- Unhashed Newsletter

- Posts

- 'Max Pain' ahead for Bitcoin?

'Max Pain' ahead for Bitcoin?

Reading time: 5 minutes

Bitcoin traders eye $107K ‘max pain’ as Bollinger Bands tighten

Key points:

Bitcoin traders keep a wary eye on the $107,000 level in anticipation of a price dip before a rebound.

Historically tight Bollinger Bands readings warn of heightened volatility for BTC.

News - Bitcoin remained rangebound in the early hours of Thursday. At the time of writing, BTC was trading at $111,459, 0.3% below the low of $111,800 it set on Monday. On that day, a liquidation cascade saw $1.7 billion worth of liquidations across the crypto market.

Bitcoin was testing the lows from Tuesday, and a $17.5 billion options expiry loomed large.

Is Bitcoin’s bottom in? In a post on X, crypto investor and entrepreneur Ted Pillows observed that BTC usually bottoms in September. His post also detailed that the $17.5 billion Options expiry has its max pain point at $107k. Historically, Bitcoin has moved toward its max pain point before the Options expiry. Hence, there was reason to believe that there was another leg downward for prices before a recovery could ensue.

Popular trader BitBull concurred, asserting that the long-term trend was still upward. There could be some corrections on the way, and a drop as deep as $103k-$105k wouldn’t be surprising. This was a repeat of what Bitcoin did in Q1 2024, the analyst argued. The dive below the 100-day exponential moving average (EMA) at $111,900, which has occurred, is also something that can create “max pain”.

Big Bitcoin price move expected within a week- Another trader, Daan Crypto Trades, predicted a volatile end to September. Traditionally BTC’s weakest month, the trader pointed to a vital resistance level at $113k that must be flipped to begin talking of a reversal.

Analyst Tony Severino showed that the weekly Bitcoin Bollinger Band was the tightest it has been in the entire history of BTC/USD price action. Such volatility contractions are generally followed by an explosive move that sets the next price trend. If the September price bottom suspicions are correct, the coming months could be crucial for BTC bulls.

Senators Warren, Slotkin call for ethics probe into Trump-linked crypto dealings

Key points:

The letter comes after a New York Times investigation found that the Trump administration was involved in two quick-fire deals involving WLFI and the approval of thousands of U.S. artificial intelligence chips.

The House and Senate are working on a larger crypto market structure bill, where Trump’s crypto ventures have already been a point of contention.

News - Democratic Sens. Elizabeth Warren and Eliza Slotkin urged an investigation into President Donald Trump, his family, and his top administration officials. The lawmakers were concerned that ethics rules were broken in connection with World Liberty Financial (WLFI).

In a letter sent on Wednesday to the acting inspector general of the Commerce Department, the acting director of the Office of Ethics, and the acting inspector general at the State Department, the Senators pressed for more information on the role of White House crypto czar David Sacks and U.S. Special Envoy to the Middle East Steve Witkoff with the United Arab Emirates.

Witkoff’s son, Zach Witkoff, is CEO of World Liberty Financial. President Trump and his three sons are listed as co-founders of the company.

Why did the ethics concerns arise now? Last week, the New York Times found that the Trump administration has been involved in two deals made in quick succession involving the WLFI and the approval of thousands of U.S. artificial intelligence chips to the UAE.

The NYT reported that UAE-founded investment firm MGX was investing $2 billion into Binance using stablecoins. MGX was using the WLFI-launched USD1 stablecoin, as revealed in May. Two weeks later, the Trump administration allowed the UAE access to “hundreds of thousands of the world’s most advanced and scarce computer chips, a crucial tool in the high-stakes race to dominate artificial intelligence”, the NYT read.

In the letter, Warren and Slotkin called this pattern of transactions “deeply troubling”. It revealed that Witkoff and Sacks were in a position to control government decisions to personally enrich themselves, and simultaneously create significant national security concerns.

