- Unhashed Newsletter

- Posts

- Ripple co-founder cashes out, XRP feels heat

Ripple co-founder cashes out, XRP feels heat

Reading time: 5 minutes

Chris Larsen’s $764M XRP sell-off triggers pressure, eyes on $2.6 support

Key points:

Ripple co-founder Chris Larsen has realized over $764 million in profits from XRP sales since 2018, with his latest 50 million-token transfer to Evernorth reigniting debate about market impact.

Analysts warn that heavy profit-taking from large holders could keep XRP below key resistance levels, even as technicals hint at a potential rebound.

News - XRP hovered near $2.39 after reports confirmed that Ripple co-founder Chris Larsen offloaded another 50 million XRP (about $120 million) tied to his investment in Evernorth. On-chain data from CryptoQuant showed his realized profits since 2018 have reached $764.2 million, much of it earned near local price peaks.

Analyst Maartunn noted that Larsen has a recurring habit of selling close to cycle highs, a pattern that has drawn community scrutiny. Despite Larsen’s explanation that the recent transaction supported Evernorth’s treasury launch, traders see continued selling from early executives as a headwind for the token.

XRP currently trades 34% below July’s $3.66 high and remains confined between $2.33 and $2.44, signaling short-term indecision.

Key levels to watch - Analysts highlight $2.60 as the critical support near the 200-day SMA. A sustained move above $2.74 to $2.80 could mark the first stage of recovery, while failure to hold $2.33 may trigger a retest of $2.28. The RSI’s bullish divergence and a possible MACD crossover indicate that selling momentum might be weakening.

Institutional tailwinds counterbalance selling - Meanwhile, Evernorth’s $1 billion XRP treasury initiative, backed by SBI Holdings, Ripple, Gumi Inc., and Pantera Capital, is expanding institutional exposure to XRP. Supporters argue that this influx could offset short-term profit-taking by fostering deeper liquidity and mainstream adoption.

Ethereum whales buy $660M in 48 hours as price tests $4K barrier

Key points:

Ethereum whales accumulated roughly $660 million worth of ETH within 48 hours, signaling renewed optimism despite short-term selling from smaller holders.

ETH’s price held near $3,875, with key resistance at $4,137 and support around $3,806, as institutional inflows added to market momentum.

News - Ethereum’s recent price weakness has not deterred large investors. On-chain data showed whales added nearly 170,000 ETH between October 21 and 23, raising their collective holdings to 100.47 million ETH, one of the sharpest accumulation spikes this month. However, fast-moving traders have continued selling into rallies, creating a tug-of-war that has kept ETH stuck between $3,806 and $4,137.

A newly created wallet purchased $32 million in ETH on OKX, joining corporate buyers like SharpLink and Bitmine Immersion Technologies, which together added over 220,000 ETH worth nearly $867 million last week. Analysts said the activity reflects rising treasury inflows and institutional accumulation, even as spot ETF flows remain mixed.

Institutional players deepen exposure - Beyond whales, Quantum Solutions in Japan acquired another 2,000 ETH to become the 11th-largest corporate Ether holder and the second-largest outside the U.S. The ARK Invest-backed firm now holds 3,865 ETH and plans to expand its treasury toward 100,000 ETH.

Meanwhile, the Ethereum Foundation quietly moved $610 million in ETH to a new Safe multisig wallet as part of its treasury migration strategy.

Key levels to watch - ETH must close above $4,137 to confirm breakout strength, with upside targets near $4,495 if momentum continues. Failure to hold $3,806 could expose the token to a deeper correction toward $3,511, though technicals such as a bullish RSI divergence suggest sellers may be losing steam.

BNB dominates Uptober; CZ mocks tokenized gold as ‘trust-me-bro’ asset

Key points:

BNB outperformed major cryptos in October, driven by memecoin mania, rising network fees, and Aster’s record trading volumes amid Binance’s renewed scrutiny.

Meanwhile, CZ reignited debate over tokenized gold, calling Peter Schiff’s upcoming gold-backed token a “trust me bro” asset built on third-party promises.

News - October’s “Uptober” narrative, typically a Bitcoin affair, belonged instead to BNB. The Binance-linked token hit new all-time highs above $1,300 before retreating to around $1,070, still up about 6% for the month.

Its rally was fueled by an explosion of BNB Chain memecoins and record network fees, even as Binance faced questions over a price oracle glitch tied to the market crash. The exchange denied responsibility, citing broader volatility following U.S.–China tariff tensions, and later confirmed $283 million in user compensation.

BNB momentum and exchange listings - Aster, BNB Chain’s rising perpetuals DEX, briefly led all decentralized exchanges with $41.78 billion in daily volume before DefiLlama removed and later reinstated its data over verification concerns.

Meanwhile, Coinbase and Robinhood both listed BNB for U.S. users, signaling growing mainstream acceptance despite Binance’s controversies.

CZ sparks tokenized gold debate - Separately, Binance co-founder Changpeng Zhao criticized tokenized gold projects following Peter Schiff’s plan to launch “Tgold.” CZ argued that tokenized gold depends on faith in custodians rather than real on-chain assets, labeling it a “trust me bro” product.

