- Unhashed Newsletter

- Posts

- Silver crash triggers Bitcoin bid

Silver crash triggers Bitcoin bid

Reading time: 5 minutes

Silver shock exposes leverage as Bitcoin tests $90K

Key points:

A sharp silver futures crash triggered margin hikes and forced liquidations, reviving broader liquidity stress fears across traditional markets.

Bitcoin briefly tested $90,000 during the turmoil, supported by whale accumulation despite weak retail demand and ongoing macro pressure.

News - A violent reversal in silver futures over the weekend sent shockwaves through global markets, offering crypto traders a familiar reminder of how quickly leverage can unwind.

After surging to record highs near $84, silver collapsed more than 10% in just over an hour, wiping out billions in leveraged positions and prompting emergency margin increases across precious metals contracts.

The speed of the move exposed severe liquidity gaps, with futures prices sliding rapidly as bids vanished. In response, the CME raised margin requirements across most precious metals products, a move aimed at reining in leverage after the violent swings.

As metals traders scrambled, Bitcoin initially caught a bid as silver rolled over, briefly testing the $90,000 level before later slipping below $88,000. While unverified rumors of a large bank-linked margin call circulated online, no official confirmation followed. Still, the scale and speed of forced deleveraging revived systemic risk chatter around paper-based leverage.

Bitcoin’s resilience meets demand challenges - Bitcoin’s ability to remain above the $84,000 support zone contrasted with its broader demand picture.

Onchain data showed apparent demand flipping negative in recent weeks, while U.S. retail activity weakened and spot Bitcoin ETFs recorded heavy outflows. At the same time, BTC continued to underperform during U.S. trading hours, closely tracking weakness in Nasdaq futures.

Despite this, positioning appeared cautious rather than aggressively leveraged. Futures open interest declined as traders scaled back leveraged bets, reflecting a more restrained market posture.

Whales step in as retail steps back - Beneath the surface, large holders continued to accumulate. Onchain data showed wallets holding between 1,000 and 10,000 BTC maintaining strong accumulation trends around the $80,000 range, even as smaller investors sold amid prolonged fear-driven sentiment.

Long positions among Bitfinex whales also climbed to their highest levels in nearly two years, indicating longer-term positioning despite short-term uncertainty. During this episode, Bitcoin was framed by several analysts as behaving like a pressure valve as leverage cracked in traditional markets.

Peter Schiff questions Strategy’s Bitcoin math as ETH treasuries gain momentum

Key points:

Strategy expanded its Bitcoin holdings to 672,497 BTC after a $108.8 million purchase, drawing criticism over long-term return efficiency.

While Bitcoin accumulation continues, institutional strategies are diverging, with Ethereum-focused treasuries leaning into staking and yield.

News - Strategy’s latest Bitcoin purchase has reignited debate over whether large-scale crypto accumulation delivers efficient returns for public companies. The firm added 1,229 BTC in late December for roughly $108.8 million at an average price of $88,568 per coin, lifting its total holdings to 672,497 BTC.

The acquisition was funded through common stock sales under its at-the-market equity program, following a brief pause to build U.S. dollar reserves.

Despite holding Bitcoin acquired for about $50.44 billion and reporting a year-to-date BTC yield of 23.2% in 2025, Strategy has faced renewed criticism from longtime Bitcoin skeptic Peter Schiff.

Schiff argued that the firm’s roughly 16% unrealized gain over five years translates into modest annualized returns, questioning whether the opportunity cost justified the scale of capital deployed.

A conviction play despite volatility - Strategy’s approach remains unchanged. The company has not reported any Bitcoin sales since adopting BTC as its primary treasury asset and continues to add during pullbacks and range-bound trading near the $90,000 level.

Bitcoin briefly pushed above $90,000 before retreating toward the $87,000 range following the latest purchase, with Strategy shares slipping about 1% in premarket trading and remaining sharply lower year-to-date.

Even so, the firm’s accumulation reinforces its position as the largest publicly traded Bitcoin holder, regardless of short-term price swings or criticism around realized efficiency.

Ethereum treasuries chart a different path - While Strategy doubles down on Bitcoin, other public companies are taking a different route.

