- Unhashed Newsletter

- Posts

- Markets rotate ahead of Fed

Markets rotate ahead of Fed

Reading time: 5 minutes

Metals rally, crypto pauses ahead of Fed decision

Key points:

Gold and silver surged to multi-year highs as investors hedged dollar weakness and geopolitical risk, pulling attention away from crypto.

Bitcoin hovered near $90,000 ahead of the Fed’s rate decision, with options markets signaling caution despite muted headline volatility.

News - Precious metals dominated market narratives this week as gold and silver climbed sharply, fueled by a weaker US dollar, geopolitical uncertainty, and expectations that central banks may lean dovish over time. BitMine’s Head of Research, Tom Lee, said the metals rally reflects a broader shift, with gold and silver now treated as core asset classes rather than niche hedges.

Lee noted that similar cycles in the past have often seen Bitcoin and Ethereum lag metals initially, only to stabilize later once safe haven flows cool. While crypto has underperformed during the recent metals surge, he argued that fundamentals have improved following last year’s industry wide deleveraging.

At the same time, markets turned their focus to Wednesday’s Federal Reserve rate decision. Futures and prediction markets priced in near certainty that rates would remain unchanged in the 3.5% to 3.75% range, keeping attention squarely on Jerome Powell’s tone during the post meeting press conference.

Why the Fed matters more than the headline decision - Bitcoin briefly tested the $90,000 level as traders positioned for the Fed outcome, with Ethereum reclaiming $3,000. Volatility indicators across BTC, ETH, XRP, and SOL suggested limited near-term price swings, reinforcing the view that any immediate rate impact is already reflected in positioning.

However, analysts warned of a potential narrative shift depending on Powell’s comments on the labor market. With unemployment at 4.4%, traders are watching for clues on whether policymakers remain comfortable with current conditions or signal caution about the pace of future easing.

Sentiment, positioning, and what comes next - Options markets showed steady demand for downside protection, signaling that traders remain wary of macro and policy risks beyond the Fed, including a looming US government funding deadline and stalled crypto legislation. Social data also reflected the current mood, with retail attention rotating toward gold and silver during their sharp rallies, while crypto interest remained more subdued.

For now, metals are setting the pace, while Bitcoin continues to trade within a narrow range near $90,000 as markets assess macro signals and policy clarity.

Stablecoins step out of crypto’s shadow

Key points:

Major institutions and crypto firms are accelerating stablecoin adoption across payments, settlement, and reserves.

Regulatory clarity in the U.S. and Europe is pushing stablecoin usage beyond trading into payments and financial infrastructure.

News - Stablecoins are increasingly being positioned for regulated use across payments, settlement, and reserves, as traditional institutions and crypto firms expand their offerings under clearer regulatory frameworks.

This week, Fidelity Investments confirmed it will launch its first stablecoin, the Fidelity Digital Dollar (FIDD), in early February. Issued by Fidelity Digital Assets, the Ethereum-based token will be backed by cash, cash equivalents, and short-term U.S. Treasuries, with daily reserve disclosures and third-party attestations.

Fidelity said the product is designed to support round-the-clock institutional settlement and onchain retail payments, placing it in direct competition with established issuers like USDC and USDT.

At the same time, reserve strategies among stablecoin issuers are diverging. Tether has continued accumulating physical gold, buying up to two tons per week and building a stockpile reported between roughly 130 and 140 metric tons, valued at more than $20 billion based on current prices.

While most of the bullion supports Tether’s own reserves, a portion backs its gold-linked XAUT token, underscoring the firm’s focus on hard-asset backing as gold prices surge.

From reserves to real-world payments - Beyond issuance, stablecoins are increasingly being used in everyday payment contexts. OKX recently launched a Mastercard-linked debit card in Europe that allows users to spend stablecoins directly from self-custody wallets at over 150 million locations. The rollout comes as the EU’s MiCA framework brings stablecoin issuers and service providers under a single regulatory regime.

Meanwhile, Coinbase is expanding stablecoin tooling by testing a feature that allows businesses to issue their own branded, dollar-backed stablecoins. The initiative highlights growing interest in customized onchain payment and treasury tools, alongside Coinbase’s continued promotion of commodities exposure such as gold futures.

