- Unhashed Newsletter

- Posts

- Safe havens shaken: Gold down, Bitcoin next?

Safe havens shaken: Gold down, Bitcoin next?

Reading time: 5 minutes

Bitcoin’s $100K risk deepens as gold melts down

Key points:

Gold’s $2.5 trillion wipeout erased value equivalent to Bitcoin’s entire market cap, amplifying panic across both safe-haven and risk assets.

Bitcoin slipped below key support as whales opened new shorts, while bearish technicals and macro fears point to a possible retest of $100,000.

News - Gold’s worst two-day drop since 2013 wiped out over $2.5 trillion in value, a decline that rivaled Bitcoin’s total market cap. The crash shook confidence in traditional hedges as gold’s rally unwound amid profit-taking and investor FOMO.

Bitcoin, often dubbed “digital gold,” mirrored the volatility. Veteran trader Peter Brandt warned that BTC’s chart is forming a rare “broadening top,” echoing the 1970s soybean crash that led to a 50% correction. Brandt cautioned that such a decline could drive Bitcoin toward $60,000, placing MicroStrategy’s holdings underwater.

Whale shorts and ETF rotations deepen market fear - Fresh on-chain data revealed a notorious whale transferred 5,252 BTC (worth $588 million) to major exchanges while opening $234 million in shorts, a move analysts labeled manipulative. The Crypto Fear & Greed Index simultaneously plunged to levels last seen in 2022, signaling “Extreme Fear.”

Meanwhile, wealthy holders are migrating Bitcoin into regulated ETFs like BlackRock’s IBIT, marking the first sustained decline in self-custody in over 15 years. Analysts say tax benefits and SEC-approved in-kind redemptions are accelerating the shift.

Stimulus bets and bear market warnings - Japan’s new Prime Minister, Sanae Takaichi, unveiled stimulus measures that BitMEX founder Arthur Hayes claims could push Bitcoin to $1 million if Japan resumes money printing.

Yet on-chain metrics from 10x Research and CryptoQuant turned bearish, hinting October could be the last calm exit window before a broader downtrend begins.

Solana’s path to $200 falters amid Hong Kong’s first spot SOL ETF launch

Key points:

Solana fell 16% over the past month as daily active users dropped from 6.9 million to 2.9 million, while on-chain data hinted at accumulation near $184.

Hong Kong approved Asia’s first spot Solana ETF, adding regulatory credibility even as SOL struggles to reclaim $200 resistance.

News - Solana’s rally has slowed after a month-long 16% slide that made it one of the weakest large-cap performers. Despite $2 billion in new corporate treasury inflows and $400 million raised through the REX-Osprey Solana ETF, the network’s daily active users have plunged from nearly 7 million in January to under 3 million, signaling waning retail momentum.

The token sits at a make-or-break level near $175. Analysts warn that if Solana breaks below this support, prices could fall toward $130. The RSI remains under its 14-day average, indicating negative momentum that has yet to reach oversold territory.

Short-term buyers accumulate near $184 - Glassnode’s HODL Waves data shows short-term holders increased their share by 26% in two weeks, while long-term outflows fell 59%, suggesting fresh accumulation and easing sell pressure.

The price pattern forms a falling wedge with a bullish divergence on RSI, which could trigger a 15–20% rebound if SOL climbs past $213–$222.

Hong Kong’s Solana ETF adds institutional boost - Hong Kong’s Securities and Futures Commission approved the ChinaAMC Solana ETF, the city’s first spot SOL product, trading October 27 in HKD, RMB, and USD lots. The fund invests directly in SOL and tracks the CME CF Solana-USD Index.

Analysts say the approval reinforces Solana’s technical relevance and could attract Asian retail investors before institutional inflows scale up.

Still, macro uncertainty and U.S. inflation data remain near-term headwinds that could decide whether Solana finally breaks toward $200, or slips back into correction territory.

Asian regulators crack down on crypto treasury models

Key points:

Stock exchanges in Hong Kong, India, and Australia are rejecting firms converting their balance sheets into crypto treasuries, citing shell company and volatility concerns.

Japan remains the regional outlier, allowing 14 listed firms to hold Bitcoin under strict disclosure rules as MSCI considers excluding heavy crypto holders from its indexes.

News - Major Asian exchanges are tightening scrutiny of companies turning their balance sheets into digital asset treasuries. Hong Kong Exchanges & Clearing has reportedly blocked at least five DAT applications under rules barring “cash companies” that hold liquid assets without active operations.

