- Unhashed Newsletter

- Posts

- Memecoins roar in 2026

Memecoins roar in 2026

Reading time: 5 minutes

Memecoins jump as PEPE, BONK, DOGE spark early 2026 buzz

Key points:

Memecoins added roughly $3 billion in market value in 24 hours, with PEPE, BONK, and DOGE posting strong double digit or high single digit gains.

Rising open interest, spot volume, and selective technical breakouts have revived discussion around a possible early 2026 meme-led recovery attempt.

News - Memecoins staged a sharp rebound at the start of 2026, lifting the sector’s total market capitalization to around $39.45 billion, its highest level in two weeks. PEPE led the move with gains above 20%, while BONK and DOGE followed with notable advances, placing meme tokens among the strongest performers of the session.

The rally unfolded after a bruising December that thinned liquidity and left spot markets highly reactive to bursts of flow. While sentiment has improved from recent lows, the move remains measured rather than euphoric, with traders closely watching whether momentum can sustain.

PEPE momentum and derivatives surge - PEPE’s move stood out, supported by a sharp rise in derivatives activity. Open interest in PEPE contracts jumped to around $441 million, alongside a surge in trading volume.

Influencer-driven narratives and bold long-term forecasts helped fuel speculative interest, while broader strength across altcoins provided additional support.

Despite the renewed optimism, market data still show that memecoin dominance remains low compared to prior cycles, suggesting that a broad-based meme resurgence has yet to be confirmed.

BONK breakout and consolidation - BONK rallied through a key technical zone near $0.00000820, with volume expanding during the breakout. After reaching the upper end of its recent range, the token pulled back slightly and began consolidating just below $0.00000840.

Price has so far held above its prior breakout area, keeping short-term momentum intact as traders watch for follow-through.

DOGE as a risk proxy - DOGE climbed toward $0.126 after clearing a well-watched resistance band around $0.121, with the move supported by strong spot trading rather than leverage alone.

On-chain data also showed large holders accumulating during recent weakness, even as network-wide unrealized profits hit multi-year lows. Together, these signals point to stabilizing conditions as DOGE trades above reclaimed levels.

South Korea’s crypto ETF ambitions clash with regulatory reality

Key points:

South Korea’s exchange infrastructure is now prepared for crypto ETFs, but legal barriers continue to block approvals.

Strict domestic rules are pushing capital offshore, while regulators intensify enforcement on local exchanges.

News - South Korea’s push toward crypto-linked exchange-traded funds (ETFs) is gaining operational momentum, even as regulation struggles to keep pace.

The Korea Exchange confirmed that its trading, clearing, and supervision systems are already capable of supporting crypto ETFs and derivatives. However, current law still prevents these products from launching, as digital assets are not recognized as eligible underlyings under the Capital Markets Act.

KRX Chairman Jeong Eun-bo said the exchange has begun extending trading hours and preparing new investment products as part of a broader effort to modernize local markets and address the long-standing Korea discount.

While the infrastructure is ready, approvals remain stalled as regulators continue to debate how crypto fits within the existing legal framework.

Capital outflows highlight regulatory gaps - The regulatory delay has had real market consequences.

In 2025, South Korean investors transferred more than 160 trillion won, or roughly $110 billion, to overseas crypto exchanges, drawn by access to derivatives and leveraged products unavailable at home. Domestic platforms remain restricted to spot trading, while foreign exchanges fill the gap with more complex offerings.

Disagreements over stablecoin rules have further slowed progress on the Digital Asset Basic Act, leaving key market structure issues unresolved and contributing to growing investor frustration.

Enforcement tightens at home - At the same time, regulators are intensifying scrutiny of domestic exchanges. Bithumb recently completed a Financial Intelligence Unit inspection that uncovered multiple AML and KYC failures, placing it in line for heavy penalties following earlier sanctions imposed on Upbit and Korbit.

Authorities have framed the enforcement push as part of a broader effort emphasizing deterrence and compliance across the sector.

Despite mounting regulatory pressure, exchange usage remains high. Bithumb continues to rank as the country’s second-largest platform, while Upbit dominates younger demographics, underscoring sustained demand even as regulatory clarity remains elusive.

