- Unhashed Newsletter

- Posts

- Silver is reshaping crypto trading

Silver is reshaping crypto trading

Reading time: 5 minutes

Commodities surge pulls Hyperliquid into a new trading phase

Key points:

Commodities trading, led by silver, emerged as a major activity driver on Hyperliquid, pushing volumes and open interest higher.

Rising trading fees strengthened HYPE buyback flows, helping the token rebound toward the upper end of its recent range.

News - Trading patterns on Hyperliquid shifted sharply over the past 24 hours as traders rotated into commodity-linked perpetual futures. Silver emerged as the focal point, generating more than $1.2 billion in daily trading volume and lifting open interest beyond $155 million.

The move marked a change in how activity is distributed on the platform. During early trading hours, silver contracts became one of Hyperliquid’s most actively traded markets, reflecting growing demand for real-world asset exposure through onchain derivatives rather than traditional crypto pairs.

Why volumes matter for HYPE - This surge in commodities trading coincided with a sharp rebound in Hyperliquid’s native token. HYPE climbed by over 25% in a single day, recovering from recent local lows and trading back near the $27 level. The rally placed the token among the strongest performers across the broader crypto market during the session.

The link between rising volumes and token performance is embedded in Hyperliquid’s design.

Since October, users have been able to deploy custom perpetual futures markets by staking HYPE tokens. Trading fees from these markets are split between creators and the protocol, with most of Hyperliquid’s share routed into open-market HYPE buybacks through its Assistance Fund. As commodity trading accelerated, higher fee generation increased buy-side pressure on the token.

HIP-3 activity expands beyond crypto - Much of the recent growth has been concentrated within Hyperliquid’s HIP-3 framework, which enables permissionless creation of perpetual markets for assets beyond crypto. Open interest across HIP-3 markets has climbed to roughly $790 million, up from around $260 million a month ago, driven largely by gold and silver trading.

TradeXYZ, which focuses on stock and commodity-linked markets, now accounts for the majority of HIP-3 activity. Silver has become one of its most actively traded contracts, highlighting how crypto-native traders are increasingly using onchain infrastructure to speculate on traditional markets without direct asset ownership.

Hyperliquid’s leadership has also argued the platform is becoming a key venue for price discovery, pointing to tighter Bitcoin perpetual spreads and fully visible onchain liquidity as activity continues to expand beyond crypto-native markets.

Tether enters US regulation with GENIUS-compliant stablecoin

Key points:

Tether launched USAt, a federally regulated dollar stablecoin issued by Anchorage Digital Bank under the US GENIUS Act.

The move positions Tether to compete directly with USDC in the US market while keeping USDT focused on global liquidity.

News - Tether has formally entered the US domestic stablecoin market with the launch of USAt, a dollar-backed token designed to operate fully within America’s new federal regulatory framework. The rollout marks a strategic shift for the issuer of USDT, which has historically operated outside the US regulatory perimeter.

USAt is issued by Anchorage Digital Bank, a federally chartered crypto-native bank, bringing the token under direct oversight aligned with the GENIUS Act. Passed in July 2025, the law established the first nationwide framework governing payment stablecoins offered to US users, effectively limiting the role of offshore-issued tokens in regulated financial channels.

At launch, USAt enters the market with an initial supply of $10 million as an ERC-20 token on Ethereum. The stablecoin is backed by reserves custodied by Cantor Fitzgerald, which also serves as preferred primary dealer, aiming to provide institutional-grade transparency from day one. The token is available through platforms including Kraken, Crypto.com, OKX, Bybit, and MoonPay.

A regulated path into the US market - The GENIUS Act created a clear divide between globally issued stablecoins and those permitted for use by US institutions. Only stablecoins issued by federally or state-qualified entities can be marketed or distributed to US users, reshaping how stablecoin issuers approach the American market.

This shift reduced the role of offshore-issued tokens in US-regulated channels, prompting issuers to reassess how they serve domestic institutions without disrupting global liquidity.

Why Tether needed a US-specific stablecoin - While USDT remains the dominant dollar token in global crypto markets, its offshore structure restricted access to US-regulated exchanges, banks, and payment providers.

USAt allows Tether to bridge that gap. Led by Tether USAt CEO Bo Hines, the project is positioned as a regulated alternative built specifically for American institutions that require bank issuance and ongoing supervision. Tether CEO Paolo Ardoino described USAt as a domestically aligned extension of the firm’s stablecoin strategy rather than a replacement for USDT.