Crypto bill coming up - The ethics concerns come at a time when lawmakers are working on a larger crypto market structure bill, where President Trump’s crypto ventures have become a sticking point. With a government shutdown looming, the legislation was likely to be pushed back even more. As these deals work their way through Washington, the information demanded by Warren and Slotkin can turn out to be vital.

UAE named among top 5 global crypto hubs for investors

Key points:

The 2025 Crypto Wealth Report by Henley & Partners ranked the UAE as the world’s fifth most crypto-friendly country.

The UAE received a perfect score of 10 for tax friendliness with its zero-tax policy on crypto, tied only with Monaco in this metric.

News - The UAE has emerged as one of the world’s most attractive destinations for crypto investors. With its perfect tax score, strong government support, and an expanding blockchain ecosystem, the Emirates is attracting more and more digital millionaires in search of financial freedom and regulatory clarity.

The tax and adoption advantage for the UAE - The Henley Crypto Adoption Index gave the UAE a perfect 10 score for tax friendliness. This recognizes the UAE’s zero tax policy on crypto trading, mining, staking, and selling across the seven emirates.

This tax structure is particularly advantageous for high-net-worth individuals (HNWIs) and crypto entrepreneurs. The other countries that make up the top five are Singapore, Hong Kong, the USA, and Switzerland.

The Index evaluated 29 investment migration programs across six parameters. These were public adoption, infrastructure adoption, innovation and technology, regulatory environment, economic factors, and tax friendliness.

The UAE was ranked second in crypto adoption, only behind the USA. The report recognized the UAE as a leading example of the government actively enabling crypto ecosystems to flourish. The combination of high digital adoption and crypto tax-friendly environments attracts retail and business, the report read.

Strategic government support - Not just tax, but long-term regulatory frameworks and national programs that support blockchain growth have been instrumental in boosting the UAE’s crypto popularity.

The Dubai Virtual Assets Regulatory Authority, established in 2022, was the world’s first regulator exclusively for virtual assets and offers a dedicated framework for digital asset governance.

The Central Bank’s Digital Dirham Program supports the adoption of central bank digital currencies and a broader digital finance integration. The UAE Golden Visa, which offers 10-year renewable residence permits for investors, and the dedicated visa tracks for tech entrepreneurs enhance the country’s appeal to crypto builders and investors.

Australia drafts proposal to require financial licenses for crypto platforms

Key points:

Crypto leaders from Circle, Tether, Ripple, Coinbase, and Crypto.com support the initiative.

Initiative builds on the CFTC’s crypto sprint and CEO Forum recommendations.

News - Australia is aiming to tighten regulations around crypto service providers with draft legislation that would extend laws from the finance sector to the crypto industry.

In a crypto conference on Thursday, Assistant Treasurer Daniel Mulino said that the legislation is “the cornerstone for our digital asset roadmap”. Currently, crypto exchanges that facilitate trading assets such as Bitcoin need only register with the Australian Transaction Reports and Analysis Centre (AUSTRAC).

Draft to make two financial products - Mulino said that, under the Corporations Act, the draft would make two new financial products, a “digital asset platform” and “tokenized custody platform”. These service providers will need to hold an Australian Financial Services License.

The license would register all exchanges with the Australian Securities and Investments Commission. Right now, only exchanges that sell financial products such as derivatives need this license.

Mulino added that crypto platforms will be subject to “a suite of obligations designed to accommodate the unique characteristics of digital assets”. This will legitimize good actors and weed out the bad ones, giving business clarity and strengthening consumer confidence.

Crypto industry backs draft law - Major crypto exchanges operating in Australia have backed the government’s draft law. Swyftx CEO Jason Titman said he welcomed the announcement and was expecting to see a requirement for exchanges to hold a financial services license. OKX Australia CEO Kate Cooper said that the real measure of the draft laws will be their enforcement. It should ensure that responsible, licensed operators are not undercut by unregulated players, hence protecting Australian consumers.