The bigger picture - Taken together, the launches and initiatives across Fidelity, Tether, OKX, and Coinbase point to a clear expansion in how stablecoins are being used. With regulatory frameworks like the GENIUS Act in the U.S. and MiCA in Europe now in place, stablecoins are increasingly being integrated into payment flows, settlement systems, and reserve strategies rather than remaining limited to crypto trading activity.

WisdomTree’s tokenized funds highlight Solana’s institutional pull

Key points:

WisdomTree expanded its full suite of tokenized funds to Solana, strengthening the network’s role in regulated onchain finance.

Rising staking participation and network activity point to long-term confidence despite ongoing price consolidation.

News - Solana’s growing role in institutional tokenization took a step forward this week after WisdomTree announced it has brought its full lineup of tokenized funds to the network. The expansion allows both institutional and retail investors to mint, trade, and hold tokenized money market, equity, fixed income, and allocation products directly on Solana through WisdomTree Connect and WisdomTree Prime.

The move is part of WisdomTree’s broader multichain strategy, which already spans Ethereum, Arbitrum, Avalanche, Base, and Optimism. The firm cited Solana’s transaction speed and scalability as key factors in the decision, positioning the blockchain as an increasingly viable distribution layer for regulated real-world assets.

Data from RWA.xyz shows Solana now hosts roughly $1.3 billion in distributed asset value, giving it a growing foothold in the tokenized funds market.

Staking and network metrics reinforce the trend - Alongside institutional expansion, onchain data shows sustained long-term participation on the network. More than 425 million SOL are currently staked, pushing the staking ratio close to 69%, the highest level since early 2024. Inflows into institutional staking products such as Marinade Select further indicate that professional investors are committing capital with longer time horizons.

Network usage has also increased sharply. Active addresses on Solana surged in January to nearly 19 million, reflecting elevated onchain activity. A portion of this growth has been linked to speculative participation around AI-themed tokens, adding volume even as price momentum remains subdued.

Price consolidation persists - SOL has recently traded in the $125 to $127 range after rebounding from support near $118. Market participants continue to watch resistance between $128 and $130, while holding above $116 is seen as important for maintaining stability. Despite the recent recovery, SOL remains well below its prior yearly high, even as institutional tokenization activity and onchain participation continue to increase.

Bitwise’s Uniswap ETF trust signals early DeFi optionality

Key points:

Bitwise registered a Delaware trust for a potential Uniswap ETF, a routine but strategic early step.

Regulatory focus has shifted from enforcement toward liquidity, structure, and execution risks.

News - Bitwise Asset Management has taken an early procedural step toward a potential Uniswap-linked exchange-traded fund after registering a Delaware statutory trust under the name “Bitwise Uniswap ETF.” The filing, dated January 27, establishes a legal vehicle that could later support a formal application to the U.S. Securities and Exchange Commission (SEC), though no federal filing has been submitted so far.

Such state-level registrations are common across the ETF industry and often precede SEC submissions by months or longer. Many never advance further, serving instead as placeholders that preserve optionality if market conditions or regulatory clarity improve. Analysts describe Bitwise’s move as preparatory rather than a signal of an imminent product launch.

Regulatory backdrop shapes the conversation - The registration follows the SEC’s decision in February 2025 to close its investigation into Uniswap Labs. With that probe resolved, regulatory scrutiny has shifted away from questions of protocol legality toward practical considerations such as liquidity depth, custody design, pricing integrity, and decentralized governance.

Market observers note that any future ETF review would focus on how Uniswap’s fragmented liquidity pools, smart contract risks, and decentralized oversight mechanisms could be evaluated within a regulated fund structure. Custody and surveillance frameworks would be central to that assessment.

Liquidity strength meets governance friction - Despite governance debates within the Uniswap ecosystem, on-chain activity remains substantial.

The protocol processed roughly $859 million in decentralized exchange volume over the past 24 hours, while UNI recorded about $161 million in daily trading volume. These figures are relevant for evaluating liquidity depth and pricing considerations, though regulators would still closely assess execution quality across venues.