The launch places Tether in direct competition with Circle’s USDC on US soil, signaling a shift toward a dual-track model where regulated and global stablecoins coexist under the same issuer.

Stablecoin growth raises global deposit and capital flow risks

Key points:

Standard Chartered warned that stablecoin adoption could drain up to $500 billion from developed-market bank deposits by 2028, with US regional banks most exposed.

Recent stablecoin outflows and policy warnings in Asia suggest capital-flow risks are becoming a global concern, not just a US banking issue.

News - The rapid expansion of stablecoins is increasingly being viewed as a systemic risk to traditional finance rather than a niche crypto development. Analysts at Standard Chartered warned that stablecoin growth could pull roughly $500 billion from developed-market bank deposits by 2028, placing disproportionate pressure on US regional banks.

According to the bank, about one-third of future stablecoin demand is expected to originate from developed markets as adoption spreads beyond emerging economies. This shift poses a direct challenge to regional lenders, whose profitability depends heavily on net interest margin income derived from retail deposits. Diversified banks and investment banks were seen as significantly less exposed.

The risk is amplified by how major stablecoin issuers manage reserves. Standard Chartered noted that Tether and Circle hold just 0.02% and 14.5% of their reserves in bank deposits, respectively, limiting any redeposit effect when funds move from banks into stablecoins.

Regulation delays add pressure - In the United States, progress on stablecoin market structure legislation remains stalled amid debate over proposed restrictions on whether issuers can pay interest. Large banks have supported limits on yield-bearing stablecoins, while crypto firms have warned such provisions could stifle the sector. Despite the impasse, Standard Chartered continues to expect the legislation to pass by the end of the first quarter of 2026.

Capital flows show early warning signs - Signs of capital movement are already emerging in market data. Over the past 10 days, the combined supply of major stablecoins fell by roughly $2.2 billion, indicating investors are exiting crypto to fiat rather than rotating into stablecoins. The outflows coincided with muted risk appetite, as Bitcoin derivatives open interest remained rangebound and capital instead flowed toward gold.

Regulators in Asia have echoed similar concerns. Bank of Korea Governor Lee Chang-yong warned that won-pegged stablecoins, combined with US dollar stablecoins, could complicate capital-flow management and foreign-exchange stability during periods of market stress. In South Korea, disagreements over who should be allowed to issue stablecoins have delayed broader digital asset legislation.

Together, these signals suggest stablecoins are becoming a cross-border policy challenge, reshaping how regulators assess deposit stability, capital controls, and financial risk.

Australia flags crypto as a regulatory perimeter risk for 2026

Key points:

Australia’s corporate regulator grouped crypto with AI and payments as a growing regulatory perimeter risk in its 2026 outlook.

ASIC warned that firms operating at the edges of licensing rules will remain a key enforcement focus as crypto regulation advances.

News - Australia’s financial watchdog has placed digital assets firmly on its 2026 risk radar, warning that rapid innovation and unclear licensing boundaries are exposing consumers to misconduct and unregulated activity. In its Key Issues Outlook 2026, Australian Securities and Investments Commission (ASIC) identified crypto firms operating outside existing frameworks as a priority area for oversight in the year ahead.

Rather than focusing on price volatility or adoption trends, ASIC grouped digital assets alongside AI-driven financial services and payment platforms, highlighting structural risks when new business models fall outside established licensing and conduct regimes. The regulator cautioned that some companies may actively seek to remain unlicensed, contributing to regulatory uncertainty and complicating enforcement.

ASIC emphasized that decisions on whether new crypto products should formally fall within licensing regimes ultimately sit with the government. Its own focus for 2026 will be maintaining clarity around licensing boundaries and strengthening oversight at the regulatory perimeter.

Enforcement signals already visible - The warning comes amid continued enforcement activity tied to unlicensed crypto conduct. This week, an Australian federal court ordered BPS Financial to pay penalties of A$14 million over misleading claims and unlicensed activity linked to its Qoin Wallet product, underscoring ASIC’s willingness to pursue perimeter breaches.

Licensing reform still in motion - Australia is simultaneously moving to close these regulatory gaps. Draft legislation released by the Treasury proposes requiring crypto trading and custody platforms to hold an Australian Financial Services Licence, extending core obligations around disclosure, risk management, and fair conduct to digital asset firms.