India’s Bombay Stock Exchange also denied Jetking Infotrain’s listing after it planned to allocate 60% of raised funds to Bitcoin. Similarly, Australia’s ASX enforces limits preventing listed entities from holding more than half their assets in cash or cryptocurrencies, effectively ruling out DAT pivots.

Global repercussions and market pressure - Analysts say the clampdown reflects rising concern that DATs could become “volatility arbitrage shells” rather than operational businesses. Bloomberg and 10x Research noted that the “age of financial magic” is ending for Bitcoin treasuries, with firms like Metaplanet now trading below net asset value.

Meanwhile, MSCI may soon exclude companies holding over 50% of assets in crypto from its global indexes, a move that could cut off passive fund inflows and add liquidity pressure.

Japan’s disclosure-driven approach - Japan’s exchanges continue to approve DAT structures under clear transparency standards, hosting 14 listed Bitcoin buyers, including Metaplanet, the world’s fourth-largest digital asset treasury. The country’s model favors regulation by disclosure rather than prohibition, setting it apart as Asia’s only crypto-treasury haven.

FalconX expands into ETFs with 21Shares acquisition

Key points:

FalconX agreed to acquire 21Shares, the world’s largest crypto ETP issuer managing $11 billion across 55 products, combining brokerage and ETF infrastructure.

The move marks FalconX’s third major 2025 deal and expands its reach across the U.S., Europe, and Asia amid growing competition in regulated digital asset products.

News - Institutional prime broker FalconX has agreed to acquire Swiss-based 21Shares, a leading issuer of cryptocurrency exchange-traded products (ETPs).

The deal, first reported by the Wall Street Journal, will merge FalconX’s $2 trillion trading infrastructure with 21Shares’ asset management platform. Together, the firms aim to design regulated crypto investment products for both institutional and retail markets.

Founded in 2018 by Hany Rashwan and Ophelia Snyder, 21Shares manages $11 billion across 55 listed products and will continue operating independently under CEO Russell Barlow.

FalconX, valued at $8 billion after its 2022 funding round, said the acquisition fits into its broader 2025 expansion strategy following previous deals with Arbelos Markets and Monarq Asset Management.

Industry consolidation picks up pace - The acquisition adds to a wave of consolidation among crypto infrastructure providers looking to scale after volatile market cycles.

Analysts say the integration of trading and ETP platforms could improve efficiency but may also draw closer regulatory scrutiny as firms blend brokerage, credit, and asset management services.

Outlook for regulated crypto products - The deal follows the rollout of multiple U.S. spot crypto ETFs, signaling increased overlap between traditional finance and digital assets.

Whether FalconX can maintain 21Shares’ rapid growth under tighter market conditions remains to be seen, but the transaction underscores how major players are positioning for the next phase of institutional crypto adoption.

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

More stories from the crypto ecosystem

Did you know?

According to the 2025 TRM Labs “Crypto Crime Report”, the blockchain ecosystem saw a largest share of illicit crypto volume in 2024 on the TRON network (~58 %), ahead of Ethereum (~24 %) and Bitcoin (~12 %) for that period.

An industry report published earlier this year found that the top 10 crypto exchange platforms (by trading volume) control over one-third of the entire global crypto exchange market, with Binance alone holding around 12.6%.

At the end of Q2 2025, decentralized finance (DeFi) lending apps accounted for 59.8% of total crypto lending market shares, up from 54.6% in Q1, showing DeFi’s comeback versus centralized venues.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Top 3 coins of the day

