting up to $103 million in revenue if DOGE hits $1.

A REX-Osprey Dogecoin ETF could launch next week, with whales split between heavy selling and accumulation.

News - Thumzup Media Corporation, a Nasdaq-listed firm tied to Donald Trump Jr., is pivoting into cryptocurrency mining with a plan to acquire Dogehash and deploy 3,500 Dogecoin rigs by year-end. The company has executed agreements to purchase Dogehash’s 2,500-rig fleet and add 1,000 more, pending shareholder approval.

If DOGE reaches $1, Thumzup projects potential annual revenue of over $100 million, though current returns are estimated closer to $22.7 million.

The firm recently rebranded toward crypto exposure after adding a $1 million Bitcoin position in January. Its treasury now spans Dogecoin, Litecoin, Solana, XRP, Ether, and USDC. Thumzup also holds 19.1 BTC worth about $2.1 million, framing the Dogehash deal as a major step toward becoming one of the largest public DOGE miners.

ETF speculation lifts DOGE profile - At the same time, Dogecoin is gaining institutional attention. ETF issuer REX Shares has filed for a DOGE fund under the 40 Act, with analysts suggesting a launch could happen as early as next week. If approved, it would mark the first DOGE ETF in the United States.

Whale activity and market risks - DOGE whales are showing mixed behavior. Data indicates about 200 million DOGE were sold in 48 hours, even as other wallets aggressively accumulated.

Analysts remain divided: some see bullish setups pointing toward $1–$1.4 targets, while others warn ETF approval delays and volatile whale trading could stall momentum.

Tether’s gold push aligns with El Salvador’s first bullion buy in 35 years

Key points:

Tether is weighing deeper investments across the gold supply chain after disclosing $8.7 billion in bullion and boosting its stake in Elemental Altus by about $100 million.

El Salvador bought 13,999 troy ounces of gold for roughly $50 million, lifting holdings to 58,105 ounces, while continuing to hold 6,290 BTC.

News - Tether has held talks to invest in gold miners, refiners, traders, and royalty firms, reflecting CEO Paolo Ardoino’s view of gold as “natural Bitcoin.”

The company disclosed $8.7 billion of gold bars in a Zurich vault and increased its minority position in Elemental Altus Royalties by about $100 million following an earlier stake purchase. Tether also issues Tether Gold (XAUT), backed one-to-one by a fine troy ounce of physical gold.

In parallel, El Salvador’s central bank made its first gold purchase since 1990, acquiring 13,999 ounces for about $50 million. The buy raises national reserves to 58,105 ounces. Officials framed the move as diversification of international reserves.

The country also holds 6,290 BTC, with its Bitcoin Office recently distributing coins across multiple new addresses as a security measure.

Why it matters - Both developments point to a complementary reserve approach that pairs Bitcoin’s upside with gold’s defensive profile. Gold has set record highs above $3,500 per ounce amid heavy central bank demand, while Bitcoin’s role continues to evolve within global portfolios.

Macro backdrop - Bitcoin recently approached $113,000 as weak U.S. jobs data lifted rate cut expectations. Analysts highlighted softer labor conditions and rising unemployment as factors supporting alternative assets.

Tether’s next steps - Tether’s discussions span the broader gold supply chain, with prior deals including equity in a royalty company. With substantial profits reported this year, the issuer has capacity to pursue commodity-linked diversification while maintaining stablecoin leadership.

SEC’s OIG says “avoidable” IT failures erased a year of Gary Gensler’s texts

Key points:

Nearly a year of Gensler’s official texts, from October 18, 2022 to September 6, 2023, were permanently deleted after syncing stopped, an auto-wipe triggered, and a factory reset was performed.

The loss overlaps major crypto and market flashpoints, drawing industry criticism and raising concerns for FOIA responses and ongoing cases.

News - The SEC’s Office of the Inspector General found that “avoidable” technology missteps erased almost a year of text messages from former Chair Gary Gensler’s government phone. The device stopped syncing with the agency’s management system on July 6, 2023 and appeared inactive for 62 days.

An August 10 policy to wipe devices that had not connected for 45 days flagged the phone as lost or stolen. When staff tried to restore it on September 6, a factory reset removed texts and system logs covering October 18, 2022 through September 6, 2023.