ASIC’s warning also follows recent amendments to the Corporations Act 2001 and the Australian Securities and Investments Commission Act 2001 that carved out rules for companies handling customers’ digital assets.

Industry observers note that while clearer licensing rules could improve consumer protection, debates continue over how tightly innovation should be constrained. Progress has been slowed by disagreements over stablecoin issuance rules, ownership caps for exchanges, and regulatory oversight responsibilities, delaying submission of the proposed Digital Asset Basic Act and leaving parts of the crypto sector operating in legal gray areas.

As crypto, payments, and AI continue to converge, ASIC’s outlook signals that perimeter enforcement, rather than market volatility, will shape Australia’s regulatory posture in 2026.

More stories from the crypto ecosystem

Dogecoin’s profit metric hits 2-year low – Is the bottom in for DOGE?

Lighter jumps 16% – LIT traders, watch THIS for a move to $2

Why Bitcoin’s pullback looks riskier after a $2.24B stablecoin exit

Decoding $155B stablecoin drop – 2 reasons why traders are abandoning risk assets

Why traders are turning to Solana as another U.S. government shutdown looms

Interesting facts

Tether became a major player in the gold market: In the fourth quarter of 2025, Tether, issuer of the USDT and XAUT stablecoins, bought about 27 metric tons of gold, matching its purchases from the prior quarter and increasing its role as a significant buyer in the global gold market.

UBS is preparing crypto investing options for private banking clients: Swiss banking giant UBS is reportedly planning to offer Bitcoin and Ethereum trading services to select private banking customers, potentially expanding the offering later to regions including Asia-Pacific and the United States.

Stablecoins could pressure national monetary systems: At the World Economic Forum in Davos, Gita Gopinath, Harvard professor and the IMF’s former First Deputy Managing Director, said that growing adoption of stablecoins in countries with weak monetary frameworks could push those nations to improve their fiscal and monetary policies as stablecoins compete with domestic currencies.