More stories from the crypto ecosystem

Jerome Powell said ‘risks shifted’ this week: How crypto analysts reacted

Tether joins the likes of SpaceX, OpenAI with $500 billion valuation talk: Report

CZ News: Binance Founder slams ‘negative narratives’- What’s going on?

From FUD to FOMO: How FTX traders reacted to SBF’s ‘gm’ tweet

Mapping Bitcoin’s setup: Volatility, reserves, and clues for what’s next

Interesting facts

Decentralized exchange (DEX) Aster [ASTER] is one of the most talked-about decentralized finance (DeFi) projects in crypto right now. DEXes offer many advantages over their centralized counterparts, such as a wider range of tokens to trade, since a central authority doesn’t need to vet the assets available for trading. Moreover, DEXes offer enhanced automation, anonymity, and privacy in comparison. Users also retain custody of their funds, nullifying the risk of a centralized exchange freezing their account or preventing withdrawals.

The AI revolution over the past year has given rise to AI agents on blockchain — designed to make decisions and perform tasks. These agents can set rules for transactions and even link to DeFi protocols. The transparency of the blockchain means AI agents can be fully autonomous, accountable fund managers with an auditable trail of activity.

Back in 2014, Dogecoin was modified to allow merged mining with other cryptocurrencies that also use the Proof-of-Work algorithm, called Scrypt. At that time, the most popular Scrypt crypto was Litecoin. Since then, miners have been able to mine Litecoin and also contribute to the Dogecoin network, receiving rewards from multiple blockchains for the same amount of work.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Top 3 coins of the day