Coinbase eyes stablecoins, Base as 2026 growth pillars

Key points:

Coinbase plans to scale stablecoins, payments, and on-chain adoption in 2026 while expanding beyond a pure crypto exchange model.

ETFs, tokenization, and regulatory clarity are expected to reinforce institutional and retail adoption next year.

News - Coinbase is positioning 2026 as a year of expansion across stablecoins, payments, and broader financial services, according to recent statements from CEO Brian Armstrong. In a New Year update, Armstrong said the company aims to become the world’s leading financial app by scaling blockchain-based payments and bringing more users on-chain.

The strategy builds on Coinbase’s strong 2025 performance, including better-than-expected quarterly results and growing institutional engagement. Armstrong highlighted major investments in automation, product quality, and global distribution, with the company’s Ethereum layer-2 network, Base, playing a central role in onboarding users and developers.

Stablecoins, payments, and the “everything exchange” - A core pillar of Coinbase’s plan is expanding stablecoin usage, particularly USDC, across remittances, cross-border payments, and everyday transactions.

The exchange sees stablecoins as foundational infrastructure rather than speculative assets, especially as regulatory clarity improves and delivery-versus-payment use cases expand.

Alongside payments, Coinbase is pushing toward an all-in-one platform that combines crypto, equities, commodities, and prediction markets. Stock trading and on-chain prediction markets launched in late 2025 are framed as early steps toward a single interface that allows users to access multiple asset classes without switching platforms.

ETFs, tokenization, and adoption limits - Coinbase’s research team has also pointed to crypto ETFs, tokenized collateral, and digital asset treasuries as structural drivers of adoption in 2026. Spot ETFs launched in 2025 are viewed as a turning point that normalized crypto exposure for traditional investors, with approval timelines expected to shorten further.

Still, some industry voices caution that Armstrong’s ambitions may reflect long-term direction rather than near-term execution. Analysts argue that sustained adoption will depend on user-centric applications, interoperability, and regulatory follow-through, rather than rapid expansion alone.

Sanctioned states turn to crypto under tight state control

Key points:

Turkmenistan has legalized crypto mining and exchanges under strict central bank oversight while maintaining tight political and financial control.

Iran is openly accepting cryptocurrency for weapons exports, using digital assets to bypass international sanctions.

News - Two heavily sanctioned and tightly controlled states are adopting cryptocurrency in sharply different ways, highlighting how digital assets are increasingly being used as state tools rather than symbols of financial openness.

Turkmenistan has officially enacted its Law on Virtual Assets, legalizing cryptocurrency mining and exchange operations as of January 1, 2026. The legislation, signed by President Serdar Berdimuhamedov in late November, establishes a formal legal framework that treats virtual assets strictly as property rather than currency or securities.

Crypto cannot be used for payments, and all activity must operate under licenses issued by the central bank.

Turkmenistan’s cautious crypto opening - The new framework allows both domestic and foreign entities to mine cryptocurrency in Turkmenistan, provided they register with authorities and comply with technical, KYC, and anti-money laundering standards.

Crypto exchanges and custodial services are also permitted, though anonymous wallets and transactions are explicitly banned.

Officials have framed the move as an economic modernization effort aimed at attracting capital and monetizing surplus energy capacity, particularly as the country seeks to diversify beyond its heavy reliance on natural gas exports.

Despite the headline shift, internet restrictions, capital controls, and tight financial oversight remain firmly in place, suggesting that expansion may be limited by existing constraints.

Iran’s crypto use under sanctions pressure - In contrast, Iran is embracing cryptocurrency as a direct workaround to financial isolation.

Iran’s Ministry of Defence Export Center, known as Mindex, is accepting cryptocurrency payments for advanced weapons systems, including missiles, drones, and warships. The offer is among the first known instances of a nation state publicly accepting crypto for military exports.

The move comes amid renewed international sanctions and reflects a broader pattern of sanctioned countries turning to digital assets to sustain trade. While Iran also accepts payments through barter and local currency, crypto provides an alternative channel that avoids traditional financial systems, which remain heavily restricted.

Together, these developments show how crypto adoption in closed economies is being shaped primarily by state priorities, energy strategy, and sanctions management.

If You Could Be Earlier Than 85% of the Market?

Most read the move after it runs. The top 250K start before the bell.