Investigators cited weak change management, missed alerts, poor vendor coordination, and a lack of backups. About 1,500 messages were later recovered from colleague records, with roughly 38 percent deemed mission related.

The OIG said the loss may impair responses to FOIA requests. The SEC notified the National Archives in June 2025 and has since disabled texting on most staff devices while adding new backup and training measures.

Why it matters - The period spans high-profile events, including the FTX collapse, the Grayscale spot BTC ETF litigation window, banking turmoil around Silvergate and Silicon Valley Bank, and the MMTLP controversy.

Critics argue the agency penalized firms for recordkeeping failures while failing its own standard, citing Gensler’s past remarks that finance depends on trust.

What changed at the SEC - The agency plans to update procedures for troubleshooting officials’ devices, bolster backups, and complete corrective actions by November 2025, subject to OIG verification.

More stories from the crypto ecosystem

SUI price prediction – Traders, a breakout to $5 could be next IF…

Is ‘overvalued’ XRP facing a bearish price trend in September 2025?

How CRO’s 183M token burn and outflows could drive price breakout

World Liberty Financial blacklists Justin Sun’s address after ‘general deposit tests’

‘End of L2s?’ Stripe’s Tempo debut challenges Ethereum’s scaling vision

Crypto scams uncovered

JSCEAL malware campaign steals crypto via malicious ads - A new, highly stealthy malware strain named JSCEAL, disseminated through over 35,000 malicious ads in the EU, infects users with a crypto wallet–stealing payload using compiled JavaScript to bypass antivirus defenses.

Deepfake crypto scam robs investor of $80K - In India, an investor was duped by an AI-generated video of the finance minister promoting a fraudulent crypto app, leading to losses of about $80,000. Authorities have arrested two suspects, underscoring how deepfakes are increasingly being weaponized in global crypto fraud schemes.

North Korean “Contagious Interview” scams target crypto workers - A wave of sophisticated scams by North Korean hackers, dubbed “Contagious Interview,” lures crypto professionals via fake LinkedIn/Telegram recruiter profiles, leading to malware downloads or direct fund theft; over 230 individuals fell victim between January and March.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Top 3 coins of the day