Top 3 coins of the day

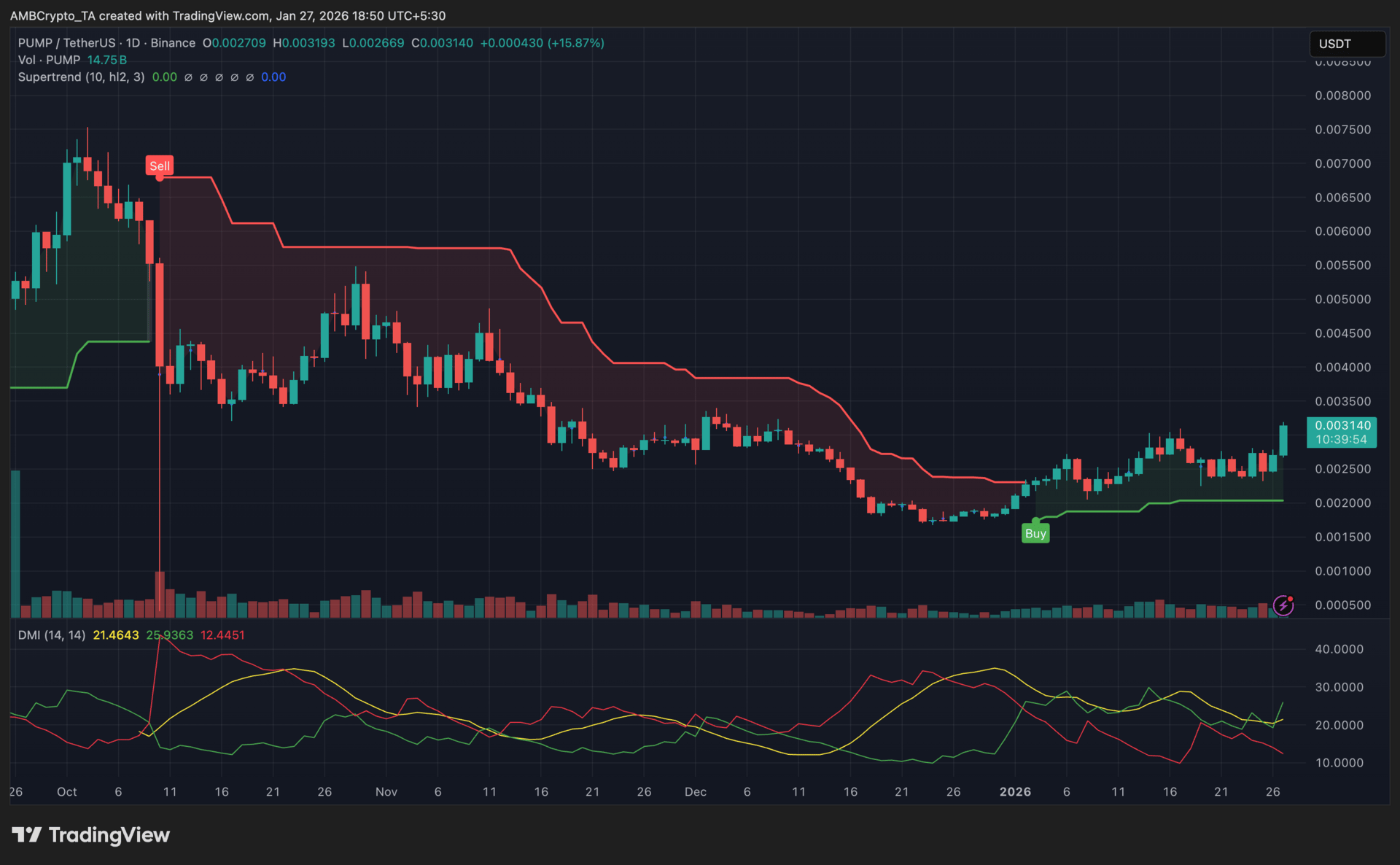

Pump.fun (PUMP)

Key points:

PUMP was last seen trading near $0.00314, after registering a double-digit daily gain, as buyers extended the rebound from its early-January base.

The Supertrend flipped bullish and DMI confirmed strengthening directional momentum, while rising volume pointed to renewed participation.

What you should know:

PUMP recorded a sharp upside move after stabilizing above the $0.00210–$0.00230 zone, where buyers repeatedly defended price. The rally unfolded alongside a Supertrend Buy signal, with price remaining firmly above the indicator, keeping the short-term trend biased to the upside.

Directional Movement also improved, as +DI moved ahead of -DI and the ADX rose above the 20 level, suggesting that bullish momentum gained structure rather than appearing as a brief spike. This shift followed an extended downtrend phase that had dominated most of the prior quarter.

Volume expanded noticeably during the advance, reinforcing the move and indicating stronger trader engagement compared to late-December conditions. Beyond technicals, renewed attention around the Pump.fun ecosystem and heightened discussion tied to legal developments appeared to contribute to volatility and liquidity.

Going forward, $0.00210–$0.00230 remains the key support band to watch, while $0.00320–$0.00350 stands as the immediate resistance zone. A sustained hold above support keeps the bullish structure intact.