Elite Trade Club turns noise into a five-minute plan—what’s moving, why it matters, and the stocks to watch now. Miss it and you chase.

Catch it and you decide.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

More stories from the crypto ecosystem

Ethereum’s 2026 roadmap puts institutional privacy front and center – Details

Fed pumps $74.6B in repo liquidity – What it means for Bitcoin’s 2026 rally

+25% in a day – Is PEPE about to break free of its downtrend?

A16z – 2026 might be the year when blockchain becomes ‘just the plumbing’

Solana’s 2026 target – Momentum, FOMO, and the $400 question!

Crypto scams uncovered

A wallet drainer made it into Google Play: Check Point Research (CPR) documented a malicious app on Google Play that used the WalletConnect name to appear legitimate, stayed available for months, and enabled wallet-drainer theft once users connected their wallets.

A fake stablecoin can poison your wallet history: The FBI has warned that criminals create lookalike tokens impersonating well-known assets (such as USDT), then send them to victims from addresses designed to resemble legitimate counterparties, an address-poisoning tactic meant to trick users into sending funds to the wrong destination.

Rug pulls often rely on liquidity mechanics, not exploits: U.S. regulators have documented rug-pull style conduct where token creators drained liquidity and left investors holding worthless tokens, with the collapse driven by liquidity withdrawal rather than a smart contract hack.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Top 3 coins of the day