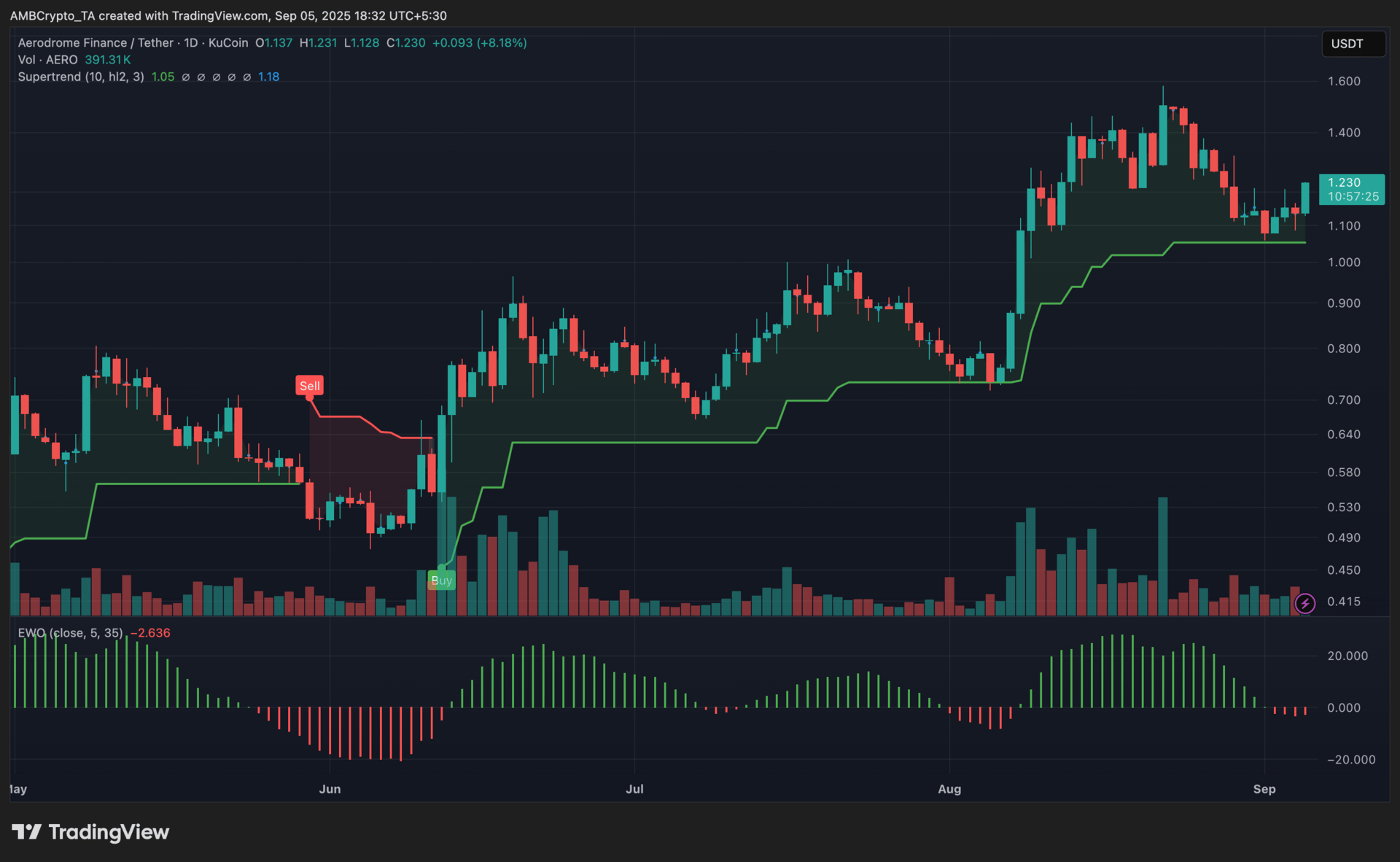

Aerodrome Finance (AERO)

Key points:

AERO was last seen at $1.23, climbing 8.2% in the past 24 hours.

The Supertrend indicator remained in buy mode, while the EWO stayed negative with red bars reflecting ongoing bearish momentum.

What you should know:

AERO advanced from $1.12 to $1.24 before closing near the top of its daily range, supported by stronger-than-usual volume at 391.31K. Despite the rally, the Elliott Wave Oscillator (EWO) stayed in red territory, suggesting that bearish momentum has yet to fully ease. The Supertrend baseline held firm at $1.05, providing key support, while immediate resistance is seen around $1.25–$1.30. Beyond technicals, sentiment has been fueled by Coinbase’s integration of Aerodrome’s DEX, giving access to over 100M potential users, and on-chain data showing increased whale accumulation in August. Together, these factors have helped anchor confidence in AERO’s position as a leading liquidity hub on the Base network. Holding above $1.05 keeps the broader uptrend intact, though bulls will need a close above $1.30 to confirm momentum.