Tom Lee’s BitMine Immersion has continued expanding its Ethereum treasury, acquiring tens of thousands of ETH and building a sizable staking position. The firm now holds over 4 million ETH, alongside a growing pool of staked tokens tied to its planned MAVAN staking platform.

This contrast highlights a widening divide in institutional crypto strategy. Strategy remains focused on Bitcoin accumulation, while BitMine emphasizes Ethereum holdings and staking participation. Schiff’s critique underscores that debate, as institutional capital weighs conviction against measurable returns.

Ethereum staking surge tightens supply, institutions lock up ETH

Key points:

Ethereum’s staking entry queue has overtaken the exit queue for the first time in months, signaling reduced near-term selling pressure.

Large corporate and institutional holders continue locking up ETH through staking, even as short-term price uncertainty persists.

News - Ethereum’s staking dynamics have flipped in a way that historically preceded major price moves.

Data from validator tracking tools showed the amount of ETH queued for staking rising above the amount waiting to exit, marking the first such crossover since June. More than 745,000 ETH is now lined up to enter staking, compared with roughly 360,000 ETH awaiting withdrawal, extending validator wait times to nearly two weeks.

This shift suggests validators are increasingly choosing to hold and stake rather than exit, easing sell-side pressure that followed several months of elevated unstaking activity highlighted by on-chain analysts.

Similar queue imbalances in March and June previously preceded sharp ETH rallies, though some market participants continue to warn that past patterns do not rule out further consolidation or downside.

Corporate treasuries drive staking momentum - Institutional behavior is reinforcing the trend.

BitMine Immersion, the world’s largest publicly owned Ether treasury, now holds over 4.1 million ETH, representing more than 3% of total supply. The company has already staked more than 408,000 ETH and is preparing to expand staking further ahead of its planned validator network launch in early 2026.

Other corporate holders are following suit. SharpLink Gaming and The Ether Machine have staked the majority of their ETH treasuries, while BitMine alone locked up more than $1 billion worth of Ether in recent days. This growing pool of staked ETH is effectively removing supply from circulation.

Bullish positioning meets near-term caution - Beyond corporate treasuries, Trend Research has continued accumulating ETH, lifting its holdings above 600,000 tokens while publicly expressing optimism for 2026.

At the same time, on-chain data showed diverging behavior among active traders, with smart money reducing spot Ether exposure while whale wallets recorded net buying over the same period.

ETH has remained range-bound near the $3,000 level, and some analysts continue to warn of potential drawdowns before any sustained breakout. Still, the combination of rising staking demand and long-term institutional positioning has strengthened the case that Ethereum’s supply dynamics are shifting beneath the surface.

China moves digital yuan toward deposit status with interest plan

Key points:

China will allow banks to pay interest on digital yuan wallets starting January 1, 2026, shifting the e-CNY toward a deposit-like model.

The move contrasts with recent policy developments in the United States, where a CBDC ban and a stablecoin-focused framework are taking shape.

News - China’s central bank is preparing a major overhaul of its digital yuan framework that will allow commercial banks to pay interest on e-CNY wallet balances beginning January 1, 2026. Officials say the change will push the digital yuan beyond its original role as a cash substitute and into a structure that more closely resembles bank deposits.

Under the new framework, the digital yuan will transition from “digital cash” to what regulators describe as “digital deposit money.”

Wallet balances will function as liabilities of commercial banks, allowing them to be integrated into asset and liability management while remaining under oversight from the People’s Bank of China. The policy follows years of pilot programs that faced adoption challenges despite widespread testing.

A push to boost adoption and infrastructure - The update is part of a broader action plan aimed at strengthening the digital yuan’s infrastructure, security, and regulatory treatment.

Authorities plan to apply reserve requirements similar to traditional deposits, improve wallet management, and support deeper integration across retail payments, government services, and cross-border transactions.

China has also moved to enhance the e-CNY’s international reach. An international digital yuan operations center has been established in Shanghai to support onchain settlement tools and cross-border payment capabilities, signaling ambitions beyond domestic use.

A policy divide with the US - China’s approach stands in contrast to recent policy developments in the United States. While Beijing advances an interest-bearing CBDC, Washington has taken a different path.