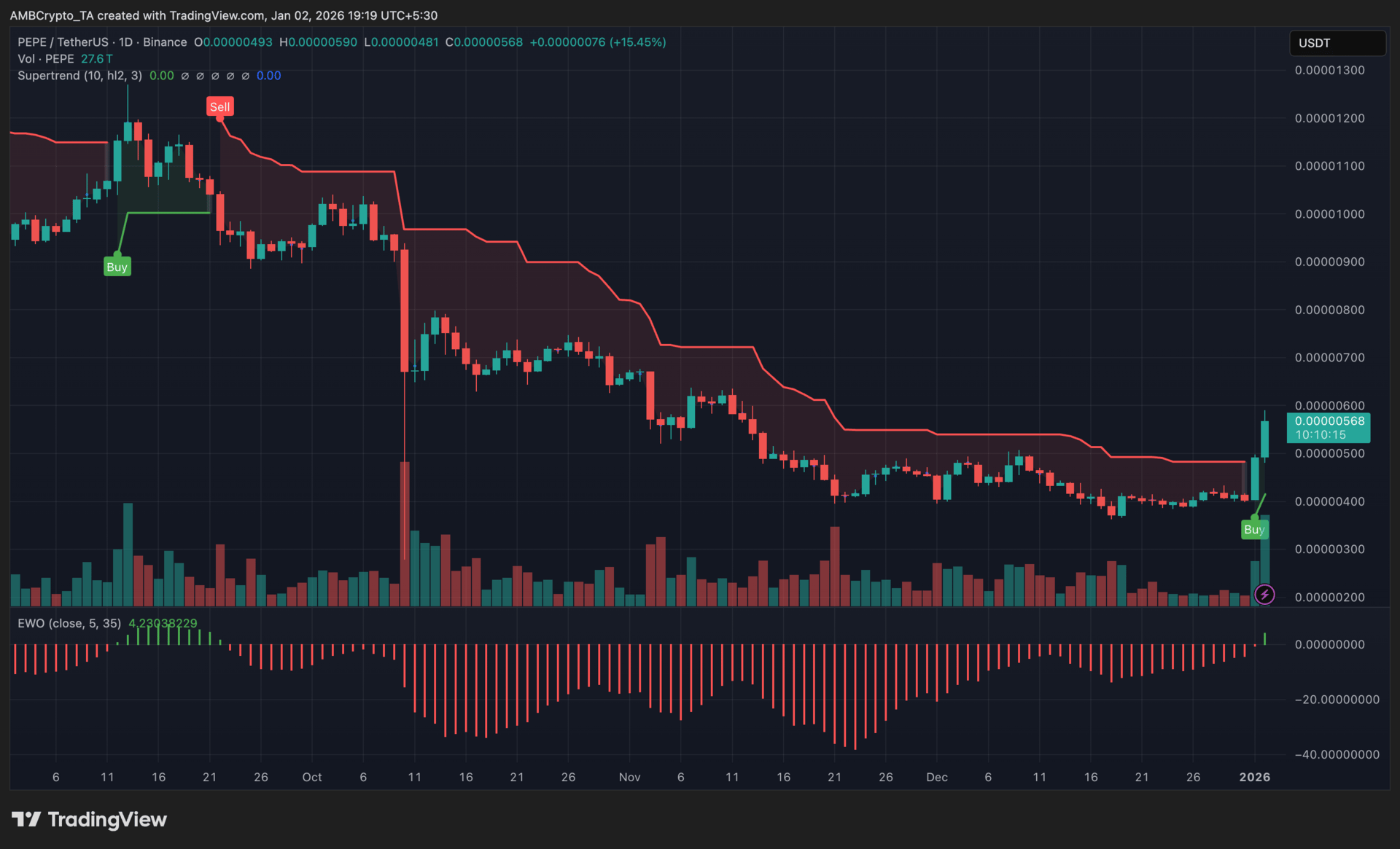

Pepe (PEPE)

Key points:

PEPE recorded a sharp daily surge, breaking out of a prolonged consolidation range as buyers stepped in with strong conviction.

The Supertrend flipped bullish while the EWO crossed into positive territory, backed by a clear expansion in volume.

What you should know:

PEPE saw a decisive upside move after spending several sessions consolidating within a tight range. The latest daily candle closed firmly above the Supertrend, marking the first bullish trend signal since the broader downtrend began. This shift suggested that bearish control weakened meaningfully, allowing momentum to rotate in favor of buyers.

The Elliott Wave Oscillator confirmed this change, with the histogram pushing above the zero line and printing a tall green bar. This behavior reflected strengthening upside momentum rather than a short-lived bounce.

At the same time, trading volume spiked well above recent averages, reinforcing that the move was supported by active participation rather than thin liquidity.

From a structural standpoint, the former consolidation ceiling around the $0.0000050 region now acts as immediate support, while the $0.0000058–$0.0000060 zone remains the next area to watch on the upside.

On the catalyst front, memecoin frenzy, derivatives-driven short liquidations and renewed retail activity appeared to amplify the move, aligning closely with the observed volume surge.