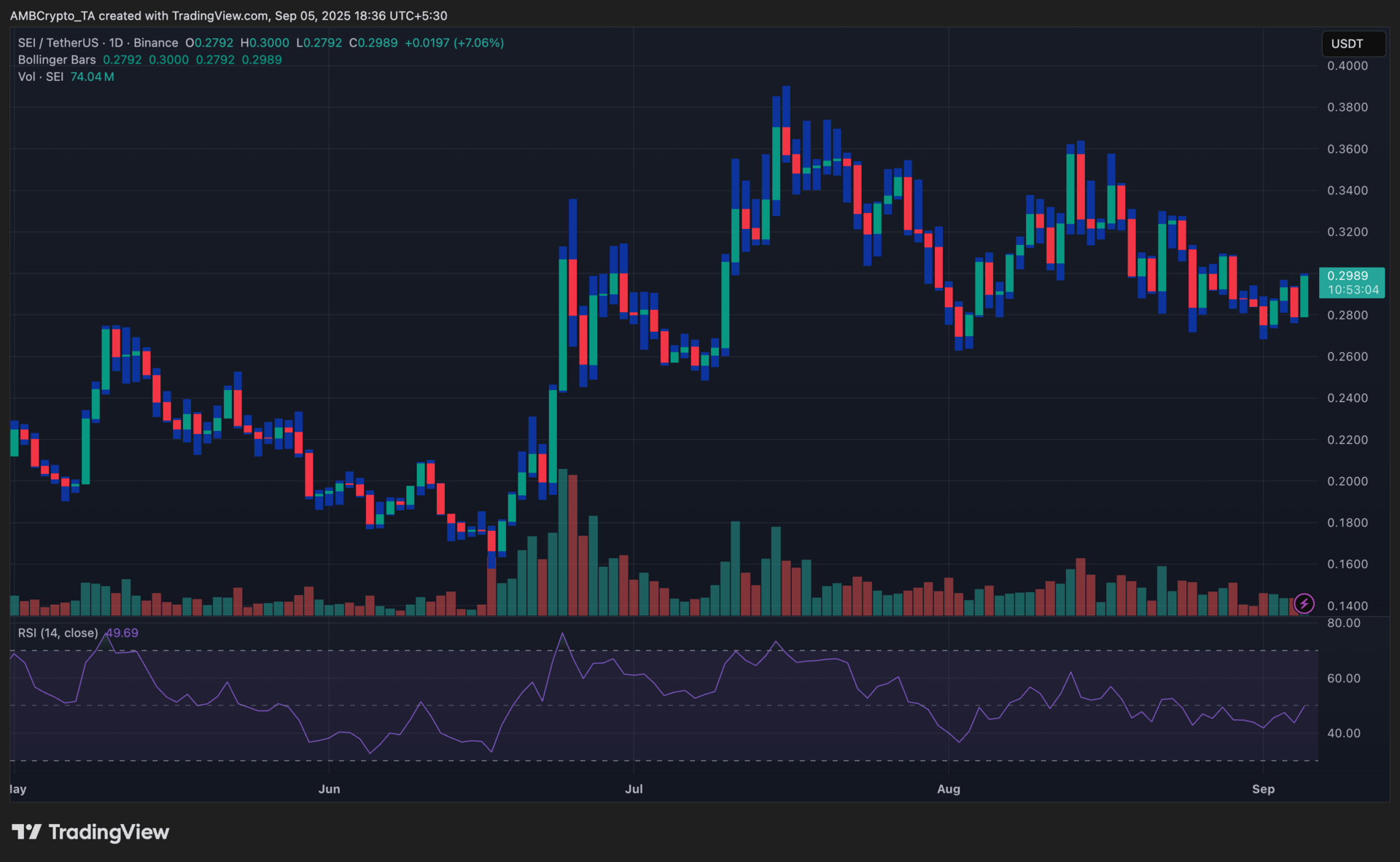

Sei (SEI)

Key points:

SEI was trading at $0.298 at press time, gaining 7.1% in the past 24 hours.

The token closed near the upper Bollinger band, while RSI at 49.7 reflected neutral momentum.

What you should know:

Sei climbed from $0.279 to $0.300 before ending the session at $0.298, closing near the upper Bollinger band and signaling firm upward pressure. The RSI held neutral at 49.7, suggesting room for further upside, while trading volume surged to 74.04M, providing confirmation for the move. Resistance is now seen in the $0.300–$0.305 zone, with support near $0.280. On the fundamental side, Sei’s adoption has grown through MetaMask integration, which opened its ecosystem to 100M+ users, and the launch of Seiscan in partnership with Etherscan, boosting transparency. Institutional developments such as ETF filings and Wyoming’s WYST stablecoin pilot have also added legitimacy. For now, holding above $0.280 is key to maintaining momentum, while a decisive breakout above $0.305 could set up a push toward higher ranges.