President Donald Trump signed an executive order prohibiting the creation and use of a US central bank digital currency, citing concerns over privacy, financial stability, and sovereignty. At the same time, US lawmakers have pushed forward a regulatory framework for dollar-backed stablecoins, supporting a stablecoin-based alternative to state-issued digital money.

Together, the differing strategies highlight contrasting national approaches to the future of digital currencies within the financial system.

The Headlines Traders Need Before the Bell

Tired of missing the trades that actually move?

In under five minutes, Elite Trade Club delivers the top stories, market-moving headlines, and stocks to watch — before the open.

Join 200K+ traders who start with a plan, not a scroll.

More stories from the crypto ecosystem

Did you know?

Ethereum quietly shipped account abstraction for everyday users: Ethereum introduced account abstraction (ERC-4337), allowing wallets to support features like gas sponsorship, bundled transactions, and smart wallet security without changing Ethereum’s core consensus layer, making user experience upgrades possible at the wallet level.

Bitcoin’s Taproot upgrade expanded smart contract privacy: Bitcoin’s Taproot upgrade, activated in November 2021, allows complex transactions like multisig and smart contracts to appear identical to regular transactions on-chain, improving privacy and efficiency without changing Bitcoin’s monetary rules.

Bitcoin’s core rules have barely changed in 15 years: Since Bitcoin launched in 2009, its 21 million supply cap and issuance schedule have never been altered, despite hundreds of upgrades, reinforcing how resistant the network is to monetary policy changes.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Top 3 coins of the day

XDC Network (XDC)

Key points:

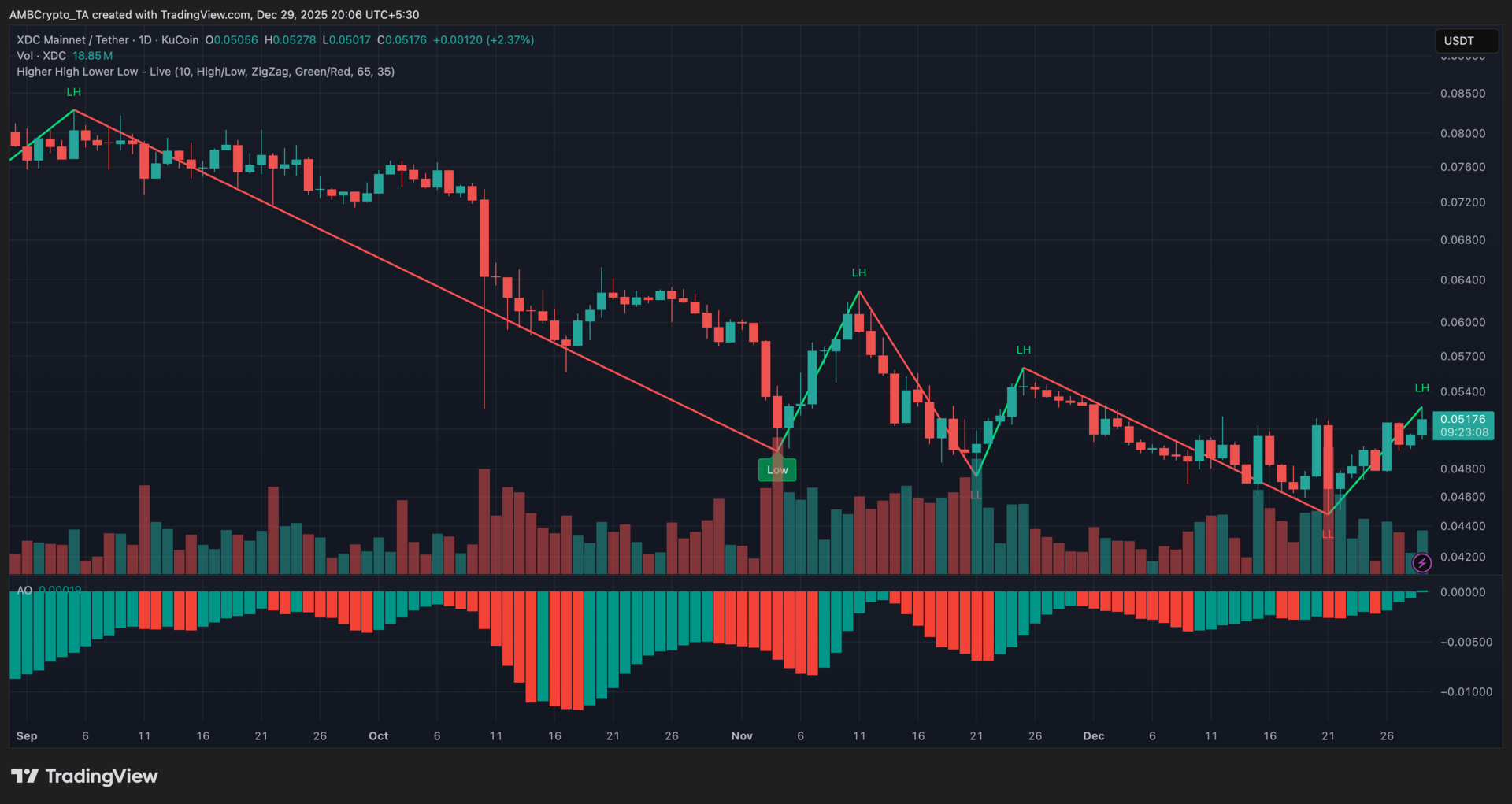

XDC was last seen trading near $0.051 after recording a modest daily gain, as price continued to recover from its mid-December lows.

Higher lows stayed intact while the most recent rally printed a lower high, signaling easing downside pressure but capped upside momentum, alongside steady volume.

What you should know:

XDC continued to stabilize after rebounding from the $0.045–$0.046 region, where selling pressure previously intensified.

Recent price action showed a sequence of higher lows, indicating that downside momentum had softened compared to earlier in the quarter. However, the latest recovery attempt failed to push beyond the prior swing high, resulting in a lower high and keeping the broader structure in a compression phase rather than a breakout.

Momentum conditions reflected this transition. The Awesome Oscillator remained below zero, but contracting green histogram bars suggested bearish momentum had weakened. Volume stayed measured during the advance, reinforcing the view that positioning remained controlled rather than speculative.

Beyond the chart, sentiment found support from ongoing DeFi incentive activity on the XDC network and continued interest in its real-world asset positioning. These factors helped underpin demand without driving sharp volatility.

The $0.045–$0.046 zone remains key support, while resistance is clustered between $0.052 and $0.054, where upside attempts have continued to stall.