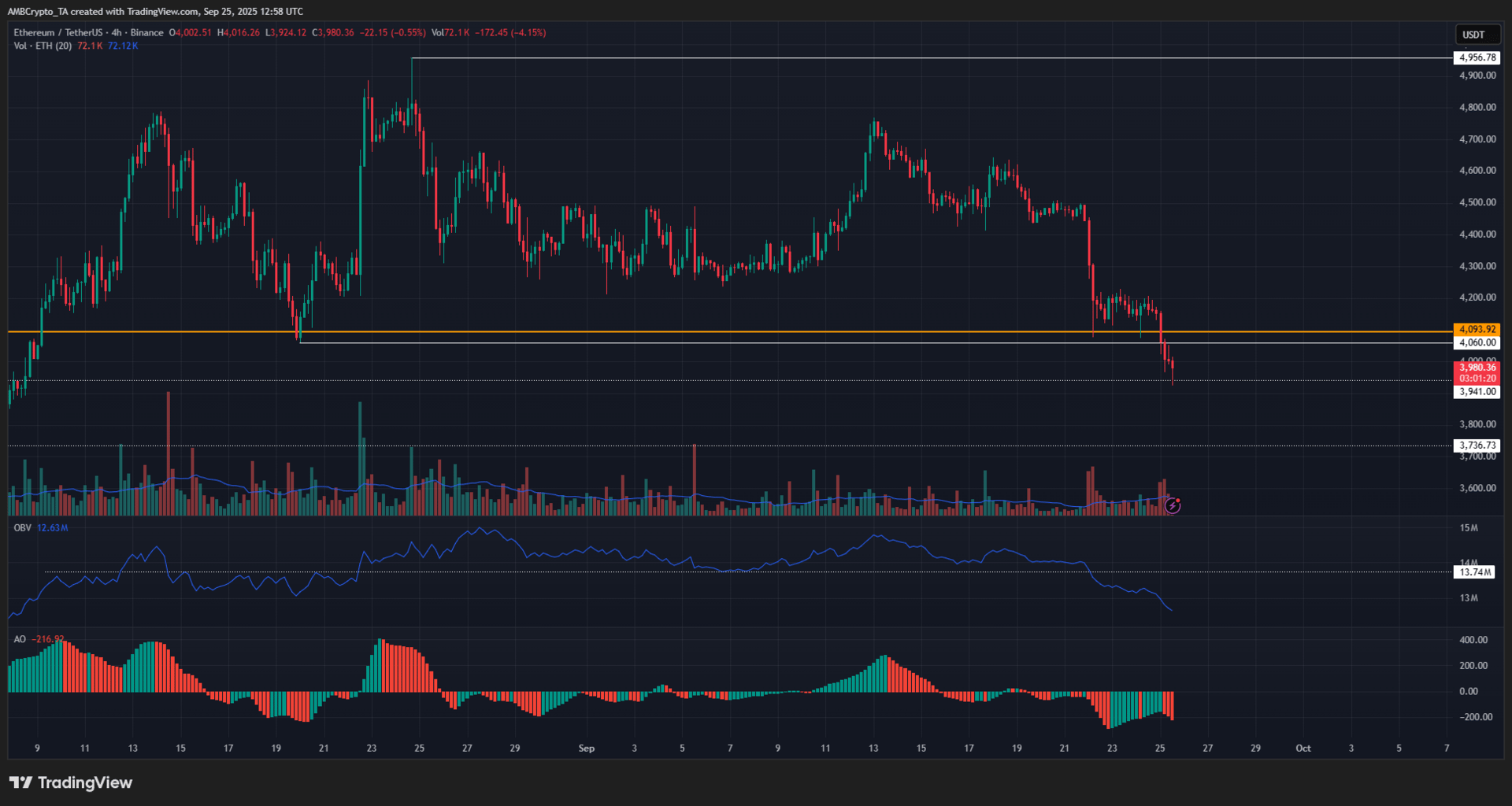

Ethereum (ETH)

Key points:

Ethereum has fallen below the psychological $4,000 round number support.

The prevalent selling pressure and bearish structure meant that another 6% price drop to $3,736 was likely.

What you should know:

The leading altcoin has faced bearish pressure alongside Bitcoin’s price reset from the $117.5k resistance. However, Ethereum’s losses have been greater- a 14.56% loss compared to BTC’s 5.84% drop from the local top over the past week. On the 1-day chart, the market structure has flipped bearishly as Ethereum fell below the swing low at $4,060. It also has a bearish structure on the 4-hour chart. Additionally, the OBV fell below local support, showing firm selling pressure. The Awesome Oscillator also confirmed downward momentum. Ethereum was trading at a local support at $3,941, and it was likely that ETH would drop to the next support level at $3,736.