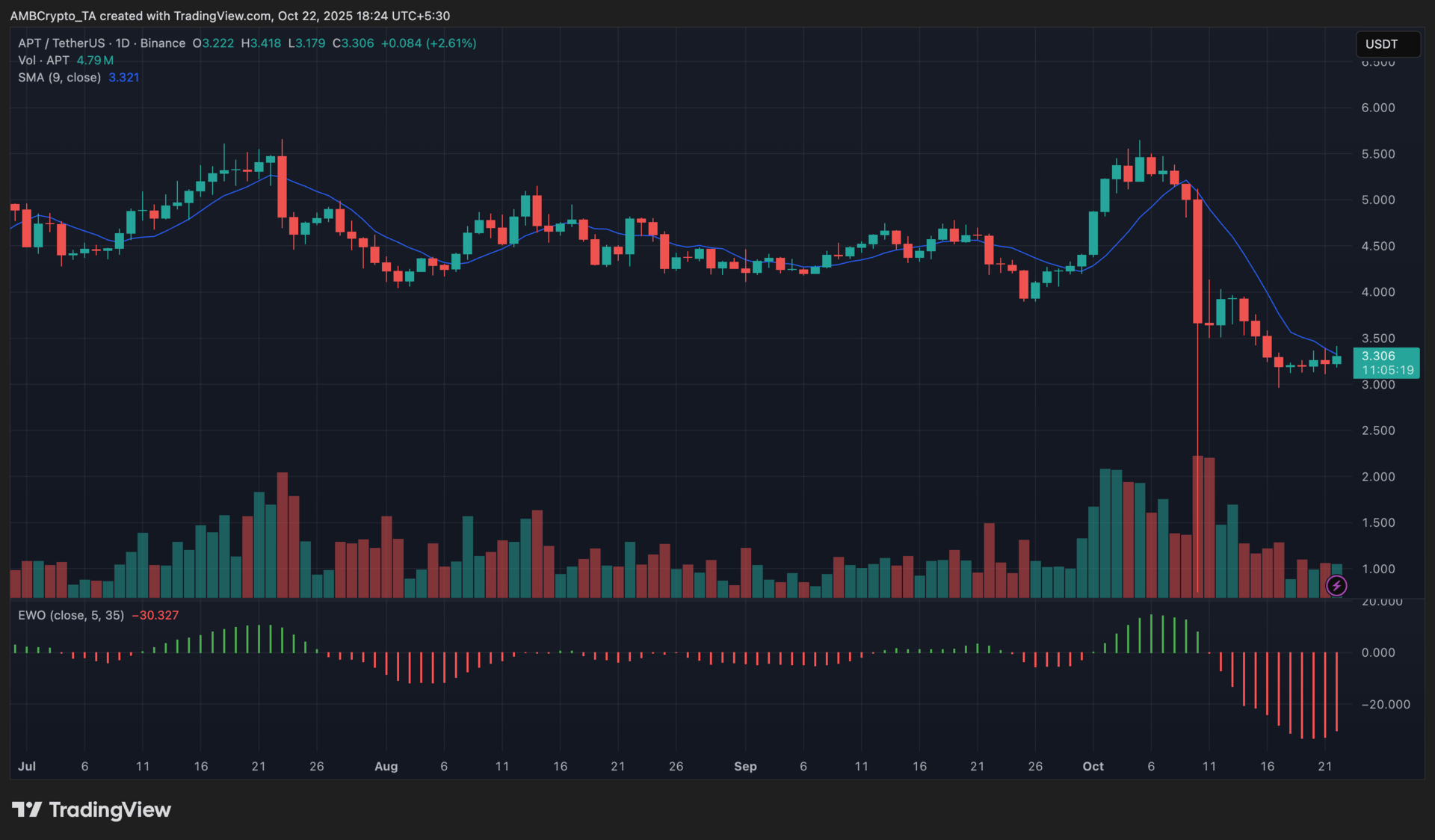

Aptos (APT)

Key points

APT was trading at $3.30, recording a 2.6% daily uptick after rebounding slightly from its recent local low near $3.00.

The Elliott Wave Oscillator deepened further into negative territory, reflecting persistent bearish pressure, while the price remained below the 9-day SMA, signaling the downtrend was still intact.

What you should know:

Aptos saw a modest recovery as traders capitalized on short-term oversold conditions, though its broader momentum stayed weak. The price tested but failed to close above the 9-day SMA ($3.32), leaving it vulnerable to renewed selling. The EWO’s extended red bars indicated that bearish momentum had not yet eased, suggesting that buyers lacked conviction despite an uptick in daily volume to 4.79 million. Outside the charts, BlackRock’s $500M tokenized asset expansion via the BUIDL fund and Jump Crypto’s Shelby launch boosted optimism about Aptos’ institutional and infrastructure growth. However, holding above the $3.00 support remains critical for avoiding a deeper breakdown.

