- Unhashed Newsletter

- Posts

- New wallets are flocking to Ethereum

New wallets are flocking to Ethereum

Reading time: 5 minutes

Ethereum adoption accelerates as new users flood the network

Key points:

Ethereum is seeing a sharp influx of first-time users, with new addresses, transaction activity, and stablecoin usage reaching multi-year and record levels.

As adoption broadens, firms like BitMine are repositioning around retail distribution rather than relying solely on ETH staking yield.

News - Ethereum activity has picked up meaningfully over the past month, driven largely by new participants entering the network rather than existing users increasing activity. On-chain data shows that monthly activity retention among first-time wallets has nearly doubled, while daily transactions recently reached an all-time high.

One of the clearest signals came from a single-day surge that added roughly 447,000 new Ethereum holders, marking a seven-year record for first-time participation. This spike followed weeks of elevated onboarding, with hundreds of thousands of new addresses interacting with the network daily.

Historically, periods led by new users rather than leveraged trading have aligned with healthier network engagement.

Stablecoin transfers have played a major role in this expansion, supported by lower transaction fees as Ethereum continues pushing execution to layer-2 networks while maintaining settlement on layer-1. The result has been increased utility-driven activity rather than speculative churn.

Price structure faces short-term friction - Despite improving fundamentals, near-term price action remains mixed. Ether has stabilized around the $3,300 level after reaching recent highs, but derivatives data suggests the market may need to flush excess leverage before a sustained rally develops.

Elevated leverage ratios and realized losses among recent buyers point to the possibility of a brief liquidation-driven pullback.

At the same time, short-term holders remain largely underwater, which historically reduces selling pressure during early recovery phases. As long as losses persist, distribution into strength tends to remain limited.

Where BitMine fits in - Against this backdrop, BitMine’s recent shareholder meeting highlighted how some companies are positioning around Ethereum’s growing user base. The firm outlined progress toward its goal of controlling 5% of ETH supply, supported by staking income already generating more than $400 million annually.

Chairman Tom Lee framed BitMine’s $200 million investment into MrBeast’s media company as a distribution strategy aimed at onboarding retail users into Ethereum-based products over time.

The bet is that as Ethereum adoption expands organically, large creator-led platforms could become a meaningful entry point for wallets, stablecoins, and tokenized assets.

RLUSD races ahead with institutions while XRP’s story splits in two

Key points:

Ripple’s RLUSD has climbed past a $1.38 billion market cap as LMAX integration, brokerage adoption plans, and new regulatory clearances expand its institutional footprint.

XRP has struggled to follow in the short term, pressured by technical selling and mixed holder behavior, even as builders and long-term metrics point to a broader XRPL utility push.

News - Ripple’s U.S. dollar stablecoin RLUSD has hit a fresh high in market capitalization, topping $1.38 billion.

Momentum has been fueled by Ripple’s multi-year partnership with LMAX Group, which will integrate RLUSD as core collateral across its institutional trading infrastructure, enabling cross-collateralization and margin efficiency across crypto and traditional products. Ripple also disclosed a $150 million financing commitment tied to the LMAX collaboration.

RLUSD is also moving closer to mainstream brokerage rails. Interactive Brokers has begun enabling stablecoin account funding using USDC through ZeroHash, offering 24/7 deposits and near-instant crediting after conversion to U.S. dollars. The broker plans to add support for RLUSD and PayPal’s PYUSD next week.

Interactive Brokers said it charges no deposit fees, while ZeroHash applies a 0.30% conversion fee with a $1 minimum. Shares jumped over 3% to a lifetime high of $75.

Regulatory progress has added credibility. RLUSD has been greenlighted by Abu Dhabi’s FSRA for regulated institutional use, while Ripple has also secured preliminary e-money authorization in Luxembourg, part of a broader compliance push that includes 75+ regulatory licenses.

Why XRP is not keeping up yet - RLUSD’s growth has not translated cleanly into XRP demand, partly because nearly 76% of RLUSD supply sits on Ethereum rather than the XRP Ledger. Meanwhile, XRP fell toward $2.07 after sellers defended $2.13, despite ETF inflows remaining steady in the background.

One dataset showed exchange-held XRP supply falling below 2 billion from over 4 billion in late 2025, but another noted about 206 million XRP moved to exchanges in early 2026, signaling fresh near-term sell pressure.

Two narratives compete - Even as “super cycle” chatter circulates, XRP’s weekly Supertrend has flashed a sell signal.