The market for such tokens, led by Tether Gold (XAUT) and Paxos Gold (PAXG), has grown to nearly $3.9 billion, underscoring rising interest despite custodial and redemption risks.

WazirX to relaunch after $234M hack with zero-fee trading and BitGo custody

Key points:

Indian crypto exchange WazirX is set to resume trading and withdrawals after more than a year, backed by a Singapore High Court-approved restructuring plan.

The platform’s phased restart introduces 30 days of zero-fee trading and a new BitGo custody partnership to rebuild trust after its $234 million hack.

News - WazirX, once India’s largest cryptocurrency exchange, has reopened for 6.6 million users following one of the country’s most severe crypto hacks. Trading and withdrawals will begin on October 24, marking the end of a 16-month shutdown that started after North Korea-linked hackers drained $234 million from the platform in July 2024.

The restart, supported by nearly 96% of creditors, was cleared by Singapore’s High Court as part of WazirX’s restructuring under parent company Zettai Pte. Ltd.

To restore confidence, the exchange has rolled out 30 days of zero-fee trading and a phased reopening across markets. Trading will begin with crypto-to-crypto pairs and the USDT/INR market, expanding to other tokens by Monday.

Security and recovery initiatives - WazirX has partnered with BitGo to provide insured, institutional-grade custody for user funds, a key upgrade from its previous multisig wallet system.

The company is also preparing to distribute Recovery Tokens, allowing users to reclaim between 75% and 80% of frozen balances, though some have reported inconsistencies in early payouts.

Industry reactions and wider impact - The comeback has drawn mixed reactions. While some users praised the transparency of the restart, others questioned payout accuracy and delayed INR withdrawals.

Analysts say WazirX’s revival could set a precedent for regulatory-compliant recoveries in Asia’s crypto market, demonstrating how exchanges can rebuild trust after major breaches through strong governance, compliance, and third-party security partnerships.

No MEV. No Gas

CoW Swap blocks MEV so bots can’t front-run your trades. Keep more of every swap.

More stories from the crypto ecosystem

Hong Kong approves first-ever Solana ETF: Why it’s a ‘sweet zone’ for SOL

Aave price prediction – Why Maple partnership did little to reverse bearish trends

Solana’s decentralization tested amid AWS outage – Here’s how it fared

Fed signals crypto pivot, floats ‘skinny master account’ for stablecoin players

Gold falls, Bitcoin rises: $1B USDT mint signals a major shift

Interesting facts

In 2025, the internet celebrated the 15th anniversary of the first real-world crypto transaction (a pizza purchase using Bitcoin) via Crypto Pizza Day, a quirky reminder of how far the space has come.

The evolving narrative for 2025 in crypto isn’t just about DeFi or tokens anymore. Reports highlight meme launchpads, liquid staking, asset tokenization (RWA) and DePIN (Decentralized Physical Infrastructure Networks) as among the top new storylines.

Earlier this year, a number of historically loss-making companies (including one that made lavender-flavored vodka and another that sold ozone-infused water) rebranded themselves as “crypto companies” to ride the wave of blockchain hype.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Top 3 coins of the day

Monero (XMR)

Key points:

XMR traded at $338, marking an 8.35% daily surge as it broke above the 9-day SMA ($310) and renewed short-term bullish momentum.

The Stochastic RSI climbed to 52, signaling an ongoing recovery from oversold conditions, while trading volume hit a two-week high at 57.3K.

What you should know:

Monero rallied strongly as privacy coins regained traction amid rising debates over blockchain surveillance. The move followed last week’s Fluorine Fermi network upgrade, which enhanced node-level privacy by limiting connections to suspicious IP clusters, reaffirming Monero’s focus on untraceable transactions. The Stochastic RSI crossover supported a bullish shift in momentum, while sustained trading above the 9-day SMA indicated improving trend strength. However, resistance near $345–$350 remains critical for confirmation. With privacy tokens like ZEC and DASH also rallying, XMR benefited from sector-wide capital rotation and narrative-driven inflows. If buyers maintain control, holding above $310 support could open the path toward the $350 zone in the sessions ahead.

Hyperliquid (HYPE)

Key points:

HYPE was trading at $39, reflecting an 8.32% daily rise as bulls regained control after a multi-day consolidation phase.

The Higher High Lower Low pattern hinted at a potential trend reversal, while RSI at 46 confirmed recovering momentum backed by rising trading activity.

What you should know:

Hyperliquid rebounded sharply after a week of subdued trading, boosted by optimism surrounding its $1 billion corporate buyback filing. The announcement from Hyperliquid Strategies Inc., detailing plans to accumulate HYPE through SEC-approved equity raises, triggered renewed investor confidence. The rebound coincided with rising volume (173.9K) and an improving market structure that suggested the formation of a higher low, hinting at early recovery signs. While RSI showed no signs of overbought pressure, resistance near $42–$43 remains crucial for confirmation of a sustained uptrend. The combination of corporate accumulation potential and technical stabilization positioned HYPE as one of the stronger mid-cap performers in today’s session.