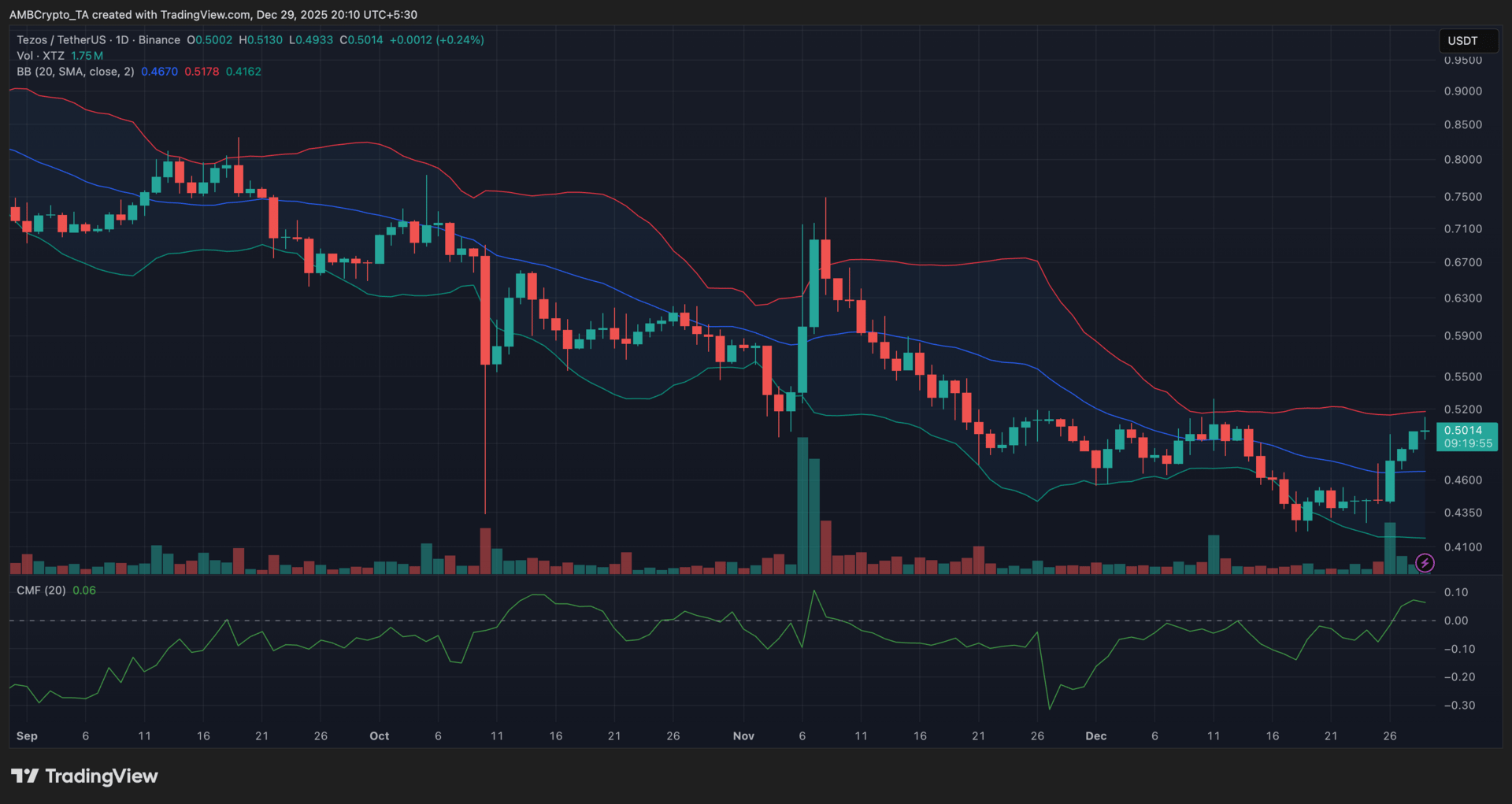

Tezos (XTZ)

Key points:

XTZ hovered near $0.50 after registering a modest daily gain, continuing its recovery from mid-December lows.

Price reclaimed the Bollinger mid-band and advanced toward the upper band, while CMF turned slightly positive, pointing to improving short-term momentum on steady volume.

What you should know:

XTZ spent much of December trading cautiously before buyers lifted the price away from the $0.44–$0.45 base.

Momentum improved as the token moved back above the Bollinger mid-band and pushed closer to the upper band, reflecting stronger upside pressure than earlier in the month. Even so, price remained below prior distribution areas, keeping the broader structure corrective rather than trend-driven.

From an indicator standpoint, the Bollinger Bands showed price gravitating toward the upper band, although the downward slope of the band suggested overhead pressure had not fully cleared.

The Chaikin Money Flow shifted into positive territory, signaling modest capital inflows, while volume stayed relatively muted, highlighting selective participation rather than aggressive buying.

Narrative support came from recent Etherlink upgrades and continued engagement within Tezos’ digital art ecosystem. The $0.44–$0.45 zone remains key support, while resistance is positioned between $0.52 and $0.54.