At the same time, XRPL builders like Anodos CEO Panos Mekras argue the ledger’s DeFi potential and upgrades, including sponsored fees, batch transactions, and stronger liquidity incentives, could unlock dormant utility. Long-term holder accumulation metrics have also strengthened, helping XRP hold around the $2.10 support area despite volatility.

Bitcoin becomes a financial lifeline as Iran’s crisis deepens

Key points:

Bitcoin usage in Iran has surged amid protests, currency collapse, and internet restrictions, with civilians increasingly withdrawing BTC into self-custodied wallets.

At the same time, state-linked actors including the Islamic Revolutionary Guard Corps are also expanding crypto activity, underscoring a dual-use dynamic.

News - Bitcoin has taken on a new role in Iran’s deepening economic and political crisis. According to data from Chainalysis, crypto activity in the country climbed sharply during periods of unrest, pushing Iran’s overall crypto ecosystem to more than $7.78 billion in 2025.

The latest surge followed mass protests that began in late December, driven by soaring inflation and the collapse of the Iranian rial.

As authorities imposed internet restrictions and tightened control over financial channels, Iranians increasingly moved Bitcoin off exchanges and into personal wallets. Chainalysis recorded sharp growth across withdrawal sizes, with transfers under $10,000 showing the fastest acceleration in both value and volume.

Why self-custody matters during unrest - Chainalysis described this behavior as more than simple hedging. Bitcoin’s self-custodial and censorship-resistant design allows individuals to retain financial flexibility when access to state-controlled financial systems becomes unreliable, particularly during periods of unrest or displacement.

The firm noted that this pattern has appeared repeatedly in regions facing war, economic turmoil, or government crackdowns, reinforcing Bitcoin’s role as a liquidity and optionality tool during systemic stress.

A dual crypto economy emerges - While civilians turn to Bitcoin to preserve savings, Iran’s state-linked actors are also active on-chain.

Chainalysis estimates that wallets associated with the IRGC accounted for roughly half of all crypto value received in Iran during the fourth quarter of 2025. These addresses handled more than $3 billion over the year, as sanctioned networks increasingly rely on digital assets to move value.

This contrast highlights crypto’s dual role in Iran. For ordinary citizens, it offers a way to protect wealth and retain financial mobility. For state-linked entities, it provides a channel to navigate sanctions and restricted access to global finance.

Despite uncertainty over how much activity may reverse once unrest subsides, Chainalysis suggests crypto adoption often proves sticky. With the rial’s purchasing power severely eroded, digital assets are likely to remain a critical option for Iranians seeking financial autonomy outside traditional systems.

CME brings Cardano, Chainlink, and Stellar futures to U.S. markets

Key points:

CME Group plans to launch futures contracts for Cardano, Chainlink, and Stellar on February 9, pending regulatory approval, expanding regulated altcoin risk-management tools.

The move highlights rising institutional demand for compliant crypto derivatives, even as spot prices for ADA, LINK, and XLM remain muted.

News - CME Group is set to expand its crypto derivatives lineup with new futures contracts tied to Cardano, Chainlink, and Stellar. The contracts, which will be available in both standard and micro sizes, are scheduled to go live on February 9, subject to regulatory approval.

The new offerings are designed to give market participants regulated tools to hedge price risk or gain exposure without holding the underlying tokens.

Standard contracts will represent 100,000 ADA, 5,000 LINK, or 250,000 XLM, while micro contracts will cover 10,000 ADA, 250 LINK, or 12,500 XLM. By offering smaller contract sizes, CME is aiming to attract both institutional investors and retail traders seeking lower capital requirements.

CME executives said the decision reflects growing demand for trusted, regulated crypto products as digital assets become more integrated into traditional portfolios. The exchange has steadily built out its crypto suite since launching Bitcoin futures in 2017, later adding Ether, XRP, and Solana contracts.

Institutional signals outpace price reaction - Despite the significance of the announcement, spot prices for ADA, LINK, and XLM showed limited immediate reaction.

Market data pointed to modest declines across all three tokens following the news, consistent with previous CME crypto product rollouts that did not trigger short-term price rallies.

A broader push into regulated altcoin exposure - The upcoming contracts also underscore CME’s broader role in expanding U.S.-regulated crypto markets beyond Bitcoin and Ether.

In 2025, the exchange reported record crypto futures and options activity, with average daily volume reaching roughly 278,000 contracts. Average open interest climbed to about 313,900 contracts, representing approximately $26.4 billion in notional value.

By adding Cardano, Chainlink, and Stellar, CME is reinforcing a wider shift toward regulated altcoin exposure. While prices may remain range-bound in the near term, the availability of compliant futures contracts marks another step in the maturation of crypto market infrastructure and institutional participation.