UNI’s market performance has remained under pressure amid broader ETF outflows and cautious investor sentiment. Still, sentiment data has highlighted elevated negative commentary around the token, a pattern some analysts associate with potential short-term rebound dynamics rather than a sustained trend shift.

What comes next - For now, Bitwise’s Delaware trust mainly reflects growing institutional interest in DeFi-based ETFs under a more structured regulatory environment. A detailed SEC filing outlining exposure mechanics, custody, and valuation methodology would be the next meaningful milestone.

More stories from the crypto ecosystem

Did you know?

Coinbase ads were banned in the UK for trivializing crypto risks: The UK’s Advertising Standards Authority (ASA) banned a series of Coinbase adverts that suggested using crypto could help ease the cost of living crisis because they downplayed the significant risks of crypto investing.

Crypto money-laundering hit an estimated $82 billion in 2025: Blockchain analytics firm Chainalysis reported that illicit crypto transactions surged to at least $82 billion in 2025, driven largely by fast-growing Chinese-language laundering networks.

A Nomura-backed crypto firm is seeking a U.S. national bank charter: Laser Digital, a crypto company backed by Japanese bank Nomura, has applied for a U.S. national bank trust charter from the OCC to offer digital asset spot trading while integrating more closely with traditional finance.

Top 3 coins of the day

Jupiter (JUP)

Key points:

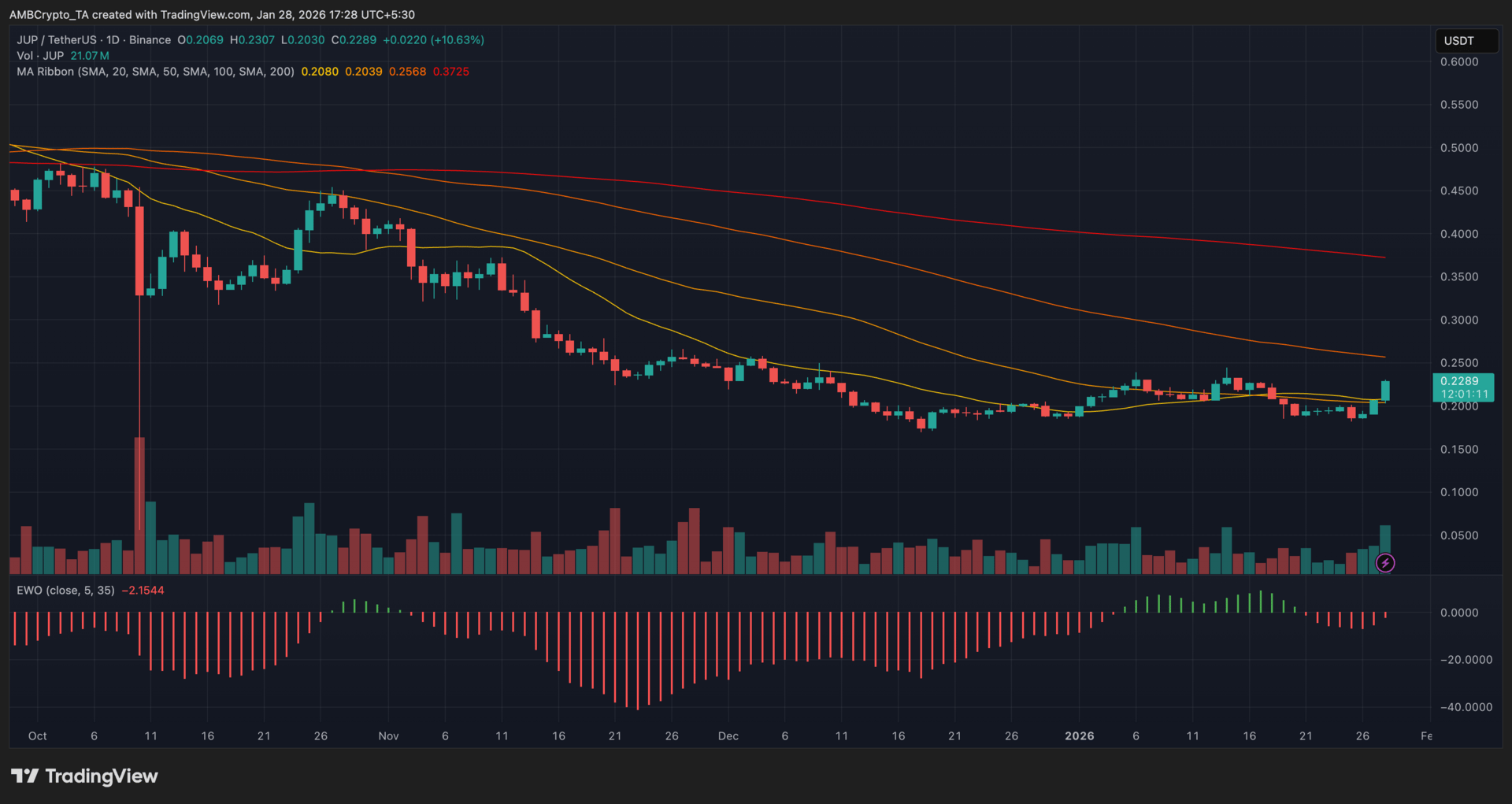

At the time of writing, JUP was trading at $0.22 after rising over 10% on the daily chart, snapping a multi-week consolidation phase.

Buying activity picked up as volume expanded and short-term momentum improved, though the broader trend structure remained cautious.

What you should know:

Jupiter showed signs of recovery after spending several weeks trading below its MA Ribbon. Price climbed back above the shorter moving averages, pointing to improving near-term strength, while the longer-term averages continued to slope downward, keeping the wider trend under pressure. The MA Ribbon remained bearishly aligned, but recent tightening suggested selling pressure had begun to ease.

Momentum conditions also improved slightly. The Elliott Wave Oscillator stayed below zero, indicating bearish control was still present, but the histogram appeared less negative than it was in December, signaling weakening downside momentum rather than a full trend reversal.

Volume expanded alongside the rebound, lending credibility to the move instead of signaling a low-liquidity bounce. On the catalyst front, renewed attention around Jupiter’s expanding role within Solana and anticipation tied to the upcoming Jupuary airdrop snapshot likely supported short-term demand.

Support sits near $0.20-$0.21, while $0.24-$0.26 remains the immediate resistance zone to watch.