Mantle (MNT)

Key points:

MNT changed hands at $1.70, logging a 6.72% daily rise as buyers stepped in after a sharp early-week decline.

The Chaikin Money Flow turned positive at +0.05, indicating renewed capital inflows as price action approached the midline of the Bollinger Bands ($1.94).

What you should know:

Mantle’s recovery followed increased trading activity around its Bybit derivatives debut and the launch of its five-month global hackathon initiative. Bybit’s integration of MNT futures and options earlier this week deepened liquidity and attracted speculative inflows, while the hackathon’s $150K prize pool sparked developer engagement in DeFi and RWA applications. On the chart, the price rebounded near the lower Bollinger Band before climbing toward the midline, supported by improving volume (188K). The positive CMF reinforced signs of accumulation, though resistance near $1.90–$1.95 could test buyer conviction. Holding above $1.55 support would strengthen Mantle’s short-term outlook amid growing ecosystem interest.

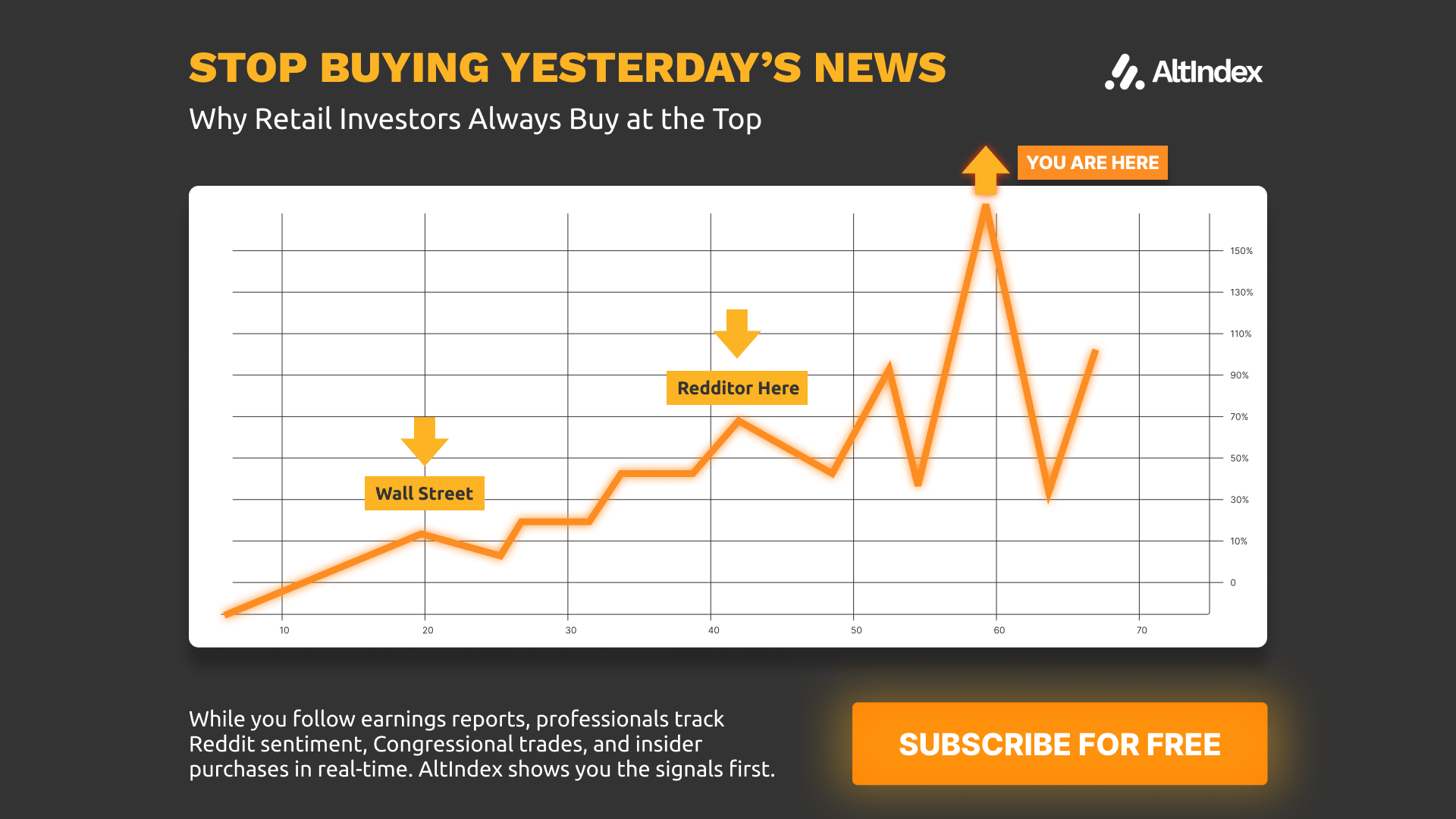

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

How was today's newsletter? |