More stories from the crypto ecosystem

Ethereum – Will this whale’s exit lead to a pullback or a surge beyond $3,450?

BlackRock strengthens Bitcoin position after scooping up 6.6K BTC – Details

Bitcoin OGs’ sell-off falls by 73%, but will that help BTC’s Q1 outlook?

XRP ETF demand builds, so why does price action remain muted?

Hyperliquid: Why $648K whale move failed to lift HYPE prices

Crypto scams uncovered

Fake browser extensions are draining wallets quietly: Malicious browser extensions posing as crypto wallets or portfolio trackers have been used to intercept private keys and seed phrases, allowing attackers to drain funds without triggering obvious phishing red flags.

Crypto recovery scams target victims twice: After a crypto theft, scammers increasingly pose as “recovery services” or ethical hackers, promising to retrieve stolen funds for a fee, only to exploit victims again with no actual recovery mechanism.

QR-code scams are replacing fake links: Scammers have begun using QR codes on social media posts, emails, and even printed materials to direct users to malicious crypto sites, bypassing traditional link filters and making scams harder to detect at a glance.

Top 3 coins of the day

Pump.fun (PUMP)

Key points:

PUMP climbed nearly 7% over the last 24 hours, extending its short-term recovery after weeks of consolidation.

The move coincided with rising volume and improving momentum, as price stayed above its short-term average.

What you should know:

PUMP recorded a strong daily advance after spending much of December and early January trading sideways. The price pushed decisively above the 9-day SMA near $0.00253 and held that level through the session, marking a clear shift in short-term structure. This reclaim suggested buyers had regained control following a prolonged downtrend.

Momentum indicators supported the move. The RSI rose into the mid-60s, reflecting strengthening bullish pressure without entering overheated territory. This balance indicated upside traction while leaving room for continuation if demand persists. Volume expanded alongside the breakout, confirming participation rather than a low-liquidity spike.

On the fundamentals side, sentiment appeared to benefit from Pump.fun’s newly introduced “callouts” feature, which boosted platform engagement, alongside a broader revival in memecoin activity across the market.

Going forward, the $0.00250–$0.00253 zone now acts as immediate support, while the $0.00291 area remains the key resistance that must be reclaimed for momentum to stay intact.