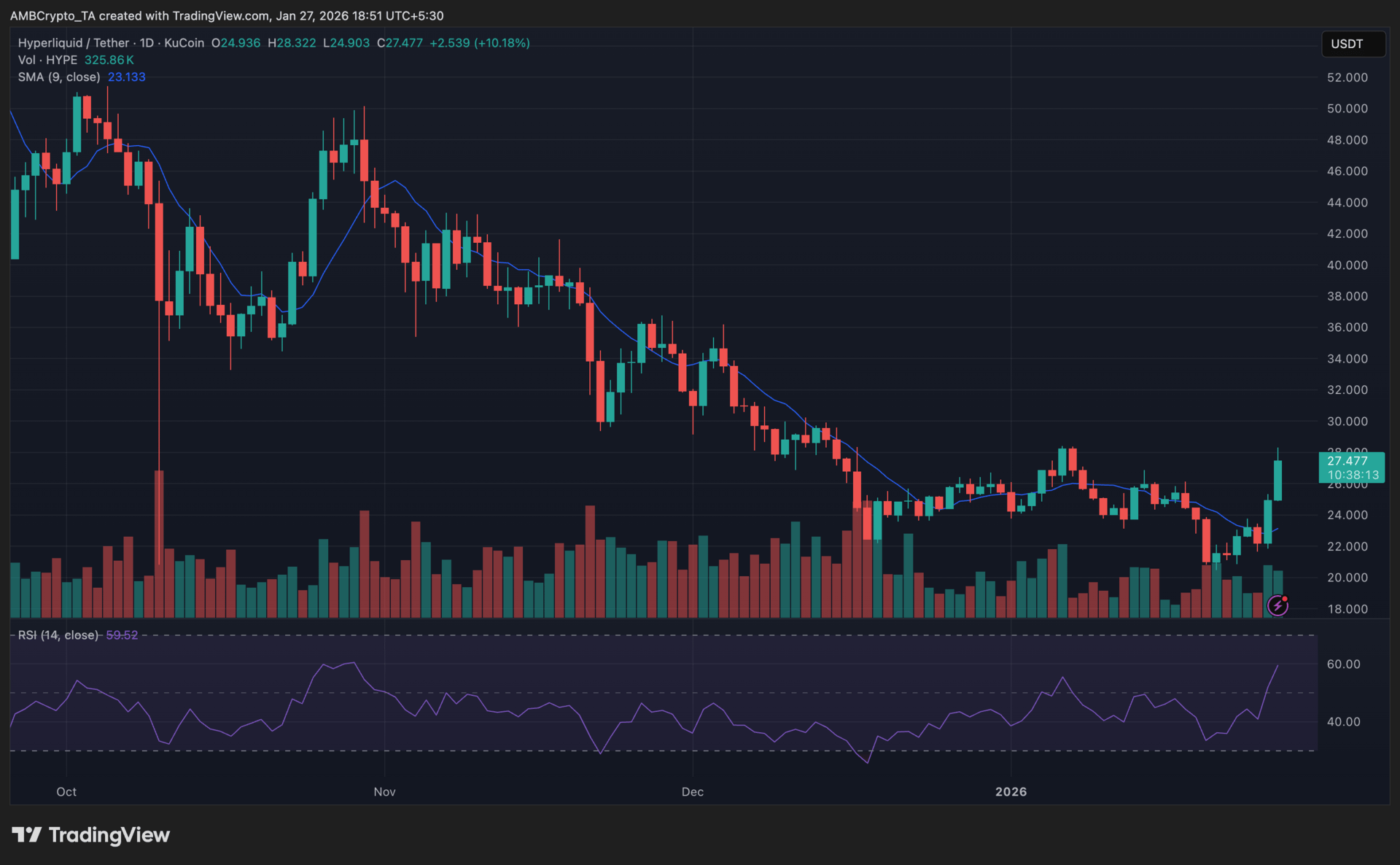

Hyperliquid (HYPE)

Key points:

HYPE surged over the last 24 hours, decisively outperforming a flat broader market as momentum returned to high-beta DeFi tokens.

Volume expansion and whale positioning aligned with platform-driven demand, reinforcing the strength of the move rather than signaling a short-lived spike.

What you should know:

HYPE rallied sharply after reclaiming the $26.00–$26.50 zone, with price pushing above its 9-day SMA as buying pressure accelerated. The RSI climbed into bullish territory without flashing extreme conditions, while volume expanded aggressively, confirming broad participation rather than thin liquidity.

A key catalyst behind the move was rising adoption of Hyperliquid’s HIP-3 framework, which has driven a surge in platform activity and open interest. Because HIP-3 deployments require HYPE staking, increased usage translated directly into token demand. Alongside this, whale accumulation was evident, with large holders reducing exchange supply during the advance, suggesting positioning rather than distribution.

On the downside, immediate support now sits near $26.00, while sustained strength keeps $28.00 in focus as the next resistance zone. Momentum remains constructive as long as price holds above short-term averages and volume stays elevated.