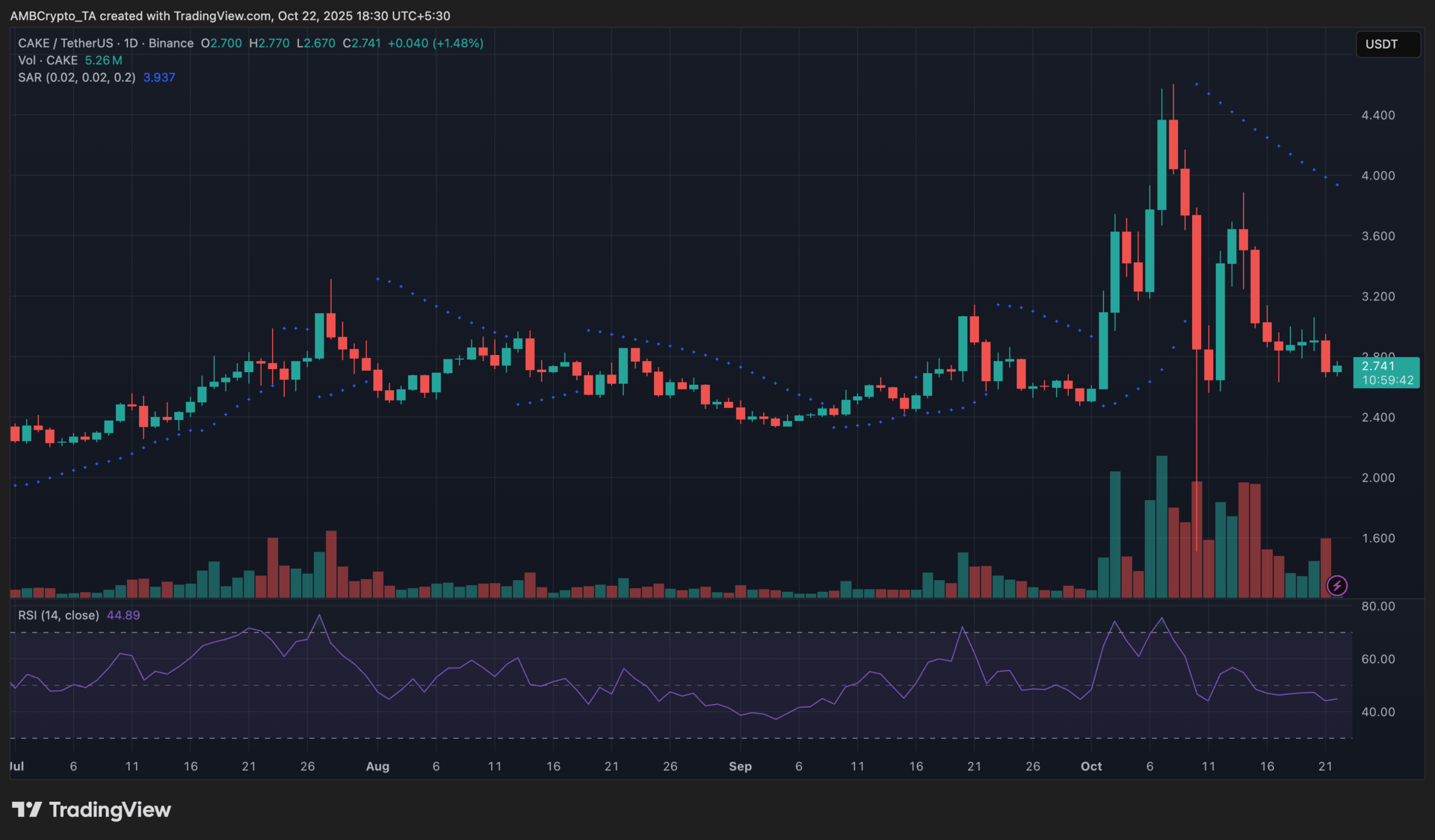

PancakeSwap (CAKE)

Key points:

CAKE changed hands at $2.74, rising 1.4% in 24 hours as traders cautiously accumulated after a sharp weekly decline.

The Parabolic SAR remained above the candles, reflecting continued bearish control, while the RSI hovered near 44.9, showing only a mild recovery from oversold conditions.

What you should know:

CAKE managed a modest rebound as dip buyers stepped in following last week’s slide. The price stayed below short-term resistance near $2.95–$3.00, with momentum still subdued according to the Parabolic SAR setup. The RSI’s gradual climb hinted at improving sentiment, but buyers lacked conviction. Volume picked up to 5.26 million, suggesting renewed interest without confirming a breakout. On the fundamentals side, BNB Chain’s $50M stablecoin initiative and PancakeSwap’s partnership with Ondo Finance strengthened its role in real-world asset liquidity and DeFi utility. For now, holding above the $2.60 support zone is essential for preventing another leg down.