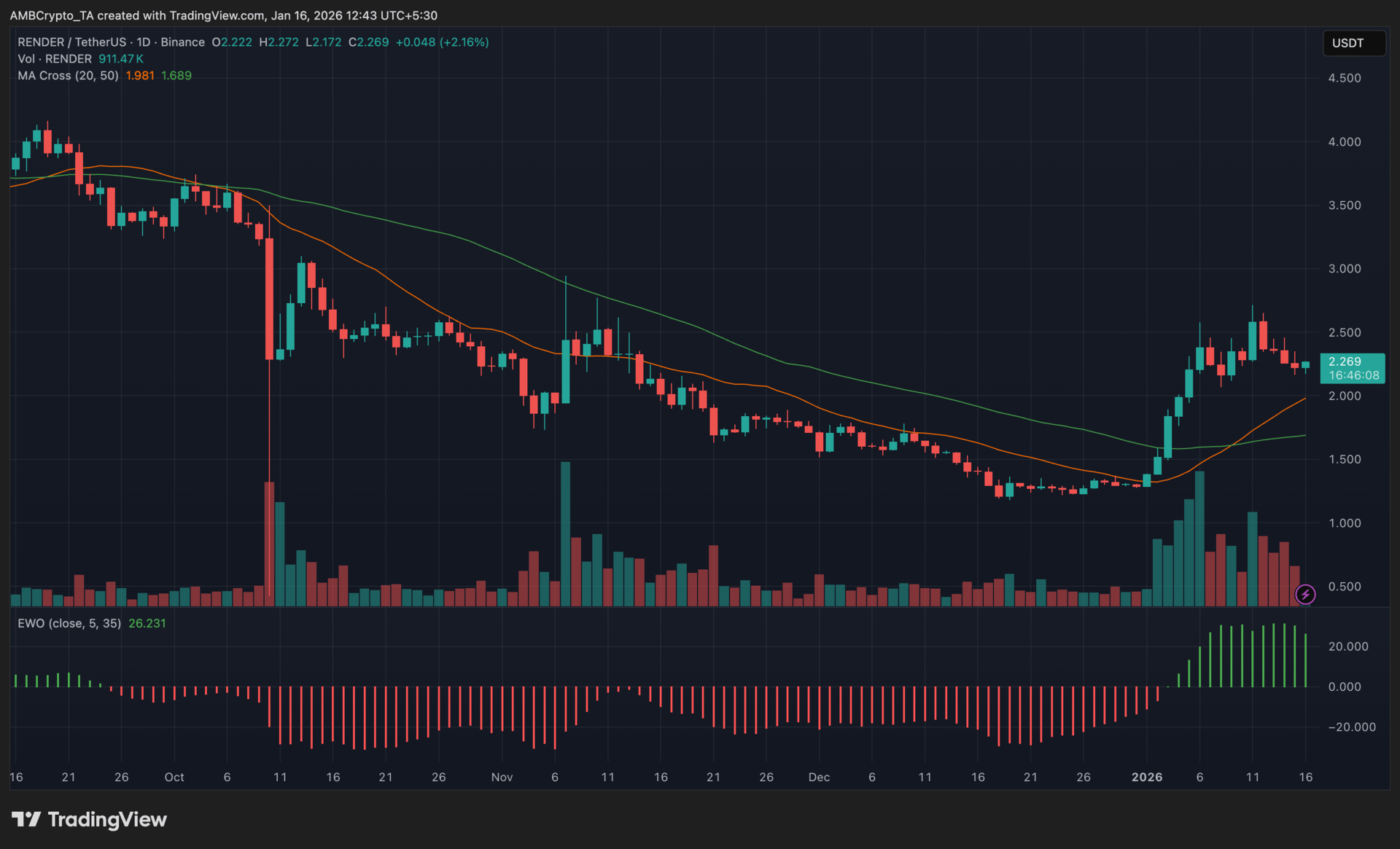

Render (RENDER)

Key points:

RENDER traded near $2.26 at press time, posting modest gains over the last 24 hours after a strong multi-week rally.

Momentum cooled slightly, though trend structure remained constructive as price held above key short-term averages.

What you should know:

RENDER’s price action reflected consolidation after a sharp upside move from the $1.20–$1.30 region. The rally had pushed price toward the $2.60–$2.70 zone, where selling pressure emerged, leading to a controlled pullback rather than a sharp reversal.

Importantly, price continued to hold above the rising 20-day moving average, suggesting buyers retained short-term control.

The broader structure stayed positive as the 20-day MA remained above the 50-day MA, keeping the medium-term trend tilted upward. On the momentum front, the EWO remained positive, though recent bars suggested slower expansion rather than renewed acceleration.

Volume expanded significantly during the initial breakout phase and tapered during the pullback, pointing to profit-taking instead of aggressive distribution. From a levels perspective, $2.00–$2.05 stands as immediate support, while $1.85–$1.90 remains a deeper downside cushion. On the upside, $2.60–$2.70 is the key resistance zone to watch.

Beyond the chart, renewed interest in AI-linked tokens and signs of whale accumulation supported sentiment around RENDER during the recent advance.

Chiliz (CHZ)

Key points:

CHZ climbed to the $0.058 zone, posting a strong daily gain as bullish momentum carried forward from its recent base.

The Parabolic SAR stayed below price, while the Awesome Oscillator expanded further into positive territory, reinforcing trend continuation.

What you should know:

Chiliz advanced steadily after breaking out of its recent consolidation, with price action showing controlled follow-through rather than a sharp, one-session spike. The Parabolic SAR flip earlier in the move marked a clear shift in trend structure, and price continued to respect that trailing support as buying pressure held firm.

Momentum indicators backed the move as well. The Awesome Oscillator remained positive, with histogram bars expanding over recent sessions, signaling strengthening upside momentum instead of waning participation. Volume also rose during the push higher, suggesting the rally attracted broader market involvement rather than relying on thin liquidity.

From a levels perspective, the $0.052–$0.054 region now acts as immediate support to watch, while the $0.060–$0.062 area stands out as near-term resistance following recent highs.

Beyond the chart, sentiment around SportsFi tokens remained constructive, supported by growing anticipation ahead of the 2026 FIFA World Cup. In parallel, increased derivatives activity pointed to heightened speculative interest, adding fuel to the ongoing trend but also raising the need for follow-through to sustain gains.

All the stories worth knowing—all in one place.

Business. Tech. Finance. Culture. If it’s worth knowing, it’s in the Brew.

Morning Brew’s free daily newsletter keeps 4+ million readers in the loop with stories that are smart, quick, and actually fun to read. You’ll learn something new every morning — and maybe even flex your brain with one of our crosswords or quizzes while you’re at it.

Get the news that makes you think, laugh, and maybe even brag about how informed you are.

How was today's newsletter? |