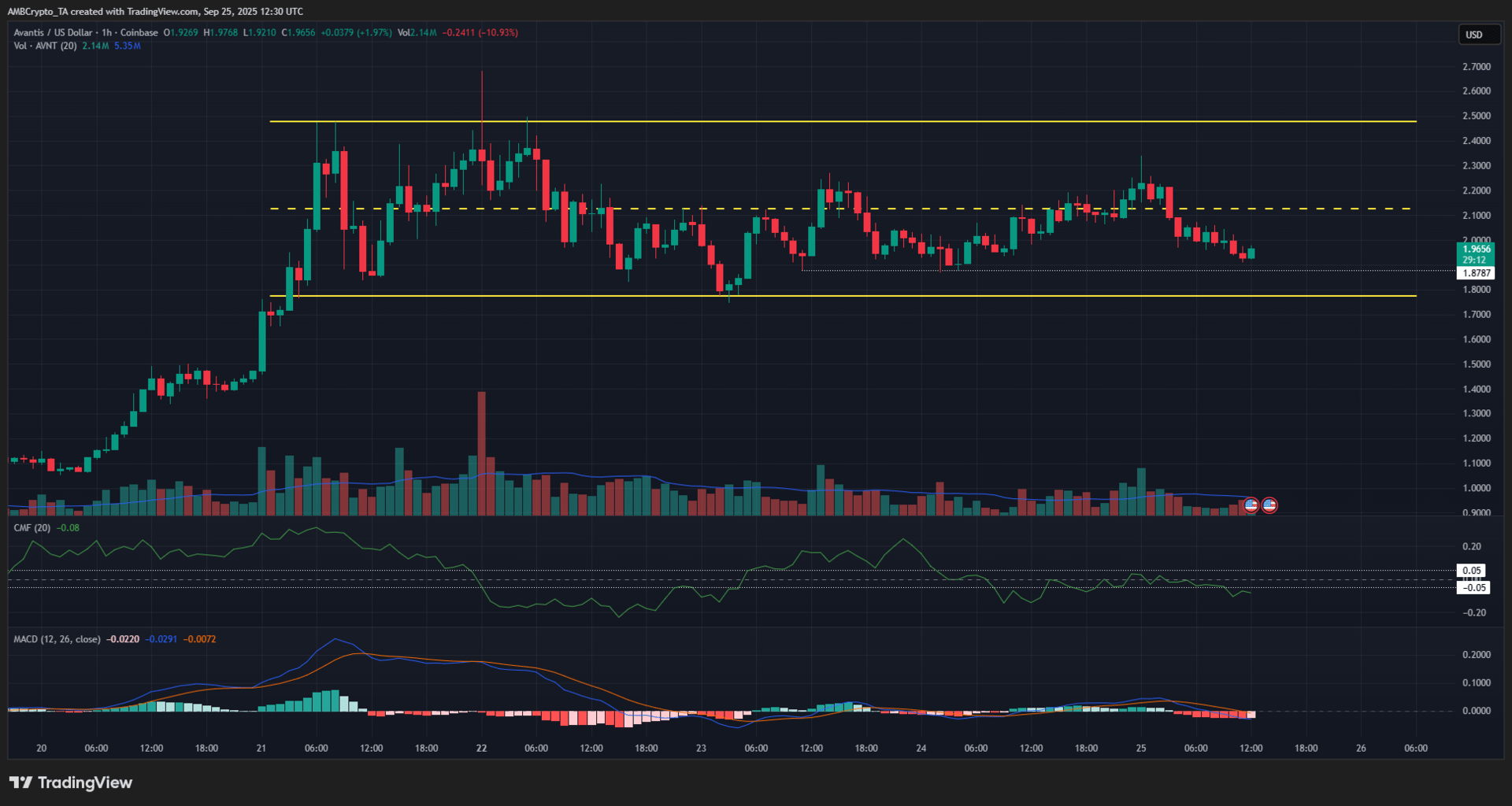

Avantis (AVNT)

Key points:

Avantis was trading at $1.96 at the time of writing, and displayed bearish momentum and steady selling pressure on the 1-hour chart.

The local support levels at $1.77 and $1.87 could offer a buying opportunity.

What you should know:

Avantis has been trading within a range since last Sunday. This range extended from $1.77 to $2.47. There was also a local support level at $1.87, established over the past two days of trading. AVNT showed strengthening selling pressure. The CMF slid below -0.05 to show sizeable capital flow out of the market. The MACD indicator also formed a bearish crossover and dropped below the neutral 50 mark to indicate a shift in momentum in favor of the bears. However, traders can look at the bright side. The $1.77 and $1.87 are levels where the price has to make a decision. A positive reaction from these levels would be an early sign that Avantis was headed for the range highs at $2.47, and potentially even higher.