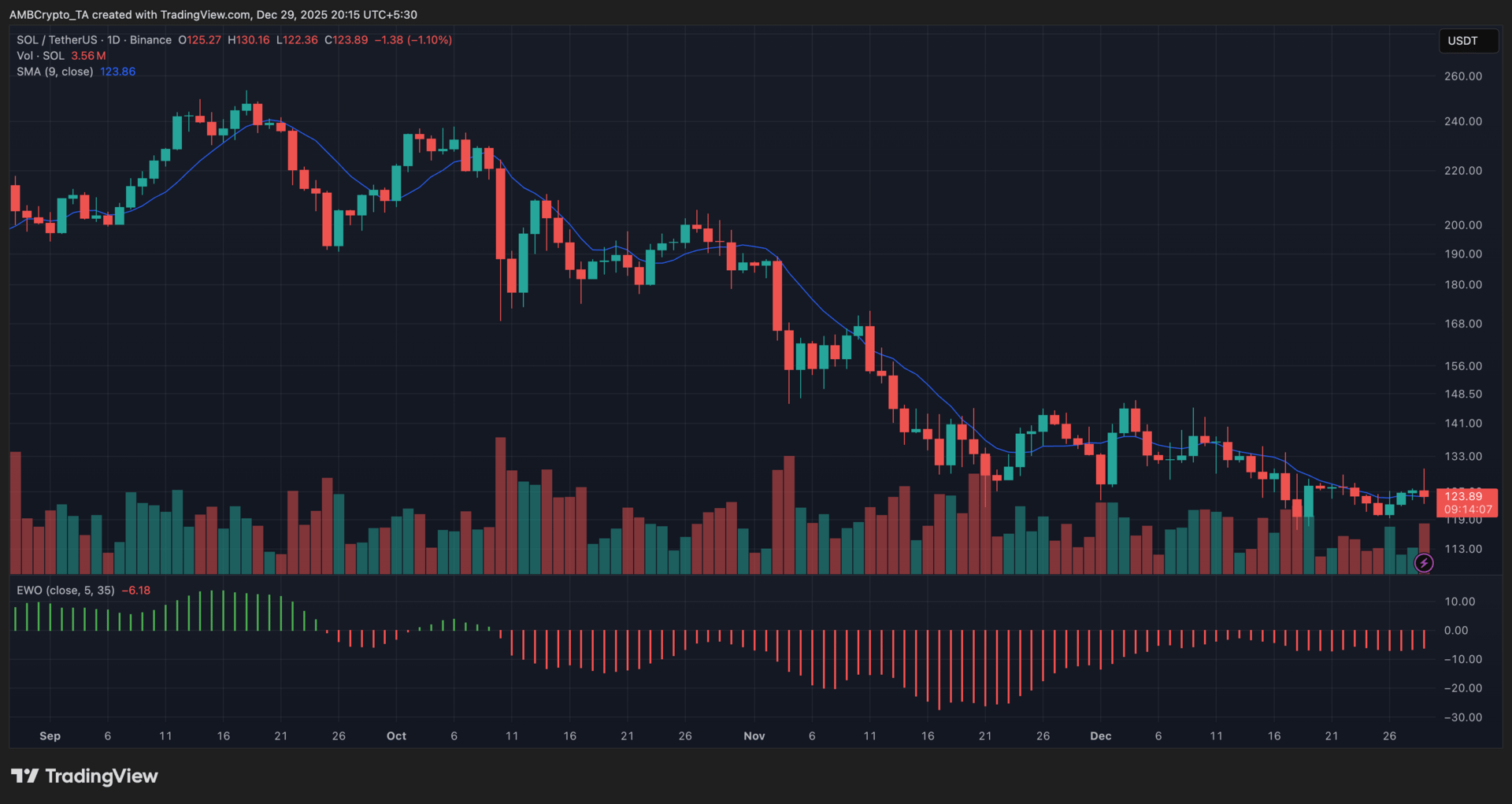

Solana (SOL)

Key points:

SOL slipped to around $123 after ending the session modestly lower, continuing its broader corrective phase through December.

The latest candle closed just above the 9-day SMA, while the EWO remained negative, pointing to tentative stabilization despite lingering bearish momentum and steady volume.

What you should know:

Solana’s price action reflected ongoing pressure after a prolonged decline from November highs, with sellers largely dictating structure through most of December.

While SOL had traded below the 9-day SMA for several sessions, the most recent close edged marginally above it, suggesting an early attempt to steady losses rather than a decisive trend shift. Even with this move, the broader structure remained fragile, as prior recovery efforts failed to gain traction.

Momentum indicators continued to lean cautious. The Elliott Wave Oscillator stayed below the zero line, although contracting histogram bars indicated that downside momentum had begun to ease. Volume remained moderate during the pullback, signaling controlled positioning instead of panic-driven exits.

From a broader context, sentiment was weighed down by risk-off positioning across crypto markets, alongside shifts in stablecoin liquidity on Solana’s network. The $120–$122 region remains key support, while resistance sits between $130 and $135, where upside attempts may continue to face pressure.

How was today's newsletter? |