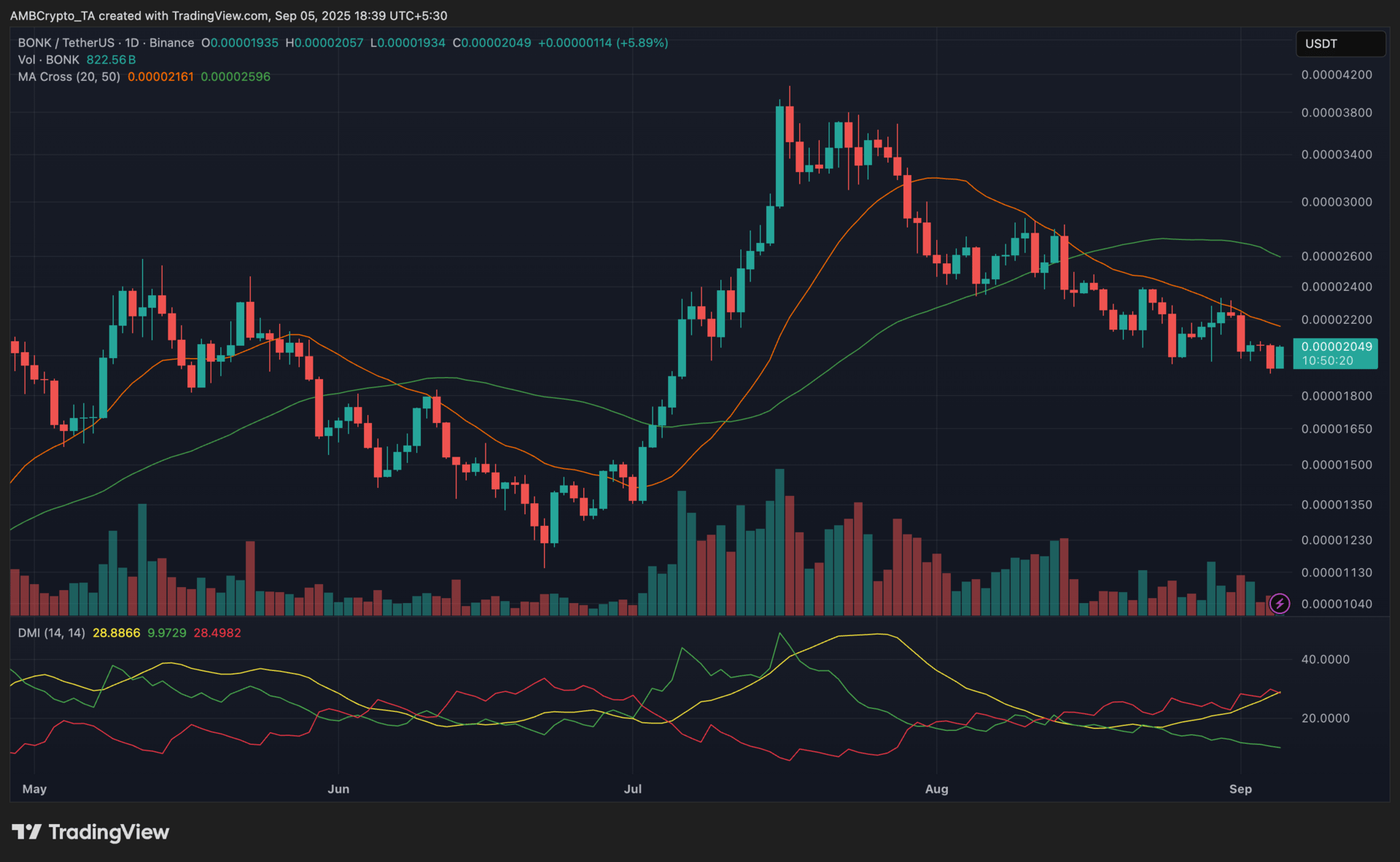

Bonk (BONK)

Key points:

BONK was last seen at $0.00002049, up 5.9% over the past day.

The 20-day MA stayed below the 50-day MA, while the DMI showed -DI above +DI, signaling bears still held an edge.

What you should know:

Bonk rebounded from $0.00001934 to $0.00002057 before closing at $0.00002049, registering a solid intraday gain on high volume of 822.56B. Despite the bounce, the Moving Average crossover remained bearish, and the DMI reflected negative pressure with -DI outweighing +DI. Resistance is now seen around $0.00002160–$0.00002200 at the 20-day MA, while support rests near $0.00001900. On the fundamental side, sentiment improved after Nasdaq-listed Safety Shot revealed a $25M BONK investment, signaling rare institutional interest in a memecoin. Bonk.fun also captured 62% of Solana’s memecoin launchpad revenue in August and introduced NFT staking, both of which increase token demand through fee burns and lockups. While technicals lean cautious, ecosystem growth and corporate adoption provide a buffer for bulls. A decisive close above $0.00002200 could shift momentum further upward.

Used by Execs at Google and OpenAI

Join 400,000+ professionals who rely on The AI Report to work smarter with AI.

Delivered daily, it breaks down tools, prompts, and real use cases—so you can implement AI without wasting time.

If they’re reading it, why aren’t you?

How was today's newsletter? |