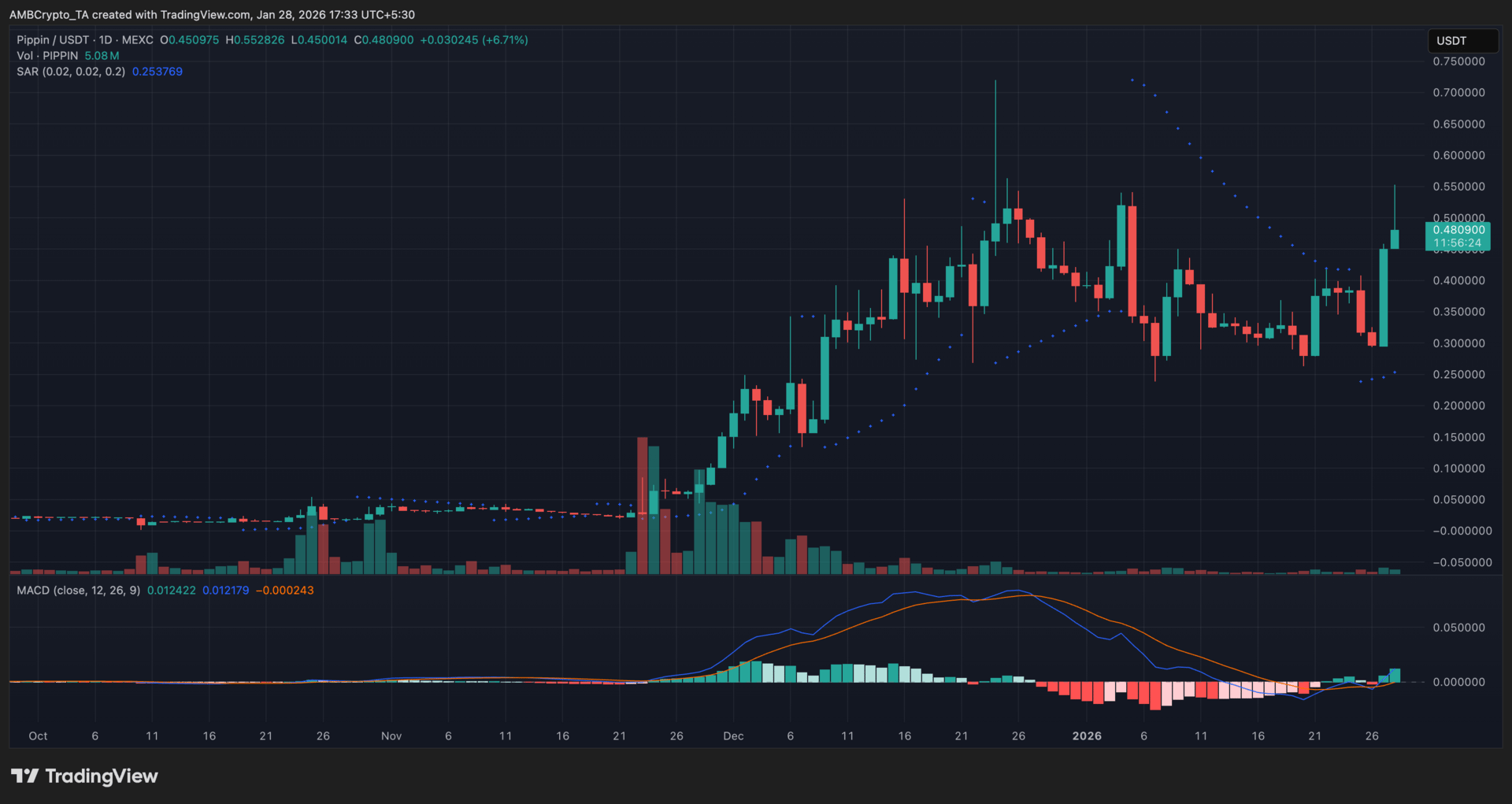

Pippin (PIPPIN)

Key points:

PIPPIN climbed over 6% in the latest session, ending a brief pullback as buyers stepped back in near recent lows.

The Parabolic SAR flipped below the candles while the MACD histogram turned positive, supported by a fresh pickup in trading volume.

What you should know:

PIPPIN rebounded after defending the $0.32 region, with price pushing back toward the $0.48 level as buying momentum returned. The Parabolic SAR shifted beneath the candles, signaling a short-term trend change, while the MACD lines crossed upward and the histogram moved into positive territory, reflecting improving momentum.

Volume expanded alongside the move, suggesting the rebound was backed by active participation rather than thin liquidity.

Beyond the chart, leverage-driven short covering appeared to contribute to the upside, as earlier bearish positioning was unwound during the bounce. At the same time, reduced sell-side pressure from large holders helped tighten available supply, amplifying price swings once demand picked up.

Going forward, $0.38 stands as the immediate support to monitor, while $0.55 marks the next resistance zone where sellers previously emerged. The Parabolic SAR and MACD remain key indicators to watch for confirmation of follow-through or early signs of exhaustion.