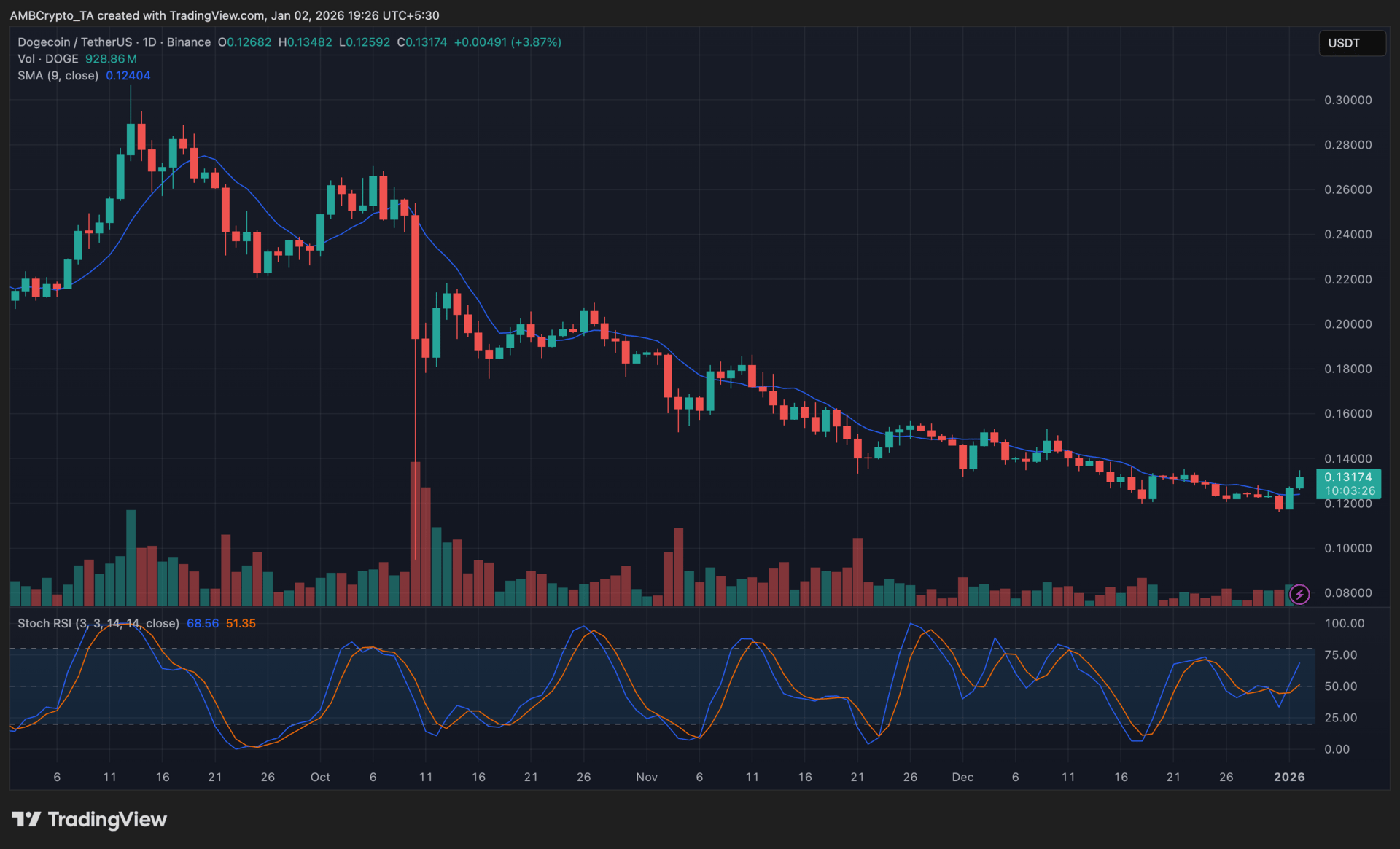

Dogecoin (DOGE)

Key points:

DOGE showed early signs of stabilization after holding the $0.12 region, with price moving back above the 9-day SMA.

Momentum indicators improved, as the Stochastic RSI lifted from oversold territory alongside a modest pickup in volume.

What you should know:

Dogecoin had remained under pressure for several weeks, printing lower highs as sellers controlled the broader trend. That decline began to slow once price stabilized near the $0.12 zone, where selling momentum visibly faded.

Recent daily candles reflected a tentative shift, with DOGE closing back above its 9-day SMA, a level that had previously acted as short-term resistance.

Momentum conditions also improved. The Stochastic RSI rebounded from the lower band and turned upward, suggesting downside momentum had eased rather than accelerated. While the indicator has not reached overbought levels, it indicated room for further recovery if demand persists.

Volume provided mild confirmation, as green candles were supported by slightly stronger participation than earlier sessions. This pointed to dip-buying interest rather than a thin, low-liquidity bounce.

Structurally, $0.12 remains immediate support, while $0.14 stands as the next resistance to monitor. Broader memecoin sentiment and futures market activity likely aided the rebound, though sustained follow-through is still required to shift the medium-term trend.

Chainlink (LINK)

Key points:

LINK pushed higher after stabilizing above the $12 region, with price reclaiming its short-term moving average and showing signs of reduced selling pressure.

Bearish momentum continued to fade, as the EWO contracted below zero while volume expanded on recent green candles.

What you should know:

LINK’s price action shifted after several sessions of consolidation, with the latest candles closing firmly above the 9-day SMA. This move followed a prolonged downtrend from October, but recent structure showed sellers losing control rather than pressing price lower.

The 9-day SMA flattened and transitioned into short-term support, reinforcing the idea that downside momentum had cooled.

The EWO remained in negative territory, but shrinking histogram bars reflected easing bearish strength rather than renewed selling. This improvement aligned with a modest pickup in volume, suggesting that recent buying carried stronger participation than earlier rebounds.

Beyond the chart, sentiment was supported by Chainlink Reserve accumulation, which signaled internal confidence in LINK’s long-term utility. Broader institutional adoption narratives also resurfaced, helping reinforce demand expectations. Holding above $12 remains key, while $13.80–$14 stands as the next resistance zone to watch.

How was today's newsletter? |