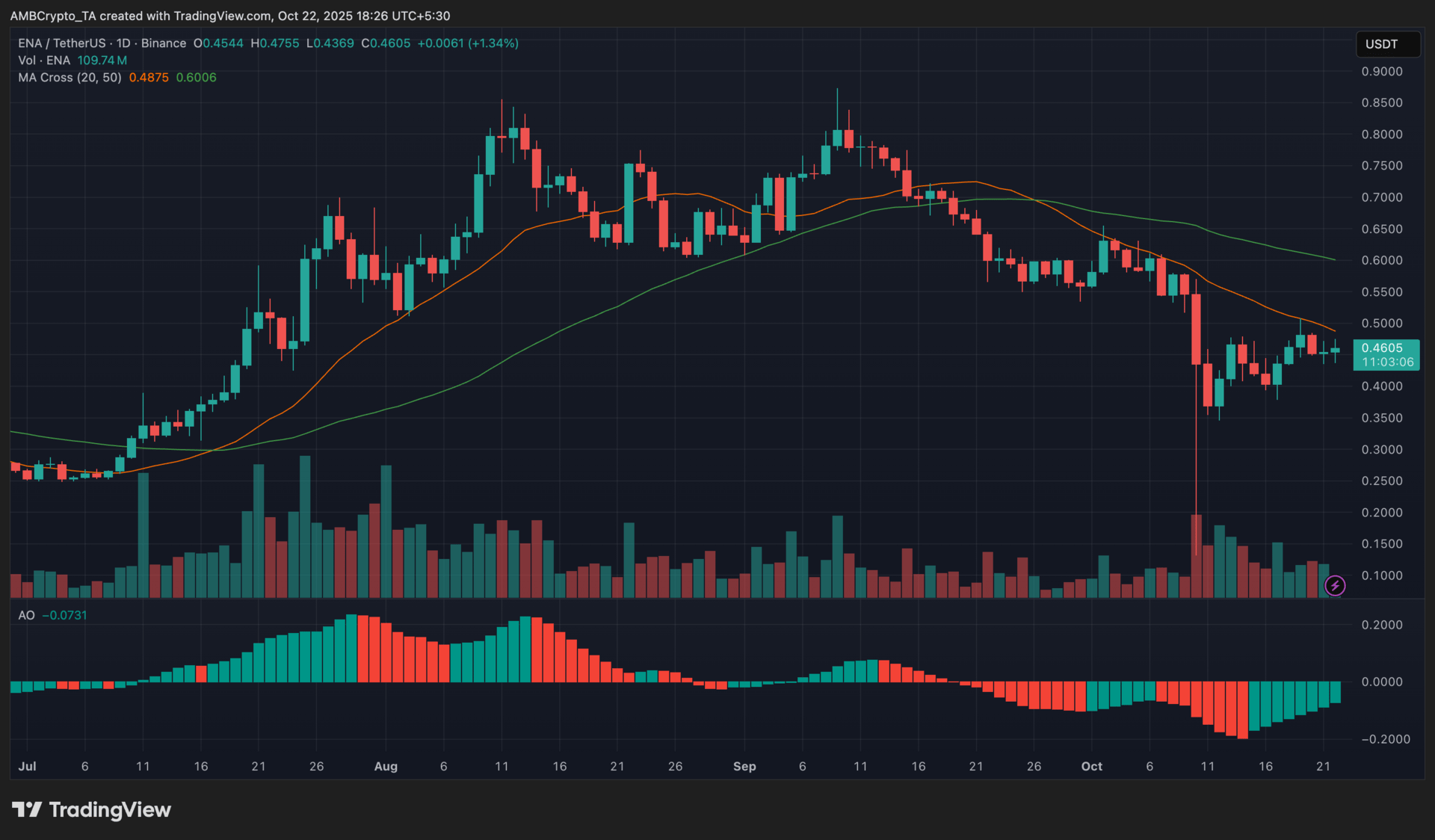

Ethena (ENA)

Key points:

ENA traded at $0.46, posting a 1.3% daily gain as it continued to recover from its mid-October low near $0.35.

The Awesome Oscillator remained green but below the zero line, showing weakening bearish momentum, while the 20-day MA stayed under the 50-day MA, confirming a lingering downtrend.

What you should know:

Ethena extended its rebound as traders accumulated near support, though the overall structure remained corrective. The Awesome Oscillator’s series of green bars below zero pointed to easing downside pressure rather than a confirmed bullish reversal. Volume rose to 109.7 million, roughly double last week’s average, signaling active participation during the recovery. Despite this, the MA cross (20, 50) still reflected a broader bearish bias, with price failing to reclaim the short-term resistance near $0.48–$0.50. On the catalyst front, Coinbase’s $375M Echo acquisition and Ethena’s internal team expansion bolstered market sentiment around its ecosystem. For now, holding above the $0.43 support remains key to sustaining short-term momentum.

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

How was today's newsletter? |