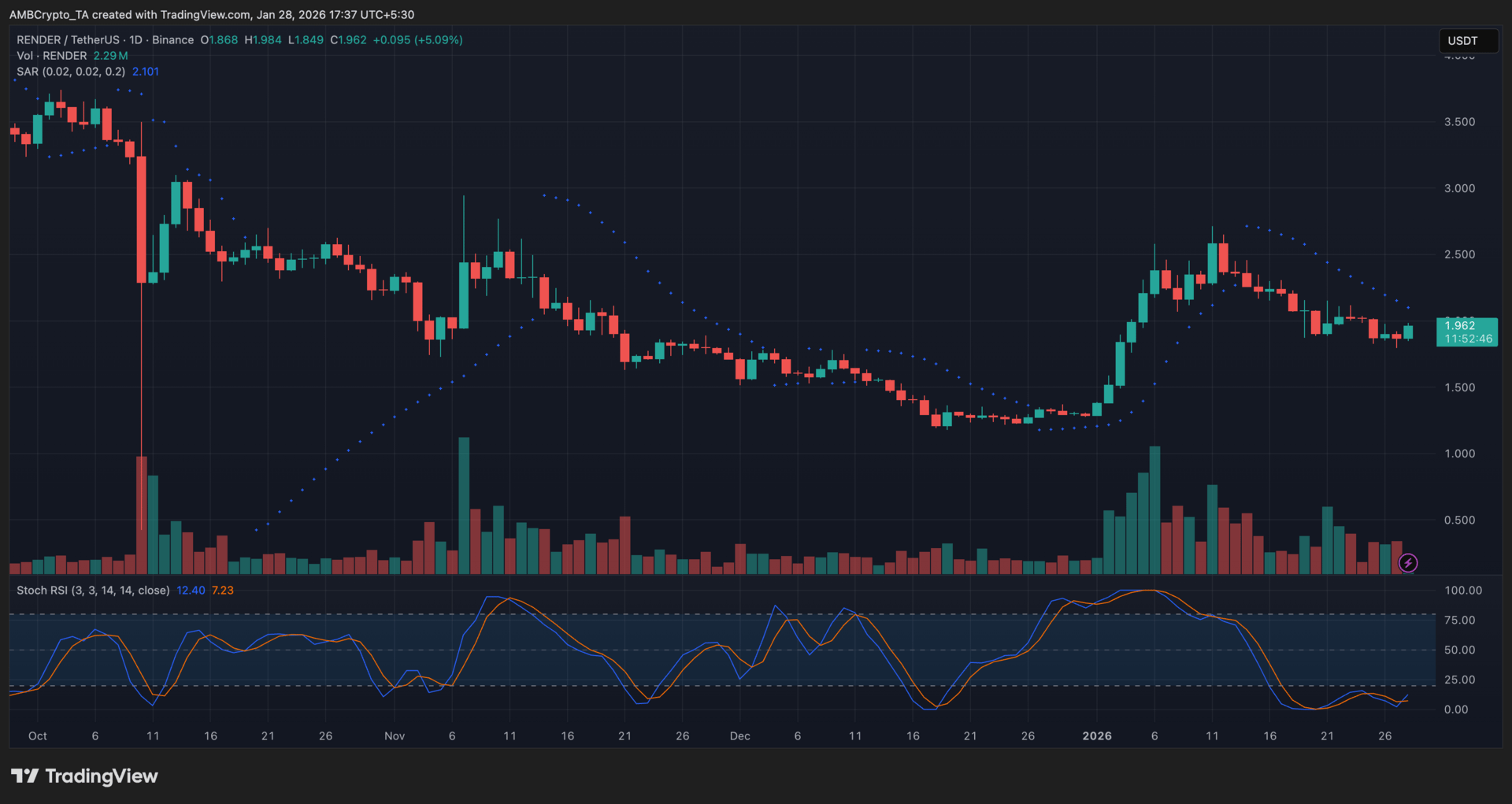

Render (RENDER)

Key points:

RENDER hovered around $1.96 after staging a modest rebound from recent session lows, ending the day with a mid-single-digit gain.

Bearish pressure lingered on the chart, with the Parabolic SAR still overhead and the Stochastic RSI pinned near oversold levels.

What you should know:

RENDER’s latest move looked more like stabilization than acceleration. Price found footing around the $1.85–$1.90 region, where selling pressure began to thin and volume showed early signs of participation. Still, the broader structure remained cautious, as the Parabolic SAR continued to trail above price, signaling that sellers retained control of the prevailing trend.

Momentum indicators echoed this restraint. The Stochastic RSI stayed compressed near the lower band, suggesting downside momentum had cooled but had not yet flipped into a recovery signal. This combination often aligns with range-bound behavior or shallow rebounds, rather than sustained upside follow-through.

From here, $2.10 stands as the first level that needs to be reclaimed to improve short-term structure. Until then, $1.85 remains the critical downside zone traders are likely to defend.

Outside the chart, ongoing attention toward AI-linked and GPU-compute tokens appeared to cushion declines, helping RENDER avoid deeper losses despite fragile technical conditions.

How was today's newsletter? |