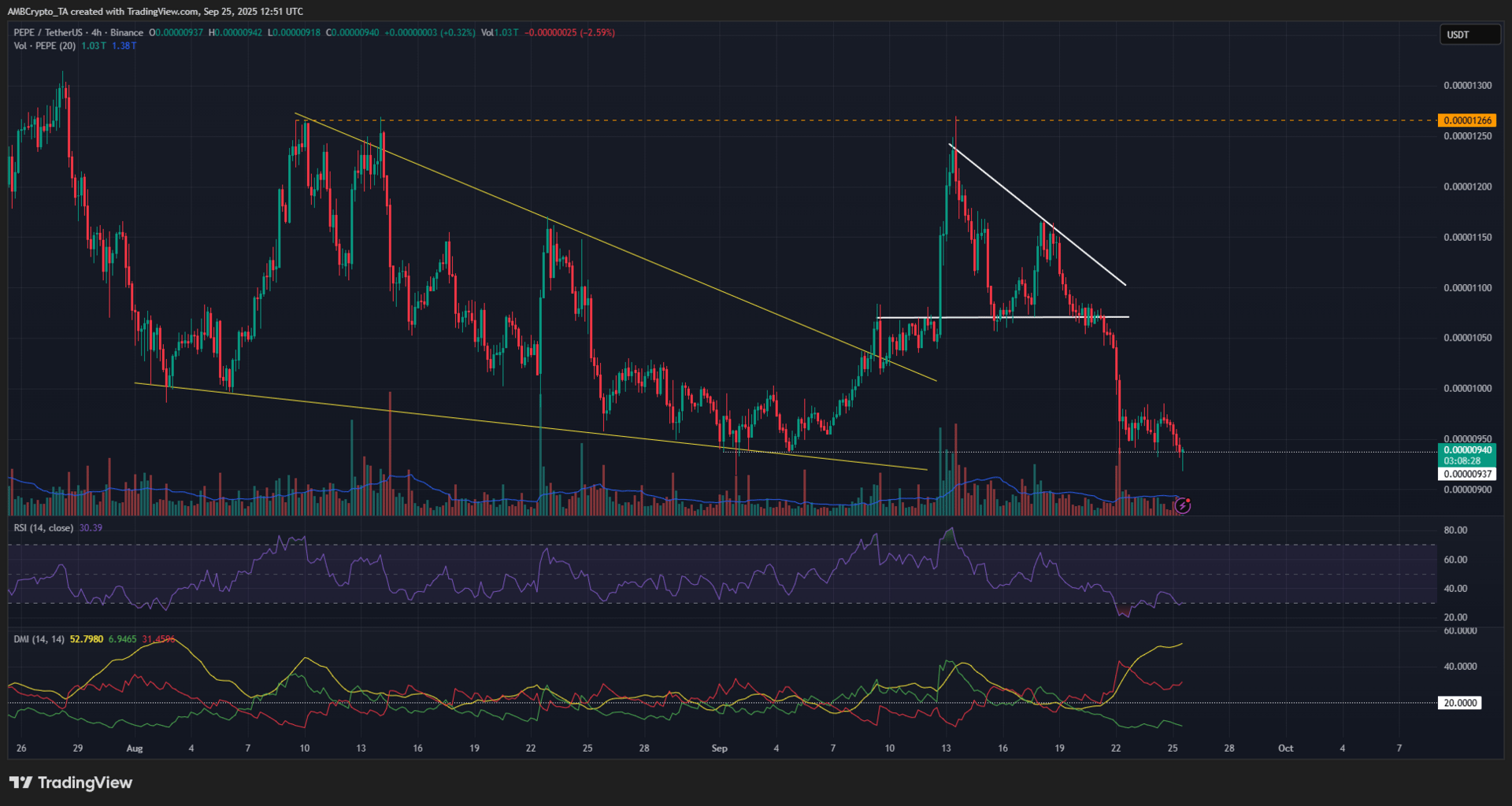

Pepe (PEPE)

Key points:

Pepe has suffered a 26% price drop in less than two weeks, taking the popular memecoin back to a support level from earlier in the month.

It looked like decision time for PEPE bulls and bears- the former needed to defend this support, but the latter were stronger.

What you should know:

The memecoin sector has been hit hard by the recent market-wide pullback, and Pepe has faced a 26% drawdown since reaching the $0.0000127 high on Saturday, the 16th of September.

The popular memecoin had a bullish breakout from a descending wedge pattern when it reached this local resistance. Since then, the bears have been dominant. On the 4-hour chart, PEPE formed a descending triangle pattern, which is generally followed by a downward price move. This outcome has come to pass, and at the time of writing, PEPE was once again testing the support at $0.00000937 from earlier in the month. More losses were likely- the Directional Movement Index showed a strong bearish trend in progress, and the RSI showed downward momentum was dominant.

How was today's newsletter? |