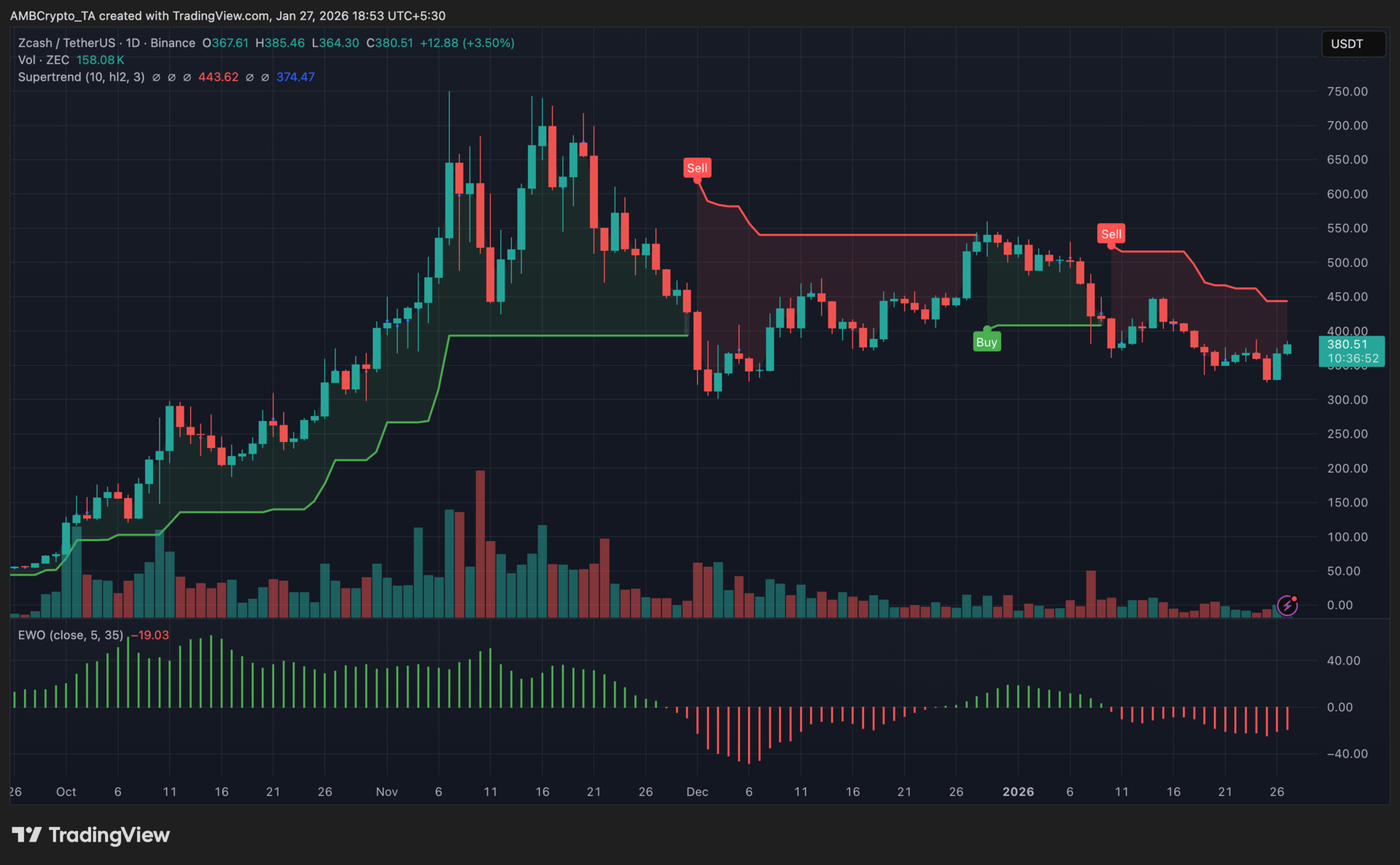

Zcash (ZEC)

Key points:

ZEC climbed to $380, posting a 3.50% daily gain, as buyers stepped in after the price stabilized above the $360 region.

The rebound coincided with privacy-coin sector momentum and whale accumulation, while momentum indicators hinted at easing downside pressure.

What you should know:

Zcash showed signs of stabilization after defending the $360–$370 zone, an area that had previously acted as a short-term floor during recent pullbacks. The bounce unfolded alongside a broader privacy-coin rotation, with renewed demand for privacy-focused assets lifting ZEC in tandem with peers.

On the technical side, the Supertrend indicator remained in sell mode, though price edged closer to its trailing resistance near $400, reflecting improving short-term structure. The EWO histogram stayed in negative territory, but the red bars were noticeably less aggressive than those seen in the previous month, indicating that bearish momentum had eased rather than intensified into late January.

This shift was supported by whale accumulation near recent lows, which helped absorb sell-side pressure as trading volume stayed steady during the rebound. For now, $360 stands as immediate support, while $400 remains the key resistance level to watch for confirmation of further upside.

How was today's newsletter? |